- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 16-03-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | House Price Index (QoQ) | Quarter IV | 2.4% | 3.9% |

| 00:30 | Australia | RBA Meeting's Minutes | |||

| 04:30 | Japan | Industrial Production (MoM) | January | 1.2% | 0.8% |

| 04:30 | Japan | Industrial Production (YoY) | January | -3.1% | -2.5% |

| 06:45 | Switzerland | SECO Economic Forecasts | |||

| 09:30 | United Kingdom | Average earnings ex bonuses, 3 m/y | January | 3.2% | 3.2% |

| 09:30 | United Kingdom | Average Earnings, 3m/y | January | 2.9% | 3% |

| 09:30 | United Kingdom | ILO Unemployment Rate | January | 3.8% | 3.8% |

| 09:30 | United Kingdom | Claimant count | February | 5.5 | 21.4 |

| 10:00 | Eurozone | Construction Output, y/y | January | -3.7% | |

| 10:00 | Eurozone | ZEW Economic Sentiment | March | 10.4 | |

| 10:00 | Germany | ZEW Survey - Economic Sentiment | March | 8.7 | -29 |

| 12:30 | Canada | Foreign Securities Purchases | January | -9.57 | |

| 12:30 | Canada | Manufacturing Shipments (MoM) | January | -0.7% | -0.5% |

| 12:30 | U.S. | Retail sales | February | 0.3% | 0.2% |

| 12:30 | U.S. | Retail Sales YoY | February | 4.4% | |

| 12:30 | U.S. | Retail sales excluding auto | February | 0.3% | 0.2% |

| 13:15 | U.S. | Capacity Utilization | February | 76.8% | 77% |

| 13:15 | U.S. | Industrial Production YoY | February | -0.8% | |

| 13:15 | U.S. | Industrial Production (MoM) | February | -0.3% | 0.4% |

| 14:00 | U.S. | NAHB Housing Market Index | March | 74 | 74 |

| 14:00 | U.S. | JOLTs Job Openings | January | 6.423 | 6.402 |

| 14:00 | U.S. | Business inventories | January | 0.1% | -0.1% |

| 21:45 | New Zealand | Current Account | Quarter IV | -6.351 | -3.509 |

| 23:50 | Japan | Trade Balance Total, bln | February | -1312.6 | 917.2 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | House Price Index (QoQ) | Quarter IV | 2.4% | 3.9% |

| 00:30 | Australia | RBA Meeting's Minutes | |||

| 04:30 | Japan | Industrial Production (MoM) | January | 1.2% | 0.8% |

| 04:30 | Japan | Industrial Production (YoY) | January | -3.1% | -2.5% |

| 06:45 | Switzerland | SECO Economic Forecasts | |||

| 09:30 | United Kingdom | Average earnings ex bonuses, 3 m/y | January | 3.2% | 3.2% |

| 09:30 | United Kingdom | Average Earnings, 3m/y | January | 2.9% | 3% |

| 09:30 | United Kingdom | ILO Unemployment Rate | January | 3.8% | 3.8% |

| 09:30 | United Kingdom | Claimant count | February | 5.5 | 21.4 |

| 10:00 | Eurozone | Construction Output, y/y | January | -3.7% | |

| 10:00 | Eurozone | ZEW Economic Sentiment | March | 10.4 | |

| 10:00 | Germany | ZEW Survey - Economic Sentiment | March | 8.7 | -29 |

| 12:30 | Canada | Foreign Securities Purchases | January | -9.57 | |

| 12:30 | Canada | Manufacturing Shipments (MoM) | January | -0.7% | -0.5% |

| 12:30 | U.S. | Retail sales | February | 0.3% | 0.2% |

| 12:30 | U.S. | Retail Sales YoY | February | 4.4% | |

| 12:30 | U.S. | Retail sales excluding auto | February | 0.3% | 0.2% |

| 13:15 | U.S. | Capacity Utilization | February | 76.8% | 77% |

| 13:15 | U.S. | Industrial Production YoY | February | -0.8% | |

| 13:15 | U.S. | Industrial Production (MoM) | February | -0.3% | 0.4% |

| 14:00 | U.S. | NAHB Housing Market Index | March | 74 | 74 |

| 14:00 | U.S. | JOLTs Job Openings | January | 6.423 | 6.402 |

| 14:00 | U.S. | Business inventories | January | 0.1% | -0.1% |

| 21:45 | New Zealand | Current Account | Quarter IV | -6.351 | -3.509 |

| 23:50 | Japan | Trade Balance Total, bln | February | -1312.6 | 917.2 |

- Says U.S. going into a "challenging" period for the economy

- Payroll tax cut will provide a lot of tax flow and liquidity

- Financial assistance for airlines is key part of discussions

- Rumors about 14-day shutdown for country are not accurate

- Green lanes/fast lanes giving priority to essential transport to keep mobility sector going and ensure economic continuity

Two sources told Reuters that Europe is looking to ban foreign nationals from coming into the Schengen zone in attempt to contain the spread of coronavirus.

The Schengen zone consists of 22 of the 27 EU states, as well as Iceland, Norway, Switzerland and Lichtenstein.

According to the sources, the matter is expected to be discussed by the EU leaders during a video conference on Tuesday on the health crisis.

FXStreet reports that strategists at TD Securities inform that the world is closed; mounting travel restrictions and border closures continue to deliver a direct and immediate hit to energy demand.

“Crude demand could very well fall in the realm of -500k bpd in y/y terms, with some in the market even anticipating as much as 10m bpd of lost demand through Q2.”

“To make things worse, increased supply from Saudi, Russia and the UAE remain on the cards amid a price war for the foreseeable future.”

“The combination of both the demand and supply shock suggest massive surpluses, swelling inventories and increasingly depressed prices are on the horizon.”

“We do not expect any material moves as funds are already positioned extremely short in the complex and elevated volatility will continue to constrain position sizing.”

FXStreet reports that analysts at Rabobank continue to see scope for the U.S. Dollar to strengthen against a broad base of currencies.

“On a 5-day view, the USD has outperformed almost all global currencies. There is no alternative to the USD as a transactional currency and it is our expectation that as long as stresses in the money market persist the USD is set to remain firm.”

“The DXY dollar index has bounced sharply from its recent sell-off. However, we would argue that the DXY index gives a very skewed view of the dollar’s performance given the high weighting of the EUR (57.6%).”

“Until there is evidence that the number of coronavirus cases has peaked, we expect the USD to remain well bid.”

- Overall, 44,105 people have been tested in UK

NFXStreet reports that economists at TD Securities apprise that gold positioning continues to be liquidated aggressively as rebalancing and margin calls prompt funds to sell the yellow metal, seeing prices post their largest weekly decline since 1983.

“The current gold market selloff is similar to what happened during the financial crisis, when prices dropped for a period of over three months along with collapsing equity valuations, as increased volatility and margin calls forced levered investors to sell to provide liquidity.”

“While the uncertainty surrounding the virus is likely to keep volatility and liquidation risks high, the pending historic low real/nominal interest rates, liquidity injections, quantitative easing and income support programs should reduce volatility and drive capital into gold once again when the dust settles.”

- Fed is ahead of issues, nobody has to pull money out of banks

- There will be a surge of demand for stocks once coronavirus threat abates

- Trump administration aims to ensure businesses have liquidity

U.S. stock-index futures fell on Monday, as the Fed's latest aggressive series of monetary policy easing moves heightened investors' fears of the U.S. economy tipping into a coronavirus-driven recession.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 17,002.04 | -429.01 | -2.46% |

| Hang Seng | 23,063.57 | -969.34 | -4.03% |

| Shanghai | 2,789.25 | -98.17 | -3.40% |

| S&P/ASX | 5,002.00 | -537.30 | -9.70% |

| FTSE | 4,962.87 | -403.24 | -7.51% |

| CAC | 3,650.25 | -468.11 | -11.37% |

| DAX | 8,327.25 | -904.83 | -9.80% |

| Crude oil | $29.06 | | -8.41 |

| Gold | $1,464.00 | | -3.47% |

FXStreet notes that the European countries are strengthening their efforts to fight COVID-19. Measures ranging from quarantine and business closures to working from home and self-isolation will hit GDP, which has been revised by analysts at ANZ Research.

“If it is assumed that restrictions will last for four weeks and activity will then take time to normalise, it is feasible to estimate that euro area GDP could fall by 2.5% in 2020.”

“Our GDP profile involves a precipitous decline in late Q1 and Q2 before a gradual normalisation in activity in the second half of the year.”

“Our current estimate of the downside risks imply the economy should contract by 2.5% in 2020. A reasonable rule of thumb is that for every week the EU economy operates at 50% of normal engagement levels, GDP will fall by 0.5%.”

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 129.3 | -12.38(-8.74%) | 13585 |

| ALCOA INC. | AA | 6.99 | -1.01(-12.63%) | 308874 |

| ALTRIA GROUP INC. | MO | 36.7 | -3.37(-8.41%) | 49844 |

| Amazon.com Inc., NASDAQ | AMZN | 1,633.00 | -152.00(-8.52%) | 129050 |

| American Express Co | AXP | 85.74 | -13.86(-13.92%) | 31269 |

| AMERICAN INTERNATIONAL GROUP | AIG | 24.28 | -4.22(-14.81%) | 8945 |

| Apple Inc. | AAPL | 239.1 | -38.87(-13.98%) | 1431917 |

| AT&T Inc | T | 31.11 | -3.36(-9.75%) | 209820 |

| Boeing Co | BA | 147 | -23.20(-13.63%) | 239045 |

| Caterpillar Inc | CAT | 89.99 | -9.65(-9.68%) | 24339 |

| Chevron Corp | CVX | 73.3 | -10.12(-12.13%) | 29040 |

| Cisco Systems Inc | CSCO | 33.55 | -4.09(-10.87%) | 88001 |

| Citigroup Inc., NYSE | C | 41.26 | -9.78(-19.16%) | 209252 |

| Deere & Company, NYSE | DE | 120.07 | -18.89(-13.59%) | 4248 |

| E. I. du Pont de Nemours and Co | DD | 33 | -4.10(-11.05%) | 7735 |

| Exxon Mobil Corp | XOM | 33.9 | -4.22(-11.07%) | 336528 |

| Facebook, Inc. | FB | 154.37 | -15.91(-9.34%) | 252818 |

| FedEx Corporation, NYSE | FDX | 93 | -13.63(-12.78%) | 15507 |

| Ford Motor Co. | F | 4.96 | -0.67(-11.90%) | 671506 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 6.41 | -1.12(-14.87%) | 140522 |

| General Electric Co | GE | 6.9 | -0.95(-12.10%) | 744796 |

| General Motors Company, NYSE | GM | 21.5 | -3.21(-12.99%) | 66780 |

| Goldman Sachs | GS | 149.6 | -27.57(-15.56%) | 65022 |

| Google Inc. | GOOG | 1,100.00 | -119.73(-9.82%) | 40485 |

| Hewlett-Packard Co. | HPQ | 15.5 | -1.68(-9.78%) | 20837 |

| Home Depot Inc | HD | 183.99 | -21.68(-10.54%) | 45649 |

| HONEYWELL INTERNATIONAL INC. | HON | 136.31 | -13.10(-8.77%) | 1266 |

| Intel Corp | INTC | 48.45 | -5.98(-10.99%) | 156642 |

| International Business Machines Co... | IBM | 96 | -11.95(-11.07%) | 42363 |

| International Paper Company | IP | 30 | -3.44(-10.29%) | 2170 |

| Johnson & Johnson | JNJ | 123.76 | -10.53(-7.84%) | 29225 |

| JPMorgan Chase and Co | JPM | 86.94 | -16.97(-16.33%) | 248224 |

| McDonald's Corp | MCD | 157.16 | -19.97(-11.27%) | 22890 |

| Merck & Co Inc | MRK | 70.39 | -6.36(-8.29%) | 17399 |

| Microsoft Corp | MSFT | 140.03 | -18.80(-11.84%) | 853724 |

| Nike | NKE | 67 | -8.58(-11.35%) | 51687 |

| Pfizer Inc | PFE | 29.97 | -2.74(-8.38%) | 84003 |

| Procter & Gamble Co | PG | 102.75 | -11.32(-9.92%) | 19871 |

| Starbucks Corporation, NASDAQ | SBUX | 60.5 | -9.42(-13.47%) | 85613 |

| Tesla Motors, Inc., NASDAQ | TSLA | 462.61 | -84.01(-15.37%) | 554302 |

| The Coca-Cola Co | KO | 42.5 | -5.97(-12.32%) | 91852 |

| Travelers Companies Inc | TRV | 98.86 | -8.59(-7.99%) | 2165 |

| Twitter, Inc., NYSE | TWTR | 26.01 | -3.28(-11.20%) | 162041 |

| United Technologies Corp | UTX | 93.67 | -11.73(-11.13%) | 8447 |

| UnitedHealth Group Inc | UNH | 245.02 | -27.02(-9.93%) | 14352 |

| Verizon Communications Inc | VZ | 50.1 | -4.07(-7.51%) | 96263 |

| Visa | V | 151.57 | -24.26(-13.80%) | 69605 |

| Wal-Mart Stores Inc | WMT | 105.95 | -8.15(-7.14%) | 32464 |

| Walt Disney Co | DIS | 91.94 | -10.58(-10.32%) | 241228 |

| Yandex N.V., NASDAQ | YNDX | 30.68 | -3.26(-9.61%) | 21166 |

Exxon Mobil (XOM) downgraded to Underperform from Sector Perform at RBC Capital Mkts; target lowered to $40

Altria (MO) upgraded to Overweight from Equal-Weight at Morgan Stanley; target $49

Caterpillar (CAT) upgraded to Buy from Hold at Stifel; target lowered to $137

The report from the New York Federal Reserve showed on Monday that manufacturing activity in the New York region contracted in March.

According to the survey, NY Fed Empire State manufacturing index came in at -21.5 this month compared to an unrevised 12.9 in February, pointing to a decline in business activity in New York State. That was the lowest reading since 2009.

Economists had expected the index to come in at 4.4

Anything below zero signals contraction.

According to the report, the new orders index dropped 31.4 points to -9.3, pointing to a contraction in orders, and the shipments index decreased 20.6 points to -1.7 indicating that shipments were little changed. Meanwhile, delivery times lengthened slightly (at 2.2 in March, down 6.1 points from February), and inventories increased (at 5.8, down 7.1 points). Elsewhere, the index for number of employees fell 8.1 points to -1.5, indicating that employment levels were little changed over the month. On the price front, prices paid index edged down 0.5 points to 24.5, suggesting that input prices rose at the same pace as last month, while the prices received index fell 6.6 points to 10.1, pointing to a deceleration in selling price expansion.

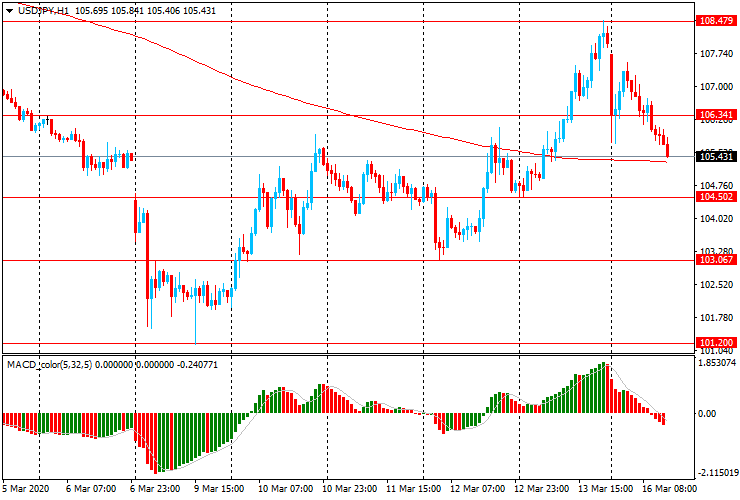

Today, the USD/JPY pair is trading mainly with a decline, returning most of the positions gained on Friday. The pair fell to Y105. 50 after rising on Friday to Y108. 30. The pair is trying to break through the moving average level of MA (200) H1 (Y105. 30), but on the four-hour chart it is trading below MA (200) H4 (Y108. 60).

⦁ Resistance levels are at: Y106.35, Y108.50, Y110.50

⦁ Support levels are at: Y104.50, Y103.05, Y101.20

The publication of analysis is a marketing communication and does not constitute recommendation, investment advice or research by TeleTrade. Analysis is not prepared in accordance with legal requirements promoting independent investment research. It is intended solely for informational and educational purposes and shall not be understood as an offer or solicitation to buy or sell financial instruments. Indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

FXStreet reports that according to Louis Boisset from BNP Paribas, the ECB has taken action and seems ready to play a greater role if needed to defend the Eurozone economy during this crisis.

“The central bank lowered its projections, notably for 2020, with eurozone GDP growth now expected to 0.8%, down from its previous forecast of 1.1% in December 2019.”

“President Lagarde insisted that the ECB would use all of the flexibility available through its securities purchasing programme.”

“Christine Lagarde has called on the eurozone member states to act in a co-ordinated and ambitious manner.”

“Avoiding an economic recession will rely on public policy interventions and fiscal policy actions in particular.”

- As virus spreads, case for coordinated and synchronized global fiscal stimulus is becoming stronger by hour

- Additional stimulus will be necessary to prevent long-lasting economic damage

- Has received interest from about 20 more countries for ongoing loan programs, in addition to 40 existing programs

- Central bank swap lines to emerging markets may be needed

- FX interventions and capital flow management measures can usefully complement other monetary policy actions

- Banks should use capital and liquidity buffers

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 11:00 | Germany | Bundesbank Monthly Report |

USD traded lower against most major currencies in the European session on Monday, but its initial decline, triggered by the U.S. Federal Reserve's unexpected decision on Sunday to cut interest rates to 0%-0.25% (the lowest level since 2015) and launch a massive $700 billion quantitative easing program (QE), was tempered somewhat.

The U.S. dollar index (DXY), measuring the value of USD relative to a basket of foreign currencies, dropped 1.02% to 97.75.

The latest Fed’s action came after it announced another emergency rate cut earlier this month. Rate cuts typically weigh on the currencies by making investments in them less attractive.

Meanwhile, JPY and CHF, which are seen as safer havens, strengthened as traders sought safety amid lingering worries the coronavirus will slow economic growth.

FXStreet notes that the COVID-19 crisis is a ‘black swan event’. It is a global shock, which was deemed improbable, yet it will cause massive consequences. Thomas Harr, PhD, Global Head of FI&C Research at Danske Bank predicts a recession.

“I now believe that we are facing a recession in the Western world.”

“The policy response should involve (a) policies to contain the virus, (b) targeted fiscal, monetary and regulatory measures to support companies and people facing liquidity shortages, supply chain disruptions and tightening credit constraints, and (c) measures to support aggregate demand. This week, policy makers ramped up their response particularly with respect to a) and b), but less so with respect to c).”

“The ECB will have to play an important role as crisis manager, in particular with respect to Italy. Moreover, I am doubtful that Lagarde will be able to convince politicians to obtain the appropriate fiscal response.”

“The expected slowdown in new people infected by COVID-19 during spring suggests that the recession in Europe and the US will be relatively short-lived, but uncertainty is obviously extraordinarily high.”

FXStreet reports that Lee Sue Ann, Economist at UOB Group, reviewed the recent decision by the RBNZ to cut the cash rate by 75bps to 0.25%.

“In an emergency move early today (16 March), the Reserve Bank of New Zealand (RBNZ) slashed the Official Cash Rate (OCR) from 1.00% to 0.25%. In its accompanying press release, the RBNZ stated that the OCR will “remain at this level for at least the next 12 months”, adding that should further stimulus be required, it would “turn to quantitative easing (QE) for the first time in New Zealand history by undertaking large-scale purchases of government bonds”.

“The RBNZ has identified that it would rather inject money into the market by buying government bonds than to implement any further cuts to the cash rate from here, noting that at 0.25%, the OCR is currently the “lower limit, given the operational readiness of the financial system for very low or negative interest rates”. It will also focus on maintaining liquidity in the market, and encouraging the banks to keep lending, by delaying the start of new capital requirements for 12 months to July 2021.”

“The RBNZ’s comments about QE are the strongest yet about how it can still stimulate the economy when interest rates are at or nearly zero. Since the RBNZ has said it was not contemplating negative interest rates at this point, we foresee the OCR to remain at the current level of 0.25% for some time.”

“The RBNZ, whose policy committee met on Sunday (15 March), was also briefed by the Treasury Secretary on the government’s intended fiscal policy measures. PM Jacinda Ardern and Finance Minister Grant Robertson are expected to signal a fiscal package worth more than $12bn later today, with details due tomorrow.”

- Move by central banks is strong signal of coordination

- We will see what effect of swap lines will be in coming days

- Very keen to ensure long-term economic damage from coronavirus is minimised

FXStreet reports that european countries are strengthening their efforts to fight COVID-19. Measures ranging from quarantine and business closures to working from home and self-isolation will hit GDP, which has been revised by analysts at ANZ Research.

"If it is assumed that restrictions will last for four weeks and activity will then take time to normalise, it is feasible to estimate that euro area GDP could fall by 2.5% in 2020."

"Our GDP profile involves a precipitous decline in late Q1 and Q2 before a gradual normalisation in activity in the second half of the year."

"Our current estimate of the downside risks imply the economy should contract by 2.5% in 2020. A reasonable rule of thumb is that for every week the EU economy operates at 50% of normal engagement levels, GDP will fall by 0.5%."

CNBC reports that roughly 5 million people in China lost their jobs amid the outbreak of the new coronavirus in the first two months of this year, data published Monday indicate.

China's official, but highly doubted, urban unemployment rate jumped to its highest on record in February at 6.2%, the National Bureau of Statistics said. That's up from 5.3% in January and 5.2% in December.

As of the end of last year, 442.47 million people were employed in urban areas, government data show, indicating that at least 4.67 million people have since lost their jobs, based on official figures.

China's unemployment data have been among the most highly doubted, even after the country changed its methodology from worker claims to a survey in 2018 in an effort to capture more of the job losses. The urban unemployment rate has hovered near 4% to 5% for the last 20 years.

That makes a jump to 6.2% particularly notable. Mao Shengyong, a spokesperson for the National Bureau of Statistics, emphasized during a press conference Monday that the unemployment rate will likely fall in the second half of the year as businesses resume work.

FXStreet reports that surveys ahead of today's data anticipated declines in the key measures but failed to predict the extent of the plunges in industrial production, investment and retail sales, Gerard Burg from National Australia Bank reports.

"China's industrial production plunged in the first two months of the year - down by 13.5% YoY."

"China's fixed asset investment contracted sharply in the first two months of 2020 - down by 24.5% YoY."

"China recorded a trade deficit in the first two months of 2020, as exports plunged amid the extended Coronavirus shutdown. The deficit totalled US$7.1 billion, compared with a surplus of US$46.8 billion in December 2019."

"China's retail sales fell rapidly in the first two months of 2020 - down by 20.5% YoY."

"We revised down our forecast for China's annual growth to 4.8% in 2020 (previously 5.4%). The resumption of normal activity should provide a boost to annual growth in 2021 - forecast at 6.1% (up from 5.8% previously)."

FXStreet reports that gold's safe haven status failed to materialise as the precious metal recorded its worst week since 1983 as prices collapsed after reaching a seven year high of just above USD1,700/oz, strategists at ANZ Research report.

"The selling was driven by a need to raise cash and cover losses in other markets, namely equities. A stronger USD over the past week also weighed on investor appetite."

"We still expect significant upside in prices. Our gold valuation model suggests current spot prices are undervalued.

"With interest rates being cut by many central banks and Treasury yields collapsing, we see gold prices hitting USD1,900/oz in the medium term."

FXStreet reports that USD/CHF spent last week bouncing from the 0.9188 2018 low. Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, reviews the technical outlook for the pair.

"We are unable to rule out a deeper 0.9600/0.9703 corrective rebound prior to another leg lower."

"The previous January low of 0.9613 should now act as a formidable resistance and we ideally look for the market to fail here."

"Below 0.9188 on a closing basis will target the 0.9072 May 2015 low and the 0.8838 the 38.2% retracement of the move from 2015."

FXStreet reports that last night, the Fed slashed rates to zero, restarted QE and introduced a number of funding facilities. Analysts at Nordea expect the Fed to stay on hold for the remainder of 2020.

"The Fed announced that the target range for the federal funds rate is lowered by 100 bp to 0-0.25%. Not since 1982 has the Fed cut rates by 100 bp."

"The Fed will buy at least USD 500 bn of Treasury securities and at least USD 200 bn of agency mortgage-backed securities."

"The decision was not unanimous as the known hawk Mester only wanted a 50 bp cut."

"We do not expect rates to go into negative as the reluctance towards this within the FOMC appears too high. We expect the target range for the federal funds rate to stay at 0-0.25% for the remainder of 2020."

-

economic upturn in Q1 not expected anymore due to coronavirus

-

German economy could stabilise in Q3 if supply chains are intact again

Prime Minister Boris Johnson's senior adviser Dominic Cummings told Reuters that Britain will make further announcements on Monday about the measures it is taking to tackle coronavirus.

"The government will be making further announcements today," Dominic Cummings said when asked about the UK response to the outbreak. When asked why the UK government had not implemented the stringent measures taken by other European governments, he declined to comment.

FXStreet reports that head of Research at UOB Group Suan Teck Kin reviewed the recent policy measure by the PBoC.

"The latest reserve requirement ratio (RRR) is targeted at supporting small and medium enterprises (SMEs) which are lagging in work resumption compared to larger companies. This comes as no surprise because it was flagged at the State Council meeting just days earlier."

"In terms of liquidity injection, the amount released so far in 2020 is on par with the two rounds of RRR reductions in 2019 which were in response to the impact from the US-China trade tensions."

"With the COVID-19 outbreak continuing to flare up outside of mainland China and with negative consequences on the demand side, we see scope for PBoC to take on another one to two rounds of RRR cut in the next 3-6 months, along with the gradual decline in its benchmark 1Y loan prime rate (LPR)."

CNBC reports that it's "totally understandable" why U.S. stock futures plunged after the Federal Reserve's latest moves to counter the economic hit from the coronavirus outbreak, said Anthony Scaramucci, a hedge fund investor who briefly served as President Donald Trump's White House communications chief.

"The reason why markets are selling off right now is we have a ton of information about the virus, but a very, very little amount of understanding," Scaramucci, founder and co-managing partner of Skybridge Capital, told CNBC.

"So, what's happening right now (is) we're starting to price in the reduction in earnings for 2020 and the possibility now of a recession," he added.

The Fed's moves on Sunday, which include slashing interest rates to zero, were aimed at countering some of the outbreak's impact on the U.S. economy.

Still, Scaramucci said there's more than a 90% chance that the U.S. economy could contract by between 4% and 6% in the second quarter this year. It's also "very, very likely" the same could happen in the third quarter, he added. "That's why you're seeing a flood out of stocks right now," he said.

FXStreet reports that RBA today announces liquidity measures to support markets and foreshadows further policy measures to be announced on Thursday, Bill Evans from Westpac Institutional Bank briefs.

"The RBA Governor's Statement noted that the Reserve Bank 'stands ready to purchase Australian government bonds in the secondary market'."

"The Statement indicated that the action was aimed at supporting the smooth functioning of the bond market."

"This action in the bond market is not the Quantitative Easing policy which we have been anticipating will be adopted when the overnight cash rate reaches 0.25%."

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 02:00 | China | Retail Sales y/y | 8% | 0.8% | -20.5% | |

| 02:00 | China | Industrial Production y/y | 6.9% | 1.5% | -13.5% | |

| 02:00 | China | Fixed Asset Investment | 5.4% | 2.8% | -24.5% | |

| 07:30 | Switzerland | Producer & Import Prices, y/y | February | -1% | -2.1% |

During today's Asian trading, the US dollar fell against the major world currencies after the decision of the US Federal reserve to urgently lower the rate.

The Fed on Monday night urgently lowered its benchmark interest rate to zero and announced the launch of a large-scale quantitative easing program to stabilize financial markets and support the us economy.

The Fed lowered the interest rate on federal loans by 1% to 0-0. 25%, announcing plans for additional purchases of government bonds worth $500 billion and mortgage-backed securities worth $ 200 billion, as well as additional measures to provide liquidity to commercial banks. The fed called on banks to increase lending from existing reserves.

The Fed said it is ready to use "the full range of tools available to it to support the availability of credit for households and businesses."

The Bank of Japan, following the Fed, announced an increase in stimulus measures in response to the pandemic. The Bank of Japan did not change the key parameters of monetary policy. The interest rate on deposits of commercial banks remained at the level of -0.1% per annum, the target yield of ten-year government bonds of Japan-about zero (+/-0.2 percentage points).

The Bank of Japan has doubled its exchange - traded index Fund (EFT) buyback program to 12 trillion yen ($112 billion), and announced its intention to adjust its corporate bond buyback program.

The ICE Dollar index, which shows the value of the us dollar against six major world currencies, fell by 0.60% compared to the previous day.

CNBC reports that the U.S. Fed latest moves - which include cutting interest rates to zero - deserve applause, even though the American economy could still head into a recession given the uncertainty around the coronavirus outbreak, a former Fed official said.

"I think recessionary conditions are definitely a risk and we're dealing with so much uncertainty now on how this virus situation unfolds and what the economic impact turns out to be, nobody really knows," Dennis Lockhart, Atlanta Fed president from 2007 to 2017, told CNBC on Monday.

"I think we should applaud the Fed for, in a way, getting as much ahead of the curve as they can," he added.

Lockhart said the Fed has now "spent all their bullets from an interest-rate cut point of view." It remains to be seen whether that'll leave the central bank with less options to support the U.S. economy in the future, he added.

-

CNBC reports that Italy's health ministry said a total of 1,809 people have died as of 6 p.m. local time on March 15; the death toll jumped from the 1,441 fatalities reported a day earlier.

-

The U.S. Centers for Disease Control and Prevention said that it is urging organizers to cancel or postpone in-person events with 50 people or more in attendance throughout the United States.

-

China's National Health Commission said another 14 people have died, all of them in Hubei province where the infection was first detected.

-

Global cases: At least 153,648, according to the latest figures from the World Health Organization

-

Global deaths: At least 5,746, according to the latest figures from the WHO

Stock market futures hit "limit down" levels of 5% lower, a move made by the CME futures exchange to reduce panic in markets. No prices can trade below that threshold, only at higher prices than that down 5% limit.

-

Increases annual pace of ETF purchases to ¥12 trillion (previously ¥6 trillion)

-

10-year JGB yields target maintained at about 0%

-

Introduces new lending program to smooth funding for firms

-

Strengthens stance on asset purchases

-

To purchase more commercial paper, corporate bonds

-

BOJ says will take additional easing measures as needed

-

May increase or cut ETF goal depending on situation

-

Economic activity likely to remain weak for the time being

-

Somewhat weak indicators of inflation expectations have been seen recently

-

Need to watch for the impact of oil price drop

-

Watching the coronavirus impact very closely

EUR/USD

Resistance levels (open interest**, contracts)

$1.1287 (3199)

$1.1257 (2055)

$1.1232 (2025)

Price at time of writing this review: $1.1122

Support levels (open interest**, contracts):

$1.1038 (2071)

$1.1017 (1572)

$1.0992 (1726)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date April, 3 is 79892 contracts (according to data from March, 13) with the maximum number of contracts with strike price $1,1000 (5198);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3008 (969)

$1.2912 (258)

$1.2820 (181)

Price at time of writing this review: $1.2333

Support levels (open interest**, contracts):

$1.2265 (664)

$1.2249 (783)

$1.2210 (368)

Comments:

- Overall open interest on the CALL options with the expiration date April, 3 is 17540 contracts, with the maximum number of contracts with strike price $1,3200 (2564);

- Overall open interest on the PUT options with the expiration date April, 3 is 19876 contracts, with the maximum number of contracts with strike price $1,2900 (2847);

- The ratio of PUT/CALL was 1.13 versus 1.13 from the previous trading day according to data from March, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 35.17 | 9.7 |

| WTI | 33.68 | 9.1 |

| Silver | 14.67 | -7.09 |

| Gold | 1529.371 | -3.08 |

| Palladium | 1789.24 | -2.39 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -1128.58 | 17431.05 | -6.08 |

| Hang Seng | -276.16 | 24032.91 | -1.14 |

| KOSPI | -62.89 | 1771.44 | -3.43 |

| ASX 200 | 234.7 | 5539.3 | 4.42 |

| FTSE 100 | 128.63 | 5366.11 | 2.46 |

| DAX | 70.95 | 9232.08 | 0.77 |

| CAC 40 | 74.1 | 4118.36 | 1.83 |

| Dow Jones | 1985 | 23185.62 | 9.36 |

| S&P 500 | 230.38 | 2711.02 | 9.29 |

| NASDAQ Composite | 673.08 | 7874.88 | 9.35 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.61759 | -2 |

| EURJPY | 119.899 | 2.45 |

| EURUSD | 1.1101 | -0.59 |

| GBPJPY | 132.732 | 0.68 |

| GBPUSD | 1.2289 | -2.27 |

| NZDUSD | 0.60626 | -0.99 |

| USDCAD | 1.38023 | -0.78 |

| USDCHF | 0.95117 | 0.71 |

| USDJPY | 107.986 | 3.02 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.