- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 29-03-2023

- USD/CHF has dropped to near 0.9180 amid rising expectations for more rates by the SNB.

- SNB Quarterly Bulletin cemented more rate hikes to ensure price stability in the Swiss region.

- The expectation of weak growth in US Retail Sales in 2023 is barricading the upside of the USD Index.

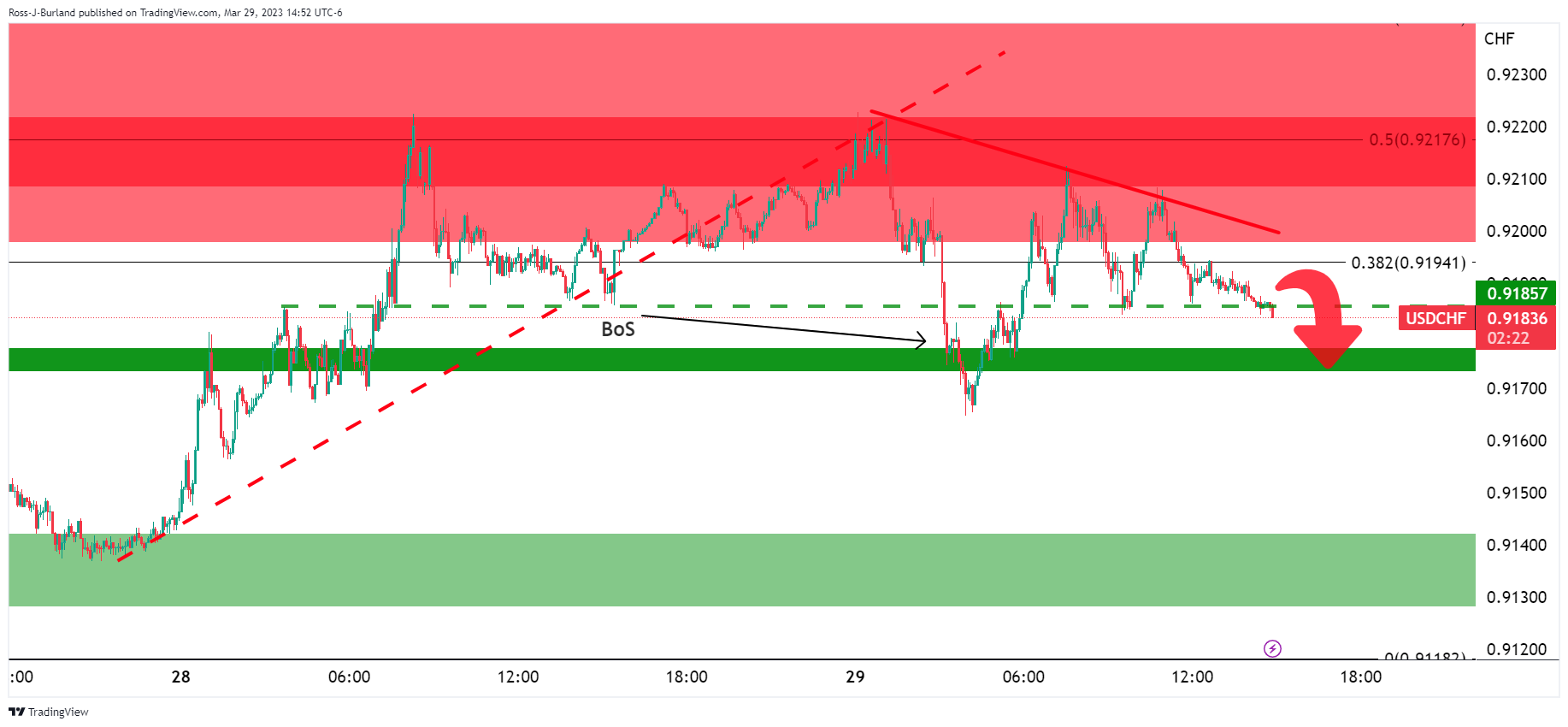

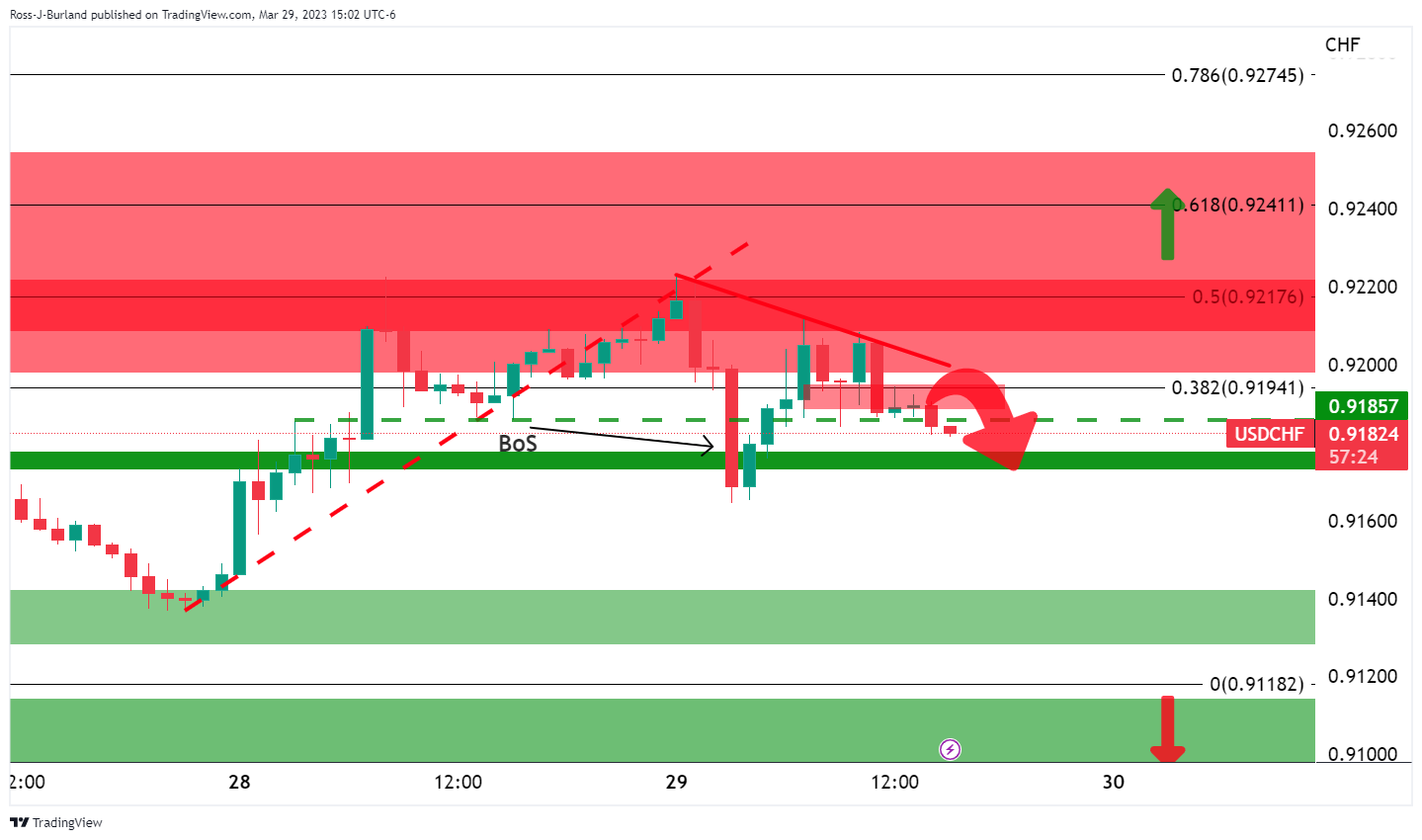

The USD/CHF pair has shown a corrective move to near 0.9180 in the early Tokyo session. The Swiss Franc asset has witnessed selling pressure led by a gradual decline in the US Dollar Index (DXY) and rising expectations for more rates by the Swiss National Bank (SNB).

In recent sessions, the collapse of Credit Suisse kept the Swiss Franc on the back foot as the currency lost its charm of safe-haven. It seems that hawkish SNB bets are aiming to retrieve its glory.

The release of the SNB Quarterly Bulletin on Wednesday confirmed that SNB Chairman Thomas J. Jordan will hike rates further to ensure price stability in the Swiss region. The SNB Quarterly Bulletin also showed that inflation escalated to 3.4% in February and the majority of the contribution to rising Swiss inflation is coming from domestic goods.

Going forward, Friday’s Real Retail Sales (Feb) data will be keenly watched. The annual retail sales data is expected to expand by 1.9% against a contraction of 2.2%, which would cement further scalability in the inflationary pressures.

Meanwhile, the USD Index has turned sideways below 102.70. The asset had a roller-coaster ride on Wednesday amid deepening expectations of a decline in the retail demand in the United States ahead. The National Retail Federation (NRF) said on Wednesday that fears of a recession and tremors in the banking industry cast a shadow over a recovery in consumer spending, as reported by Reuters. The NRF is expecting a growth in retail demand in the 4-6% range, lower than expansion by 7% recorded in 2022.

- NZD/USD´s 4-hour chart shows that the price needs to break below 0.6215.

- Below 0.6215, bears will seek a continuation below 0.6150.

NZD/USD is flat on the day so far after what was a relatively quiet session on Wednesday. The pair has stuck to familiar ranges around 0.6220 amid growing expectations that the Reserve Bank of New Zealand will lift the official cash rate by 25bps to 5.0% at its meeting next week and a move to hike rates again to 5.25% in May.

However, until then, there is room for the US Dollar to claw back some ground and the following illustrates a downside bias for NZD/USD:

NZD/USD daily charts

The price is on the back side of the prior bullish trend but a break of another micro trendline support will open the risk of a break below 0.6190 and then 0.6150.

NZD/USD H4 chart

NZD/USD´s 4-hour chart shows that the price needs to first break below 0.6215.

- WTI crude oil remains sidelined inside a short-term bullish channel after reversing from the highest levels in a fortnight.

- Five-week-old horizontal hurdle guards immediate upside, convergence of 200-SMA, channel’s top line is the key hurdle.

- 100-SMA lures intraday sellers of Oil but further downside needs validation from $69.45.

WTI crude oil seesaws around $73.00 during Thursday’s sluggish Asian session, following its pullback from a 12-day high. In doing so, the black gold remains with the fortnight-old ascending trend channel while retreating from the channel’s top line and a five-week-long horizontal hurdle of late.

It should be noted that the energy benchmark’s latest pullback takes clues from the impending bear cross on the MACD and a retreat in the RSI (14) line after it touched the overbought territory.

With this, the commodity price is likely to decline further towards the immediate support of 100-SMA, around $71.70 by the press time.

In a case where the quote remains bearish past $71.70, the $70.00 and bottom line of the stated channel, close to $69.45, become crucial to watch as they hold the gate for the Oil bear’s entry.

Meanwhile, the aforementioned five-week-old horizontal resistance near $73.90-74.00 restricts the immediate upside of the WTI crude oil.

Following that, a convergence of the stated channel’s top line and the 200-SMA together highlights $74.60 as a tough nut to crack for Oil buyers.

Should the commodity price rally beyond $74.60, the odds of witnessing a run-up toward $77.50 and then to the $78.00 hurdles can’t be ruled out. Though, multiple hurdles marked since February 13 highlight the $80.80-81.00 as crucial resistance to watch afterward.

WTI: Four-hour chart

Trend: Pullback expected

- The EUR/JPY struggled at 144.00 and dived toward the 143.70s area.

- An EUR/JPY fall below 143.50, and the 20/50-day EMAs, could be tested before Friday’s session.

- EUR/JPY buyers reclaiming 144.00, and a new YTD high could be possible, above 145.56.

The EUR/JPY reached a weekly high at 144.09, but as the Asian session began, it retreated under 144.00. Although the EUR/JPY double bottom is still in play, it is at the brisk of being invalidated once the pair drops below the March 22 daily high at 143.62. At the time of writing, the EUR/JPY is trading at 143.75, registering minuscule losses of 0.01%.

EUR/JPY Price Action

From the daily chart perspective, the EUR/JPY rallied sharply on Wednesday, piercing the 20 and the 50-day Exponential Moving Averages (EMAs), each at 142.65 and 142.58, respectively. However, failure to hold to its gains above 144.00 could exacerbate a pullback toward the 142.00 area.

Oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC), portray the pair might be headed for a bullish continuation. But the RSI’s slope shifted flat, suggesting buyers are getting a respite.

If the EUR/JPY buyers reclaim 144.00, that could open the door to test the March 15 high at 144.96, ahead of piercing 145.00. A breach of the latter, and the EUR/JPY could be trading at new YTD highs, nearby the December 15 high at 146.72. But firstly, the EUR/JPY needs to face solid resistance at 145.50 and 146.00.

On the other hand, if the EUR/JPY extended its losses below 143, the 20-day EMA, at 142.64, could be tested. Break below, and the 50-day EMA is next at 142.58.

EUR/JPY Daily Chart

EUR/JPY Technical Levels

- USD/JPY is aiming to recapture 133.00 as ebbing fears of US banking shakedown have trimmed the Japanese Yen’s appeal.

- The street believes that the US banking sector has already reported its collateral damage.

- Tokyo CPI is expected to soften consecutively led by declining oil prices.

The USD/JPY pair is facing barricades in reclaiming the immediate resistance of 133.00 in the Asian session. The major is expected to resume its upside journey as global banking fears have eased, the US Dollar Index (DXY) has shown a decent recovery, and fears of softening of Japan’s inflation have renewed.

Easing US banking jitters after the announcement of the acquisition of collapsed Silicon Valley Bank’s (SVB) deposits and loans to efforts made by US authorities to infuse confidence among investors have trimmed appeal for the Japanese Yen as a safe-haven.

Investors were gung ho for the Japanese Yen when the US administration alarmed shakedown in the banking sector. However, the market participants believe that the US banking sector has already reported its collateral damage, which has forced them to withdraw funds from the Japanese Yen. This also helped the USD Index in building a cushion around 102.40. A recovery move by the USD Index has already pushed it to above 102.60.

The US Dollar is expected to remain in action ahead of the release of the Federal Reserve’s (Fed) preferred inflation tool, core Personal Consumption Expenditure (PCE) Price Index (Feb) data. According to the estimates, monthly core PCE inflation would accelerate by 0.4%, lower than the former expansion of 0.6%. The annual figure is expected to remain steady at 4.7%.

On the Tokyo front, investors are focusing on Tokyo Consumer Price Index (CPI) data, which will release on Friday. The street is anticipating further softening of the headline Tokyo CPI to 2.7% from the former release of 3.4% led by declining oil prices in the international market. However, the core CPI that strips off oil and food prices is seen expanding to 3.3% from the former release of 3.2%. More stimulus measures are expected from the Bank of Japan (BoJ) in keeping inflation steadily above desired levels.

- US Dollar Index fades bounce off one-week low, sidelined of late.

- Fed Chair Powell signal one more rate hike in 2023, Vice Chair Barr highlights data dependency.

- US inflation expectations remain firmer ahead of Fed’s favorite inflation gauge.

- Dicey markets, quarter-end positioning also restrict DXY moves ahead of Thursday’s second-tier data.

US Dollar Index (DXY) struggles to keep the previous day’s bounce off weekly low around 102.65 amid mixed signals from the Federal Reserve (Fed) officials despite inflation woes, as well as due to the recently receding banking fears.

Corrective bounce in the US Treasury bond yields joined the quarter-end positioning and cautious optimism in the market to underpin the US Dollar’s latest rebound. Adding strength to the greenback’s rebound could be the geopolitical fears emanating from China, Russia and North Korea. However, an absence of hawkish comments from the Federal Reserve (Fed) officials joins the absence of talks about banking woes to weigh on the US Dollar.

The US blacklisting of Chinese companies and Beijing’s dislike of a meeting between the White House Speak and the Taiwan President can be considered the key catalysts to challenge the previously firmer sentiment and allowed the US Dollar to snap a two-day downtrend. Though, optimism on the technology and banking front challenged the risk-off mood, as well as the DXY’s rebound.

It’s worth noting that the US inflation expectations, per the 10-year and 5-year breakeven inflation rates from the St. Louis Federal Reserve (FRED), jumped to a two-week high the previous day and allowed the US Dollar to remain firmer.

However, Bloomberg came out with the news suggesting Fed Chair Jerome Powell showed forecasts for one more rate hike in 2023, which in turn pushed back talks of policy pivot and favor the US Dollar bulls. Though, Vice Chair for Supervision Michael Barr said, “We will be looking at incoming data, financial conditions to make a meeting-by-meeting judgment on rates.

Against this backdrop, Wall Street closed with notable gains led by tech and bank stocks while the US Treasury bond yields eased.

Looking ahead, the final readings of the US fourth quarter (Q4) Gross Domestic Product (GDP) will join the Q4 Core Personal Consumption Expenditure (PCE) details and the weekly jobless claims to direct intraday moves. However, Friday’s US Core PCE Price Index, the Fed’s favorite inflation gauge becomes crucial for the market to watch for clear directions.

Technical analysis

US Dollar Index bulls need to provide a daily closing beyond a three-week-old descending resistance line, around 102.90 by the press time, to retake control.

- GBP/USD seesaws in a tight range after reversing from a two-month high.

- One-month-old ascending resistance line challenges bulls despite firmer oscillators.

- Bears need validation from two-week-long support line before taking control.

GBP/USD stays defensive above 1.2300 amid early Thursday’s Asian session, making rounds to a 15-pip trading range in the last, as bears struggle to keep the reins after the Cable pair reversed from a two-month high the previous day.

That said, the Cable pair took a U-turn from a multi-day top the previous day after an upward-sloping resistance line from late February challenged the bulls. However, the bullish MACD signals and an absence of the overbought RSI (14) seem to have tamed the bearish bias.

Adding strength to the upside bias is the pair’s ability to trade beyond the two-week-old upward-sloping support line and the key moving averages.

With this, the GBP/USD buyers are likely to again challenge the aforementioned resistance line, around 1.2370 by the press time.

In that case, a horizontal area comprising multiple tops marked since mid-December 2022, around 1.2445-50, gains major attention.

However, likely overbought conditions of the RSI around then could challenge the Cable bulls afterward, if not then the GBP/USD price won’t hesitate to challenge the May 2022 high of around 1.2670.

On the flip side, a two-week-long ascending support line, close to 1.2290 by the press time, restricts the immediate downside of the pair, a break of which highlights the 10-DMA support of 1.2270.

It should be noted, however, that a clear downside break of the 10-DMA can direct GBP/USD towards the 50-DMA, close to 1.2150 by the press time.

GBP/USD: Daily chart

Trend: Further upside expected

- The AUD/JPY daily chart portrays the pair might consolidate as it faces solid resistance.

- In the short term, the AUD/JPY must reclaim 89.00 to pursue higher prices.

- Otherwise, the AUD/JPY could fall toward the 87.00 area.

The AUD/JPY retreats as the Asian session begins, some 0.06%, following Wednesday’s gains of 1.09%. at the time of writing, the AUD/JPY is trading at 88.68, below the week’s high at 88.82, and also 20 pips under the 20-day Exponential Moving Average (EMA).

AUD/JPY Price Action

From a daily chart perspective, the AUD/JPY failed to hurdle solid resistance at the 20-day EMA and at March’s 22 high of 89.00. Oscillators turned flat at bearish territory, suggesting that sellers are lurking around current exchange rates. Additionally, the Rate of Change (RoC), albeit bullish, is at the mercy of Thursday’s price action. Therefore, sudden shifts in market sentiment and the AUD/JPY could reverse its course.

Short term, the AUD/JPY is hovering around the 100-EMA at 88.68, slightly above the central pivot point. After the AUD/JPY crossed above the 20-EMA, the pair registered gains of 1.41%. However, the Relative Strength Index (RSI) is shifting downward, albeit at bullish territory, while the Rate of Change (RoC) portrays that buying pressure is waning. The AUD/JPY could print a leg-down before testing 89.00 and beyond.

Hence, the AUD/JPY first support would be the pivot point at 88.42, followed by the confluence of the 50/20-EMAs, and the S1 pivot point at around 87.95/88.02. Once cleared, the pair could dive to the S1 daily pivot at 87.28

On the upside, the AUD/JPY could test the 200-EMA once it clears 89.00 and the R1 daily pivot at 89.16. The next resistance would be the 200-EMA at 89.58.

AUD/JPY 4-Hour Chart

AUD/JPY Technical levels

- USD/CAD is likely to refresh its monthly low below 1.3555 amid the risk-on mood.

- S&P500 futures were heavily bought as fading US banking fears infused confidence among investors.

- Oil price has extended its correction below $73.00 despite the US EIA reporting a huge drawdown in oil stockpiles by 7.489 million barrels.

The USD/CAD pair is hovering near a monthly low around 1.3555 in the early Asian session. The Loonie asset is expected to refresh the same despite some sort of recovery from the US Dollar Index (DXY). The major has shown a three-day losing spell and is expected to continue the same if it surrendered the 1.3555 support. The USD Index is juggling in a narrow range after a mild correction as the upside looks capped around 102.80.

S&P500 futures were heavily bought by the market participants on Wednesday as fading United States banking fears infused confidence among investors. Also, US authorities are making efforts in assuring households of continuing deposits to mid-size banks after the collapse of a couple of banks.

The risk appetite theme underpinned by the market participants has improved the appeal of the Canadian Dollar. Going forward, investors will keep focusing on the Canadian Gross Domestic Product (GDP) data, which will release on Friday. As per the consensus, the Canadian economy has grown by 0.3% in January on a monthly basis against a contraction of 0.1% reported earlier.

But before that, US GDP data will release on Thursday. The economic data is expected to remain steady at 2.7%. The Federal Reserve (Fed) will keep its focus on the GDP data as any contraction in growth rate could propel keeping rates steady ahead. As per the CME Fedwatch tool, more than 60% of investors are favoring an unchanged monetary policy by the Fed.

On the oil front, the oil price has extended its correction below $73.00 despite the US Energy Information Administration (EIA) reporting a huge drawdown in oil stockpiles by 7.489 million barrels for the week ending March 24.

“Federal Reserve Chair Jerome Powell, asked in a private meeting with US lawmakers how much further the central bank will raise interest rates this year, pointed to policymakers’ latest forecasts showing they anticipate one more increase, according to Republican Representative Kevin Hern per Bloomberg.

On the other hand, Reuters claim that US Senator Hern said that Fed’s Powell told Republican lawmakers that Congress should re-evaluate limits on the size of federally insured bank deposits.

"We talked about that but he said it was the role for Congress to really evaluate. Thought it was a great topic to bring up," Hern said after Powell spoke to a closed-door meeting of the Republican Study Committee per Reuters.

The news also adds that the Federal Deposit Insurance Corporation (FDIC) currently insures up to $250,000 per depositor, but the Silicon Valley Bank (SVB) and Signature Bank collapses this month have raised questions over whether insurance limits needed to be raised.

Also read: EUR/USD stays firm around 1.0840, with traders eyeing German and US inflation data

“Some recommendations from an independent review of the Reserve Bank of Australia’s (RBA) monetary policy decision-making and board make-up may require legislative changes to enact,” said Australian Treasurer Jim Chalmers on Thursday while speaking on ABC Radio per Reuters.

Reuters also added that the review was called after the RBA undershot its inflation target of 2% to 3% for much of the last decade and issued guidance during the COVID-19 pandemic that rates were not expected to rise until at least 2024,” while also mentioning, “But the RBA has made 10 straight rate hikes since May to tame surging inflation.”

Aussie Treasurer Chalmers looks set to receive on Friday the findings of the report on the RBA.

Additional quotes

The government would look to reach consensus with the opposition parties to amend any laws ‘if we go down that path’.

If there are some that require a change to the (RBA Act) that we're keen on progressing, then ideally we would do that in a bipartisan way.

I would release the report with the government's initial views next month, ahead of the federal budget in May.

So I'd like to put it out in April, and people can go through it and see what they think about it.

A decision whether to re-appoint Governor Philip Lowe, whose term ends in September, would be taken ‘closer to the middle of the year’ in consultation with Prime Minister Anthony Albanese and the cabinet.

AUD/USD stays pressured

AUD/USD remains depressed around 0.6680 by the press time, following the first daily loss in three.

Also read: AUD/USD struggles below 0.6700 as market sentiment dwindles on inflation, banking concerns

- The Euro is registering gains of 0.78% in the week after hitting a low of 1.0744.

- A risk-on impulse, US Dollar weakness, and expectations for higher rates in the Eurozone boosted the EUR.

- EUR/USD Price Analysis: Set to test 1.1000 above 1.0900; otherwise, it could fall to 1.0700.

The Euro (EUR) advanced for three straight sessions against the US Dollar (USD), but late in the North American session, the EUR/USD retreated, forming a doji. Hence, indecision is the game's name, as the greenback staged a recovery on Wednesday. The EUR/USD is trading at 1.0841, down 0.02%, as the Asian session begins.

German and US inflation figures, eyed by EUR/USD traders

The shared currency has been bolstered by a soft US Dollar, which snapped two days of straight losses, as shown by a basket of six currencies vs. the buck. The US Dollar Index rose 0.22%, at 102.654 on Wednesday.

The US economic docket featured Pending Home Sales, which increased by 0.8% MoM in February, exceeding expectations for a 0.3% drop. Annually, it fell by 21.1%, less than the 29.4% drop predicted. On the Eurozone (EU) side, the German Gfk Consumer sentiment in April improved to -29.5 from a revised -30.6 in March. Although it improved, it was beneath the estimates of -29.0.

In the meantime, European Central Bank (ECB) policymakers have stressed the need for higher interest rates after the bank turmoil dissipated. Philip Lane, the ECB Chief Economist, said, “Under our baseline scenario, to make sure inflation comes down to 2%, more hikes will be needed.”

Therefore, the EUR/USD pair has been upward pressured as market participants estimate that the US Federal Reserve (Fed) would leave rates unchanged at 4.75%-5.00%. After that, a few rate cuts have been priced in by the year’s end.

The EUR/USD would be influenced by inflation data in the US and the EU on Thursday and Friday. The Fed’s preferred gauge for inflation, the core PCE, will be revealed on Friday. Any upward revisions could put into play further rate increases by the US central bank. On the EU’s front, rising inflation in Germany would cement the case for another interest rate increase by the ECB.

What to watch?

On Thursday, the EU’s calendar will feature German inflation figures. In the US, the Gross Domestic Product (GDP) for Q4, alongside Initial Jobless Claims for the last week, will be released.

EUR/USD Technical analysis

Given the backdrop, the EUR/USD triple bottom remains in play. A fall below the March 15 daily high at 1.0759 would invalidate the chart pattern and exacerbate a fall. That would expose the 20-day Exponential Moving Average (EMA) at 1.0744, followed by the 50-day EMA, shy of 1.0700, at 1.0696. On the flip side, a break above 1.0900 and the EUR/USD pair will test the week’s high at 1.0929 before challenging 1.1000.

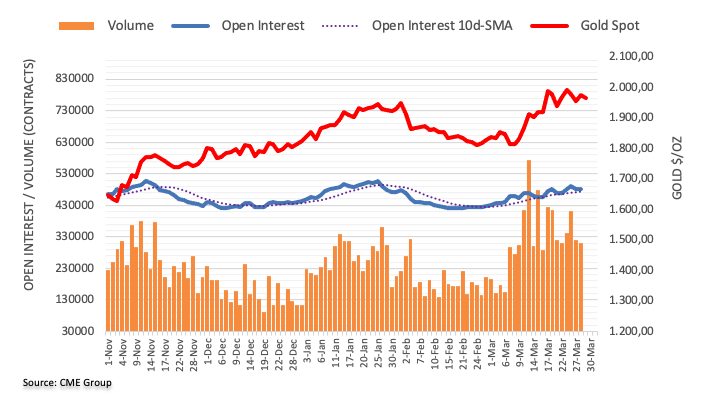

- Gold price is oscillating above $1,960.00 ahead of US PCE Price Index for fresh impetus.

- S&P500 recorded a stellar rally on Wednesday as fears of a global banking crisis receded, portraying a risk-on mood.

- Fed Barr assured investors that the failure of a couple of lenders is unable to lead to a widespread contagion.

Gold price (XAU/USD) is displaying topsy-turvy moves in a $12 range above 1,960.00 in the early Asian session. The precious metal is defending the $1,960.00 support despite easing global banking jitters, which has trimmed the appeal for Gold as a safe-haven asset.

The asset is unable to find a decisive move as investors are awaiting the release of the United States the core Personal Consumption Expenditure (PCE) Price Index (Feb) data will be of significant importance. As per the consensus, monthly core PCE would accelerate by 0.4%, lower than the former expansion of 0.6%. The annual figure is expected to remain steady at 4.7%.

S&P500 recorded a stellar rally on Wednesday as fears of a global banking crisis receded, portraying a firmer risk appetite of the market participants. The commentary from Federal Reserve (Fed) Vice Chair for Supervision Michael Barr told Senate Banking Committee that the United States banking system is ‘sound and resilient’. He assured investors that the failure of a couple of lenders is unable to lead to a widespread contagion.

The US Dollar Index (DXY) has shown some gradual correction to near 102.70 after a solid recovery on hopes that ebbing global banking jitters would allow the Fed to continue its policy-tightening spell. The demand for US government bonds remained choppy as fears of a banking crisis are ebbing, which left 10-year US Treasury yields steady at around 3.56%.

Gold technical analysis

Gold price is auctioning in a Symmetrical Triangle chart pattern on a two-hour scale. The upward-sloping trendline of the chart pattern is plotted from March 22 low at $1,934.34 while the downward-sloping trendline is placed from March 20 high at $2,009.88. Any side break of the Symmetrical Triangle, a volatility contraction pattern, will result in wider ticks and heavy volume.

The 20-period Exponential Moving Average (EMA) at $1,965.00 overlaps with the asset price, indicating a rangebound performance ahead.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in the 40.00-60.00 range, which indicates that investors are awaiting a fresh trigger for further action.

Gold hourly chart

“Underlying inflation in the eurozone is proving sticky and the recent fall in energy costs may not pull it down as fast as some expect, European Central Bank (ECB) policymaker Isabel Schnabel said on Wednesday, highlighting the bank's chief concern,” reported Reuters late Wednesday.

Schnabel, head of the ECB's market operations, also added that last year's energy price spike seeped into the broader economy quickly but the reversal may take longer.

It’s worth noting that ECB’s Schnabel spoke at a National Association for Business Economics conference in Washington.

More comments

My suspicion is that it is not the case, that it may not drop out as quickly as it moves in.

And it's not even clear whether it's going to be completely symmetric in the sense that everything is even going to drop out at all.

ECB has some flexibility in reaching its 2% target and did not want to create needless pain by acting too quickly.

Our target is defined over the medium term, and so of course, we do not want to cause unnecessary pain.

Market reaction

EUR/USD remains sidelined around 1.0850 by the press time, after a mostly inactive day.

Also read: EUR/USD stays firm around 1.0840, with traders eyeing German and US inflation data

- AUD/USD remains sidelined after reversing from weekly high, up on weekly basis so far.

- Downbeat Aussie inflation data, fears of further rate hikes and geopolitical woes weigh on the risk-barometer pair.

- Light calendar in Asia favors traders to extend latest pullback ahead of Friday’s key US inflation clues.

AUD/USD justifies its risk-barometer status as the quote seesaws around 0.6680 amid a mixed start to Thursday’s trading, following a downbeat closing. That said, the Aussie pair’s previous losses could be linked to the US Dollar’s rebound and downbeat Australia inflation numbers while the latest inaction is likely due to a lack of major catalyst, as well as mixed concerns about inflation and banking.

On Wednesday, Australia’s Monthly Consumer Price Index dropped to 6.8% YoY in February versus 7.2% expected and 7.4% prior. The reading followed downbeat Retail Sales and triggered a fall in the odds of witnessing another 0.25% rate hike from the Reserve Bank of Australia (RBA).

On the other hand, the US Dollar Index (DXY) marked the first daily gain in three even as the market sentiment improved and the US Treasury bond yields. The reason might be the month-end positioning, as well as the hawkish Fed comments, not to forget the recent fears emanating from China.

Amid these plays, Wall Street closed with notable gains led by tech and bank stocks while the US Treasury bond yields eased.

Given the light calendar in the Asia-Pacific region, the AUD/USD pair may rely on the risk catalysts for clear directions. Among them, the inflation and banking headlines will be the key to follow.

Technical analysis

AUD/USD pair gradually recovers towards the 50-DMA hurdle of 0.6830, backed by the latest breakout of the 21-DMA, close to 0.6665 by the press time.

- USD/CHF is being offered but the bears need to get below the support near 0.9120.

- The pair is being resisted at key structure across the time frames.

USD/CHF is running into offers again as the following technical analysis will illustrate. Meanwhile, the US Dollar rose against most major peers on Wednesday and was 0.22% higher on the day printing a high of 102.78 at one point. Nevertheless, the CHF ran into offers and stays bearish as follows:

USD/CHF M5 chart

The 5-minute charts show the price moving lower into bearish territory again after the break of structure, BoS, from the prior day.

USD/CHF H1 chart

The resistance on the hourly chart shows that the price is being resisted.

USD/CHF daily chart

The M-formation is bearish with the price struggling at the neckline resistance.

USD/CHF H4 chart

The bears need to get below the support near 0.9120.

The FX market offers no clear signs ahead of crucial inflation data from the Euro Area and the US. The US Dollar is moving between gains and losses despite risk appetite. The economic calendar for the Asian session is light and could favor more price consolidation.

Here is what you need to know on Thursday, March 30:

Wall Street indexes closed with strong gains, and the VIX posted the lowest close in three weeks. The S&P 500 reclaimed the 4,000 mark with a 1.40% gain, while the Nasdaq soared 1.79%. Tech and bank sectors rose, as banking concerns continued to ease. Investors turn their focus to incoming inflation data.

US bonds moved sideways on a quiet session, with yields hovering near recent highs. The Japanese Yen was the worst performer, affected by risk appetite, higher yields and expectations that the Bank of Japan will continue its current policy until the second half of the year. USD/JPY was last seen approaching 133.00, after a 200-pip rally.

The rally in USD/JPY boosted the US Dollar Index, which rose after two days, ending above 102.50. Regarding US data, Jobless Claims and the third Q4 GDP growth estimate on Thursday will be the preview for Friday’s critical inflation PCE report.

EUR/USD hit weekly highs and pulled back; it is consolidating around 1.0840. German inflation will be released on Thursday and Eurozone’s on Friday. European Central Bank (ECB) officials will watch those numbers closely and could have considerable market implications.

GBP/USD climbed to the highest level in two months above 1.2350 but reversed, falling toward 1.2300. The Euro and the Pound are holding on to significant monthly gains versus the US Dollar.

The optimism in the stock market did not reflect the usual correlation among commodity currencies. The Loonie continues to outperform, while AUD and NZD weaken. USD/CAD dropped sharply for the third consecutive day, posting the lowest daily close in a month at 1.3560.

Australian lower-than-expected February CPI data (6.8% YoY vs 7.1%) supported the case for the Reserve Bank of Australia (RBA) to pause at next week’s meeting. AUD/USD slid after the report, bottomed on European hours at 0.6659 and then trimmed losses.

The Kiwi was the worst among commodity currencies. NZD/USD peaked at 0.6270 and then tumbled toward 0.6200, while AUD/NZD bounced sharply from three-day lows under 1.0700 to weekly highs at 1.0747, despite softer Australian inflation.

Emerging market currencies cheered the upbeat tone in Wall Street. USD/MXN is looking at 18.00 after falling for the fifth consecutive day, reaching three-week lows. On Thursday, Banxico will announce its monetary policy decision.

Gold pulled back, finding support around the $1,960 zone, while Silver ended flat at $23.30. All major cryptocurrencies rose on Wednesday. Bitcoin gained more than $1,000, or 4%, to reclaim $28,000. XRP jumped 4.45%.

Like this article? Help us with some feedback by answering this survey:

- Eurozone countries will release preliminary March inflation figures.

- US Dollar recovers modestly despite risk appetite.

- EUR/USD flattens below 1.0850, holds above key daily moving averages.

The EUR/USD hit the highest level in four days at 1.0871 and then pulled back, ending flat around 1.0840. The pair is consolidating as market participants await critical inflation data from the Eurozone and the US. The US Dollar rose during the American session despite a rally in US stocks.

European Central Bank’s rate-setters on the wires continued to talk about the need to raise interest rates further, also considering the situation in financial markets. Forecasts point to a 25 basis points rate hike at the next meeting on May 4. The hawkish comments continue to offer support to the Euro.

Regarding economic data, Germany reported April GfK Consumer Confidence. The survey came in at -29.5, below the -29.2 of market consensus, showing an indiscernible improvement. More German data is coming with March inflation figures (preliminary) on Thursday and February Retail Sales and March Unemployment Rate on Friday.

Euro area HICP Preview: Peak inflation or base effects? No trade-off for ECB (for now)

On both sides of the Atlantic, attention is set on inflation data. On Thursday, Spain and Germany will release the estimated reading of March inflation and the rest of the countries and the Eurozone on Friday. In the US, the number of the week will be the Core Personal Consumption Expenditure Price Index on Friday. In addition, the US Labor Department will release the weekly Jobless Claims and the Bureau of Economic Analysis, the third estimate of Q4 GDP growth. Also, on Thursday, the European Commission will release its business and consumer surveys.

Inflation numbers will be the main focus for the next sessions unless some bank hits the wires. As the banking crisis eases, the outlook for the Euro improves. The EUR/USD bias is to the upside, but a return above 1.0900, for the moment, needs a weaker Dollar.

EUR/USD short-term technical outlook

-638157184843609332.png)

The EUR/USD lost its positive momentum; however the retreat from the peak of 1.0871 has been limited. The daily chart is still biased to the upside, but the Euro is struggling to extend gains. The key area on the chart is 1.0740/50: while above, upside risk dominates.

In the near term, the 4-hour chart favors the bulls as the price remains above the 20-period Simple Moving Average (SMA) that turned north. However, RSI and Momentum flattened as EUR/USD entered a consolidation phase. Ahead of relevant events, if the pair breaks and holds above 1.0865, more gains seem likely. The mentioned 20-SMA and an uptrend line around 1.0810/15 should limit a potential slide. A downward extension below the latter should expose 1.0785.

View Live Chart for the EUR/USD

- NZD/USD is under pressure as the US Dollar perks up.

- Eyes will turn to the RBNZ next week.

NZD/USD is losing ground, down some 0.5% and falling from a high of 0.6270 to 0.6214 on the day so far. All in all, it's been relatively quiet mid-week. Meanwhile, market worries about the banking system have ebbed following a U.S. regulator-backed sale of failed lender Silicon Valley Bank's assets.

Nevertheless, as analysts at ANZ Bank noted, ´´US 10yr bond yields haven’t moved much; the bounce in equities and commodities did little for the Kiwi. It’s a quiet week on the data front, and some consolidation was always due ahead of next week’s OCR decision.´´

In this regard, the analysts said that markets seem to be coming around to the view that we’re likely to get a hawkish tone, and are slowly pricing out hikes that were expected in the second half of the year. ´´But fears of a credit crunch are alive and well in markets around the globe, and broad risk appetite (a key ally of the Kiwi) is suffering a touch as a result.´´

In a prior note, the analysts said that they ´´expect the Reserve Bank of New Zealand will raise the Official Cash Rate (OCR) 25bp to 5.00% at its Monetary Policy Review (MPR) next Wednesday. If that’s not to be, we see a 50bp hike as likelier than a pause.´´

As for the greenback, DXY is up slightly and trading near 102.70 after two straight down days. However, a firm move below 102.50 would expose last week’s low near 101.915. With that being said, analysts at Brown Brothers Harriman argued that ´´markets are overestimating the Fed’s capacity to ease and so the dollar should eventually recover when expectations are repriced.´´

- The USD/CAD slid on market sentiment and high oil prices.

- An offered US Dollar would keep the USD/CAD under heavy stress, as the USD/CAD eyes 1.3500.

- USD/CAD Price Analysis: Would continue headed downwards unless buyers conquer 1.3600.

The Canadian Dollar (CAD) extended its gains against the US Dollar (USD) for three straight days, spurred by a risk-on impulse and overall US Dollar weakness. The buck is pressured on expectations for a less hawkish US Federal Reserve (Fed). The USD/CAD is trading at 1.3569 after printing a high of 1.3616.

Canadian Dollar boosted by high oil prices, risk appetite and soft USD

The USD/CAD continued its fall on higher oil prices, as Western Texas Intermediate (WTI) rose more than 6% weekly. Canada is one of the world’s major crude oil and natural gas exporters. Therefore, higher energy prices it usually underpins the Canadian Dollar.

Additionally, a softer US Dollar gave another leg-down to the USD/CAD pair, as it’s falling to a three-week low. However, the US Dollar Index (DXY), a barometer for the greenback’s value vs. a basket of six currencies, has paired some of its losses, gains 0.23%, at 102.665.

Traders should be aware that the Canadian Dollar, as a risk-perceived currency, would be subject to weakening on geopolitical tensions rise or sentiment shifts. As long as investors’ mood remains upbeat, the USD/CAD has room for another leg down, and it might test the 100-day Exponential Moving Average (EMA) at 1.3520.

Data-wise, the US economic docket featured Pending Home Sales for February, which rose by 0.8% MoM, above estimates for a plunge of 0.3%. Annually based, it decreased by 21.1%, less than the 29.4% plunge foreseen.

On the Canadian front, the docket featured the Bank of Canada (BoC) Deputy Governor Toni Gravelle. Gravelle did not speak about monetary policy; thought commented the BoC is ready to step in, if the banking system comes under pressure. He added that the BoC’s Quantitative Tightening (QT) program would run its course by the first half of 2025.

USD/CAD Technical analysis

USD/CAD remains downward biased after dropping below the 50-day Exponential Moving Average (EMA) at 1.3594. a drop below 1.3550 will expose the 100-day EMA at 1.3520, ahead of testing 1.3500. Once cleared, a support trendline at around 1.3420/30 could be tested before retracing to 1.3400.

On the other hand, the USD/CAD buyers reclaiming the 50-day EMA at 1.3594 could pave the way to test 1.3600, followed by the 20-day EMA.

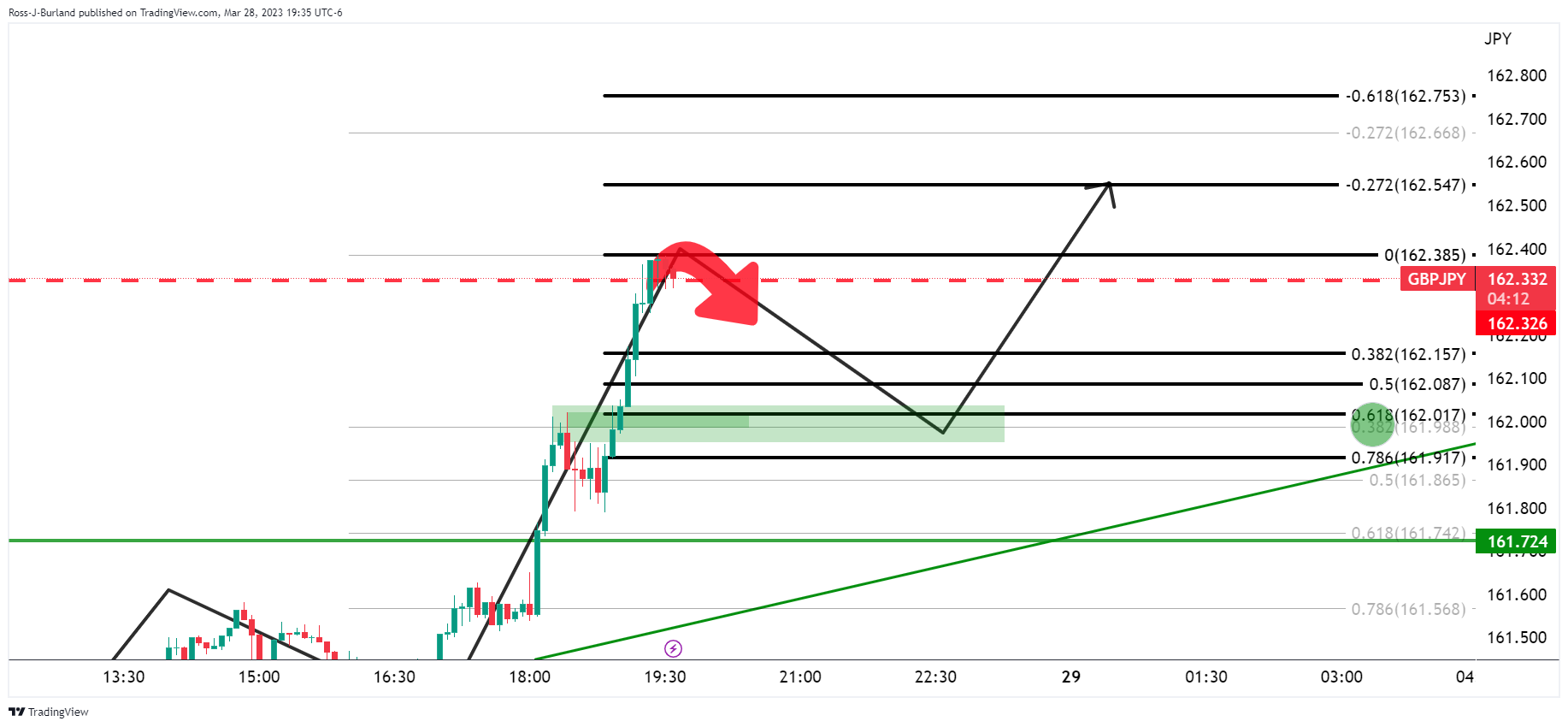

- GBP/JPY holds near microcycle highs around 163.40.

- The Yen is lower across the board on a risk-positive mood.

GBP/JPY shot higher to reach 163.47 on a day when the cross rallied from 161.34 on broad Yen weakness. The yen retreated after Japan’s government approved ¥2.2tn of reserve money to tame escalating price pressures.

However, as analysts at Rabobank noted, the window of opportunity for policy tightening for the BoJ now appears to be even smaller than before the banking crisis given the BoJ is unlikely to tighten policy if the US economy is facing down a recession.

´´It remains the case that growth in Japan is already fairly lacklustre. That said, while the JPY may not see much support from policy tightening this year, it is likely to act as a safe haven,´´ the analysts said.

However, they note that risk appetite has improved this week, the global economy has to become accustomed to operating in a higher interest rate environment. ´´That suggests that the stresses of the past few weeks are unlikely to be the last. We maintain a 3 mth USD/JPY131.00 forecast.´´

For the cross, GBP has derived some support from the recently better-than-expected UK economic data may have provided some recent support as well. However, talk of a policy pause clearly made the market nervous ahead of last week’s Bank of England meeting where the BoE hiked by 25bp to 4.25% with 7 members voting for a 25bp hike and two members voting for keeping the Bank Rate unchanged.

´´Overall, the forward guidance was limited with the BoE leaving the door open for another hike at the May meeting if persistent inflation pressures persist,´´ analysts at Danske Bank argued.

´´We revise our forecast to include a final 25bp hike in May, marking a peak in the Bank Rate at 4.50%,´´ the analysts said. ´´Our expectations are in line with current market pricing (currently 30bp priced until August 2023) as we expect the rest of the BoE committee to increasingly turn less hawkish amid a weakening growth backdrop and easing labour market conditions.´´

´´Markets are pricing in 30bp of cuts during H2. We still believe that the first-rate cuts will not be delivered before the beginning of 2024,´´ the analysts concluded.

- Silver price is trading sideways after hitting a daily high of $23.39.

- XAG/USD Price Analysis: Short term, the XAG/USD might test $24.00 once it reclaims $23.50: otherwise, it would consolidate.

Silver price consolidates for the fourth straight day after hitting a weekly high of $23.52. However, the white metal faces solid resistance and trades sideways on Wednesday. At the time of typing, the XAG/USD is trading at $23.32 for a gain of 0.40%.

XAG/USD Price action

On Wednesday, the XAG/USD failed to sustain the early break above March’s 28 high of $23.37, which would open the door to test the week’s low at $22.83 once sellers break the $23.00 psychological level. That would open the door for a leg down, and if the XAG/USD tumbles below the former, that could exacerbate a test of the 20-day Exponential Moving Average (EMA) at $22.32.

On the flip side, with Silver’s buyers cracking $23.50, upside risks would lie at $24.00, followed by a test of the YTD high at $24.63.

In the short term, the XAG/USD 4-hour chart portrays the white metal as neutral to upward bias, and it might test $23.50 soon. A breach of the latter will clear the path to test higher pivot points, like #2 at $23.70, before assaulting R3 at $24.04.

XAG/USD 4-hour chart

XAG/USD Technical levels

- GBP/USD pulls away from the eight-week highs.

- Analysts forecast to include a final 25bp BoE hike in May.

The British Pound pulled back from the highest level against the dollar in eight weeks on Wednesday, a high made as worries about the health of the global financial system continued to ease. At the time of writing, GBP/USD is down some 0.2% after falling from a high of 1.2361 to a low of 1.2302.

Prior to today's pullback, the Pound Sterling rose by over 0.1% against the US Dollar to 1.2361, its highest since February 2 as it was supported by the rebound in risk appetite. The rebound followed cooling concerns about the banking sector turmoil sparked by US tech lender Silicon Valley Bank (SVB) and the emergency takeover of Credit Suisse by banking rival UBS. The worries of systemic stress had led to market volatility in the anticipation of more bank failures but these worries, however, have now faded. Investors took solace from First Citizens BancShares' agreement to buy all of the failed lender Silicon Valley Bank's deposits and loans.

Additionally, the fact that no further cracks have emerged in global banking this week is a positive. On Tuesday, Michael Barr, the Fed's vice chairman for supervision, told the Senate Banking Committee that Silicon Valley Bank's problems were due to "terrible" risk management, suggesting it could be an isolated case.

Meanwhile, on the domestic front, recently better-than-expected UK economic data may have provided some recent support as well. However, talk of a policy pause clearly made the market nervous ahead of last week’s Bank of England meeting where the BoE hiked by 25bp to 4.25% with 7 members voting for a 25bp hike and two members voting for keeping the Bank Rate unchanged.

´´Overall, the forward guidance was limited with the BoE leaving the door open for another hike at the May meeting if persistent inflation pressures persist,´´ analysts at Danske Bank argued.

´´We revise our forecast to include a final 25bp hike in May, marking a peak in the Bank Rate at 4.50%,´´ the analysts said. ´´Our expectations are in line with current market pricing (currently 30bp priced until August 2023) as we expect the rest of the BoE committee to increasingly turn less hawkish amid a weakening growth backdrop and easing labour market conditions.´´

´´Markets are pricing in 30bp of cuts during H2. We still believe that the first-rate cuts will not be delivered before the beginning of 2024,´´ the analysts concluded.

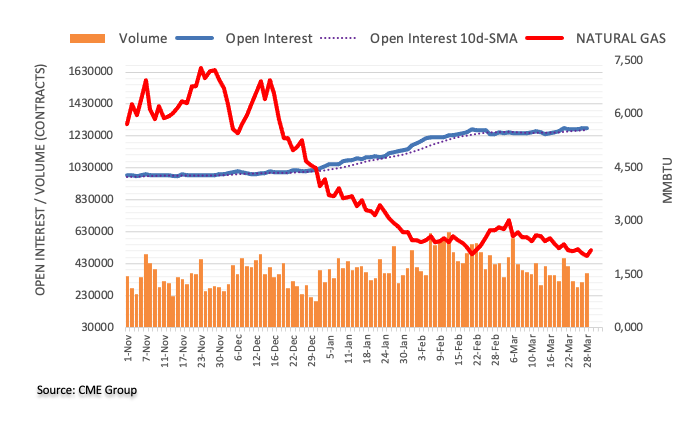

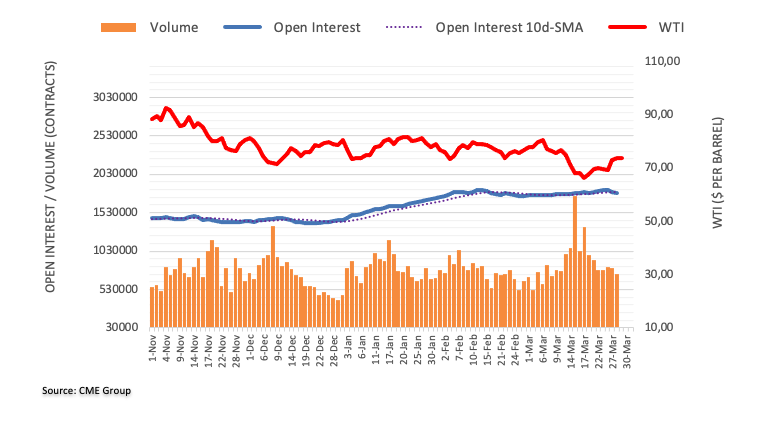

- US Energy Information Administration (EIA) reports an inventory decrease for the last week.

- US crude oil imports drop to the lowest level since March 2021.

- WTI Price Analysis: Would resume upwards if it breaks above $75.00; otherwise, it would remain sideways.

Western Texas Intermediate (WTI), the US crude oil benchmark, retreated from weekly highs and reached $74.32 in the early New York session. Inventories in the United States (US) dropped, though it failed to underpin WTI’s price. At the time of typing, WTI exchanges hands at $73.08 PB.

US EIA announced that inventories dropped, but WTI remains down

Traders’ sentiment is positive, as shown by US equities climbing. The US Energy Information Administration (EIA) revealed that inventories in the last week fell as refineries ramped up operations once the maintenance period ended. US crude oil imports fell to their lowest level since March 2021.

Delving into the data, crude oil stockpiles dropped by 7.5 million barrels in the week to March 24 to 473.7 million barrels, vs. estimates of 92,000 barrels rise.

Although there was an oil shortage, WTI failed to capitalize as the greenback recovered some ground. The US Dollar Index (DXY), which track’s the value of the American Dollar (USD) against a basket of six currencies, is up 0.31%, at 102.745. That makes oil prices more expensive for international buyers.

After an arbitrage decision, the Norwegian oil firm DNO began shutting down production in Kurdistan’s fields.

WTI Technical analysis

After recovering from trading nearby the YTD lows, WTI is consolidating within the 20 and 50-day Exponential Moving Averages (EMAs), at $72.45-$74.85. For a bullish continuation, WTI needs to crack $75.00, with upside risks at around the 100-day EMA At $77.90. On the other hand, WTI’s would re-test the YTD lows at 64.41, once it broke below $72.00 PB.

Bank of Canada (BOC) Deputy Governor Toni Gravelle said on Wednesday that the BOC is ready to act in the case of severe market-wide stress and provide liquidity support to the financial system, as reported by Reuters.

Additional takeaways

"Quantitative tightening program will likely end sometime around the end of 2024 or first half of 2025; QT is working but will take some time to run its course."

"If faced with extreme event that caused severe dysfunction in government of Canada (GoC) bond market, bank could resort to large-scale GoC bond purchases."

"Bar is very high for bank to use large-scale GoC bond purchases to support market functioning again."

"Bank would only be offering extraordinary liquidity in extreme market-wide situations, when entire financial system faced funding constraints."

"Penalty pricing should be built into extraordinary actions whenever possible to make program unattractive once financial conditions improve."

"If bank were faced with a UK-style pension fund crisis, it could use its contingent term repo facility; this would reduce need for bank to conduct outright bond purchases."

"This level is well below current level of roughly C$200 bln; our best estimate is somewhere in the range of C$20 bln to C$60 bln."

"Canadian banks are not immune to spillover from events elsewhere, which can negatively affect things here."

Market reaction

The USD/CAD showed no reaction to these comments and was last seen losing 0.15% on the day at 1.3580.

- US Pending Home Sales improved, but investors are focused on core PCE figures on Friday.

- Banxico’s monetary policy decision loom, with analysts expecting a 25 bps rate hike.

- USD/MXN Price Analysis: Further downside is estimated, but Banxico’s decision could spur a leg-up.

The USD/MXN continues its free-fall during the week, down 1.45% since Monday, registering five days of consecutive losses. Sentiment improvement, and a strong US Dollar (USD), have not stopped the appreciation of the Mexican currency. At the time of writing, the USD/MXN is trading at 18.1060, down 0.69% in the day.

The Mexican Peso at the mercy of Banxico’s policy decision

A risk on impulse underpinned the Mexican Peso (MXN), which continues to drag the USD/MXN exchange rate, further below the psychological 18.50 barrier, eyeing to test 18.00. Investors’ appetite for risk improved on news that Alibaba will split into six business groups seeking Initial Public Offerings (IPOs). Therefore, Wall Street portrays an optimistic sentiment after a “short-lived” banking crisis.

A light economic calendar in the United States (US) featured that Pending Home Sales for February grew at a 0.8% MoM and exceeded estimates for a plunge of 0.3%, though on an annual basis, decreased by 21.1%, less than the 29.4% plunge foreseen.

Market participants ignored US data as they shifted to the US Federal Reserve’s (Fed) preferred gauge for inflation, the Core Personal Consumption Expenditure (PCE) for February, estimated at 0.4% MoM and 4.7%, annually based.

Additionally, Thursday’s calendar will be packed, with Initial Jobless Claims for the last week, and the Gross Domestic Product (GDP) for Q4

In the meantime, US Treasury bond yields are retreating, with 2s and 10s, each at 4.05% and 3.56%, respectively. The greenback climbs 0.27%, as shown by the US Dollar Index, up at 102.704.

On the Mexican front, the Bank of Mexico (Banxico) will unveil its interest rate decision on Thursday. Analysts foresee a 25 bps rate hike by Banxico. Expectations lie around a possible pause in the hiking cycle, which, although it favors the Mexican Peso (MXN) due to its interest rate differential, could trigger some profit-taking. Therefore, further upside in the USD/MXN could be possible.

USD/MXN Technical analysis

From a daily chart perspective, the USD/MXN is downward biased, eyeing a renewed test of YTD lows at 17.8968. But, the USD/MXN pair needs to clear some hurdles on its way south, like the 18.00 figure, followed by the March 7 low of 17.9664, before challenging the YTD low. If that price level is cleared, the next support would be July 2017 low at 17.4498.

Conversely, the USD/MXN’s first resistance would be the 20-day Exponential Moving Average (EMA) at 18.4607. But oscillators staying at bearish territory suggest the least resistance path is downwards.

"We will be looking at incoming data, financial conditions to make a meeting-by-meeting judgement on rates," Federal Reserve Vice Chair for Supervision Michael Barr said on Wednesday, as reported by Reuters.

Key takeaways

"it's fair to ask if the supervisors of SVB could have been more aggressive."

"We have substantial authority to supervise firms in an appropriate way."

"A tiering approach makes sense."

"But we do need stronger rules on capital and liquidity for banks of $100 bln and up."

"Monetary policy decisions were well-telegraphed and essential to meet mandates."

"Bank management failed to manage straightforward interest-rate risk."

Market reaction

The US Dollar Index clings to modest daily recovery gains at 102.70 following these comments.

Gold remains below its $2,070/2075 record highs and has started a short-term consolidation. A sustained move above $2,000/10 is needed to reinvigorat upside pressure, economists at Credit Suisse report.

XAU/USD could see further weakness on failure to defend 55-DMA

“A sustained move beyond $2,000/10 stays seen needed to clear the way for a retest of long-term resistance from the $2,070/75 record highs of 2020 and 2022. Whilst this should clearly be respected, a clear and sustained break higher would be seen to open the door to a move to $2,300 next.”

“Ideally, the 55-DMA, currently seen at $1,891, floors the market now. If this breaks, we could see further weakness towards the recent range low at $1,805, before the crucial 200-DMA, currently seen at $1,781, which we would once more expect to provide a floor.”

The month of March proved eventful for the Euro with a nearly 4 cent difference between the low and high marks. Economists at the National Bank of Canada expect the shared currency to strengthen in the second half of the year.

Financial system volatility

“March was characterized by disruption in the global financial system stemming from the repercussions of woes in the US banking system. Compounded to this was the takeover of Credit Suisse by UBS. With the dust now settling from the transpired events, the collective currency has stabilized to some extent.”

“Continued tightening by the European Central Bank and a let up from the US Federal Reserve could translate into a narrowing of monetary policy. As such, we see the potential for some Euro appreciation in the second half of the year assuming data remains resilient on the European side.”

CAD pessimism looks overdone, in the view of Kit Juckes, Chief Global FX Strategist at Société Générale.

In 2019, peak Fed Funds signalled peak USD/CAD

“No-one expects the Bank of Canada to hike rates on April 14, rate differentials and consensus growth forecasts are both CAD-unfriendly. Soft oil prices don’t help, and a North American banking crisis could spill over the border. All of these negative factors are known, however.”

“Short USD/CAD on this basis, is well positioned to benefit from a gradual easing in concerns about the banking sector, and a peak in Fed rates. The last time the speculative market was this short of CAD, back at the start of 2019, the Fed had just finished hiking rates, and by the end of the year, USD/CAD was back under 1.30.”

- Pending Home Sales in the US increased unexpectedly in February.

- US Dollar Index clings to modest recovery gains slightly above 102.50.

Pending Home Sales in the US rose by 0.8% on a monthly basis in February, the data published by the National Association of Realtors showed on Wednesday. This reading followed January's increase of 8.1% and came in better than the market expectation for a decrease of 0.8%.

On a yearly basis, Pending Home Sales declined by 21.1%, compared to analysts' estimate for a decline of 29.4%.

Market reaction

The US Dollar Index showed no immediate reaction to these data and was last seen trading modestly higher on the day at 102.60.

- EUR/USD advances to the 1.0870 region earlier on Wednesday.

- The dollar remains bid across the board amidst higher US yields.

- Hawkish ECB speak keeps the pair on the positive side.

EUR/USD clings to daily gains around the 1.0850 region against the backdrop of a firm note in the greenback on Wednesday.

EUR/USD: Weekly gains look capped near 1.0870

EUR/USD trades within the familiar range, up slightly in the mid-1.0800s against the backdrop of the moderate bounce in the greenback.

The better tone in the European currency looks propped up by comments from ECB’s rate setters. Indeed, ECB Board member Kazimir suggested that the core inflation could take a key role when it comes to interest rate decisions at the time when he left the door open to further rate hikes, albeit at a slower pace. In addition, member Lane defended further rate hikes and suggested inflation in the region could drop rapidly by year end.

In the euro calendar, Consumer Confidence tracked by GfK in Germany improved marginally to -29.5 for the month of April (from -30.6), while the Consumer Confidence in France receded to 81 in March (from 82).

In the US, MBA Mortgage Applications expanded 2.9% in the week to March 24 and Pending Home Sales are due later.

What to look for around EUR

The weekly recovery in EUR/USD meets initial resistance near 1.0870 amidst the resumption of some USD-buying.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next moves from the ECB in a context still dominated by elevated inflation, although amidst dwindling recession risks for the time being.

Key events in the euro area this week: Germany GfK Consumer Confidence, France Consumer Confidence (Wednesday) – Germany Flash Inflation Rate, EMU Consumer Confidence, Economic Sentiment (Thursday) – Germany Retail Sales/Labor Market Report, EMU Flash Inflation Rate/Unemployment Rate, France Flash Inflation Rate, Italy Flash Inflation Rate (Friday).

Eminent issues on the back boiler: Continuation, or not, of the ECB hiking cycle. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.04% at 1.0846 and a break above 1.0929 (monthly high March 23) would target 1.1032 (2023 high February 2) en route to 1.1100 (round level). On the downside, the next support aligns at 1.0712 (low March 24) followed by 1.0637 (100-day SMA) and finally 1.0516 (monthly low March 15).

- AUD/USD drifts lower on Wednesday and is pressured by a combination of factors.

- The softer Australian CPI lifts RBA rate pause bets and weighs heavily on the Aussie.

- Rising US bond yields revive the USD demand and further contribute to the decline.

The AUD/USD pair comes under some renewed selling pressure on Wednesday and reverses a major part of the previous day's positive move. The pair maintains its offered tone through the early North American session and is currently placed near the lower end of its daily range, around the 0.6670-0.6660 region.

The Australian Dollar started losing ground in reaction to the softer-than-expected domestic consumer inflation figures, which fuels speculation that the Reserve Bank of Australia (RBA) could pause its rate-hiking cycle at the April meeting. In fact, the Australian Bureau of Statistics (ABS) reported that the headline CPI decelerated from the previous month's reading of 7.4% to 6.8% in the year to February, marking the slowest rise since June 2022. This, along with a modest pickup in the US Dollar (USD) demand, is seen exerting some downward pressure on the AUD/USD pair.

Having registered losses over the past two days, the USD regains some positive traction amid a further rise in the US Treasury bond yields. Easing fears of a full-blown banking crisis continues to push the US bond yields higher. That said, the Federal Reserve's less hawkish outlook could act as a headwind for the US bond yields and the Greenback. It is worth recalling that the US central bank last week toned down its approach to reining in inflation and signalled that a pause to interest rate hikes was on the horizon in the wake of the recent turmoil in the banking sector.

Apart from this, the prevalent risk-on mood - as depicted by a strong opening rally around the US equity markets - could cap gains for the safe-haven buck and lend some support to the risk-sensitive Aussie. This, in turn, makes it prudent to wait for strong follow-through selling before positioning for any further depreciating move for the AUD/USD pair. Even from a technical perspective, the recent two-way price action witnessed over the past two weeks or so points to indecision over the next leg of a directional move and warrants some caution for bearish traders.

Technical levels to watch

Risks for BRL remain high despite hawkish Brazilian central bank (BCB), economists at Commerzbank report.

Toing and froing about the fiscal framework is another risk factor for BRL

“The government’s criticism of the monetary policy not only constitutes a risk factor for the BRL but also makes the BCB’s job more difficult. The government’s debate about revising the inflation target is likely to have contributed to higher inflation expectations.”

“In our view the toing and froing about the fiscal framework is another risk factor for BRL. Even though the government seemed optimistic that it would convince the market with its solid household plans thanks to the fiscal framework, doubts remain. In particular since the susceptibility of the BRL regarding budget risks is likely to have increased further as a result of the recent turbulence on the global financial markets.”

- Japanese Yen is under pressure across the board on risk appetite and higher US yields.

- DXY is up by 0.30% on Wednesday, down by 2.20% in March.

- USD/JPY is having the biggest daily gain of the month, rising more than 150 pips.

Following a correction to 131.55, the USD/JPY resumed the upside, breaking firmly above 132.00. It is trading at its highest level in a week at 132.55/60. It is up by 175 pips, the biggest daily gain in a month.

The pair has been moving all day with a bullish bias. On Asian hours it was supported by a broad-based recovery of the US Dollar. More recently, the move higher gained speed boosted by higher US yields.

The US 10-year Treasury bond yield reached 3.61% and the 2-year climbed to 4.14%, both at the highest levels in a week. On Wall Street, US equities opened with strong gains. The Dow Jones is up by 0.70% and the Nasdaq gains 1.30%.

The combination of risks appetite and higher US yields, as the banking crisis fades, weighs on the Japanese Yen. The currency is the worst performer on Wednesday among the most traded currencies.

USD/JPY looking at 133.00

In the daily chart, the pair is above the 55-periord Simple Moving Average (SMA), currently at 132.40. On the upside, the next barrier is the 133.00 area. A consolidation above would clear the way to more gain. On the flip side, the 131.80 zone has become the key support.

-638156942991823286.png)

Technical levels

S&P 500 strength stays seen as temporary. Analysts at Credit Suisse look for an eventual test of the 200-week average at 3743.

Break above 4078 to reassert an upward bias

“The S&P 500 rebound has been capped at its downtrend from February, and the market could be forming a potential ‘head and shoulders’ top. Strength therefore stays seen as temporary, and we look for an eventual test of the 200-week average at 3743. Below here at any stage would open up a move back to the 3505/3492 lows.”

“Above 4078 would be seen to reassert an upward bias for strength back to 4195, possibly even 4312/4325.”

The USD is trading mixed versus the majors. Economists at Scotiabank expect the greenback to sustain further losses ahead.

Strengthening downtrend continues to develop

“Passive equity hedge rebalancing signals for the USD over the past month appear to be USD-negative (ex-JPY) but positive over a Q1 perspective and may ultimately work against each other – but these flows could still buffet intraday trade to an extent.”

“USD losses are poised to extend further overall as markets focus on the maturing Fed policy cycle; the DXY’s failure to make deeper headway through the mid-103 area last week keeps the near-term technical tone negative as a strengthening downtrend continues to develop.”

- GBP/USD pulls back from its highest level since February touched earlier this Wednesday.

- A further rise in the US bond yields revives the USD demand and exerts some pressure.

- The fundamental backdrop supports prospects for additional near-term gains for the pair.

The GBP/USD pair retreats from the 1.2360 area, or its highest level since February 03 touched this Wednesday and trades with modest losses during the early North American session. Spot prices, for now, seem to have snapped a two-day winning streak, though manage to hold comfortably above the 1.2300 round-figure mark, or the daily swing low.

The US Dollar (USD) gains some positive traction amid a further rise in the US Treasury bond yields and is seen as a key factor acting as a headwind for the GBP/USD pair. Hopes that a full-blown banking crisis can be averted might have been averted fuel speculations that the Federal Reserve (Fed) might stick to its policy tightening path, which, in turn, continue to push the US bond yields higher. That said, the prevalent risk-on mood - as depicted by a generally positive tone around the equity markets - might hold back traders from placing aggressive bullish bets around the safe-haven Greenback.

In the absence of negative news from the banking sector over the past two weeks, the takeover of Silicon Valley Bank by First Citizens Bank & Trust Company calmed market nerves about the contagion risk. Furthermore, US regulators reiterated strength in the banking system and helped reverse the recent negative sentiment in the markets. Furthermore, the Bank of England (BoE) Governor Andrew Bailey told the House of Commons Treasury Select Committee on Tuesday that the UK banking system is in a strong position and is not experiencing stress linked to the global turmoil in the banking sector.

Apart from this, bets for additional rate hikes by the BoE continue to act as a tailwind for the British Pound. The expectations were reaffirmed after the British Retail Consortium (BRC) reported that UK shop prices increased from 8.4% previously to 8.9% in the year to March - the highest reading on record since the survey started in 2005. Adding to this, food prices increased 15.0% over the year, also a record high. This, in turn, supports prospects for a further near-term appreciating move for the GBP/USD pair, warranting some caution before positioning for any meaningful corrective pullback.

Technical levels to watch

EUR/USD could increase further and challenge the 1.10 level, economists at HSBC report.

Key local driver is likely to be core inflation

“The key local driver is likely to be core inflation, which has continued to push higher. We believe it can nudge higher still. Germany will reveal its preliminary March data on 30 March, with France and the Eurozone aggregate data out the next day.”

“EUR/USD is vulnerable to any ‘risk off’ mood but, barring surprises, a test of 1.10 level is likely over the near term, supported by rate differentials.”

- EUR/USD rose to fresh 3-day tops around 1.0870 on Wednesday.

- Further upside could revisit the monthly high near 1.0930.

EUR/USD climbs to fresh multi-day highs near 1.0870 amidst the continuation of the weekly rebound on Wednesday.

The likelihood of extra advances appears favoured for the time being. Against that, the pair could now set sail to the March peak at 1.0929 (March 23) prior to a potential test of the 2023 high at 1.1032 (February 2).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0336.

EUR/USD daily chart

Economists at TD Securities do not expect a meaningful MXN reaction to Banxico's decision on Thursday as they consider it has been mostly priced in.

Banxico to fulfill its 25 bps hike promise

“We expect Banxico to hike in 25 bps on March 30 and hit terminal at 11.25%. We think the bar is high for the central bank to contradict its own forward guidance once again.”

“We do not expect a meaningful MXN reaction to Banxico's decision as we think it has been mostly priced in. However, we expect gradual weakening of MXN against the USD in the coming months.”

“We still expect USD/MXN levels at 20.00 by year-end, though we acknowledge risks are tilted to the downside.”

- USD/CAD drops to over a three-week low, though lacks strong follow-through.

- Bullish Crude Oil prices continue to underpin the Loonie and exert pressure.

- A modest USD strength lends some support to the pair and helps limit losses.

The USD/CAD pair turns lower for the third straight day following an early uptick to the 1.3615 area on Wednesday and drops to its lowest level since early March heading into the North American session. The pair, however, manage to bounce a few pips in the last hour and currently trades with only modest intraday losses, just below the 1.3600 round-figure mark.

Crude Oil prices prolong a three-day-ole bullish trend and climb to over a two-week high, which, in turn, is seen underpinning the commodity-linked Loonie and exerting some downward pressure on the USD/CAD pair. A halt to some exports from Iraq's Kurdistan region raised concerns about tightening global supplies. This, along with hopes for a strong fuel demand recovery in China, continues to support Oil prices amid a drop in US crude inventories.

In fact, market sources, citing American Petroleum Institute figures on Tuesday, suggested that Crude stocks in the US fell by 6.1 million barrels last week. Investors now look to the official US inventory data from the Energy Information Administration to see if it confirms the Crude stock decline. In the meantime, easing fears of a full-blown banking crisis remains supportive of the prevalent risk-on environment and lends additional support to the black liquid.

That said, the emergence of some US Dollar (USD) buying lends some support to the USD/CAD pair and limits the downside, at least for the time being. The USD uptick, meanwhile, lacks any obvious fundamental catalyst and runs the risk of fizzling out rather quickly in the wake of the Federal Reserve's (Fed) less hawkish outlook. In fact, the US central bank signalled last week that a pause to interest rate hikes was on the horizon amid the recent banking turmoil.

This, along with a fresh leg down in the US Treasury bond yields and a generally positive tone around the equity markets, keeps a lid on any meaningful gains for the safe-haven Greenback. The fundamental backdrop suggests that the path of least resistance for the USD/CAD pair is to the downside. The negative outlook is reinforced by the overnight breakdown below the 1.3630 support. Hence, any attempted recovery move might still be seen as a selling opportunity.

Technical levels to watch

Economists at HSBC maintain their bullish view on the British Pound.

GBP should benefit from an improvement in global risk appetite

“Our base case is that the GBP should benefit from an improvement in global risk appetite.”

“Recent upward surprises to domestic activity data, a potentially sharp fall in supply-side driven inflation through the summer, and an improving UK trade balance should also support the GBP. Until we see clearer signs of those factors changing, we maintain our bullish view on the GBP.”

The CAD is trading at its highest against the USD since the early part of March. Economists at Scotiabank expect the USD/CAD pair to challenge the low 1.35s on a move under the 1.3570 support.

Resistance aligns at 1.3650/60

“USD/CAD losses through the low/mid 1.36s confer a softer technical tone on the short-term charts but the Loonie has a lot of work to do still to show any real technical strength.”

“A move under 1.3570 (50% retracement of the Feb/Mar USD rise) would pave the way for a test of the low 1.35 region where the 100-Day Moving Average (which has been a good bellwether for USD/CAD recently) stands at 1.3517.”

“Resistance is 1.3650/60.”

EUR/USD rebounds from early losses. Ultimately, a move through to 1.10+ looks on the cards, economists at Scotiabank report.

Limited scope for counter-trend corrections

“Bullish trend signals on the short, medium and long-term oscillators suggests limited scope for counter-trend corrections and ongoing pressure for gains to extend towards the low 1.09s and a retest of last week’s high at 1.0927.”

“Higher rates in Europe while the outlook for Fed policy remains uncertain will help keep the EUR supported and on tracking for a test of 1.10+.”

- USD/JPY catches aggressive bids on Wednesday and climbs to a one-week high.

- The risk-on mood undermines the safe-haven JPY and lends support to the pair.

- The Fed’s less hawkish stance keeps the USD on the defensive and caps the upside.

The USD/JPY pair regains positive traction following the previous day's downfall and maintains its bid tone through the mid-European session on Wednesday. The momentum pushes spot prices to a one-week high, though bulls struggle to capitalize on the move further beyond the 132.00 round-figure mark.

Easing fears of a full-blown banking crisis remains supportive of a generally positive tone around the equity markets, which, in turn, undermines the safe-haven Japanese Yen (JPY) and acts as a tailwind for the USD/JPY pair. The takeover of Silicon Valley Bank by First Citizens Bank & Trust Company calmed market nerves about the contagion risk. This, coupled with the lack of negative news from the banking sector over the past two weeks, further boosted investors' confidence and helps reverse the recent negative sentiment.

The JPY is further weighed down by the overnight dovish-sounding remarks by Bank of Japan (BoJ) Governor Haruhiko Kuroda, saying that it is too early to debate an exit from easy monetary policy. Adding to this, the recent widening of the US-Japan rate differential, led by a rally in the US Treasury bond yields witnessed since the beginning of the current week, also contributes to driving flows away from the JPY. That said, subdued US Dollar (USD) demand holds back traders from placing fresh bullish bets around the USD/JPY pair.

The Federal Reserve (Fed) last week toned down its approach to reining in inflation and signalled that a pause to interest rate hikes was on the horizon in the wake of the turmoil in the banking sector. This leads to a fresh leg down in the US Treasury bond yields and could act as a headwind for the USD. The BoJ, on the other hand, is expected to tweak its bond yield control policy and whittle down its massive stimulus under new Governor Kazuo Ueda. This further contributes to keeping a lid on the USD/JPY pair, at least for the time being.

Market participants now look to the US economic docket, featuring the release of Pending Home Sales later during the early North American session. Apart from this, the US bond yields will influence the USD price dynamics and provide some impetus to the USD/JPY pair. Traders will further take cues from the broader market risk sentiment to grab short-term opportunities. The focus, however, remains glued to the release of the Fed's preferred inflation gauge - the US Core PCE Price Index, due on Friday.

Technical levels to watch

- DXY attempts a mild rebound to the 102.70.75 band on Wednesday.

- The monthly low near 101.90 emerges as a decent contention area.

DXY attempts to leave behind part of the recent downside pressure, although the bull run faltered near 102.70 on Wednesday.

In the meantime, it seems the index has moved into some consolidative phase. The drop below the March low at 101.91 (March 23) is expected to encourage sellers to return to the market and open the door to a potential visit to the 2023 low around 100.80 (February 2).

Looking at the broader picture, while below the 200-day SMA, today at 106.57, the outlook for the index is expected to remain negative.

DXY daily chart

GBP/USD trades firm in mid-1.23s. Economists at Scotiabank expect the pair to retest the late 2022/early 2023 peaks at 1.2445.

Foreign investors remain wary of Gilts

“Foreign investors remain net sellers of UK government bonds. Net outflows were much smaller than Jan record net exodus (GBP28 bn) but the trend remains a concern after the late 2022 volatility in UK markets. The data had no impact on the GBP’s intraday performance, however.”

“GBP/USD gains are pressuring last week’s peak at 1.2342; trend oscillators are bullishly aligned across a range of timeframes making a retest of the late 2022/early 2023 peaks at 1.2445 a likelihood in the near future, provided that strong trend support on the intraday chart at 1.2290 remains intact.”

- EUR/JPY leaves behind Tuesday’s small downtick and retakes 143.00.

- The breakout of the consolidation theme faces resistance near 145.60.

EUR/JPY advances markedly and regain the area beyond the 143.00 hurdle to print new multi-session peaks on Wednesday.

The cross so far surpasses the key 200-day SMA near 141.80, and a sustainable surpass of this region should open the door to further upside in the short-term horizon. Moving forward, the consolidation theme is expected to remain unchanged, while a more serious bounce should target the monthly highs around 145.50.

In the meantime, extra losses remain on the table while the cross trades below the 200-day SMA.

EUR/JPY daily chart

The US Dollar weakened modestly further yesterday. Nonetheless, economists at MUFG Bank expect the EUR/USD rally to fade as the pair nears the 1.10 mark.

It is difficult to envisage the current divergence in policy expectations being sustained

“It is difficult to envisage the current divergence in policy expectations being sustained if the data from the US remains resilient.”

“The OIS market currently implies 50 bps of hikes by the ECB by September while the market is 80% priced for a 25 bps rate cut from the Fed by then. Without further banking sector turmoil, data flow will dictate the sustainability of that degree of divergence in policy expectations and based on the consumer confidence data there is a greater risk of that divergence closing which could see EUR/USD again run out of steam as we move toward the 1.1000 level.”

EUR/CZK erased gains of the past two days yesterday. A break below 23.58/23.53 would open up 23.35, then 23.00/22.88, analysts at Société Générale report.

Initial resistance seen at 23.85

“Lower band of this range at 23.58/23.53 which is also the 76.4% retracement of recent bounce is important support. If the pair fails to defend this, resumption in downtrend is not ruled out. In such a scenario, next potential objectives are likely to be at the low formed earlier this month near 23.35 and 23.00/22.88.”