- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 27-03-2023

- NZD/USD rebounds from 0.6181 low as Silicon Valley Bank deal eases banking crisis concerns.

- Making inflation their top priority, Fed officials.

- Upcoming US Personal Consumption Expenditure (PCE) data release to influence US Dollar dynamics.

The NZD/USD currency pair experienced a slight rebound after reaching the 0.6181 mark, following a significant decline over several days due to jittery market sentiment amid the ongoing banking crisis.

The New Zealand dollar struggled last week as bank stress impacted risk appetites. However, on Monday, the risk-sensitive currency found some support following the Silicon Valley Bank (SVB) deal and the Federal Deposit Insurance Corporation's (FDIC) confirmation that First Citizens bank would assume all deposits and loans of Silicon Valley Bridge Bank from the FDIC.

Bloomberg reported that US regulators are considering expanding an emergency lending facility for banks, allowing First Republic Bank (FRC) more time to strengthen its balance sheet.

Over the weekend, Federal Reserve (Fed) voter Kashkari spoke with a dovish tone, emphasizing the uncertainty of the banking crisis's impact on the economy and the Fed's close monitoring of the situation. This contrasts with the hawkish views of non-voting colleagues Barkin and Bullard, who focused on addressing inflation over financial stability.

Fed Vice-Chair of Supervision Barr, in recent testimony, reassured that the banking system remains sound and resilient, with the Fed committed to ensuring deposit safety. He also discussed planned regulations to enhance the financial system's resiliency, including long-term debt requirements for large banks, improved stress testing, and exploration of liquidity rules and other reforms.

Market focus now shifts to the upcoming US Personal Consumption Expenditure (PCE) data release later this week, which will likely shape US Dollar dynamics.

Levels to watch

- AUD/NZD has shown a decent recovery from 1.0720 ahead of the release of the Aussie retail demand data.

- Australian inflation has remained extremely stubborn led by a shortage of labor and robust demand.

- RBA policymakers would maintain their intention of pausing the policy-tightening spell from its April meeting if inflation decelerates.

The AUD/NZD pair has sensed strength after a correction to near 1.0720 in the early Asian session. The cross is likely to show some action as the Australian Bureau of Statistics will report February’s monthly Retail Sales data. According to the estimates, the economic data is expected to expand by 0.4% lower than the former expansion of 1.9%.

Inflationary pressures in the Australian economy have remained extremely stubborn led by a shortage of labor and robust demand by households. The Reserve Bank of Australia (RBA) has already pushed its Official Cash Rate (OCR) to 3.60% to bring down persistent inflation, however, the Consumer Price Index (CPI) has not reacted in tandem with the velocity of hiking rates. Going forward, softening of retail demand would provide some relief to RBA Governor Philip Lowe and other policymakers.

This week, Australia’s monthly inflation data (Feb) will be keenly watched. Australia’s monthly inflation decelerated dramatically from 8.4% to 7.4% in January, which has cemented hopes of investors that the momentum would continue. The street is anticipating a decline in monthly CPI to 7.1% from the former release of 7.4%. An occurrence of the same would allow RBA policymakers to maintain their intention of pausing the policy-tightening spell from its April meeting.

On the New Zealand Dollar front, investors are worried about the economic outlook of the kiwi economy as flood situation has dented the sentiment of households. This week, investors will focus on New Zealand Building Permits (Feb) data. The economic data is expected to expand by 05% against a contraction of 1.5% witnessed earlier.

Retail Sales Overview

Early Tuesday, the market sees preliminary readings of Australia's seasonally adjusted Retail Sales for February month at 00:30 GMT. Market consensus suggests a softer seasonally adjusted monthly print of 0.4% versus 1.9% prior, suggesting a reduction in the pressure for the Reserve Bank of Australia (RBA) to act faster to tame inflation woes.

Given the recently softer Aussie inflation data and the mixed comments from the Reserve Bank of Australia's (RBA) officials, not to forget the challenges to sentiment ahead of the month-end consolidation, today’s Aussie Retail Sales data appears crucial for the AUD/USD traders.

It should be noted that comments from Assistant Governor (Economic) at the Reserve Bank of Australia, Luci Ellis, scheduled for 04:15 AM GMT, also increase the importance of the Asia-Pacific economic calendar on Tuesday.

Ahead of the data, Westpac said,

Our Westpac Card Tracker suggests the underlying trend in retail slowed further in Feb, dipping into negative on a rolling 3mth basis. That said, the volatile monthly profile since Nov, and the big decline in Dec in particular, mean the Feb month is still likely to see a gain vs Jan. A 0.5% rise will still leave retail sales down 1.4% on a 3mth basis (i.e. Dec-Jan-Feb vs Sep-Oct-Nov). With retail prices still rising, this suggests there has been a more pronounced weakening in sales volumes.

How could it affect AUD/USD?

AUD/USD extends the week-start rebound to refresh intraday high around 0.6660 heading into the key Aussie event. It’s worth noting that the firmer sentiment and broad US Dollar weakness underpins the risk-barometer pair’s latest run-up while the pre-data anxiety seems to test the bulls of late.

That said, the recent chatters surrounding the Aussie recession, amid fears of comparatively higher rates in Australia than the US, may also seek validation from today’s Aussie Retail Sales data. Hence, recovery in the key statistics may allow the AUD/USD buyers to extend the latest rebound to cross the immediate technical hurdle while a negative surprise, which is more likely, could recall the Aussie pair buyer by highlighting the hawkish Fed concerns.

It should be noted, however, that Wednesday’s Aussie Consumer Price Index (CPI) also increases the importance of today’s Retail Sales data as any disappointment from the figures could prod the firmer inflation-led run-up of the AUD/USD pair.

Technically, AUD/USD rebound remains elusive unless providing a sustained daily close beyond 0.6700 support-turned-resistance comprising lower line of the short-term rising wedge.

Key Notes

AUD/USD continues to juggle below 0.6660 ahead of Australian Retail Sales and CPI data

AUD/USD Forecast: More weakness below 0.6630

About Australian Retail Sales

The Retail Sales released by the Australian Bureau of Statistics is a survey of goods sold by retailers based on a sampling of retail stores of different types and sizes and it's considered an indicator of the pace of the Australian economy. It shows the performance of the retail sector over the short and mid-term. Positive economic growth anticipates bullish trends for the AUD, while a low reading is seen as negative or bearish.

North Korean leader Kim Jong Un called for scaling up weapons-grade nuclear materials to increase the country's nuclear arsenal, saying it should be fully ready to use the weapons at any time, state media KCNA said on Tuesday.

His remarks suggest he will continue provocative weapons tests in a pressure campaign to wrest concessions from the US and its allies. The parade on Monday night was to mark the 90th anniversary of North Korea’s army and was held as the country’s economy is battered by pandemic-related difficulties, punishing US-led sanctions and its own mismanagement.

- GBP/USD picks up bids to extend week-start recovery moves from short-term key support.

- 50-SMA, 61.8% Fibonacci retracement level challenge bears amid looming bull cross on the MACD.

- Rising wedge confirmation keeps Cable sellers hopeful unless the quote stays below 1.2330 previous support.

GBP/USD remains on the front foot as bulls attack the 1.2300 mark during Tuesday’s Asian session, following an upbeat start of the week.

In doing so, the Cable pair stretches the previous run-up from the 50-bar Simple Moving Average (SMA) and the 61.8% Fibonacci retracement level of the quote’s January-March downside. Adding strength to the upside bias could be the impending bulls cross on the MACD.

However, the previous week’s confirmation of the rising wedge bearish chart pattern keeps the Cable pair sellers hopeful unless the quote stays below the previous support line of the wedge, near 1.2330 by the press time.

Following that, the stated wedge’s top line near the 1.2400 round figure and multiple hurdles near the 1.2420-25 area can test the GBP/USD pair’s further upside ahead of directing it to the Year-To-Date (YTD) top surrounding 1.2450.

On the flip side, the 50-SMA and the aforementioned key Fibonacci ratio can challenge short-term GBP/USD bears around 1.2220 and 1.2200 respectively.

In a case where the Cable pair remains bearish past 1.2200, the 50% Fibonacci retracement and 200-SMA can test the downside moves around 1.2125 and 1.2080 in that order before directing bears towards the 1.2000 psychological magnet.

It should be noted that multiple supports near 1.1920 act as the last defense of the GBP/USD buyers.

GBP/USD: Four-hour chart

Trend: Further upside expected

- USD/CHF is expected to deliver a breakdown below 0.9150 on hopes that Fed won’t be heavy on interest rates.

- The street is anticipating that tight credit conditions by US banks are sufficient to bring down inflation further.

- Swiss ZEW Survey- Expectations (March) might decline heavily to -18.9 from the former release of -12.3.

The USD/CHF pair looks vulnerable above the immediate cushion of 0.9150 in the Asian session. The Swiss franc asset is expected to break down the aforementioned support as odds for an unchanged monetary policy by the Federal Reserve (Fed) are advancing.

S&P500 futures have extended their gains after a positive Monday on hopes that the United States banking system will get to the road of recovery sooner and the Fed won’t be heavy on interest rates from now, portraying positive market sentiment.

The demand for US government bonds remained extremely weak as investors channelize their funds into other assets. Safe-haven appeal for US government bonds eased dramatically as US authorities are making efforts to bail out the vulnerable banking system. Reuters reported that First Citizens BancShares said it would take on the deposits and loans of failed Silicon Valley Bank (SVB). On weekend, the US government planned to stretch its emergency lending facility for small banks as households rushed for their deposits while borrowings soared.

Meanwhile, the US Dollar Index (DXY) has gradually corrected to near 102.83 as investors’ domain is advocating an unchanged monetary policy by the Federal Reserve (Fed) ahead. The street is anticipating that tight credit conditions by US banks are sufficient to bring down inflation further. And further policy tightening could harm the economy.

On the Swiss front, expectations for a tight monetary policy by the Swiss National Bank (SNB) could keep the Swiss franc solid. SNB Chairman Thomas J. Jordan confirmed that the central bank won’t hesitate in hiking rates further if inflation continues to remain persistent.

Going forward, Swiss ZEW Survey-Expectations (March) data will remain in focus. As per the consensus, the economic data would decline heavily to -18.9 from the former release of -12.3. It seems that the demise of Credit Suisse has dented the sentiment of firms.

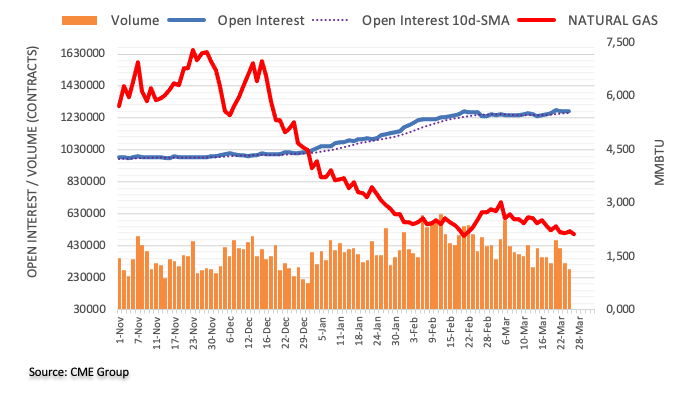

- West Texas Intermediate crude is sinking on Thursday.

- Investors fear a recession in the aftermath of the Fed.

West Texas Intermediate crude oil surged higher and was posting a 1-1/2 week high and gasoline posted a 2-week high. A weaker US Dollar on Monday was also bullish for energy prices. Easing banking sector concerns helped lift the mood after US authorities said they were considering expanding a lending facility to help regional banks shore up their balance sheets. West Texas Intermediate is currently flat near $72.80 after rallying from $69.18.

´´The extension of a lending facility for the sector comes as a buyer was found for the Silicon Valley Bank. This saw crude oil track broader markets amid the improved risk appetite,´´ analysts at ANZ Bank said. ´´The market was also encouraged by improving demand prospects. China’s top refiner, CNPC said that apparent oil demand in the country may expand by 5.1% to 756mt this year. This follows data showing that US exports of crude oil and refined products surged to a record 12mb/d. Disruption to supply is also raising concerns.´´ The analysts at ANZ also noted that Exxon Mobil said it would begin shutting down its refinery in Gravenchon France, representing 20% of the country’s refinery capacity, as protests across the country impact crude supply.

Additionally, last Wednesday, India's oil ministry reported that India Feb crude oil imports rose +8.5% YoY to 19.1 MMT, the most in seven months. Also, an EIA report showed that US crude oil inventories as of March 17 were +7.6% above the seasonal 5-year average, gasoline inventories were -4.0% below the seasonal 5-year average, and distillate inventories were -8.8% below the 5-year seasonal average.

Baker Hughes reported last Friday that active U.S. oil rigs in the week ended March 24 rose by +4 rigs to 593 rigs, moderately below the 2-1/2 year high of 627 rigs posted on December 2. US active oil rigs have more than tripled from the 17-year low of 172 rigs seen in Aug 2020, signaling an increase in US crude oil production capacity.

- AUD/JPY justifies its risk-on mood to grind higher after reversing from one-year low.

- Yields rally as banking fears ease, central bankers remain shy of backing further rate hikes.

- Upbeat Japan data failed to impress sellers amid risk-on mood.

- Australia Retail Sales for February and speeches from BoJ Governor Kuroda and RBA Policymaker Ellis eyed.

AUD/JPY seesaws near 87.50, following a clear rebound from the one-year low, as bulls await the key catalysts from Australia and Japan during early Tuesday. That said, the cross-currency pair cheered firmer sentiment to post the first daily gains in four the previous day.

With the European and the US authorities’ announcements of the extension of emergency lending to banks, the market players took a sigh of relief from the banking sector crisis. On the same line were comments from the central bank officials pushing back the banking crisis concerns and the Silicon Valley Bank (SVB) deal. It’s worth noting that the month-end consolidation could also be held responsible for the AUD/JPY pair’s run-up, especially when it eyes the second monthly fall with above 4.0% loss.

While portraying the mood, Wall Street closed mixed, losing some of the intraday gains in the late hours, whereas yields rebound after a four-week downtrend.

It should be noted that the AUD/JPY pair’s run-up ignored upbeat prints of Japan’s Coincident Index and Leading Economic Index for January, as well as growing chatters of the Bank of Japan (BoJ) exit from the ultra-easy monetary policy.

Looking ahead, Australia’s Retail Sales for February, expected 0.4% versus 1.9% prior, could offer immediate direction to the AUD/JPY pair ahead of a speech from BoJ’s exiting Governor Haruhiko Kuroda. Following that, comments from Assistant Governor (Economic) at the Reserve Bank of Australia, Luci Ellis will be important to watch for clear directions.

Among the key catalysts, talks about the banking crisis and central bank comments will be important for near-term directions.

Technical analysis

AUD/JPY recovery remains elusive unless the quote stays below a three-week-old resistance line, around the 88.00 round figure by the press time.

- USD/JPY rebounds from 129.64 low as banking sector receives relief from FDIC intervention.

- US regulators explore emergency lending expansion, bolstering USD against safe-haven Yen.

- Fed's cautious stance on interest rates amid inflation concerns and banking crisis impact USD/JPY outlook.

The USD/JPY currency pair has found some stability above the 131.50 mark, as US Treasury (UST) bond yields rise. The US Dollar has reached a five-day high against the Japanese Yen due to US authorities' efforts to alleviate concerns surrounding the global banking system, which has helped calm investors.

After dropping to the 129.64 mark, USD/JPY reversed course as market sentiment improved amid the ongoing banking crisis. Global banking stocks, which had been negatively impacted this month after the sudden collapse of Silicon Valley Bank (SVB) and Signature Bank, experienced relief on Monday. The Federal Deposit Insurance Corporation (FDIC) announced that First Citizens BancShares Inc would acquire all of Silicon Valley Bank's deposits and loans from the regulator.

According to Bloomberg, US regulators are considering expanding an emergency lending facility for banks in ways that would grant First Republic Bank (FRC) additional time to strengthen its balance sheet. This news has reduced concerns, leading the US Dollar to gain ground against the Japanese Yen as investors scaled back their demand for the safe-haven Yen.Even with positive developments in the banking sector and rising UST bond yields, the US Dollar has remained in a narrow range against most of its counterparts.

On Wednesday, the U.S. Federal Reserve (Fed) increased interest rates by 25 basis points (bps) as anticipated but maintained a cautious outlook due to the banking sector turmoil. However, Fed Chair Jerome Powell left the possibility of further rate hikes on the table if necessary.

Market expectations for the US Dollar may remain subdued, as investors are pricing in approximately a 55% chance that the Fed will keep interest rates unchanged at its next meeting in May. Additionally, they anticipate a potential rate cut as early as July. Earlier comments from Federal Reserve Board Governor Philip Jefferson highlighted that inflation has been more persistent and higher than desired. Recent Fed commentary has emphasized addressing inflation above the ongoing banking crisis.

The US calendar will feature the Goods Trade Balance for February on Tuesday. Later this week, the market focus will shift toward the release of the US Personal Consumption Expenditure (PCE) data, which could provide further direction for the USD/JPY currency pair.

Levels to watch

- EUR/JPY turns bullish as it forms a double bottom and a bullish engulfing candle pattern.

- Short term, the EUR/JPY is neutrally biased, trapped within the EMAs.

- EUR/JPY Price Analysis: Bullish above 142.00; otherwise would turn downwards.

EUR/JPY rallied sharply on Monday and formed a bullish engulfing candle chart pattern. A double bottom takes shape as the EUR/JPY is poised to test solid resistance at around the 142.29-47 area. At the time of writing, the EUR/JPY is trading at 142.03.

EUR/JPY Price action

The EUR/JPY daily chart is neutral to upward biased. Nevertheless, the last few days’ price action has opened the door for further gains. Oscillators are mixed, with the Relative Strength Index (RSI) flat at bearish territory, while the Rate of Change (RoC) jumped on Monday’s trading session. Therefore, mixed signals could keep EUR/JPY traders at bay.

Short term, the EUR/JPY climb is pausing nearby the 142.00 mark. The EUR/JPY drew a doji, indicating that buyers/sellers are at equilibrium while oscillators remain bullish. The Relative Strength Index (RSI) at 54 turned flat, while the Rate of Change (RoC) was neutral. Therefore, the EUR/JPY might trade sideways before resuming upwards or downwards.

If the EUR/JPY cracks the 142.00 figure, the pair will test the 100-EMA at 142.35. A breach of the latter will expose the 142.54 as the pair sets to test the 143.00 mark.

On the flip side, the EUR/JPY first support would be the 50-EMA at 141.88. Once cleared, the pair would tumble to the confluence of the 20-EMA and the pivot point at 141.58 before testing 141.00.

EUR/JPY 4-hour chart

EUR/JPY Technical levels

- USD/CAD seesaws around intraday low after falling the most in two weeks the previous day.

- One-month-old ascending support line restricts immediate downside; 200-EMA is the key hurdle for Loonie pair bears.

- Downbeat oscillators add strength to the bearish bias.

- Recovery needs validation from 1.3815 to convince the bulls.

USD/CAD bears take a breather around 1.3660 during the early Asian session, following the biggest daily loss in a fortnight. In doing so, the Loonie pair seesaws around the key short-term support, as well as floats above the 1.3630 support confluence.

USD/CAD pair’s weakness gains support from the bearish MACD signals and downbeat RSI (14) line, not oversold. However, upward-sloping support from late February, around 1.3650 at the latest, restricts immediate declines of the quote.

Following that, a convergence of the 200-bar Exponential Moving Average (EMA) joins the 38.2% Fibonacci retracement level of the pair’s February-March upside, near 1.3630, appears a tough nut to crack for the USD/CAD bears to crack.

Should the quote remains bearish past 1.3630, the odds of witnessing a slump toward the 50% Fibonacci retracement surrounding 1.3560 can’t be ruled out.

Meanwhile, recovery moves may initially aim to regain the 1.3700 round figure before challenging the latest tops surrounding 1.3750 and 1.3800.

However, a three-week-long horizontal resistance around 1.3815-20 holds the key to the USD/CAD bull’s conviction.

Overall, USD/CAD is likely to decline further but the downside needs validation from 1.3630.

USD/CAD: Four-hour chart

Trend: Limited downside expected

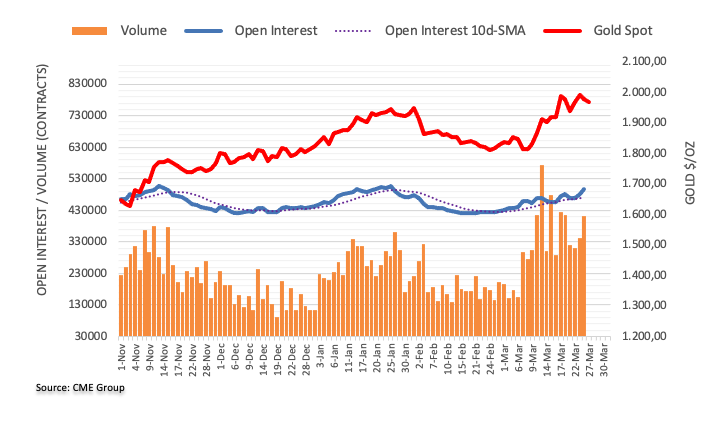

- Gold price is sensing barricades around $1,960.00 as fears of US banking turmoil have eased.

- Appeal for Gold and US government bonds as safe-haven amid US banking jitters has trimmed dramatically.

- Risk appetite is improving further on hopes that US banking recovery will be faster.

Gold price (XAU/USD) is juggling below $1,960.00 in the early Asian session. The upside for the Gold price seems restricted as fears of the United States banking debacle have eased. Therefore, investors have liquidated their positions in Gold and US government bonds, which were considered safe-haven amid banking jitters.

On Monday, First Citizens BancShares said it would take on the deposits and loans of failed Silicon Valley Bank (SVB). The news came after Bloomberg reported that US authorities are looking to expand the emergency lending facility for small banks amid turbulent times. Back-to-back supportive headlines for the US banking system infused confidence among the market participants.

Meanwhile, S&P500 futures are showing nominal gains after a bullish Monday on hopes that US banking recovery will be faster and chances of banking turmoil like the 2008 financial crisis are extremely lower. Easing US baking jitters impacted the demand for US government bonds heavily. This led to a perpendicular rise in 10-year US Treasury yields to 3.54%.

The US Dollar Index (DXY) has corrected to near 102.83 as hopes for a sooner conclusion of the rate-hiking spell by the Federal Reserve (Fed) are escalating.

Fed Governor Philip Jefferson cited on Monday, “Inflation ‘should fall back’ toward the Fed's 2% target as higher interest rates discourage spending in interest-rate sensitive sectors of the economy like housing,” as reported by Reuters. He further added, would like to say inflation will return to 2% soon, but have to avoid damaging the economy ‘any more than is necessary’.

Gold technical analysis

Gold price has shown a sheer fall after forming a Double Top chart pattern on an hourly scale plotted from March 23 high at $2,003.37. The precious metal re-tested critical resistance with less buying strength, which triggered aggressive selling from responsive sellers. Gold price is declining towards the horizontal support placed from March 15 high at $1,937.39. The yearly high is placed from March 20 high at $2,009.88.

The 20-period Exponential Moving Average (EMA) will continue to act as a barricade for the Gold bulls.

Meanwhile, the Relative Strength Index (RSI) (14) is making efforts in shifting its range to 40.00-60.00.

Gold hourly chart

- EUR/USD picks up bids to extend week-start rebound amid downbeat US Dollar, firmer sentiment.

- Receding fears of banking fallouts allow markets to take a breather from the previous risk aversion.

- Upbeat German data, hawkish ECB talks add strength to the Euro pair.

- ECB President Lagarde’s speech, US CB Consumer Confidence eyed for fresh impulse.

EUR/USD extends the week-start recovery to 1.0800 during early Asian session on Tuesday, picking up bids to refresh intraday high of late, as risk-on mood joins the hawkish comments from the European Central Bank (ECB) officials. Adding strength to the Euro pair’s run-up are the firmer data from Germany, Europe’s powerhouse, as well as the recent comments from the Federal Reserve (Fed) Governor.

Market sentiment improved as the European and the US authorities announced extension of emergency lending to banks. Adding strength to the optimism were comments from the central bank officials pushing back the banking crisis concerns and the Silicon Valley Bank (SVB) deal.

That said, the upbeat prints of Germany’s IFO data for March also favored the EUR/USD bulls. On Monday, Germany’s IFO Business Climate Index rose to 13-month high of 93.3 for March versus 90.9 market forecasts and 91.1 prior. Further, the IFO’s gauges of Current Assessment and Expectations also increased to 95.4 and 91.2 in that order during the said month compared to respective expected figures of 94.1 and 88.0, versus 93.9 and 88.4 previous readings.

Further, hawkish ECB talks were also part of the bullish ammunition for the pair. ECB policymaker, Pablo Hernandez de Cos, said on Monday, “Future monetary policy decisions will depend on three factors, such as new economic and financial data and core inflation.” The policymaker also said that tensions in financial markets have generated a further tightening of financial conditions, affecting the outlook for economic activity and inflation. On the same line, ECB Governing Council member Gediminas Šimkus said that the bank liquidity and capitalization is high in the euro area while also adding, “Financial stability is an important factor.”

Also positive was S&P Global’s announcement on Monday that it revised the 2023 Gross Domestic Product (GDP) growth forecast for Eurozone to 0.3% from 0% previously. However, the S&P Global also anticipates Eurozone GDP to grow by 1% in 2024, down from 1.4% expected in the previous forecast.

Looking ahead, EUR/USD pair traders should keep their eyes on ECB President Christine Lagarde’s speech and the US Conference Board’s (CB) Consumer Confidence for clear directions. That said, bulls will be more interested in seeking a further normalization of banking sector, as well as inflation run-up in the bloc, not to forget softer US data.

Technical analysis

A clear bounce off the 50-DMA, around 1.0735 by the press time, directs EUR/USD towards the 1.0930 horizontal resistance.

Federal Reserve Governor Philip Jefferson said on Monday, per Reuters, “Fed is ‘still learning’ how much impact its interest rate increases have had on the economy and inflation.”

“Inflation ‘has started to come down,’ with some of that due to tighter monetary policy and some due to other factors such as improving global supply chains,” Fed’s Jefferson said in remarks prepared for delivery at an event at Washington and Lee University.

Additional comments

Inflation ‘should fall back’ toward the Fed's 2% target as higher interest rates discourage spending in interest-rate sensitive sectors of the economy like housing.

Inflation ‘has started to come down’ with some of that due to tighter monetary policy and some due to other factors such as improving global supply chains.

Monetary policy affects the economy and inflation with long, variable, and highly uncertain lags, and we are still learning about the full effect of our tightening thus far.

No comments on recent bank stress.

No views about whether the Fed should continue raising interest rates at upcoming meetings.

Following the speech, the policymaker also participates in the Question and Answer (Q&A) session.

Following the speech, the policymaker also participates in the Question and Answer (Q&A) session.

Q&A response

Inflation has been longer lasting and current rate is too high.

Want to return to 2% sooner rather than later; don't want expectations to become embedded.

Some components of inflation have proved persistent, lowering them will take time.

Would like to say inflation will return to 2% soon, but have to avoid damaging the economy ‘any more than is necessary’.

Fed actions in recent weeks has aimed to show depositors there is ‘someone out there willing to lend’.

Fed wants banks that need liquidity to feel its okay to use the discount windown.

Recent rise in discount window lending is appropriate at the moment.

Here is a high degree of transparency at the Fed.

If small and regional banks contract in size could see lending standards change and could have a disproportionate impact on small business.

Fed will need to see how changes in credit standards play out, want community and regional banks to be strong.

Climate change important to the point that it influences safety and soundness of banks.

Important fed knows what is happening in the financial sector in terms of risk.

Market reaction

EUR/USD was last seen rising to 1.0800, extending the week-start rebound amid sluggish Asian session.

Also read: EUR/USD rebounds after two consecutive days of losses, boosted by risk-on impulse, weaker USD

- AUD/USD is continuously oscillating below 0.6660 as the focus has shifted to Australian Retail Sales and CPI data.

- Tuesday’s Retail Sales (Feb) data is expected to expand by 0.4% lower than the former expansion of 1.9%.

- The USD Index has corrected to near 102.83 as the Fed would terminate its rate-hiking spell sooner.

The AUD/USD pair is demonstrating a back-and-forth action below 0.6660 from Friday’s session. The sideways performance in the Aussie asset is expected to conclude and a power-pack action will be witnessed. Sheer volatility is expected in the Australian Dollar after the release of Tuesday’s Retail Sales and Wednesday’s Consumer Price Index (CPI) data.

Tuesday’s Retail Sales (Feb) data is expected to expand by 0.4% lower than the former expansion of 1.9%. The Reserve Bank of Australia (RBA) is extremely worried about persistent inflation in the Australian economy and a softening retail demand would provide some relief to policymakers.

However, the important catalyst is the monthly CPI data, which is likely to ease to 7.1% from the former release of 7.4%. RBA policymakers have already stated that there is evidence that indicates that Australian inflation has started easing. And, the RBA could terminate its policy-tightening process from April’s monetary meeting as the current monetary policy is restrictive enough to tame the stubborn inflation.

Meanwhile, S&P500 settled Monday’s trading session with decent gains on hopes that the United States banking system will be bailed out as US authorities are making significant efforts by expanding liquidity assistance, portraying a solid risk appetite theme.

The US Dollar Index (DXY) has corrected gradually to near 102.83 as the market participants are split about guidance on interest rates. As per the CME Fedwatch tool, more than 50% of investors are advocating for the maintenance of a status quo by the Federal Reserve (Fed) in its May monetary policy meeting as tight credit conditions approach by US banks would actively weigh on US inflation.

- Silver’s daily chart indicates a neutral to upward bias, although the 20-day EMA crossed above the 50-day EMA.

- The appearance of back-to-back hammers on Friday and Monday could signal a possible pullback.

- XAG/USD Price Analysis: Bounces off 20-EMA, set to challenge resistance at $23.09

Silver price clashes with solid resistance and dwindles after hitting a daily high of $23.26. At the time of writing, the white metal is down 0.69%, trading at $23.06, a troy ounce.

XAG/USD Price action

Silver’s daily chart suggests the XAG/USD is neutral to upward biased, with the 20-day Exponential Moving Average (EMA) crossing above the 50-day EMA. Nevertheless, back-to-back hammers, last Friday’s inverted and Monday’s price action, could open the door for a pullback. In bullish territory, the Relative Strength Index (RSI) favors higher prices, but its slope turned south, while the Rate of Change (RoC) is neutral. That said, mixed signals warrant caution.

Short-term, the XAG/USD 4-hour chart indicates the pair is consolidating. The XAG/USD dipped toward the 20-EMA at $22.93, bouncing off and reclaiming the $23.00 figure. That, alongside the recent cross of the 100-EMA over the 200-EMA, could exacerbate a rally toward new YTD highs. Additionally, the Relative Strength Index (RSI) and the Rate of Change (RoC) shifted upwards.

Given the backdrop, the XAG/USD first resistance would be the March 27 high at $23.09. Once cleared, the white metal would be poised to test, the last week was high at $23.52 before challenging $24.00.

XAG/USD 4-hour chart

XAG/USD Technical levels

- GBP/USD stalls on the bid and moves into consolidation.

- Investors seek clarity on the fallout from the recent collapse of two US lenders and Credit Suisse recue.

GBP/USD climbed to 1.2293 from a low of 1.2218 while the US dollar was weighed within a narrow range against most major currencies while traders sought clarity on the fallout from the recent collapse of two US lenders and the rescue of Credit Suisse.

Data released earlier Monday showed that UK Retail Sales conditions from the Confederation of British Industry declined modestly in March and BoE Governor Andrew Bailey spoke and said that the central bank has to be very alert to any signs of persistent inflationary pressures.

Elsewhere, Minneapolis Federal Reserve’s president, Neel Kashkari, warned the US is on the brink of a recession. As for US data, the Dallas Fed Manufacturing Activity Index dropped to -15.7pts in March as perceptions of broader business conditions worsened. The company outlook subindex rose four points to -13.3.

Analysts at ANZ Bank noted that ´´the outlook uncertainty subindex came in at 22.0, down slightly from February but still high. Labour market measures remained positive, with 24% of firms net hiring, while 14% reported net layoffs. Price and wage pressures receded in March.´´

Here is what you need to know on Tuesday, March 28:

After a quiet beginning of the week, market participants will continue to evaluate the consequences for the economy of the banking crisis. Key economic reports due on Asian hours include Australian Retail Sales, ahead of Wednesday’s CPI and next week’s RBA meeting.

Markets showed some relief on Monday following the latest banking news, which led to a rebound in bank stocks. The Dow Jones gained 194 points or 0.60%, while the Nasdaq dropped by 0.46%. The VIX continued to trend lower, and Crude Oil jumped by more than 5%. Deutsche shares rebounded and First Citizens Bancshares agreed to buy parts of Silicon Valley Bank (SVB).

The DXY lost ground on Monday and dropped below 103.00 even as US yields rose (the curve remains inverted). The US 10-year Treasury bond yield rose toward 3.55% while the 2-year rate climbed back above 4.00%. The Japanese Yen was among the worst performers hit by the improvement in market sentiment and higher yields in Europe and the US. USD/JPY rose more than a hundred pips, climbing above 131.50.

EUR/USD is moving with a bullish bias, advancing at a slow pace toward 1.0800. Still, more consolidation seems likely ahead of key inflation data from the Eurozone on Thursday (Preliminary March Consumer Price Index) and from the US on Friday (February Core Personal Consumption Expenditure).

GBP/USD rose modestly on the back of a weaker US Dollar, approaching 1.2300. USD/CHF dropped from near 0.9200 to 0.9155.

AUD/USD is moving sideways in a small range near 0.6650. On Tuesday, Australia will report Retail Sales. NZD/USD oscillated under 0.6200, with the Kiwi underperforming.

The Loonie was the best among commodity currencies. USD/CAD lost more than 50 pips and posted the lowest daily close in three weeks, holding above the critical 1.3645/50 support area. The Federal Budget will be released on Tuesday.

Emerging market currencies were mixed. The Colombian Peso and the Chilean Peso outperformed on Monday. On the contrary, the South African Rand fell across the board, losing 0.85% versus the US Dollar.

Gold fell more than $20 and settled around $1,950/oz. Bitcoin dropped more than 3%.

Like this article? Help us with some feedback by answering this survey:

- NZD/USD is consolidating at the start of the week in mixed risk sentiment.

- Poor performance on crosses suggests the Kiwi is still out of favour.

NZD/USD is flat after falling by 1% last week due to fears of a repeat of the systemic banking crisis that swept through markets in 2008. On the day so far, NZD/USD has traveled between a low of 0.6180 and a high of 0.6211.

Sentiment, however, remains fragile due to concerns about a global credit crunch. ´´The roller-coaster ride continues, again leaving FX markets fairly untouched. Which begs the question; will NZ’s remoteness to all this deliver NZD strength if the RBNZ can get the OCR to 5¼%? It might, especially if things are wobbly enough to keep the Fed from tightening much more, but not wobbly enough to crash things,´´ analysts at ANZ Bank explained. ´´But poor performance on crosses suggests the Kiwi is still out of favour.´´

Elsewhere, a surprisingly large contraction in New Zealand's growth numbers in Q4 of 2022 came as the RBNZ is still in the process of cooling runaway inflation. The central bank has lifted its policy rate by a total of 450 basis points in ten straight meetings, pushing the cash rate to a 41-year record of 4.75%.

Meanwhile, the IMF chief Kristalina Georgieva said Sunday that 2023 would be another challenging year, with global growth slowing to below 3%, reflecting the impact of pandemic disruptions, the war in Ukraine, and monetary tightening. She added that even with a better outlook for 2024, global GDP will remain below its historic average of 3.8% and the overall outlook remained weak.

- GBP/JPY rises and trades above the 20 and 50-day EMAs, reflecting a gain of 1.18%.

- The pair formed a bullish engulfing candle pattern, with oscillators favoring the upside in the daily chart.

- GBP/JPY Price Analysis: In the short term might test 160.00 unless buyers reclaim 162.00.

GBP/JPY pops after three days of losses, and trades above the 20 and 50-day Exponential Moving Averages (EMAs), sitting at 161.54 and 161.59, respectively. After hitting a daily low of 159.56, the GBP/JPY is trading at 161.68, gaining 1.18%.

GBP/JPY Price Analysis

Friday’s price action portrayed a hammer preceded by a downtrend, meaning that the GBP/JPY might print a leg-up. On Monday, the GBP/JPY resumed its uptrend, forming a bullish engulfing candle pattern, favoring the upside in the cross-currency pair. The Relative Strength Index (RSI) also shifted bullish, while the Rate of Change (RoC) jumped from neutral.

From an intraday perspective, the GBP/JPY 4-hour chart portrays the pair as neutral to downward biased facing the confluence of the 100 and 200-EMAs, around 161.52/58. A decisive break and the GBP/JPY could rally to 162.00, followed by the R2 daily pivot point at 162.22. Upside risks lie at a 5-month-old downslope trendline at around 162.50-60, followed by a March 23 daily high test at 163.33.

On the other hand, and the GBP/JPY path of least resistance in the near term, the first support would be the 50-EMA at 161.14, immediately followed by the R1 daily pivot at 161.01. Once hurdle, the pair might fall to the 20-EMA at 160.78, followed by a dip to the central pivot at 159.63.

GBP/JPY 4-Hour chart

GBP/JPY Technical levels

- USD/CAD bulls eye a move into prior support that meets a 61.8% ratio.

- Canada's budget is due on Tuesday is on the radar.

USD/CAD made its biggest drop in two weeks as the commodity complex picks up a bid in the face is easing stress in the banking sector and contributing to a surge in oil prices.

USD/CAD was down some 0.6% at the time of writing, losing space from a high of 1.3745 and reaching a low of 1.3649 on the day so far. The financial system was calmed after First Citizens BancShares said it would take on the deposits and loans of failed Silicon Valley Bank, supporting a risk-on mood. Additionally, the price of oil, a major Canadian export, settled 5.1% higher at $72.18 a barrel on hopes that banking sector issues would be contained, supporting the Loonie.

Looking at the calendar, Canada's budget is due on Tuesday. It will introduce a system to lock in future carbon credit prices, a move meant to boost investments by giving businesses certainty to develop low-carbon technologies, a senior government source with knowledge of the document told Reuters. Analysts at TD Securities said they look for January GDP to print above flash estimates at +0.4%. Growth should be broad-based, with unseasonably warm weather providing a tailwind. ´´A 0.4% print would leave Q1 GDP tracking well above BoC forecasts, though financial stability concerns take precedent for the moment. We look somewhat larger deficit projections in the budget compared to the Fall Economic Statement.´´

USD/CAD technical analysis

The price is meeting support and this leaves prospects of a move into prior support that meets a 61.8% ratio.

- Despite high US T-bond yields, EUR/USD rebounds after two consecutive days of losses.

- A risk-on impulse underpinned the Euro to the detriment of the US Dollar.

- EUR/USD Price Analysis: Triple bottom pattern remains in play as long as EUR/USD stays above 1.0759

EUR/USD snaps two straight days of losses and climbs after hitting a daily low of 1.0744 amidst a subdued session. Despite high US Treasury bond yields, risk-appetite improvement and a softer US Dollar (USD) opened the door for further Euro (EUR) upside. At the time of writing, the EUR/USD is trading at 1.0789 above its opening price.

US equity markets are mixed, with the Dow Jones and the S&P 500 rising while the Nasdaq tumbles. Market participants cheered First Citizens BancShare’s takeover of the Silicon Valley Bank (SVB), while US authorities are considering expanding emergency lending facilities to First Republic Bank.

Data-wise, the March US Dallas Fed Manufacturing Index plunged -15.7, more than February’s -13.5 collapse and worse than the -10.9 estimate. Delving into the data, the Production Index and the Employment component rose. New Orders declined, and the Price Index fell from 15.5 to 7.0.

US Treasury bond yields recovered, with 2s meandering around 4%, while the 10-year benchmark note rate sits at 3.515%, gaining thirteen basis points. The greenback has failed to capitalize on the US bond yields rise, with the US Dollar Index (DXY) sliding 0.19% at 102.915.

On the Eurozone (EU) front, European Central Bank (ECB) speakers are crossing the wires. Nagel acknowledged the increasing importance of taking a meeting-by-meeting approach, though he emphasized that the path of monetary policy normalization would continue. He added that QT would accelerate soon. On the flip side, ECB’s de Cos took a cautious approach due to high levels of uncertainty in the financial markets.

Of late, ECB’s board member Isabel Schnabel commented that she wanted to signal that further rate hikes were possible, according to people who know the matter.

EUR/USD Technical analysis

Technically speaking, the EUR/USD is neutral to upward biased, with a triple bottom staying in play as long as the EUR/USD remains above 1.0759. Oscillators are giving mixed signals. The Relative Strength Index (RSI) favors EUR/USD upside, while the Rate of Chance (RoC) suggests that buying pressure is waning. The path of least resistance is upwards; therefore, the EUR/USD first resistance would be 1.0800. Once broken, the EUR/USD’s next ceiling would be 1.0929, followed by the 1.1000 figure.

- USD/CHF bulls are tiring at a key resistance level.

- USD/CHF meets a 50% mean reversion level with 0.9050 now in focus.

USD/CHF is down 0.35% after the Swiss National Bank moved forward with a 50bps increase in borrowing costs as expected last week, citing a renewed rise in inflationary pressure and discarding the recent turmoil in the banking sector and the Credit Suisse takeover.

The SNB noted that measures announced by the federal government, FINMA, and the SNB had put a halt to the crisis and reiterated it was providing large amounts of liquidity assistance in Swiss francs and foreign currencies, backed by collateral and subject to interest.

Meanwhile, inflation in Switzerland unexpectedly climbed to 3.4% in February, overshooting market expectations of 3.1% and SNB forecasts of 3%.

Technically, the price is capped by a 50% mean reversion as the following illustrates:

USD/CHF daily chart

The M-formation is a reversion pattern and the neckline is currently holding.

With resistance at a 50% mean reversion level, the bias is to the downside with 0.9050 in focus.

Bank of England's Andrew Bailey has crossed the wires and said that the central bank has to be very alert to any signs of persistent inflationary pressures.

Key notes

If they become evident, further monetary tightening would be required.

MPC´s response will be firmly anchored in the emerging evidence.

Evidence has pointed to more resilient activity in the economy.

We have seen some big strains in parts of the global banking system emerge.

Rise in inactivity driven by early retirement seems likely to have contributed to a rise in cyclical r-star rate

This is part of the reason why we have had to raise the bank rate by as much as we have.

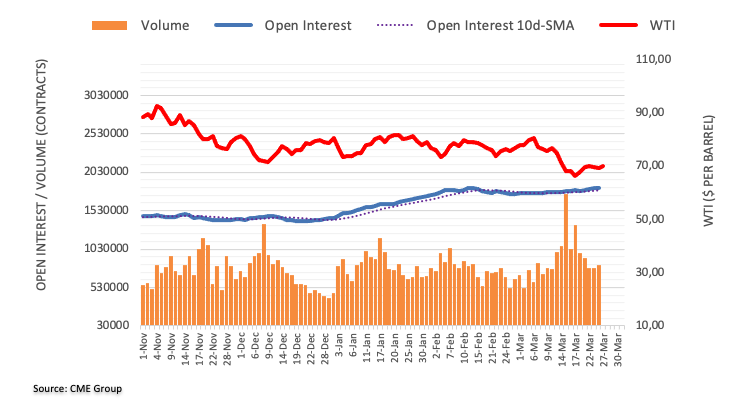

- WTI advances on sentiment, Kurdistan oil exports halt.

- Investors shrugged off the US banking system woes after First Citizens BankShares acquired Silicon Valley Bank.

- WTI Price Analysis: Stuck in neutral to the downward trend but could rally to $80.00 once RSI turns bullish.

Western Texas Intermediate (WTI), the US crude oil benchmark, advances sharply on an upbeat sentiment. Another reason for oil’s jump was a halt to oil exports from Iraq Kurdistan and Putin’s nuclear threats. At the time of writing, WTI is trading at $71.13 per barrel.

A confidence vote in the banking system sparked a shift in market mood after First Citizens BankShares, Inc. takeover the Silicon Valley Bank (SVB). Reports emerging that US authorities are considering expanding emergency lending facilities gave another reason for hope, which was cheered by investors.

WTI’s reversed its course after a dragonfly doji emerged on its daily chart after Friday’s close. Hence, oil traders threaten to push prices to the 20-day EMA at $72.10.

In the middle east, an arbitrage case won by Baghdad halted 450K bpd exports from Kurdistan to Turkey due to Kurdistan’s need for Iraq’s consent to ship oil.

Russian President Vladimir Putin’s announcement to deploy tactical nuclear weapons in Belarus in an attempt to intimidate the West due to its support for Ukraine also contributed to the increase in oil prices. NATO described Putin’s comments as “dangerous and irresponsible:, and Ukraine called for a UN Security Council meeting.

At the same time, Russia’s Deputy Prime minister Alexander Novak commented that Moscow is close to achieving its 500K crude output, to about 9.5 million bpd.

WTI Technical analysis

WTI is still neutral to downward biased, though approaching the 20-day EMA. Oscillators remain bearish, with the Relative Strength Index (RSI) below 50, but it’s aiming up. So, if RSI turns bullish, WTI’s could rally to $80.00. Hence, WTI’s first resistance would be the 20-day EMA at $72.10. A breach of the latter will expose the 50-day EMA at $74.93, followed by the 100-day EMA at $78.06, before testing $80.00.

European Central Bank (ECB) Governing Council member Isabel Schnabel said on Monday that they have no real concern about financial stability risks but added that the situation is still fragile, as reported by Reuters.

Key takeaways

"No sign of weakening in labour market."

"Balance sheet is expected to decline meaningfully over the coming years."

"Balance sheet will not return to the levels seen before the global financial crisis."

"Our balance sheet should only be as large as necessary to ensure sufficient liquidity provision and effectively steer short-term interest rates."

"If the corridor is sufficiently narrow, the implied rate volatility from fluctuations in aggregate excess reserves may not be a first-order concern."

"Banks might want to hold much higher liquidity buffers than in the past."

Market reaction

EUR/USD clings to modest daily gains slightly below 1.0800 following these comments.

"We are prepared to use all of our tools for any size institution as needed to keep the system safe," Federal Reserve Vice Chair for Supervision Michael Barr's prepared testimony to Congress reads, as reported by Reuters.

Additional takeaways

"Banking system is sound and resilient."

"Recent actions demonstrate we are committed to ensuring all deposits are safe."

"Committed to ensuring Federal Reserve fully accounts for any supervisory or regulatory failings around Silicon Valley Bank."

"It appeared contagion from SVB's failure could be far-reaching and damage the broader banking system."

"SVB had inadequate risk management, supervisors found deficiencies in its liquidity risk management near the end of 2021."

"Fed is examining whether applying more stringent standards would have prompted SVB to better manage risks."

"We plan to propose long-term debt requirement for large regional banks, need to enhance stress testing, explore changes to liquidity rules."

Market reaction

This headline doesn't seem to be having a significant impact on risk mood. As of writing, the Dow Jones Industrial Average was up 0.5% on the day.

- USD/MXN prints losses below $18.40 spurred on risk appetite despite high UST bond yields.

- US recession risks had risen, according to Minnesota’s Fed President Kashkari.

- USD/MXN Price Analysis: To continue its downtrend below 18.7968.

The USD/MXN tumbles to fresh two-week lows in the North American session at 18.3259, and sellers are taking a respite, exchanging hands slightly above the week’s lows. Investors shrugging off banking crisis woes shifted sentiment positively. Therefore, risk-perceived currencies in the FX space are printing gains. The USD/MXN trades at 18.3902.

USD/MXN touched fresh weekly lows, despite a deficit in Mexican Trade Balance

Wall Street is opening the week with gains. A light economic docket in the United States (US) keeps traders focused on the developments around global banks. News emerged that First Citizens BancShares, Inc. agreeing to buy SVB Financial Group spurred an uptick in sentiment, which sent the USD/MXN sliding to its new weekly lows. Nevertheless, US Treasury bond yields are recovering, capping the USD/MXN drop.

US Treasury bond yields are rising, with the 10-year benchmark note rate at 3.473%, gaining almost ten basis points. However, the greenback has failed to follow suit with UST bond yields, with the US Dollar Index registering losses of 0.14%, at 102.973.

Meanwhile, money market futures expect the US Federal Reserve (Fed) to hold rates unchanged at the May meeting, as shown by the CME FedWatch Tool. Odds are at 63.8%, vs. 38.2% chances of a 25 bps rate hike.

During the weekend, Minnesota’s Fed President Neil Kashkari said that the risks for a recession have improved after the banking system crisis.

On the Mexican front, the Balance of Trade for February missed estimates of a $0.9B surplus and printed a deficit of $1.84B. However, the figures showed some improvement after January’s $4.125B deficit. Exports were reduced by 2.80% YoY in February, blamed on crude oil exports dropping 19.2%, while Imports grew at a 4.1% YoY pace.

USD/MXN Technical analysis

USD/MXN remains neutral to downward biased, capped by the 20-day Exponential Moving Average (EMA) at around 18.5290, slightly above the psychological $18.50 figure. Oscillators remained at bearish areas, with the Relative Strength Index (RSI) below 50, while the Rate of Change (RoC) stayed below the neutral line. Therefore, further downside is warranted, but the market mood could spur a reversal.

Hence the USD/MXN first support would be the weekly low at 18.3259. A breach of the latter will expose the March 13 low at 18.2369, followed by the YTD low at 17.8967. On the other hand, if the USD/MXN reclaims $18.50, that could open the door for further gains. But as long as the USD/MXN stays below 18.7968, the pair will remain tilted downwards.

- Dallas Fed Manufacturing Index for March missed market expectations.

- US Dollar Index drops 0.10% on a quiet day.

The headline General Business Activity Index of the Federal Reserve Bank of Dallas' Texas Manufacturing Survey declined to -15.7 in March from -13.5 in February. This reading came in weaker than the market expectation of -10.9

Further details of the survey revealed that the Production Index rose from -2.8 to 2.5, the Employment Index improved to 10.4 from -1.0, the New Orders declined from -13.2 to -14.3, the Prices received fell from 15.5 to 7.0 and the Price Paid for raw material dropped from 25.1 to 20.3.

Market reaction

The US Dollar Index is falling 0.10% on Monday, as it trades around 103.00, weakened amid a better tone in market’s mood.

Wild whipsaws in rates markets associated with banking stress newsflow have weighed on Gold prices to start the week. However, the trend for the yellow metal is unchanged, strategists at TD Securities report.

Gold has only seen lackluster interest associated with safe-haven buying

“Interestingly, the evidence suggests that Gold markets have only seen lackluster interest associated with safe-haven buying.”

“In Comex Gold markets, the crisis catalyzed some discretionary short covering, but much of the increase in long positioning has been associated with CTA buying activity. Even so, marginal liquidations from this cohort are unlikely to occur above the $1,955 mark, whereas additional buying activity could be catalyzed just north of the $2,000 range.”

“The wild gyrations observed in rates markets are unlikely to spark a change in trend for Gold.”

Nasdaq 100 is seen a short-term uptrend. The index could reach previous gap levels at 13075/13210 and perhaps even last August's peak of 13720, economists at Société Générale report.

Inching towards previous gap levels at 13075/13210

“Nasdaq 100 has witnessed a golden crossover i.e. the 50-DMA has crossed above the 200-DMA; this generally highlights further upside.”

“Daily MACD has been posting positive divergence and has now established itself above the equilibrium line denoting prevalence of upward momentum.”

“The index is expected to inch higher gradually towards previous gap levels at 13075/13210 and perhaps even towards last August peak of 13720.” “Defence of 200-DMA near 11900 would be crucial for persistence in up move.”

European Central Bank (ECB) policymaker Mario Centeno said on Monday that the wage increase in the Eurozone is still compatible with the monetary policy and added that they are not observing and second round effect on wage-setting, as reported by Reuters.

"We haven't seen a deanchoring inflation expectations," Centeno further reiterated and noted that the ECB has the tools for "whatever-it-takes" action for banks.

Market reaction

EUR/USD continues to edge higher in the second half of the day on Monday and was last seen rising 0.3% on the day at 1.0790.

The USD is narrowly mixed and may continue to range trade in the short run. But the greenback is set to weaken in the long run, Shaun Osborne, Chief FX Strategist at Scotiabank, reports.

Not at all clear that there is another 75 bps of tightening ahead

“It looks a bit of a toss-up about how equity hedge rebalancing flows might shake out at the end of the week and markets will likely remain subject to short-term bouts of uncertainty. Regardless of short-term haven demand or rebalancing flows, the longer-run outlook for the USD remains challenged by narrowing rate differentials.”

“Credit tightening will slow business investment and growth and I still think there is a risk that inflation starts to fall more obviously in the next month or two. The Fed might have one more hike in it but it’s not at all clear that there is another 75 bps of tightening ahead.”

EUR/USD came under pressure into late week. Economists at OCBC Bank expect the pair to recover if confidence among European bank bondholders is restored.

Near term corrective pullback

“Fragile sentiments may weigh on EUR in the interim but if concerns re EU banking sector prove short-lived (i.e. no material sell-off), then we should expect EUR to recover.”

“Daily momentum remains mild bullish, but RSI shows signs of fading. Corrective pullback not ruled out in the near term.”

“Support at 1.0730 (50-DMA), 1.0660/80 (21-DMA, 23.6% fibo retracement of Sep low to Feb high) before 1.0540 levels. Resistance at 1.0820, 1.0930 (recent high) and 1.1030 (2023 high).”

“Barring any extended risk sell-off, we look to buy dips on the pullback especially with ECB being one of the remaining hawks in town.”

- USD/JPY gains strong positive traction on Monday and recovers further from a multi-week high.

- A combination of factors weighs heavily on the JPY and remains supportive of the momentum.

- The Fed’s less hawkish outlook keeps the USD bulls on the defensive and could cap the upside.

The USD/JPY pair builds on Friday's goodish rebound from the 129.65 region, or its lowest level since February 03 and kicks off the new week on a positive note. The steady intraday move-up remains uninterrupted through the early North American session and lifts spot prices to a fresh daily peak, around the 131.75 region in the last hour.

The risk-on impulse undermines the safe-haven Japanese Yen (JPY), which is further weighed down by the widening of the US-Japan rate differential amid a strong rally in the US Treasury bond yields. That said, the Federal Reserve's less hawkish outlook fails to assist the US Dollar (USD) to capitalize on its recent recovery from a multi-week low and might keep a lid on any further gains for the USD/JPY pair, at least for the time being.

The intraday move up, meanwhile, pushes spot prices beyond the 100-hour Simple Moving Average (SMA), though lacks follow-through beyond the 23.6% Fibonacci retracement level of the recent downfall from the monthly peak. Moreover, oscillators on the daily chart - though they have been recovering from lower levels - are still far from being in positive territory and warrant some caution before placing bullish bets around the USD/JPY pair.

Hence, any subsequent move up is more likely to confront stiff resistance around the 200-hour SMA, currently pegged just ahead of the 132.00 round figure. Some follow-through buying, however, might prompt a short-covering rally and push the USD/JPY pair towards the 132.80-132.85 region, representing the 38.2% Fibo. level. This is closely followed by the 133.00 mark, which if cleared will suggest that spot prices have formed a near-term bottom.

On the flip side, an intraday pullback now seems to find decent support near the 131.00 round-figure mark. The said handle should now act as a pivotal point, which if broken decisively could accelerate the fall towards the 130.55-130.50 intermediate support. The USD/JPY pair could decline further towards the 130.00 psychological mark before eventually dropping back to the multi-week low, around the 129.65 area touched on Friday.

USD/JPY 1-hour chart

Key levels to watch

- The grey metal trades on the defensive below $23.00.

- Recent tops near $23.50 caps the upside so far.

- There is an interim support at the 100-day SMA ($23.48).

Prices of the ounce of silver starts the new trading week on the defensive and retreat for the first time after three consecutive daily advances on Monday, probing at the same time the sub-$23.00 region.

In fact, silver comes under renewed selling pressure despite the so far bearish performance in the greenback and soon after hitting fresh multi-week peaks just beyond $23.50 on March 24.

In case the bullish mood returns to the market, the industrial metal is expected to meet the next up barrier at the March top at $23.52 (March 24). The surpass of this level should put silver en route to a potential visit to the 2023 peak at $24.62 (February 2) ahead of the April 2022 high at $26.21 (April 18). If losses accelerate, then there are provisional contention at the 100- and 55-day SMAs at $22.48 and $22.35, respectively, prior to the minor support level at $21.47 (low March 16). Further down comes the key 200-day SMA at $20.96, which precedes the 2023 low at $19.90 (March 10).

XAG/USD daily chart

GBP/USD has once again failed to overcome the key resistance at 1.2450. A break above here would open up 1.2610, then 1.2750, analysts at Société Générale report.

Defending 1.2010 critical for persistence in bounce

“Ongoing bounce is likely to persist towards recent high near 1.2450. If this is overcome, GBP/USD is expected to inch higher towards 1.2610 and 1.2750, the 61.8% retracement from 2021.”

“Defending recent higher low at 1.2010 is crucial for persistence in bounce.”

See – GBP/USD: Door open for the GBP to regain 1.23 in the short run – Scotiabank

- USD/CAD edges lower on Monday and is weighed down by a combination of factors.

- An uptick in Oil prices underpins the Loonie and exerts pressure amid a softer USD.

- Rallying US bond yields acts as a tailwind for the buck and should any further losses.

The USD/CAD pair comes under some selling pressure following a brief intraday consolidation on Monday and drops to a fresh daily low, around the 1.3700 mark heading into the North American session. The intraday downtick drags spot prices away from the 1.3800 round figure, or over a one-week high touched on Friday and is sponsored by a combination of factors.

Crude Oil prices edge higher on the first day of a new week amid expectations that a demand recovery in China and lower Russian production will tighten global supply. This, in turn, underpins the commodity-linked Loonie, which, along with subdued US Dollar (USD) demand, exerts some downward pressure on the USD/CAD pair. The risk-on impulse - as depicted by a positive tone around the equity markets - is seen as a key factor acting as a headwind for the safe-haven buck

Investors breathe a sigh of relief in reaction to the news that First Citizens Bank & Trust Company will buy all of Silicon Valley Bank's deposits and loans from the Federal Deposit Insurance Corporation (FDIC). Moreover, reports that US authorities were in the early stage of deliberation about expanding emergency lending facilities further boosted investors' confidence. Apart from this, the Federal Reserve's signal last week that it might soon pause the rate-hiking cycle weighed on the Greenback.

It is worth recalling that the US central bank raised interest rates by 25 bps on Wednesday, as was widely anticipated, though sounded cautious on outlook. That said, a strong follow-through rally in the US Treasury bond yields, bolstered by easing fears of a full-blown banking crisis, helps limit the downside for the USD and should lend some support to the USD/CAD pair. This, in turn, warrants some caution for aggressive bearish traders and before positioning for further intraday losses.

There isn't any major market-moving economic data due for release on Monday, either from the US or Canada. That said, the US bond yields and the broader risk sentiment might still influence the USD. Apart from this, traders will take cues from Oil price dynamics to grab short-term opportunities around the USD/CAD pair. The focus, meanwhile, remains on this week's important US macro data - the Conference Board's Consumer Confidence Index on Tuesday, followed by the final GDP print on Wednesday and the Fed's preferred inflation gauge - the US Core PCE Price Index on Friday.

Technical levels to watch

Lee Sue Ann, Economist at UOB group, reviews the latest BoE monetary policy meeting.

Key Takeaways

“As expected, the Bank of England (BoE)’s Monetary Policy Committee (MPC) voted by a majority of 7-2 to increase the Bank Rate by 25bps to 4.25%. The latest decision marked the 11th increase since the BoE started hiking in Dec 2021.”

“Clearly, the BoE is in a difficult position, and rightly so, has left the door open to options, indicating that if there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required.”

“There is no monetary policy decision in Apr, and the next one on 11 May is still some time away. Whether the MPC will be comfortable with pausing by the time of the next meeting in May will depend very much on incoming data and developments. We are still expecting a 25bps hike in May (albeit with lower confidence), solely on the premise of the BoE’s focus on fighting inflation.”

The US Dollar Index (DXY) trades little changed as markets continue to adopt a cautious stance. Economists at OCBC Bank expect the greenback to come under renewed downside pressure if concerns around the banking system ease.

Next resistance at 103.40, support at 102.80

“On net, the mix of growth worries, lingering concerns of banking stresses could temporarily benefit safe haven proxies such as JPY, Gold and USD in the interim. But if concerns dissipate, we should expect USD to remain under pressure with risk proxies should recover.”

“Next resistance at 103.40 levels (50% fibo retracement of 2023 low to high, 50-DMA), 103.95 (38.2% fibo) and 104.20 (21-DMA).”

“Support at 102.80 (61.8% fibo), 102 levels.”

- EUR/USD trades within a narrow range around 1.0770.

- Occasional bearish moves could revisit the 1.0710 region.

EUR/USD looks cautious around 1.0760/70 amidst alternating risk appetite trends at the beginning of the week.

In case bears regain the upper hand, the pair could slip back to the provisional 55-day SMA near 1.0730 ahead of the minor support at 1.0712 (low March 24). A deeper retracement could extend to the 100-day SMA, today at 1.0621.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0333.

EUR/USD daily chart

US 10-Year Treasury Yields have pulled back after forming a lower peak near 4.09% earlier this month. The decline is set to continue towards 3.07%, economists at Société Générale report.

Correction towards 3.07%?

“An initial bounce is not ruled out, however, last week's high of 3.65%/3.70% should provide resistance.”

“Daily MACD has entered negative territory denoting possibility of potential downside.”

“Holding below 3.65%/3.70%, ongoing down move is expected to persist towards the lower limit of a multi-month channel at 3.17% and projections of 3.07%/3.02%.”

See – US 10-year Yield: Any break below 3% should prove short-lived – ING

- GBP/USD catches fresh bids on Monday and reverses a major part of Friday’s downfall.

- The risk-on mood undermines the safe-haven USD and remains supportive of the move.

- Rallying US bond yields acts as a tailwind for the buck and might cap any further gains.

The GBP/USD pair regains positive traction on the first day of a new week and builds on its steady intraday ascent through the mid-European session. Spot prices climb to a fresh daily high, around the 1.2270-1.2275 area in the last hour, and reverse a major part of Friday's losses amid the risk-on impulse.

Investors breathe a sigh of relief in reaction to the news that First Citizens Bank & Trust Company will buy all of Silicon Valley Bank's deposits and loans from the Federal Deposit Insurance Corporation (FDIC). This is evident from a generally positive tone around the equity markets, which fails to assist the safe-haven US Dollar (USD) to capitalize on last week's goodish rebound from its lowest level since February and lends support to the GBP/USD pair.

The Greenback is further undermined by the Federal Reserve's hints of a possible pause to its rate-hiking cycle in the wake of the recent turmoil in the banking sector. That said, a strong follow-through rally in the US Treasury bond yields acts as a tailwind for the buck, which, in turn, might keep a lid on any meaningful upside for the GBP/USD pair. Hence, any subsequent move is more likely to confront stiff resistance near the 1.2300 round-figure mark.

Technical indicators on the daily chart, meanwhile, are holding in the positive zone and are still far from being in the overbought territory. This, in turn, suggests that some follow-through buying should pave the way for additional gains and a move towards retesting the monthly peak, around the 1.2340-1.2345 region. The positive momentum could get extended further and allow the GBP/USD pair to aim back to reclaim the 1.2400 round-figure mark.

On the flip side, the 1.2230 level now seems to protect the immediate downside ahead of the 1.2200 round figure and the 1.2175 support zone. A convincing break below might prompt some technical selling and drag the GBP/USD pair towards the 1.2100 mark. The latter coincides with the 100-day Simple Moving Average (SMA), below which spot prices could slide to the next relevant support near the 1.2055-1.2050 region en route to the 1.2000 psychological mark.

GBP/USD 4-hour chart

Key levels to watch

In view of Markets Strategist at UOB Group Quek Ser Leang, a sustainable breakdown of 14,095 in USD/IDR seems unlikely for the time being.

Key Quotes

“We did not anticipate the sharp drop in USD/IDR to a low of 15,130 (we were expecting USD/IDR to consolidate).”

“The sharp and rapid drop has room to extend but in view of the deeply oversold conditions, a sustained drop below the major support at 14,095 is unlikely. Resistance is at 15,250, followed by 15,300.”

The US Dollar Index is drifting towards the February trough near 100.80. Failure to hold above here would trigger another leg lower, economists at Société Générale report.

Reclaiming 104 crucial to affirm bounce

“It would be interesting to see if the index can carve out a higher low and gradually establish itself above 104, the 50% retracement of recent pullback. Failure would mean continuation in decline.”

“In case the index breaks below 100.80, the downtrend is likely to persist. Next potential supports could be at 100.00 and projections of 98.90.”

EUR/USD steadies after finding support in the low 1.07s. The pair could see another leg higher on a break past 1.0785, economists at Scotiabank report.

EUR to remain firm on minor dips

“The short-term charts retain a bearish look after the EUR’s tumble from last week’s high. But spot has steadied around the 50% retracement of the EUR rally from 1.05 around the middle of the month and underlying trend dynamics remain EUR-bullish on the longer term oscillators. This should mean dips remain well-supported.”

“EUR gains back through 1.0785 will give spot a bit more lift.”

“Key resistance is 1.0930 – last week’s high.”

- AUD/USD struggles to gain any meaningful traction and oscillates in a range on Monday.

- A positive risk tone lends support to the risk-sensitive Aussie amid subdued USD demand.

- Rallying US bond yields acts as a tailwind for the buck and caps the upside for the major.

The AUD/USD pair lacks any firm intraday direction on Monday and oscillates in a narrow trading band around mid-0.6600s through the mid-European session. Spot prices, meanwhile, remain well within the striking distance of over a one-week low touched on Friday and seem vulnerable to prolonging last week's rejection slide from a technically significant 200-day Simple Moving Average (SMA).

A generally positive tone around the equity markets, bolstered by easing fears of a full-blown banking crisis, turns out to be a key factor offering some support to the risk-sensitive Aussie. News that First Citizens Bank & Trust Company will buy all of Silicon Valley Bank's deposits and loans from the Federal Deposit Insurance Corporation (FDIC) calm market nerves about the contagion risk. Furthermore, reports that US authorities were in the early stage of deliberation about expanding emergency lending facilities boost investors' confidence.

The risk-on flow, meanwhile, fails to assist the safe-haven US Dollar (USD) to capitalize on its recent strong recovery from a multi-week low touched last Thursday, which further contributes to limiting the downside for the AUD/USD pair. That said, a strong follow-through rally in the US Treasury bond yields acts as a tailwind for the Greenback. This, along with a dovish signal from the Reserve Bank of Australia (RBA) and the Fed, hinting at a pause in the rate-hiking cycle, warrants caution before placing aggressive directional bets around the major.

In the absence of any major market-moving economic releases from the US on Monday, the US bond yields might influence the USD price dynamics and provide some impetus to the AUD/USD pair. Apart from this, the broader risk sentiment could produce short-term trading opportunities, though the lack of any meaningful buying suggests that the path of least resistance for spot prices remains to the downside.

Technical levels to watch

GBP/USD inches higher from the 1.22 support zone. Economists at Scotiabank believe that the pair could surge above the 1.23 level.

Cable remains well-supported on dips back to the 1.22 zone

“Retests of 1.22 over the past few sessions have generated solid gains and while short-term trend dynamics are soft, they are leaning GBP-bullish. That leaves the door open for the GBP to regain 1.23+ in the short run. However, the intraday chart does reveal a potential weakness – a possible Head & Shoulders top whose neckline trigger falls right on the 1.22.”

“Near-term weakness below the 1.22 region would imply GBP losses back to the 1.2075 zone in the next 1-3 days.”

The Dollar regained some ground in the past two trading sessions. Economists at ING see more balanced risks for the US Dollar Index (DXY) this week.

Dollar support comes from Europe

“The resurgence in banking stress in Europe forces some softening of our bearish Dollar view for the moment, at least until we can get more clarity on the stability of the EU banking sector.”

“Still, we continue to see the Fed as mostly carrying downside risks for the greenback, as the lack of clear communication leaves the door open for dovish speculation as the US regional crisis remains unresolved and is keeping the monetary policy outlook in the US in stark contrast (for now) to that of most European central banks.”

“On balance, we see more balanced risks for DXY this week, but volatility may remain elevated, and if anything our preference remains for a higher EUR/USD.”

- DXY alternates gains with losses around the 103.00 region.

- The resumption of the selling bias could see the sub-102.00 area retested.

DXY trades within an inconclusive range in the 103.00 neighbourhood at the beginning of the week.

If bulls fail to regain control of the sentiment – ideally in the very near term - the index could lose the grip and challenge recent lows in the sub-102.00 zone (March 23). Extra losses from here could put a visit to the 2023 low around 100.80 (February 2) back on the investors’ radar

Looking at the broader picture, while below the 200-day SMA, today at 106.59, the outlook for the index is expected to remain negative.

DXY daily chart

S&P Global announced on Monday that it revised the 2023 Gross Domestic Product (GDP) growth forecast for Eurozone to 0.3% from 0% previously.

On a negative note, S&P Global now expects Eurozone GDP to expand by 1% in 2024, down from 1.4% in the previous forecast.

Market reaction

This headline doesn't seem to be having a noticeable impact on the Euro's performance against its major rivals. As of writing, EUR/USD was trading modestly higher on the day at 1.0770. Meanwhile, Euro Stoxx 50 is up more than 1% on a daily basis.

After probing graphical support at 4030, a bounce in Euro Stoxx 50 is underway. But if the index fails to surpass the 4240 mark, a deeper down move would be the most likely scenario, in the view of economists at Société Générale.

Break below the 4030 mark can extend the decline

“Failure to overcome 4240, the 76.4% retracement of recent pullback could mean risk of a deeper down move.”

“Break of 4030 can extend the decline towards 3910 and December low of 3800/3770.”

USD/MYR now seems to have moved into a 4.4100-4.4700 range, according to Markets Strategist at UOB Group Quek Ser Leang.

Key Quotes

“While we expected USD/MYR to weaken last week, we were of the view that ‘the next support at 4.4300 is unlikely to come under challenge’.”