- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-03-2023

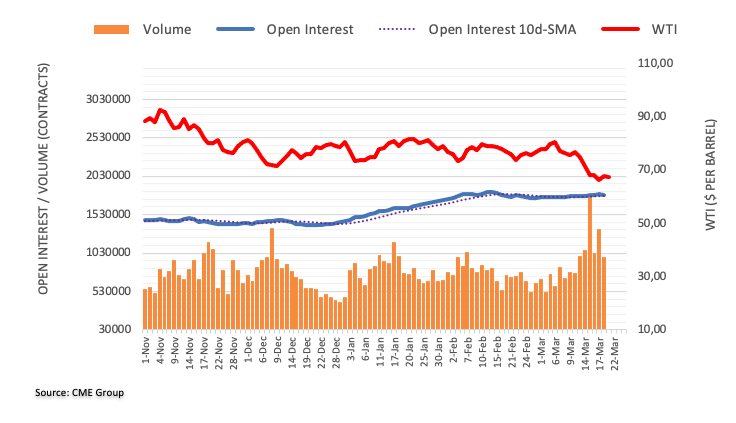

- WTI Price Rebound: Relief rally amid US intervention in banking turmoil.

- Russian President Putin welcomed the Chinese proposal for de-escalation in Ukraine.

- OPEC struggles to maintain elevated oil prices despite production cuts.

WTI prices experienced a sharp rebound after finding support around the $64 mark. This relief rally was fueled by US authorities' intervention to address the ongoing banking turmoil. US Treasury Secretary Janet Yellen stated on Tuesday that the government is prepared to intervene and provide deposit guarantees to all small US banks if needed amidst the banking crisis.

In addition, at the conclusion of Chinese President Xi's state visit to Moscow, a joint statement was issued. Russian President Putin welcomed the Chinese proposal of a 12-point paper calling for a de-escalation and eventual ceasefire in Ukraine, although it lacks details on how to end the war. Putin suggested that Chinese proposals could form the basis of a peace settlement in Ukraine, but noted that the West and Kyiv were not yet prepared.

Both of these developments positively impacted risk appetite, causing WTI prices to surge toward the $70 mark.

On the Organization of the Petroleum Exporting Countries (OPEC) front, Russian Deputy Prime Minister Alexander Novak announced on Tuesday that Russia will maintain a 500,000 barrels per day oil production cut until the end of June. In light of the current market situation, the decision to voluntarily reduce production by 500K bpd will remain in effect until June 2023.

Despite numerous efforts from OPEC nations, they have been unable to keep oil prices at elevated levels. Major oil traders and energy hedge funds, such as Andurand Capital, have argued that the current oil price downturn is speculative and not based on fundamentals. It will be important to observe how OPEC addresses these corrective declines in oil prices.

Levels to watch

- Silver price is auctioning in a 50-pip range for the past two sessions ahead of the interest rate decision by the Fed.

- The Fed will face a difficult balancing act between banking sector turmoil and persistent inflation.

- Two-day winning spell by S&P500 indicate that investors’ risk appetite is solid.

Silver price (XAG/USD) has rebounded firmly from $22.20 in the early Asian session. The white metal has been consolidating in a range of $22.20-22.70 for the past three trading sessions. The asset is expected to remain inside the woods ahead as pre-Federal Reserve (Fed) anxiety could come into play despite the odds favoring a consecutive 25 basis point (bp) rate hike to 4.75-5.00%.

Fed chair Jerome Powell couldn’t take risk of a revival in the inflationary pressures, therefore, the central bank would continue its policy-tightening spell to keep weighing on the Consumer Price Index (CPI). Analysts at Swedbank are sticking with their call that the Fed will hike rates by 25 bps both this week and at its May meeting. They further added, the Fed will, however, face a difficult balancing act between on the one hand being ready to support the financial sector, while also signaling further tightening is on the cards to tame inflation.

Commenting on the risk impulse, a two-day winning spell by S&P500 indicates that investors’ risk appetite is solid now, however, caution prevails as fears of a banking sector meltdown are not faded yet. The US Dollar Index (DXY) is juggling near 103.20 after failing to extend its recovery above 103.50. A sheer volatility would be visible in the USD Index if Fed decides to take an unchanged stance on interest rates as it is more versed in the situation of the banking sector.

Silver technical forecast

Silver price is demonstrating a sideways auction in the 50-pip range for the past two sessions on an hourly scale. The white metal is showing signs of weakness in the upside momentum, which indicates that a corrective move is on cards. The asset is putting efforts into keeping itself above the 20-period Exponential Moving Average (EMA) at $22.40.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in the 40.00-60.00 range, which indicates that investors are awaiting a new trigger for further action.

Silver hourly chart

-638150384867169601.png)

China President Xi Jinping and his Russian counterpart Vladimir Putin cemented friendship and jointly criticised the West, which moved to buttress Ukraine against Moscow's invasion with nearly $16 billion in financial aid and faster delivery of battle tanks, reported Reuters.

Developing story...

- EUR/GBP retreats from the key EMA convergence after rising the most in three months.

- Steady RSI, easing bearish MACD signals keep buyers hopeful backed by a clear upside break of two-week-old trend line.

- 200-EMA, 61.8% Fibonacci retracement constitutes strong support to challenge bears.

EUR/GBP treads water around 0.8810-15, after rising the most in three months, as it braces for the key UK data/events during early Wednesday.

In doing so, the cross-currency pair retreats from the convergence of the 21-day and 50-day Exponential Moving Average (EMA).

However, the recent easing in the bearish bias of the MACD signals and steady RSI joins the EUR/GBP pair’s successful break of a two-week-old descending trend line keep the buyers hopeful of crossing the 0.8820 resistance confluence.

Following that, a run-up towards the 0.8900 round figure can’t be ruled out.

However, a downward-sloping resistance line from mid-February, around 0.8920 by the press time, could challenge the EUR/GBP bulls afterward.

On the contrary, pullback moves gain importance if breaking the previous resistance line, around 0.8765 at the latest.

EUR/GBP: Daily chart

Trend: Further upside expected

- AUD/JPY formed a bullish harami candle pattern, suggesting the pair is upward biased.

- However, oscillators are still pointing south, so caution is warranted.

- AUD/JPY Price Analysis: Once it clears 89.00, that would pave the way toward 90.00.

The AUD/JPY trimmed some of its Monday losses on Tuesday and gained 0.16%. The pair formed a bullish harami two-candle pattern that could open the door for further gains, but firstly it needs to the region the 89.00 figure. At the time of writing, the AUD/JPY is trading at 88.32, up 0.01% as the Asian session begins.

AUD/JPY Price action

On Monday, the AUD/JPY printed a new YTD low at 87.12, then rallied above the 88.00 mark and registered a huge spinning top candlestick. On Tuesday, price action shrank, as usual, ahead of the US Federal Reserve’s (Fed) monetary policy meeting and formed a hammer. Additionally, price action was well contained within the previous day and formed a bullish harami. That said, the AUD/JPY is headed upward, although oscillators, such as the Relative Strength Index (RSI), stay in bearish territory.

Therefore, the AUD/JPY first resistance would be the March 21 high at 88.50, followed by the 89.00 mark. Once broken, the AUD/JPY would challenge the March 20 high at 89.23. A breach of the latter will expose the 20-day Exponential Moving Average (EMA) at 89.67. ahead of reaching 90.00.

In an alternate scenario, an AUD/JPY bearish continuation could happen if the pair dives below the March 21 lows of 87.71, putting into play a fall toward new YTD lows at 87.12.

AUD/JPY Daily chart

AUD/JPY Technical levels

“Will allocate more than 2 trillion yen from reserves for measures to cushion blow to economy from rising prices,” said Japanese Chief Cabinet Secretary Hirokazu Matsuno during early Wednesday in Asia.

Reuters also mentioned that Matsuno made the comment at a government meeting to decide on the package of measures, which includes fresh cash payouts to low-income households and subsidies to curb households' electricity bills.

The news confirms the previous day’s headlines from Japanese media Yomiuri that signaled the government’s efforts to defend the citizens from rising prices. The news also stated that the subsidies on Liquefied Petroleum (LP) gas is recommended for low-income households.

“The pillar is to add a total of 1.2 trillion yen to the “regional revitalization temporary subsidy” that promotes measures at the discretion of local governments, so that they can respond more flexibly to the actual situation of the region,” said Yomiuri before the latest decision.

Also read: USD/JPY finds stability near 132.50, as market eagerly awaits the Fed’s decision

- NZD/USD is looking to recapture the immediate resistance of 0.6200 amid the risk-on mood.

- The Fed is preparing for a consecutive 25bp rate hike despite fears of a banking sector meltdown.

- The demand for US Existing Home Sales soared amid cracked-down prices.

The NZD/USD pair has shown a recovery move from 0.6167 and is focusing to recapture the round-level resistance of 0.6200 in the early Asian session. The upside bias in the kiwi asset looks solid despite the Federal Reserve (Fed) is preparing for a consecutive 25 basis point (bp) rate hike for its March monetary policy.

S&P500 carry forwarded Monday’s recovery in Tuesday’s session and settled it on a promising note. This portrays a risk-on market mood as investors have digested the continuation of the policy-tightening spree by the Fed. The US Dollar Index (DXY) is struggling in maintaining its auction above 103.20 as investors are still not convinced that a liquidity influx of $30 billion into the First Republic Bank would safeguard it from the debacle.

Apart from the interest rate decision, guidance on borrowing rates through the Dot plot, inflation projections, and updates on the banking fiasco will be of utmost importance. Economist at UOB Group Lee Sue Ann suggested the Fed is likely to raise the Fed Funds Target Range by 25 bps at both its March and May gatherings. Fed chair Jerome Powell to bound to bring down the stubborn inflation and it would be interesting to see how he would handle the sticky inflation amid the banking sector shakedown.

On Tuesday, a solid recovery in United States Existing Home Sales data conveyed that the demand for real estate is recovering. Existing Home Sales in the US rose by 14.5% in February to an adjusted annual rate of 4.58 million, the National Association of Realtors (NAR) reported. It seems that cracked prices of real estate due to prolonged weaker demand amid higher interest rates have infused confidence among home buyers.

Meanwhile, the New Zealand economy is struggling to revive after the flood situation, which resulted in superlative liquidity flush into the economy and a vulnerable growth rate. However, the Reserve Bank of New Zealand (RBNZ) would continue to elevate the Official Cash Rate (OCR) to scale down persistent inflation.

- GBP/JPY remains sidelined after rising the last two consecutive days.

- Recovery in yields favors bulls ahead of the key day comprising multiple data/events.

- Japan’s return from holiday, UK House of Commons vote on Brexit bill and British CPI for February in focus.

GBP/JPY remains mildly offered near 161.70 as it pares the recent gains ahead of the key day, snapping two-day uptrend at the latest.

In doing so, the cross-currency pair justifies the market’s fears amid negative reception of UK PM Rishi Sunak’s Brexit deal among some of the fellow Conservatives and the European Research Group (ERG). On the same line could be the looming fears of the Bank of England’s (BoE) likely dovish hike as the banking crisis challenges the “Old Lady”, as the UK central bank is informally known.

It should be noted that the recovery in the US Treasury bond yields and Tuesday’s holiday in Japanese markets allowed the quote to remain firmer of late. That said, the US 10-year and two-year Treasury bond yields stretched late Monday’s bounce off the lowest levels since September 2022 to 3.60% and 4.18% respectively.

While tracing the latest rebound in the bond coupons, the comments from the US policymakers, as well as actions, to tame the fears emanating from the latest banking fallouts gain major attention. Among them, US Treasury Secretary Janet Yellen’s comments gained major attention as she said, "Treasury, Fed, FDIC actions reduced risk of further bank failures that would have imposed losses on deposit insurance fund." Earlier on Tuesday, Bloomberg shared the news stating that the “US officials are studying ways they might temporarily expand Federal Deposit Insurance Corporation (FDIC) coverage to all deposits, a move sought by a coalition of banks arguing that it’s needed to head off a potential financial crisis.”

It should be noted that the talks of the US authorities discussing ways to surpass Congress to defend the banks also seem to have underpinned the yields and the GBP/JPY rebound.

However, the cautious mood ahead of today’s UK’s Consumer Price Index (CPI) data for February, expected 9.8% YoY versus 10.1% prior, prod the bulls. On the same line is the anxiety surroudning Brexit voting in the UK’s House of Commons amid recent rejections from the European Research Group (ERG) and the Democratic Unionist party (DUP).

Technical analysis

GBP/JPY grinds higher between a one-month-old descending resistance line and an ascending support line from mid-January, respectively near 163.30 and 160.75 in that order.

- USD/JPY gains ground, as the rising US Treasury yields boost the currency pair.

- FOMC meeting takes center stage with markets converging on a 25 bps rate hike consensus.

- Banking development and diplomatic developments supporting USD/JPY resurgence.

USD/JPY finds some respite on the back of rising US Treasury (UST) bond yields. U.S. Treasury Secretary Janet Yellen informed bankers on Tuesday that she is ready to intervene to protect depositors in smaller U.S. banks amid contagion concerns.

The strong commitment from US officials has ignited a positive risk appetite, leading Wall Street to close Tuesday on a positive note. UST yields experienced a strong bounce as investors moved away from bonds and into riskier assets.

Tuesday's upbeat sentiment received additional support from a meeting between Chinese President Xi and Russian President Putin. Putin suggested that Chinese proposals could form the basis of a peace settlement, but noted that the West and Kyiv were not yet prepared.

Investors' attention has now shifted to the FOMC meeting on Wednesday, as volatility subsided due to increased stability in the banking sector. Markets are pricing in an 85% chance of a 25-basis-point (bps) rate hike from the Federal Reserve (Fed).

Despite the ongoing banking turmoil, the market is finding consensus for a 25 bps rate hike, following the argument that liquidity injections and rate hikes can both occur simultaneously.

It is likely that the US Treasury will take measures to support deposit guarantees, despite opposition from some senators. However, such a support plan must first pass through the parliamentary process.

Given that the summary of projections for the upcoming Fed meeting was conducted before the banking turmoil, the focus will shift to the accompanying statement and dot plots. The most crucial aspect will likely be the opening remark during Fed Chair Powell's press conference and his assessment of the ongoing banking crisis.

Any indication of a pause in rate hikes is expected to be positive for risk assets.

Levels to watch

- USD/CHF turns neutral bearish after dropping below the 50/20 day EMAs.

- USD/CHF Price Analysis: Downward is biased in the near term and might fall beneath 0.9200.

USD/CHF erased Monday’s gains and fell below crucial technical indicators on Tuesday. A risk-on impulse and a soft UD Dollar (USD) were the main reasons for the USD/CHF pair fall. At the time of writing, the USD/CHF is exchanging hands at 0.9222.

USD/CHF Price action

From the daily chart perspective, the USD/CHF remains neutral-to-downward biased. After falling below the 50 and 20-day Exponential Moving Averages (EMAs) at 0.9290 and 0.9273, the USD/CHF accelerated its downfall toward the current exchange rates. Consequently, oscillators turned bearish, meaning the USD/CHF could dive toward the March 15 low at 0.9122.

The USD/CHF 4-hour chart portrays the pair as downward biased after breaking below the 0.9239-0.9317 range. Furthermore, the Relative Strength Index (RSI) is bearish, while the Rate of Change (RoC) shows sellers are in charge.

Therefore, the USD/CHF first support would be the 0.9200 figure. A breach of the latter will expose the S1 daily pivot at 0.9182, followed by the S2 pivot at 0.9142 and the 0.9100 mark. In an alternate scenario, the USD/CHF first resistance would be the daily pivot at 0.9250, followed by the R1 pivot point at 0.9288, before testing 0.9300.

USD/CHF 4-hour chart

USD/CHF Technical levels

- USD/CAD struggles to defend the bounce off two-week low inside short-term triangle.

- Convergence of 50-SMA, triangle’s top line challenge Loonie pair buyers.

- Bears have a bumpy road to travel before retaking control.

- Sustained trading beyond key SMA, bullish chart pattern and absence of momentum-negative oscillators favor buyers.

USD/CAD grinds near 1.3715-20 as it resists welcoming bulls during the initial hours of the Federal Reserve (Fed) day. In doing so, the Loonie pair struggles to extend the previous day’s recovery moves from the lowest levels in a fortnight inside a two-week-old descending triangle formation.

That said, the quote’s latest hesitance could be linked to the failure to cross the 1.3730 resistance confluence including the 50-SMA and upper line of the stated triangle.

However, the Loonie pair’s ability to provide successful trading above the key SMAs joins the bullish MACD signals and firmer RSI (14), not overbought, keeps the USD/CAD bulls hopeful of overcoming the 1.3730 hurdle.

In that case, the buyers could aim for the monthly high surrounding 1.3865, with the 1.3800 round figure acting as an intermediate halt, before portraying a run-up towards the previous yearly top of 1.3977 and then to the 1.4000 psychological magnet.

On the flip side, the USD/CAD bears need validation from the stated triangle’s lower line, close to 1.3650. Even so, the 200-SMA support near 1.3575 appears a crucial challenge for the sellers to tackle. It’s worth noting that the 100-SMA can offer immediate support near 1.3695.

Overall, USD/CAD is likely to remain firmer but the immediate pullback can’t be ruled out.

USD/CAD: Four-hour chart

Trend: Further upside expected

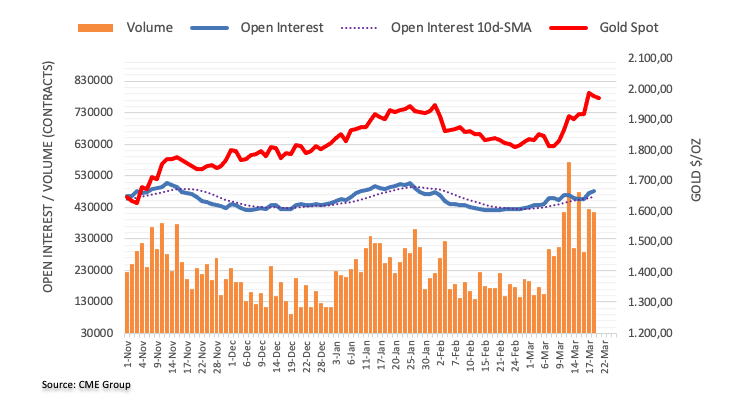

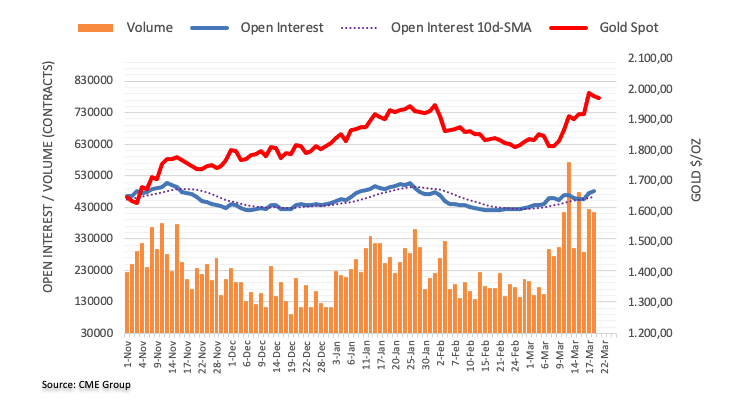

- Gold bulls are being squeezed in a strong bearish correction.

- All eyes turn to the Fed as the next catalyst.

Gold price sold off nicely on Tuesday in textbook fashion as the technical analysis below illustrates. The yellow metal dropped from a high of $1,970 and melted into a low of $1,935. The fall follows a move up above $2,000 intraday Monday, the highest level since Russia's invasion of Ukraine early last year.

Gold prices are pressured with the 10-year government bond rebounding on Tuesday, making it more appealing to hold Treasurys than gold as we head into the Federal Reserve interest rate decision on Wednesday. The central bank is expected to raise interest rates by a quarter-percentage point which could further cool gold's rally even further.

All in all, it was a risk on tone across markets that has weighed on the Gold price whereby the market now sees a roughly 80% chance of a 25bp hike. However, analysts at ANZ Bank argued that ´´this would ultimately support the precious metals sector.´´

Meanwhile, analysts at TD Securities argued that, ´´looking forward, we still could see substantial CTA buying activity above the $2,045 mark, but the journey towards this key trigger level will require additional discretionary interest. This puts the focus on the Fed meeting, where we expect a dovish 25bp hike.´´

´´In contrast,´´ they said, ´´we could see some marginal selling activity below the $1,950 mark, but expect that the combination of strong physical demand and resurgent investor flows should keep prices from tumbling.´´

Gold technical analysis

In the prior analysis, above, it was stated that ´´the Gold price could be forming a topping pattern in the right-hand shoulder of the head and shoulders on the 4 and 1-hour charts:

Gold price update

The head and shoulders played out and now the price is on the backside of a critical trendline.

However, there are prospects of a meanwhile correction into the Fibonacci scale prior to the next surge to the downside.

- EUR/USD is juggling around 1.0780, gathering strength for a fresh upside.

- Odds are favoring that the Fed would go for hiking rates despite knowing the banking sector debacle.

- Eurozone-ZEW Survey dropped to 10.0 after a five-month rising spell.

The EUR/USD pair has turned sideways in the early Tokyo session after printing a fresh five-week high at 1.0788 on Tuesday. The major currency pair has been underpinned despite the odds favoring a 25 basis point (bp) rate hike by the Federal Reserve (Fed). As per the CME Fedwatch tool, more than 87% chances are in favor of a 25 bps rate hike, which would push rates to 4.75-5.00%.

The context that has spooked the market’s sentiment is that Fed chair Jerome Powell would go for hiking rates despite knowing the banking sector debacle whose consequences are yet to be faced ahead.

Meanwhile, a two-day winning spell by S&P500 has shown that the market is trying hard to revive itself from the banking sector shakedown. The risk appetite theme has also weighed on the US Dollar Index (DXY). The USD Index looks vulnerable above 103.00 and is prone to further downside.

On the Eurozone front, the banking sector debacle has hurt the sentiment of the market participants. Eurozone-ZEW Survey that considers the sentiment of institutional investors dropped to 10.0 after a five-month rising spell.

EUR/USD is struggling to extend the 50% Fibonacci retracement (placed from February 01 high at 1.1033 to March 15 low at 1.0516) at 1.0776 on a four-hour scale. Usually, a perpendicular rally in an asset is followed by a mean reversion to near the 20-period Exponential Moving Average (EMA), which is hovering around 1.0711, at the time of writing.

The Relative Strength Index (RSI) (14) is oscillating in the bullish range of 60.00-80.00, which indicates that the upside momentum is active.

For further upside, the shared currency pair needs to surpass the immediate resistance plotted from January 20 low at 1.0802, which will drive the asset toward January 18 high at 1.0887 and the round-level resistance at 1.0900.

On the flip side, a downside break below March 17 low at 1.0612 would drag the shared currency pair toward March 16 low at 1.0551, followed by March 15 low at 1.0516.

EUR/USD four-hour chart

- GBP/USD picks up bids to reverse the first daily negative close in four, grinds higher of late.

- Improvement in market sentiment, US Treasury bond yields allow US Dollar to stabilize near multi-day low.

- Mixed concerns over Brexit deal’s acceptance, hawkish Fed bets tease sellers.

- UK inflation data for February will be the key ahead of “Super Thursday”.

GBP/USD stays defensive around 1.2220-10 as the Cable bears struggle to keep the reins after entering the ring for the first time in four days. Also challenging the quote could be the market’s cautious mood ahead of the key data/events as the Federal Reserve (Fed) decision data begins.

The Cable pair’s latest losses could be linked to the improvement in the market’s sentiment and a rebound in the US Treasury bond yields that allowed the US Dollar to pro recent south-run at the five-week low.

Behind the moves could be the comments from the US policymakers, as well as actions, to tame the fears emanating from the latest banking fallouts.

Among them, US Treasury Secretary Janet Yellen’s comments gained major attention as she said, "Treasury, Fed, FDIC actions reduced risk of further bank failures that would have imposed losses on deposit insurance fund." Earlier on Tuesday, Bloomberg shared the news stating that the “US officials are studying ways they might temporarily expand Federal Deposit Insurance Corporation (FDIC) coverage to all deposits, a move sought by a coalition of banks arguing that it’s needed to head off a potential financial crisis.”

Amid these plays, the benchmark Wall Street indices closed with more than 1.0% daily gains each whereas the US 10-year and two-year Treasury bond yields stretched late Monday’s bounce off the lowest levels since September 2022 to 3.60% and 4.18% respectively.

Looking ahead, the GBP/USD pair appears more interesting to watch as Brexit voting in the UK’s House of Commons will be crucial amid recent rejections from the European Research Group (ERG) and the Democratic Unionist party (DUP).

Also important will be the UK’s Consumer Price Index (CPI) data for February, expected 9.8% YoY versus 10.1% prior, as the same could hint at the Bank of England’s (BoE) action on the “Super Thursday”.

Above all, the Federal Reserve’s (Fed) reaction to the banking crisis will be crucial to watch for clear directions as the 0.25% rate hike is already priced in.

Also read: Federal Reserve Preview: Powell to persevere and raise rates, US Dollar set to (temporarily) rise

Technical analysis

A four-month-old horizontal resistance area surrounding 1.2270-90 challenges the GBP/USD bulls cheering a sustained break of the 50-DMA hurdle surrounding 1.2145.

- AUD/USD is struggling in extending its recovery above 0.6670 ahead of Fed policy.

- RBA policymakers still believe that Australian inflation could show volatility in the inflation monthly figures.

- A two-day winning spell in S&P500 is conveying confidence among investors despite fears of potential banking shakedown.

The AUD/USD pair is facing barricades in extending its recovery move above the immediate resistance of 0.6670 in the early Asian session. The Aussie asset is expected to remain volatile ahead as investors are awaiting the Federal Reserve (Fed) monetary policy for fresh impetus. The Australian Dollar remained in action on Tuesday after the release of the Reserve Bank of Australia (RBA) monetary policy minutes.

According to the RBA minutes, policymakers were considering a pause in the tightening process just after a two-month fall in the monthly Consumer Price Index (CPI) numbers. However, RBA policymakers still believe that Australian inflation could show volatility in the inflation figures on a month-on-month basis. Also, the surety lacks that inflation has peaked now.

Meanwhile, S&P500 continued its recovery move firmly on Tuesday, portraying a steep rise in the risk appetite of the market participants. A two-day winning spell is conveying confidence among investors despite fears of potential banking shakedown after the collapse of three mid-size United States banks in a span of one week.

The US Dollar Index (DXY) has shown a recovery move from the cushion of 103.00 and sheer volatility is expected as investors are likely to react to changing odds for the interest rate decision by the Fed. Odds for an unchanged policy are solid as the street anticipates that further rate hikes by the fed would be unable to restore the confidence of investors after banking sector fiasco. Also, investors are worried that a liquidity influx of $30 billion into First Republic Bank is unable to get the institution out of trouble.

- The S&P 500, the Dow Jones, and the Nasdaq 100 advanced sharply in the day.

- US Treasury bond yields climbed ahead of the FOMC’s meeting.

- Investors focus shifted toward the Federal Reserve’s monetary policy decision.

Wall Street finished the day with gains, spurred by optimism in the financial markets, which triggered gains in the S&P 500, the Dow Jones, and the heavy-tech Nasdaq Composite. As the New York session ended, the S&P 500 gained 1.3%, 4,002.87, while the Dow Jones climbed 0.98%, 32,560.60. The Nasdaq Composite led the pack, up 1.58%, at 11,860.11.

US equities rose, sponsored by a risk-on impulse

Investors had shrugged off the banking system’s woes. On Tuesday, the Secretary of Treasury Janet Yellen stated that if regulators perceive a potential run on the banking system, the federal government could intervene to safeguard depositors at more banks. Data-wise, Existing Home Sales in the United States (US) rose above the prior’s month figures as lower mortgages boosted sales. Existing Home Sales in February rose by 14.5% MoM, crushing the 5% consensus, and ended a 12-month run of declines in sales.

Aside from this, US Treasury bond yields jumped, with 2s and 10s gaining 18 and 12 basis points, respectively, ahead of tomorrow’s Federal Reserve’s decision. The US 2-year Treasury bond yield is 4.179%, while the 10-year rate is 3.607%.

Traders focus shifted toward the US Federal Reserve monetary policy decision, with investors expecting a 25 bps rate hike by the Fed. However, tomorrow’s spotlight would be Fed Chair Jerome Powell’s press conference, which would be scrutinized by investors expecting Powell to deliver any forward guidance.

Sector-wise, Energy, Consumer Discretionary, and Financials led the pack, each up 3.45%, 2.71%, and 2.54%. Contrarily, Utilities, Real Estate, and Consumer Staples finished with losses of 2.05%, 0.66%, and 0.12%m respectively.

In the FX space, the US Dollar Index (DXY), a measure that tracks the buck’s value against a basket of six currencies, lost 0.09%, down at 103.214, after hitting a YTD low of 103.000.

What to watch?

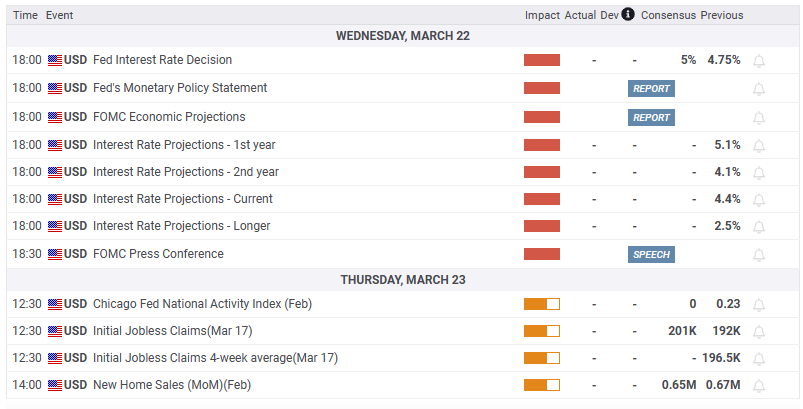

The US calendar will feature the Federal Reserve Open Market Committee (FOMC) monetary policy meeting, alongside the Fed Chairman Jerome Powell press conference, at around 18:00 and 18:30 GMT.

S&P 500 Daily chart

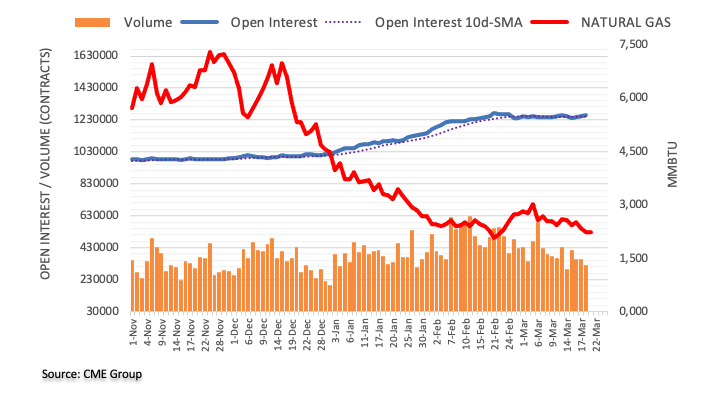

- Crude is higher as investors regained some confidence in the economic outlook

- WTI traders turn to the Fed for the next catalyst.

West Texas Intermediate WTI crude is trading up by some 2.4% towards the close on Wall Street and rallied from a low of $66.96 to a high of $69.72 as investors regained some confidence in the economic outlook following the weekend rescue of Credit Suisse.

Meanwhile, the Federal Reserve will announce the interest rate decision on Wednesday after it began its two-day meeting on Tuesday whereby markets are pricing in the likelihood that it will end with a quarter-point hike to interest rates. Swiss authorities helped to calm market fears of an extended banking crisis and crude prices are now 3.9% higher since the week began after dropping by 13% last week. The black gold has also rallied as investors rushed back into risk assets following more assurances from regulators on support for the US banking sector. T

´´The potential expansion of FDIC’s coverage to all deposits soothed concerns of further bank runs. The support was aided by further supply-side issues. Russian extended its 500kb/d crude output cut through June,´´ analysts at TANZ Bank explained.

´´This was based on current market conditions, according to Deputy Prime Minister Alexander Novak. This is despite tanker tracking data showing little sign of reduction in trade. Broader sentiment remains bullish, with top traders saying oil’s fundamentals are getting stronger. There are concerns that supply may also get hit more than demand amid the banking crisis. US shale output is most at risk from tighter credit conditions from regional US banks.´´

Meanwhile, we have the pair of weekly US oil inventory reports starting with trade group API today followed by the official EIA inventory data on Wednesday. The API has shown a large headline build vs. the draw expected.

Apart from that, traders are unlikely to position too heavily one way or another before the Federal Reserve makes its highly anticipated announcement on interest rates tomorrow. The central bank is still expected to continue to try and slow the US economy to lower inflation, despite the banking crisis and the fears it could spur a demand-destroying recession.

The Fed is expected to hike and take the Fed Funds rate to 4.75%-5.00%. There will also be the dot plot and the post-meeting communication is likely to emphasize that the Fed is not done yet in terms of tightening.

Analysts at TD Securities argued that the officials will likely be flagging the more uncertain economic environment.

´´Treasuries will react to the Fed's messaging around future hikes and the dot plot. Any hint that the Fed will stop hikes due to stability worries could create an outsized market reaction,´´ the analysts said. ´´Messaging and dot-plot will be critical. Our base case is hawkish which poses a risk that STIR vol persists, (The short-term interest rate (STIR) analytics)´´

Here is what you need to know on Wednesday, March 22:

Wall Street indexes rose sharply on Tuesday ahead of the Federal Reserve decision, led by shares of regional banks. First Republic stock rose 29%. The Dow Jones gained 0.98%, and the Nasdaq advanced 1.58%. Banking fears keep easing, paving the way for more tightening from central banks.

US Treasury Secretary Janet Yellen said the US banking system is sound and mentioned the government is ready to take more action to help bank depositors.

US yields rose sharply, with the 10-year reaching 3.60% and the 2-year 4.17%. The German 10-year yield jumped almost 8% to 2.29%.

Data released in the US showed Existing Home Sales jumped 14.5% in February, above the 5% of market consensus, to a 4.58 million-unit pace, the largest monthly increase since December 2015, excluding the volatile pandemic era. The Philly Fed Non-Manufacturing dropped to -12.8 in March.

On Wednesday, the Fed is expected to raise rates by 25 bps; however, there are also calls for a no change and even for a rate cut. Analysts will watch the decision, the projections, the statement and Powell’s words closely. As a result, traders should expect high volatility during the American session.

Federal Reserve Preview: Powell to persevere and raise rates, US Dollar set to (temporarily) rise

EUR/USD rose for the fourth consecutive day, approaching 1.0800 on Tuesday. The pair reached monthly highs before losing momentum. The Euro was among the biggest gainers as the banking crisis eased, suggesting the European Central Bank (ECB) could raise rates further if needed.

GBP/USD pulled back from six-week highs near 1.2300 to 1.2178 and then climbed back above 1.2200. On Wednesday, key inflation data and retail sales are due in the UK. On Thursday, the Bank of England (BoE) will announce its policy decision.

USD/JPY rose to the 132.50 area, having the best day in two weeks, boosted by higher government bond yields. The Japanese Yen was also affected by risk-on flows.

USD/CHF fell from above 0.9300 toward 0.9200. The Swiss National Bank (SNB) will announce its monetary policy decision on Thursday. Market consensus if for a 50 bps rate hike; however some analysts forecast a smaller hike given recent market volatility and uncertainty around the Swiss banking system.

USD/CAD rebounded sharply from weekly lows under the critical 1.3650 area toward 1.3740. Inflation data in Canada showed the Consumer Price Index dropped from 5.9% to 5.2%, the lowest level in 13 months. The Loonie rose for the second day in a row versus AUD and NZD.

AUD/USD and NZD/USD pulled back from weekly highs to 0.6175 and 0.6650, respectively, despite the improvement in global market sentiment. Reserve Bank of Australia (RBA) minutes suggested the central bank is considering a pause at the next meeting.

XRP rose 30% and Bitcoin gained 1.50% on Tuesday and settled at $28,280. So far, in 2023, the largest cryptocurrency has risen 70%.

Gold corrected further to the downside, losing $30 and bottomed around $1,935, weighed by surging US yields.

Crude oil prices rose again, extending the recovery from multi-month lows. The WTI barrel gained 2.49%, approaching $70.00, helped by the better mood across financial markets.

Like this article? Help us with some feedback by answering this survey:

- EUR/GBP bulls capped at the day´s highs ahead of key central bank meetings.

- Eyes are on the BoE, UK data and the Fed.

EUR/GBP is up some 1% on the day but is running into offers at the high of 0.8840. The British Pound came under pressure ahead of the Federal Reserve and Bank of England (BoE) which are both due to meet this week.

Interest rate expectations have shifted dramatically during a tumultuous few weeks in financial markets owing to the risks of contagion in the banking sector. First of all, the Federal will announce its next rate decision on Wednesday, while the Bank of England will convene on Thursday.

As of Tuesday morning, markets were pricing in a 44% chance of no change from the Bank of England, and a 56% chance of a 25 basis-point increase. We will have the United Kingdoms' inflation data on Wednesday also and traders will be looking to this for prospects of some easing.

Analysts at TD Securities say that headline inflation likely fell 0.2ppts in March, in line with the MPC's forecast, on the back of another decline in petrol prices. ´´A shortage of certain vegetables and fruits adds some upside risk to the print. We also expect a rebound in hotel prices and continued strong core goods momentum to keep core inflation elevated.´´

Meanwhile, the Federal Reserve is expected to hike buy maybe just 25bp, taking the Fed Funds rate to 4.75%-5.00%. There will also be the dot plot and the post-meeting communication is likely to emphasize that the Fed is not done yet in terms of tightening.

Analysts at TD Securities argued that the officials will likely be flagging the more uncertain economic environment.

´´Treasuries will react to the Fed's messaging around future hikes and the dot plot. Any hint that the Fed will stop hikes due to stability worries could create an outsized market reaction,´´ the analysts said. ´´Messaging and dot-plot will be critical. Our base case is hawkish which poses a risk that STIR vol persists, (The short-term interest rate (STIR) analytics)´´

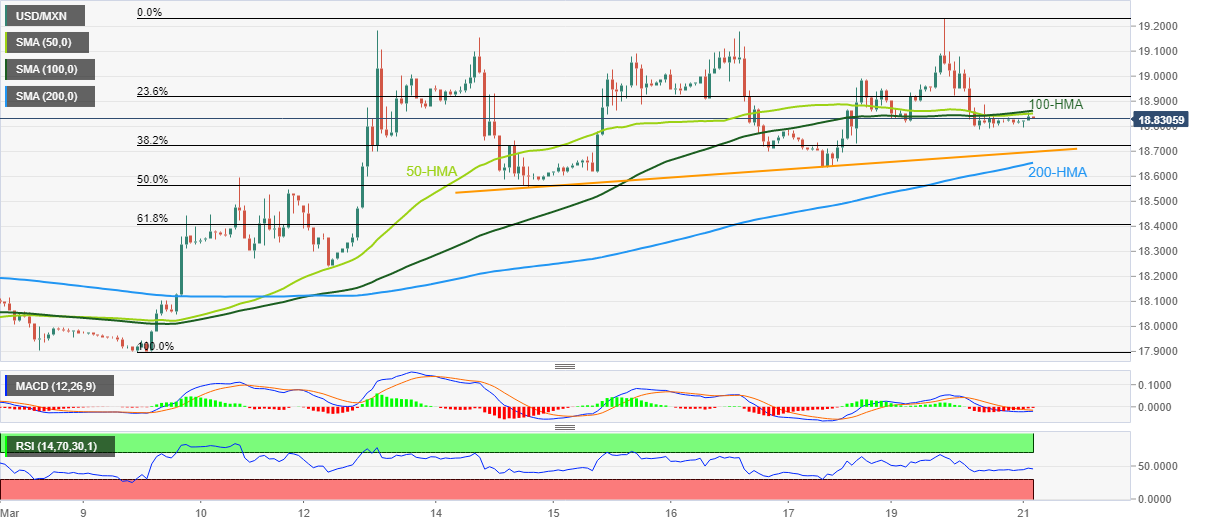

- USD/JPY is on the backside of the prior bear trend which gives a bullish bias.

- A 50% mean reversion comes in at 131.80 meeting the neckline structure.

USD/JPY is up on the day by some 0.9% as the pair moves in on prior resistance near 132.60, making its way to the backside of the prior bearish trend. This leaves the outlook bullish for the days ahead.

Meanwhile, the Federal Reserve began a two-day meeting earlier on Tuesday and the central bank is expected to raise interest rates by 25 basis points on Wednesday, or skip a chance at raising borrowing costs this month.

The following illustrates the technical outlook as per the falling wedge on the 4-hour charts and the W-formation:

USD/JPY H4 charts

The W-formation shows the price meeting prior resistance and a restest of the neckline, which would be expected to act as support, could be the final show from the bears as bulls take control.

The price is on the backside of the prior bear trend and a 50% mean reversion comes in at 131.80 meeting the necklines structure.

- XAG/USD drops on risk-on mood and technical factors as a dragonfly doji emerges.

- If the XAG/USD drops below $22.00, sellers would face support barricades in the $21.80-90 area.

- XAG/USD Price Analysis: To consolidate around familiar levels ahead of the FOMC’s decision.

Silver price reversed its bullish course, dropping around 1.20% late in the mid-North American session. After hitting a seven-week high of $22.71 on Monday, the XAG/USD has retraced some of those gains, trading nearby March’s 20 daily low of $22.22. At the time of writing, the XAG/USD is trading at $22.29, down 0.27 percent.

XAG/USD Price action

The week began with the white metal printing a new multi-week high before reversing and closing above $22.50. On its way north, the XAG/USD reclaimed the 200-day EMA, shifting the white metal bias to neutral upwards. Nevertheless, a dragonfly doji emerged at the daily, exacerbating Silver’s fall toward the $22.20 area.

If XAG/USD tumbles below $22.00, that would pave the way for a dip to the 50-day EMA at $21.91, immediately followed by the 100-day EMA At $21.89. Once cleared, the 200-day EMA at $21.81 would be next, ahead of falling to the 20-day EMA at $21.60.

Conversely, the XAG/USD first resistance would be the March 17 daily high at $22.59, followed by the March 20 high at $22.71. Upside risks remain above $23.00.

XAG/USD Daily chart

XAG/USD Technical levels

- GBP/USD bulls are in the market ahead of the central banks.

- Bulls are the front side of the bullish trend leaving the bias bullish near and longer term.

GBP/USD is grappling with the 1.22 area on Tuesday, keeping close to an almost seven-week high as traders reckoned banking stress could keep the Federal Reserve and the Bank of England from hiking rates much further.

The pair is on the front side of the bullish trend as we head into the central bank meetings this week and a multi-timeframe analysis determines a bullish bias for both the near-term and longer term as follows:

GBP/USD H1 chart

From an hourly perspective, the bulls are in control but the recent drop leaves prospects of some consolidation for the foreseeable sessions into the Federal Reserve event on Wednesday.

GBP/USD monthly chart

Zooming all the way out, the monthly chart shows that the market broke structure near 1.2245 but failed to hold above. The correction was relatively shallow so there are risks of a deeper move into the Fibonacci scale to at least test the 1.1650s and a 38.2% ratio. With that being said, there is just as much chance that the bulls will stay committed.

GBP/USD weekly charts

Afterall, on the weekly chart, the bear trend was broken and support has held so far.

This leaves an upside bias for the weeks ahead.

The price is in a box and there are equal highs and lows on both sides with liquidity above and below. However, the bullish bias persists while the price is on the backside of the prior bearish trend and in a phase of accumulation.

GBP/USD daily chart

There are also inverse head and shoulders on both the daily and 4-hour charts.

GBP/USD H4 charts

The 4-hour chart´s H&S´s neckline is already broken.

The M-formation is a reversion pattern and the price is being supported on the front side of the bullish trend.

- EUR/USD stays firm above 1.0750s ahead of the Federal Reserve’s March meeting.

- ECB policymakers have not expressed on monetary policy and stayed focused on banks.

- Traders are expecting a 25 bps rate hike by the Fed at its March meeting.

EUR/USD extends its rally to four consecutive days, spurred by an improvement in market sentiment after a two-week turbulence in the financial markets. Woes linked to the banking system crisis eased after UBS took over Credit Suisse, and US banks provided aid to First Republic Bank. At the time of writing, the EUR/USD is trading at 1.0774 after hitting a low of 1.0703.

EUR/USD advances amidst the lack of fresh catalyst, soft USD

Wall Street extends its recovery to two consecutive days, with the major stock indices gaining between 0.51% and 0.96%. Global authorities stepping in to reassure that the crisis would not blow up and trigger another financial crisis increased the appetite for risk-perceived assets. The US Dollar (USD), a safe-haven play, continues to drop, as shown by the US Dollar Index (DXY). The DXY is down 0.05%, at 103.253.

The EUR/USD continued to rally to a five-week high of 1.0788 but fell shy of testing the 1.0800 mark. European Central Bank (ECB) policymakers have been crossing newswires, mainly discussing the Eurozone’s (EU) banking system and liquidity conditions amidst a period of higher interest rates.

US data-wise, the economic docket revealed that Existing Home Sales exceeded estimates in February, due to falling mortgage rates, after dropping for 12 straight months, evidence that the housing market could be stabilizing.

Meanwhile, traders focus shifted to the FOMC’s monetary policy decision. The Fed has the challenge of providing stable prices and financial stability. Given that inflation stays at three times the Fed’s target, the Fed could take a page of the Bank of England’s (BoE) blueprint for handling financial stability.

Last year, the BoE had to step up and provide liquidity to calm the markets. Yet the BoE tightened monetary policy in November and hiked rates by 75 bps. Therefore, if the Federal Reserve follows that path and delivers a hawkish hike, the EUR/USD might reverse course and erase some of the last four days’ gains below 1.0700.

EUR/USD Technical analysis

The EUR/USD formed a triple bottom at the daily chart. Since then, the shared currency (EUR) rallied above the March 15 high of 1.0759 and validated the pattern. Therefore, the EUR/USD initial target profit would be 1.1000, but the EUR/USD needs to hurdle some resistance levels on its way north.

The first resistance would be 1.0800, followed by the 1.0900 figure. Once cleared, the next stop would be the February 3 daily high at 1.0940, followed by the 1.1000 mark.

- US Dollar gains momentum as US yields rise ahead of FOMC decision.

- Canada: CPI rose 0.4% in February, core up 0.5%.

- USD/CAD support at 1.3650 remains in place.

The USD/CAD bottomed at 1.3643 following the release of Canadian inflation, the lowest since March 7 and then rebounded sharply amid a stronger US Dollar, approaching 1.3740.

The move to the upside occurred amid rising US yields that boosted the Greenback. The US 10-year yield approached 3.60% and the 2-year is back above 4.00%.

The Federal Reserve started on Tuesday it's two-day meeting. On Wednesday, the US central bank is expected to announce a 25 bps rate hike to 4.75% - 5.00%. Attention is set on how the Fed assess current development regarding the banking sector. Ahead of the decision, the US Dollar is posting mixed results.

Canada's inflation keeps slowing

Data released on Tuesday showed the Consumer Price Index dropped to the lowest level in 13 months from 5.9% to 5.2%, below the 5.4% of market consensus; the core rate fell from 5% to 4.7%. The Loonie rose marginally after the report.

Despite falling versus the US Dollar on Tuesday, CAD is up for the second day in a row versus AUD and NZD.

The USD/CAD peaked during the American session at 1.3736 and it is hovering around 1.3730. It rose almost a hundred pips from the daily low.

The pair was rejected from under the key support area of 1.3350. If the Loonie consolidates below, more losses seem likely. On the upside, USD/CAD is testing a downtrend line, and above 1.3740, the upside could extend further.

USD/CAD 4-daily chart

-638150150344193554.png)

- Gold price drops on risk-appetite improvement, and US Treasury bond yields rising.

- US Treasury bond yields rise, with 10-year TIPS, a proxy for real yields advancing above 1.30%.

- The Federal Reserve will commence its two-day monetary policy meeting, expected to deliver a 25 bps rate increase.

Gold price is tumbling across the board, down more than $30.00 or 1.59%, as US Treasury bond yields rise, while risk appetite improvement dented Gold’s demand. Hence, US equities climb moderately as the Federal Reserve’s Open Market Committee (FOMC) meeting begins soon. At the time of writing, XAU/USD is trading at $1947.26 after hitting a daily high of $1985.08

Gold price tumbles on high US Real Yields, and traders booking profits

Traders’ fears calmed in the last 48 hours after the UBS takeover of Credit Suisse, and US banks continued to try to stabilize First Republic Bank. The Federal Reserve (Fed) would begin its March monetary policy meeting, with traders expecting the Fed to raise rates by 25 bps as Powell and Co. continued their efforts to curb stubbornly high inflation.

The XAU/USD retreated most of its gains after reaching a YTD high on Monday at $2009.75. Since then, the yellow metal plunged 3.09%, as traders apparently booked profits ahead of the FOMC’s meeting.

Money market futures anticipate an 83.4% chance for a quarter percent increase in the Federal Funds Rate (FFR), according to CME FedWatch Tool. However, there is still uncertainty around the potential outcome of Fed Chair Jerome Powell’s press conference, which could cause instability in financial markets.

Another reason for XAU/USD’s fall is that US Treasury bond yields are climbing. The US 10-year Treasury bond yield is 3.58%, up nine bps. The 10-year Treasury Inflation-Protected Securities (TIPS), a proxy for US Real Yields, stands at 1.351% after tumbling as low as 1.142% on March 16.

In the meantime, the US Dollar Index, a gauge of the buck’s value against six peers, is trimming some of its earlier losses after hitting a low of 103.00, down 0.03%, at 103.274.

Gold technical analysis

XAU/USD’s daily chart portrays a bullish bias in the yellow metal. However, price action in the last three days could form an evening star candlestick chart pattern. This means that Gold can drop in the near term. The first support would be the March 15 daily high turned support at $1937.31, followed by the $1900 barrier. Once cleared, the 20-day Exponential Moving Average (EMA) at $1892.89 is next, followed by the 50-day EMA at $1867.89.

What to watch?

Gold briefly exceeds $2,000 again for the first time in a year. Market’s expectations with respect to the Fed’s monetary policy are set to drive the yellow metal price action, economists at Commerzbank report.

Gold to rise towards $2,000 again if Powell fails to dampen rate cut expectations

“The gold ETFs tracked by Bloomberg registered inflows of just shy of 22 tons last week. The majority of last week’s inflows were registered in the world’s largest and most liquid gold ETF in the US, which is the preferred choice of professional investors.”

“What statements the Fed makes in its communiqué tomorrow about its future monetary policy, and what Fed Chair Powell says in the subsequent press conference about the interest rate outlook, are likely to play a key role. If they manage to dampen rate cut expectations, Gold is likely to fall. Otherwise, another rise towards the $2,000 mark is on the cards.”

See – Fed: Banks Preview, no pause yet, going ahead with 25 bps hike

How risky are EM currencies? Economists at Commerzbank analyze which currencies are more vulnerable to a coming crisis of the financial system.

For currencies with high-interest rates, central banks have more room to cut rates

“It would be presumptuous to explain, for example, the negative performance of LatAm currencies with inherently higher risk. I rather think one has to state a very simple correlation: For currencies with high-interest rates, central banks have more room to cut rates. Thus, if you want to arm yourself against a coming crisis of the financial system, you have to get out of such currencies.”

“Among the biggest losers, tragically, are the currencies whose central banks have so far pursued a particularly sound monetary policy and have been particularly aggressive in raising their key interest rates in response to the global inflation shock.”

The US Federal Reserve will announce its monetary policy decision on Wednesday, March 22 at 18:00 GMT and as we get closer to the release time, here are the expectations as forecast by analysts and researchers of 15 major banks.

Markets expect the Fed to raise its policy rate by 25 basis points to the range of 4.75-5% but there are too many uncertainties surrounding Fed's policy outlook after the Silicon Valley Bank (SVB) crisis.

ANZ

“Inflation remains a major problem for the Fed. We favour a 25 bps increase. The FOMC will debate the suitable course of action given recent developments. A pick-up in volatility, and thus tighter financial conditions, going into the meeting could force a pause. We think the Fed will stress that future rate decisions will depend on both the data and the functioning of the financial system. We expect Powell to stress that the Fed will do whatever is required to preserve financial stability to raise 75 bps on way to 5.0%, pivot data dependent.”

Commerzbank

“We now assume that the Fed will raise key rates by 25 bps. Otherwise, the markets would probably already safely assume that the interest rate cycle is at an end and that it is only a matter of time before the Fed cuts again. Then the Fed would first have to convince market participants again that it will continue to raise rates after a pause in order to fight inflation. This poses the risk of additional volatility in the markets. As for the outlook going forward, the current turmoil shows that the tighter monetary policy is having an impact and is leading to negative consequences in parts of the economy. Accordingly, the Fed is likely to proceed more cautiously and raise interest rates in 25 bp steps to 5.50% (previously, we expected 6.00%). Moreover, we see our forecast confirmed that the US economy will slide into recession in the second half of the year, to which the Fed is likely to respond with the first interest rate cuts in early 2024.”

Swedbank

“We stick to our call that the Fed will hike by 25 bps both this week and at its May meeting. The Fed will however face a difficult balancing act between on the one hand being ready to support the financial sector, while also signal further tightening is on the cards to tame inflation.”

ING

“With the ECB hiking rates by 50 bps without causing too many market ructions, this is likely to embolden the Fed to move by 25 bps.”

Erste Group Research

“We expect the following: In addition to a 25 bps hike in policy rates, the new survey of FOMC members should see rates peaking at about the same level as in December. This corresponds to rate hikes of another 50 bps from current levels. If the rate peak is seen higher, we expect to see accompanying softening statements that emphasize the high level of uncertainty and highlight the possibility of pauses in the ongoing process of monetary tightening. Anything that indicates a more cautious approach by the FOMC should be received positively by the markets.”

Danske Bank

“We like our call of a 25 bps rate hike this week and a terminal rate at 5.00-5.25% in May. Hence, we see modest upside risks to short-term rates from current levels.”

TDS

“We expect a 25 bps rate hike taking the Fed funds target range to 4.75%-5.00%. We anticipate that post-meeting communication will: (i) stress that the Fed is not done yet in terms of further tightening of its policy stance, (ii) acknowledge the more uncertain economic environment, with a large emphasis on data dependence, and (iii) underscore a willingness to guarantee sufficiently liquid market conditions.”

BMO

“We are holding to our call that the Fed will lift rates 25 bps to 4.75%-to-5.00%, assuming no major new news breaks before the meeting. We are also maintaining the view that they will deliver one final hike in May, and then hold at that 5.00%-to-5.25% range through the second half of the year.”

CIBC

“Our base case is that the Fed opts for a quarter point hike, dialing down what would have been a 50 bps move in the absence of the past week’s banking events, but likely showing a follow up quarter point move in the ‘dots’.”

Standard Chartered

“On balance, a 25 bps policy rate hike is more likely than flat; a 50 bps roll of the dice is unlikely. We expect the Fed to hold to QT for now but possibly open a door to slowing or a pause.”

SocGen

“We expect a 25 bps hike, although that expectation is conditioned on a gradual restoring of calm since the seizure of the three banks. The economic evidence validates a hike. Fear among depositors might demand a pragmatic response, which might be to pause. Powell warned in 2022 that the inflation fight could be painful. The Fed’s resolve is now being tested. It’s time to follow-up on those words with action.”

NBF

“We’ll be looking for a 25 bps rate increase. More important than the decision itself will be updated FOMC guidance. Until last week, it was clear that March’s new ‘dot plot’ would signal higher policy rates for the coming years. That has now been thrown into question in light of recent financial events. Markets are expecting rate cuts in the second half of the year, though we don’t think policymakers will be willing to signal this yet.”

CitiBank

“We expect a 25 bps rate hike to take the Fed Funds rate to 4.75-5.0%. Chair Powell is likely to emphasize inflation can be addressed through policy rates, while financial stability can be addressed through other tools. No hike might be interpreted as the Fed being aware of more problems in the banking sector than the public. We also expect median dot for year-end 2023 to rise 25 bps from 5.00-5.25 to 5.25-5.5% and 2024 dot to rise 25 bps. Fed will also update its quarterly economic forecasts.”

Wells Fargo

“We forecast that the FOMC will raise its target range for the federal funds rate to 5.00%-5.25% by June from its current setting of 4.50%-4.75%. But as the pace of economic contraction that we forecast gathers pace in the fourth quarter of this year and as inflation recedes, then we look for the FOMC to begin an easing cycle that lasts until the third quarter of next year.”

BofA

“We expect the Fed to hike by 25 bps, but the decision and outlook for any tightening depend on financial stability. We retain our outlook for monetary policy, including a terminal target range of 5.25-5.5%, and a mild recession in the US beginning in Q3 of 2023. We now see a greater risk of Fed tightening and balance sheet reduction ending sooner; we saw risks that both would last longer previously. For USD, we expect some Dollar appreciation on the back of a 25 bps hike, but acknowledge that the range of USD outcomes is wide; it largely depends on the financial sector headlines.”

The British Pound remains the second-best performing G10 currency on a one-month view after the safe-haven Japanese Yen. Economists at Rabobank target the EUR/GBP pair at 0.88 on a three-month view.

0.90 target pushed further away

“Whilst the lineup of UK fundamentals is not great, it is better than the market had been expecting. In our view, this will push the EUR/GBP 0.90 target further away.”

“We have pared back our EUR/GBP forecasts and expected the pair at 0.88 on a three-month view.”

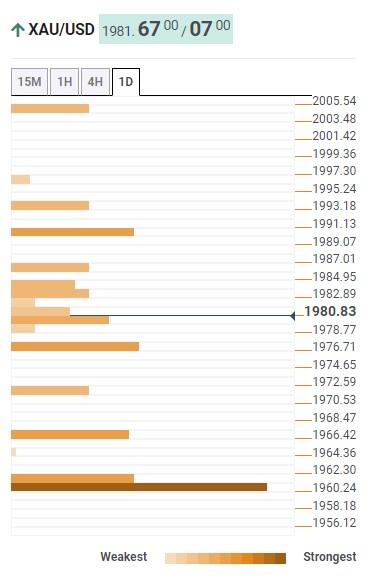

- The Mexican Peso appreciates against the US Dollar ahead of the FOMC’s meeting.

- An upbeat sentiment in the financial markets was one of the main reasons the USD/MXN fell.

- The US Treasury bond yield recovery began to reflect a 25 bps rate hike by the Fed.

- USD/MXN Price Analysis: Could resume downwards if it conquers 18.60; otherwise, upside risks remain.

The Mexican Peso (MXN) strengthens against the US Dollar (USD) courtesy of an upbeat sentiment amongst investors after Wall Street’s three major indices opened with gains. Therefore, the USD/MXN pair extended its losses below Monday’s low of 18.7857, though the 50-day EMA at 18.6820 capped the US Dollar losses. At the time of writing, the USD/MXN is trading at 18.7673, down 0.24%.

USD/MXN drops on risk-appetite, traders eyeing Fed’s decision

Sentiment remains upbeat. The financial markets narrative changed from inflation to a banking and credit crisis after the failure of two banks in the United States and another at the brisk of default. That has shifted global central banks’ interest rate increases expectations, with traders foreseeing that the Fed could cut rates in the year.

Money market futures expect the Fed to hike 25 bps, with odds at 83.4%, compared to Monday’s 73.8%. Nevertheless, uncertainty around how Fed Chair Jerome Powell’s press conference will go could rock the boat in the financial markets.

Societe Generale economists foresee a 25 bps rate hike

Delving a little deep into Jerome Powell’s press conference, Societe Generale analysts said, “the language around inflation and guidance on interest rates will take precedence over the next 48 hours. The Fed must err on the side of caution, and this means toning down the hawkish narrative until confidence in bank liquidity has been restored. SG economists forecast a +25bp hike, while the market is pricing in nearly 26% probability of a pause.”

Given the backdrop, the USD/MXN might consolidate around current exchange rates. The lack of economic data from Mexico would keep traders leaning into the dynamics of the US Dollar.

The US Dollar Index continues to edge lower, down 0.17%, at 103.132. US Treasury bond yields responded to expectations for a rate hike, with 2s and 10s up 16 and 9 bps each, at 4.148% and 3.579%, respectively.

Of late, Existing Home Sales in the United States in February rose 14.5% MoM, above estimates of 5%, the biggest increase since July 2020, and finished one full year of declines in sales.

USD/MXN Technical analysis

After failing to hold to gains above 19.0000, the USD/MXN resumed its downtrend, clearing the 100-day Exponential Moving Average (EMA) support at 18.9846. However, it should be said that the USD/MXN moved from trading within the low 18.00s to 18.10s towards the 18.60-18.90s area. Oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC) are still bullish, but RSI’s slope shifted downwards, suggesting that buying pressure is waning.

If the USD/MXN resumes upwards, the first resistance would be the 100-day EMA at 18.9848, followed by the $19.00. A breach of the latter will expose the weekly high at 19.2327. for a bearish resumption, the USD/MXN needs to crack $18.60, so sellers could have a chance to test the 20-day EMA at 18.5635 before diving toward $18.00.

- Existing Home Sales in the US rose sharply in February.

- US Dollar Index recovers from daily lows after the data.

Existing Home Sales in the US rose by 14.5% in February to an adjusted annual rate of 4.58 million, the National Association of Realtors (NAR) reported on Tuesday. This reading followed January's contraction of 0.7% and came in much better than the market expectation of 0%.

"The median existing-home sales price decreased 0.2% from the previous year to $363,000," the NAR further noted.

Commenting on the data, "conscious of changing mortgage rates, home buyers are taking advantage of any rate declines," said NAR Chief Economist Lawrence Yun. "Moreover, we're seeing stronger sales gains in areas where home prices are decreasing and the local economies are adding jobs."

Market reaction

The US Dollar Index recovered modestly with the initial reaction to the upbeat data and was last seen losing 0.1% on the day at 103.20.

- EUR/USD advances further and approaches 1.0800.

- Immediately to the upside comes the weekly top at 1.0804.

EUR/USD climbs to 5-week tops in the 1.0785/90 band on Tuesday, extending the upside momentum for the fourth session in a row.

The continuation of the recovery could now see the weekly high at 1.0804 (February 14) revisited in the near term, while the surpass of this level should face the next obstacle not before the 2023 peak near 1.1030 (February 2).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0327.

EUR/USD daily chart

Nod by Fed Chair Powell to tighter financial conditions and downside growth risks could accelerate Dollar profit taking, economists at Société Générale report.

Dovish Fed hike could trip up the Dollar

“A smaller 25 bps rate increase by the Fed and minor revision to the dot plot poses downside risk for the Dollar this week.”

“A 50 bps increase would be a surprise but could backfire for the Dollar if the dot-plot shows no significant compared to December.”

“Even if the Fed raises rates, a nod by Fed Chair Powell to the downside growth risks could accelerate Dollar profit taking.”

- USD/JPY gains strong positive traction on Tuesday and recovers further from a multi-week low.

- The risk-on impulse undermines the JPY and lends support, though weaker USD caps the upside.

- The technical setup warrants some caution before placing directional bets ahead of the FOMC.

The USD/JPY pair once again shows some resilience below the 61.8% Fibonacci retracement level of the January-March rally and attracts fresh buying near the 131.00 round-figure mark on Tuesday. Spot prices recover further from the lowest level since February 10, around the 130.55-130.50 area touched on Monday, and climb back closer to mid-132.00s during the early North American session.

The risk-on impulse - as depicted by a further strong rally in the equity markets - undermines the safe-haven Japanese Yen (JPY) and acts as a headwind for the USD/JPY pair. Bulls further take cues from the widening of the US-Japan rate differential, led by a solid recovery in the US Treasury bond yields over the past two sessions. That said, the prevalent US Dollar selling might cap any meaningful gains for the major.

The aforementioned mixed fundamental backdrop warrants caution before confirming that the USD/JPY pair's recent rejection slide from a technically significant 200-day Simple Moving Average (SMA) has run its course. Traders might also refrain from placing aggressive bets and prefer to move to the sidelines ahead of the highly-anticipated two-day FOMC monetary policy meeting, starting this Tuesday.

From a technical perspective, the intraday positive move stalls near 50% Fibo. level. This is closely followed by the overnight swing high, around the 132.65 region, which should now act as a pivotal point. Some follow-through buying could trigger a short-covering rally and push the USD/JPY pair further beyond the 133.00 round figure, towards testing the 38.2% Fibo. level, around the 133.80-133.85 region.

Heading into the key central bank event risk, the latter should keep a lid on any further upside for the USD/JPY pair. That said, a sustained move beyond the said barrier will negate any near-term negative outlook and shift the near-term bias in favour of bullish traders. This, in turn, will set the stage for a further appreciating move towards the 135.00 psychological mark, which coincides with the 100-day SMA.

On the flip side, 61.8% Fibo. level, around the 131.35 region, now seems to protect the immediate downside ahead of the 131.00 mark and the overnight swing low, around the mid-130.00s. Failure to defend the said support levels will make the USD/JPY pair vulnerable to challenging the 130.00 psychological mark. Spot prices could eventually drop to the 129.55-129.50 intermediate support en route to the 129.00 round figure.

USD/JPY daily chart

Key levels to watch

Economist at UOB Group Lee Sue Ann suggests the Fed is likely to raise the Fed Funds Target Range by 25 bps at both its March and May gatherings.

Key Quotes

“The latest FOMC minutes strongly suggest that we are not quite near the end of the current tightening cycle, despite the improving inflation trajectory.”

“While the Fed retained its pledge that ‘ongoing increases’ remaining appropriate; the minutes also showed that the view of downshifting to 25bps hike is the majority of the FOMC policy makers, we continue to expect the Fed to hike for the next two meetings in clips of 25-bps hikes at the Mar and May 2023 FOMC meetings, bringing our terminal FFTR level to 5.25%.”

Gold crossed 2,000 on safe-haven buying amid the ongoing US banking crisis. The sharp fall in US Treasury yields has been supportive of the yellow metal, strategists at ANZ bank report.

Central banks’ purchases remain resilient

“Changing market expectations around the fed funds rate continue to drive Gold prices amid the US banking crisis. The sharp fall in US Treasury yields has been supportive of Gold.”

“Inflation expectations over the next 12 months have retreated to 4%, but the Fed’s determination to tame inflation remains a key short-term risk.”

“Speculative positions have fallen, but ETF holdings are seeing net inflows.”

“Central banks continue to add more Gold to their reserves to hedge against geopolitical and economic risks.”

- DXY remains well on the defensive and threatens 103.00.

- Further losses could see the weekly low at 102.58 revisited.

DXY adds to the ongoing decline and puts the 103.00 region to the test on Tuesday.

The bearish mood appears unabated for the time being. Against that, there is a minor support at the weekly low at 102.58 (February 14), while the loss of this region could spark a deeper pullback to the 2023 low near 101.80 (February 2).

Looking at the broader picture, while below the 200-day SMA, today at 106.62, the outlook for the index is expected to remain negative.

DXY daily chart

Senior Economist at UOB Group Alvin Liew reviews the latest performance of the non-oil domestic exports (NODX) in Singapore.

Key Takeaways

“Singapore’s non-oil domestic exports (NODX) continued to fall, albeit less sharply by -15.6% y/y in Feb (from -25.0% y/y in Jan), the fifth straight month of contraction after 22 months of unabated expansion. On a seasonally adjusted sequential basis, NODX fell sharply by -8.0% m/m in Feb (compared to +0.9% m/m gain in Jan), the deepest m/m fall since Sep 2020 (-9.2%). The nominal value of NODX fell further to S$13.0bn (S$13.3bn seasonally adjusted) in Feb, the lowest since Jun 2019.”

“Jan exports to major destinations continued to reflect the weak global demand backdrop, but there were some positive developments as 1) there were three markets (US, Japan and Thailand) reporting positive y/y outcomes in Feb versus two in Jan, 2) NODX to US returning to growth, at 8.7% (from -31.5% in Jan) and 3) while demand weakness persisted in China the magnitude of decline is much more moderate at -11.3% y/y (from -41.1% y/y in Jan), and similar moderation in demand weakness was seen in most of ASEAN (such as NODX to Malaysia which contracted -10.5% y/y vs. -23.5% y/y in Jan and NODX to Indonesia which declined by -2.0% y/y vs. -17.5% in Jan).”

“NODX Outlook – The broad-based weakness in both electronics and nonelectronics performance continues to weigh negatively on NODX momentum and manufacturing demand for Singapore. The improvement (in the form of less negative prints on NODX declines from major export destinations of China and the ASEAN region) is encouraging but we caution against prematurely calling this to be the start of an uptrend. We continue to expect weakness in global demand on the back of further monetary policy tightening and worries about economic slowdown in the developed markets. It should also be noted that high base effect will continue to work against the NODX in early 2023, as seen in the months of Jan and Feb. We keep our view that we are likely to see a few more months of y/y declines in NODX for 1H 2023 before factoring some improvement in the second half of the year. We still expect full year NODX to contract by 5.5% in 2023.”

- GBP/USD comes under some selling pressure on Tuesday and snaps a three-day winning streak.

- The downside remains limited amid sustained USD selling and ahead of the FOMC/BoE meetings.

- The technical setup still favours bulls and supports prospects for the emergence of dip-buying.

The GBP/USD pair stalls a three-day-old uptrend on Tuesday and retreats from its highest level since early February touched the previous day. The pair maintains its offered tone through the early North American session and is currently placed just below the mid-1.2200s, though lacks follow-through.

The pullback could be attributed to some repositioning trade ahead of this week's key central bank event risks - the crucial FOMC policy decision on Wednesday, followed by the Bank of England (BoE) meeting on Thursday. In the meantime, the prospects for a less hawkish Federal Reserve (Fed), along with a strong follow-through rally in the equity markets, drag the safe-haven US Dollar (USD) to a fresh five-week low and lends support to the GBP/USD pair.

From a technical perspective, the overnight breakout through the 1.2200 mark, or the 61.8% Fibonacci retracement level of the January-March downfall was seen as a fresh trigger for bulls. Moreover, oscillators on the daily chart are holding in positive territory and are still far from being in the overbought zone. This suggests that the path of least resistance for the GBP/USD pair is to the upside and supports prospects for the emergence of some dip-buying at lower levels.

That said, it will still be prudent to wait for some follow-through buying beyond the monthly top, around the 1.2285 region set on Monday, before positioning for any further gains. The GBP/USD pair might then climb to test the next relevant hurdle near the 1.2320 region before eventually aiming to reclaim the 1.2400 round-figure mark. The momentum could get extended further towards the double-top resistance near the 1.2450 region, or the YTD peak touched in January.

On the flip side, 61.8% Fibo. level, around the 1.2200 mark, now seems to protect the immediate downside. Sustained weakness below might prompt some technical selling and drag the GBP/USD pair towards the 1.2125 confluence support. The latter comprises 50% Fibo. level and the 200-day Exponential Moving Average (SMA), which if broken decisively might shift the near-term bias back in favour of bearish traders and pave the way for deeper losses.

GBP/USD daily chart

Key levels to watch

The ball for EUR/USD moves to the court of the Fed this week. Economists at Société Générale analyze how the FOMC meeting could impact the world’s most popular currency pair.

A smaller 25 bps rate increase or a pause by the FOMC to help EUR/USD

“A smaller 25 bps rate increase or a pause by the FOMC on Wednesday and minor (upward) revision of the dot-plot should, in theory, help EUR/USD to return to the upward trajectory of January.”

“A 50 bps increase by the Fed and/or significant upward revision of the dots would be a major surprise and would backfire for risk assets and smother the bullish EUR/USD argument.”

The collapse of Silicon Valley Bank has created turmoil in the US banking system, prompting comparisons with the global financial crisis. Economists at UBS do not see the current bank failures and government action as a precursor to a systemic crisis

US banking system is better capitalized than prior to the 2008 global financial crisis

“While we are monitoring unfolding events, we do not see the current bank failures and government action as a precursor to a systemic crisis.”

“The US banking system is better capitalized than prior to the 2008 global financial crisis: The industry’s Tier 1 risk-based capital ratio stood at 10.11% at the end of 2007 compared with 13.65% at the end of 2022.”

“Silicon Valley Bank was in some ways unique. It had a high exposure to VC startups experiencing cash burn, leaving it vulnerable to deposit outflows. It had the highest ratio of securities to total assets in the industry and so was virtually the only US bank that had close to negative equity if mark-to-market losses were included.”

“Where US regulators let Lehman Brothers fail in 2008, they have stepped in proactively this time to make depositors whole.”

Economist Ho Woei Chen at UOB Group comments on the latest interest rate decisions by the PBoC.

Key Takeaways

“From 27 Mar, banks’ reserve requirement ratio (RRR) will be lowered by 25 bps to bring the effective RRR to 7.6%.”

“The 25 bps cut to the RRR is estimated to release CNY500 bn of long-term liquidity into the system. This is in addition to net injections of CNY559 bn via the 1Y medium-term lending facility (MLF) since the start of the year.”

“Banks have issued a record CNY6.71 tn of new loans in the first two months of the year (vs. CNY5.21 tn in the same period of 2022) and there may be concerns that the pace of credit expansion could ease sharply in the later part of the year.”

“The 1Y and 5Y loan prime rates (LPR) were unchanged at 3.65% and 4.30% respectively in Mar for the 7th straight month.”

“We now see the 1Y MLF rate to remain steady at 2.75% and consequently the 1Y LPR at 3.65%, for the rest of 2023. More important to watch will be the 5Y LPR as a reduction to the rate will signal stronger government support to the real estate sector. However, another RRR reduction later this year cannot be ruled out.”

- Annual inflation in Canada declined more than expected in February.

- USD/CAD trades with marginal daily gains above 1.3650.

Annual inflation in Canada, as measured by the Consumer Price Index (CPI), declined to 5.2% in February from 5.9% in January, Statistics Canada reported on Tuesday. This reading came in below the market expectation of 5.4%. On a monthly basis, CPI rose 0.4% in February, compared to analysts' estimate of 0.6%.

Additionally, the Bank of Canada's Core CPI, which excludes volatile food and energy prices, dropped to 4.7% on a yearly basis from 5% in January.

Market reaction

USD/CAD edged higher with the initial reaction and was last seen rising 0.05% on the day at 1.3672.

- EUR/JPY extends the upside momentum sparked on Monday.

- Next on the upside comes the YTD peak near 145.60.

EUR/JPY adds to the uptick seen at the beginning of the week and trades closer to the 143.00 region on Tuesday, an area coincident with the 100-day SMA.

The rebound appears strong and the continuation of this price action should target the 2023 high at 145.56 (March 2) ahead of a potential visit to the December 2022 peak at 146.72 (December 15).

In the meantime, extra losses remain on the cards while the cross trades below the 200-day SMA, today at 141.78.

EUR/JPY daily chart

EUR/CHF has rebounded after retesting last November's low of 0.9710/0.9670. The pair must surpass the 1.0010/40 resistance zone to enjoy further gains, analysts at Société Générale report.

Break of 0.9710/0.9670 to result in an extended decline