- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 12-05-2022

- EUR/JPY bulls are moving in following a hard landing on Thursday.

- Risk-off tones have put a bid in the yen and the euro has been pressured.

EUR/JPY was pressured by a strong US dollar and risk-off tones with news relating to tensions between Europe and Russia that escalated again Thursday when Finland said it would apply to join NATO "without delay." Sweden is expected to follow. Russia has said it will be forced to take "retaliatory steps" and this has led to a bid in the yen as the following technical analysis illustrates.

EUR/JPY weekly chart

The weekly chart shows that the price is making its way into a key demand area. The M-formation is a reversion pattern so there are prospects of a bullish correction that could be underway.

EUR/JPY daily chart

As it stands, the 38.2% Fibonacci on the daily chart has a confluence of prior lows and support.

- AUD/USD rebounds from 23-month low as bears take a breather after the biggest daily fall since Monday.

- US Treasury yields, stock futures print mild gains to portray market’s consolidation amid a light calendar and fewer macros.

- Comments from Fed’s Powell, Daly also seemed to have paused the bear run of late.

- RBA’s Bullock eyed for the pace of the next rate hike, US Michigan Consumer Sentiment data will be important too.

AUD/USD bears step back from two-year low as the quote refreshes intraday peak near 0.6875 during an inactive Asian session on Friday.

The Aussie pair’s latest rebound from the multi-month low lacked any major change in the macros. However, improvement in the key risk barometers and optimism ahead of a speech from RBA Assistant Governor (Financial System) Michele Bullock could be cited as favoring the latest run-up in the quote.

That said, the US 10-year Treasury yields also portray a corrective pullback after refreshing a two-week low the previous day, around 2.86% by the press time, whereas the S&P 500 Futures print mild gains while licking its wound near one-year low.

Comments from Fed Chair Jerome Powell and San Francisco Fed President Mary Daly could also be linked to the AUD/USD pair’s latest rebound. Fed’s Powell repeated the expectation that the Fed will raise interest rates by half a percentage point at each of its next two policy meetings. The Fed boss also pledged that if data turn the wrong way "we're prepared to do more." On the same line, Fed’s Daly mentioned, “Is it 50, is it 25, is it 75? Those are things that I’ll deliberate with my colleagues, but my own starting point is we don’t want to go so quickly or so abruptly that we surprise Americans”.

It should be noted that the broad risks concerning inflation, economic growth and China’s covid, not to forget the Ukraine-Russia crisis, remain as is, which in turn challenges the AUD/USD buyers despite the latest rebound.

Also, RBA’s Bullock need not cite the economic fears from China’s lockdowns and rallying inflation to keep the AUD/USD on the road to recovery, failing to do so can renew the multi-day bottom marked the previous day.

Following that, the preliminary readings of US Michigan Consumer Sentiment data for May, expected 64 versus 65.2 prior, will be eyed for fresh impulse.

Technical analysis

AUD/USD recovery moves remain doubtful until crossing the early month’s swing low surrounding 0.7030. That said, the 50% Fibonacci retracement (Fibo.) of March 2020 to February 2021, around 0.6760, lures the bears of late.

- An intense sell-off is expected to be followed by a pullback to near the 20-EMA.

- The RSI (14) is hovering in a bearish range of 20.00-40.00, which adds to the downside filters.

- The asset is likely to print a fresh 19-year low after violating Thursday’s low at 1.0356.

The EUR/USD pair is advancing higher at a nominal pace after printing a low of 1.0355 on Thursday. The asset has extended its losses after witnessing a downside break of a tad wider consolidation placed in a range of 1.0471-1.0642 from April’s last week. In the Asian session, the asset is oscillating in an extremely narrow range of 1.0375-1.0384, which is likely to be followed by a firmer volatility expansion.

On the hourly scale, the shared currency bulls have been through an extreme sell-off after breaking below May’s range of 1.0471-1.0642. This will be followed by a minor bullish pullback to near the 20-period Exponential Moving Average (EMA) at 1.0418 as initiative sellers will kick in. The 50-EMA at 1.0460 is declining sharply, which adds to the downside filters.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in a bearish range of 20.00-40.00, which signals more pain ahead.

A pullback move to near the 20-EMA at 1.0418 will trigger an initiative selling action that will drag the asset towards Thursday’s low at 1.0356, followed by the round level support at 1.0300.

On the flip side, euro bulls could regain control if the asset oversteps May 6 high at 1.0600, which will drive the asset higher towards May 5 high and April 25 low at 1.0642 and 1.0700 respectively.

EUR/USD hourly chart

-637879964033737148.png)

- NZD/USD pares recent losses around the lowest levels since May 2020.

- New Zealand’s Business NZ PMI eased to 51.2 in April.

- Fed’s Powell reiterates 50 bps rate hike concerns, Fed’s Daly turns down debate on the pace of rate lifts.

- Risk-aversion keeps USD firmer, US Michigan Consumer Sentiment Index eyed.

NZD/USD picks up bids to 0.6245 while portraying a corrective pullback from the lowest levels in 24 months, flashed on Thursday, as bears take a breather amid a quiet Asian session on Friday. In doing so, the Kiwi pair ignores recently softer activity data from New Zealand (NZ).

That said, Business NZ PMI dropped to 51.2, below 52.8 market forecasts and 53.8 prior, in April. The activity data part ways from the previous day’s upbeat inflation expectations from the Reserve Bank of New Zealand (RBNZ) that raised concerns about the Kiwi central bank’s widely chattered 50 basis points (bps) of a rate hike in June.

It’s worth noting, however, that the kiwi pair’s latest rebound isn’t a sign of recovery as broad economic fears join the Fed’s faster tightening to keep the US dollar ahead of everybody on the currency platter. That said, the US Dollar Index (DXY) refreshed its 20-year high around 105.00 on Thursday, before easing to 104.80 afterward.

The latest pullback in the greenback gauge could be linked to comments from Fed Chairman Jerome Powell as he repeated the expectation that the Fed will raise interest rates by half a percentage point at each of its next two policy meetings. The Fed boss also pledged that if data turn the wrong way "we're prepared to do more." On the same line were statements from President and CEO of the Federal Reserve Bank of San Francisco, Mary C. Daly who mentioned, “Is it 50, is it 25, is it 75? Those are things that I’ll deliberate with my colleagues, but my own starting point is we don’t want to go so quickly or so abruptly that we surprise Americans”.

Amid these plays, the US 10-year Treasury yields also portray a corrective pullback after refreshing a two-week low the previous day, around 2.86% by the press time, whereas the S&P 500 Futures print mild gains while licking its wound near one-year low.

Moving on, the preliminary readings of US Michigan Consumer Sentiment data for May, expected 64 versus 65.2 prior, will be important data to watch but major attention should be given to qualitative catalysts for clear directions.

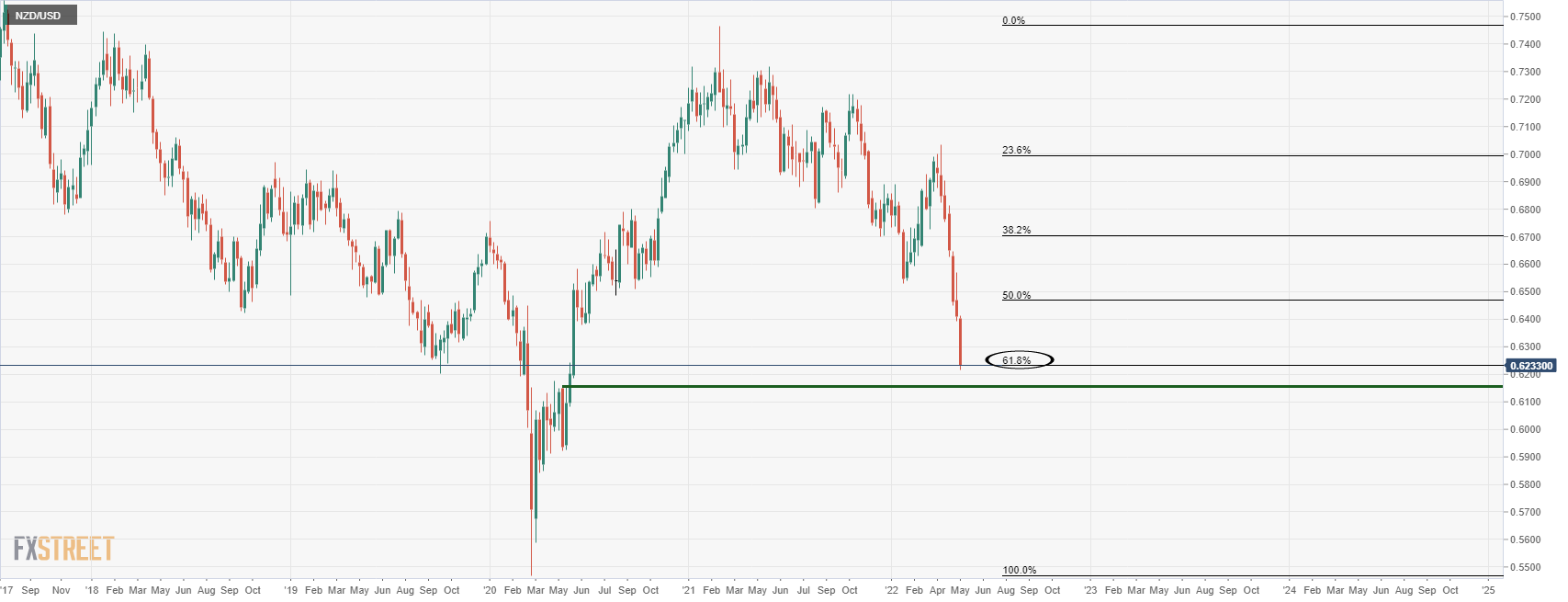

Technical analysis

Unless crossing the mid-2020 lows surrounding 0.6380, NZD/USD prices are vulnerable to testing April 2020 peak of 0.6176.

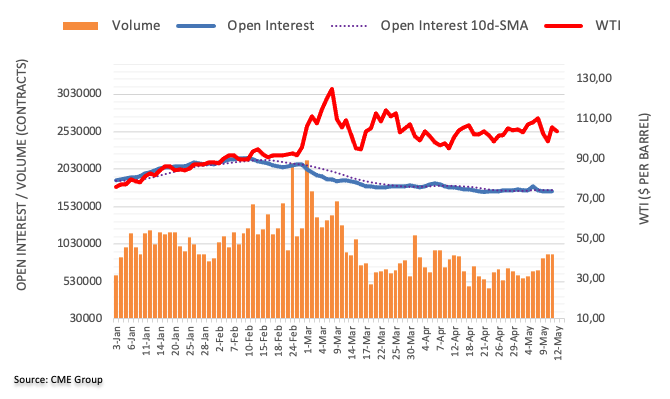

- WTI grinds higher past $105.00 after two-day uptrend.

- Steady RSI, DMA breakout keeps buyers hopeful to challenge 50% Fibo.

- Monthly support line appears a tough nut to crack for bears during the pullback.

WTI crude oil prices seem defensive at around $105.00 during Friday’s Asian session, after rising to a four-day high on crossing the 21 and 50 DMAs the previous day.

The black gold’s latest inaction fails to disappoint buyers, backed by the key DMA breakout and steady RSI.

That said, the commodity’s upside momentum remains bumpy as the 50% Fibonacci retracement of February-March upside, around $107.00, appears the nearby key hurdle for buyers to tackle before heading towards the resistance line from late March, near $109.30.

It’s worth noting that, the black gold’s rally beyond $109.30 needs validation from the monthly high near $110.35 to aim for late March’s peak surrounding $115.85.

On the contrary, the 50-DMA and the 21-DMA may initially challenge the quote’s pullback moves respectively around $104.10 and $103.65.

Following that, the 61.8% Fibo. and an upward sloping support line from April 11, close to $102.30 and $98.80 in that order, will challenge the WTI bears.

Overall, WTI is up for further advances but there prevails a bumpy road to the north until the quote stays below $109.30

WTI: Daily chart

Trend: Further upside expected

- USD/CAD is failing to establish above 1.3050 as oil prices recover Wednesday’s losses.

- Feds Powell is focusing more on price stability and warns of more than two 50 bps rate hikes this year.

- Inflationary pressures are deteriorating the paychecks of the households.

The USD/CAD pair is struggling to sustain above the crucial resistance of 1.3050 as oil prices have rebounded sharply after a mild correction. The asset has juggled in a range of 1.2922-1.3074 the whole week and is likely to display a sheer move going forward.

The odds of a spree of 50 basis point (bps) rate hike by the Federal Reserve (Fed) have strengthened. As per the interview of Fed chair Jerome Powell with Marketplace national radio program, the Fed is expected to raise interest rates by half a percentage point at each of its next two policy meetings. Also, Powell added that the Fed is prepared to do more if data turns the wrong way.

The statement clears that investors should brace for at least more than two rate hikes by 50 bps this year. The price pressures are depreciating the paychecks of the households in the US and price stability is highly needed to stabilize the economy from inflationary shocks.

On the oil front, a rebound in the oil prices after a corrective Wednesday has frozen the asset in a tight range. Lowering restrictions to contain Covid-19 in China has trimmed the fears of demand worries. The oil prices have overstepped $105.00 and are expected to advance further. A pending embargo on oil imports from Russia by Europe will keep the oil prices on edge. The US relies heavily on imports of oil from Canada, therefore higher oil prices are acting as headwinds for the asset.

Amid the sustained fall in US Treasury yields, in contrast to the market’s inflation fears, the US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, dropped to the lowest levels since February 25.

In doing so, the inflation gauge reversed the mid-week rebound from the lowest levels since early March by flashing a 2.59% figure by Thursday’s end of the North American trading session.

Given the market’s rush to risk-safety, the yields have been ignored of late, which n turn weighs on the inflation expectations despite reflation woes. However, the Fedspeak has been hawkish and maintains a view of more than two rate hikes in 2022, although the size of the rate hike being 75 bps is a question.

Hence, although the inflation expectations have recently refreshed multi-day low, the fears of tighter monetary policy and price pressure may remain elevated until the quote drops below the early 2022 levels.

Read: Climbing down from peak inflation looks increasingly challenging

- Silver prices stabilize around 22-month low after the biggest drop in eight months.

- Clear break of 50% Fibonacci retracement level directs bears toward September 2019 peak.

- Corrective pullback needs validation from eight-month-old horizontal resistance, previous support.

Silver (XAG/USD) bears take a breather after the biggest daily fall since September 2021, taking rounds to $20.60-80 during Friday’s Asian session.

The bright metal dropped to the lowest levels since July 2020 the previous day while breaking the 50% Fibonacci retracement (Fibo.) of its run-up from March 2020 to February 2021.

In addition to the downside break of the key Fibo. level, bearish MACD signals and broad risk-off mood also keep XAG/USD sellers hopeful to visit the September 2019 high, around $19.65.

That said, the $20.00 psychological magnet may offer an intermediate halt during the fall whereas February 2020 high of around $19.00 could lure the silver bears past $19.65.

Alternatively, the corrective pullback may initially aim for the aforementioned Fibonacci retracement level near $20.85.

Following that, lows marked during September and December 2021, close to $21.40, could challenge the silver buyers.

Silver: Daily chart

Trend: Bearish

- GBP/USD bears take a breather around two-year low after six-day downtrend.

- Flight to safety fuels US dollar, firmer data, Fed concerns add strength to the run-up.

- UK data, Brexit fears join inflation fears of BOE’s Ramsden to weigh on Sterling.

- US Michigan Consumer Sentiment to decorate calendar, risk catalysts are the key for clear directions.

GBP/USD licks its wounds near 1.2200, after refreshing a two-year low during the uninterrupted fall in the last six days, during the initial Asian session on Friday. In addition to the broad US dollar strength, pessimism surrounding Brexit and the UK’s economic fears are extra negatives that drowned the cable during the last few days.

The US Dollar Index (DXY) refreshed its 20-year high as traders rushed to the greenback in search of risk safety. Market’s fears were mainly propelled by the inflation woes that push global central bankers toward dialing back the easy money and challenging the already weary economic growth. Also challenging the sentiment are the negative impacts of the Russia-Ukraine crisis and China’s covid.

At home, Bank of England (BOE) Deputy Governor Dave Ramsden conveyed fears of prolonged higher inflation, which in turn raised worries for economic growth. The concerns become grim especially when the UK reports downbeat data.

That said, the UK’s first readings of the Q1 2022 GDP eased to 0.8% QoQ, below 1.0% forecasts while the monthly negative print of -0.1% for March, versus +0.1% expected and prior, gains major attention and drown the GBP/USD prices. Other than the UK GDP, Industrial Production and Manufacturing Production for March also disappoint the cable traders and add strength to the bearish bias.

It should be noted that British PM Boris Johnson’s likelihood of repealing part of the Brexit deal, relating to the Northern Ireland Protocol (NIP), joins the Western sanctions on Russia to exert additional downside pressure on the GBP/USD prices.

Amid these plays, Wall Street saw the red while the US Treasury yields renewed their weekly low to 2.85%, down 5.8 basis points (bps).

Looking forward, the preliminary readings of US Michigan Consumer Sentiment data for May, expected 64 versus 65.2 prior, will decorate the calendar but major attention will be given to headlines concerning risk-off mood, Brexit and inflation for clear directions.

Technical analysis

Although oversold RSI teases a corrective pullback towards June 2020 low surrounding 1.2250, buyers aren’t likely to take risks unless witnessing a clear run-up beyond a three-week-old resistance line, around 1.2390 by the press time.

On the contrary, May 2020 bottom surrounding 1.2075 and the 2000 psychological magnet lure sellers.

- A pullback to near 1.0000 looks likely as oscillators have turned extremely overbought.

- The trendline placed from 0.9710 will act as major support for the counter.

- The 20- and 50-EMAs are scaling higher, which cushion the greenback bulls.

The USD/CHF pair has witnessed minor selling pressure after consolidating in a narrow range of 1.0033-1.0049 to a low of 1.0022 in the early Asian session. On a broader note, the asset has remained tightened in the grip of bulls for the past few weeks.

The upside break of the consolidation phase plotted in a range of 0.9873-0.9977 on an hourly scale is demanding a minor correction to test the strength of the greenback bulls. The pair is balancing above the psychological resistance of 1.0000 and a test of the same will add more buyers for resuming the upside rally. The trendline placed from May 5 low at 0.9710, adjoining the weekly lows at 0.9874, will continue to act as major support for the counter.

The 20- and 50-period Exponential Moving Averages (EMAs) at 0.9997 and 0.9873 respectively add to the upside filters.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in a bullish range of 60.00-80.00, which usually signals further upside. However, an overbought situation cannot be ruled out.

Should the asset correct to near the psychological support of 1.0000, an initiative buying interest will drive the asset higher towards Thursday’s high at 1.0050. A breach of the latter will send the asset towards a fresh three-year high at 1.0123, which is a little over than 17 May 2019 high at 1.0122

Alternatively, the Swiss franc bulls could regain control if the asset drops below Thursday’s low at 0.9932. This will drag the asset towards Wednesday’s low at 0.9873, followed by May 6 low at 0.9827.

USD/CHF hourly chart

- AUD/USD pressured in risk-off markets and US dollar picks up the flows.

- AUD/USD has tracked global shares falling to their lowest point in 18-months.

At 0.6855, AUD/USD is starting out the day flat in Asia following another sell-off to fresh cycle lows weighed by a sea of red on Wall Street while the greenback attracts a safe-haven bid again on Thursday.

The antipodeans have been hit hard again with global shares falling to their lowest point in 18-months, supporting the greenback to a fresh 20-year-high. The markets are worried that inflation pushing up interest rates will bring the global economy to a standstill which is driving up the US dollar.

Additionally, weighing on risk sentiment further, tensions between Europe and Russia escalated on Thursday. Finland said it would apply to join NATO "without delay." Sweden is expected to follow. Russia has said it will be forced to take "retaliatory steps" over its neighbour Finland's move to join Nato. A foreign ministry statement said the move would seriously damage bilateral relations, as well as security and stability in northern Europe, the BBC reported.

As for US data, the headline April Producer Price Index climbed in line with expectations by 0.5% MoM. The annual rate was left at 11.0%. The core measure rose 0.4% MoM (0.7% expected), down from a revised 1.2% in March. Core rose 8.8% YoY vs 9.6% YoY. Consequently, US yields were softer. The yield on the US 10-yr note fell 9.4bps to 2.83%.

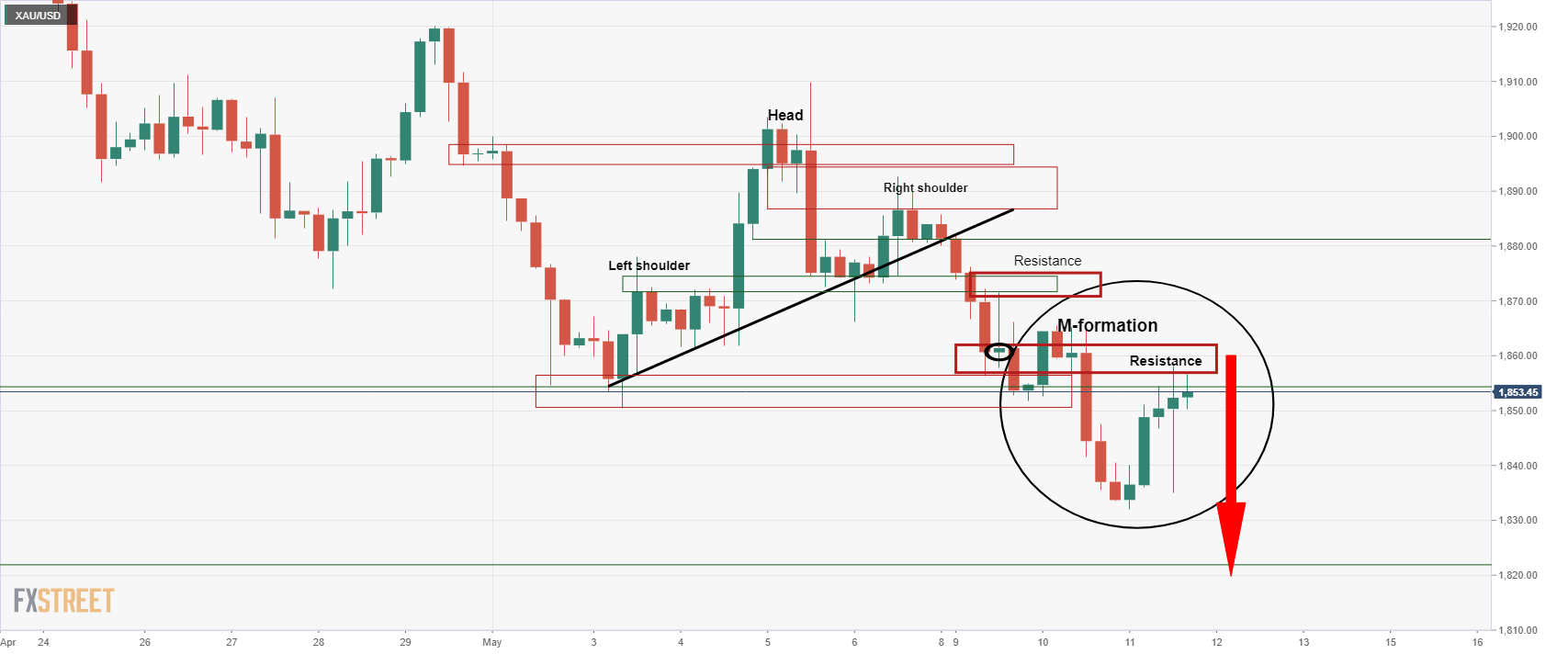

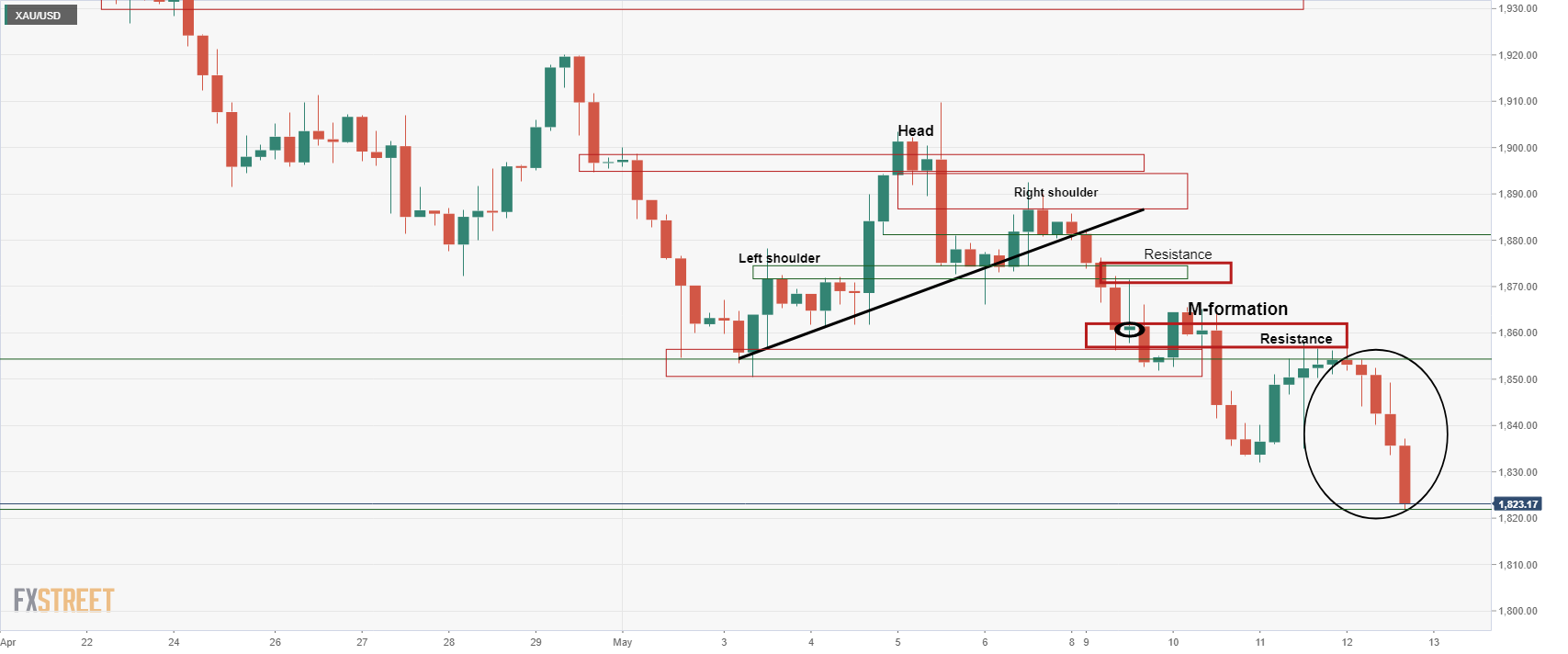

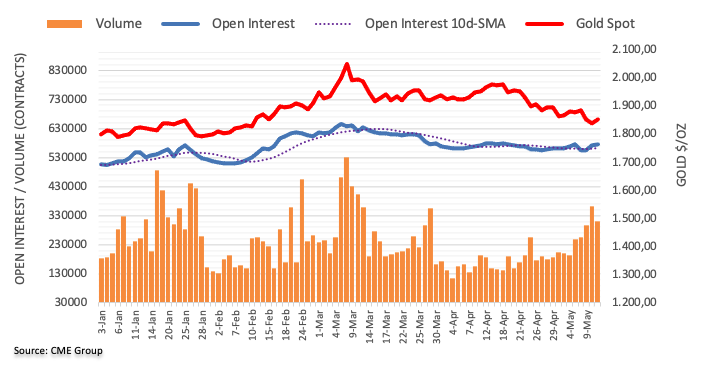

- Gold price is declining towards $1,800.00 as DXY has strengthened on upbeat economic data.

- The precious metal has struggled at best to overstep the 200-EMA.

- The DXY has renewed its 19-year high at 104.93 on a higher US PPI.

Gold Price (XAU/USD) is continuously dropping south as raising odds of a bumper rate hike by the Federal Reserve (Fed) in its June monetary policy are punishing the precious metal. The bright metal extended its losses on Thursday after establishing below the two-day low at $1,832.07. The selling momentum is expected to drag the gold prices to near the psychological support of $1,800.00.

The US administration is outperforming on the economic data front. The upbeat US Nonfarm (NFP) Payrolls, higher-than-expected US Consumer Price Index (CPI), and strong Producer Price Index (PPI) numbers are advocating for the continuation of an aggressive hawkish stance by the Fed. The tight labor market and galloping inflationary pressures have left no other option for the Fed than to step up the interest rates.

On the US dollar front, the US dollar index (DXY) has renewed its 19-year high at 104.93 after the US Bureau of Labor Statistics reported the yearly US PPI at 11%, higher than the forecasts of 10.7%. While the core PPI that excludes food and energy prices is landed at 8.8%, a little lower than the consensus of 8.9%.

Gold technical analysis

On the daily scale, gold prices struggled to regain their mojo by overstepping the 200-period Exponential Moving Average (EMA) at $1,858.04. Failing to do so, bears drag the precious metal sharply lower. The 20-EMA at $1,883.18 will continue to act as a major resistance for the counter. Meanwhile, the Relative Strength Index (RSI) (14) has shifted into a bearish range of 20.00-40.00, which adds to the downside filters.

Gold daily chart

The Federal Reserve Chair Jerome Powell said on Thursday that the US central bank's battle to control inflation would "include some pain" as the impact of higher interest rates is felt, but that the worse outcome would be for prices to continue speeding ahead."

''We fully understand and appreciate how painful inflation is," Powell said in an interview with the Marketplace national radio program, repeating his expectation that the Fed will raise interest rates by half a percentage point at each of its next two policy meetings while pledging that if data turn the wrong way "we're prepared to do more.""

''Nothing in the economy works, the economy doesn’t work for anybody without price stability," Powell said.

"We went through periods in our history where inflation was quite high ... The process of getting inflation down to 2% will also include some pain, but ultimately the most painful thing would be if we were to fail to deal with it and inflation were to get entrenched in the economy at high levels, and we know what that's like. And that's just people losing the value of their paycheck."

Meanwhile, the US dollar has made a fresh 20-year high on Thursday due to the persisting concerns that the Fed's actions to drive down high inflation would crimp global economic growth, boosting the currency's safe-haven appeal.

- NZD/USD bears take on the 61.8% Fibo of the 2020 rally.

- The US dollar picks up a safe haven bid and US stocks drop, weighing on the high beta currencies.

At 0.6238, NZD/USD is lower by some 0.90% on the day as Wall Street draws to a close. The pair has been in the hands of the bears following a brief correction on Wednesday while the US dollar picks up a safe-haven bid again on Thursday.

The high beta currencies have been pummeled as risk-off sentiment takes hold. Global shares are at their lowest point in 18-months, supporting the greenback to a fresh 20-year-high as investors fear that inflation pushing up interest rates will bring the global economy to a standstill.

''It has been a punishing time for financial assets since the Fed raised rates by 50bps last week and the subsequent strong US jobs market, and CPI data have reinforced concerns over the extent of the task facing the Fed,'' analysts at ANZ Bank said.

''One notable aspect of the turmoil has been lower bond yields, with the US 10yr at ~2.83%, having touched 3.20% on Monday. That signifies that markets think the drama could influence policy. If the ramifications of volatility/tumbling asset prices become that significant, it’s hard to see markets shying away from the USD’s safe-haven appeal any time soon. This morning’s NZD break of 0.6230 (the 61.8% Fibo of the 2020/21 rally off COVID lows) is a negative technical development.''

NZD/USD technical analysis

The price is en route towards a break below 0.62 the figure that guards the late May 2020 highs.

What you need to take care of on Friday, May 13:

The American dollar soared on the back of risk-aversion. Panic selling hit equities and cryptos the most, as speculative interest priced in massive quantitative tightening. More and more central bankers are hinting at measures set to drain liquidity.

European Central Bank officials keep paving the way towards a July rate hike, while Bank of Canada Deputy Governor Toni Gravelle suggested that the central bank would need to raise rates above neutral. Finally, Bank of England Governor Ramsden noted that inflation might not drop as fast as forecast, highlighting the need for more rate hikes.

It is worth noting that the US Federal Reserve is two steps ahead of other central banks, hiking rates by 50 bps in May and pledging for at least 2 or 3 more 50 bps hikes while drawing plans to reduce its balance sheet.

Adding to the ruling concerns, tensions escalate between Russia and the western world. Russian Deputy Chairman Dmitry Medvedev warned that military assistance for Ukraine risks creating a conflict between Russia and NATO. Meanwhile, Ukraine has announced it would suspend Gazprom gas transit on its territory. European Commission President Ursula von der Leyen said Russia was the “most direct threat” to the international order.

Also, Russia menaced with retaliation should Finland join NATO. Earlier, Finland’s president and the prime minister said that the country should apply to join NATO “without delay.”

EUR/USD fell to 1.353, now trading at around 1.0370. The GBP/USD pair plunged below the 1.2200 figure. The USD/CHF pair reached parity for the first time since December 2019, now trading at around 1.0040, while USD/JPY edged sharply lower, stabilizing at around 128.40.

Commodity-linked currencies edged lower against the greenback. AUD/USD is now at 0.6850, while USD/CAD trades in the 1.3040 price zone.

Spot gold reached a fresh monthly low, now changing hands at around $1,824 a troy ounce, while crude oil prices kept recovering, with WTI trading at $106.85 a barrel.

Global indexes closed in the red, although Wall Street managed to trim most of its intraday losses ahead of the close.

US Treasury yields retreated amid renewed demand for safety.

Bitcoin price presents buying opportunity despite Coinbase Q1 losses and custody fears

Like this article? Help us with some feedback by answering this survey:

President and CEO of the Federal Reserve Bank of San Francisco, Mary C. Daly has stated that there is no reason to alter the course for 50 bps at the next two meetings, adding that the debate between 50 bps-75 bps is not a primary consideration. She also said she still wants to reach a neutral rate of 2.5% by end of the year.

“Is it 50, is it 25, is it 75? Those are things that I’ll deliberate with my colleagues, but my own starting point is we don’t want to go so quickly or so abruptly that we surprise Americans” already dealing with 40-year-high inflation, Daly told Yahoo Finance earlier on Thursday.

“I’m watching over this year to see how much our move to neutral restrains the economy, along with the repair of supply chains and the fiscal rolloff,” all of which should contribute to easing inflation, she said.

Meanwhile, the US dollar has climbed to a fresh 20-year high on Thursday as concerns persisted that central bank actions to drive down high inflation would crimp global economic growth, boosting the currency's safe-haven appeal.

- USD/JPY bears sink in their teeth on lower US yields, stocks and a heightened sense of risk aversion.

- Bears break below critical support, bucking the trend of bullish flag breakouts.

USD/JPY fell on Thursday to a low of 127.51 from a high of 130.05. A combination of lower US yields and global shares are at their lowest point in 18-months has been supporting both the greenback to a fresh 20-year-high and the yen that has moved out of bearish territory vs. the US dollar.

As a consequence of the risk-off sentiment, the DXY, an index that measures the US dollar vs. a basket of rivals is trading at a new cycle high of 104.925, carving out the way towards the 2002 high near 107. However, the yen has caught a bid also, rallying to its way out of a bullish structure on the daily chart.

Benchmark 10-year Treasury yields, which hit the lowest level in two weeks are down over 3% while the more Fed tentative 2-years are losing 3.7%, weighed by Producer Prices that fell short of expectations. The US Producer Price Index increased by 0.5% in April compared with a 1.6% jump in March. Excluding food and energy, the core PPI climbed by 0.4%, lagging the 0.7% gain expected. Core PPI grew by 1.2% in March. On a year-over-year basis, producer price inflation surged 11% in April, and core PPI jumped 8.8%, the Bureau of Labor Statistics said Thursday.

Meanwhile, the summary of opinions from the April 27-28 Bank of Japan meeting came across as universally dovish and largely unconcerned about rising inflation and the weak yen. The Next policy meeting is June 16-17 and all signs point to continued dovishness from the BOJ.

USD/JPY technical analysis

The pair has bucked the trend on Thursday, breaking below prior support and has denied the bulls that were otherwise seeking more from the bullish flag pattern on the daily chart:

The price action has left an M-formation on the daily chart, a pattern which often sees the price reverting to restest the prior lows, or the neckline of the chart pattern.

- EUR/USD falls to fresh bearish cycle lows as the US reaches a new 20-year high.

- Risk-off sentiment is supporting a flight to the US dollar.

EUR/USD is down some 1.35% after falling from a high of 1.0529 to a low of 1.0353 on Thursday due to a firm US dollar as risk-off sentiment takes hold. Global shares are at their lowest point in 18-months, supporting the greenback to a fresh 20-year-high as investors fear that inflation pushing up interest rates will bring the global economy to a standstill.

Europe's continent-wide STOXX 600 index fell 0.63% on Thursday as German warned that Russia was now using energy supplies as a "weapon" which has weighed on the single currency. Tensions were stoked as Finland confirmed it would apply to join NATO "without delay" in the wake of Russia's invasion of Ukraine, a war that is driving up global energy and food prices.

As a consequence of the risk-off sentiment, the DXY, an index that measures the US dollar vs. a basket of rivals is trading at a new cycle high of 104.925, carving out the way towards the 2002 high near 107. Subsequently, the euro is trading at a new cycle low near despite hawkish the European Central Bank's comments.

European Central Bank policymaker Peter Kazimir dropped a hint about a July interest rate increase on social media on Wednesday, joining a growing number of colleagues in calling for a hike to tackle record-high inflation.

"(I am) ready to hike in July -- and not just the beautiful Atlas Mountains here in #Morocco," the Slovak governor wrote on Twitter.

''Of course, this is a bit anti-climactic after President Lagarde pretty much sealed the deal earlier this week. More importantly, there seems to be a growing consensus that the deposit rate will move into positive territory by year-end, which would require three hikes to accomplish,'' analysts at Brown Brothers Harriman argued.

Meanwhile, the market's expectations for Fed tightening picked up a bit after the Consumer Price Index data but have since fallen back, weighed by Producer Prices that fell short of expectations. The US Producer Price Index increased by 0.5% in April compared with a 1.6% jump in March. Excluding food and energy, the core PPI climbed by 0.4%, lagging the 0.7% gain expected. Core PPI grew by 1.2% in March. On a year-over-year basis, producer price inflation surged 11% in April, and core PPI jumped 8.8%, the Bureau of Labor Statistics said Thursday.

Parity eyed

''The US dollar is gaining today despite falling yields, which illustrates the so-called dollar smile whereby it gains during periods of risk-off as well as in periods of strong US data and rising yields. Either way, the dollar’s climb is likely to continue for the time being,'' the analysts at BBH forecasted. ''We continue to target the January 2017 near $1.0340. After that, we have to start talking about parity.''

Meanwhile, analysts at Rabobank, ''in the current environment'' continue to view the USD as the obvious haven currency.

''We have argued repeated our view the USD’s safe haven credentials stem from the greenback’s own fundamentals rather than those of the US. The USD dominates the global payments systems and is used as an invoicing currency all over the world. Even in the Eurozone, a high proportion of invoices are written in USD,'' the analysts explained.

''In recent years, low US rates has encouraged steady growth of USD denominated det issuance from non-US currencies. These debts need to be maintained. The implication is that there is a strong need for USDs across the globe which is brought into focus as liquidity is tightened.

While we don’t see US fundamentals as creating the USD’s safe haven status, the US’s relatively strong position in terms of food and energy security is likely enhancing the appeal of the greenback. Earlier this week, we revised up our USD forecasts across the board. We see risk of EUR/USD at 1.03 on a 1 month and 3-month view.''

The Bank of Mexico, abbreviated BdeM or Banxico, sets the benchmark interest rate at 7%, although Reuters reports that the board was not unanimous on rate decision with one member of the board voting to hike rates to 7.25%.

Key notes

- Banxico says another four board members voted to hike the rate to 7.00%.

- Says for the next monetary policy decisions the board will monitor thoroughly the behaviour of inflationary pressures and factors impacting foreseen path for inflation and its expectations.

- Says preliminary information suggests that economic activity rebounded during the first quarter of 2022.

- Says given the growing complexity in the environment for inflation and its expectations, taking more forceful measures to attain the inflation target may be considered.

- Says an environment of uncertainty and ample slack conditions continues to prevail, although the latter narrowed compared to the previous quarter.

- Says in view of greater-than-anticipated pressures on inflation, forecasts for headline and core inflation were revised upwards up to the second and third quarters of 2023.

- Says, however, convergence to the 3% target in the first quarter of 2024 is maintained.

- Says the balance of risks for the trajectory of inflation within the forecast horizon remains biased to the upside and continues deteriorating.

- Says took into consideration increasing challenges posed by tightening global monetary and financial conditions, the environment of significant uncertainty, and greater inflationary pressures associated with geopolitical conflict.

- Says in addition to shocks that have affected inflation throughout the pandemic, now there are pressures associated with geopolitical conflict and strict lockdown measures recently imposed by China.

The peso is a touch stronger on the decision with USD/MXN down 0.17% at 20.2685.

- Gold drops into a fresh critical daily support structure.

- The US dollar is bid and making fresh 20-year highs.

- Price pressures are entrenched and investors are seeking out the safe havens.

The price of gold is losing some 1.60% at the time of writing, falling from a high of $1,858.87 to a fresh cycle low of $1,822.27. The US dollar is bid and climbed to fresh two-decade highs on Thursday as investors flock to the safe-haven currency in the face of surging inflation.

Data on Wednesday confirmed expectations for further aggressive hikes in interest rates by the Federal Reserve. The Consumer Price Index climbed 8.3%, higher than the 8.1% estimate but below the 8.5% in the prior month. The index rose just 0.3% last month, the smallest gain since last August, the Labor Department said on Wednesday, versus the 1.2% MoM surge in the CPI in March, the most significant advance since September 2005. However, ''the fact that the CPI is driven by rents and services implies that price pressures are entrenched and may manifest in upward pressure on wages too,'' analysts at TD Securities argued.

As a consequence, the dollar index (DXY), which measures the greenback's strength against a basket of six currencies, rose 0.4% to 104.92 on Thursday following a jittery day on Wednesday.

"Dollar is rallying as things potentially look negative in the US, which is hurting gold. Also, the market is realising the likelihood of seeing pretty aggressive interest rate increases," analysts at TD Securities said.

However, precious metals are holding up relatively as a drop in the benchmark 10-year Treasury yields, which hit the lowest level in two weeks, has capped some of the bear's progress. The ten-years are down over 3% while the more Fed tentative 2-years are losing 3.7%, weighed by Producer Prices that fell short of expectations.

The US Producer Price Index increased by 0.5% in April compared with a 1.6% jump in March. Excluding food and energy, the core PPI climbed by 0.4%, lagging the 0.7% gain expected. Core PPI grew by 1.2% in March. On a year-over-year basis, producer price inflation surged 11% in April, and core PPI jumped 8.8%, the Bureau of Labor Statistics said Thursday.

''The dollar is gaining today despite falling yields, which illustrates the so-called dollar smile whereby it gains during periods of risk off as well as in periods of strong US data and rising yields. Either way, the dollar’s climb is likely to continue for the time being,'' analysts at Brown Brothers Harriman explained.

Gold technical analysis

The gold price has fallen from a 4-hour resistance as follows:

Prior analysis:

Live update:

A move below the lows of the day will open new territories for the bears and prospects of a test below the psychological $1,800 round figure:

The deterioration in the growth outlook in the United Kingdom has been negative for the pound, explained analysts at CIBC. They forecast the GBP/USD pair will remain around 1.22 during the next months.

Key Quotes:

“The updated BoE macro outlook now reflects a negative GDP trajectory in 2023, the bank now assumes -0.25% rather than 1.25% previously. The key driver of the deteriorating growth trajectory is the most aggressive correction in real household disposable incomes on record. The drag on consumption will squeeze activity out of the system, obviating the need to tighten as aggressively as the market expects. While Governor Bailey may suggest that a further tightening may be appropriate, this remains in stark contrast to the market implying almost 115bps of additional tightening by the end of 2022.”

“We favour rates ending 2022 at 1.25%. The BoE is in an increasingly uncomfortable position in terms of forecasting an ever higher CPI peak and slowing growth. The combination of extended and elevated price pressures set against downgraded growth forecasts, which are impacting rate assumptions, do not sit comfortably against a backdrop of enduring political uncertainty.”

“Overall, there seems to be little to commend regarding Sterling, hence we have revised our GBP forecasts down.”

US Treasury Secretary Janet Yellen mentioned on Thursday that the Financial Stability Oversight Council (FSOC) is concerned about the functioning of the Treasury market. “We had episodes in which liquidity has dried up.” She is giving testimony before the House Financial Services.

While she testifies, stocks erased gains printing fresh YTD lows and the dollar strengthened. The DXY is at multi-year highs above 104.70. The 10-year US yield stands at 2.84%, down 3% for the day.

Analysts at Wells Fargo continue to believe that the US dollar can strengthen against G10 and emerging market currencies. They consider the aggressive tightening from the Federal Reserve, safe haven capital flows as well as markets that are mispriced for interest rate hikes abroad should all result in a stronger greenback going forward.

Key Quotes:

“A hawkish Federal Reserve has boosted the US dollar against most G10 and emerging market currencies year to date, and we believe this trend is likely to continue. Given our view that the Fed is likely to tighten policy aggressively, we believe capital flows should revert back toward the United States.”

“As higher yields attract capital back to the U.S., the dollar should benefit and strengthen against G10 and developing currencies going forward. We believe emerging market currencies are the most vulnerable against this backdrop, especially as political risks rise and central banks across the developing world may be running out of space to lift interest rates.”

“As far as the G10 currencies, we believe financial markets may be priced for too much tightening by many foreign central banks. As markets adjust to a more gradual pace of tightening abroad, G10 currencies should weaken and the U.S. dollar should get a tailwind.”

Analysts at CIBC forecast the AUD/USD pair at 0.72 by the end of the second quarter, and at 0.75 by the third quarter. They see the Reserve Bank of Australia rising at least another 150bps of tightening by year-end.

Key Quotes:

“The RBA has moved to suggest it is “committed to doing what is necessary to ensure that inflation in Australia returns to target over time. ” The switch to policy front loading is partly a function of the substantive uptick in the inflation profile contained in the Statement on Monetary Policy.”

“As prices are now expected to reach 6% by year-end, the bank deemed it necessary to act aggressively. The central bank has become increasingly wary of inflation expectations becoming de-anchored.”

“Beyond the expected uptick in headline prices, the continued tightening in the labour market also supports tighter monetary policy, and we look for at least another 150bps of tightening by year-end. An unemployment rate below 4% underlines the need for additional tightening. After hiking this month, the market is currently pricing more than 35bps of tightening for the 7 June meeting.”

“We continue to view the AUD as undervalued versus supportive terms of trade and long-term interest rate differentials. However, rising external headwinds, linked to rising Chinese concerns, suggest AUD bulls may need to be patient.”

- US dollar pulls back as Wall Street turns positive.

- Tensions across financial markets remain on the table.

- NZD/USD rebounds modestly, bearish bias persists.

The NZD/USD bottomed during the American session at 0.6222, the lowest level since June 2020 and then rebounded modestly to 0.6266, trimming losses. The dollar moved off high across the board but stays firm amid a volatile financial market.

A recovery in equity prices in Wall Street helped NZD/USD. After a negative opening, the S&P 500 turned positive. Risk aversion is still dominant amid fears about the global economic outlook with higher interest rates ahead.

Data from the US showed the Producer Price Index slowed down from a multi-decade high of 11.5% to 11% in March (annual); on a monthly basis, it rose 0.5%. Jobless claims showed a mixed picture: Initial Claims hit an 11-week high at 203K while Continuing Claims dropped to 1.343M, the lowest since 1970.

Short-term outlook

The bearish pressure remains in place, and more losses seem likely while under 0.6275. The 20 Simple Moving Average in four hours chart is located at 0.6300; if the kiwi rises above, it would alleviate the short-term negative momentum. The next resistance is seen at 0.6335.

On the flip side, a slide under 0.6235 would expose the 0.6222 low. The following support might be located at 0.6190 (Feb 2020 low) and 0.6160.

Technical levels

- USD/USD is consolidating just above 1.3000, not far below 18-month highs at 1.3050.

- A strong US dollar amid recent hot US inflation data and risk-off flows is outweighing higher oil prices.

- Focus is on upcoming comments from BoC’s Tony Gravelle from 1630BST.

USD/CAD stabilised just below multi-month highs in the low 1.3000s on Thursday, as a downturn in global macro risk appetite coupled with the strong performance of the safe-haven US dollar offered the pair support. At current levels around 1.3020, the pair is trading with gains of about 0.25% on the day and earlier came within a whisker of hitting Tuesday’s more than 18-month highs just above 1.3050.

Given US CPI and PPI data over the past two days, both of which showed an (as far as the Fed is concerned, anyway) insufficient moderation of inflationary pressures, it's not surprising to see the US dollar performing so well. The data means that the Fed will likely press ahead with its current aggressive tightening plans and, with fears about central bank tightening weighing heavily on global equities, the buck is also deriving support as a safe haven.

A rebound from earlier session lows in crude oil prices has failed to revive the loonie, which seems likely to continue to trade on the back foot in the run-up to commentary from BoC’s Deputy Governor Tony Gravelle at 1630BST. Gravelle might offer further hints about the extent and timing of the BoC’s monetary tightening plans. Traders should note, however, that the BoC’s hawkish stance has failed to shield the loonie from the US dollar’s advances in recent weeks and probably won’t start this Thursday.

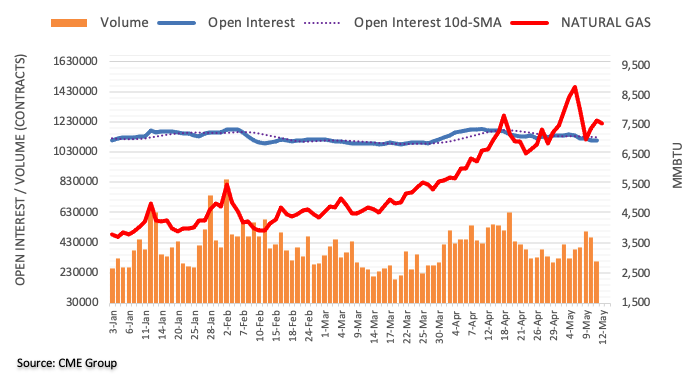

- Oil prices are currently trading on the front foot, though it’s been a choppy day so far.

- WTI has rallied back into the $106.00s from earlier lows in the $102.00s.

- Traders are weighing geopolitical tensions against a bearish macro backdrop.

Oil prices are currently trading on the front foot, though it’s been a choppy day so far. Front-month WTI futures fell as low as the mid-$102.00s earlier in the day, but have since reversed back to trading modestly in the green in the $106.00s. Risk appetite remains ropey at the start of the US trading session, with US equities probing multi-month lows, international equity bourses also suffering and bond yields falling amid a flight to safety.

Traders continue to cite fears about slowing global growth, still, sky-high inflation (see this week’s Consumer and Producer Price Inflation reports) and central bank tightening, all of which come against the backdrop of the ongoing Russo-Ukraine war and widening lockdowns in China, as weighing on sentiment. This clearly was weighing on oil prices earlier in the day.

Commentary from major oil market players has also been bearish sounding. Both OPEC and the International Energy Agency (IEA) released their monthly oil market reports on Thursday. The former cut its global oil demand growth forecast for this year for a second successive month due to the impact of the Russo-Ukraine war, demand destruction as a result of inflation and lockdowns in China.

The IEA’s message was similar. “Soaring pump prices and slowing economic growth are expected to significantly curb the demand recovery through the remainder of the year and into 2023,” they said. “Extended lockdowns across China ... are driving a significant slowdown in the world’s second-largest oil consumer”. The agency also revised lower their expectations for demand growth this year.

But there has also been plenty of focus on worsening Russia/EU relations as Finland and Sweden head closer to joining NATO and Germany accuses Russia of “weaponising” its energy exports. This is keeping fears about the impact on Russian oil output of Western sanctions on Russia over its invasion of Ukraine in the spotlight. The EU is expected to agree on a plan to end Russian oil imports soon, in what analysts have said would be a crippling blow to Russia’s energy industry.

Meanwhile, a French Diplomatic source was recently quoted by Reuters as being pessimistic that the US and Iran will swiftly resolve their differences and return to the 2015 nuclear deal. A return to the old deal would see US sanctions on Iran lifted and as much as 1.3M barrels per day in Iranian exports return to global markets, commodity strategists have said.

The combination of these latter two themes seems to have been enough to entice dip-buyers to return to WTI markets as it prices closer to $100. But against such a bearish macro backdrop, it remains to be seen whether WTI can continue its recovery and test earlier weekly highs above the $110 per barrel mark.

The loonie is having a hard time against the USD in the current market environment. Against the EUR, on the other hand, the CAD was able to gain noticeably as a commodity currency. Economists at Commerzbank expect a more pronounced downward movement in EUR/CAD than in USD/CAD in 2023.

EUR/CAD should trend lower in 2023

“In our main scenario, we continue to expect that the EUR will recover noticeably from the summer onwards, largely supported by the ECB's turnaround. As a result, EUR/CAD should drift upwards. At the same time, the CAD should be able to gain somewhat against the USD.”

“For USD/CAD, a key factor remains how the market views the BoC's stance compared to the Fed. If it is perceived as more hawkish and rate hike expectations change correspondingly, the loonie should benefit – conversely, it should lose accordingly.”

“With the continued tightening of monetary policy in 2023, the BoC is likely to differ from the ECB. We expect the latter to end its rate hike cycle again early in 2023, which should contribute to renewed EUR weakness. Accordingly, we expect a more pronounced downward movement in EUR/CAD than in USD/CAD in 2023.”

Gold dips back to low $1,840s. Economists at TD Securities expect the yellow metal to remain under downside pressure.

A significant amount of complacent length in gold

“A liquidity vacuum is dragging all assets lower, leaving gold to circle the drain in defiance of its safe-haven status, despite the fierce rally in Treasuries.”

“With CTA trend followers joining into the liquidation party, substantial selling flow continues to weigh on the yellow metal at a time when liquidity is scarce. Prices are now struggling to hold onto the bull-market-era defining uptrend in the yellow metal under the pressure of this selling flow.”

“For the time being, the trendline has held despite the strong CPI report, as the turbulence in risk assets sparked a bid in Treasuries, but we continue to see a significant amount of complacent length in gold which could weigh on prices, while the breadth of traders short has just started to rise from near-record lows.”

- USD/JPY came under intense selling pressure on Thursday and dived to over a two-week low.

- The flight to safety benefitted the JPY and dragged the pair lower amid sliding US bond yields.

- The technical set-up favours bearish traders and supports prospects for further near-term losses.

The USD/JPY pair added to the previous day's modest losses and witnessed heavy follow-through selling on Thursday. This marked the second successive day of a negative move - also the third in the previous four - and dragged spot prices to over a two-week low, around mid-127.00s during the early North American session.

The prevalent risk-off mood boosted the traditional safe-haven Japanese yen and exerted heavy downward pressure on the USD/JPY pair. Bearish traders further took cues from an extension of the sharp pullback in the US Treasury bond yields, which forced the US dollar to trim a part of its intraday gains to a two-decade high.

Given the formation of a double-top pattern near the 131.35 region, the overnight breakdown through an ascending trend-line extending from late March was seen as a fresh trigger for bearish traders. A subsequent fall and acceptance below the 129.00 round figure prompted aggressive technical selling and contributed to the steep decline.

From current levels, sustained weakness below the 128.00 mark will set the stage for additional losses and drag the USD/JPY pair further towards testing the 127.55-127.50 intermediate support. The downward trajectory could further get extended towards the next relevant support near the 127.00-126.90 region touched on April 27.

On the flip side, attempted recovery might now confront stiff resistance near the 128.60 area. Any further move up is likely to meet with a fresh supply and remain capped near the 129.00 level. That said, some follow-through buying could trigger a short-covering move and lift the USD/JPY pair back towards the 130.00 psychological mark.

USD/JPY 4-hour chart

-637879594515066872.png)

Key levels to watch

- EUR/USD collapses to fresh lows in the sub-1.0400 area.

- The door is now open to a visit to the 2017 low at 1.0340.

EUR/USD saw its decline markedly accelerated on Thursday, breaking below the 1.0400 support for the first time since early January 2017.

Extra retracements remain well on the cards for the time being. That said, bets are now on the rise for a test of the 2017 low at 1.0340 sooner rather than later. This area is reinforced by the 2003 low at 1.0334 (January 2).

Below the 3-month line near 1.0910, the pair is expected to remain under pressure and vulnerable to extra losses.

EUR/USD daily chart

- Silver is consolidating above $21.00 after hitting its lowest level since July 2020 in the $20.75 region.

- Risk-off flows and lower yields aren’t doing much to help XAG/USD, which is about 2.0% lower on the day.

- Technicians are eyeing more downside to sub-$20.00 levels.

After briefly hitting its lowest level since July 2020 in the $20.75 area per troy ounce, the price of spot silver (XAG/USD) has stabilised just above the $21.00 level. That leaves the metal trading lower by about 2.0% on the session, as the precious metal complex reels against the backdrop of a strong US dollar. With no notable support, all before the 2019 highs in the $19.60s, many technicians think that further XAG/USD downside is likely.

Lower yields across developed markets as a result of a strong safe-haven bid as global equities and other risk assets continue their recent slide has not come to the aid of silver, which is traditionally seen as a safe-haven asset. Meanwhile, further evidence that US inflation isn’t easing as quickly as hoped in the form of the latest US Producer Price Inflation data released earlier on Thursday, which comes on the back of Wednesday’s also hotter than forecast Consumer Price Inflation numbers, has also not sparked any fresh demand for inflation protection that might normally benefit the precious metal

Markets remain very much focused on central bank tightening, with the rhetoric from Fed members this week very much in fitting with Fed Chair Jerome Powell’s message in the post-FOMC meeting press conference last week that substantial further tightening should be expected. Higher interest rates not only by themselves dissuade investors from allocating capital towards silver and gold (given the higher opportunity cost of holding non-yielding assets), but are also likely to result in lower inflation in the long run (as a direct result of demand easing due to tighter financial conditions), lessening the demand for inflation protection.

Reduced demand for inflation protection as a result of the Fed’s hawkish shift in recent weeks can be seen in the recent pullback to multi-month lows in US inflation expectations. 10-year break-evens went as high as 3.1% in mid-April but are now back to the 2.75% area, with this pullback coinciding with the recent drop in XAG/USD.

- DXY’s upside momentum gathers extra steam.

- The dollar clinches new cycle tops around 104.70.

The dollar keeps the bid bias unchanged and pushes DXY to new 19-year peaks in the 104.70 region on Thursday.

Considering the ongoing price action, further gains in the index remains well on the cards and with the immediate hurdle at the round level at 105.00 ahead of 105.63 (December 11 2002 high). Further up, the index is expected to challenge the December 2002 high at 107.31.

The current bullish stance in the index remains supported by the 8-month line around 97.00, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 96.21.

DXY daily chart

- AUD/USD prolonged its recent slump and dived to a near two-year low on Thursday.

- Retreating US bond yields capped the USD and assisted the pair to find some support.

- The set-up still favours bearish traders and supports prospects for additional losses.

The AUD/USD pair has managed to rebound a few pips from its lowest level since June 2020 and was last seen trading around the 0.6875-0.6880 region, still down 0.90% for the day.

The US dollar trimmed a part of its intraday gains to a nearly two-decade high amid an extension of the recent sharp pullback in the US Treasury bond yields. This, in turn, assisted the AUD/USD pair to find some support near the mid-0.6800s, though any meaningful recovery still seems elusive.

Wednesday's higher-than-expected US consumer inflation figures reaffirmed bets for a more aggressive policy tightening by the Fed. This, along with recession fears, continued weighing on investors' sentiment, which should act as a tailwind for the safe-haven buck and cap the AUD/USD pair.

From a technical perspective, the overnight sharp pullback from the 0.7055-0.7060 region and subsequent weakness below the previous YTD low, around the 0.6910 area marked a fresh bearish breakdown. The latter should now act as a strong barrier and cap the AUD/USD pair's attempted recovery.

Any further move up might continue to face still resistance and met with a fresh supply near the 0.7000 psychological mark. This should act as a key pivotal point for short-term traders, which if cleared decisively might trigger a short-covering bounce back towards the 0.7055-0.7060 area.

On the flip side, the daily swing low, around mid-0.6800s, now seems to protect the immediate downside. Some follow-through selling will reaffirm the bearish outlook and make the AUD/USD pair vulnerable to prolonging the downward trajectory to test the next relevant support near the 0.6800 mark.

AUD/USD daily chart

-637879573906596704.png)

Key levels to watch

- There were 203K initial claims in the week ending 7 May, a tad above the 195K expected.

- Continued claims saw a much larger than forecast drop.

- FX markets did not react to the latest weekly jobless claims report.

There were 203,000 Initial Jobless Claims in the week ending on 7 May, a little above the expected drop to 195,000 from 202,000 one week ago, data released by the US Department of Labour on Thursday showed. As a result, the four-week average number of Initial Jobless Claims rose to 192,750 from 188,500 a week earlier.

Continued Claims fell to 1.343 million in the week ending on 30 April, larger than the expected decline from 1.387 million to 1.38 million. The Insured Unemployment rate nonetheless remained unchanged at 1.1% for the week ending on 30 April.

Market Reaction

FX markets did not react to the latest weekly jobless claims report.

- Annual headline PPI came in at 11.0% in April, a tad above expected, but Core PPI was a tad lower than expected.

- FX markets hardly reacted at all to the data.

The annual rate of US Producer Price Inflation (PPI) fell to 11.0% in April, above expectations for a fall to 10.7% from 11.2% in March, data released by the Bureau of Labour Statistics and Department of Labour showed on Thursday. MoM, headline producer price pressures came in at 0.5% as expected, falling back from a 1.6% MoM gain in March.

The annual pace of Core PPI came in at 8.8%, a tad lower than the expected drop to 8.9% from 9.6% in March. The MoM pace of Core PPI was also a little lower than expected at 0.4% versus expectations for a drop to 0.6% from 1.2% in March.

Market Reaction

FX markets have hardly reacted at all to the latest mixed US inflation data release.

- A bullish breakout in the buck to fresh yearly highs has seen spot gold pull back from earlier highs in the $1,850s.

- But XAU/USD is finding support and remaining in the $1,840s above its 200-DMA amid geopolitical angst/risk-off flows.

Whilst a broad cross-market bid for safe-haven assets which has resulted in strength in the yen and in government bond prices (meaning yields are lower) is keeping the spot gold (XAU/USD) price supported above its 200-Day Moving Average in the mid-$1,830s for now, a breakout to fresh year-to-date highs in the US dollar that has seen the DXY push into the upper 104s has seen the precious metal reverse back from earlier session highs near $1,860.

XAU/USD current trades in the low $1,840s and is down about 0.5% on the day as the stronger greenback makes USD-denominated commodities (like spot gold) more expensive for international buyers. Whether the buck’s bullish breakout will be enough to push gold to fresh multi-month lows below Wednesday’s $1832 bottom remains to be seen.

At the moment, US (and global yields) are on the back foot amid a safe-haven bid, and lower yields mean a lower opportunity cost of holding non-yielding assets like gold. Meanwhile, concerns about slowing global growth remain ever-present, while European markets are seemingly rattled by the latest geopolitical developments there.

Finland is on the verge of applying to join NATO with Sweden expected to follow. Russia has vowed an unspecified response. Geopolitical tensions in the region add to downside growth risks, all of which could be cited by investors as reasons to own gold. Looking ahead, the imminent release of US Producer Price Inflation figures for April will be worth noting at 13:30 BST, as will any further rhetoric from Fed policymakers.

- GBP/USD dropped to a near two-year low on Thursday in reaction to softer UK macro data.

- Aggressive Fed rate hike bets continued underpinning the USD and added to the selling bias.

- Extremely oversold conditions helped limit losses, though the set-up favours bearish traders.

The GBP/USD pair managed to rebound a few pips from a two-year low and was last seen trading just below the 1.2200 mark, down nearly 0.50% for the day.

The pair extended the overnight rejection slide from the 1.2400 mark and witnessed heavy follow-through selling on Thursday, marking the sixth successive day of a negative move. The British pound took a hit following the release of weaker UK macro data, which, along with sustained US dollar buying exerted pressure on the GBP/USD pair.

The Preliminary UK GDP report showed that the British economy expanded by 0.8% during the first quarter of 2022 as against the 1.3% growth recorded in the previous quarter and the 1.0% anticipated. Adding to this, the monthly GDP print also fell short of market expectations and came in to show that the economy contracted by 0.1% in March.

Separately, the Office for National Statistics (ONS) reported that Manufacturing and Industrial output declined by 0.2% in March, both missing consensus estimates. Moreover, the UK goods trade balance data showed that the deficit unexpectedly jumped to £23.897 billion in March from £21.614 billion recorded in the previous month.

The data reaffirmed a bleak economic outlook by the Bank of England and the National Institute of Economic and Social Research (NIESR), warning that Britain is on course to enter a technical recession. This, in turn, suggested that the current rate hike cycle could be nearing a pause and dragged sterling lower across the board.

On the other hand, the US dollar prolonged its recent strong bullish run and shot to its highest level since December 2002 amid firming expectations for a more aggressive policy tightening by the Fed. Wednesday's release of the US CPI reaffirmed market bets for at least a 50 bps Fed rate hike move at the upcoming policy meetings on June 15 and July 27.

The prospects for rapid rate hikes in the US, along with tight global supply chains resulting from China's zero-COVID policy and the war in Ukraine, fueled worries about a possible recession. This, in turn, took its toll on the global risk sentiment, which was evident from an extended sell-off in the equity markets and further benefitted the safe-haven buck.

That said, extremely oversold conditions helped limit further losses for the GBP/USD pair, only for the time being. Nevertheless, the fundamental backdrop remains tilted in favour of bearish traders, suggesting that any attempted recovery runs the risk of fizzling out rather quickly.

Technical levels to watch

EUR/USD fell below the 1.0400 level for the first time since January 2017 on Thursday, with the bears now eyeing a test of 2017 lows in the 1.0340 area. EUR/USD's on-the-day losses now stand at over 1.1% as traders dump the euro in favour of the safe-haven US dollar amid heightened worries about tensions between the EU and Russia amid the latter's ongoing invasion of Ukraine.

- EUR/JPY corrects sharply lower and challenges 134.00.

- Further downside could see the 55-day SMA retested initially.

EUR/JPY extends the weekly leg lower and revisits the 134.00 neighbourhood on the back of the resurgence of the risk aversion in the broader markets.

The continuation of the downtrend should meet temporary support at the 55-day SMA and the 100-day SMA at 133.87 and 132.27, respectively, in the short-term horizon. Down from here emerges the always relevant 200-day SMA, today at 131.00.

In the meantime, while above the 200-day SMA, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

No final decision has been taken on the Northern Ireland Protocol, a spokesperson for UK PM Boris Johnson said on Thursday. The UK will see what, if any, progress can be made on the protocol and there will be further discussions at the official level with the EU in the coming days, the spokesperson added.

The UK government has been threatening to unilaterally scrap the protocol, which is currently the focal point of a political impasse preventing the formation of a new regional Northern Ireland government following regional elections there over the weekend. The EU has threatened to scrap its post-Brexit trade deal with the UK if it takes such a move.

Economist at UOB Group Ho Woei Chen, CFA, reviews the latest inflation figures in the Chinese economy.

Key Takeaways

“China’s headline CPI rose at a faster than expected pace, by 2.1% y/y (Bloomberg est: 1.8% y/y, Mar: 1.5% y/y), to a 5-month high in Apr. Higher fresh food prices due to domestic COVID-19 disruption and increases in fuel costs more than offset the negative impact on services and consumption demand. Compared to the previous month, CPI was up 0.4% m/m after staying flat in Mar.”

“China’s Producer Price Index (PPI) moderated to 8.0% y/y in Apr (Bloomberg est: 7.8% y/y, Mar: 8.3% y/y) due to the high comparison base but this was still above consensus expectation. The sequential gains indicated the presence of cost pressures on producers as PPI rose for the third consecutive month, by 0.6% m/m in Apr (Mar: 1.1% m/m).”

“We maintain our full-year 2022 inflation forecast at 2.9% (2021: 0.9%). The full-year PPI is likely to come in at the higher end of our 5%-6% forecast (2021: +8.1%).”

“Demand-side inflationary pressure has eased in Apr as seen in the moderation of China’s core CPI. The PBoC could reduce its 1-year medium-term lending facility (MLF) rate this month (13-16 May) by 5-10 bps as it increases growth support. We maintain our forecast for the benchmark 1Y loan prime rate (LPR) to fall to 3.55% by the end of 2Q/3Q 2022.”

European Central Bank (ECB) Governing Council member Gabriel Makhlouf said on Thursday that it was realistic to expect that the ECB interest rates are likely to be in positive territory by early next year, as reported by Reuters.

Additional takeaways

"We have reached the point where we on ECB's Governing Council need to act."

"It is time for the council to move to end net asset purchases under the asset purchase programme next month or in July."

"The current level of inflation is concerning."

"Our objective is for inflation to be at 2 % over the medium term - levels are significantly above that now."

"The era of negative rates is reaching its conclusion."

"We are continuing on a path towards the normalisation of monetary policy."

"Tightening labour market should result in stronger and broader-based wage growth than we have observed in recent years."

"Potential of wages becoming detached from underlying productivity growth presents clear risks to Irish competitiveness."

Market reaction

The shared currency stays under selling pressure despite these hawkish comments and EUR/USD was last seen losing 0.75% on a daily basis at 1.0433.

- USD/CAD regained positive traction on Thursday and climbed back closer to the YTD peak.

- Aggressive Fed rate hike bets continued benefitting the USD and extended some support.

- A fresh leg down in oil prices weighed on the loonie and provided an additional lift to the pair.

The USD/CAD pair extended its steady intraday ascent through the mid-European session and climbed to the 1.3045 area, back closer to the YTD peak in the last hour.

A combination of supporting factors assisted the USD/CAD pair to build on the overnight goodish rebound from the 1.2920 area and gain some follow-through traction on Thursday. Firming expectations for a more aggressive policy tightening by the Fed pushed the US dollar to its highest level in nearly two decades. Apart from this, sliding crude oil prices undermined the commodity-linked loonie and acted as a tailwind for the major.

Despite signs that inflationary pressures in the world's biggest economy are peaking, investors seem convinced that the Fed will stick to its rate hike cycle. In fact, money market futures are now pricing in an 81% chance of a jumbo 75 bps rate hike in June amid concerns that China's zero-covid policy and the war in Ukraine would push consumer prices even higher. This, along with the risk-off mood, further benefitted the safe-haven buck.

Worries that fast-rising inflation will drive a sharp rise in interest rates and bring the global economy to a standstill tempered investors' appetite for perceived riskier assets. Apart from growing recession fears, strict Covid-19 lockdowns in China raised concerns about slowing fuel demand. Adding to this, a delay in the approval of the European Union's proposed phased embargo on Russian oil weighed on crude oil prices.

It, however, remains to be seen if bulls can capitalize on the move or if the USD/CAD pair meets with a fresh supply at higher levels, warranting some caution before positioning for any further gains. Market participants now look forward to the US Producer Price Index (PPI), which, along with the US bond yields and the broader risk sentiment, will influence the USD. Traders will further take cues from oil price dynamics to grab some short-term opportunities.

Technical levels to watch

- Copper price resumes the downslide as growth concerns fuel demand fears.

- Comex copper threatens the $4-mark, LME copper breaches the $9,000 level.

- Investors seek refuge in the safe-haven US dollar, as hot US CPI spooks the market.

Copper, the so-called economic bellwether, has resumed its bearish momentum following a temporary rebound seen on Wednesday.

The latest downside leg in the red metal has knocked down the rates to the lowest level since September 2021, as bears look to take out the $4 mark on Comex futures while the LME copper futures are already trading under the $9,000, having lost the $10,000 threshold a week ago.

The renewed sell-off in copper price is mainly driven by growing demand concerns for the metal, as the global economy risks a slowdown amid surging inflation and a hawkish Fed outlook.

Hotter than expected US CPI data fuelled concerns that the Fed could go in for aggressive rate hikes in the coming months, bringing the post-pandemic global economic recovery to a standstill.

Further, China’s covid lockdowns and Ukraine crisis-led supply chain disruptions also add to the global growth worries, eventually heightening fears over the demand for the red metal.

That said, any recovery attempts in the barometer of the world economy are likely to remain short-lived and could be seen as a good selling opportunity for traders.

- EUR/USD collapses to the 1.0420 region on Thursday.

- The re-emergence of the risk aversion put the pair under extra pressure.

- ECB’s Kazimir advocated for a rate hike in July.

Sellers regained control over the single currency and dragged EUR/USD to fresh cycle lows in the 1.0420 region on Thursday, an area last visited back in January 2017.

EUR/USD weak on USD-buying, risk-off

The resurgence of geopolitical-led risk aversion lent unexpected legs to the greenback and the rest of the safe haven universe in the second half of the week and forced EUR/USD to break below the multi-session consolidative theme to print fresh lows in the 1.0420 zone.

In addition, the moderate demand for bonds motivated the German 10y Bund yields to shed ground for the third session in a row and return to the sub-0.90% region so far on Thursday.

No reaction in the exchange rate after ECB’s Board member Kazimir joined the July-rate-hike bandwagon earlier in the session, falling in line with his colleagues’ comments so far this week.

The domestic calendar is muted on Thursday, although Producer Prices and the usual Initial Claims will take centre stage across the Atlantic.

What to look for around EUR

EUR/USD loses the grip and revisits the 1.0420 region for the first time since January 2017. The outlook for the pair remains well entrenched into the negative camp, always in response to dollar dynamics, geopolitical concerns and the Fed-ECB divergence. Occasional pockets of strength in the single currency, in the meantime, should appear reinforced by speculation the ECB could raise rates at some point in the summer, while higher German yields, elevated inflation and a decent pace of the economic recovery in the region are also supportive of an improvement in the mood around the euro.

Key events in the euro area this week: EMU Industrial Production (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Impact on the region’s economic growth prospects of the war in Ukraine.

EUR/USD levels to watch

So far, spot is losing 0.84% at 1.0424 and a break below 1.0422 (2022 low May 12) would target 1.0400 (round level) en route to 1.0340 (2017 low January 3 2017). On the flip side, the next up barrier aligns at 1.0641 (weekly high May 5) followed by 1.0936 (weekly high April 21) and finally 1.1000 (round level).

The Bank of England (BoE) is set to undertake a gradual tightening of monetary policy, which will put the pound under depreciation pressure, economists at Commerzbank report. Moreover, the EUR should benefit from the ECB's interest rate hikes from the summer onward. Thus, EUR/GBP is set to grin higher until end-2022

Cautious BoE to weigh on sterling

“The BoE is continuing its gradual tightening of monetary policy. However, it is likely to act less restrictively than expected by the market. The pound should suffer increasingly from this.”

“Another burdening factor is that the ECB is also likely to initiate its monetary policy turnaround in July. We, therefore, expect EUR/GBP to trade higher in the course of the year.”

“Since the ECB is likely to pause after three rate hikes, while the BoE in our opinion will tighten its monetary policy further in 2023, the pound should be able to appreciate again against the EUR in 2023.”

GBP/USD has slumped to its weakest level in two years below 1.22 as weaker than expected UK growth data weigh heavily on the pound. In the view of FXStreet’s Eren Sengezer, the pair looks likely to continue to push lower amid risk aversion.

Things look bad for the pound after dismal data

“The UK's Office for National Statistics reported that the British economy grew by 0.8% on a quarterly basis in the first quarter. This print missed the market expectation of 1% and reminded investors of the Bank of England's (BoE) warning that there could be a recession in 2022, causing the pound to come under heavy selling pressure.”

“Brexit jitters put additional weight on the pound's shoulders. The European Union (EU) is reportedly ready to suspend the trade deal with the UK if the Northern Ireland Protocol is revoked unilaterally.”

“In case the pair fails to reclaim 1.22 (psychological level, descending trend line), additional losses toward 1.2150 (static level from May 2020) and 1.2100 (May 15, 2020, low, psychological level) could be witnessed.”

“1.2250 (former support, static level from June 2020) and 1.2300 (psychological level, 20-period SMA) align as the next recovery targets if buyers manage to lift cable above 1.22.”

- Gold oscillated in a narrow band around the $1,850 area through the first half of the European session.

- Aggressive Fed rate hike bets pushed the USD to a two-decade higher and capped the commodity.

- Retreating US bond yields and the global flight to safety helped limit losses for the safe-haven metal.

Gold struggled to capitalize on the overnight post-US CPI gains and witnessed subdued/range-bound price action on Thursday. The XAUUSD seesawed between tepid gains/minor losses through the first half of the European session and was last seen trading in neutral territory, around the $1.850 region.

The latest US consumer inflation readings came in higher than expected and reinforced market bets for a more aggressive policy tightening by the Fed. In fact, money market futures are now pricing in an 81% chance of a jumbo 75 bps rate hike in June amid concerns that China's zero-covid policy and the war in Ukraine would continue to push consumer prices higher. This, in turn, pushed the US dollar to its highest level in nearly two-decade and dented demand for the dollar-denominated gold.