- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 24-03-2023

- EUR/USD is set to finish the week with decent gains of 0.89%.

- US economic data was mixed, though it portrays a deceleration of the economy.

- ECB policymakers remain focused on tackling high inflation levels in the Eurozone.

As the New York session finished, EUR/USD fell 0.64% or 69 pips. A risk-on impulse did not help the Euro (EUR), which, pressured by a banking crisis threatening to spread to the Eurozone, weakened the shared currency. At the time of writing, the EUR/USD is trading at 1.0759.

EUR/USD drops on US Dollar strength, weak EU PMIs

Despite experiencing another turbulence, the US equities market is poised to finish the week positively. Deutsche Bank’s stock experienced a sharp decline due to concerns over the possibility of default, reflected in a 220 basis point increase in Credit Default Swaps (CDS). Although this harmed Wall Street at the beginning of the session, investors appeared to dismiss these fears and instead speculated that the Federal Reserve (Fed) would lower interest rates in 2023.

Wall Street finished the week with gains. Deutsche Bank’s stock experienced a sharp decline due to concerns that the bank may default, as evidenced by the 220 basis point rise in Credit Default Swaps (CDS). Although this initially caused some concern on Wall Street, investors ultimately dismissed these fears, speculating that the Federal Reserve (Fed) would reduce interest rates in 2023.

St. Louis Fed President James Bullard expressed that rates should be raised further to reach the 5.50%-5.75% range, which would mean an additional 75 bps of rate hikes on top of the Fed’s recent increase of 4.75%-5.00%. Meanwhile, Atlanta Fed President Raphael Bostic commented that the decision made in March was not easy, as there was a lot of debate and it was not a simple choice.

Thomas Barkin, the President of the Richmond Federal Reserve, stated that he felt the banking sector was very stable when they arrived at the meeting. Therefore the conditions were suitable for implementing monetary policy as intended.

The S&P Global PMI showed improvement in March, surpassing both expectations and the data from the previous month. Although the Manufacturing Index remained in a state of contraction, Durable Good Orders saw a 1% drop, which was still an improvement compared to the reading from the previous month.

In the Euro area (EU), March’s S&P Global PMIs were positive, except for the Manufacturing component, which remained in recessionary territory. European Central Bank (ECB) policymakers crossed news wires, led by the ECB’s President Christine Lagarde, saying there’s no trade-off between price and financial stability.

Bundesbank President Joachim Nagel commented that a pause is not in order as inflation, seen averaging around 6% in Germany, the euro zone’s biggest economy, will take too long to come back to the ECB’s 2% target.“Wage developments are likely to prolong the prevailing period of high inflation rates,” Nagel said in Edinburgh. “In other words: Inflation will become more persistent.”

EUR/USD Technical analysis

The EUR/USD failed to hold to its previous gains, though the triple bottom chart pattern remains in play as long as it stays above 1.0759. A breach of the latter would invalidate the pattern, and open the door for further losses. On the upside, the first resistance would be 1.0800, followed by the 1.0900 figure, ahead of the YTD high at 1.1032.

- GBP/USD is set to finish the week with gains of around 0.40%.

- Federal Reserve officials remained committed to curbing inflation to its 2% target.

- Mixed economic data in the UK, a headwind for the GBP/USD, despite expectations for a Fed rate cut in 2023.

GBP/USD finished the week on a lower note after it reached 1.234, the high of the week, but retreated as sentiment dampened. On Friday, the GBP/USD is trading at 1.2228, retracing 0.47% at the time of typing.

Fed policymakers ready to combat inflation, UK data paints a gloomy economic scenario

The US equities market prepares to end the week in positive territory despite a renewed round of turbulence. Deutsche Bank stock fell sharply on fears that the German bank could default, as shown by the Credit Default Swaps (CDS) rising 220 basis points. Although it hurt Wall Street as the session opened, investors shrugged off those fears, as they speculated the Federal Reserve (Fed) would cut rates in 2023.

Federal Reserve officials crossed wires in the session. St. Louis Fed President James Bullard noted that rates need to get to the 5.50%-5.75% range, which would require an additional 75 bps of rate hikes after the Fed’s raised rates to the 4.75%-5.00%. Earlier comments from his colleague Raphael Bostic from the Atlanta Fed said that March’s decision was not easy. “There was a lot of debate. This wasn’t a straightforward decision.”

Richmond Fed President Thomas Barkin commented that the situation in the banking sector “felt very stable by the time we got there (to the meeting). So the conditions were right to do monetary policy the way we want to do monetary policy.”

On the data front, the US economic calendar featured the S&P Global PMI improved in March, exceeding expectations and the prior’s month data. The Manufacturing Index stood in the contractionary territory. At the same time, Durable Good Orders plunged by 1% but improved compared to the last month’s reading.

The UK economic docket featured Retail Sales, which beat estimates on an annual and monthly basis, while the S&P Global PMIs were worse than foreseen. The Manufacturing PMI failed to improve, while the Services and Composite PMIs, ticked slightly down.

Catheryn Mann, a member of the Bank of England, said she voted for a 25 bps rate hike compared to a larger one because she saw signs that inflation expectations are falling.

GBP/USD Technical analysis

Given the backdrop, the GBP/USD extended its losses, boosted by a stronger US Dollar. Even though the GBP/USD hit a daily low at 1.2190, buyers could hurdle the 1.2200 mark. It should be said that failure to achieve a daily close above 1.2300 could exacerbate a fall below 1.2200, which could extend to the 20-day EMA around 1.2135. Once cleared, the 200-day EMA would be up for grabs. On the flip side, buyers reclaiming 1.2300 can pave the way to the weekly high of 1.2343.

Worsening market conditions will continue to favor the Japanese Yen, point out analysts at Rabobank. They see that banking sector strains are set to persist.

Banking risks in focus but FX moves contained

“After sustained selling of the US dollar, we are now seeing evidence of a turnaround as fears wider scale banking sector problems pick up. We have highlighted one supportive factor for EUR/USD as being the relative resilience of euro-zone banks compared to the US highlighted by the outperformance of the Euro Stoxx 600 Bank Index which is currently around unchanged on a year-to-date basis compared to more than a 20% drop for the S&P 500 equivalent.”

“Given the plunge in global yields on the back of this ongoing banking sector crisis the yen remains the most consistent performer highlighting the re-emergence of the yen’s more traditional safe-haven characteristics. We expect that to continue.”

“If confidence in European banks continues to deteriorate it seems highly likely that the correction lower in EUR/USD could have further to go. Furthermore, the broader the crisis of confidence becomes, the greater the implications for global growth and hence the higher-beta G10 FX will also suffer and the recent resilience of AUD and NZD could well start to give way.”

“The renewed banking sector risks evident in Europe today underline the potential for liquidity problems in the banking sector morphing into credit problems for sectors of the real economy. A worsening backdrop will continue to benefit the yen which remains the best performing currency in March. While this might not be a repeat of 2008 it may well rhyme in many ways.”

Analyst at Rabobank maintain their one and three month forecasts for the EUR/USD pair at 1.06 and 1.05 respectively, but they tweaked their six and 12-month forecast, pushing them slightly higher.

Key Quotes:

“The greenback's safe haven quality stems from its position as the dominant currency in the global payment system. This means that crisis can trigger USD hoarding behaviour. These should have been assuaged by the Fed's announcement last weekend that it had put in place daily swap line with five other major central banks. These could run to the end of next month. In our view, this action by the Fed was instrumental in allowing EUR/USD to trend higher at the start of the week and break (temporarily) the key 1.08 resistance level. This measure, however, is unlikely to totally offset safe haven demand for the greenback if confidence in banks fall further.”

“In view of prevailing tensions we have not at this time revised our forecast of a dip in EUR/USD to 1.05 on a 3 month view, although we are clearly watching events carefully. However, have raised our 6-month forecast from EUR/USD1.03 to 1.06 which also reflects a relatively firm profile for the USD. While calmer waters in this time frame would lessen safe haven USD demand, in tune with our central view this would facilitate the pricing out of Fed rate cuts which would provide the greenback with support.”

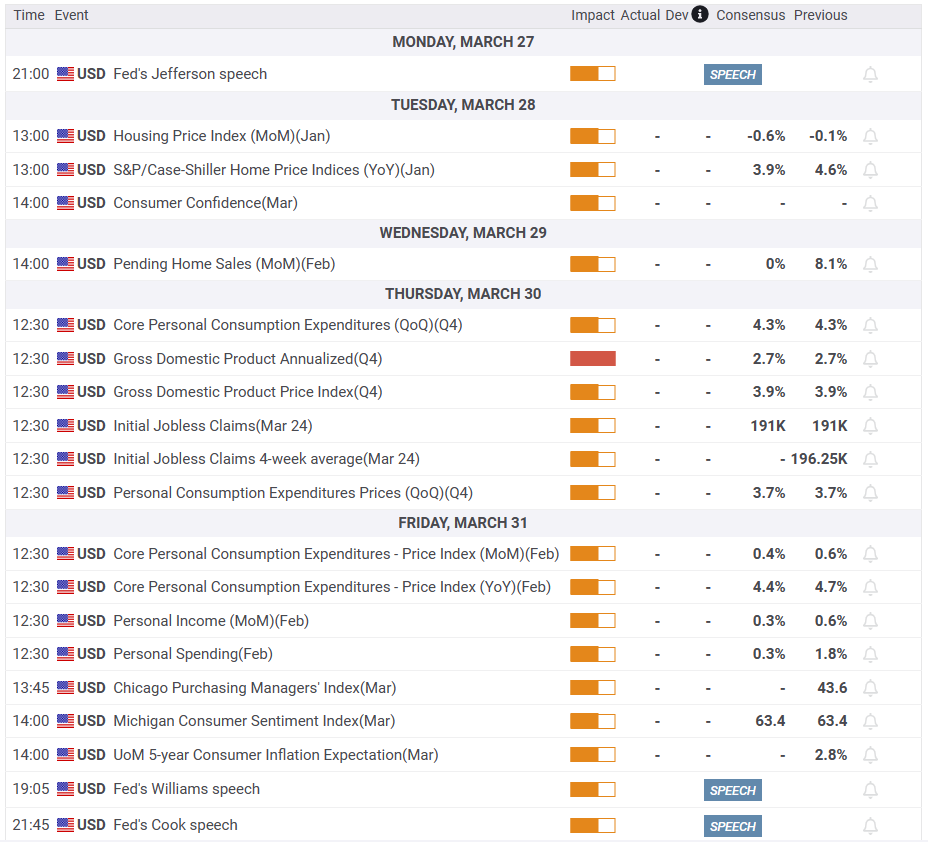

Here is what you need to know for next week:

After a week with the focus on central banks, economic data will be back at the center, surrounded by the ongoing banking crisis. The DXY finished the week lower, but looking stronger, resurfacing even as US yields tumbled, helped by a deterioration in market sentiment.

A new market season started on March 8 with the Silicon Valley Bank collapse. In the most recent episode, more central banks decided to raise rates showing determination to bring inflation down despite banking jitters. Developments in the banking sector will continue to be critical for sentiment and monetary policy expectations. It has tightened bank credit standards, doing part of the central bank's job. Next week, central bankers will probably stay close to the recent guidance next week.

On Wednesday, the Federal Reserve (Fed) raised rates by 25 bps as expected, signaling a dovish pace of future hikes. Initially, markets reacted by selling the US Dollar, and Wall Street cheered timidly. That day, markets heard from Fed officials for the first time since the banking system crisis.

Wall Street finished the week with modest gains, and the VIX dropped sharply. Still, regional bank stocks remain under pressure and with the potential to damage confidence significantly. During the weekend, market participants will stay alert on potential banking news. Also, US Treasury Secretary Janet Yellen could be preparing some surprises.

Potential movers for next week:

- Regional bank stocks

- US Treasury Secretary Yellen

- Eurozone inflation numbers

- US Core PCE

The DXY settled above 103.00 after testing levels under 102.00. The Greenback rebounded despite lower yields, helped by the renewed concerns. Economic data showed activity, at least before the SVC collapse, was not near a recession. US employment data still presents a tight market. Next week's data includes the Core PCE on Friday, a closely watched inflation indicator.

EUR/USD finished the week higher, pointing lower, and momentum fading quickly. The pair dropped 200 pips from the 1.0930 area to close around 1.0750, still above the 20-week Simple Moving Average. The preliminary PMIs on Friday showed overall positive figures. The preliminary March inflation numbers next week will be critical. European Central Bank officials continued to speak about the need to do more. Expectations about more rate hikes supported the Euro, which was among the top performers.

GBP/USD ended the week virtually flat around 1.2220, after being unable to hold above 1.2300. The Bank of England (BoE) raised the key rate as expected to 4.25% (7-2 vote). The bank could rise further if inflation does not surprise to the downside in March. Next Friday, Q4 GDP data is due.

The Japanese Yen benefited from the decline in US yields, outperforming most of its G10 rivals. USD/JPY dropped for the fourth consecutive week, ending above 130.00, an area that seems poised to be tested again over the following sessions.

USD/CAD reached monthly highs above 1.3800 and pulled back. Next Tuesday, the Canadian government will present the budget. January GDP will be out on Friday.

AUD/USD's run from monthly lows ended at the daily 200-SMA near 0.6760, and now it is up to the Dollar to decide how low it goes. Australia will report Retail Sales on Tuesday and critical inflation numbers on Wednesday. Those figures could cement the decision of the Reserve Bank of Australia that will have its meeting on April 4.

The Mexican peso was the biggest gainer among the most traded currencies, making a solid comeback after plunging during the previous two weeks. USD/MXN lost more than 2%, falling below 18.50. The Bank of Mexico will announce its decision next week. It is seen raising rates further but at a smaller pace than in February, when it hiked by 50 bps. Core inflation is finally coming down in Mexico, with the half-month print at 8.15%, down from 8.21%.

Note to traders: Daylight saving time in Europe. On the morning of Sunday, Europe will turn the clock forward by one hour.

Like this article? Help us with some feedback by answering this survey:

- The S&P 500 and the Dow Jones edge higher while the Nasdaq 100 remains downward pressured.

- US Treasury bond yields collapsed after the Fed’s decision, as investors expect a rate cut.

- US economic data was mixed, spurred by cumulative tightening by the Fed.

US equities are trading mixed across the board due to a dampened market mood caused by a crisis with Deutsche Bank (DB) being in the spotlight. The shares of the German bank dropped 14%, while its CDS, a form of insurance against its default, skyrocketed 200 bps.

In the mid-North American session, the S&P 500 and the Dow Jones are climbing 0.10% and 0.06%, each at3951.28 and 32119.30, respectively. Contrarily the heavy-tech Nasdaq Composite is down 0.23%, at 11757.02.

S&P Global revealed that business activity in the United States (US) during March improved, above estimates and the prior month’s readings. Nonetheless, the S&P Global Manufacturing PMI was shy of expansion territory, at 49.3, but smashed estimates and February’s data.

Meanwhile, US Durable Good Orders plummeted 1%, beneath forecasts of 0.6% but exceeded the previous month’s 5% decline, reported the US Department of Commerce. Excluding transportation equipment, it remained unchanged. Albeit the report was better than January’s data, the cumulative tightening by the Federal Reserve (Fed) could begin to weigh on businesses, as traders are expecting a hard landing by the Fed.

Sector-wise, the three main drivers of Wall Street are Utilities, Consumer Staples, and Real Estate, each gaining 2.08%, 1.37%, and 1.18%. The laggards are Consumer Discretionary, Technology, and Financials, down 0.79%, 0.45%, and 0.34%.

In the FX space, the US Dollar Index (DXY) found a bid, gains 0.53%, at 103.135, despite falling US Treasury bond yields. The US 10-year Treasury bond yield falls six basis points, down at 3.372%, putting a lid on the greenback gains

Federal Reserve officials were one of the reasons that underpinned the greenback, with Bostic and Bullard saying that the US central bank needs to get inflation under control. Bullard foresees the Federal Funds Rate (FFR) to peak at around 5.50% - 5.75%, meaning policymakers are short three-quarters of percentage points. Atlanta’s Fed President Bostic said there was a “debate” in the latest FOMC meeting about raising rates. HE confirmed that signs that the banking system is solid were the main reason to pull the trigger.

S&P 500 Daily chart

What to watch

- The US Dollar Index advances for two days, forming a “morning star” candle chart pattern.

- Oscillators paint a mixed picture, though RSI could be turning bullish.

- A daily close above 103.26 will pave the DXY’s way to test 104.00

The US Dollar Index (DXY), which tracks a basket of six currencies against the US Dollar (USD), advances 1.58% after hitting a 7-week low of 101.91. At the time of writing, the DXY is trading at 103.12 after hitting a daily low of 102.50.

US Dollar Index Price action

From a daily chart perspective, the DXY is neutrally biased, as it remains above the 2023 low of 100.85. In addition, the US Dollar Index pierced the last higher-high (HH) of 105.63 and printed a YTD high at 105.88. In addition, a candlestick chart pattern, “morning star,” it’s forming, which could pave the way to test the daily Exponential Moving Averages (EMAs) sitting at around 103.782.

For a bullish resumption, the DXY must achieve a daily close above the March 22 high at 103.26. Once done, the DXY could test the confluence of the 20-day EMA and 2017 high at 103.78. If that strong resistance area is broken, the 50-day EMA at 103.97 is up for grabs, ahead of 104.00.

Otherwise, buying weakness could mean that the ongoing leg-up is a correction of a continued downtrend. That said, the US Dollar Index’s first support would be 103.00. A breach of the latter will expose the March 23 swing low at 101.91, followed by the YTD low at 100.85.

Oscillators, like the Relative Strength Index (RSI), are tracking the trend, though it remains bearish. Contrarily, the Rate of Change (RoC) shows that sellers’ momentum is waning, about to turn neutral.

US Dollar Index Daily chart

US Dollar Index Technical levels

St. Louis Federal Reserve President James Bullard said on Friday that the United States remains in a position to see disinflation in 2023. They will see if the Fed may need to react more. He sounded optimistic, by saying the he expected the Fed to be dealing more with the strong economy in the coming months and not worrying as much about financial stresses.

Bullard sees an “80% chance” that financial stress will abate, and the discussion will shift back to inflation. According to him, the other outcome with a lower probability, is a recession. He cautioned that there could be downside risks if financial stress worsens.

The probability of a global crisis from recent stress is low, said Bullard. He mentioned that the Fed will continue to monitor the situation closely and will take appropriate action if necessary.

St. Louis Fed President argued that in response to the strong economy, the terminal rate for this year was raised by 25 basis points to a range of 5% to 5.75%, taking the assumption that financial stress subsides.

Regarding the interest rate path, Bullard said the projections suggest one more rate hike that could be at the next FOMC meting or soon after.

Fed's Bullard: Swift response to bank stress allows monetary policy to focus on inflation

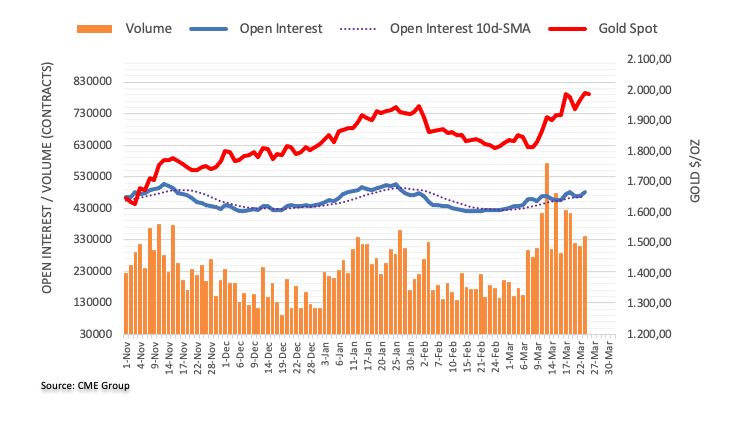

Gold price back at $2,000 after Fed meeting. Economists at Commerzbank expect the yellow metal to see renewed downside pressure as the market will be forced to correct its expectation of a rapid interest rate turnaround again.

Robust Swiss Gold exports to Asia in February

“Currently the market expects key rates in the US to be lowered before year’s end, which has recently lent buoyancy to the Gold price again. However, we believe that the market will be forced to correct its expectation of a rapid interest rate turnaround again. This is likely to put XAU/USD back under pressure.”

“The fact that the price level has repercussions for physical demand should not be ignored: Swiss Gold exports indicate that demand for Gold in China and India, in February at least, was considerably higher because prices were lower then. China’s Gold imports from Hong Kong should likewise turn out to have been correspondingly robust.”

- USD/MXN drops below $18.60 even though the US Dollar remains strong.

- US economic data was mixed, with Durable Good Orders showing some strains blamed on cumulative tightening by the Fed.

- USD/MX Price Analysis: Trapped within the 50/20-day EMAs.

USD/MXN stays depressed after drawing back-to-back hammers in the daily chart and slides; looking forward to testing the daily low of 18.5160. The USD/MXN fluctuates around 18.54 after hitting a daily high of 18.7968.

USD/MXN fluctuated, as a strong US Dollar, has capped the pair’s fall

Wall Street opened the last trading day of the week with losses. Bank’s riot continues, with Deutsche Bank (DB) Credit Default Swaps (CDS), a form of insurance in the case of a DB default, skyrocketing 220 basis points. Investor’s sentiment turned pessimistic, even though financial market participants estimated rate cuts by the US Federal Reserve (Fed).

Data-wise, the United States (US) economic docket revealed that business activity in March improved, above estimates and the prior’s month readings. Nevertheless, the S&P Global Manufacturing PMI fell short of expansion territory, at 49.3, but smashed estimates and February’s data.

At the same time, US Durable Good Orders plunged 1%, below forecasts of 0.6% but above the previous month’s 5% decline, reported the US Department of Commerce. Excluding transportation equipment, it remained unchanged. Albeit the report was better than January’s data, the cumulative tightening by the Federal Reserve (Fed) could begin to weigh on businesses, as traders are expecting a hard landing by the Fed.

US Treasury bond yields continued to edge lower. The US 18-month to 3-month yield curve deepened further, -1.28%, meaning that investors are estimating a recession in the US.

The US Dollar Index (DXY) found a bid, gains 0.60%, at 103.190, a reason that capped the USD/MXN earlier losses. Federal Reserve officials were one of the reasons that underpinned the greenback, with Bostic and Bullard saying that the US central bank needs to get inflation under control.

On the Mexican front, economic activity grew 0.6% in January from December, and 4.4% YoY from 2022, as said by INEGI. In the meantime, Banxicos’s deputy Governor Irene Espinosa noted that although inflation data is “good news,” Mexico remains in an uncertain environment. She added that Banxico’s primary concern is core inflation and that the bank would consider the Fed’s decision.

USD/MXN Technical analysis

The USD/MXN continues under heavy stress, although it has recovered some ground. The pair’s jump to its daily high at 18.7968 was short-lived, as prices retreated below the 50-day Exponential Moving Average (EMA) at 18.6677. Oscillators like the Relative Strength Index (RSI) turned flat at bullish territory, while the Rate of Change (RoC) is neutral. A bullish resumption will occur if the USD/MXN reclaims the 50-day EMA. A breach of the latter will expose the March 21 high at 18.8769 and will put into play the 100-day EMA at 18.9590. Conversely, a bearish continuation would happen, with the USD/MXN stumbling below the 18.50 area.

The greenback could be relatively stable in the near term. But an extended period of US Dollar depreciation is fast approaching, wchi should lift EUR/USD to 1.13 by the end of the year, economists at Wells Fargo report.

Eventual ECB easing to be later and more gradual than that of the Fed

“We expect ECB rate hikes will outpace those of the Fed in the near term and, with the Eurozone economy proving quite resilient, we expect eventual ECB easing to be later and more gradual than that of the Fed.”

“After the period of brief greenback stability in early 2023, we think the prospects for the Euro will brighten, and expect the EUR/USD exchange rate to reach 1.13 by the end of this year.”

Bank Of England’s (BoE) Monetary Policy Committee member Catherine Mann said on Friday, that she voted at this week’s meeting for a 25 basis point rate hike instead of a bigger increase, motivated in part by the fact that inflation expectations began to moderate, reflecting that monetary policy is having an effect.

According to Mann, the decision on interest rates is based on financial conditions. She argued that there is more to come before tight conditions in the United Kingdom. She added that February’s retail sales numbers are pretty robust.

On Thursday, the BoE raised its key interest rate by 25 basis points to 4.25%. The Monetary Policy Committee voted 7-2 for the decision. Two members (Swati Dhingra and Silvana Tenreyro) voted against it, preferring to maintain the rate at 4%.

Market reaction

GBP/USD is falling on Friday, trading around 1.2250, after hitting earlier levels below 1.2200.

BoE’s Mann: Inflation expectations are very important to the outlook

Banxico's determined stance in the fight against inflation supports the Peso. However, if the recent market turmoil weighs on the outlook for the US economy, economists at Commerzbank see downside risks for MXN due to Mexico's close ties with the US.

How much support will Banxico provide?

“As soon as inflation slowly approaches its target again, Banxico should have more room for rate cuts. Nevertheless, it will probably continue to secure an attractive real interest rate. By comparison, the Fed's rate cuts threaten to take more of a toll on monetary policy credibility, so we do not see the Peso at a disadvantage against the Dollar due to rate cuts.”

“There are, of course, major risks to our forecast from the recent market turmoil. Banxico does not see major contagion risks thanks to the good capitalization of the Mexican banking sector and intends to continue to focus on the fight against inflation. However, given the close linkages with the US, it would significantly weigh on the MXN outlook if the outlook for the US economy deteriorates.”

Source: Commerzbank Research

Economists at MUFG continue to see a lower USD/JPY as the most likely scenario.

JPY strength will be more than just about the Fed

“The scale of easing now priced for this year (Dec ’23 fed funds future at 4.10%) leaves the US dollar vulnerable and we are likely to see USD/JPY trading down to the YTD lows between 127-128 relatively quickly.”

“The monthly trade data in Japan for the month of February indicated the reversal of that negative terms of trade shock is well under way in Japan. The February import bill for fuel and minerals totalled JPY 2,577bn. The peak total for imports was back in August when natural gas prices peaked with the total import bill at JPY 3,423bn.”

“Understandably, the Fed and the drop in yields in the US is getting the attention as a key factor in pushing USD/JPY lower but the energy story will certainly add to positive JPY momentum this year.”

Bank Of England’s Monetary Policy Committee member Catherine Mann said on Friday that inflation expectations are very important to the outlook.

Regarding inflation, Mann said that wholesale energy prices are expected to slow down the Consumer Price Index. She added that the process regarding Brexit is important for food price inflation in the United Kingdom.

Market reaction

The Pound is rising versus Euro on Friday, but is falling against the US Dollar. GBP/USD trades above 1.2250 after testing earlier levels below 1.2200.

Economists at Wells Fargo expect the Argentine Peso to suffer a substantial depreciation this year.

Explicit Argentine Peso devaluation in Q4-2023

“Argentine authorities allowed for greater Peso depreciation in 2022; however, in order to continue receiving IMF disbursements, the central bank will need to allow for an even greater pace of currency depreciation.”

“Once presidential elections are completed in October, we believe an outsized and intentional Peso devaluation will materialize, and the Argentine Peso will be the worst performing emerging market currency in 2023.”

The USD is trading broadly higher. However, economists at Scotiabank expect the greenback to turn back lower.

Markets start to think about rate cuts in the US

“Broader USD gains may extend somewhat to correct some its steady losses over the past week but there is little getting round its loss of appeal as the Fed rate cycle peak nears – and markets start to think about rate cuts in the US.”

“Short-term, corrective USD gains driven by risk aversion will give way to more, fundamentally driven losses.”

The Bank of England raised its policy rate by 25 basis points to 4.25%. Economists at Rabobank belive that Bank rate could rise as high as 4.75% and forecast the next 25 bps hike in May.

Another 25 bps hike for the May meeting

“The BoE raised its policy rate by 25 bps to 4.25%. The vote was split 7-2-0, with external members Tenreyro and Dhingra voting for a hold.”

“It will tighten policy further in May if price pressures persist and credit conditions permit. The shift to a meeting-by-meeting approach is not as dovish as some expected.”

“The Financial Policy Committee has judged that the UK banking system remains resilient, effectively giving the green light to this rate increase.”

“For now, we hold on to our long-held view that Bank rate could rise as high as 4.75% with the next 25 bps hike in May. This requires that global financial stability risks remain contained.”

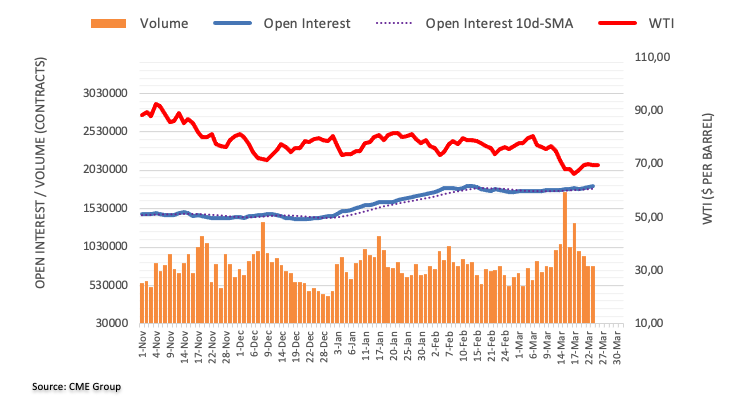

- Prices of the WTI adds to Thursday’s losses on Friday.

- Weekly gains appear capped near $72.00 per barrel.

- Driller Baker Hughes will report on the weekly drilling activity later.

Prices of the barrel of the American benchmark for the sweet light crude oil add to Thursday’s pullback and revisit the sub-$67.00 region at the end of the week, or 3-day lows.

WTI weaker on banking turmoil, strong dollar

In fact, banking concerns and rising jitters on a potential contagion continue to weigh on traders’ sentiment and underpin at the same time the daily retracement.

Also playing against the commodity appears the marked bounce in the greenback in combination with recent news that the Biden administration could delay until the next year its restocking of oil inventories.

Later in the session, Baker Hughes will publish its usual weekly report on US oil rig count in the week to March 24.

WTI significant levels

At the moment the barrel of WTI is down 0.94% at $68.81 and a breach of $64.41 (2023 low March 20) would aim for $61.76 (monthly low August 23 2021) and then $61.58 (monthly low May 21 2021). On the upside, the next hurdle is located at $71.63 (weekly high March 23) followed by $76.33 (55-day SMA) and finally $80.90 (monthly high March 7).

While the Yen underperformed during the global monetary tightening phase, in the view of economists at Wells Fargo, the JPY will likely outperform as tightening cycles eventually come to an end and central banks turn to easing.

Japanese Yen strength over time

“We believe the Japanese Yen can experience a strong rebound as bond yields, especially in the United States, eventually come down, and less negative yield spreads support the Japanese currency.”

“During the global tightening phase in which Japan maintained its easy monetary policy stance, the yen came under significant downside pressure. On the flip side, as the global monetary policy cycle turns to easing, we expect the Yen to be a key beneficiary and target a USD/JPY exchange rate of 127.00 by the end of this year.”

- GBP/USD retreats further from a multi-week high set on Thursday amid resurgent USD demand.

- The technical setup still supports prospects for the emergence of some dip-buying.at lower levels.

- A sustained weakness below the 50-day SMA is needed to negate the near-term positive outlook.

The GBP/USD pair comes under intense selling pressure on Friday and extends the overnight retracement slide from the vicinity of mid-1.2300s, or its highest level since February. Spot prices, however, manage to rebound a few pips from the daily low and trade above the 1.2200 mark during the early North American session, still down nearly 0.60% for the day.

A fresh wave of the global risk-aversion trade - amid lingering concerns about a full-blown banking crisis - assists the safe-haven US Dollar (USD) to build on the previous day's solid bounce from a seven-week low. Apart from this, the weaker-than-expected release of UK PMI prints for March weighs on the British Pound and further contributes to the heavily offered tone surrounding the GBP/USD pair.

That said, the Federal Reserve's hints of a pause to interest rate hikes, along with the anti-risk flow, lead to a further steep decline in the US Treasury bond yields. Furthermore, the disappointing US Durable Goods Orders act as a headwind for the USD and lend some support to the GBP/USD pair. Spot prices, meanwhile, showed some resilience below the 1.2200 resistance-turned-support.

The said handle is followed by the 50-day Simple Moving Average (SMA), currently around the 1.2150-1.2145 region, which if broken decisively might prompt some technical selling and pave the way for deeper losses. The GBP/USD pair might then accelerate the fall towards the 1.2100 mark (100-day SMA) before eventually dropping to the next relevant support near the 1.2040 horizontal zone.

On the flip side, any meaningful recovery now seems to confront an immediate hurdle near the 1.2270-1.2275 region. A sustained move beyond has the potential to push the GBP/USD pair back above the 1.2300 round figure, towards resting the multi-week high, around the 1.2340-1.2345 region touched on Thursday. Bulls might then aim to reclaim the 1.2400 mark and the YTD peak around the 1.2445-1.2450 zone.

GBP/USD daily chart

Key levels to watch

Financial market stress, central bank decisions. Economists at Commerzbank expect the US Dollar to benefit more than the Euro from the easing of global financial market stress.

What will happen to the Dollar now?

“The more the financial market stress eases, the sooner FX traders are likely to assume that the tightening of credit conditions will only be moderate. As a consequence, they will have to price in further Fed rate hikes.”

“From now on the Dollar might benefit more from the easing of the stress than the Euro.”

St. Louis Federal Reserve president James Bullard said on Friday that the response to the bank stress was swift and appropriate, allowing the monetary policy to focus on inflation, as reported by Reuters.

Additional takeaways

"Inflation remains too high, US macro data are stronger than expected."

"Regulators can do more as needed to contain financial stress."

"Not uncommon for some firms to fail to adjust to changing financial conditions."

"Inflation expectations relatively low, a good sign for disinflation this year."

"Silicon valley bank was a very unusual case,hard-pressed to find other banks in a similar situation."

"Markets so far giving a thumbs up to Credit Suisse deal."

"People need to keep in mind that there are many macroprudential tools that can be deployed."

Market reaction

The US Dollar Index continues to trade in positive territory above 103.00 following these comments.

- S&P Global Manufacturing and Services PMIs rose more than expected in February.

- US Dollar Index clings to strong daily gains above 103.00.

The business activity in the US private sector expanded at a strengthening pace in February with the S&P Global's Composite PMI rising to 53.3 from 50.1 in January.

S&P Global Manufacturing PMI recovered to 49.3 from 47.3 in January but remained in the contraction territory. Finally, the Services PMI rose to 53.8 from 50.6, surpassing the market expectation of 50.5 by a wide margin.

Commenting on the data, "March has so far witnessed an encouraging resurgence of economic growth, with the business surveys indicating an acceleration of output to the fastest since May of last year," noted Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

Regarding inflation dynamics, "there is also some concern regarding inflation, with the survey’s gauge of selling prices increasing at a faster rate in March despite lower costs feeding through the manufacturing sector," Williamson explained. "The inflationary upturn is now being led by stronger service sector price increases, linked largely to faster wage growth.”

Market reaction

These data don't seem to be having a noticeable impact on the US Dollar's performance against its peers on Friday. As of writing, the US Dollar Index was up 0.6% on the day at 103.20.

- EUR/USD adds to Thursday’s decline and approaches 1.0700.

- A deeper drop could revisit the 100-day SMA near 1.0615.

EUR/USD accelerates losses and sinks well south of 1.0800 the figure at the end of the week.

The corrective move could extend further in the near term and could put the 100-day SMA around 1.0615 back on the traders’ radar. Below the latter emerges the March low at 1.0516 (March 15).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0332.

EUR/USD daily chart

- USD/JPY continues losing ground for the third straight day and drops to a fresh multi-week low.

- A combination of factors strengthens the safe-haven JPY and exerts heavy pressure on the major.

- A strong pickup in the USD demand lends some support and helps limit losses, for the time being.

- The technical setup favours bearish traders and supports prospects for a further depreciating move.

The USD/JPY pair remains under heavy selling pressure for the third successive day and touches its lowest level since February 03, around the 129.65 region on Friday. Spot prices, however, trim a part of the intraday losses and trade just above the 130.00 psychological mark during the early North American session, still down nearly 0.50% for the day.

The Japanese Yen (JPY) draws support from data showing that an important gauge of Japan’s consumer prices rose at its fastest pace since 1982 in February. Apart from this, a fresh wave of the global risk-aversion trade, amid lingering concerns about a full-blown banking crisis and looming recession risks, provides an additional boost to the safe-haven JPY and drags the USD/JPY pair lower.

Furthermore, the narrowing of the US-Japan rate differential, led by the ongoing steep decline in the US Treasury bond yields in the wake of the Federal Reserve's hints of a pause to interest rate hikes, is seen driving flows towards the JPY. That said, a strong broad-based US Dollar (USD) rally lends some support to the USD/JPY pair and helps limit any further losses, at least for the time being.

From a technical perspective, the overnight sustained break and acceptance below the 61.8% Fibonacci retracement level of the January-March rally could be seen as a fresh trigger for bearish traders. Moreover, oscillators on the daily chart are holding deep in the negative territory and are still far from being in the oversold zone, which, in turn, supports prospects for a further depreciating move.

Hence, any further recovery move is more likely to attract fresh sellers around the 131.00 round-figure mark. This should cap the USD/JPY pair near the 131.30 region, or the 61.8% Fibo. level. That said, some follow-through buying could trigger a short-covering move and lift spot prices to the 132.00 mark. The momentum could get extended towards the 132.50 area, or the 50% Fibo. level.

On the flip side, the daily swing low, around the 129.65 region, now seems to protect the immediate downside, below which the USD/JPY pair could fall to the 129.00 mark. The next relevant support is pegged near the 128.55-128.50 zone, below which spot prices could slide towards the 128.00 round figure and aim to challenge the YTD low, around the 127.20 region touched in January.

USD/JPY daily chart

Key levels to watch

- Silver outperforms gold on Friday, XAG/XAU ratio at one-month lows.

- Price hit $22.50 for the first time since early February.

Silver jumped during the last hour, climbing from $23.16 to $23.52, reaching the highest level since early February. Gold is algo rising, trading at weekly highs slightly above $2,000.

Since the beginning of the week, XAG/USD has gained 4% and from the March 10 low, almost 20%. Price is testing a relevant technical area and a consolidation above $23.50 could keep the road to more gains clear, even as technical indicators show extreme overbought conditions.

-638152602454450106.png)

Friday’s rally in metals takes place amid a deterioration in market sentiment. Wall Street futures trade in negative on renewed bank concerns. At the same time, the decline in US bond yields offers support to the rally in Gold.

However, Silver is outperforming Gold on Friday and also during the week. The ratio peaked early in March and since then it trended lower. It is back at February levels.

Silver/Gold ratio daily chart

-638152602374459606.png)

Technical levels

European Central Bank President Christine Lagarde told EU leaders on Friday that the Euro area banking sector is resilient with strong capital and liquidity positions, Reuters reported citing EU officials.

Key takeaways

"Recent developments were a reminder how important it has been to continuously improve regulatory standards."

"We need to progress on completing the banking union, further work is also necessary to create truly European capital markets."

"There is no trade-off between price stability and financial stability, ECB has tools to address risks to both."

"ECB is determined to bring back inflation to 2%, will decide on future rates based on incoming data."

"ECB is fully equipped to provide liquidity to euro area financial system, if needed."

Market reaction

EUR/USD showed no immediate reaction to these remarks and was last seen losing 0.8% on the day at 1.0744.

The Dollar has been the big loser since the banking turmoil started. Economists at ING expect the EUR/USD to hit 1.15 by the end of the year.

Combination of lower Fed rate expectations and improved risk sentiment is negative for USD

“There is a possibility that we’ll see a scenario in line with current market conditions, where the US banking situation remains troublesome but doesn’t turn into a fully-fledged systemic crisis, and the Fed sticks to some ambiguous communication until a tighter financial environment hits the economy and forces large cuts.”

“In this scenario, further Dollar depreciation seems inevitable, and if the EU banking sector remains broadly shielded, stickier inflation in the Eurozone should force more hikes by the ECB and ultimately a contraction in the USD-EUR rate differentials.”

“Ultimately, EUR/USD should easily break above 1.10, and be on track to touch 1.15 by year-end.”

- USD/CAD gains strong positive traction on Friday and draws support from a combination of factors.

- The risk-off impulse boosts the safe-haven USD and lends support amid tumbling Crude Oil prices.

- A steep fall in the US bond yields, the disappointing US Durable Goods Orders might cap the buck.

The USD/CAD pair catches aggressive bids following a brief consolidation on Friday and extends its strong rally heading into the North American session. The momentum lifts spot prices to over a one-week high, closer to the 1.3800 mark, and is sponsored by a combination of factors.

The global risk sentiment took a turn for the worst on the last day of the week amid lingering concerns over a full-blown banking crisis. Apart from this, the rather unimpressive flash PMI prints from the Eurozone and the United Kingdom (UK) revived fears of a deeper economic downturn, which, in turn, tempers investors' appetite for riskier assets. The anti-risk flow lifts demand for the safe-haven US Dollar (USD) and turns out to be a key factor acting as a tailwind for the USD/CAD pair.

Furthermore, worries that a global recession will dent fuel demand triggers a fresh bout of selling around Crude Oil prices and weighs on the commodity-linked Loonie. Apart from this, the softer-than-expected Canadian consumer inflation released on Tuesday reaffirmed expectations that the Bank of Canada (BoC) will refrain from raising interest rates any further. This further seems to undermine the Canadian Dollar and contributes to the USD/CAD pair's strong intraday rally.

With the latest leg up, spot prices now seem to have confirmed a breakout through a one-week-old trading range and seem poised to appreciate further. That said, tumbling US Treasury bond yields, led by the Federal Reserve's hints of a pause to interest rate hikes, could act as a headwind for the Greenback. This, along with the disappointing release of the US Durable Goods Orders data, might hold back bullish traders from placing aggressive bets around the USD/CAD pair.

Technical levels to watch

- DXY picks up further traction and surpasses the 103.00 mark.

- Further bounce could see the transitory 100-day SMA revisited.

DXY leaves behind Thursday’s lows in the sub-102.00 area and retakes the 103.00 mark on quite a convincing note.

The initial up-barrier comes at the temporary 55-day SMA near 103.40, while the continuation of the rebound is expected to meet another provisional resistance at the 100-day SMA at 104.37.

Looking at the broader picture, while below the 200-day SMA, today at 106.60, the outlook for the index is expected to remain negative.

DXY daily chart

- EUR/JPY drops sharply and challenges 139.00 on Friday.

- A move to the YTD low near 137.40 appears on the cards.

EUR/JPY adds to Thursday’s losses and drops markedly well below the key 200-day SMA (141.79) at the end of the week.

In case the selling pressure gathers extra steam, the cross could extedn the decline to the 2023 low at 137.38 (January 3).

In the meantime, extra losses remain in store while the cross trades below the 200-day SMA.

EUR/JPY daily chart

At the beginning of the week, crude oil was cheaper than it was last 15 months ago. Strategists at Commerzbank have lowered their oil price forecast. However, they still expect the oil price to rise in the course of this year.

Oil market to be significantly undersupplied in the second half of the year

“Even if the market turmoil subsides, the higher risk aversion sparked by it is likely to ease only gradually. Together with the fundamental data, which are unlikely to be as supportive, this suggests that the oil price will be lower in the months ahead than we have previously expected.”

“On the other hand, OPEC+ is unlikely to stand by and watch a further decline in the oil price, but rather reduce supply if necessary, which argues against a further decline in the oil price.”

“We are lowering our oil price forecast for mid-year to $80 per barrel (previously $95), which would still be higher than current levels.”

“We are sticking to our general view that the price of oil will rise. If the market stabilizes, the US government can be expected to buy oil to replenish its strategic reserves. In addition, the oil market is likely to be significantly undersupplied in the second half of the year due to a strong increase in demand, especially in China, and stagnating supply. We expect that the oil price will rise to $90 per barrel by the end of the year (previously $100).”

Atlanta Fed President Raphael Bostic told NPR on Friday that it was not an easy decision to raise the policy rate, as reported by Reuters.

Additional takeaways

"Clear signs banking system is safe and resilient."

"Inflation still too high, Fed needed to remain focused on that."

"Comfortable Fed can navigate banking sector troubles."

"Fed has to get inflation under control."

"Not expecting economy to fall into recession."

Market reaction

These comments don't seem to be having a significant impact on the US Dollar's performance against its rivals. At the time of press, the US Dollar Index was up 0.55% on the day at 103.15.

- Durable Goods Orders in the US declined unexpectedly in February.

- US Dollar Index stays in positive territory above 103.00.

Durable Goods Orders in the US decreased by 1%, or $2.6 billion, in February to $268.4 billion, the US Census Bureau announced on Friday. This reading followed January's declined of 5% (revised from -4.5%) and came in weaker than the market expectation for an increase of 0.6%.

"Excluding transportation, new orders were virtually unchanged," the publication further read. "Excluding defense, new orders decreased 0.5 percent. Transportation equipment, also down three of the last four months, drove the decrease, $2.6 billion or 2.8 percent to $89.4 billion."

Market reaction

The US Dollar Index keeps its footing after this data and was last seen rising 0.6% on the day at 103.20.

The Bank of England (BoE) announced that it raised its policy rate by 25 basis points to 4.25%. The decision barely moved the Pound. Economists at MUFG Bank expect the GBP/USD pair to see further gains.

BoE hiked but the reasoning was less than clear

“Given the MPC guidance in February repeated yesterday that ‘if there were to be evidence of more persistent (inflation) pressures, then further tightening in monetary policy would be required’ the decision to hike is from those perspective difficult to explain.”

“The BoE did highlight stronger than expected labour demand and due in part to the budget GDP growth was also going to be stronger. But clearly the case for tightening wasn’t compelling but the stronger CPI data overall probably forced the BoE’s hand. We see a good chance now that yesterday’s hike was the last.”

“There was not enough in the details for any abrupt shift in market expectations and there’s been minimal impact on GBP. Hence the positive momentum in GBP/USD could continue and we see scope for further gains to the upside from here given the broader less favourable backdrop for the Dollar.”

EUR losses have extended, with the EUR/USD pair dropping under the 1.08 area. Shaun Osborne, Chief FX Strategist at Scotiabank expect the low 1.07s to offer a solid floor.

Resistance aligns at 1.0825/30

“EUR losses have taken back about half of the past week’s rally and extended a bit more than I expected yesterday when noting the bearish short-term developments on the charts.”

“Look for support to firm up in the low 1.07s (55-day MA at 1.0733, 50% Fib of the EUR rally from the Mar 15th low is 1.0725).”

“Intraday resistance is 1.0825/30.”

AUD/USD has failed to stay above the 0.6660 support, exposing the pair to further downside, economists at OCBC Bank report.

Bulls seem to run into fatigue

“Risk sentiment remains fragile over lingering and spill over concerns to European banks. We had earlier cautioned that contagion/worries going outside of US could see risk proxies under pressure.”

“Immediate support at 0.6660 (50% fibo retracement of 2022 low to 2023 high). Break below that exposes the pair to further downside.”

“Next support at 0.6620, 0.6560 levels. Resistance at 0.6680 (21-DMA), 0.6760 (200-DMA).”

CAD slips versus USD and looks prone to more losses, economists at Scotiabank report.

Firm USD support on moderate dip

“USD/CAD gained strongly from yesterday’s attempted push under 1.3650 support and today’s strength in the USD has taken funds above descending trend resistance off the early Mar high at 1.3725 (now support). A bullish break from what has been in effect an extended consolidation boosts upside risks for USD/CAD in the short run at the very least and puts a retest of 1.3850/60 on the radar.

“Trend signals are bullishly aligned on the short-term oscillators, implying firm USD support on moderate dips.”

EUR/USD staged a steady bounce after defending 100-DMA at 1.0520 (now at 1.0610) but the move faltered near 1.0910. The pair must hold above this Moving Average to avoid a deeper pullback, economists at Société Générale report.

Uptrend could extend towards 1.1040/1.1080 on a break past 1.0910

“Daily MACD has entered positive territory pointing towards prevalence of upward momentum.”

“If the pair establishes itself above 1.0910, the uptrend could extend towards recent peak of 1.1040/1.1080.”

“Defending the MA at 1.0610 would be crucial for averting a deeper pullback.”

US Durable Goods Orders overview

The US Census Bureau will publish the monthly Durable Goods Orders data for February at 12:30 GMT this Friday. The report is expected to show that headline orders rose by 0.6% during the reported month, which will represent a modest rebound from the 4.5% sharp fall reported in January. Orders excluding transportation items, which tend to have a broader impact, are anticipated to register a 0.2% growth in February as compared to the 0.8% rise recorded in the previous month.

How could it affect EUR/USD?

Ahead of the key macro data, a fresh wave of the global risk-aversion trade assists the safe-haven US Dollar (USD) to gain strong follow-through traction on Friday and build on the previous day's goodish recovery from a seven-week low. This, in turn, is seen as a key factor behind the EUR/USD pair's sharp intraday slide back closer to the 1.0700 mark. A stronger US macro data might force investors to scale back their expectations for an imminent pause of the Federal Reserve's rate-hiking cycle and would be enough to provide an additional boost to the Greenback.

Conversely, a weaker report will add to worries about a deeper global economic downturn and further take its toll on the global risk sentiment. This, in turn, suggests that the path of least resistance for the USD is to the upside and supports prospects for an extension of the EUR/USD pair's ongoing retracement slide from its highest level since February 03, around the 1.0930 region touched on Thursday.

Eren Sengezer, Editor at FXStreet, offers a brief technical outlook for the major and writes: “EUR/USD broke below the ascending regression channel and the Relative Strength Index (RSI) indicator on the four-hour chart declined slightly below 60 after having stayed in overbought territory early Thursday, suggesting that buyers have moved to the sidelines.”

Eren also outlines important technical levels to trade the EUR/USD pair: “On the downside, 1.0820 (Fibonacci 23.6% retracement of the latest uptrend, 20-period Simple Moving Average (SMA)) aligns as immediate support. In case the pair falls below that level and starts using it as resistance, the downward correction could extend toward 1.0760 (Fibonacci 38.2% retracement) and 1.0720 (50-period SMA).”

“First resistance is located at 1.0850 (static level) ahead 1.0900 (psychological level, static level) and 1.0930 (multi-week high set on Thursday),” Eren adds further.

Key Notes

• EUR/USD Forecast: Euro could extend correction if 1.0820 support fails

• EUR/USD comes under heavy pressure and breaches 1.0800

• EUR/USD: 1.1000 can be tested quite soon – ING

About US durable goods orders

The Durable Goods Orders, released by the US Census Bureau, measures the cost of orders received by manufacturers for durable goods, which means goods planned to last for three years or more, such as motor vehicles and appliances. As those durable products often involve large investments they are sensitive to the US economic situation. The final figure shows the state of US production activity. Generally speaking, a high reading is bullish for the USD.

Sterling has not escaped the corrective rebound in the USD. Cable could fall to the 1.2075/1.2125 range on a break under the 1.22 level, economists at Scotiabank report.

Loss of support at 1.2260 confers a soft look on the GBP outlook in the short run

“Short-term pressure on the GBP is moderating around the 1.22 line – minor pivot support on the intraday chart. Loss of support at 1.2260 (minor resistance intraday now ) confers a soft look on the GBP outlook in the short run, however.”

“Weakness below the 1.22 point will tip the balance of risks towards a deeper drop to the 1.2075/1.2125 range.”

We saw a Dollar rebound yesterday, but that may not last long, economists at ING report.

Yellen is the new Powell

“The most obvious symptom of how the Fed has lost its grip on the market is US Treasury secretary Janet Yellen ‘stealing’ Fed Chair Jerome Powell’s spotlight as a market driver. This happened blatantly on Wednesday when a dovish Fed hike was out-shadowed by Yellen’s backtracking on a ‘blanket’ bank deposit insurance. Yesterday, she offered some reassurance to markets in that sense, saying: ‘Certainly, we would be prepared to take additional actions if warranted’.”

“Markets seriously struggle to see the US small bank troubles being resolved without substantial support from the government. Ultimately, this continues to endorse our baseline bearish bias on the Dollar, as a situation that neither develops into a fully-fledged systemic crisis (which would be USD positive) nor significantly improves on the US regional banking side which should keep markets betting on Fed easing later this year.”

“At the moment, there are around 90 bps of cuts priced in, starting in July, and the unclear Fed communication is doing very little to reliably push back against those.”

The continuation of the downward bias in USD/CNH should meet tough contention around 6.8000 for the time being.

Key Quotes

24-hour view: “Yesterday, USD dropped to 6.8108 in Asian trade before rebounding to trade sideways for the rest of the sessions. USD appears to have moved into a consolidation phase and it is likely to trade in a range of 6.8150 and 6.8500 today.”

Next 1-3 weeks: “We have expected a weaker USD for more than a week. As USD struggled to extend its weakness, in our most recent narrative from 21 Mar (spot at 6.8800), we stated that USD ‘has to break and stay below 6.8550 in the next couple of days or it is unlikely to weaken further’. USD dropped below 6.8550 on Wednesday (22 Mar) and yesterday, it dropped further to 6.8108. While the price actions suggest USD could weaken further, any decline is expected to face strong support at 6.8000. The downside risk is intact as long as it stays below 6.8710 (‘strong resistance’ level previously at 6.9100).”

- AUD/USD comes under heavy selling pressure on Friday amid resurgent USD demand.

- Reviving recession fears weigh on investors’ sentiment and boost the safe-haven buck.

- Traders now look to the US Durable Goods Orders and flash PMIs for a fresh impetus.

The AUD/USD pair attracts fresh sellers on Friday and extends the previous day's rejection slide from over a two-week peak, around the 0.6755-0.6760 region, which coincides with a technically significant 200-day Simple Moving Average (SMA). The intraday downfall drags spot prices to over a one-week high, around the 0.6635 area during the first half of the European session and is sponsored by resurgent US Dollar (USD) demand.

In fact, the USD Index, which tracks the Greenback against a basket of currencies, builds on the previous day's solid bounce from a seven-week low and gains strong follow-through traction amid a sharp fall in the equity markets. The disappointing release of manufacturing PMIs from the Eurozone and the UK revived worries about looming recession risks. This, in turn, takes its toll on the global risk sentiment, which forces investors to take refuge in traditional safe-haven assets, including the Greenback.

This comes on the back of data released earlier this Friday, which indicated renewed contraction in Australia's private sector business activity in February and drives flows away from the perceived riskier Aussie. In fact, the gauge for the manufacturing sector dropped to 48.7 in March from the 50.7 previous, while Services PMI came in at 48.2 during the reported month as compared to 50.7 in February. Furthermore, the Composite PMI also dropped to 48.1 in March from February's 50.6 final print.

This, along with the Reserve Bank of Australia's (RBA) dovish signal, indicating that a pause in the rate-hiking cycle may be on the cards next month, exerts additional downward pressure on the AUD/USD pair. It, however, remains to be seen if the USD bulls can maintain their dominant position amid the Fed's less hawkish outlook on Wednesday. The US central bank raised interest rates by 25 bps, as expected, though sounded cautious about the outlook in the wake of the recent turmoil in the banking sector.

This leads to a further decline in the US Treasury bond yields and could act as a headwind for the Greenback, which should help limit losses for the AUD/USD pair, at least for the time being. Market participants now look forward to the US economic docket, featuring the release of Durable Goods Orders and flash PMI prints for March. This, along with the broader risk sentiment, will influence the USD price dynamics and allow traders to grab short-term opportunities around the pair heading into the weekend.

Technical levels to watch

European Central Bank (ECB) policymaker Joachim Nagel argued on Friday that the ECB's current interest level was not high in comparison to rates of inflation in the Eurozone, as reported by Reuters.

"Wage developments are likely to prolong the prevailing period of high inflation rates," Nagel said in a lecture in Edinburgh. "In other words: Inflation will become more persistent."

"It will be necessary to raise policy rates to sufficiently restrictive levels in order to bring inflation back down to 2% in a timely manner," Nagel further added.

Market reaction

EUR/USD failed to capitalize on these hawkish comments and it was last seen losing 0.9% on the day at 1.0733.

The Bank of England (BoE) raised its key interest rate by 25 basis points. BoE has done a good job, in the opinion of Ulrich Leuchtmann, Head of FX and Commodity Research at Commerzbank.

BoE did not give even the slightest hint of a less hawkish approach

“The BoE has done a good job. I do not mean its monetary policy, but its communication policy. Despite its small rate step of only 25 bps it did not create the impression that its determination to fight inflation has weakened. And that is why yesterday’s BoE decision was neutral for Sterling – contrary to my expectations.”

“Contrary to the Fed, the British central bankers did not give even the slightest hint of a less hawkish approach. That is why the rate cut was not GBP negative.”

For the second time this week on Thursday, Gold price climbed above $2,000. Economists at ANZ Bank note that the yellow metal sees increasing demand on speculation about a possible pause in rate hikes by the Federal Reserve.

Gold finds support from increased interest in haven assets amid ongoing banking crisis

“The metal has one of the strongest relationships with the greenback and is highly sensitive to interest rate moves. A potential pause in interest rate hikes by the Fed is seeing investors increase their allocation to the precious metal.”

“Gold is also finding some support from increased interest in haven assets amid the ongoing banking crisis.”

“An increase in net long positions by speculators has been driven by both new longs and short covering. The inflows into gold-backed ETFs have risen sharply in recent weeks.”

- GBP/USD meets with aggressive supply on Friday and is pressured by a combination of factors.

- The risk-off impulse boosts the safe-haven USD and triggers the initial leg of the intraday slide.

- The disappointing release of the UK PMI weighs on the GBP and contributes to the downfall.

The GBP/USD pair comes under heavy selling pressure on the last day of the week and retreats further from its highest level since early February, around the 1.2340-1.2345 region touched on Thursday. The selling bias remains unabated through the first half of the European session and drags spot prices back closer to the 1.2200 mark in the last hour.

A fresh wave of the global risk-aversion trade - as depicted by a sharp intraday fall in the equity markets - assists the US Dollar (USD) to gain strong follow-through traction on Friday and build on the previous day's goodish rebound from a seven-week low. This, in turn, is seen as a key factor weighing heavily on the GBP/USD pair. The British Pound is further weighed down by the Bank of England Governor Andrew Bailey's dovish remarks and the disappointing release of the flash UK PMI prints for March.

In an interview with BBC on Friday, Bailey noted that there is evidence of encouraging progress on inflation and that companies should bear in mind that BoE forecasts inflation will fall. Furthermore, the S&P Global/CIPS UK Manufacturing PMI contracted further to 48.0 in March versus the 49.8 expected and the previous month's final reading of 49.3. Adding to this, the Preliminary UK Services Business Activity Index for March dropped to 52.8 from 53.5 in February and consensus estimates for a reading of 53.0.

With the latest leg down, the GBP/USD pair has now reversed a major part of its gains recorded over the past two sessions and has now moved well within the striking distance of the weekly low. Market participants now look forward to the US economic docket, featuring the release of Durable Goods Orders and the flash PMI prints for March. This, along with the broader risk sentiment, will influence the USD price dynamics and allow traders to grab short-term opportunities around the major.

Technical levels to watch

The Turkish central bank (CBT) surprised in the hawkish direction in some theoretical sense – the FX market was unimpressed, economists at Commerzbank report.

Approaching crucial elections

“Many observers had expected CBT to lower its benchmark rate by 50 bps yesterday. Hence, the hold decision was theoretically a hawkish surprise.”

“Still, several commentators think that a rate cut next month remains likely. Perhaps this is why the hold decision by CBT had no noticeable impact on USD/TRY.”

“We are approaching crucial elections: our base-case may be that Erdogan will hold on to the presidency, but polls suggest that he faces a genuine threat. The outlook for rates is therefore highly ‘bifurcating’ under the two competing scenarios, hence the market is justified in taking no strong position at this time.”

“Of course, all this is not to deny that the Lira’s inert response could be primarily because the currency has become increasingly disconnected from international markets as more and more capital controls have been imposed.”

- EUR/USD adds to Thursday’s losses below the 1.0800 mark.

- Flash Manufacturing PMIs in Germany and EMU disappoint in March.

- US Durable Goods Orders, advanced PMIs next on tap across the pond.

Further selling pressure now drags EUR/USD back below the 1.0800 yardstick, or 2-day lows, at the end of the week.

EUR/USD weaker post-PMIs

EUR/USD extends the pessimism in the second half of the week and retreats from recent monthly peaks north of 1.0900 the figure on the back of the moderate pick-up in the demand for the greenback, while the mixed prints from preliminary PMIs in the euro bloc also collaborate with the corrective daily decline.

On the latter, while the Services sector in the euro area remains healthy, the Manufacturing sector still struggles to find a firmer foot after preliminary readings showed the Manufacturing PMI in Germany and the broader Euroland are expected to have eased to 44.4 (from 46.3) and 47.1 (from 48.5), respectively, during March.

Later in the US data space, Durable Goods Orders for the month of February are due seconded by flash PMIs and the speech by St. Louis Fed J.Bullard.

What to look for around EUR

EUR/USD gathers further downside traction and breaks below the 1.0800 mark on the back of some profit taking mood, the dollar’s recovery and disheartening results from the domestic calendar.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next moves from the ECB in a context still dominated by elevated inflation, although amidst dwindling recession risks for the time being.

Key events in the euro area this week: European Council Meeting, EMU, Germany Flash PMIs (Friday).

Eminent issues on the back boiler: Continuation, or not, of the ECB hiking cycle. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is retreating 0.53% at 1.0769 and faces immediate support at 1.0732 (55-day SMA) followed by 1.0614 (100-day SMA) and finally 1.0516 (monthly low March 15). On the upside, a break above 1.0929 (monthly high March 23) would target 1.1032 (2023 high February 2) en route to 1.1100 (round level).

- UK Manufacturing PMI contracts to 48.0 in March, a negative surprise.

- Services PMI in the UK comes in at 52.8 in March, a big miss.

- GBP/USD remains in the red near 1.2250 on disappointing UK PMIs.

more to come ...

Further decline in USD/JPY should meet initial and firm support at 130.15 ahead of 129.80, according to Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

24-hour view: “Yesterday, USD dropped to a low of 130.31. The low is not far above a major support level of 130.15. While downward momentum has waned somewhat, there is potential for USD to break 130.15 today. The next support at 129.80 is unlikely to come under threat. Resistance is at 131.00, a breach of 131.40 would indicate that the weakness in USD has stabilized.”

Next 1-3 weeks: “In our most recent update from Wednesday (22 Mar, spot at 132.50), we stated that the recent USD weakness has ended. Our call was premature as USD continues to drop as it fell to a low of 130.31 yesterday. Despite the decline, short-term conditions remain severely oversold. However, there is room for USD to weaken further though there are a couple of rather solid support levels at 130.15 and 129.80. On the upside, a breach of 132.50 would suggest USD is not weakening further.”

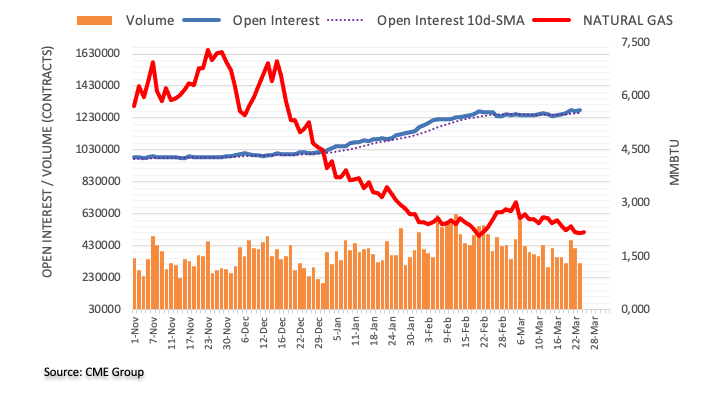

Open interest in natural gas futures markets resumed the uptrend and rose marginally by 349 contracts on Thursday, according to preliminary readings from CME Group. On the other hand, volume dropped for the second session in a row, this time by around 96.5K contracts.

Natural Gas: Another visit to $2.00 seems just around the corner

Natural gas prices dropped for the second consecutive day on Thursday. The downtick was in tandem with a small increase in open interest, exposing the continuation of the multi-week retracement for the time being. That said, the next target of note still at the $2.00 region per MMBtu.

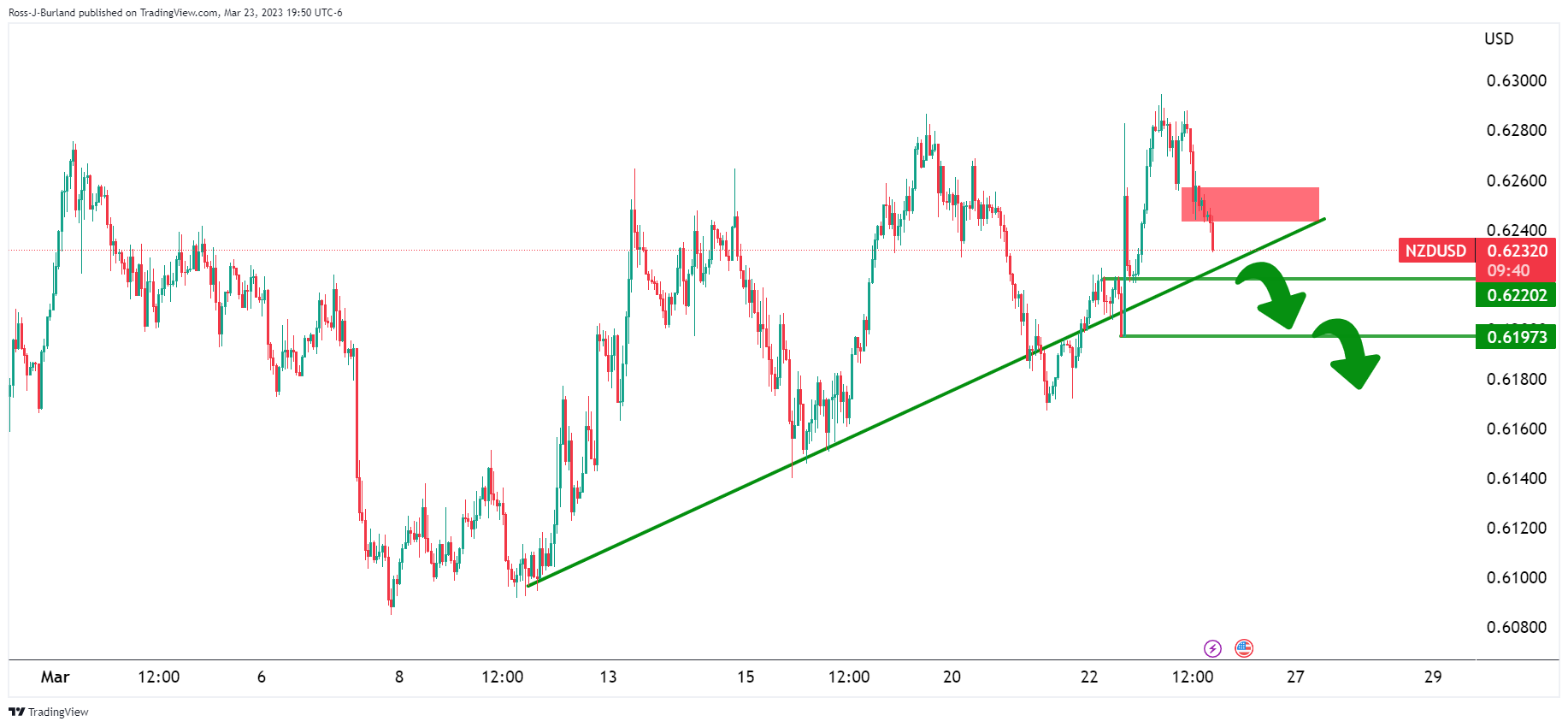

- NZD/USD comes under renewed selling pressure on Friday amid the ongoing USD recovery.

- A fresh leg down in the equity markets benefits the buck and weighs on the risk-sensitive Kiwi.

- The Fed’s less hawkish stance, sliding US bond yields could cap any further gains for the USD.

The NZD/USD pair extends the overnight pullback from the vicinity of the 0.6300 mark, or its highest level since February 16 and witness some follow-through selling on the last day of the week. The downward trajectory picks up pace during the first half of the European session and drags spot prices to a fresh daily low, closer to the 0.6200 round figure in the last hour.

The US Dollar (USD) is gaining positive traction for the second straight day on Friday and recovering further from a seven-week low touched the previous day, which, in turn, is seen weighing on the NZD/USD pair. As investors digest the Federal Reserve's less hawkish outlook, a fresh leg down in the equity markets drives some haven flow towards the Greenback and exerts pressure on the risk-sensitive Kiwi.

Against the backdrop of worries about a full-blown banking crisis, the disappointing release of the flash German Manufacturing PMI for March revives fears of a deeper global economic downturn. This, in turn, takes its toll on the global risk sentiment and boosts demand for traditional safe-haven assets, including the buck. That said, the Fed's hints of a pause to interest rate hikes could cap gains for the USD.

It is worth recalling that the US central bank, as was widely anticipated, raised interest rates by 25 bps on Wednesday, though sounded cautious in the wake of the recent turmoil in the banking sector. Furthermore, the Fed lowered its median forecast for real GDP growth projections for 2023 and 2024. This leads to a further decline in the US Treasury bond yields and should act as a headwind for the Greenback.

This, in turn, warrants some caution before positioning for an intraday depreciating move for the NZD/USD pair. Even from a technical perspective, the recent two-way range bound price action witnessed over the past two weeks or so also points to indecision over the next leg of a directional move. That said, repeated failures to find acceptance above the 200-day Simple Moving Average (SMA) favour bearish traders.

Market participants now look forward to the US economic docket, featuring the release of Durable Goods Orders and flash PMI prints later during the early North American session. This, along with the US bond yields, might influence the USD and provide some impetus to the NZD/USD pair. Traders will further take cues from the broader risk sentiment to grab short-term opportunities on the last day of the week.

Technical levels to watch

The Hungarian Forint and the Czech Koruna has strengthened this week. Economists at ING expect this trend to continue in the coming days.

Ready to rally further

“Our bullish view on the Hungarian Forint and the Czech Koruna is materialising, benefiting all week from higher EUR/USD, reduced risk aversion and record-low gas prices.”

“We expect this trend to continue in the coming days and especially next week when the National Bank of Hungary and the Czech National Bank are both scheduled to hold meetings. Both central banks should confirm stable rates and a hawkish tone and push back against the dovish market pricing coming from the global story. In our view, this should extend the rally in the Forint and the Koruna.”

- Eurozone Manufacturing PMI arrives at 47.1 in March vs. 49.0 expected.

- Bloc’s Services PMI climbs to 55.6 in March vs. 52.5 expected.

- EUR/USD holds lower ground near 1.0775 on the mixed Eurozone PMIs.

The Eurozone manufacturing sector contraction deepened in March, the latest manufacturing activity survey from S&P Global research showed on Friday.

The Eurozone Manufacturing Purchasing Managers Index (PMI) arrived at 47.1 in March vs. 49.0 expected and 48.5 previous. The index reached a four-month low.

The bloc’s Services PMI stood at 55.6 in March vs. 52.5 estimates and February’s 52.7, hitting a 10-month high.

The S&P Global Eurozone PMI Composite jumped to 54.1 in March vs. 51.9 estimated and 52.0 last. The measure recorded a new 10-month high.

Comments from Chris Williamson, Chief Business Economist at S&P Global

“The eurozone economy is showing fresh signs of life as we enter spring, with business activity growing at its fastest rate for ten months in March.”

“The survey is consistent with GDP growth of 0.3% in the first quarter, accelerating to an equivalent rate of 0.5% in March alone.”

FX implications

EUR/USD remains pressured near 1.0775 following the release of the mixed Eurozone PMIs. The spot is losing 0.50% on the day.

- Gold price bulls come alive and push XAU/USD back above the $2,000 mark.

- US Dollar and Treasury yields fall to a new low, supporting Gold’s comeback.

- Central banks to increase their Gold reserves due to geopolitical concerns, says report.

XAU/USD price has broken back up above the $2,000 level after dip-buying in the $1,960 vicinity on Thursday led to the start of a new leg higher for the precious metal. Falling Treasury yields and a weaker US Dollar supported Gold’s uptrend. The release of Durable Goods Orders and PMI data later on Friday could dictate the metal’s next move.

US Dollar sinks to new monthly low before recovery

Markets tick over with no one major theme driving price action. The Dollar Index (DXY) has recovered from new monthly lows set on Thursday in the 101.90s, forming a bullish hammer candlestick on the daily chart suggestive of a reversal after March’s sharp decline. Without a strong bullish confirmation day to back it up, however, it’s still too early to say. If the US Dollar does start to reverse higher, however, it will be a negative factor for XAU/USD.

The next data release to impact the US Dollar is likely to be Durable Goods Orders on Friday, at 12:30 GMT, followed by the US Manufacturing and Services PMI at 13:45 GMT. The Federal Reserve’s James Bullard is also scheduled to speak at 13:30 GMT, and his views on inflation and the future trajectory of rates may also impact prices.

Central banks diversify into Gold

Central banks in parts of the world not aligned to the West are ‘de-Dollarising’ due to geopolitical polarization and diversifying into Gold instead, according to a recent report by French bank Société Générale.

“The longer the Russia-Ukraine conflict endures, the faster countries not aligned with the West will be willing to isolate themselves from the USD. This will encourage central banks to continue their strong Gold purchases,” says the report.

“The central banks of non-aligned countries should continue to de-Dollarise their portfolios and keep buying Gold (6% of our allocation, unchanged) which, at a later stage, will be backed by lower real yields,” Soc Gen adds.

Gold gently pulls back after breaking above key $2,000 level

XAU/USD trades at $1,988 at the time of writing. It is in an uptrend on a medium and short-term basis, so bullish bets are favored. On Thursday it breached above the key $2,000 psychological mark for the first time since Monday when markets went bananas over the demise of Credit Suisse. Overnight it has undergone a gentle pullback and may now be said to be in what traders call the ‘buy zone’.

-638152444611838784.png)

Gold price: 4-hour Chart.