- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 11-05-2022

- EUR/USD bears sinking in their teeth at daily support.

- US dollar remains on firm grounds with eyes on US inflation.

At 0.6934, EUR/USD is flat on the day so far in an environment of positive stocks in APAC despite the sea of red into the close on Wall Street. The euro was pressured as a consequence of a resilient US dollar and the market's conclusion that the inflation data for April was hot enough to panic, fuelling a bid on the greenback.

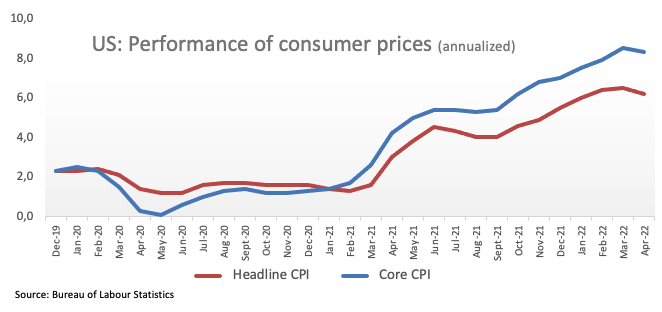

It was a mixed report in that the Consumer Price Index climbed 8.3%, higher than the 8.1% estimate but below the 8.5% in the prior month. The index rose just 0.3% last month, the smallest gain since last August, the Labor Department said on Wednesday, versus the 1.2% MoM surge in the CPI in March, the most significant advance since September 2005. However, ''the fact that the CPI is driven by rents and services implies that price pressures are entrenched and may manifest in upward pressure on wages too,'' analysts at TD Securities argued.

As a consequence, the Dow Jones Industrial Average was 1% lower at 31,834.11, wiping gains achieved earlier in the day. The S&P 500 slid 1.7% to 3,935.18. The Nasdaq Composite tumbled 3.2% at 11,364.24. The US 10-year yield slumped by 7.4 basis points to 2.92% but that did not prevent the greenback from rallying.

''The positive surprise in core prices will not be favourable for currencies not named the US dollar. We think the market is far too premature in reducing the Fed's optionality set for tightening. This should leave the USD resilient for now,'' analysts at TD Securities argued.

The US dollar index, DXY, ended towards the session highs of 104.105. It is currently bid and trading at 104.01 which is weighing on the euro as investors assess how aggressive the Fed will need to be. Expectations are completely priced in for another hike of at least 50 basis points at the central bank's June meeting, according to CME's FedWatch Tool.

-

Fed's Bullard: April inflation was “hot” but not far from what was expected

For the week ahead, investors will get another look at inflation data on Thursday in the form of the Producer Price Index for April, with expectations of a monthly increase of 0.5% versus the 1.4% jump in March. On an annual basis, expectations are for a jump of 10.7% compared with the 11.2% surge the prior month.

ECB about to hike?

Meanwhile, a number of European Central Bank speakers including ECB President Christine Lagarde spoke. The communication was decidedly hawkish, as analysts at ANZ Bank explained: ''Lagarde said that a first rate hike could come just weeks after the ECB finishes its QE program in June. This signals the growing possibility of a July hike from the central bank. With the final April CPI data for Germany confirming a 7.8% YoY rise in prices, the hawkish members of the ECB governing council are likely to keep pushing for an earlier tightening in monetary policy.''

EUR/USD technical analysis

As per the pre-Asian session analysis, EUR/USD Price Analysis: Bears lurking near to cycle lows, breakout on the cards? the price is testing critical daily and 4-hour support. A break here could lead to lower levels for longer as per the daily chart:

- Silver prices remains sidelined after snapping four-day downtrend.

- Bearish chart pattern, downbeat MACD signals keep sellers hopeful.

- 100-HMA, weekly horizontal resistance adds to the upside filter.

Silver (XAG/USD) struggles to extend recovery moves from a two-year low inside immediate bearish pennant formation, taking rounds to $21.50 during Thursday’s Asian session.

In addition to a two-day-old bearish chart pattern, sluggish MACD signals also hint at a lack of buying momentum, which in turn keeps sellers waiting for a trigger to take fresh entry.

As a result, a downside break of the stated pennant’s support of around $21.40 will serve as the short-term key level to watch for fresh short positions.

Following that, the recent low of $21.18 and the $21.00 round figure may entertain traders ahead of directing them to the $20.00 threshold.

Meanwhile, recovery moves will have a tough time crossing the $22.00 level comprising the pennant’s upper line and the 100-HMA.

Also challenging the XAG/USD buyers is a weekly horizontal area surrounding $22.10-15.

Should silver buyers keep reins past $22.15, multiple hurdles near $22.85, $23.00 and the monthly peak of $23.28 could flash on their radars.

Silver: Hourly chart

Trend: Further weakness expected

- GBP/JPY has tumbled to near 159.00 on an expectation of mixed UK GDP.

- The quarterly and yearly GDP is seen at 1% and 9% vs. 1.3% and 6.6% respectively.

- On the Japanese front, PPI numbers are due next week.

The GBP/JPY pair is consolidating in a narrow range of 158.91-159.31 after a serious drop from 161.31 in the New York session. The cross failed to sustain above 161.00 and tumbled sharply to a low of 158.83. The sheer downside move in the cross is expected to drag it lower to near the crucial support at 157.70.

A preliminary estimate for the quarterly UK Gross Domestic Product (GDP) is 1% against the prior print of 1.3% while the yearly UK GDP may land at 9%, higher than the former figure of 6.6%. The expectation of underperformance from the quarterly UK GDP is denting the demand for sterling in the FX domain.

The renewed fears of recession after the statement from Bank of England (BOE) Governor Andrew Bailey brought a sell-off in pound over the past few trading sessions. Apart from that, BOE’s bailey dictated that the UK inflation could reach 10% by 2023.

Meanwhile, the value buying structure is strengthening the Japanese yen against sterling. Also, the ongoing risk-off impulse has improved the appeal of safe-haven assets. Going forward, yen bulls will be impacted by the release of the Japan Producer Price Index (PPI), which is due on Monday. Japan's PPI is seen at 0.3% and 9.7% on a monthly and yearly basis.

- AUD/USD dribbles around yearly low after more than 100-pip move.

- Risk appetite remains divided, mostly sour, as equities/yields initially gained before closing negative.

- Firmer US inflation, mixed Fedspeak and headlines from China keep traders confused even as bears hold the reins.

- Australia’s Consumer Inflation Expectations for May will be observed closely after RBA’s surprise rate hike.

AUD/USD traders take a breather around 0.6940, following a whippy move of near 120 pips surrounding the US inflation release, as markets wait for fresh clues during the initial Asian session on Thursday. That said, Australia’s Consumer Inflation Expectations for May appear an immediate catalyst to watch for the pair traders, in addition to the widely chatters news over China, Russia and inflation.

The Aussie pair rallied 120 pips before reversing from 0.7050 to just end Wednesday with a “no-change day” sign, suggesting the traders’ indecision despite the firmer US inflation data. That said, the headline Consumer Price Index (CPI) rose to 8.3% YoY versus 8.1% expected and 8.5% prior. More importantly, the CPI ex Food & Energy, better known as Core CPI, crossed 6.0% forecasts with 6.2% annual figures, versus 6.5% previous readouts.

Following the data, Fedspeak turned out to be mixed as the previously hawkish Federal Reserve Bank of St. Louis James Bullard mentioned that he ''won't emphasize single inflation report too much but inflation is more persistent than many have thought.'' However, Cleveland Fed President and FOMC member Loretta Mester previously recalled the bears as she said, “They don't rule out a 75 basis points rate hike forever”.

Not only the Fed but multiple policymakers from the European Central Bank (ECB) also sounded hawkish and renewed rate-hike, as well as growth fears, which in turn weighed on the AUD/USD prices.

Also exerting downside pressure on the quote were softer prints of Australia’s Westpac Consumer Confidence, -5.6% versus -0.9%. However, firmer inflation numbers from China and news that eight districts from Shanghai witnessed zero covid spread seemed to have kept the buyers hopeful, before the US inflation woes weighed on the prices.

Amid these plays, equities initially rose before ending in the red while the US Treasury yields also rose past 3.0% before ending Wednesday at a one-week low of 2.92%. It’s worth observing that S&P 500 Futures print mild gains by the press time.

Looking forward, an expected weakness in the Aussie Consumer Inflation Expectations for May, to 4.8% from 5.2% prior, could add strength to the AUD/USD pair’s bearish bias as the same won’t back the Reserve Bank of Australia’s (RBA) 50 basis points (bps) rate hike and hints at softer move ahead.

Technical analysis

A three-week-old descending trend channel restricts short-term AUD/USD moves between 0.6870 and 0.7170. That said, a horizontal area comprising lows marked during late 2021 and early 2022, around 0.6990-7000, appears a nearby hurdle to cross for the pair buyers.

- USD/CHF is approaching 1.000 as DXY strengthens on higher US inflation.

- The DXY is holding itself above 104.00 ahead of the US PPI.

- The flat jobless rate and CPI have pushed the Swiss franc into a negative trajectory over the last week.

The USD/CHF pair is moving north firmly after the release of the US Consumer Price Index (CPI) on Wednesday. The asset found significant bids at around 0.9874 and is now scaling sharply higher towards the psychological resistance of 1.0000.

It is worth noting that the major is displaying a broader consolidation in a range of 0.9874-0.9975 from Monday. No doubt the anxiety over the release of the US CPI was keeping investors on the edge. Now, the above-expected US inflation figure at 8.3% is telling a different story. The yearly inflation levels are at a peak now and the curve may start trending downside amid the strict deployment of quantitative measures by the Federal Reserve (Fed). No wonder the story of contained inflation is far from over and investors will continue to brace volatility at the higher side but price pressures will ease gradually.

The US dollar index (DXY) is trying to hold itself above 104.00 as the negative market sentiment has diminished the risk appetite of investors. In the New York session, investors will keep the US Producer Price Index (PPI) on the radar, which will provide further guidance to the market participants. The US PPI is seen at 10.7% on yearly basis.

On the Swiss front, the Swiss franc is underperforming continuously for the last week after the Swiss agencies reported the Unemployment Rate and CPI numbers. The former landed at 2.2% while the latter printed at 2.5%, both catalysts remained in line with the market consensus.

- GBP/USD remains sidelined around two-year low, maintains weekly falling channel.

- Sluggish RSI, MACD tests further downside around channel’s support.

- Multiple hurdles to the north challenge recovery move unless crossing 1.2415.

- UK’s monthly data dump includes preliminary readings of Q1 GDP, making it the key.

GBP/USD takes rounds to the lowest levels since June 2020 as traders await the UK Q1 GDP during Thursday’s Asian session. In doing so, the cable pair stays inside a one-week-old descending trend channel, flirting with the 1.2250 level by the press time.

Also read: UK GDP Preview: BOE’s R-word to overshadow a mild expansion

That said, the support line of the stated channel, around 1.2235-40, joins nearly oversold RSI and sluggish MACD to challenge the GBP/USD pair’s immediate moves.

Should the quote bounces back from the latest multi-month low, a convergence of the channel’s upper line and three-week-old descending trend line, around 1.2385-80, will test the rebound. Also acting as an immediate upside hurdle is the 50-SMA level surrounding 1.2415.

Hence, the GBP/USD bears seek more clues after traveling a long distance. However, the bulls have a bumpy road to travel and remain unwelcomed before crossing 1.2415.

Should the quote rises past 1.2415, early May’s top surrounding 1.2640 should be on the GBP/USD pair buyer’s radar.

GBP/USD: Four-hour chart

Trend: Corrective pullback expected

- NZD/USD seesaws near Wednesday’s open after a 100-pip move.

- US inflation crossed forecasts in April, justifying hawkish Fedspeak and firmer USD.

- NZ FinMin Robertson signals short-term inflation pressure at home.

- China’s covid conditions, geopolitical tensions add to the bearish bias ahead of a busy calendar in Asia.

NZD/USD revisits the 0.6300 mark, completing a home round after almost 100 pips of the inflation-induced move, as the pair traders await a set of key data from New Zealand during early Thursday morning in Asia. Also likely to have restricted the Kiwi pair’s moves are mixed concerns amid firmer US CPI and zigzag moves of yields, not to forget risks emanating from China and Russia.

The much-awaited US Inflation data rose past market consensus but the traders sought solace in softer-than-previous releases. That said, the headline Consumer Price Index (CPI) rose to 8.3% YoY versus 8.1% expected and 8.5% prior. More importantly, the CPI ex Food & Energy, better known as Core CPI, crossed 6.0% forecasts with 6.2% annual figures, versus 6.5% previous readouts.

It should be noted, however, that the Fedspeak remained hawkish and renewed US dollar strength just after an initial drop. That said, Federal Reserve Bank of St. Louis James Bullard recently mentioned that he ''won't emphasize single inflation report too much but inflation is more persistent than many have thought.''

At home, New Zealand Finance Minister (FinMin) Grant Robertson praised the nation’s economic strength in a pre-budget speech while also highlighting inflation as a short-term challenge. The policymaker also expects the price pressure to ease in the second half of the year.

On a different page, global markets dwindled as equities initially rose before ending in the red while the US Treasury yields also rose past 3.0% before ending Wednesday at a one-week low of 2.92%.

It’s worth observing that China’s struggle with covid and Europe’s readiness for the sixth round of sanctions on Russia are extra catalysts that weigh on the market sentiment, in addition to the inflation fears. The same exerts downside pressure on the NZD/USD prices ahead of the key Q2 Inflation Expectations from the Reserve Bank of New Zealand (RBNZ), previous 3.27%.

“The RBNZ will be hoping to see some moderation in inflation expectations measures – especially at the longer horizons. That would give them some leeway to slow down the pace of rate hikes after what we expect will be another 50bp hike to 2% on 25 May,” said Australia and New Zealand Banking Group (ANZ) ahead of the data release.

Other than the RBNZ Inflation Expectations for Q2, US Jobless Claims and Producer Price Index (PPI) will also be important to watch for immediate directions.

Technical analysis

Given the pair’s failure to rebound from a two-year low, NZD/USD prices are likely bracing for October 2019 low surrounding 0.6200.

Meanwhile, multiple lows marked during mid-2020, around 0.6380-85, restrict immediate recovery moves.

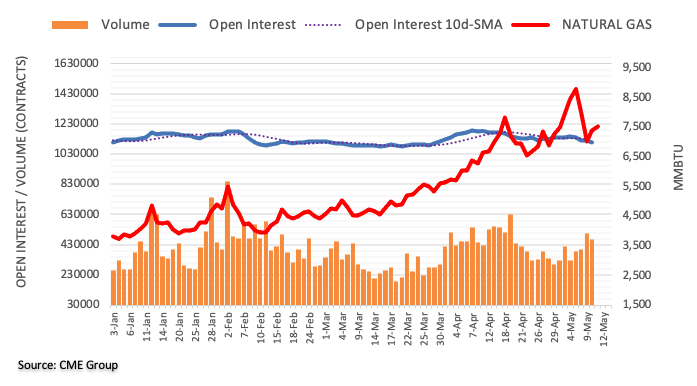

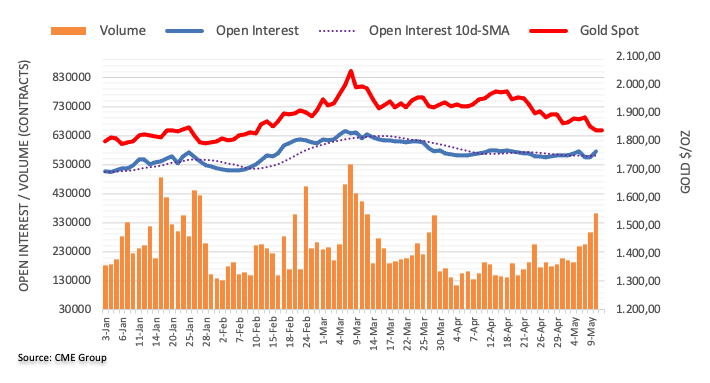

- Gold prices are stuck in a $14-range on upbeat US inflation.

- The DXY is sustaining above 104.00 as the odds of a rate hike by the Fed have bolstered.

- Higher US CPI at 8.3% indicates the Fed has a long way to go to ease price pressures.

Gold Price (XAU/USD) has frozen at around $1,852.00 after the US Bureau of Labor Statistics unveiled the US Consumer Price Index (CPI) for the month of April. The precious metal is oscillating in a minor range of $1,846.44-1,858.30 as investors are planning the next move after the higher-than-expected inflation figures. The US agency reported yearly inflation at 8.3% against the estimate of 8.1% while the core CPI figure has climbed to 6.3%, higher than the forecasts of 6%.

The Federal Reserve (Fed) is getting prepared for a bumpy ride as soaring price pressures will demand more mega rate hikes from the central bank. No doubt, the odds of a rate hike by 75 basis points (bps) have also strengthened as surging inflationary pressures are required to get contained with extremely aggressive quantitative measures.

Meanwhile, the US dollar index (DXY) is establishing above 104.00 and is likely to remain topsy-turvy till it violates the 19-year high at 104.20 or breaks below the previous week’s low at 103.19. In today’s session, the US Producer Price Index (PPI) will remain in focus, which is expected to land at 10.7% on yearly basis.

Gold technical analysis

On an hourly scale, Gold prices have shown some signs of exhaustion on the downside. The bright metal has formed a Bullish Divergence. The asset formed a lower low at $1,832.09 while the momentum oscillator, Relative Strength Index (RSI) (14) denied forming a lower low, which shows exhaustion in the downtrend. The RSI (14) has shifted to a 40.00-60.00 range from a bearish range of 20.00-40.00 but seeks more validation. Gold bulls are firmer above the 20-period Exponential Moving Average (EMA) at $1,849.90.

Gold hourly chart

-637879044849328009.png)

- USD/CAD bears are holding up the bullish advance.

- Eyes on 1.29 the figure prior to fresh higher highs.

USD/CAD is under pressure again despite the rise in the greenback. The technical picture is meanwhile bearish given the daily wick on Wednesday close and the prospects of a more thorough correction prior to the next significant rally and prospects of a fresh cycle high. The following illustrates this on the daily and hourly time frames:

USD/CAD daily chart

The surge in the greenback on Wednesday has sent the price higher for a bearish candle close and bearish wick. There is a high probability that the wick will be mitigated in the coming sessions which would mean a more purposeful move to the downside to targeting the prior daily highs near 1.29 the figure.

USD/CAD H1 chart

The hourly picture has price being resisted and a followthrough from the bears will need to take out the near term support in the 1.2950s. If, however, his were to hold the test of time, then the bulls could be encouraged to move in and cack the 1.30 figure again with sights on higher daily highs.

- USD/JPY looks to overstep 130.00 on higher-than-expected US inflation.

- The US inflation print at 8.3% indicates that the Fed needs to struggle more going forward.

- The core CPI has also increased to 6.3% against the forecasts of 6%.

The USD/JPY pair is struggling a little around 130.00 but is likely to accelerate further as the higher-than-expected US Consumer Price Index (CPI) has bolstered the odds of a mega rate hike by the Federal Reserve (Fed) in June.

As per the market consensus, the US CPI was seen at 8.1%, lower than the former figure of 8.5%. While the print of 8.3%, higher than the forecasts has cleared that the Fed has a long way to go and an aggressive hawkish tone will remain on the cards. One thing can be concluded that the inflation is near its peak levels and now the market participants could expect a diminishing rate journey led by higher rates and a quicker balance sheet reduction process.

Meanwhile, the core CPI that excludes food and energy prices has landed at 6.2% higher than the estimates of 6%, which clears that higher energy bills and food prices are not the only expenses that are impacting the real income of the households. The US dollar index (DXY) is attempting to sustain above 104.00 as higher-than-expected CPI has worsened the situation for Fed policymakers.

On the Tokyo front, yen bulls are displaying some strength after a prolonged weak period. The situation of value bet is supporting the yen bulls against the greenback. Although the situation won’t persist longer as the Bank of Japan (BOJ) will continue to stick with its ultra-loose monetary policy, which will dampen the demand for yen sooner rather than later.

- EUR/USD bears moving in around the cycle lows.

- Bears in the verge of taking the euro to fresh lows, but the daily M-formation is compelling.

The price of the euro has been shunned yet again by the bears in an attempt to correct from the cycle lows of 1.0470 this month so far.

The bulls met fierce opposition at the start of May when the price was rejected from a corrective high of 1.0641 in the face of renewed US dollar strength. The bulls have been unable to recover from the sell-off and there are prospects of a downside continuation for the forthcoming days ahead.

As per the prior analysis, EUR/USD Price Analysis: redistribution taking shape?, the EUR/USD price remains in a consolidation phase and it is yet to be seen if this is just a respite or accumulation. However, the price action is leaning more and more bearish as the week moves along:

EUR/USD H4 chart

From a 4-hour perspective, the price could be on the verge of a move lower:

EUR/USD daily chart

From a daily perspective, however, a move lower will leave a bullish reversion chart pattern behind as follows:

As illustrated, the M-formation would be something to note and would require management in case of a move back higher to restest the old support area, or the neckline, of the M-pattern.

Finance Minister Grant Robertson is making a pre-Budget speech to the Wellington Chamber of Commerce, further pushing along Labour’s fiscal agenda for the year.

The speech comes ahead of both the Budget, and the country’s first emission reduction plan which will be unveiled by James Shaw next Monday. Before then, we will have inflation expectations which will bring the central bank sentiment into the forex market for the day ahead.

Robertson has said that New Zealand's short-term inflation challenge is significant and that the economy is facing capacity constraints, and they will set fiscal policy in place with that in mind.

- He says the economy is in a strong position to weather whatever storm.

- Not signalling that they are about to enter a recession. Will return to surplus in 2024/25.

James "Jim" Bullard who is the president and CEO of the Federal Reserve Bank of St. Louis, is crossing the wires and says that he ''won't emphasize single inflation report too much but inflation is more persistent than many have thought.''

His comments, that follow, come after today's Consumer Price Index report that has contributed t markets turning on a dime in recent trade and sell off to session lows.

Key comments

- 50bps hikes at coming meetings "a good benchmark for now".

- Feel goal should be about 3.5% on the Fed funds rate by end of the year.

- Some of April's inflation number is "transitory," but "a big chunk" is likely persistent and will need a policy response.

- "Base case" does not include a three quarter-point rate increase.

- April inflation was "hot" but not far from what was expected.

- Effects of Fed policy being felt quickly in financial markets.

- Says does not think recession risk is that high in the US right now.

- Volatility in stablecoin market does not look "systemic," but is validating to those who perceive them as risky.

Market implications

The markets are in a freefall into the closing bell on Wall Street on hawkish Fed sentiment. Markets have digested the inflation data over the course of the trading day making for swings in risk sentiment and price action across the financial asset classes. It was a mixed report in that the Consumer Price Index climbed 8.3%, higher than the 8.1% estimate but below the 8.5% in the prior month.

Also, the index rose just 0.3% last month, the smallest gain since last August, the Labor Department said on Wednesday, versus the 1.2% MoM surge in the CPI in March, the most significant advance since September 2005. However, ''the fact that the CPI is driven by rents and services implies that price pressures are entrenched and may manifest in upward pressure on wages too,'' analysts at TD Securities argued. The sentiment is weighing on US stocks into the closing bell.

At the time of writing, the Dow Jones Industrial Average is falling some 1% giving up earlier gains to print fresh lows for the session. The S&P 500 slid 1.7% after increasing 0.5% earlier in the session to new session lows and the Nasdaq Composite has dropped by over 3%, currently extending intraday declines while the 2-year yield increased to 2.857% and is aligned closely with Federal Reserve's interest rate policy.

- AUD/USD bears move in after a significant 38% daily correction.

- The focus is on keeping below daily resistance and weekly downside targets.

- US inflation keeps investors hitting the bid on Wall Street, weighing on high beta FX.

AUD/USD is back under pressure into the closing hours on Wall Street as risk sentiment deteriorates. Traders are moving back into the US dollar and selling equities in what has been a volatile trading session for North American markets. At 0.6935, AUD/USD is now printing in the red after falling from a high on the day of 0.7053 to a low of 0.6927.

Markets have digested the inflation data over the course of the trading day making for swings in risk sentiment and price action across the financial asset classes. It was a mixed report in that the Consumer Price Index climbed 8.3%, higher than the 8.1% estimate but below the 8.5% in the prior month.

Also, the index rose just 0.3% last month, the smallest gain since last August, the Labor Department said on Wednesday, versus the 1.2% MoM surge in the CPI in March, the most significant advance since September 2005. However, ''the fact that the CPI is driven by rents and services implies that price pressures are entrenched and may manifest in upward pressure on wages too,'' analysts at TD Securities argued.

Wall Street hitting the bid

As a consequence, we have seen both a bid and an offer in the US dollar and US yields and stocks. The high beta currencies, such as the Aussie, have been pulled along for the ride. In most recent trade, after an initial rally, the Dow Jones Industrial Average is falling some 0.9% giving up earlier gains to print fresh lows for the session. The S&P 500 slid 1.7% after increasing 0.5% earlier in the session to new session lows and the Nasdaq Composite has dropped 3.19%, currently extending intraday declines while the 2-year yield increased to 2.857% and is aligned closely with Federal Reserve's interest rate policy.

''The positive surprise in core prices will not be favourable for currencies not named the US dollar. We think the market is far too premature in reducing the Fed's optionality set for tightening. This should leave the USD resilient for now,'' analysts at TD Securities argued.

Expectations are completely priced in for another hike of at least 50 basis points at the central bank's June meeting, according to CME's FedWatch Tool. The US dollar index, DXY, is making its way back towards the session highs of 104.105 in a firm but slow bullish drift to currently trade at 103.99 which is weighing on the antipodeans as investors assess how aggressive the Fed will be.

For the week ahead, investors will get another look at inflation data on Thursday in the form of the Producer Price Index for April, with expectations of a monthly increase of 0.5% versus the 1.4% jump in March. On an annual basis, expectations are for a jump of 10.7% compared with the 11.2% surge the prior month.

AUD/USD technical analysis

As per the prior session's analysis, AUD/USD Price Analysis: Longer-term 'Shorts' eye a run to June 2020 lows, 0.6776, where the price was expected to make a bullish correction to the 38.2% ...

the bulls moved in on Wednesday and came in within a few pips shy of the target as follows:

If the bears can now stay on top and keep the price below the resistance, 6990, then there will be prospects of an extension all the way to a weekly target as follows:

What you need to take care of on Thursday, May 12:

The American dollar finished the day with gains against most major rivals, although price action was choppy across the FX market. The greenback rallied after the US annual Consumer Price Index printed at 8.3%, higher than the 8.1% anticipated. The monthly figure was up 0.3% against the 0.2% expected. Finally, the annual core CPI hit 6.2%, slightly below the previous 6.5%, but above the 6% expected. Investors were hoping for confirmation inflation would have peaked, but such numbers hint at a long battle ahead to tame price pressures.

Stocks plunged with the news and managed to turn green afterwards, although the positive tone was short-lived. US indexes closed the day in the red. US government bond yields ended the day down amid demand for safety, with the 10-year Treasury note yielding 2.92% at the close.

The EUR/USD pair trades around 1.0520, weighed by central banks’ imbalance. The European Central Bank has decided to catch up with the rest of major central banks. President Christine Lagarde hinted the central bank could hike rates as soon as July as inflation continues to rise. Also, ECB’s Governor Madis Muller noted that the stimulus program known as APP should end in July, while a hike must not be far behind. Another Governing Council Member, Francois Villeroy, added that the central bank would start hiking this summer.

GBP/USD plunged to the 1.2240 price zone, its lowest since May 2020. The Pound was hit by Brexit woes as the EU announced it would suspend its post-Brexit trade deal with the UK if the UK unilaterally revokes the Northern Ireland Protocol

Meanwhile, the European Commission keeps discussing an embargo on Russian oil imports. The main issue is Hungary’s dependence on Russian supplies.

AUD/USD is down, trading at around 0.6930, while USD/CAD stands at around 1.3000. The Japanese yen appreciated against the greenback, with USD/JPY ending the day at 129.85.

Commodities posted modest intraday advances. Gold is trading at around $1,854 a troy ounce, while WTI recovered to $105.00 a barrel.

Why the current XRP price slump has nothing to do with the SEC

Like this article? Help us with some feedback by answering this survey:

- GBP/USD bears are moving back in and have eyes on 1.2251 weekly lows.

- US dollar remains firm as investors price in Fed rate hikes following strong CPI data.

- US stocks are under pressure in a risk-off pivot late in the US session.

GBP/USD is on the backfoot as US session risk sentiment deteriorates. Cable is down some 0.3% at the time of writing around 1.2272 and is extending from a high of 1.2400 to a low of 1.2263.

The US dollar has moved sharply off its lows, turning positive again for the day as markets digest the inflation data from earlier in the US session. While the data showed that inflation has slowed, underlying price pressures remain elevated which is weighing on investor sentiment and US stocks.

The Consumer Price Index climbed 8.3%, higher than the 8.1% estimate but below the 8.5% in the prior month. Also, the index rose just 0.3% last month, the smallest gain since last August, the Labor Department said on Wednesday, versus the 1.2% MoM surge in the CPI in March, the most significant advance since September 2005.

However, ''the fact that the CPI is driven by rents and services implies that price pressures are entrenched and may manifest in upward pressure on wages too,'' analysts at TD Securities argued.

The Dow Jones Industrial Average fell 0.8% giving up earlier gains. The S&P 500 slid 1.3% after increasing 0.5% earlier in the session. The Nasdaq Composite dropped 2.5% and is currently extending intraday declines while the 2-year yield increased to 2.857% and is aligned closely with Federal Reserve's interest rate policy.

''The positive surprise in core prices will not be favourable for currencies not named the US dollar. We think the market is far too premature in reducing the Fed's optionality set for tightening. This should leave the USD resilient for now,'' analysts at TD Securities said.

The dollar index (DXY), which had touched a four-session low of 103.37 ahead of the report, immediately strengthened to a session high of 104.13 in the wake of the data, just below the two-decade high of 104.19 reached on Monday. However, it has been volatile as traders try to unravel the finer details. Investors have been attempting to assess how aggressive the Fed will be.

Expectations are completely priced in for another hike of at least 50 basis points at the central bank's June meeting, according to CME's FedWatch Tool. The US dollar is making its way back towards the session highs in a firm but slow bullish drift which is weighing on the pound.

For the week ahead, investors will get another look at inflation data on Thursday in the form of the Producer Price Index for April, with expectations of a monthly increase of 0.5% versus the 1.4% jump in March. On an annual basis, expectations are for a jump of 10.7% compared with the 11.2% surge the prior month.

UK GDP coming up

The UK's growth data for March will be released on Thursday. ''While the real income squeeze likely put substantial downward pressure on GDP in March, we look for strong growth in accommodation and food services to put overall services sector growth at 0.1% MoM (in line with consensus),'' analysts at TD Securities explained.

''We expect manufacturing growth of 0.5% (mkt: flat), leaving overall GDP growth just in positive territory in the month and at 1% for the quarter.''

GBP/USD technical analysis

The bears have been in control since breaking 1.3670 back in November 2021. The price is making its way into meeting a prior low of 1.2251 which guards a run to mitigate the imbalance of price between there and the 1.2075 May 18 2020 low:

- The price of gold is trying to correct from daily support.

- Bullish correction eyed towards M-formation neckline but bears lurk at a daily 38.2% Fibo.

- US CPI was regarded as a meanwhile relief for financial markets.

At the time of writing, the gold price is some 0.8% higher and correcting from daily support located in the lows of the day at $1,832.07. At $1,853.40, gold is close to the day's highs of $1,858.30. The markets have been centred around US inflation on Wednesday when the Consumer Price Index was released earlier in the North America session.

While the US inflation data reinforces a hawkish sentiment from the Federal Reserve and justifies front loading called for by the Fed's chairman, Jerome Powell, markets were relieved that the data showed a decline in CPI on an annual basis.

CPI climbed 8.3%, higher than the 8.1% estimate but below the 8.5% in the prior month. Also, the index rose just 0.3% last month, the smallest gain since last August, the Labor Department said on Wednesday, versus the 1.2% MoM surge in the CPI in March, the most significant advance since September 2005.

The dollar index, DXY, moved sharply off its lows on the knee jerk as the data came in higher than expected, so it was unlikely to cause the Federal Reserve to adjust its aggressive path of monetary policy. DXY, which hit a four-session low of 103.37 ahead of the report, immediately strengthened to a session high of 104.13 in the wake of the data.

However, the rally came in short of the 20-year high of 104.19 reached on Monday and traders were quick to move in again and sell the US dollar to a fresh season-low of 103.372 before making its way back towards the session highs in a firm but slow bullish drift.

US stocks back under pressure

Markets have digested the data that shows that inflation has slowed, and underlying price pressures remain elevated which is weighing on investor sentiment and US stocks.

''The fact that the CPI is driven by rents and services implies that price pressures are entrenched and may manifest in upward pressure on wages too,'' analysts at TD Securities argued. ''This likely means gold traders will expect the Fed to step up their hawkish signals.''

The Dow Jones Industrial Average fell 0.8% giving up earlier gains. The S&P 500 slid 1.3% after increasing 0.5% earlier in the session. The Nasdaq Composite dropped 2.5% and is currently extending intraday declines while the 2-year yield increased to 2.857% and is aligned closely with Federal Reserve's interest rate policy.

''The positive surprise in core prices will not be favourable for currencies not named the US dollar. We think the market is far too premature in reducing the Fed's optionality set for tightening. This should leave the USD resilient for now,'' analysts at TD Securities said.

The bearish outlook for gold

''Given that positioning is still tilted to the long end of exposure, continued higher-than-expected price prints could easily send gold below $1,830/oz in the not too distant future. Higher nominal and real rates along with less liquidity due to QT are the likely financial market catalysts driving gold,'' the analysts at TD Securities explained.

''If prices dip below the $1,830s support levels, technicians could pull the yellow metal down toward the $1790s fairly quickly.''

Gold technical analysis

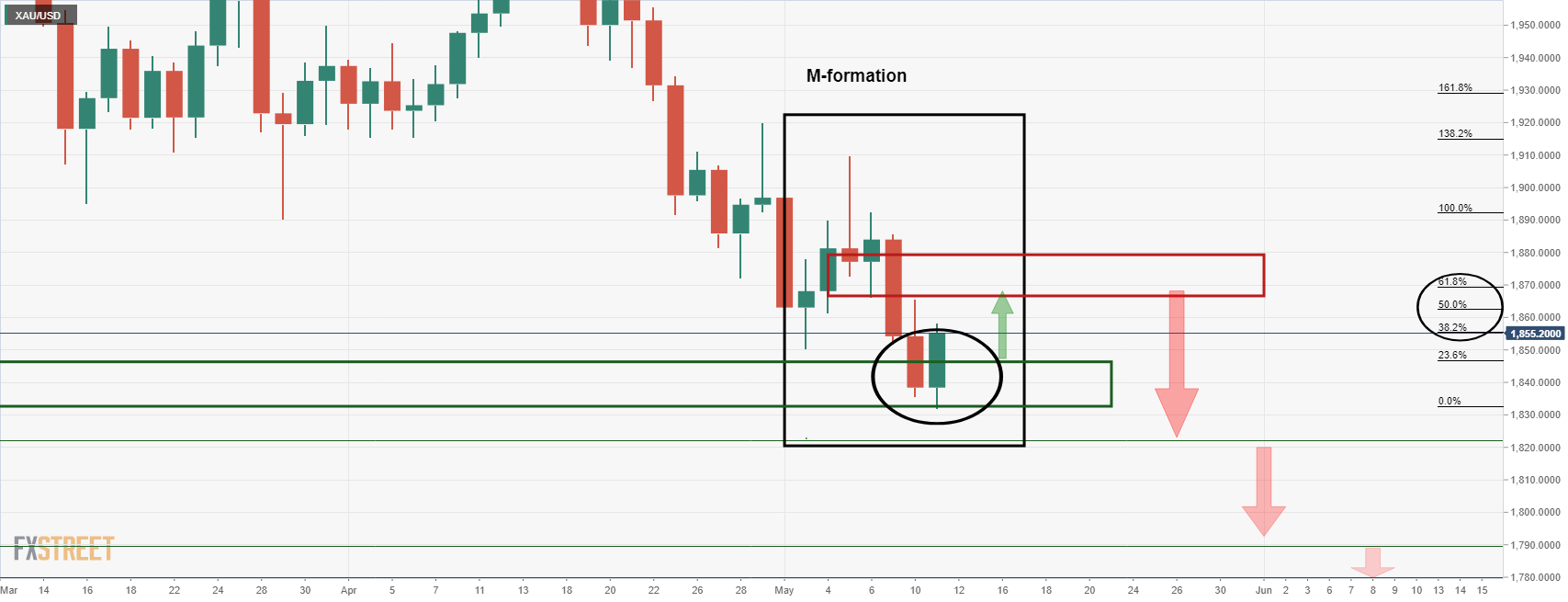

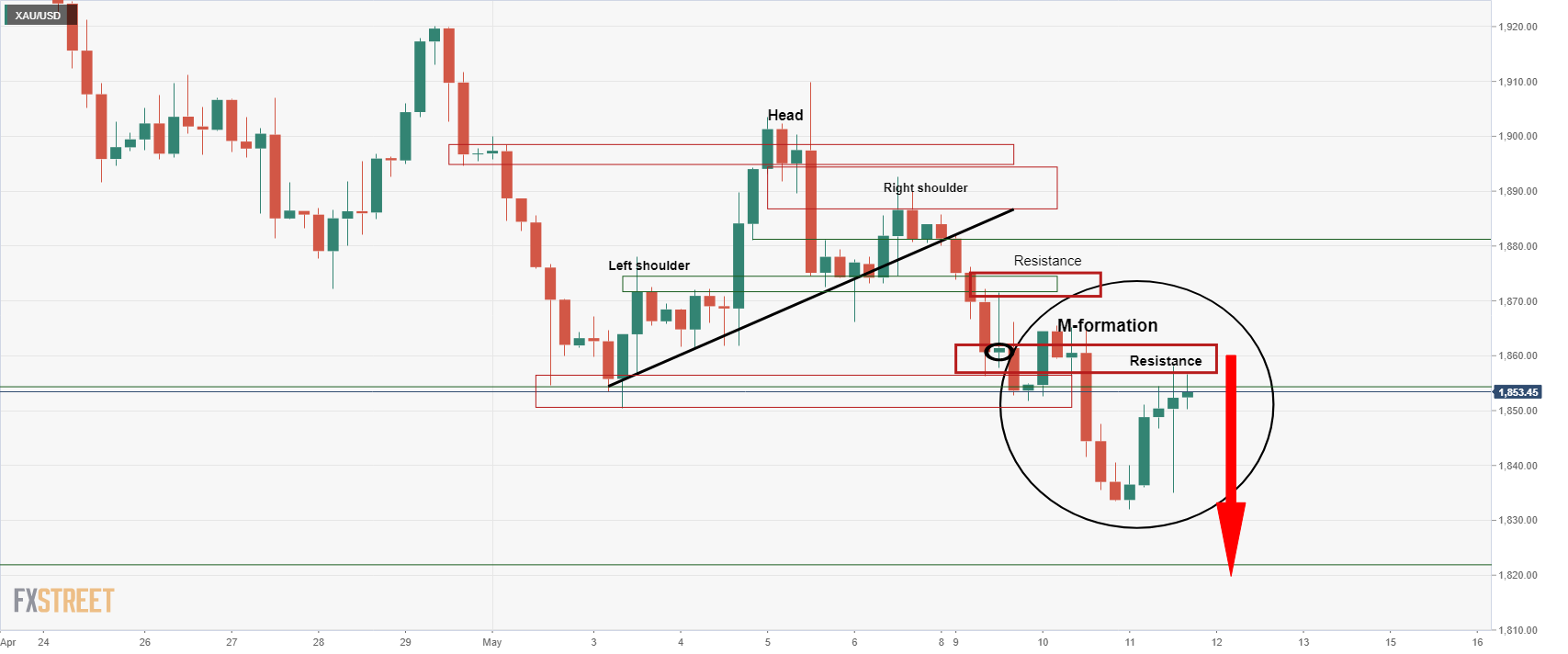

Gold prices had perked up on the news and were moving in on a the M-formation's neckline as follows:

The above charts are daily charts and following a break of a 38.2% Fibonacci resistance at the current highs of the day, there would be prospects of a move into the 50% and 61.8% ratios that align with the M-formation's neckline. However, the 4-hour chart could put up some resistance in the way there:

The 4-hour chart has formed an M-formation also and the resistance of the neckline could lead to a downside continuation. This marks a 38.2% Fibonacci retracement on the daily chart as well.

- US dollar jumps and then makes a full pullback.

- Mexican peso gains on risk appetite, on Thursday Banxico’s decision.

- USD/MXN upside capped by 20.45, testing the 20-day SMA.

The USD/MXN made a run to 20.46 after the release of US inflation data, reaching the highest level in a week. Then, amid a general reversal of the US dollar pulled back all the way down back and printed a fresh daily low at 20.21, slightly above the 20-day Simple Moving Average (SMA).

The 20-SMA at 20.20 is the immediate support level and a break lower should clear the way for a test of an uptrend line at 20.08. Below the line there is not much support until the May low at 19.99, also a horizontal critical area.

The daily RSI and the Momentum turned south, suggesting some strength ahead for the Mexican peso that would be confirmed with a daily close under 20.20.

If USD/MXN remains above 20.25, a new test of 20.45 would remain on the table. The area around 20.45 also contains the 200-day SMA. A consolidation above should clear the way for more gains above the 20.50 horizontal resistance. The next significant barrier is seen at 20.70.

USD/MXN daily chart

-637878828137070246.png)

The key report of the week was released on Wednesday. The annual inflation rate in the US dropped in April to 8.3% from the March 8.5% reading (41-year high). The increase was larger than expected. Analysts at Wells Fargo point out April's CPI data served as a stark reminder that the Federal Reserva has a long road ahead of it in bringing down inflation.

Key Quotes:

“The onslaught of inflation this past year eased somewhat in April with the Consumer Price Index posting its smallest gain in nine months. Prices rose 0.3% over the month compared to consensus expectations for a 0.2% rise. Yet even accounting for the moderation, prices continue to rise at a formidable pace. While the year-over-year rate of CPI inflation slowed for the first time since August, prices are still up 8.3%—a rate unthinkable a year ago.”

“Core inflation rose 0.6% in April, hotter than even our above-consensus call for a 0.5% increase and a pickup from last month's 0.3% rise. After slipping in March, core goods prices rose 0.2% in April. The resilience of core goods prices can be tied to a more modest drop in used vehicles and a 1.1% jump in new vehicles as the BLS incorporated new source data with today's release.”

“Although base effects are starting to help drive the year-over-year rates of inflation lower, that will no longer be the case come mid-summer. With the underlying trend in inflation still well-above what the Fed considers desirable, another 50 bps rate hike at the June 14-15 FOMC meeting seems all but assured, with further hikes of that magnitude highly likely to follow in our view.”

- US April inflation data above expectations triggers volatility.

- US dollar jumps across the board and then tumbles.

- EUR/USD remains sideways in the recent range.

The EUR/USD is marginally higher on Wednesday as it trades around 1.0550 after making sharp moves following the April US CPI. The dollar is falling but is off lows.

Dollar drops as yields pullback and stock rise

The greenback weakened on Wednesday after economic data and amid an improvement in risk sentiment. The Dow Jones is rising by 1.24%, and the Nasdaq gains 0.33%, after a negative opening. At the same time, the US 10-year yield stands at 2.96% after reaching 3.07% following the CPI report.

Inflation in the US rose 8.3% in April compared to a year ago; the number was above 8.1% consensus and marked a slowdown from the 41-year high March reading of 8.5%. The core numbers also rose above expectations, sending the dollar to the upside immediately after the numbers were released.

“The positive surprise in core prices will not be favorable for currencies not named the US dollar. We think the market is far too premature in reducing the Fed's optionality set for tightening. This should leave the USD resilient for now”, said analysts at TD Securities.

Despite volatility, EUR/USD continues to trade sideways, in a range unable to move away from the 1.0550 area. A close above 1.0600 should point to more gains ahead, while on the flip side, the 1.0500 is the immediate support followed by the critical area of 1.0480 that if broken, could trigger a bearish acceleration.

Technical levels

Consumer prices surpassed expectations in April, rising a firm 0.3%. The core index surged above the consensus median as well, posting a strong 0.6% MoM increase. These figures bode well for the US dollar, economists at TD Securities report.

Core services shock

“Consumer prices surpassed expectations in April, rising a firm 0.3% MoM. The core index surged above the consensus median as well, posting a strong 0.6% MoM increase led by strengthening services inflation.”

“The positive surprise in core prices will not be favorable for currencies not named the US dollar.”

“We think the market is far too premature in reducing the Fed's optionality set for tightening. This should leave the USD resilient for now.”

Economists at Commerzbank are seeing depreciation pressure for the Chinese yuan over the coming year. They forecast USD/CNY at 6.70 and 6.80 by the year-end of 2022 and 2023 respectively.

A weakening bias for CNY

“A strong dollar due to policy tightening is likely to the main theme in the coming years, while China has much smaller room to maneuver which implies a downside risk for the Chinese currency.”

“The policy divergence between PBoC and Fed implies a weakening bias for the Chinese currency.”

“We forecast 6.7 and 6.8 for USD/CNY at year-end of 2022 and 2023 respectively.”

- NZD/USD has rebounded to the 0.6350 area on Wednesday as risk appetite steadies, despite hot US CPI data.

- But the outlook for a sustained rebound doesn’t look good, with NZD/USD still trading near its lowest levels since 2020.

- Continued concerns about global growth and central bank tightening could yet send the pair lower.

A broad stabilisation in the market’s appetite for risk (US equities are mostly higher) on Wednesday despite the release of hotter-than-expected US Consumer Price Inflation figures coupled with a broad commodity price rebound has seen shorts on the risk/commodity-sensitive New Zealand dollar pared. NZD/USD was last trading higher by nearly 1.0% on the day in the mid-0.6300s after hitting its lowest level since June 2020 at 0.6276 on Tuesday.

But the pair has struggled to push into the upper 0.6300s amid the presence of key chart resistance levels around the 0.6400 mark. NZD/USD failure to break convincingly back to the north of the 0.6350 mark also reflects broader concerns that Wednesday’s improvement in risk appetite will not last.

Indeed, it’s been a rough couple of weeks for the likes of the global stock market and risk-sensitive currencies like the kiwi. NZD/USD has been on a bearish trajectory for more or less the entirety of the last six weeks, with market participants worried about Fed (and global central bank) tightening to address sky-high inflation even though global growth appears to be quickly slowing. The pair is currently down nearly 10% versus its early April highs.

For the rest of the week, commentary from Fed policymakers and the University of Michigan’s preliminary May Consumer Sentiment survey will be the main focus stateside. NZD/USD traders should also keep an eye on the upcoming release of New Zealand Q1 inflation expectations data, which could impact RBNZ tightening expectations. However, it should be noted that the fact that the RBNZ is well ahead of the Fed regarding the lifting of interest rates, and looks set to remain so, has not prevented NZD/USD’s decline in recent weeks.

US core prices have leaped by 0.6% MoM in April, substantially higher than expected. After dropping to the low $1,840s shortly after the data release, gold popped higher into the $1,850s. Despite today's bounce, stubborn inflation poses downside risks for the yellow metal, strategists at TD Securities report.

Still plenty of long exposure in gold

“The US CPI came in at a higher-than-expected 0.3% MoM, with core also up a higher-than-expected 0.6%. While inflation is down to 8.3% and 6.2% y/y in April, it is higher than was anticipated and may suggest that inflation is more entrenched than the Fed is anticipating.”

“The fact that the CPI is driven by rents and services implies that price pressures are entrenched and may manifest in upward pressure on wages too. This likely means gold traders will expect the Fed to step up their hawkish signals.”

“Given that positioning is still tilted to the long end of exposure, continued higher-than-expected price prints could easily send gold below $1,830/oz in the not too distant future.”

“If XAU/USD dips below the $1,830s support levels, technicians could pull the yellow metal down toward the $1,790s fairly quickly.”

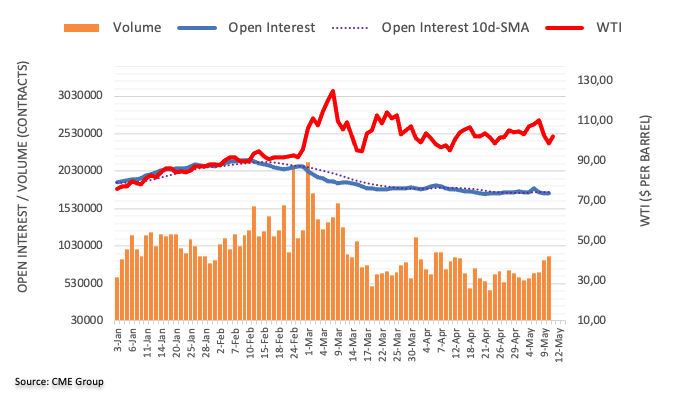

- Oil is on the front foot on Wednesday with geopolitics in focus amid disruption to gas flows to Europe via Ukraine.

- WTI has rallied nearly $6.0 on the day to the $105.00s, though is still down over $5.0 on the week.

Global oil prices, though still substantially lower on the week, have seen solid gains on Wednesday, with front-month WTI futures posting an aggressive recovery from earlier session lows underneath the $100 per barrel mark. WTI is now trading above the $105.00 level, still about $5.0 below earlier weekly highs, but up nearly $6.0 on the day.

The ongoing downturn in global equity markets (led by US tech) as investors fret about central bank tightening amid still sky-high inflation and a slowing global growth impulse can be attributed as causing the pullback from recent highs above $110. But fears about supply shortages as a result of the Russo-Ukraine war continue to entice dip-buying upon retests of the $100 level.

Those fears have been in focus in recent weeks as the EU wrangles its way closer to an agreement on a ban on all Russian oil imports, a move that commodity strategists think would be devastating to the country’s producers. Hungary is for now blocking a final deal on the embargo, the latest reporting on the issue suggests, but it seems a compromise is soon likely to be reached.

Meanwhile, gas flows to Europe via Ukraine have been disrupted for the first time amid alleged interference in a major transit route by occupying Russian forces (so Ukraine says), marking the first disruption to gas flows in the country since the war started two and a half months ago. This is likely also to be giving oil markets some support on Wednesday.

WTI bulls will be hoping for a retest of recent highs above $110 in the coming days, though so long as broader risk appetite remains on the ropes, this will be a difficult task to manage. In the immediate future, crude oil traders will be monitoring official weekly US crude oil inventory data out at 1530BST after private weekly inventory data on Tuesday showed a surprise build.

The tensions have calmed somewhat on the markets since the start of the Ukraine war, and the Swiss franc is less in demand as a safe haven. Economists at Commerzbank see EUR/CHF higher in the course of the year but only moderately.

Dovish SNB

“The SNB is likely to want to stick to the status quo for the time being. As long as risk aversion does not pick up more strongly again, the franc could trend weaker due to the SNB's monetary policy stance. Moreover, if the ECB initiates its turnaround in July, the EUR should gain.”

“We see EUR/CHF strengthening somewhat in the course of the year. However, only moderately since the SNB should then ultimately raise its key rate in July as well.”

“Against the USD, the franc should appreciate somewhat in the course of the year, when it becomes clear that the SNB is also initiating the turnaround in monetary policy. However, since the Fed will probably act much more actively, we see USD/CHF at higher levels again next year.”

Another session of range-trading for the EUR/USD leaves the pair’s technical picture looking broadly intact. Economists at Scotiabank note that the 1.05 and 1.06 levels remain solid support and resistance, respectively.

Losses below 1.05 find support at the late April low of 1.0472

“The 1.05 and 1.06 figure areas remain solid support and resistance zones, respectively, while the broad trend in the EUR points to this consolidation period eventually giving way to further losses to a five-year-low.”

“Intraday support ahead of the figure is ~1.0525 while the daily high of ~1.0575 stands as intermediate resistance followed by ~1.0585 ahead of the figure zone.”

“Losses below 1.05 find support at the late Apr low of 1.0472.”

- USD/TRY clinches new 2022 peaks near 15.40.

- Turkey 10y bond yields rise above 24.00%.

- Markets’ attention no shift to the CBRT event in late May.

The Turkish lira remains on the defensive and pushes USD/TRY to new YTD peaks in the vicinity of 15.40 on Wednesday.

USD/TRY in 5-month highs

USD/TRY posts gains for the fifth consecutive session on Wednesday and extends the recent breakout of the 15.00 barrier on the back of the persistent sell-off in the Turkish currency.

Indeed, the lira drops to levels last seen back in late December 2021, as the currency remains under heavy pressure following prospects of a longer-than-anticipated military conflict in Ukraine and its potential impact on energy prices.

In the meantime, investors continue to closely follow any indication of intervention by the Turkish central bank (CBRT) in the FX markets in order to prevent the lira to depreciate to unwelcomed levels.

The CBRT meets again on May 26 and market participants have already started to price in another “on hold” stance from the central bank, despite inflation rose to almost 70% in the year to April.

What to look for around TRY

The lira broke below the multi-week range bound theme vs. the greenback and lifted USD/TRY to the area beyond the 15.00 neighbourhood. So far, price action in the Turkish currency is expected to gyrate around the performance of energy prices, the broad risk appetite trends, the Fed’s rate path and the developments from the war in Ukraine. Extra risks facing TRY also come from the domestic backyard, as inflation gives no signs of abating, real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Key events in Turkey this week: Unemployment Rate (Tuesday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Upcoming Presidential/Parliamentary elections.

USD/TRY key levels

So far, the pair is gaining 0.38% at 15.3059 and faces the next hurdle at 15.3746 (2022 high May 11) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a drop below 14.6836 (monthly low May 4) would expose 14.5458 (monthly low April 12) and finally 14.5136 (weekly low March 29).

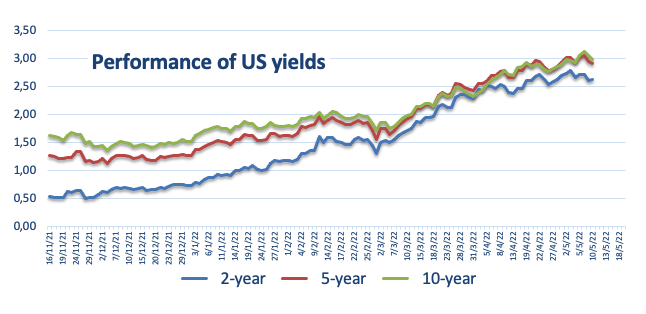

The past month has seen significant further increases in US yields, with 10Y US Treasury yields rising to 3%. Economists at Danske Bank expect yields to peak in six months.

10-year US yields to peak six months from now

“We now expect 10Y Treasury yields to increase to 3.5% in the course of the next 6 to 12 months. We previously expected an increase to 3.1%.”

“Note that we have now pencilled in a peak for yields in 6 months’ time. On a 12-month horizon, we estimate that markets will seriously begin to price short rates at close to peaking and the next shift in rates to be downwards – not least, if the economic cycle turns out weaker in 2023 than we expect.”

- USD/JPY faded stronger US CPI-led intraday bullish spike and retreated to the 130.00 mark.

- The formation of a double-top and ascending trend-line breakdown favours bearish traders.

- Weakness below the 100-period SMA on the 4-hour chart will reaffirm the negative bias.

The USD/JPY pair caught aggressive bets during the early North American session and shot to the daily high in reaction to stronger-than-expected US consumer inflation figures. The momentum, however, ran out of steam near the 130.80 region and the subsequent pullback dragged spot prices back closer to the 130.00 psychological mark.

Looking at the broader picture, this week's pullback from a fresh two-decade high, around the 131.35 region touched on Monday, constitutes the formation of a bearish double-top on short-term charts. A subsequent slide below an ascending trend-line extending from late March could be seen as a fresh trigger for bearish traders.

The negative outlook is reinforced by the fact that technical indicators on hourly charts have just started drifting into bearish territory. Some follow-through selling below the 100-period SMA on the 4-hour chart will reaffirm the bearish bias and pave the way for some meaningful corrective slide for the USD/JPY pair.

Spot prices could then accelerate the fall towards intermediate support near the 129.35 region before eventually dropping to the 129.00 round-figure mark. The downward trajectory could further get extended towards testing the 128.25-128.20 region en-route the 128.00 mark and the 127.70-127.65 support zone.

On the flip side, the 130.70-130.75 region now seems to have emerged as an immediate strong resistance ahead of the 131.00 mark. Some follow-through buying would negate the near-term bearish bias and allow the USD/JPY pair to surpass the recent swing high, around the 131.35 region, and aim to conquer the 132.00 round figure.

USD/JPY 4-hour chart

-637878745052326385.png)

Key levels to watch

- USD/CAD has been choppy in wake of US CPI, but has ultimately fallen back below 1.2950 as crude prices rise.

- However, the sour tone to trade in US equities hampers the prospect for a broader loonie rebound.

- USD/CAD hit its highest level since November 2021 on Tuesday in the mid-1.30s.

USD/CAD saw a momentary jump higher in recent trade in wake of hotter than forecast US Consumer Price Inflation data and came close to testing Tuesday’s multi-month highs in the mid-1.3000s. However, almost as quickly as the pair rose, it has reversed lower again and recently fell back to the 1.2950, where it trades with on the day losses of about 0.5%.

Global crude oil prices have regained their poise after dipping earlier in the week and this is helping the loonie to recover from its weakest levels against the US dollar since November 2021. But the downbeat tone to US (and global) equity markets presents a barrier to USD/CAD trading any lower or testing support in the 1.2900 area.

US equities, with which the risk-sensitive loonie has been closely correlated (as has also been the case with other risky currencies) in recent weeks, are under pressure once again on Wednesday as investors fret about what the latest US inflation figures mean for the Fed policy outlook. Investors are concerned about the Fed tightening aggressively this year and next to stymie still elevated inflation despite a weakening global growth outlook.

Even though the BoC is arguably even more hawkish than the Fed, this hasn’t been enough to shield the risk-sensitive loonie from the impact of the downturn in risk appetite in recent weeks. The BoC will be in focus later this week when its Deputy Governor Toni Gravelle speaks on the topic of commodities, growth and inflation on Thursday. Traders will listen closely, as he could offer further hints about the outlook for interest rates.

- GBP/USD quickly recovered around 75 pips from the post-US CPI slide to the 1.2275 area.

- The USD witnessed selling following the release of a stronger US CPI and extended support.

- Negative Brexit headlines, a bleak outlook for the UK economy should cap any further gains.

The GBP/USD pair reversed the post-US CPI slide during the early North American session and was last seen trading with modest intraday gains, around mid-1.2300s.

The headline US CPI rose 0.3% MoM in April and the yearly rate decelerated to 8.3% from 8.5%. This, however, was still above consensus estimates pointing to a reading of 0.2% and 8.1%, respectively. Adding to this, core CPI, which strips out volatile food and energy prices, climbed 0.6% during the reported month, surpassing the 0.4% expected.

This comes amid tight global supply chains resulting from China's zero-covid policy and the war in Ukraine and suggested that inflationary pressures are likely to remain high in the next few months. Nevertheless, the data reaffirmed bets for a more aggressive policy tightening by the Fed, which was evident from a sharp spike in the US Treasury bond yields.

The US dollar, however, witnessed a typical 'buy the rumour, sell the news' kind of trade and also seemed rather unaffected by a turnaround in the global risk sentiment. This, in turn, assisted the GBP/USD pair to rebound swiftly from the 1.2275 area, though any meaningful upside seems elusive and the attempted recovery runs the risk of fizzling out rather quickly.

Against the backdrop of the Bank of England's gloomy economic outlook last week, the UK economic think-tank - NIESR - warned that Britain is on course to enter a technical recession in the second half of 2022. This, along with negative Brexit-related headlines, should act as a headwind for the British pound and cap gains for the GBP/USD pair, at least for the time being.

A spokesperson for UK Prime Minister Boris Johnson said that Northern Ireland Protocol (NIP) talks are in a serious situation. Britain reserves the right to take further action if solutions cannot be found urgently, the spokesman added further. Separately, an EU official threatened that the EU is ready to suspend its post-Brexit trade deal and might also halt talks regarding Gibraltar if the UK unilaterally revokes the NIP.

Hence, it will be prudent to wait for strong follow-through buying before confirming that the GBP/USD pair has bottomed out in the near term and positioning for a further appreciating move. Nevertheless, spot prices, for now, seem to have snapped a four-day losing streak and are holding comfortably above the YTD low, around the 1.2260 region touched earlier this week.

Technical levels to watch

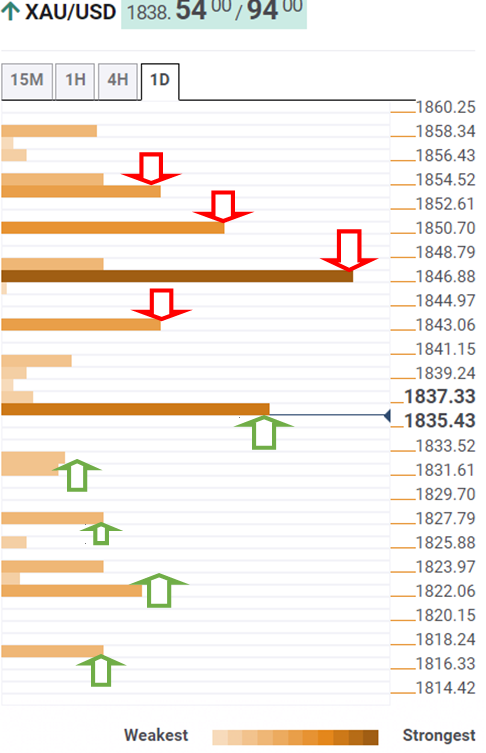

- Gold has pulled back from earlier highs in the $1850s in wake of hotter than forecast US CPI data.

- XAU/USD is for now being supported by its 200DMA in the mid-$1830s.

- But for how long the 200DMA can hold amid rising US yields and buoyant buck remains to be seen.

After rebounding from a test of its 200-Day Moving Average at $1835 during Asia Pacific trade to as high as the $1850s during the late European morning, spot gold (XAU/USD) prices have slipped up once again following hotter than expected US inflation data. Prices are back to trading in the low $1840s, after market participants upper their Fed tightening bets on the back of a larger than expected MoM in Core price pressures.

At current levels, XAU/USD still trade about 0.3% higher on the day, with demand ahead of the 200DMA for now remaining robust. But in wake of the US inflation data, US yields have turned sharply higher, with the 10-year back above 3.0% from the low 2.90s%, while and the DXY also bounced to the upper 103.00s. Both are eyeing a test of recent multi-year highs.

Against the backdrop of buoyant US yields (which represent a higher “opportunity cost” of holding non-yielding assets like gold) and a stronger US dollar (which makes USD-denominated commodities more expensive for international buyers, it feels like a matter of time under XAU/USD drops under its 200DMA.

That would open the door to a run lower towards the psychologically important $1800 level and a test of annual lows around $1780 just below it. Gold bulls will be hoping for fresh negative developments regarding Western sanctions on Russian energy exports (an EU embargo to be agreed soon?) and China lockdowns (Beijing and Shanghai are still struggling to contain infections) to spur safe-haven/inflation protection demand and avert a drop back under $1800.

- Silver prices have pulled lower from earlier highs near $22.00 following hotter than expected US inflation data.

- XAG/USD is back under $21.50 and eyeing a move to fresh multi-year lows under $21.00 as hawkish Fed bets build.

Spot silver (XAG/USD) prices have fallen back sharply from earlier session highs in the upper $21.00s per troy ounce and are now back to trading back under the $21.50. At current levels in the $21.40s, on-the-day gains have now been pared to about 1.0%. Just released US Consumer Price Index data showed a slower than expected moderation in the YoY rate of headline price pressures and a larger than expected jump in MoM Core price pressures in April.

The US dollar and US yields jumped as a result and this explains the recent pullback in XAG/USD. Some traders had been hoping for a moderation in inflation pressures to ease the pressure on the Fed to tighten monetary policy so aggressive this year and next. The latest data certainly doesn’t do that, hence the rebuilding of some hawkish Fed bets.

After breaking out to its lowest levels under $21.20 since mid-2020 on Tuesday, XAG/USD attempted rebound has been cut short. Should the US dollar and yields continue to press higher, a drop towards $21.00 certainly seems on the cards. A break lower would open the door to an eventual drop to the next area of key support under the $20 mark.

- EUR/USD gives away initial gains and challenges the 1.0500 region.

- ECB-speakers advocated for a rate hike this summer.

- US CPI rose more than expected in April.

The initial reaction to the release of US CPI sent EUR/USD back to the negative territory in the boundaries of the 1.0500 zone on Wednesday.

EUR/USD looks supported near 1.0500

EUR/USD now alternates gains with losses around the 1.0500 neighbourhood after US inflation figures showed the headline CPI rise at an annualized 8.3% in April, and the Core CPI advance 6.2%. Despite both prints came above initial estimates, they eased a tad from the previous readings, hinting at the possibility that consumer prices could have peaked in March.

The higher-than-predicted CPI figures encouraged US yields to make a U-turn and now advance modestly along the curve.

Earlier in the session, ECB’s Lagarde suggested the APP could end early in Q3, while normalization will be at a gradual pace following the initial rate hike. Previous comments from ECB Board members also advocated for the first rate hike at some point this summer.

What to look for around EUR

EUR/USD revisits the 1.0570/80 band following the choppy performance of the greenback on Wednesday. The outlook for the pair still points to the bearish side, always in response to dollar dynamics, geopolitical concerns and the Fed-ECB divergence. Occasional pockets of strength in the single currency, in the meantime, should appear reinforced by speculation the ECB could raise rates at some point in the summer, while higher German yields, elevated inflation and a decent pace of the economic recovery in the region are also supportive of an improvement in the mood around the euro.

Key events in the euro area this week: Final Germany Inflation Rate, ECB Lagarde (Wednesday) – EMU Industrial Production (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Impact on the region’s economic growth prospects of the war in Ukraine.

EUR/USD levels to watch

So far, spot is gaining 0.05% at 1.0529 and faces the next up barrier at 1.0641 (weekly high May 5) followed by 1.0936 (weekly high April 21) and finally 1.1000 (round level). On the other hand, a break below 1.0470 (2022 low April 28) would target 1.0453 (low January 11 2017) en route to 1.0340 (2017 low January 3 2017).

- AUD/USD surrendered a major part of its intraday gains in reaction to stronger US CPI print.

- The US CPI report reaffirmed aggressive Fed rate hike bets and boosted demand for the USD.

- A turnaround in the risk sentiment also benefitted the safe-haven buck and exerted pressure.

The AUSD/USD pair fell over 60 pips in reaction to hotter-than-expected US consumer inflation figures and was last seen trading with only modest intraday gains, just below mid-0.6900s.

The Bureau of Labour Statistics reported this Wednesday that the headline US CPI rose 0.3% MoM in April as against consensus estimates pointing to a reading of 0.2%. The yearly rate also surpassed market expectations and climbed 8.3% during the reported month. Core inflation, which excludes food and energy prices, came in at 0.6% MoM and 6.2% YoY rate as against 0.4% and 6% anticipated, respectively.

The data suggested that inflationary pressures in the world's biggest economy are peaking, though were strong enough to reaffirm market bets for a more aggressive policy tightening by the Fed. In fact, the markets are still pricing in a further 200 bps rate hike for the rest of 2022 amid concerns that China's zero-covid policy and the war in Ukraine might continue to push consumer prices higher.

Apart from this, a turnaround in the global risk sentiment - as depicted by a sharp intraday slide in the equity markets - boosted demand for the safe-haven US dollar and exerted downward pressure on the AUD/USD pair. The emergence of fresh selling at higher levels suggests that the recent downtrend witnessed over the past one month or so might still be far from over and favours bearish traders.

Technical levels to watcha

- Headlines CPI came in at 8.3% YoY, above the expected 8.1%.

- Measures of core inflation were also hotter than forecast.

- The DXY jumped as a result and is now probing the 104.00 level once again.

The annual pace of headline inflation in the US according to the Consumer Price Index (CPI) fell to 8.3% in April from 8.5% in March, according to the latest release from the Bureau of Labour Statistics on Wednesday. That was above the expected decline to 8.1% YoY. The MoM pace of headline inflation fell to 0.3% in April from 1.2% in March, also above the expected drop to 0.2%.

Measures of core inflation according to the Core Consumer Price Index also came in above expectations. The YoY rate clocked 6.2%, below March's 6.5%, but above the expected drop to 6.0%, while the MoM saw a larger than expected jump to 0.6% from 0.3% in March versus the expected 0.4% reading.

Market Reaction

The US Dollar Index (DXY) jumped to print fresh session highs near 104.00 as a result of the higher than expected inflation readings, especially given the MoM pick up in the pace of Core CPI inflation. These numbers will worry the Fed and underpin expectations for aggressive tightening this year and next.

There is a risk that high inflation becomes entrenched, ECB Executive Board member Isabel Schnabel said on Wednesday in a speech. As a result, its time to conclude the measures that were enacted to combat low inflation, she continued, adding that policy action is required for price stability.

- GBP/JPY dropped to a two-week low in reaction to the incoming negative Brexit headlines.

- The gloomy UK economic outlook further undermined the GBP and exerted some pressure.

- The risk-on impulse dented demand for the safe-haven JPY and helped limit further losses.

The GBP/JPY cross quickly recovered over 60 pips from a two-week low touched during the mid-European session and was last seen trading in neutral territory, around mid-160.00s.

The British pound weakened a bit in reaction to negative Brexit-related headlines, which, in turn, was seen as a key factor that exerted some downward pressure on the GBP/JPY cross. A spokesperson for UK Prime Minister Boris Johnson said that Northern Ireland Protocol (NIP) talks are in a serious situation. Britain reserves the right to take further action if solutions cannot be found urgently, the spokesman added further.

Separately, an EU official warned that the EU is ready to suspend its post-Brexit trade deal and might also halt talks regarding Gibraltar if the UK unilaterally revokes the NIP. This comes on the back of the Bank of England's gloomy economic outlook. Moreover, the UK economic think-tank - NIESR - noted that Britain is on course to enter a technical recession in the second half of 2022, which further weighed on sterling.

On the other hand, strong recovery in the global risk sentiment - as depicted by a generally positive tone around the equity markets - dented the Japanese yen's safe-haven status. Apart from this, the Bank of Japan's dovish monetary policy stance kept a lid on any meaningful gains for the JPY and assisted the GBP/JPY cross to rebound swiftly from sub-160.00 levels. The mixed fundamental backdrop warrants some caution for aggressive traders.

Technical levels to watch

- EUR/USD regains upside traction and retests 1.0570.

- The weekly high at 1.0641 emerges as the next target of note.

EUR/USD keeps the choppy trade well and sound above the 1.0500 region so far this week.

While further consolidation remains likely in the very near term, occasional bouts of strength could see the pair initially targeting the round level at 1.0600 prior to the more relevant weekly high at 1.0641 (May 5).

Above the 3-month line near 1.0920, the selling pressure is expected to alleviate somewhat. This area reinforces the weekly high recorded on April 21 at 1.0936.

EUR/USD daily chart

- GBP/USD is subdued in the mid-1.2300s in the run-up to the release of US CPI data.

- Sterling has been resilient to increased negative Brexit newsflow and forecasts for a UK recession in H2 2022.

- Some are saying a lot of bad news is already in the price, but political risk limits rebound potential.

Despite the increasingly concerning tone to Brexit newsflow, with the EU threatening to revoke its trade deal with the UK should the latter unilaterally scrap the Northern Ireland Protocol (as it has been jawboning about this week), and despite a UK-based economic think tank forecasting that the UK will be in a technical recession in the second half of this year, GBP/USD continues to trade in a stable fashion in the mid-1.2300s and is well with recent intra-day ranges.

After recent big moves to the downside, some are arguing that a lot of pessimism about the UK economy (and thus the outlook for BoE monetary policy tightening), is already in the price, limiting the scope for further near-term downside in cable. Meanwhile, subdued FX market trade in the run-up to key US Consumer Price Inflation data at 13:30 BST should not be too surprising. Traders tend to refrain from placing big bets ahead of big, potentially market-moving events.

US inflation data is expected to moderate versus recent months and some are saying this could induce some USD profit-taking as traders scale down the excessiveness of recent hawkish Fed bets. That could offer GBP/USD a modest short-term lift, perhaps back into the 1.2400s. But as political jawboning about the NIP and post-Brexit trade deal from the UK and EU gets louder, this could prevent sterling from making any further substantial gains.

There has been no progress on Wednesday towards an agreement on an embargo of Russian oil imports at a meeting between ambassadors of EU 27 nations, a WSJ reporter wrote on Twitter. According to the reporter, some are beginning to think a EU 27 leaders summit is going to be needed to reach an agreement on this.

Hungary has been the main opponent of a Russian import oil embargo and reports earlier suggested the EU might be considering giving the country financial compensation.

US CPI Overview

Wednesday's US economic docket highlights the release of the critical US consumer inflation figures for April, scheduled later during the early North American session at 12:30 GMT. The headline CPI is anticipated to rise by 0.2% during the reported month, down sharply from the 1.2% rise reported in March, suggesting that inflationary pressures in the world's biggest economy are peaking. The yearly rate is also projected to have decelerated from 8.5% in the previous month to 8.1% in April. Core inflation, which excludes food and energy prices, is expected to rise 0.4% MoM and come in at a 6% YoY rate as compared to 0.3% and 6.5%, respectively, in March.

According to Eren Sengezer, Editor at FXStreet: “coronavirus-related restriction measures and lockdowns in China remained in place throughout the month, suggesting that supply-chain challenges are likely to continue to drive prices higher. In the meantime, consumer demand remains healthy in the US. The strong consumer demand combined with higher input and energy prices in the private sector indicates that inflationary pressures are likely to remain high in the next couple of months.”

How Could it Affect EUR/USD?

The markets seem convinced that the US central bank would need to take more drastic action to bring inflation under control. A stronger than expected CPI print would further boost bets for a more aggressive policy tightening by the Fed and push the US bond yields higher, along with the US dollar. Conversely, a softer reading might do little to ease recession fears, which should continue to benefit the greenback's safe-haven status. Apart from this, concerns that the European economy will suffer the most from the Ukraine crisis suggest that the path of least resistance for the EUR/USD pair is to the downside.

Meanwhile, Eren Sengezer offered a brief technical outlook for the EUR/USD pair: “The Relative Strength Index (RSI) indicator on the four-hour chart rose above 50 early Wednesday, pointing to a bullish tilt in the near term. Additionally, EUR/USD continues to trade above the 20 and 50-period SMAs on the same chart, confirming the view that sellers remain on the sidelines.”

Eren also outlined important levels to trade the major: “On the upside, 1.0600 (psychological level, Fibonacci 23.6% retracement of the latest downtrend) aligns as key resistance. With a four-hour close above that level, further recovery gains toward 1.0630 (100-period SMA) and 1.0660 (Fibonacci 38.2% retracement) could be witnessed. Supports are located at 1.0540 (20-period SMA, 50-period SMA), 1.0500 (psychological level and 1.0470 (multi-year low set on April 26).”

Key Notes

• US April CPI Preview: Has inflation peaked?

• US CPI Preview: Hard core inflation to propel dollar to new highs, and two other scenarios

• EUR/USD Forecast: Euro could break out of weekly channel on US CPI

About the US CPI

The Consumer Price Index released by the US Bureau of Labor Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of USD is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or Bearish).

The EU is ready to suspend its post-Brexit trade deal with the UK if the UK unilaterally revokes the Northern Ireland Protocol (NIP), reported Bloomberg on Wednesday citing an EU official. The EU might also halt talks regarding Gibraltar if the UK acts unilaterally on the Brexit deal, the EU official warned.

NIP talks are in a serious situation, a spokesperson for UK PM Boris Johnson said on Wednesday, adding that whilst the UK prefers a negotiated solution, it reserves the right to take further action if solutions cannot be found urgently.

- DXY extends its consolidation in the upper end of the recent range.

- Immediately to the upside comes the 2022 peak near 104.20.

DXY comes under some selling pressure and drops well below the 104.00 mark on Wednesday.

According to the recent price action, the index could face some consolidation in the very near term. The break above this theme could open the door to a visit to the 19-year high at 104.18 (May 9) prior to the round level at 105.00, which precedes 105.63 (December 11 2002 high).