- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 16-05-2022

- The 50% mean-reversion target comes in near 103.70.

- Bears can aim for a deeper test towards the golden 61.8% ratio near 103.37.

The bulls are out of town at the start of the week and the price is moving towards a 38.2% Fibonacci retracement of the daily bullish impulse after hitting a 20-year peak last week. The following illustrates the potential for lower.

DXY prior analysis

DXY live update and outlook

From the 4-hour perspective, the price drifted lower as forecasted into the first level of support near 104.20. With commitment from the bears, any upside correction will be met by supply and potentially lead to a deeper correction on the daily chart as follows:

The 50% mean-reversion target comes in near 103.70 while the golden 61.8% ratio is located at the bottom of the wicks around 103.37.

- AUD/USD dribbles inside 20-pip range, pausing a two-day rebound from mid-2020 lows.

- Yields, stock futures dwindle amid an absence of major macros.

- Softer US data, Fedspeak enabled buyers to ignore downbeat signals from China.

- RBA Meeting Minutes will be observed for rate hike clues, US Retail Sales for April, covid updates important too.

AUD/USD remains sidelined as buyers await the key catalysts after a two-day rebound from multi-month lows. That said, the Aussie pair seesaws between 0.6965 and 0.6985 during the initial Asian session as traders brace for the Reserve Bank of Australia’s (RBA) Monetary Policy Meeting Minutes, as well as the US Retail Sales for April.

After a dull start to the week, the AUD/USD pair managed to cheer the US dollar weakness by extending the previous week’s corrective pullback near a two-year low.

Recently weighing on the quote could be Australia’s weekly ANZ Roy Morgan Consumer Confidence dropped to 89.3 from 90.5.

Also challenging the pair’s upside momentum are covid woes and downbeat data from the biggest customer China. On Monday, China reported downbeat figures for April month’s Retail Sales and Industrial Production, backed by conveying fresh fears over the coronavirus resurgence. That said, Shanghai City Official’s comments and weekend updates from Beijing were the major catalysts to renewing COVID-19 fears. While Shanghai City Official initially mentioned that the city's epidemic is under control, he also stated, “However the risks of rebound remain and we need to continue to stick to controls,” which in turn drowned the market’s risk appetite.

On the flip side, the US Dollar’s pullback could be linked to a fall in the NY Empire State Manufacturing Index for May, expected +15.5 versus -11.6 actual, as well as comments from New York Fed President John Williams. Fed’s Williams backed Chairman Jerome Powell’s 50 basis points (bps) rate hike idea by highlighting inflation as the main issue. It should be noted that the news suggesting the US extend covid public health emergency beyond July also allowed the US dollar to pare some gains. That said, the US Dollar Index (DXY) eased further from its 20-year top, printed a two-day downtrend as sellers approach 104.00 by the end of Monday’s North American session.

Against this backdrop, Wall Street benchmarks closed mixed and the US 10-year Treasury yields dropped to 2.88%, down 3.6 bps. Further, the S&P 500 Futures remain directionless by the press time.

Moving on, the Minutes of the RBA’s latest meeting will be crucial amid indecision over the size of the next rate hike by the Aussie central bank. Following that, the US Retail Sales for April, expected at 0.7% versus 0.5% prior, will also be important to watch for fresh impulses. Additionally, headlines concerning China’s covid conditions and the Russia-Ukraine crisis are also useful for determining short-term AUD/USD moves.

Technical analysis

AUD/USD bulls attack January 2022 bottom surrounding 0.6965-70 to dominate further. However, lows marked during late 2021 and earlier in the month, respectively around 0.6995 and 0.7030, will challenge the additional upside.

Alternatively, a downward sloping trend line from August 2020, near 0.6820, challenges the pair’s downside moves.

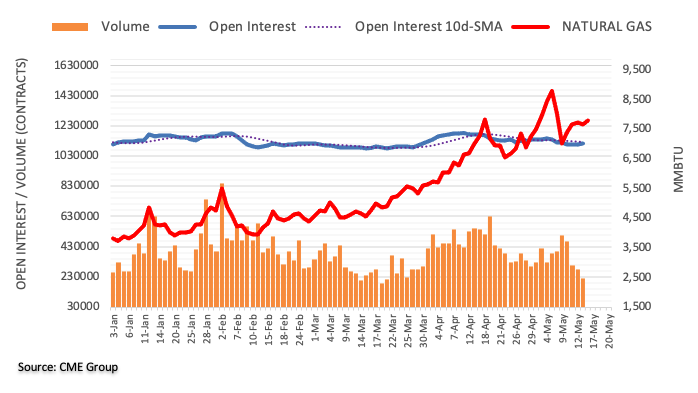

- WTI oil prices remain firmer around seven-week high, extending four-day uptrend.

- Softer USD, fears of EU oil embargo on Russia keep buyers hopeful.

- Headlines from the Middle East, covid fears in China challenge upside momentum.

- US Retail Sales for April, Weekly API inventory figures will be important for near-term directions.

WTI grinds higher around $112.00, after poking the late March tops during the four-day uptrend. That said, the black gold recently takes rounds to $111.80-90 as traders await more clues, which in turn highlights today’s US Retail Sales and API Weekly Crude Oil Stock.

The energy benchmark rose the most in four days the previous day, by refreshing the multi-day high, as the US Dollar Index (DXY) eased further from its 20-year top. That said, the greenback gauge printed a two-day downtrend as sellers approach 104.00 of late.

A fall in the NY Empire State Manufacturing Index for May, expected +15.5 versus -11.6 actual, joined comments from New York Fed President John Williams to weigh on the US dollar. Fed’s Williams backed Chairman Jerome Powell’s 50 basis points (bps) rate hike idea by highlighting inflation as the main issue. It should be noted that the news suggesting the US extend covid public health emergency beyond July also allowed the US dollar to pare some gains.

On the other hand, Saudi Arabia and Iran showed concerns over the latest economic scenario that restricts them to pump more oil into the markets. Also, China’s downbeat Retail Sales and Industrial Production for April joined fears of more days to overcome the covid resurgence to weigh on the commodity prices.

Alternatively, the European Union (EU) remains on the way to announcing major sanctions on Russian oil imports, which in turn could favor the WTI bulls. However, Hungary, the Czech Republic and Slovakia try to pull back the verdict but are likely to fail.

Moving on, the US Retail Sales for April, expected at 0.7% versus 0.5% prior, will precede the private oil inventory data from the American Petroleum Institute (API), prior 1.618M, to direct short-term WTI. Should the scheduled data suggests more draw and further weakness into the USD, the oil prices may have further upside room to track.

Technical analysis

A daily closing beyond an upward sloping trend line from late March, around $111.00 by the press time, enables WTI bulls to aim for the March 24 swing high surrounding $115.85-90.

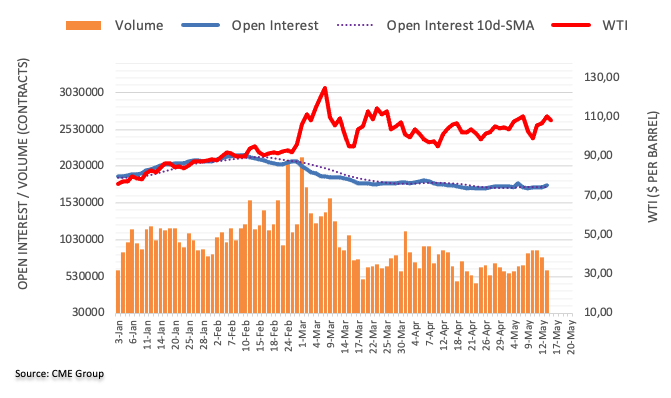

- Gold price has moved above $1,820 as DXY weakens on fewer economic events.

- The Fed is expected to feature two more jumbo rate hikes in CY2022.

- A bullish range shift in the RSI (14) has strengthened the gold bulls.

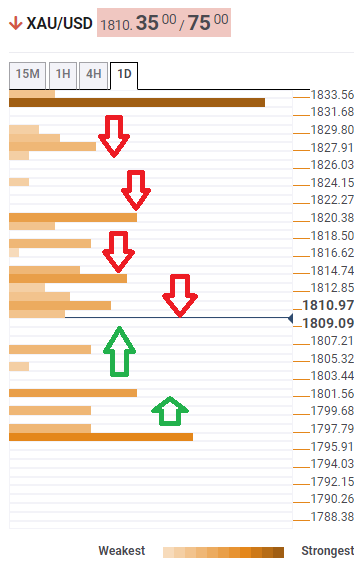

Gold price (XAU/USD) is establishing itself above $1,820.00 after finding an intense responsive buying action below the psychological support of $1,800.00 on Friday. It looks like the firmer rebound in the precious metal has turned the table in the favor of bulls. The bright metal is eyeing an initiative buying interest for a further upside move amid weakness in the US dollar index (DXY).

The DXY has witnessed a steep fall after failing to sustain at fresh 19-year highs of 105.00 last week. A follow-up correction in the DXY after a juggernaut rally has improved the demand for the yellow metal. The recent fall in the DXY could be the result of fully discounted two more jumbo interest rate hikes by the Federal Reserve (Fed) this year. The Fed announced a rate hike by 50 basis points (bps) in May’s first week and the interview of Fed chair Jerome Powell with the Marketplace national radio program has bolstered the odds of two more jumbo rate hikes consecutively.

US Retail Sales

In today’s session, the release of the US Retail Sales will hog the limelight. A preliminary estimate for the monthly US Retail Sales is 0.7% against the prior print of 0.5%. Higher Retail Sales will indicate the confidence of consumers in the economy and eventually, it will strengthen the DXY and weaken the gold prices.

Gold technical analysis

On an hourly scale, a firmer responsive buying action in the gold prices below the psychological support of $1,800.00 has strengthened the asset. The precious metal is trading near the trendline placed from May’s high at $1,909.83. A bullish range shift has been witnessed from the momentum oscillator, Relative Strength Index (RSI) (14). The oscillator has shifted into the 60.00-80.00 range, which signals a firmer upside move ahead. The RSI (14) faced multiple failures while overstepping 60.00. Also, the gold prices have established above the 20-period Exponential Moving Average (EMA) at $1,816.50, which adds to the upside filters.

Gold hourly chart

-637883406244797847.png)

US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, probe the US Dollar bulls as the figure drops back towards the lowest level in 11 weeks, flashed on Thursday.

That said, the latest print of the US inflation expectations appears 2.68% by the end of Monday’s North American session.

Amid the sustained fall in US Treasury yields, in contrast to the market’s inflation fears, the US dollar also fails to extend the north-run in the last few days. That said, the US Dollar Index (DXY) eased for the second consecutive day by the end of Monday’s trading, stepping back from the 20-year high marked on Thursday.

This makes today’s US Retail Sales for April, expected at 0.7% versus 0.5% prior, important to watch for near-term trade directions.

Read: Further pressure on central banks

- The Australian dollar rose vs. the yen, despite a risk-aversion environment.

- On Tuesday, Asian equity futures point to a higher open, boosting the prospects of risk-sensitive currencies.

- AUD/JPY Price Forecast: Monday’s candlestick left a large bottom wick, meaning that bulls lifted prices but remain downward pressured unless a daily close above 91.00 is achieved.

The AUD/JPY marches firmly for the second consecutive day but remained below the April 27 swing low of 90.43, amidst a downbeat market mood that faltered to push AUD/JPY prices lower, despite JPY strength. At 90.02, the AUD/JPY is above the 90.00 mark, and the pair is trapped between the 50 and 100-day moving averages (DMAs) at 91.05 and 86.89, respectively.

Sentiment-wise, Asian equity futures point to a higher open, contrarily to New York’s mood, despite investors’ concerns about the Federal Reserve’s pace of tightening monetary policy and China’s economic slowdown, as Industrial Production and Retail Sales shrank, reflecting the impact of covid-19 zero-tolerance restrictions.

During the overnight session, the AUD/JPY opened at around 89.50, daily highs, followed by a dip towards 88.50, as risk-aversion took its toll on risk-sensitive currencies like the AUD, the NZD, and the CAD. However, late in the overlap of the European/North American session, sentiment improved, and boosted the prospects of the Australian dollar, as the Japanese yen, finished as the laggard in the FX space.

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY is neutral-upward biased once the cross-currency pair broke below the 50-DMA to the downside. Now that the pair sits nearby the 100-DMA, that could open the door for further upside price action, as witnessed by Monday’s candlestick, with a large bottom-wick, meaning that AUD/JPY bulls leaned ahead of the 100-DMA around 88.29 and pushed prices higher.

That said, the AUD/JPY’s first resistance would be the 90.00 barrier. Once cleared, the following resistance would be September 2017 daily high at 90.30, followed by the 50-DMA at 91.05. On the flip side, the AUD/JPY first support would be 89.00. Break below would expose the 88.00 mark, followed by the May 12 daily low at 87.30.

Key Technical Levels

- GBP/JPY pauses two-day recovery moves inside one-month-old bearish channel.

- Bearish MACD signals join recent pullback to suggest further grind to the south.

- 160.30-35 appears a tough nut to crack for bulls, sellers have multiple hurdle to visit.

GBP/JPY fades from a two-day rebound near 159.00 as traders await UK data during Tuesday’s Asian session.

In doing so, the cross-currency pair remains inside a one-month-old descending trend channel formation, recently firmer around the 50% Fibonacci retracement (Fibo.) of December 2021 to April 2022 upside.

It’s worth noting that the GBP/JPY breakout of 50% Fibo enables the quote to aim for further upside. However, bearish MACD signals and a strong resistance to the north comprising the 50-day EMA and upper line of the stated channel, near 160.35-30, could challenge the buyers.

Meanwhile, a clear upside break of the 160.35 won’t hesitate to aim for the monthly high surrounding 163.90.

Alternatively, pullback moves may aim for the 50% and 61.8% Fibonacci retracement levels, respectively near 158.65 and 156.35.

Even so, the 200-day EMA and an upward sloping support line from late 2021, close to 156.00 and 152.70 in that order, will act as the last defenses for buyers.

GBP/JPY: Daily chart

Trend: Further weakness expected

- EUR/USD is facing barricades around 1.0440 as investors need a fresh trigger for a decisive move.

- Eurozone GDP numbers are seen stabled while the US Retail Sales could outperform.

- Investors should brace for two more 50 bps rate hikes by the Fed this year.

The EUR/USD pair is displaying back and forth moves in a tight range of 1.0428-1.0443 after a modest upside move from a low of 1.0354 last week. A minor improvement in the risk appetite of the market participants has supported the shared currency bulls. The risk-sensitive assets have rebounded gradually amid the value buying structure in the FX domain. Risky assets were beaten hard by investors on souring market mood for a tad higher time period.

Some signs of profit-booking in the US dollar index (DXY) amid fewer economic events this week have pushed the DXY to near 104.00. The DXY printed a fresh 19-year high of 105.00 last week o rising expectations of more than two jumbo rate hikes by the Federal Reserve (Fed) this year. Fed chair Jerome Powell in his interview with the Marketplace national radio program on Friday investors should brace for two more jumbo rate hikes consecutively in the next two policy meetings. Also, he emphasized bringing price stability as it is hurting the paychecks of the households.

In today’s session, investors will focus on the release of the US Retail Sales. The economic data is seen at 0.7% against the prior print of 0.5% on monthly basis. While the euro docket will report the Gross Domestic Product (GDP) numbers. The yearly and quarterly figures are expected to remain unchanged at 5% and 0.2% respectively.

- GBP/USD holds onto two-day rebound from multi-month low amid US dollar pullback, mild risk-on.

- UK PM Johnson is set for announcing plans to override parts of Northern Ireland protocol despite EU’s warning.

- BOE’s Bailey raised concerns about inflation, Fed’s Williams backs 50 bps rate hike.

- UK Jobs report, Brexit news eyed for immediate directions, US Retail Sales will be important afterward.

GBP/USD grinds higher past 1.2300, keeping the two-day recovery moves from the lowest levels since mid-2020, as cable traders await the UK’s jobs report, as well as key Brexit updates, for fresh impulse. That said, the quote stays firmer around 1.2330 by the press time of early Tuesday morning in Asia.

The Sterling had all it needed to begin the week’s trading on a negative side, which it did before printing a daily positive. However, a softer USD and broad risk-on mood played it all to help the pair consolidate the latest losses ahead of the key UK data and upbeat surrounding the Northern Ireland Protocol (NIP).

Starting with Brexit, UK PM Boris Johnson is all set to alter part of the NIP by citing it as an “insurance” in case of the European Union’s (EU) failure to respect other terms. Johnson’s move is in contrast to the bloc’s warning of cutting trade and will be observed closely. “Foreign Secretary Liz Truss will give a major statement on Tuesday - after the PM said in Northern Ireland: 'To have the insurance, we need to proceed with a legislative solution,’” said UK Mirror.

On the other hand, Bank of England (BOE) Governor Andrew Bailey testified before the House of Commons Treasury Committee amid allegations that the “Old Lady” stayed soft on inflation. During his speech, BOE’s Bailey revealed his “unhappiness” with inflation and warned of more suffering.

Elsewhere, a fall in the NY Empire State Manufacturing Index for May, expected +15.5 versus -11.6 actual, joined comments from New York Fed President John Williams to weigh on the US dollar. Fed’s Williams backed Chairman Jerome Powell’s 50 basis points (bps) rate hike idea by highlighting inflation as the main issue. It should be noted that the news suggesting the US extend covid public health emergency beyond July also allowed the US dollar to pare some gains.

Amid these plays, Wall Street benchmarks closed mixed and the US 10-year Treasury yields dropped to 2.88%, down 3.6 bps.

Looking forward, the UK’s Claimant Count for April is expected to improve from -46.9K to -38.8K whereas the ILO Unemployment Rate for three months to March may remain unchanged at 3.8%. The Average Earnings, however, could improve while excluding the bonus. Hence, the overall data is likely to help the GBP/USD prices to keep the latest rebound even as the qualitative catalysts are against the same.

Read: UK Jobs Preview: Why GBP/USD may offer an early selling opportunity, and when

Following the UK data, the US Retail Sales for April, expected at 0.7% versus 0.5% prior, will be important to watch amid ongoing concerns over inflation and consumer behavior.

Additionally, central bank speakers, Brexit updates and covid headlines are some other catalysts that can direct short-term GBP/UDS moves.

Technical analysis

GBP/USD recently confirmed a falling wedge bullish chart pattern with a clear break above 1.2300, suggesting further advances towards the monthly high surrounding 1.2640. The recovery moves also gain support from the MACD line’s impending bull cross and nearly oversold RSI.

Alternatively, a downside break of 1.2280 will negate the bullish breakout and can drag the quote back to the latest lows surrounding 1.2155.

- USD/CHF has slipped below 1.0020 ahead of the US Retail Sales.

- A light economic calendar has brought some exhaustion to the DXY’s rally.

- The quarterly Swiss Industrial Production will be the major trigger for the Swiss franc.

The USD/CHF pair has witnessed a minor correction after printing a fresh two-year high of 1.0064 on Monday. A rebound in the risk-on impulse has supported the risk-perceived currencies, which has underpinned the Swiss franc against the greenback.

The US dollar index (DXY) has remained firmer over the past few trading weeks amid expectations of two more 50 basis points (bps) rate hikes by the Federal Reserve (Fed) in its next monetary policy meetings. Now, the unavailability of any major trigger in the US economic calendar has brought some profit-booking to the counter.

The DXY is facing some signs of exhaustion after hitting a 19-year high of 105.00 last week. In today’s session, investors will keep an eye on US Retail Sales. The monthly Retail Sales figure is seen at 0.7% against the prior print of 0.5%. A higher-than-expected figure may support the DXY and renewal of a multi-year high could be seen.

On the Swiss franc front, a prolonged prudent monetary policy by the Swiss National Bank (SNB) to support the aggregate demand will continue to keep the Swiss franc on the sidelines. Inflation levels are rock-bottom, which may not compel SNB policymakers to adopt a hawkish tone. Going forward, the Swiss Statistics will report the quarterly Industrial production data on Friday. Previously, the Swiss agency reported the quarterly Industrial Production at 7.3%.

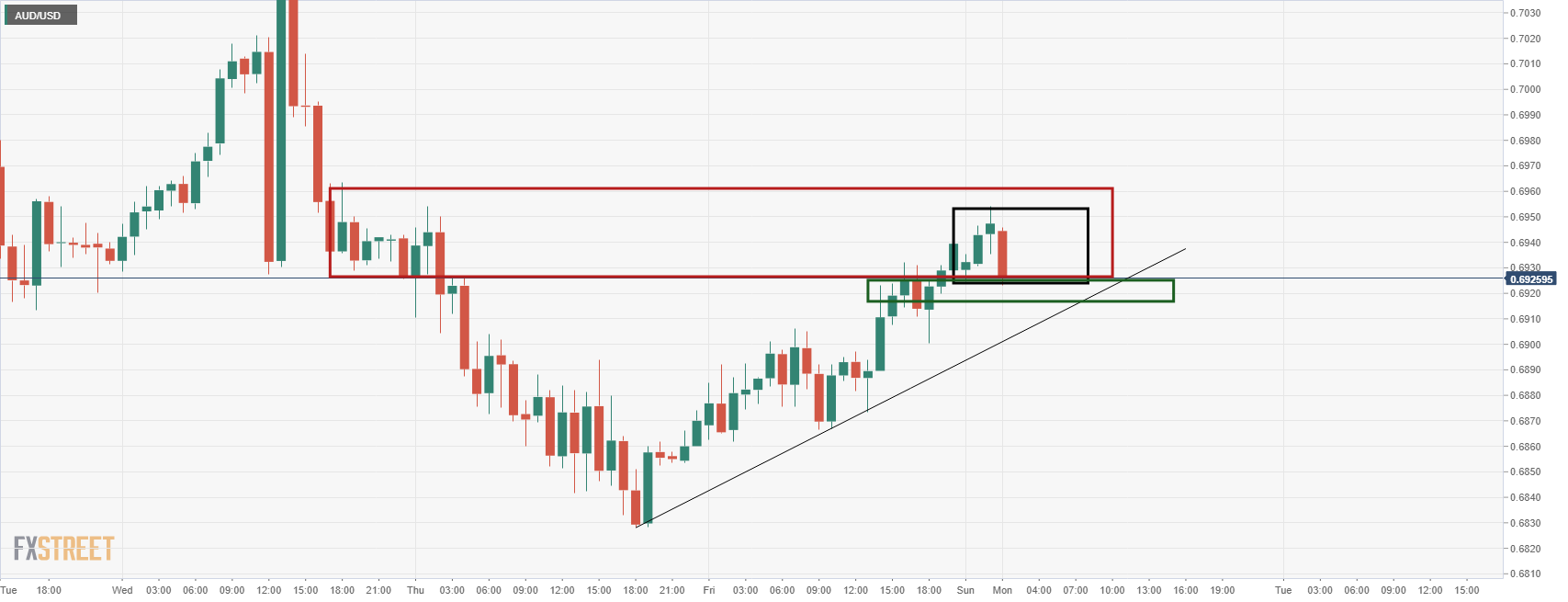

- AUD/USD bulls are moving in on critical daily resistance.

- The bears are lurking for a discount and lower lows ahead in the bearish cycle.

As per the start of the week's pre-open analysis, AUD/USD Price Analysis: Pre-open glance on daily chart eyes prospects for a downside continuation, the price is moving in the direction of the 0.7050 target as follows:

AUD/USD daily charts, prior analysis

AUD/USD, live update

The first objective and the test of 0.6967 28 Jan lows as per the structure illustrated above is underway.

Thereafter, the 0.7050s will still be eyed. If bulls commit at either of these levels, it could be all downhill from thereon:

- The greenback remains trading on the backfoot vs. the Japanese yen amid falling US Treasury yields.

- Risk-aversion, a headwind for the USD/JPY, as US equities finished with losses in the New York session.

- USD/JPY Price Forecast: Remains upward biased, though a dip towards 126.94 first and then 125.10 is on the cards.

The USD/JPY is losing some ground as the Asian Pacific session begins, down some 0.10%, as US Treasury yields could not recover from earlier losses, led by the 10-year benchmark note, down some three basis points, amid a risk-off market mood. At the time of writing, the USD/JPY is trading at 129.02.

US equities fell at the close of NY, and US Treasury yields rebound

Late in the New York session, market sentiment fluctuated, finishing downbeat, as market participants assessed the Federal Reserve monetary policy pace and China’s economic slowdown, courtesy of restrictions re-imposed on the last Covid-19 outbreak. US Treasury yields pare some losses in the long-end of the curve, but in the short and mid-end, dropped.

In the meantime, the US Dollar Index, a gauge of the greenback’s value against a basket of peers, suffered decent losses of 0.25% for the second straight session and sat at 104.206, retreating from multi-month highs around 105.00.

Meanwhile, Fed speaking dominated the headlines in the US docket. John Williams, NY Fed President, said that the US central bank is focused on one issue, named inflation, and added that it is running far too high and stubbornly persistent. He said that 50-bps rate hikes make sense at upcoming meetings and added to the list of central bankers, expressing worries about China’s economic deceleration.

Elsewhere, China’s Industrial Production and Retail Sales contracted, meaning that the zero-tolerance Covid-19 restrictions are already showing on the economic indicators, despite efforts made by the People’s Bank of China (PBoC), which is stimulating the economy but failing to provide the results foreseen by Beijing.

Data-wise, the US economic docket featured the New York Fed Empire State Index, which disappointed expectations of +17.0, and came at -11.6. Ahead in the week, April’s Retail Sales, Industrial Production, Building Permits, and Initial Jobless Claims would offer some fresh impetus to USD/JPY traders regarding the economic conditions of the US.

On the Japanese front, the GDP on its Preliminary reading is expected to grow by 1.1% in Q1, while annualized is foreseen at 5.4%, both readings to be released on Wednesday.

USD/JPY Price Forecast: Technical outlook

Since last Thursday, May 12, the USD/JPY broke below a one-and-a-half month-old upslope trendline, right at the 130.00 mark. As the major was printing higher highs, the Relative Strength Index was printing lower highs, usually called a negative divergence between the price action/oscillator. Nevertheless, the USD/JPY remains upward biased, but a break below 126.94 would expose the March 28 daily high-turned-support at 125.10.

The USD/JPY first support would be the 129.00 mark. Once cleared, the next support would be May 12 daily low at 127.51, followed by April’s 27 daily low at 126.94. On the flip side, and on the path of least resistance of the major, the first resistance would be 130.00, followed by the upslope trendline, passing nearby the 130.70-90 area, and then the YTD high at 131.34.

- USD/CAD is hovering around 1.2850 as investors await US Retail Sales.

- Canada’s CPI is seen unmoved at 6.7% on yearly basis.

- Oil prices have gained sharply on multi-year lowest US SPR.

The USD/CAD pair is oscillating below 1.2850 after a sheer downside fall from a high of 1.3076 published last week. The asset has been shifted into a negative trajectory after the US dollar index (DXY) saw signs of exhaustion on elevated levels.

The DXY entered into a correction phase after hitting a high of 105.00 last week. The asset has eased around 0.75% from its recent high and is expected to remain subdued this week amid a light economic calendar. Although the major event for the DXY will be the release of the US Retail Sales, which are due in the New York session. The monthly Retail Sales are seen at 0.7%, higher than the prior print of 0.5%.

On the oil front, galloping oil prices have underpinned the loonie bulls against the greenback. A four-day winning streak with fresh monthly highs has supported the Canadian dollar. Oil prices have gained sharply as supply worries have been renewed on the falling US Strategic Petroleum Reserves (SPR) and OPEC’s inability to produce the required oil. The US SPR has fallen to 538 million barrels, the lowest since 1987, as per Reuters. Earlier, US President Joe Biden announced the highest release of oil from its US SPR to support the demand catalyst.

Going forward, the loonie bulls will react to the release of Canada’s Consumer Price Index (CPI) on Wednesday. The yearly figure is expected to remain stable at 6.7% while the monthly figure could fall vigorously to 0.7% from the previous print of 1.4%.

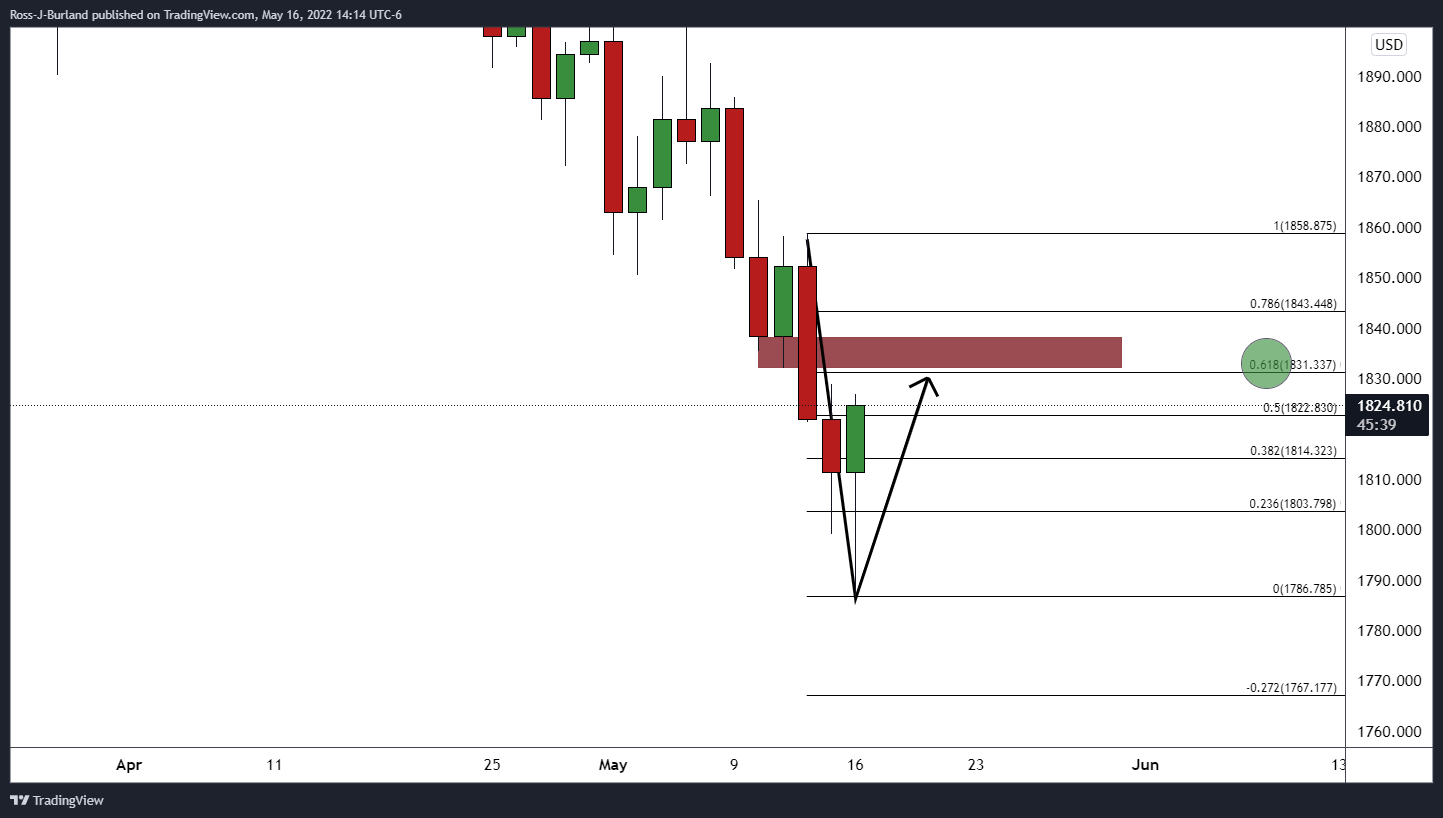

- Gold is correcting firmly on Monday with a softer US dollar as investors take profits.

- The bulls are aiming for a 61.8% golden ratio that aligns with prior support near $1,832.

At $1,825, the gold price is 0.8% higher, climbing from a low of $1,786.78 and reaching a high of $1,826.40. The gold price has been recovering in the face of a softer US dollar after closing out a week that saw its biggest weekly drop in close to a year. Risk assets are desperately seeking some stabilisation after seven consecutive weeks of losses across global shares and exacerbating market concerns over the combination of a global economic slowdown, higher inflation and monetary tightening.

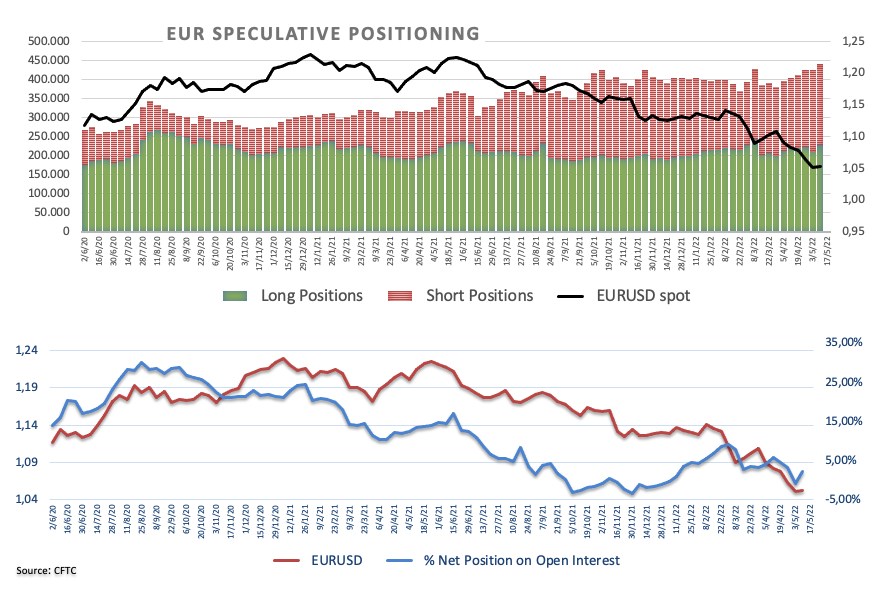

However, the greenback has been consolidating after its recent strength and trading in the dollar may be muted partly as investors move to the sidelines while waiting for key events such as the US Retail Sales and the Federal Reserve Chair Jerome Powell both scheduled for Tuesday. ''With the Fed telegraphing their every move, Fedspeak this week will be increasingly important, particularly as gold positioning is continuously squeezed with bearish sentiment building,'' analysts at TD Securities explained.

Meanwhile, defensive dollar positions have seen Speculators’ net long USD index positions edging up to the highest levels since mid-February. "Haven demand for USDs combined with expectations for progressive Fed rate hikes this year suggests the USD has the potential to remain well supported for some time," analysts at Rabobank argued. Recent data has all but endorsed the prospect of more aggressive tightening by the Fed, and this week's Retail Sales, Industrial Production and housing figures should b are anticipated to show that the US economy remains in a good place.

"We look for retail sales to advance firmly in April (1.5%), continuing with the monthly gains registered so far this year,'' analysts at TD Securities said. ''Spending was likely aided by a strong rebound in auto purchases and an increase in control group sales. We also look for a 1%+ MoM gain in the eating/drinking segment (i.e. bars & restaurants) as consumers continue to transition away from goods spending.''

With regards to gold, the analysts say precious metals sentiment becoming increasingly bearish. ''Even with recent liquidations accounted for, positioning analytics still argue for the potential of additional pain for gold bugs. While position sizing has reverted to more normal levels, the number of traders long the yellow metal remains elevated, while the breadth of traders short has just started to rise from near-record lows.''

''Importantly, CTA trend followers have also joined into the liquidation party, and with prices now below the bull-market-defining uptrend as we expected, a significant liquidation event may now be unfolding as these funds target a large net short position.''

Gold technical analysis

As per the pre-open analysis, Gold, Chart of the Week: Bulls are moving in, but weekly levels are eyed, the bulls have moved in but they are staying in control, exceeding piercing the first level of 4-hour resistance and taking on the next cohort of potential offers:

However, despite the move higher, the W-formation is a reversion pattern, so there could be a revisit to the neckline before a follow through to the upside for the sessions ahead if the support structure holds. In doing so, this will lead to a firm correction of the daily bearish impulse as follows:

The bulls are aiming for a 61.8% golden ratio that aligns with prior support near $1,832.

- NZD/USD bulls are taking control and pushing against a key area of resistance.

- A break of 0.6350 opens risk to a 61.8% ratio that meets the prior support near 0.6430.

At 0.6310, NZD/USD is up some 0.36% towards the close of North American markets after rallying from a low of 0.6228 and reaching a high of 0.6320 on the day. The greenback was lower on Monday after hitting a 20-year peak last week, despite weak economic data from China highlighting worries about the prospects for a global slowdown.

Nevertheless, risk markets remain vulnerable to the broader concerns over deteriorating global growth prospects. The data from China was highly disappointing that initially sent the antipodeans sharply lower. However, a plunge in the US Empire State manufacturing index raised anxiety that economic activity in the US may also be suffering from an abrupt loss in momentum as supply-chain disruption intensifies.

''The profile of the data suggests that supply issues related to the zero-COVID policy in China are the key factor,'' analysts at ANZ Bank argued.

''The Kiwi is higher this morning amid a broad softening of the US dollar. The move seems slightly odd compared to the prevailing mood of recent days, especially given renewed China/global growth concerns, which have been enough to cap bond yields. But commodity prices are up again overnight (led by grains and oil),'' analysts at ANZ bank explained.

''Newswire reports that a local forecaster is calling for three more 50bp OCR hikes have also seemingly helped the NZD along this morning,'' the analysts added. ''While the bounce does align with our medium-term forecasts, it does seem too early to call time on the recent bout of extreme volatility and risk aversion, and we think it pays to be cautious. Indeed, cross-asset correlations remain high, indicating that markets are being driven by risk sentiment, not their own fundamentals.''

NZD/USD technical analysis

The weekly bearish impulse is likely in need of a correction. This could correct as far as the prior support and beyond 0.64 the figure. The build-up of daily resistance is being broken which supports the bullish outlook:

The price is trying to break through the resistance where eyes will be on the 38.2% ratio at 0.6350 that guards a 61.8% ratio where prior support near 0.6430 is eyed.

What you need to take care of on Tuesday, May 17:

The American dollar appreciated at the beginning of the week but ended the day with modest losses against most rivals as stocks markets changed curse. European indexes closed mixed, but Wall Street managed to post gains.

The EUR/USD pair ended the day at around 1.0430, with the bullish potential limited amid persistent tensions with Russia. Ministers from the Union were unable to agree on a Russian oil import embargo, with Hungary, the Czech Republic and Slovakia being the main opponents. Also, the European Commission reviewed its economic growth projections to the downside amid the war in Ukraine, while they now see inflation rising at a faster pace this year and holding above the European Central Bank target through 2023.

GBP/USD is changing hands at around 1.2310. Brexit-related headlines are once again in the spotlight after UK PM Boris Johnson's spokesman noted they want to make significant changes to the Northern Ireland protocol, although clarifying they believe that it is possible within the protocol framework.

Additionally, Bank of England Governor Andrew Bailey testified before the House of Commons Treasury Committee. He said he is not at all happy about the inflation outlook and that it is a bad situation to be in, but added that over 80% of the UK's inflation overshoot is due to energy and tradeable goods. BOE’s member Saunders noted that Brexit might worsen UK inflation.

AUD/USD trades around 0.6960, helped by gold, as the latter trades above $1,820 a troy ounce. The USD/CAD pair plunged to 1.2646 as crude oil prices soared, with WTI now trading at $111.30 a barrel.

Safe-haven currencies posted modest gains against the greenback.

This week, the UK, the EU and Canada will publish inflation data.

Top 3 Price Prediction Bitcoin, Ethereum, XRP: Cryptos to consolidate after weekend rally

Like this article? Help us with some feedback by answering this survey:

- The euro marches decisively towards the neckline of the head-and-shoulders, though it is facing solid resistance around 134.77.

- A positive market mood in the FX space decreased appetite for safe-haven peers.

- EUR/JPY Price Forecast: The head-and-shoulders pattern remains intact, as the exchange rate remains below 135.25.

The shared currency stays defensive vs. the Japanese yen amidst a raft of negative market moods, courtesy of market players’ worries about the Fed tightening monetary policy aggressively, which threatens to slow down the economic recovery in the US. Alongside the aforementioned, China’s coronavirus crisis and the Ukraine war weighed on sentiment, increasing the appetite for safe-haven peers. At 134.72, the EUR/JPY recovered some ground but remained downward pressured, below the head-and-shoulders neckline, a zone that could see some selling pressure, re-entering the market.

Market sentiment in the New York session has improved, as shown by US equities trading in the green. In the FX space, the safe-haven currencies remain downward pressured, a relief for the battered euro, underpinned recently by ECB policymakers expressing that the central bank would hike rates and get to 0% around the summer.

The EUR/JPY opened around the 134.50 area during the overnight session and dipped below the daily pivot point around 133.70s, recording a daily low. Nevertheless, the cross-currency pair bounced off those levels and settled between the central daily pivot and the R1, around 134.70s.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY remains downward pressured and is testing the 50-day moving average (DMA) at 134.79. It’s worth noting that around the 135.00-25 area passes the neckline of a head-and-shoulders pattern targeting 130.00. However, the head-and-shoulders pattern remains intact unless EUR/JPY bulls reclaim the abovementioned area.

If the EUR/JPY is about to test the abovementioned level, the first resistance would be April’s 27 daily low at 134.77. Break above would expose 135.00, followed by the necklines, which pass nearby 135.25.

On the flip side, the EUR/JPY’s first support would be May 12 daily low at 132.65, followed by the 100-DMA at 132.36 and the 200-DMA at 131.05.

Key Technical Levels

- EUR/USD bulls take control and target the M-formation's neckline.

- A 50% mean reversion is on the cards for the sessions ahead.

The US dollar is down slightly on Monday after hitting a 20-year peak last week, which is giving the euro bulls some relief and the price moves higher in a correction of the latest bearish impulse. The following illustrates the price action and market structure from a daily and H4 perspective as the bulls take over control and target key levels to the upside.

EUR/USD daily chart

The price is recovering on the daily chart as illustrated above from the cycle lows and the bulls are moving in on the 38.2% Fibonacci level through 1.0460. A break of there will open risk to the 50% mean reversion target near 1.05 the figure and then the golden ratio, the 61.8% Fibo near 1.0530. The M-formation is a bullish reversion pattern and the neckline meets the targetted area as an additional confluence.

EUR/USD H4 chart

On the 4-hour time frame, the price is ascending in a bullish channel and has been supported by last week's close and prior resistance near 1.0390 and 1.0413.

- The white metal is rallying more than 2% in the day amidst falling US Treasury yields.

- Sentiment has improved in the session, a headwind for the greenback.

- Silver Price Forecast (XAG/USD): Bears take a breather and gather around $22.00, expecting to defend that resistance level.

Silver spot (XAG/USD) held its ground for the last two trading days and advances firmly in the North American session, almost 2% up, and is closing at around the $21.50 mark, boosted by falling US Treasury yields. At the time of writing, XAG/USD is surging sharply and is trading at $21.53.

Silver is soaring as US Treasury yields fall; Fed Chair Powell to speak on Tuesday

Meanwhile, US Treasury yields remain pressured, led by the 10-year benchmark note sitting at 2.879%, dropping four-and-half basis points, a headwind for the greenback. The US Dollar Index, a gauge of the buck’s value vs. a basket of peers, declines sharply from around daily highs and is at 104.367, down 0.19%.

Late in the New York session, market sentiment shifted positive, despite European stocks finishing with losses. Despite investors’ growing concerns that an aggressive Federal Reserve could cause a recession, US stocks are recording gains during the day. The aforementioned, alongside China’s struggling with Covid-19 lockdowns, threatens to derail the global economic recovery.

Earlier in the New York session, the New York Fed President John Williams expressed that the number one issue for the Fed is inflation, and it is running far too high and stubbornly persistent. Williams stated that 50-bps rate hikes make sense at upcoming meetings

The US economic docket would feature additional Fed speaking led by Fed Chair Jerome Powell on Tuesday. Regarding macroeconomic data, April’s Retail Sales, Industrial Production, Building Permits, and Initial Jobless Claims would shed some light regarding the actual economic status of the United States.

Silver Price Forecast (XAG/USD): Technical outlook

XAG/USD remains downward biased, despite rallying in the last couple of days. The daily moving averages (DMAs) are still above the spot price, meaning that bears are in control unless silver bulls conquer February’s 3 pivot low at around $22.00, which would mean that the trend would shift from bearish to neutral-bearish.

However, the jump from the oversold territory of the Relative Strength Index (RSI) at 35.04 could add some support to the bounce at the YTD lows around $20.45, but unless it breaks the RSI’s trendline drawn at around the 50-midline, XAG/USD remains downward pressured.

That said, XAG/USD’s first support would be $21.00. Break below would expose the YTD low at $20.45. Once cleared, the next support would be July 17, 2020, at a daily low at $18.93.

- A busy schedule ahead and Brexit risks leave the pound in focus.

- Bulls eye the M-formation and the 1.24 figure that guards the 50% mean reversion mark at 1.2450.

At 1.2280, GBP/USD is 0.17% higher in midday New York trade, pulling away from the consolidation between 1.2150 and 1.2250 after travelling from a low of 1.2216 to a high of 1.2296 so far on the day.

The US dollar and global growth have been the main focus at the start of the week with China releasing downbeat April activity data. The disappointments fuelled a bid in the greenback after the Chinese yuan came under pressure and weighed on risk-related currencies, including the pound. However, the greenback has been mixed vs. its G10 rivals in the main.

The US dollar index (DXY) was last down 0.08%, after having briefly crossed the 105 level on Friday, a 20-year peak. Weekly positioning data showed investors built their long dollar bets. Speculators’ net long USD index positions edged up to the highest levels since mid-February. "Haven demand for USDs combined with expectations for progressive Fed rate hikes this year suggests the USD has the potential to remain well supported for some time," analysts at Rabobank explained.

Meanwhile, there will be more key data events for the week that will include April readings for US Retail Sales and Industrial Production on Tuesday, Home Construction on Wednesday and Existing Home Sales on Thursday.

"We look for Retail Sales to advance firmly in April (1.5%), continuing with the monthly gains registered so far this year," analysts at TD Securities argued. "Spending was likely aided by a strong rebound in auto purchases and an increase in control group sales. We also look for a 1%+ MoM gain in the eating/drinking segment (i.e. bars & restaurants) as consumers continue to transition away from goods spending."

Fed speakers are also a theme for this week and markets are looking for more reassurance that the Fed will move cautiously in its fight against inflation rather than act with large rate increases of 75 basis points.

Domestically, the focus will be on Headline Inflation readings and this is set to surge on the increase in the energy price cap and VAT changes in April. "We look for the headline rate to soar to 9.2% YoY and core inflation to come in at 6.4%. The labour market likely remained tight, with the unemployment rate staying put at 3.8% and ex-bonus and headline wage growth coming in at 4.1% and 5.3% 3m/y respectively," analysts at TDS said.

As for positioning, net short GBP positions increased for a tenth consecutive week as concerns about the cost-of-living crisis rise in the UK. The BoE has hiked rates to 1.00% and is signalling that more is to come. However, despite the inflationary risks, MPC members are increasingly concerned about the UK growth outlook. This suggests the potential for a relatively short window for interest rate hikes. The Bank of England's next meeting is scheduled for June 16, when another rate increase of 25 basis points is expected.

Brexit risks

Brexit-related developments may end up generating more downside pressure on the British currency. Boris Johnson is flying to Belfast to try to sort out the consequences of a Brexit deal he signed. The UK is saying it will have to take unilateral action to override part of the Northern Ireland Brexit protocol unless the EU shows the “requisite flexibility”. The EU has said it believes a deal can be done but only through negotiation, so all ears are to the ground as to the progress, or there-lack-of, for the days ahead.

GBP/USD technical analysis

The bears have been in control since breaking 1.3670 back in November 2021. The price is making its way into meeting a prior low of 1.2251 which guards a run to mitigate the imbalance of price between there and the 1.2075 May 18 2020 low:

From a daily perspective, the price is reverting in the M-formation and the 1.24 figure could come under pressure that guards the 50% mean reversion mark at 1.2450 that meets the neckline of the formation.

- Bad China’s economic data paints a gloomy environment for Australia’s largest trading partner, a headwind for the AUD.

- A risk-off mood boosts the prospects of the US dollar.

- AUD/USD Price Forecast: The major could be subject to a mean-reversion move towards 0.7029 before resuming its downtrend.

The Australian dollar records from decent gains, despite weaker than expected Chinese economic data, ahead of the release of the Reserve Bank of Australia’s (RBA) last meeting minutes. In the North American session, the AUD/USD is trading at 0.6945 at the time of writing.

The market sentiment keeps weighing on riskier assets, as witnessed by European and US equities trading mixed. Also, a reflection of China’s Covid-19 zero-tolerance policy is China’s worst than expected economic data, with Industrial Production contracting 2.9% y/y and Retail Sales plummeting 11.1% y/y, paints a cloudy economic outlook for the second-largest economy in the world. That its a headwind for the Aussie dollar, which has its largest trading partner in China.

ING: RBA minutes to hint the size and timing of monetary policy

Regarding the RBA minutes, ING analysts wrote in a note that “the minutes from the Reserve Bank of Australia’s May meeting will be scanned closely for hints about the timing and size of additional monetary tightening. On Wednesday, the long-awaited wage data for 1Q will be released. On Thursday, the employment figures for April will be published, with a chance the jobless rate will fall below 4.0%.”

They added that “some recovery in global equities is surely needed at this point for AUD/USD to climb back above 0.7000, while another risk-off wave could send the pair to the 0.6600-0.6700 area in the near-term.”

Before Wall Street opened, the New York Fed President John Williams said that the number one issue to resolve is inflation, and it is running far too high and stubbornly persistent. He added that 50-bps rate hikes make sense at upcoming meetings.

The US docket would feature additional Fed speaking in the week ahead, led by Chief Jerome Powell on Tuesday. Data-wise, April’s Retail Sales, Industrial Production, Building Permits, and Initial Jobless Claims would shed some light regarding the actual economic status of the United States.

On the Australian side, the AUD/USD traders would take cues from the RBA’s Minutes, alongside Employment data and the Australian Federal Elections.

AUD/USD Price Forecast: Technical outlook

The AUD/USD remains defensive, below the daily moving averages (DMAs). A downslope trendline drawn from April 2022’s highs could give AUD/USD bears a line in the sand to lean on, but the speed of the drop from 0.7600 to 0.6820s suggests that a mean reversion move lies ahead, having May’s 2 daily low at around 0.7029 as a target, before extending its losses.

If that scenario plays out, the AUD/USD first resistance would be 0.7000, followed by May 2 daily low at 0.7029. A break above would expose the downslope trendline around the 0.7100 area.

Failure at the abovementioned would exert downward pressure on the AUD/USD. The first support would be 0.6900. A breach of the latter would expose the YTD low at 0.6828, followed by the 0.6800 mark.

Analysts at Rabobank see the EUR/SEK pair moving back to 10.30 on a three-month view. They warn the forecast is dependent on developments around Russia and the response to Sweden's membership bid to join NATO.

Key Quotes:

“The 25 bps rate hike from the Riksbank at the end of last month had little lasting impact on the value of the SEK vs. the EUR. Having failed to hold below the 200 day sma, EUR/SEK bounced higher into early May, with the SEK only claiming back some ground in recent sessions on the back of stronger than expected Swedish CPI inflation data.”

“Given the risk that the window of opportunity for the ECB to hike rates may prove to be narrow due to recessionary fears in the Eurozone, we see scope for EUR/SEK to adjust moderately lower on a 3 to 6 month below. This view, however, is dependent on whether investor confidence is impacted by developments in the relationship between Russia and Sweden given the latter’s decision to move away from its neutral position.”

“The market will be looking for more clarity from the Riksbank about the outlook for its balance sheet.”

“The Riksbank concluded its bond buying programme last year but is currently still reinvesting proceeds. The next policy meeting is scheduled for June 30. We see EUR/SEK moving back to 10.30 on a 3 month view.”

- The Mexican peso rises for the fifth consecutive day on Monday versus the US dollar.

- USD/MXN’s momentum favors the downside as it approaches the 20.00 area.

- The 20.25 area turns now to resistance.

The USD/MXN continued its decline on Monday and dropped to 20.04, reaching the lowest level since April 5. Bearish signs increased after the pair decreased below the 20-day Simple Moving Average and as Momentum turned further to the downside, under 100. Another negative sign for the pair is the decline under a short-term bearish trendline.

If the decline continues, USD/MXN will likely challenge the 20.00 area. The May low at 19.99 is a strong support and a break lower could clear the way to 19.90, the next support.

Any rebound, while under 20.25, should be seen as corrective. While a recovery above 20.30 would negate the current negative bias. Above the critical resistance await at 20.45. A daily close above would be a positive development for the greenback, exposing 20.70.

USD/MXN daily chart

-637883132745916994.png)

- Gold bull’s lifted the yellow-metal shy of the YTD low at around $1780.

- A wobble sentiment boosts gold prices in tandem with the greenback.

- Gold Price Forecast (XAU/USD): Will remain bearish, below a two-year-old upslope trendline, unless bulls reclaim the previously-mentioned.

Gold spot (XAU/USD) recovers some ground after slipìng below the $1800 mark on Friday, on higher US Treasury yields, which during the session are sliding, thus lifting the prospects of the non-yielding metal. XAU/USD is trading almost flat, around $1811.02 a troy ounce at the time of writing.

Sentiment-wise, the rhetoric of the last couple of weeks remains, with European and US equity bourses split between gainers and losers. The Federal Reserve’s aggressive tightening expectations, China’s Covid-19 lockdowns, and high inflationary pressures spurred by the ongoing war in Ukraine remain on investors’ radar.

Meanwhile, the yellow metal has benefited from lower US Treasury yields, with the 10-year benchmark note down five basis points, sitting at 2.88%, a headwind for the greenback. The US Dollar Index, a measurement of the buck’s value, is gaining 1.26%, sitting at 104.517, but without weighing on gold.

In the mid-North American session, money market futures have priced in a 100% chance of a 50-bps increase by the Fed in the June meeting. Earlier in the day, the New York Fed President John Williams said that the number one issue is inflation, and it is running far too high and stubbornly persistent. Williams stated that 50-bps rate hikes make sense at upcoming meetings and added to the rhetoric of central bank policymakers that China’s struggling with the coronavirus and Ukraine’s war are the significant drivers of market volatility.

Elsewhere, China continues struggling with Covid-19 as its Industrial Production shrank by 2.9, lower than the 0.4 growth expected, its lowest reading since March 2020. Despite the previously-mentioned, a ray of hope shows in the window, as Shanghais is about to gradually begin reopening businesess, including shopping malls and the manufacturing hub. Contrarily Beijing will extend work from home guidance in several districts.

In the week ahead, the US docket would feature Fed Chief Jerome Powell, St. Louis President James Bullard, and Chicago’s Fed President Charles Evans. Data-wise, April’s Retail Sales, Industrial Production, Building Permits, and Initial Jobless Claims would shed some light regarding the actual economic status of the United States.

Gold Price Forecast (XAU/USD): Technical outlook

Interestingly, the Gold Price jumped near the YTD low at around $1786 and is forming a “gravestone doji,” which is perceived as a signal of “indecision.” Also, it’s worth noting that an almost-two-year-old upslope trendline, previous support, has been broken. Unless gold bulls reclaim the aforementioned, XAU/USD is vulnerable to further downward pressure.

If XAU/USD’s bulls reclaim the upslope trendline, they will find resistance levels around the 200-DMA at $1837, followed by May 3 cycle low at $1850, and then the $1890 barrier.

On the flip side, XAU/USD’s first support would be $1800. Break below would expose May 16 daily low at $1786, followed by the YTD low at $1780 and then December’s 15 cycle low at $1752.35.

- NZD/USD flat on Monday, holds onto Friday’s gains.

- US stocks slide, stay away from recent lows.

- US data: unexpected contraction in the Empire Manufacturing.

The NZD/USD climbed to 0.6295 during the American session reaching the highest level since Thursday. The pair is rising as dollar’s strength takes a pause and amid lower US yields.

The Dow Jones is falling 0.27% but still holds to most of Friday’s rally. Volatility eased and commodity prices are rising at the beginning of the week. The US Dollar Index is flat for the day hovering around 104.50. The context offers support to the NZD/USD, however is not enough for pushing it above 0.6300.

Economic data released on Monday showed an unexpected decline in the US Empire Manufacturing Index. The numbers weigh modestly on the US Dollar. The key economic report of the week, the April’s Retail Sales is due on Tuesday.

Downtrend intact, consolidating in the very short-term

Last week, the NZD/USD bottomed at 0.6205, the lowest level in almost two years and then started a recovery that weakened near 0.6300. In the short-term, the pair is seen consolidating in a range between 0.6260 and 0.6295; and below 0.6260/0.6225 range.

The bearish trend remains intact. To open the doors to further losses the dollar needs to break under 0.6200. On the upside, a confirmed recovery above 0.6300 should point to more gains.

Technical levels

BoE Governor Andrew Bailey on Monday said that food prices are a major worry for the UK and developing world, reported Reuters.

Speaking alongside Bailey at a House of Commons Treasury Committee, BoE's Michael Saunders said that inflation would still be well above the bank's target this year even if the BoE had tightened policy sooner, a sentiment with which BoE Deputy Governor Ramsden agreed.

Bailey earlier said that he is not at all happy about the inflation outlook and that it is a bad situation to be in.

- EUR/USD has fallen back to near 1.0400 after comments from ECB’s Villeroy gave it a boost earlier in the day.

- Risks remain tilted to the downside amid Fed/ECB monetary policy divergence, as well as a diverging Eurozone/US economic outlook.

The euro got a short-lived boost from comments from the head of the French central bank head Francois Villeroy de Galhau during early European trade, with Villeroy noting the bank will be carefully monitoring developments in the FX rate, which has been a significant driver of imported inflation. A euro that is too weak would go against the ECB’s objective of price stability, Villeroy added, in comments that suggest the recent euro downside is increasing concern at the ECB.

But a broadly downbeat tone to risk appetite and weakness in the yuan in wake of the latest downbeat Chinese Industrial Production and Retail Sales data for April which kept global growth concerns in focus have capped any rally. EUR/USD nearly hit 1.0440 but has since fallen back to around 1.0410, where it is back to trading flat on the day as FX markets turn their attention to upcoming risk events later in the week.

US Retail Sales data will be released on Tuesday prior to the US open and then Fed Chair Jerome Powell will be speaking later on in the day. He is expected to reiterate his recently espoused stance, and the stance also being unanimously espoused by other Fed policymakers including NY Fed President John Williams on Monday, that inflation is unacceptably high and, as a result, interest rates need to be lifted “expeditiously” towards neutral.

Even as the ECB turns more hawkish (Villeroy said June’s meeting would be “decisive”, teeing up hikes for July), traders remain reluctant to buy into EUR/USD rallies with the Fed still substantially more hawkish by comparison. Divergence in economic outlook between the Eurozone and US is another factor weighing on the pair’s long-term prospects, with the impact of the yet to be agreed upon EU ban on Russian oil imports on the bloc’s economy still not known. Many strategists are still calling for EUR/USD to hit parity in the weeks/months ahead.

Bank of England Governor Andrew Bailey said in a testimony before the House of Commons Treasury Committee said he is not at all happy about the inflation outlook and that it is a bad situation to be in, reported Reuters. However, Bailey added, over 80% of the UK's inflation overshoot is due to energy and tradeable goods.

It is accepted practice to accommodate supply shocks when they are transient and focus on second-round effects, Bailey added, adding that he does not reasonably think that they could have done anything differently on monetary policy. Bailey highlighted the weakness in the latest Chinese activity data when discussing shocks to the global economy.

It is not out of place to describe the impact on demand patterns in the UK as "transient", unlike in the US. Bailey noted that the scale and persistence of the fall in the UK labour force is very unusual.

- EUR/USD adds to Friday’s gains beyond 1.0400.

- Bulls could push the pair to the 1.0640 area.

EUR/USD’s rebound gathers further traction north of the 1.0400 mark on Monday.

Considering the pair’s ongoing price action and oversold condition (as per the daily RSI), it seems to be extra room for the continuation of the rebound in the very near term at least. Against that, the next hurdle emerges at the weekly high at 1.0641 (May 5). In light of the underlying bearish view of the pair, further upside should be deemed as selling opportunities.

Below the 3-month line around 1.0900, the pair is expected to remain under pressure and vulnerable to extra losses.

EUR/USD daily chart

- DXY comes under further selling pressure and revisits 104.30.

- Next on the downside comes the post-FOMC low around 102.30.

DXY extends the corrective decline, as the dollar exits the overbought territory at the beginning of the week.

Against that, further retracements remain well on the cards and initially target the minor support at 103.37 (low May 11). The breach of this area could force the index to drop further and visit 102.35 (May 5 low), where decent contention is expected to emerge.

The current bullish stance in the index remains supported by the 8-month line around 97.15, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 96.34.

DXY daily chart

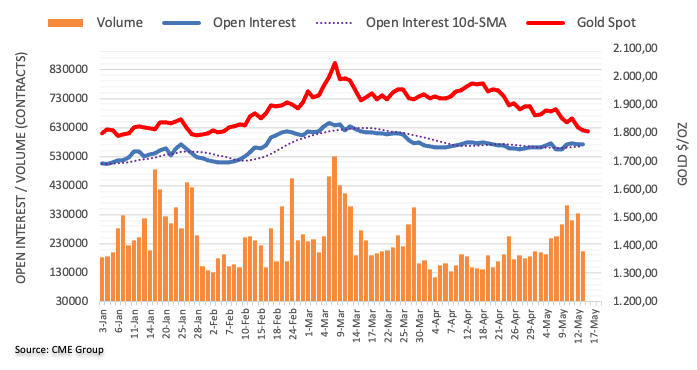

- Oil is supported at the start of the week near multi-week highs with the EU’s Russia oil embargo expected soon.

- WTI has been trading in the $110 region, but unable to breakout towards late-March highs in the $116s.

- Worries about a weakening Chinese economy in wake of soft economic data seem to be holding things back for now.

Oil prices have seen a choppy start to the week though remain reasonably well supported. Front-month WTI futures prices hit their highest levels since late March in the upper $111s, but have since eased back to around the $110 mark, where they trade broadly flat on the day. The Foreign Ministers from both Germany and Austria were on the wires on Monday saying they expect the EU to agree on a deal on the proposed embargo of Russian oil imports later this week, despite ongoing Hungarian resistance.

This seems to have negated the negative impact on prices from weaker than expected April Chinese Industrial Production and Retail Sales data released over the weekend. The data highlights a drastic, ongoing slowdown in the economy there as a result of strict lockdowns to contain Covid-19, which analysts said now impact 46 cities and as much as 40% of China’s GDP.

The lockdowns have had a chilling impact on oil demand in China. Data released by China’s National Bureau of Statistics on Monday alongside the aforementioned Industrial Production and Retail Sales figures showed that refineries in China processed crude oil at the slowest rate in two years in April. So-called refinery “throughput” fell to 12.61M barrels per day (BPD) from 13.8M BPD in March and 14.09M BPD in April 2021.

So while crude oil prices remain well supported on Monday, the focus on economic/oil demand weakness in China has likely prevented WTI from mustering a bullish breakout. However, local press in China is reporting that the situation in Shanghai is improving (though not yet in Beijing). If this narrative gets further traction this week alongside an agreed EU ban on Russian oil, a push towards late March highs in the $116s is on the cards.

- USD/CHF regained positive traction on Monday and shot to a fresh two-year high.

- A softer risk tone underpinned the safe-haven CHF and capped amid weaker USD.

- Sliding US bond yields, disappointing US macro data exerted pressure on the buck.

The USD/CHF pair retreated a few pips from a two-year peak touched during the early North American session and was last seen trading around the 1.0050 area, still up nearly 0.20% for the day.

Following Friday's brief pause, the USD/CHF pair attracted fresh buying on the first day of a new week and is now looking to build on its upward trajectory witnessed over the past one-and-half months or so. That said, a combination of factors held back bulls from placing aggressive bets and kept a lid on any meaningful upside for spot prices.

Investors remain worried that a more aggressive move by major central banks to constrain inflation could hit global economic growth amid the war in Ukraine and China's zero-COVID-19 policy. The concerns were further fueled by weaker Chinese macro data, which weighed on investors' sentiment and extended some support to the safe-haven Swiss franc.

Conversely, the US dollar was pressured by a softer tone around the US Treasury bond yields. This was seen as another factor that acted as a headwind for the USD/CHF pair. The USD remained on the defensive following the disappointing release of the Empire State Manufacturing Index, which indicated worsening conditions and unexpectedly plunged to -11.6 in May.

That said, expectations that the Fed will tighten its monetary policy at a faster pace to curb soaring inflation should help limit losses for the buck and lend support to the USD/CHF pair. The fundamental backdrop favours bullish traders, suggesting that any meaningful pullback might be seen as a buying opportunity and remain limited, at least for now.

The market focus now shifts to the release of the US Retail Sales figures on Tuesday. Investors will also scrutinize remarks by several FOMC officials, including Fed Chair Jerome Powell, for clues about the possibility of a 75 bps rate hike. This would influence the USD price dynamics and determine the next leg of a directional move for the USD/CHF pair.

Technical levels to watch

Gold has fallen briefly back below $1,800 again on Monday. Economists at TD Securities highlight that XAU/USD is set to succumb to bearish sentiment across the precious metals market.

Potential of additional pain for gold bugs

“Speculative length and ETF positions continue to be sold off in gold with precious metals sentiment becoming increasingly bearish.”

“Even with recent liquidations accounted for, positioning analytics still argue for the potential of additional pain for gold bugs.”

“With the Fed telegraphing their every move, Fedspeak this week will be increasingly important, particularly as positioning is continuously squeezed with bearish sentiment building. In turn, we continue to expect substantial selling flow to weigh on the yellow metal at a time when liquidity is scarce.”

NY Fed President and influential FOMC member John Williams said on Monday that demand in the US economy far exceeds supply and that the Fed's monetary policy can bring it back in line with supply, report Reuters.

Additional Remarks:

"We're seeing inflation in a broad set of goods."

"Without price stability, you're not going to achieve the growth and employment opportunities you would otherwise."

"We are starting to see some impact of inflation on spending behavior."

"The MBS cap of $35 bln is a 'big number'."

"I do not expect to hit the MBS cap each month."

"Right now we're not focused on the possible sale of MBS, but it is an option we could consider in the future."

"MBS sales in the future might be an option to bring the balance sheet more closely to long-run goal of mostly treasuries."

"The balance sheet reduction itself will occur over the next few years."

"The balance sheet will still be larger than it was 10 years ago."

"The best position to be is to own primarily treasuries and we're not anywhere near that."

"Buying both MBS and treasuries have had a stronger effect on overall financial conditions than buying just treasuries."

"Buying MBS has proven to be a powerful tool."

"We've indicated clearly that our primary tool is the federal funds rate."

"We'd need to understand what the effects of MBS sales would be and consider market functioning carefully."

"MBS have a lot of desirable features and there is historically strong demand for those."

"The housing market now is the product of a 'unique' set of circumstances."

"We are not seeing a lot of risk-taking by mortgage lenders."

"We're seeing high rents as well as high home prices."

"We need more housing supply to meet the demand."

"We are seeing increases in rents that we had not seen before."

"Right now we have an enormous number of job openings."

USD/CAD holds little changed on the day after negative close Friday. Economists at Scotiabank note that the pair needs to drop below 1.2890 to develop more downside momentum.

A top may be developing

“The USD closed well off the week’s high last week and the pattern on the weekly chart suggests a top may be developing (via a weekly ‘shooting star’ signal).”

“Intraday chart patterns are supportive of a top developing for the USD but spot needs to crack 1.2890 today/tomorrow to develop more downside momentum. That could put funds on track for a test of the low/mid-1.27s.”

GBP/USD is little changed on the day. Nonetheless, the pair traded positively Friday for a bullish close. Economists at Scotiabank are closely watching a push towards 1.24 which would be a more obviously bullish technical development.

Key support is 1.2155

“There’s little obviously positive for the GBP on the intraday chart, with gains struggling to break above 1.2250/75. But a step back to the daily chart shows a rather surprising bullish close (key reversal day) Friday which suggests one of the G10 weaklings may be finding a base after all.”

“It’s tentative at this point but worth monitoring for a push on towards 1.24+ which would be a more obviously bullish technical development.”

“Key support is 1.2155.”

Economists at Credit Suisse believe this first phase of JPY weakness has now come to a temporary end. Therefore, USD/JPY is expected to break support at 126.95 to mark a top for a fall to support next at 125.10.

A temporary phase of JPY strength

“With 10yr US bond yields rejecting major support at 3.21/3.26%, we look for 131.25/132.20 to cap for now for a correction/consolidation phase.”

“Support is seen at 126.95, beneath which should see a fall back to price support at 125.10. With the 23.6% retracement of the 2021/2022 rally seen not far below at 124.56 and with the strongly rising 55-day average also seen not far below here, we then look for a floor in this 125.10/124.56 zone. We would then look for a consolidation phase to develop ahead of an eventual move back to 132.20.”

USD/CAD declined sharply on Friday. Nevertheless, analysts at Credit Suisse stay bullish and expect 1.2895/92 to hold to avoid deeper weakness.

Break above 1.3076 is needed to reinforce the medium-term upside

“Whilst a weekly close above the 200-week moving average and the recent high at 1.3040/76 is needed to confirm a medium-term turn higher, we remain with our bullish stance on the back of the rising moving averages and with weekly MACD momentum turning higher.”

“Above 1.3040/76 would confirm the breakout and see next resistance at 1.3091/3100, with a move above here seeing scope to reach 1.3172, ahead of a potential challenge of the 50% retracement of the 2020/21 downtrend at 1.3334 in due course.”

“Near-term support remains at last week’s low at 1.2895/92, which ideally holds to prevent a more severe weakness.”

“Whilst a close below 1.2895/92 would likely shift the short-term risk lower again, only below the 55-day moving average and May low at 1.2716/2698 would negate our medium-term upside bias.”

Swedish PM Magdalena Andersson announced on Monday that the Swedish government has formally decided that it will apply for NATO membership, reported Reuters. Accession to full membership should not take more than a year, she noted.

Sweden's decision to formally apply for NATO membership was expected and comes after Finland also announced its intentions to join the defensive alliance. Russian President Vladimir Putin earlier on Monday warned that Russia would react to any military expansion in Sweden or Finland and said NATO expansion was a problem.

EUR/USD remains heavy just above 1.04. Economists at BBH expect the pair to break below the January 2017 low near 1.0340 and move towards parity.

ECB tightening expectations remain subdued

“The end of QE June 9 and liftoff July 21 remain fully priced in. However, the swaps market is now pricing in only 140 bp of tightening over the next 12 months followed by another 45 bp of tightening priced in over the following 12 months that would see the deposit rate peak near 1.35% vs. 1.75% at the start of last week. This repricing clearly reflects the worsening economic outlook and is likely to continue weighing on the euro.”

“We continue to target the January 2017 low near 1.0340. If that level breaks, we have to start talking about parity and below.”

- EUR/JPY adds to Friday’s advance and retakes the 135.00 yardstick.

- Further upside needs to clear the 138.30 region in the near term.

EUR/JPY extends the recovery further and manages to revisit the area just above 135.00 the figure on Monday.

If the recovery picks up extra pace, then the cross could see the downside mitigated on a close above the May peak at 138.31 (May 9). Surpassing the latter should put a potential visit to the 2022 high at 140.00 (April 21) back on the radar.

In the meantime, while above the 200-day SMA at 131.05, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

NY Fed President and influential FOMC member John Williams said on Monday that inflation remains the number one issue given that it is running far too high and persistently so, reported Reuters. The Fed's goal is to get the economy back into balance, he continued, adding that it's a challenging task, but that the Fed is committed to doing it.

Williams added that events in China and the war in Ukraine are major drivers of recent market volatility but noted that the Fed is not seeing signs of dysfunction in the US treasury market. Indeed, plans to reduce the size of the balance sheet are having an impact on longer-term interest rates, he added, noting that we have already seen a tightening of financial conditions akin to that seen in 1994.

Nonetheless, we need to get real interest rates back to zero, he added, before noting he expects inflation to come down quite a bit next year. Williams' remarks come ahead of commentary from Fed Chair Jerome Powell on Tuesday, which will also be closely scrutinised.

EUR/USD has seen a further sharp fall for a test of the 1.0341 low of 2017. Whilst economists at Credit Suisse look for some near-term consolidation here, the pair is set to break below this mark in due course for a move to parity.

Resistance at 1.0530 to cap on a closing basis

“We continue to look for the 1.0341 low of 2017 to hold at first for some consolidation, but big picture, our base case remains for a move below here to reinforce the bear trend even further, with support then seen next at 1.0217/09 and eventually parity/0.9900, which is also the 78.6% retracement of the 2000/2008 bull trend. Our bias would then be for this to act as a much better floor for a potentially lengthier phase of consolidation. Should weakness directly extend though, we see support next at 0.9609.”

“Near-term resistance moves to 1.0420, above which can ease the immediate downside bias for a recovery back to 1.0471, with the 13-day exponential average at 1.0530 ideally capping on a closing basis further strength.”

- USD/JPY gained some positive traction for the second successive day on Monday.

- The set-up favours bulls and supports prospects for a further appreciating move.

- Sustained weakness below the 128.00 mark is needed to negate the positive bias.

The USD/JPY pair attracted some dip-buying near the 128.70 region on Monday and turned positive for the second straight day. The intraday uptick, however, ran out of steam following the disappointing release of the NY Empire State Manufacturing Index, which tumbled to -11.6 in May.

Nevertheless, the momentum assisted spot prices to build on last week's bounce from the 127.50 region, or support marked by the 38.2% Fibonacci retracement level of the 121.28-131.35 strong move up. The subsequent strength beyond the 23.6% Fibo. and acceptance above the 129.00 mark favours bullish traders.

The positive outlook is reinforced by the emergence of some buying and the fact that oscillators on the daily chart are holding comfortably in bullish territory. That said, it will still be prudent to wait for some follow-through buying before positioning for any further appreciating move.

From current levels, the 129.75-129.80 region now seems to act as immediate resistance. This is closely followed by the 130.00 psychological mark, which if cleared decisively will be seen as a fresh trigger for bullish traders and push the USD/JPY pair back towards the 131.00 mark.

On the flip side, any meaningful pullback now seems to find decent support near the 129.00 mark ahead of the daily low, around the 128.70 region and the 128.20 horizontal zone. Failure to defend the said support levels would make the USD/JPY pair vulnerable to retesting mid-127.00s (38.2% Fibo.).

Some follow-through selling would set the stage for an extension of the recent corrective decline from a two-decade high and drag spot prices further towards the 127.00 mark. The downward trajectory could get extended to the next relevant support near the 126.45 region or the 50% Fibo. level.

USD/JPY 4-hour chart

-637883014976598443.png)

Key levels to watch

- The headline NY Fed Manufacturing Index slumped to -11.60 in May from 24.6 in April, much bigger than the expected drop.

- The subindices were mixed and the US dollar seemed to weaken a tad.

The headline General Business Conditions Index of the NY Fed's Empire State Manufacturing Survey slumped to -11.60 in May from 24.60 in April. That was much larger than the expected drop to 17.00 and marked the largest miss on expectations since April 2020, when the pandemic first struck the US.

Subindices:

- The New Orders Index fell to -8.8 in May from 25.1 in April.

- The Prices Paid Index fell to 73.7 from 86.4.

- The Employment Index rose to 14.0 from 7.3.

- The Six-Month Business Conditions Index rose to 18.0 from 15.2.

Market Reaction

The DXY saw some weakness in wake of the latest NY Fed data, though remains reasonably well supported in the mid-104.00s. The data has resulted in heightened calls that the US might be in/going into a recession.

- Gold fell briefly back below $1800 again on Monday to hit fresh multi-week lows as traders mull upcoming risk events.

- Bears continue to eye a test of annual lows around $1780 against the backdrop of a still buoyant buck.

Spot gold (XAU/USD) prices briefly fell back below the $1800 per troy ounce level on Monday to hit fresh multi-week lows, though have since entered into a consolidation pattern on either side of the big figure. At current levels just above, the precious metal is trading with losses of over 0.5% on Monday, marking a continuation of recent weakness since XAU/USD dipped below its 200-Day Moving Average (in the $1830s) last week.

Earlier in the session, XAU/USD event dipped as low as the $1780s for the first time since early February this year and the bears are eyeing a test of annual lows around the $1780 level. Weak Chinese data for April released over the weekend put fears about global growth back in the spotlight and this seemed to weigh on global risk appetite a tad, though not enough to support the safe-haven precious metal.

Key upcoming risk events this week, which include remarks from NY Fed President and influential FOMC member John Williams later on Monday ahead of the release of the April US Retail Sales report ahead of comments from Fed Chair Jerome Powell on Tuesday, are likely keeping gold traders on the defensive. Fed policymakers have signaled that they are unanimously on board with rapid policy tightening in the coming quarters as the US economy continues to suffer from sky-high inflation.