- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 19-10-2021

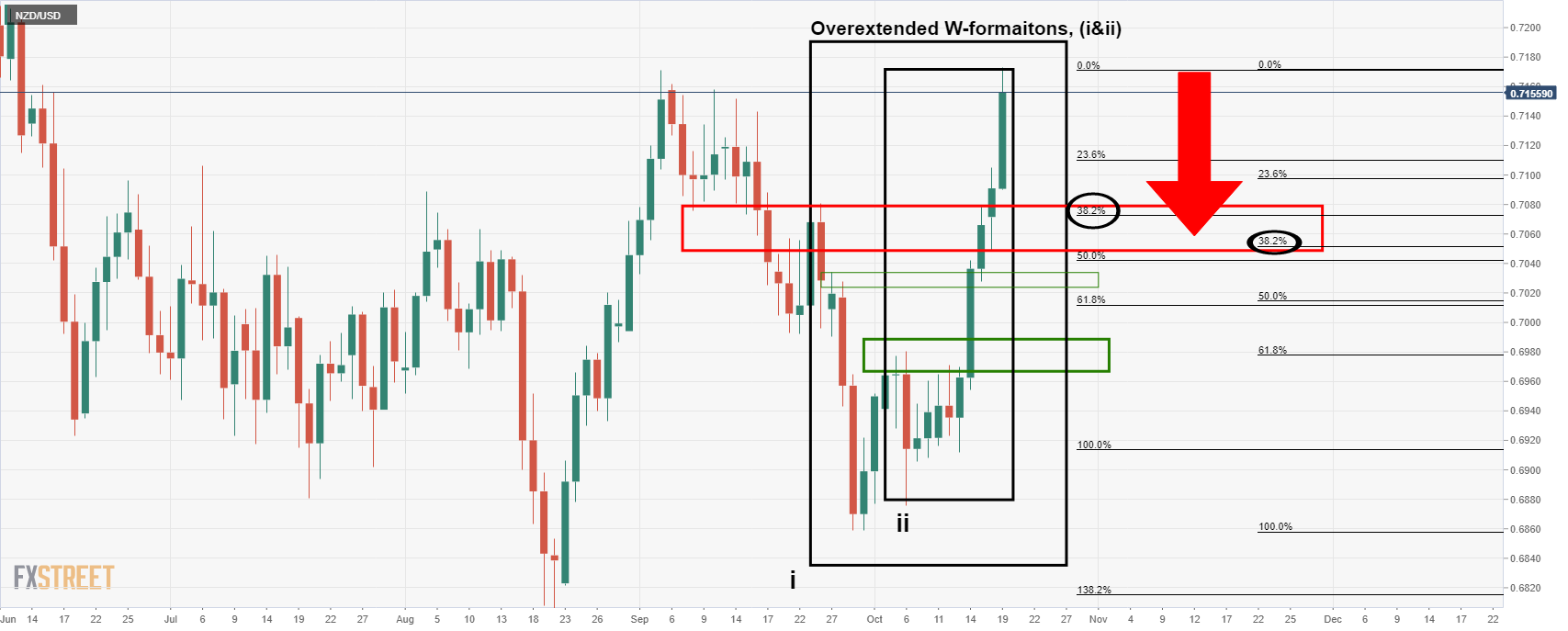

- NZD/USD bulls are moving in on critical hourly resistance.

- There are bullish fundamentals at play, but the rally is overextended, relative to historic price action.

NZD/USD has fallen from the highs of the experiential rally that .started on Oct 13 as the greenback started to tail off before the more recent catalyst in New Zealand's inflation data. At the time of writing, NZD/USD is trading at 0.7150 and flat ahead of the Tokyo open and fix that could kick start some price action in Asia today.

''The Kiwi is around 80bps higher than it was 24hrs ago, having benefited from a combination of USD weakness and its own credentials, with good performance seen on most crosses,'' analysts at ANZ Bank noted.

Earlier in the week, New Zealand's Consumer Price Index (CPI) was reported to have risen 2.2% in the third quarter, beating expectations and surging at the fastest pace in over a decade driven by housing-related costs and other supply constraints, data released on Monday showed.

Statistics New Zealand said in a statement. CPI rose 2.2% in the quarter ending September from a rise of 1.3% in the second quarter, the biggest quarterly movement since a 2.3% rise in the December 2010 quarter. Annual inflation surged 4.9% compared to a rise of 3.3% in the previous quarter, also the biggest annual movement in more than a decade.

The data beat analysts' expectations in a Reuters poll and forecasts of the Reserve Bank of New Zealand (RBNZ), both of which put the quarterly inflation rise at 1.4%, lifting annual inflation to 4.1%.

''While the reaction seems delayed and had been haphazard, the sharp move higher in short-end interest rates looks to now be impacting. Yesterday we changed our OCR call; we now expect six more hikes – one at each meeting between now and August, taking the OCR to 2%,'' analysts at ANZ Bank said, adding:

''Perhaps more importantly, we have also lifted our inflation forecasts. In an environment of still well-anchored inflation expectations, that speaks to the RBNZ being ahead of the pack and cyclically higher rates, which should benefit the NZD.''

NZD/USD technical analysis

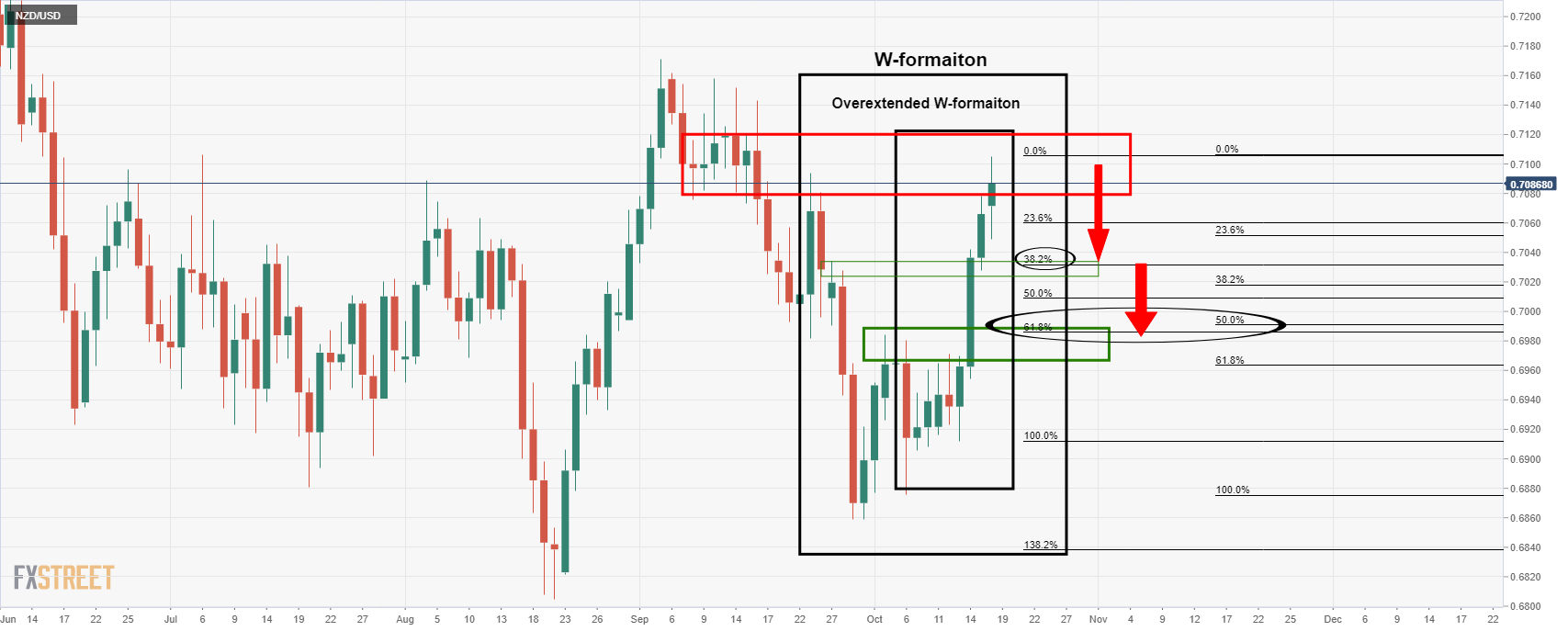

- NZD/USD Price Analysis: Countertrend traders to eye 0.7050

''The 38.2% Fibonacci channel between Wi and Wii offers a target area between 0.7080 and 0.7050 as the closest round numbers, the latter being aligned to the weekly counter trendline.''

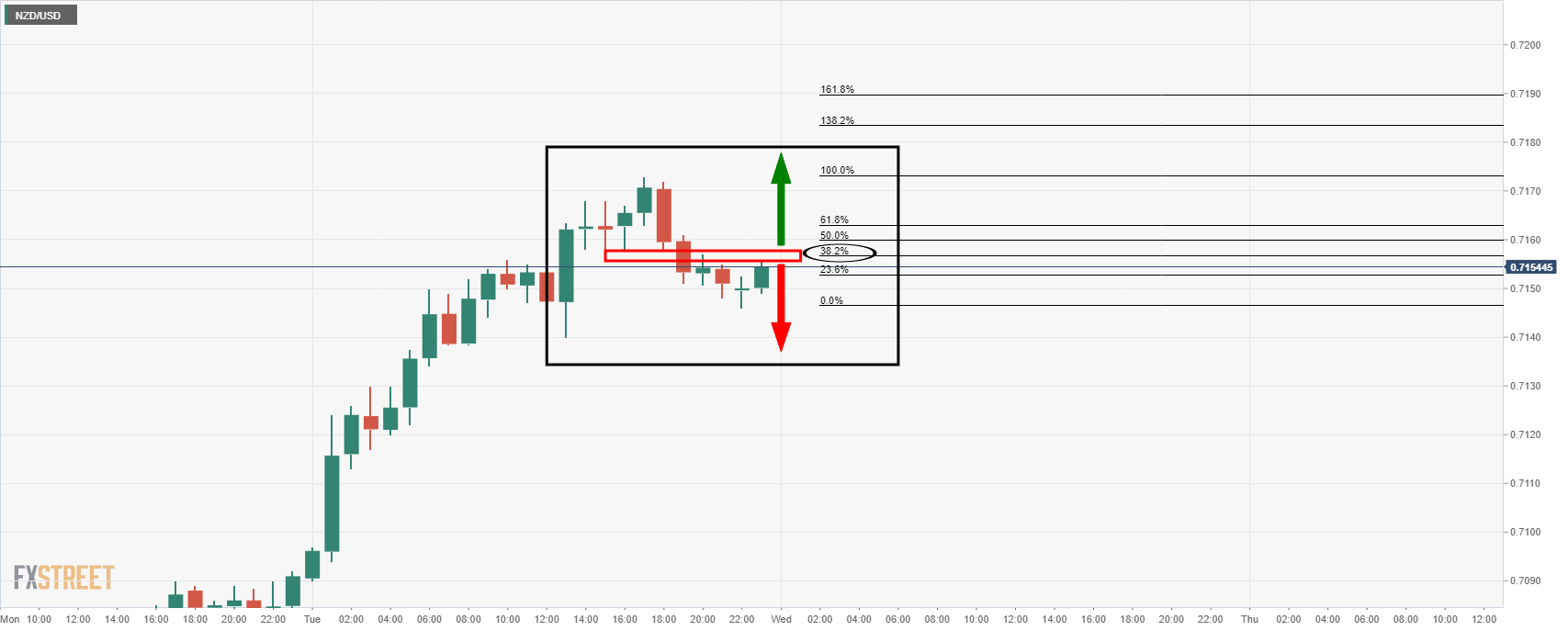

From an hourly perspective, however, the price is moving in on the M-formation as follows:

The price is making a 38.2% retracement to the neckline that would be expected to hold. This could lead to a downside 1-hour bearish impulse in the sessions ahead. If it breaks the neckline, then there will be prospects of some consolidation and a potential upside continuation from the newly formed bullish structure in coming sessions.

- EUR/GBP licks its wounds near 20-month low, stays inside bearish chart pattern.

- Downbeat momentum, sustained trading below 200-SMA favor sellers.

- Monthly horizontal hurdle adds to the upside barriers.

EUR/GBP stays defensive around 0.8430 amid Wednesday’s Asian session. In doing so, the cross-currency pair remains near the lowest levels since February 2020, test the last week, while staying inside a two-week-old descending trend channel.

Given the downbeat Momentum line and the pair’s inability to rebound from the multi-month low, EUR/GBP bears remain hopeful of visiting the 0.8400 threshold.

However, the support line of the stated channel, near the 0.8400 round figure, will restrict the quote’s further weakness.

Should EUR/GBP bears keep reins past 0.8400, the year 2020’s low near 0.8280 will be in focus.

Meanwhile, corrective pullback needs to defy the bearish chart pattern by crossing the channel’s resistance line, close to 0.8455 by the press time.

Following that, a horizontal area from September 16 and 200-SMA, respectively near 0.8500 and 0.8535, will challenge the EUR/GBP buyers.

EUR/GBP: Four-hour chart

Trend: Bearish

- The GBP/JPY continue its rally for the third consecutive week, trades at five-month highs.

- Positive market sentiment weighs on the Japanese yen, boosts the British pound.

- GBP/JPY: The weekly chart depicts the possibility of a break of a trading range, opening the door for higher prices.

The GBP/JPY edges higher as the Asian session begins, up 0.13%, trading at 157.88 at the time of writing. Positive market sentiment surrounds the financial markets, depicted by Asian equity futures rising between 0.67% and 2.17%, except for the Nikkei 225 falling 0.04%. Furthermore, risk-sensitive currencies like the British pound, the Australian, and the New Zealand dollar, rallied against the safe-haven status Japanese yen.

GBP/JPY Price Forecast: Technical outlook

The weekly chart depicts the GBP/JPY is breaking to the upside, leaving February 2018 resistance level around 156.61 as its first support. A weekly close over the abovementioned could open the way towards the March 2016 swing highs around 163.90. A breach of the latter would open a test of the February 2015 highs around 175.02.

On the flip side, failure at 156.61 could open the way for further losses. The first support level would be psychological 156.00. A break below that level would exert downward pressure on the pair, exposing vital support levels, as the September swing highs around 153.42, followed by the 150.00 psychological level.

The Relative Strength Indes (RSI) is at 67, indicating that upward pressure remains in place. However, as it is closer to overbought conditions, the GBP/JPY pair could print a correction before resuming the upward trend.

- USD/CHF edges lower on Wednesday in the Asian session.

- Higher highs and higher lows depict the upside trend in the pair since August 30.

- MACD holds onto the overbought zone with receding upside momentum.

USD/CHF remains muted on Wednesday in the initial Asian trading hours. After testing the low of 0.9185 in the US session, the pair managed to close higher while composing more than a 50-pips movement. At the time of writing, USD/CHF is trading at 0.9298 down 0.02% for the day.

On the daily chart, the USD/CHF pair has been trading in a rectangle formation in a range of 0.9220 and 0.9230 since September 15. The spot showed a weakening trend after it slipped below the 21-day Simple Moving Average (SMA) at 0.9275. Further, the mid-term uptrend from the low of 0.9018 made on August 4 invalidated after USD/CAD breaks below the bullish slopping line in the previous session.

Having said that, If the price break below the intraday low it could immediately test the psychological 0.9200 mark followed by the low made on September 15 at 0.9163. Furthermore, the Moving Average Convergence Divergence (MACD) trades in the overbought zone with receding upside momentum. Any downtick in the MACD would encourage the USD/CHF bears to test the 0.9140 horizontal support level.

Alternatively, if the price reverses direction then the possibility of meeting the 0.9250 horizontal resistance level emerges. A daily close above the 21-day SMA will fuel the upside rally toward the 0.9300 horizontal resistance level, and then the October, 1 high of 0.9337.

- GBP/USD grinds higher around five-week top after cheering broad US dollar weakness.

- BOE rate hike concerns joined risk-on mood to favor bulls.

- UK coronavirus fears, Brexit jitters challenge upside ahead of British CPI for September.

- US stimulus, Fed tapering concerns may also entertain traders.

GBP/USD seesaws around 1.3800 as traders brace for the key inflation data during Wednesday’s Asian session. The cable pair cheered hopes of the Bank of England’s (BOE) rate hike, as well as broad US dollar weakness, to refresh the multi-day high the previous day. However, challenges surrounding the UK’s covid conditions and Brexit woes probed the bulls.

Bloomberg quotes BOE Governor Andrew Bailey’s latest comments to highlight the rate hike chatters. “Speaking to an online panel organized by the Group of 30, Bailey said that while central banks don’t have the tools to counter supply disruptions and he still believes the recent acceleration of inflation will be temporary, officials need to seek to prevent higher inflation expectations from becoming entrenched,” said the news.

On a different page, the US dollar eased after the downbeat housing data cooled down tapering tantrums. US Housing Starts registered a sharp fall in September, -1.6% MoM versus +1.2% prior, whereas the Building Permits registered the largest contraction since February, down 7.7% compared to 5.6% previous readouts. That being said, the US Dollar Index (DXY) dropped to a three-week low before consolidating losses around 93.77 at the latest.

It’s worth noting that the risk-on mood helped the Wall Street benchmarks to poke record tops whereas the US 10-year Treasury yields gained 5.7 basis points (bps) to rise to the highest levels since late May by the end of Tuesday’s North American session.

Alternatively, the UK recorded the highest coronavirus-led daily death numbers since March 9 the previous day. “The weekly rate of new reported cases of Covid-19 in the UK is one of the highest in the world, having jumped from 367 cases per 100,000 people at the start of October to its current level of 463 per 100,000,” said the HuffPost UK.

Also negative for the GBP/USD prices were Brexit headlines quoting UK Minister David Frost who pushes the bloc for easing controls over the Northern Ireland (NI) border. However, UK PM Boris Johnson sounds optimistic noting job losses and disruption to capital flows have been lower than feared, per Bloomberg.

Given the latest supply crunch and fresh reflation chatters, any uptick in the UK CPI, expected to remain unchanged at 3.2% YoY in September, may well anchor the expectations of a BOE rate hike in 2021, which in turn could propel the GBP/USD further towards the north.

Read: UK September CPI Inflation Preview: Will rising price pressures boost British pound?

Technical analysis

In addition to the 100 and 200-DMA, respectively around 1.3810 and 1.3850, a downward sloping resistance line from July 30, close to 1.3860, also challenges GBP/USD upside. However, sellers may refrain from fresh entries until the quote stays beyond the 50-DMA level surrounding 1.3710.

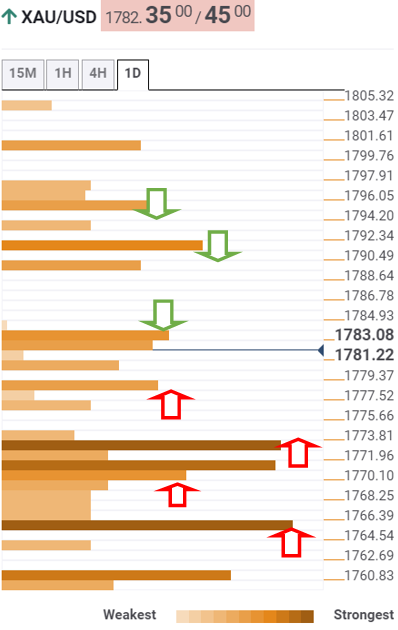

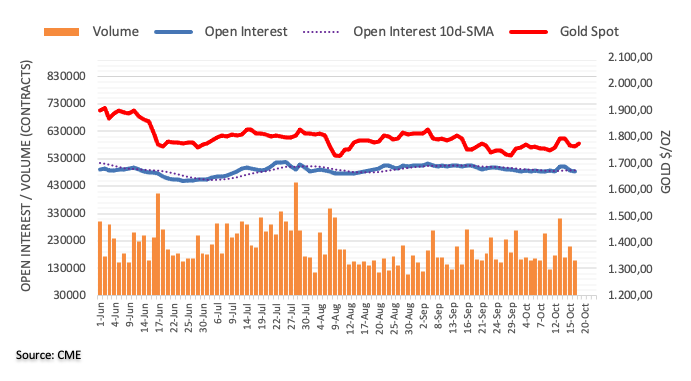

- Precious metals benefit from US dollar weakness to rival currencies.

- The stagflation themes feed through into the precious metals hedge.

- Gold price remains bound by daily dynamic support.

Gold is subdued and rests in familiar territory awaiting the next major catalyst to kick start it into gear within bullish territory towards the psychological $1,800 level. At the time of writing, XAU/USD is trading at 41,769 and flat in Asia, so far.

Precious metals are finding support from the stagflation theme that has been brewing in recent weeks as well as weakness in the US dollar. The greenback had struggled against its rivals on Tuesday in a bout of profit-taking as rival currencies of central banks that are on the verge of lift-off play catch-up. The moves in forex are denting the US dollar's appeal that had otherwise benefitted by expectations of sooner-than-previously expected interest rate hikes.

''Market pricing for Fed hikes is far too hawkish,'' analysts at TD Securities argued. ''This suggests gold is an ideal hedge against rising stagflationary winds, and reasons to own the yellow metal are growing more compelling as Fed pricing is likely to unwind.''

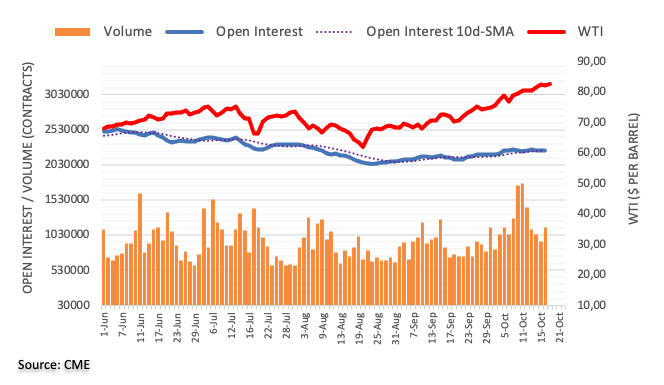

US Oil (WTI) extends higher

The analysts added that a ''cold winter could send energy prices astronomically higher, potentially pricing-out industries and fueling price asymmetries in markets — which translates into a fat right tail for gold prices. Chinese brokers have also increased their net length in SHFE gold, pointing to increased appetite for the yellow metal amid a growing wall of worry.''

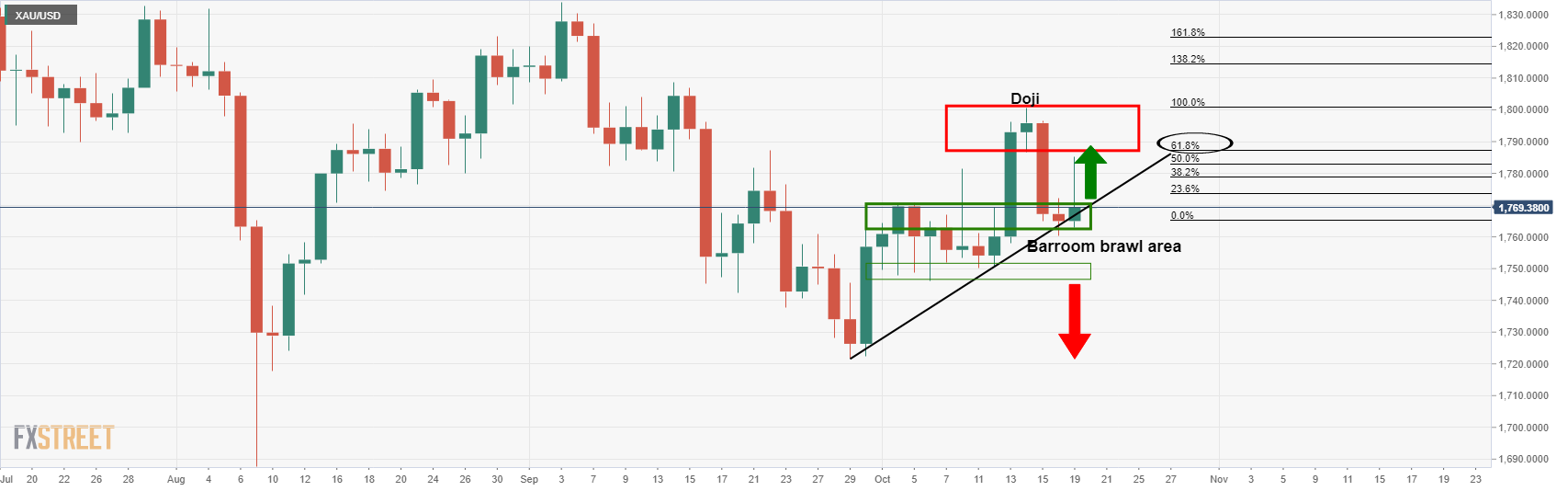

Gold technical analysis

For an in-depth technical analysis of gold, see here: Gold Chart of the Week: XAU hit the $1,800 target, now what?

However, at a snapshot, we are likely to see some consolidation to continue to play out:

The price is consolidated unfamiliar territory mid-week and resting by the dynamic trendline support. A move beyond $1,800 is required if the bulls are going to take charge again, or otherwise, a break below the barroom brawl area and $1,750 will open the risk of a downside continuation.

This can be illustrated better from a weekly perspective, as follows:

The price has met a 61.8% Fibonacci retracement of the prior bearish impulse. This is significant and could lead to a break below the dynamic support. A fresh bearish impulse to the downside in the coming weeks would, however, be in contrast to the fundamental stagflation theme.

- USD/JPY trades virtually unchanged on Wednesday in the initial Asia session.

- The US dollar trades below 94.00 despite higher US T-bond yields.

- US spending bill, hawkish Fed members, and higher equities rule traders' decisions.

USD/JPY remains muted on Wednesday, extending the previous session’s momentum. The pair stays in a relatively narrow price band, after hovering near the daily highs in the US session. At the time of writing, USD/JPY is trading at 114.37, up 0.02% for the day.

The US benchmark 10-year Treasury bond yields trade at 1.64%, for the first time since May. As investors continue to anticipate the Fed’s tapering next month amid rising inflationary pressure and soaring energy prices. The weaker housing data dented the sentiment, which kept the greenback below 94.00.

The US Building Permits fell 7.7% in September whereas Housing Starts dropped 1.6%. The comments from Fed’s Governor Christopher Waller that a more aggressive policy might be required if higher inflationary pressure persists limits the losses for the buck.

Meantime, US President Joe Biden and Democratic lawmakers were close to a deal on the cost and scope of their cornerstone economic revival package as per Reuters.

On the other hand, the Japanese yen lost its ground on improved risk sentiment. It is worth noting that, S&P 500 Future is trading at 4,512, up 0.02% for the day.

As for now, traders are waiting for Japan's Balance of Trade data, and US Fed’s Quarles speech to gauge the market sentiment.

USD/JPY additional levels

- USD/CAD seesaws within a 30-pip trading range, edging higher of late.

- Risk-on mood, strong WTI crude oil prices battle multi-day-old horizontal support.

- US EIA Crude Oil Stocks Change, Canada CPI will be important catalysts to watch.

USD/CAD struggles to keep the bounce off at the lowest levels since early July, taking rounds to 1.2365-70 amid Wednesday’s Asian session. In doing so, the Loonie pair stays within the immediate trading range between 1.2375 and 1.2345 amid a brighter mood and upbeat prices of Canada’s key export item, WTI crude oil.

The USD/CAD dropped to the lowest since early July during Tuesday before bouncing off 1.2311 horizontal support, established in late April. The rebound also took clues from a pullback in oil prices after downbeat weekly inventory data from the industry source, namely the American Petroleum Institute (API). API Weekly Crude Oil Stock rose past 2.233M forecast to 3.294M for the period ended on October 15. It’s worth noting that the previous readout was 5.213M.

It’s worth noting that the latest comments from Fed Governor Christopher Waller also underpinned the USD/CAD rebound. “If inflation keeps rising at its current pace in coming months rather than subsiding as expected, Federal Reserve policymakers may need to adopt ‘a more aggressive policy response’ next year,” said the Fed policymaker per Reuters.

On the contrary, the downbeat US housing numbers questioned the Fed’s tapering plans. US Housing Starts registered a sharp fall in September, -1.6% MoM versus +1.2% prior, whereas the Building Permits registered the largest contraction since February, down 7.7% compared to 5.6% previous readouts.

Against this backdrop, the Wall Street benchmarks poked record tops whereas the US 10-year Treasury yields gained 5.7 basis points (bps) to rise to the highest levels since late May by the end of Tuesday’s North American session. Further, the US Dollar Index (DXY) dropped to a three-week low before consolidating losses around 93.77 at the latest. That being said, S&P 500 Futures struggle for clear direction amid uncertainty over US stimulus and Fed tapering tantrums by the press time.

Looking forward, the official weekly oil inventory data from the Energy Information Administration (EIA), expected 2.233M versus 6.088M prior, will direct short-term oil prices and help USD/CAD traders. However, Canada’s Consumer Price Index (CPI) for September, market forecast 4.3% YoY versus 4.1% prior, as well as the BOC CPI Core which is expected to improve to 0.3% from 0.2% previous readings, will be crucial for USD/CAD moves. Should the oil prices stay firmer around multi-month top amid supply outage fears, also backed by hopes of improving demand, upbeat Canadian data may weigh on the pair.

Technical analysis

A horizontal area comprising multiple levels marked since late April challenge USD/CAD bears near 1.2315-10. The corrective pullback also takes clues from the upside break of a monthly resistance line, now support around 1.2350. Even so, the pair buyers remain cautious until the quote rises past the 100-DMA level of 1.2510 on a daily closing basis.

- AUD/JPY: The prevailing trend still tilted to the upside on the back of the interest rate differentials.

- AUD/JPY: Monday’s doji was a pause for bulls, as witnessed by a 100 pip jump on Tuesday, which printed a fresh five-month high.

- AUD/JPY: An upside break opens the door to 2018 highs around 89.00.

The AUD/JPY edges low as the Asian session kicks in, barely down 0.01%, trading at 85.46 at the time of writing. Positive market sentiment through the New York session found some follow through as Asian equity futures rise between 0.67% and 2.17%. Solid US third-quarter corporate earnings spurred risk-on mood in the market, as energy prices stabilized around familiar levels, like US crude oil benchmark WTI, which sits around $82.36 per barrel.

AUD/JPY Price Forecast: Technical outlook

Back to the AUD/JPY cross-currency pair, it is trading at five-month highs. At press time, the daily chart depicts the cross-currency is approaching the May 10 high, at 85.80, a strong resistance level. In the case of an upward break above the latter, December 5, 2017, high at 86.84 would be the first resistance level. A breach of the abovementioned could expose crucial supply zones towards 89.00, but it would find some hurdles on the way, like January 10, 2018, low at 87.20, followed by January 31, 2018, high at 88.49.

On the flip side, failure at 85.80 could send the AUD/JPY sliding lower. A daily close below the 84.27 level could trigger a downward move towards the before resistance-now support area around 83.80. A breach of the latter would expose the 200-day moving average (DMA) at 82.47.

The Relative Strength Index (RSI), a momentum indicator, is at 81, in overbought levels, indicating that the AUD/JPY might consolidate before resuming the upward move, confirmed by the daily moving averages (DMA’s), which are located well below the spot price.

- Silver eases after refreshing a six-week high, consolidates the heaviest daily jump in a week.

- Sustained break of the key trend line resistances, now supports, join firmer RSI line to direct bulls toward 100-DMA.

- Two-month-old horizontal support adds to the downside filters.

Silver (XAG/USD) steps back from the highest levels since early September, easing to $23.65 during the initial Asian session on Wednesday. Even so, the bright metal keeps the latest upside breaks of the previous key resistance lines.

Also favoring the silver buyers is the firmer RSI line, not overbought, as well as a successful run-up beyond horizontal support established since August 20.

That being said, the XAG/USD bulls are well-directed towards the 100-DMA, around $24.70 by the press time.

However, September’s high around $24.85-90 and 50% Fibonacci retracement of the May-September downside of the metal, close to $25.10, will challenge the quote’s further upside.

Alternatively, a downward sloping trend line from early July, near $23.40, acts as immediate support for the commodity before highlighting the resistance-turned-support line from June 10, close to $23.05.

Even if the XAG/USD sellers manage to conquer the $23.05 support, the $23.00 threshold and aforementioned horizontal line near $22.88 will be important to watch.

Silver: Daily chart

Trend: Further upside expected

- AUD/USD grinds higher around three-month top after the heaviest daily jump in seven weeks.

- Upbeat market sentiment underpinned stocks, US Treasury yields refresh five-month high.

- RBA Meeting Minutes offered no surprise, IMF comments on China failed to stop the bulls.

- Aussie Westpac Leading Index, PBOC Interest Rate Decision eyed for fresh impulse.

AUD/USD bulls take a breather around 0.7475-80 during early Wednesday morning in Asia, following its heaviest daily jump since late August. The risk barometer pair cheered US dollar weakness amid a brighter mood to refresh the multiday high the previous day. However, strong resistance around 0.7480 challenges the quote’s further upside of late.

Global market sentiment improved on Tuesday after the downbeat US housing number questioned the Fed’s tapering plans. Also positive for the AUD/USD was a lack of any surprises from the Reserve Bank of Australia’s (RBA) Monetary Policy Meeting Minutes, as well as easing coronavirus fears at home.

Additionally, chatters that the US Democrats are close to the much-awaited economic stimulus offered extra strength to the risk appetite and the AUD/USD prices. “President Joe Biden and Democratic lawmakers are close to a deal on the cost and scope of their cornerstone economic revival package and hope to reach a compromise this week, people briefed on the negotiations said on Tuesday,” per Reuters.

US Housing Starts registered a sharp fall in September, -1.6% MoM versus +1.2% prior, whereas the Building Permits registered the largest contraction since February, down 7.7% compared to 5.6% previous readouts. Further, the RBA Meeting Minutes was a copy of September wherein the policymakers reiterated cautious optimism while cutting down the reflation fears.

Elsewhere, the International Monetary Fund (IMF) expects the Chinese economy to grow by 8% in 2021 but added that the economic recovery remains unbalanced, per Reuters. The news also said, “China's economic setbacks have darkened the outlook for countries in its orbit, from South Korea to Thailand, as a sharp factory slowdown and trade bottlenecks in the world's second-largest economy hit Asia on the supply as well as demand sides.”

Amid these plays, the Wall Street benchmarks flirt with the record tops whereas the US 10-year Treasury yields gained 5.7 basis points (bps) to rise to the highest levels since late May. Further, the US Dollar Index (DXY) dropped to a three-week low before consolidation losses around 93.77 at the latest.

Looking forward, Australia’s Westpac Leading Index for September, prior -0.27%, will precede the People’s Bank of China (PBOC) Interest Rate Decision and China Housing Price Index for September, previous readouts 4.2%, will be important data/events for AUD/USD traders. Although the PBOC isn’t expected to alter monetary policy, strong defense from financial market risks emanating from reality companies’ defaults can’t be ruled out, which in turn could help Aussie bulls.

Technical analysis

AUD/USD needs a daily closing beyond the four-month-old horizontal hurdle surrounding 0.7480 to justify a 100-DMA breakout. Bullish MACD and a clear cross of the key moving average keep buyers hopeful to aim for 0.7530-35 resistance line, established in early April. However, RSI conditions seem nearly overbought and hence bulls may take a breather but the stated 100-DMA and an ascending support line from September 30, respectively around 0.7405-7400, restrict the bear’s entry.

AUD/USD: Daily chart

Trend: Further upside expected

Reuters reported that President Joe Biden and Democratic lawmakers are close to a deal on the cost and scope of their cornerstone economic revival package and hope to reach a compromise this week, people briefed on the negotiations said on Tuesday.

However, this is little news to markets as the US House of Representatives Speaker Nancy Pelosi had previously set Oct. 31 as the deadline for the House to pass a $1.2 trillion infrastructure deal. Additionally, the Senate has already approved and has broad bipartisan support.

''Biden held a busy day of meetings with lawmakers, seeking to close what may be the signature effort of his administration, a multitrillion-dollar, two-bill legislative package that expands social safety net programs and infrastructure spending,'' Reuters reported.

''One source said a deal could be announced midweek if things go well, a second said the White House was hoping for an announcement in coming days.''

''A spending package that was originally estimated at $3.5 trillion could be $1.9 to $2.2 trillion, Representative Pramilia Jayapal, the chair of the Progressive Caucus said at the White House after meeting with Biden.''

''Any final deal is likely to severely curtail Biden's initial ambition. Initiatives in his original proposal that may see cuts include $322 billion for affordable housing, money for paid family leave and some $400 billion earmarked to increase home-based care for the elderly and disabled, according to a person familiar with the matter.''

- S&P 500, Nasdaq climb for 5th straight session as investors cheer earnings.

- The S&P 500 led the gains in percentage points of 0.74% followed by the Nasdaq Composite that added 107.28 points, or 0.71%.

- The Dow Jones Industrial Average was the laggard and rose 199.36 points or 0.57%.

Wall Street's benchmarks got a boost on Tuesday from the technology and healthcare sectors as investors cheered strong quarterly reports. Notably, in its fifth straight session of gains, the benchmark S&P 500 index neared its early September record high. Analysts now expect S&P 500 earnings to rise 32.4% from a year earlier, according to Refinitiv data.

In healthcare, Johnson & Johnson raised its 2021 adjusted profit forecast which lifted the S&P 500 while insurer Travelers Cos Inc TRV climbed after beating third-quarter profit estimates. In other earnings-related outcomes, high-profile technology and communications companies were also big contributors to the S&P's gain with Apple Inc AAPL, Facebook FB and Microsoft MSFT all rising.

Meanwhile, the CBOE market volatility index hit its lowest level since mid-August during the session. Unofficially, the Dow Jones Industrial Average rose 199.36 points, or 0.57%, to 35,457.97, the S&P 500 gained 33.3 points, or 0.74%, to 4,519.76 and the Nasdaq Composite added 107.28 points, or 0.71%, to 15,129.09.

In related markets, the 10-year US Treasury yield increased 5.1 basis points to 1.635% and West Texas Intermediate crude oil climbed to a multi-year high of $83.72 a barrel. DXY, a measure of the US dollar vs a basket of rival currencies recovered from the lows of 93.50 and targets 93.80 at the close with higher levels eyed:

US dollar 1-hour chart

As illustrated, the price has retested the neckline of the W-formation and is now making tracks towards 93.80. A break there opens risk towards 93.87 18 Oct lows.

DJIA daily chart

- EUR/USD extends its five-day rally, trades above 1.1600.

- A weaker dollar boosts the EUR/USD pair, despite surging US 10-year yields, above 1.641%.

- EUR/USD: The target of an inverse head-and-shoulders is 1.1750, but first, euro bulls need to reclaim 1.1700.

The EUR/USD climbs during the New York session, up some 0.22%, trading at 1.1636 at the time of writing. The market sentiment remains upbeat, as major US stock indices record gains between 0.46% and 68%, while the safe-haven status of the US dollar weakens across the board.

The euro extended its five-day rally, though weaker, reclaimed the 1.1600 figure. The US dollar sell-off witnessed the US Dollar Index drop below the 94.00 threshold despite higher US T-bond yields, with the 10-year coupon, rallying almost six basis points, sitting at 1.641%, at press time.

EUR/USD Price Forecast: Technical outlook

The daily chart of the EUR/USD shows that an inverse head-and-shoulders formed around the 2021 lows, indicating the EUR/USD is under some buying pressure. The inverse head-and-shoulders pattern measured target is 1.1750, near the 50% Fibonacci retracement, which could resume the long-term downward move towards a renewed test of 2021 lows.

To challenge US dollar bulls, euro buyers will need a daily close above 1.1800, near the 100-day moving average (DMA). In that outcome, the September 14 high at 1.1846 would be the first resistance level, followed by the 1.1900.

On the flip side, to resume the downward trend, US dollar bulls will need to push the EUR/USD below the 1.1600 threshold. If EUR/USD sellers exert enough pressure to spur a daily close below 1.1600, a challenge of the 2021 lows around 1.1524 is on the cards.

The Relative Strength Index (RSI), a momentum indicator, is at 48, trending slightly up, indicating that buying pressure is piling on the EUR. However, caution is warranted, as the RSI remains below the 50-midline.

Netflix (NFLX) announced Q3 results after the close on Tuesday. Q3 Earnings Per Share came in ahead of estimates at $3.19 versus $2.56 estimate. Revenue was in line, coming in at $7.48 billion versus the $7.48 estimate.

Netflix (NFLX) stock forecast

Netflix (NFLX) stock is trading up just over 1% in Tuesday's after market.

- The US dollar has found its feet in the US session and has started to carve out a bullish structure.

- There is room for an upside extension to target 93.80/90.

The price of the US dollar, as measured by the DXY index vs a basket of rival currencies, has recovered from the 93.50 targets and is embarking on a run to 93.80 at the time of writing.

US dollar 1-hour chart

As illustrated, the price has retested the neckline of the W-formation and is now making tracks towards 93.80. A break there opens risk towards 93.87 18 Oct lows.

US yields and dollar to continue higher

In confluence, US yields are rising and the 10year benchmark is printing a fresh daily high of 1.642% with 1.706% now eyed 13 May pivot. ''Global yields are stabilizing after yesterday’s panic moves,'' analysts said but argued that the inflation debate is by no means settled, not with supply chain issues and higher commodity prices still percolating through the system.

''As we wrote yesterday, this debate will likely take weeks, if not months, before some sort of definitive conclusion can be reached. However, we are confident that US rates and the dollar will continue rising throughout this debate.''

What you need to know on Wednesday, October 20:

The American dollar edged lower against high-yielding rivals and remained flat against those considered safe-havens as the market’s sentiment somehow improved. Global indexes closed in the green, with speculative interest ignoring tepid macroeconomic figures.

The EUR/USD pair hit a three-week high of 1.1669 but ended the day in the 1.1630 price zone, as demand for the EUR was capped by comments from ECB’s Lane. The chief economist said that medium-term inflation pressures are under the central bank’s target, somehow suggesting a longer wait-and-see stance.

GBP/USD trades around 1.3800, backed by speculation the BOE will soon start raising rates. The UK will publish inflation figures on Wednesday and may trigger some wild action in the pound’s crosses.

The Australian dollar was the best performer, advancing up to 0.7485 against the greenback and retaining its intraday gains. The USD/CAD pair fell to 1.2310 but trimmed losses ahead of the close.

Crude oil prices maintained their positive tone, with WTI settling at $82.20 a barrel. Gold surged intraday but finished the day with modest gains at around $1,769 a troy ounce.

US Treasury yields rallied to fresh multi-week highs ahead of Wall Street’s close. The yield on the 10-year note hit 1.644% and settled nearby. Firmer yields may give the dollar a respite should the rally there continues.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Investors prepare to sell on ETF news

Like this article? Help us with some feedback by answering this survey:

- The pound turns higher to reach one-month highs at 1.3845.

- BoE rate hike speculation remains fuelling sterling's recovery.

- GBP/USD: Monetary tightening might not be enough to lift the pound – MUFG.

The British pound has appreciated beyond 0.5% on Tuesday, favored by a moderate reversal on the USD, to hit one-month highs at 1.3835 before consolidating around the 1.3800 level.

The pound on BoE hike expectations, US dollar weakness

On a broader view, the pair has been performing a solid recovery in October, appreciating a nearly 3% after bouncing from year-to-date lows near 1.3400. The sterling has regained most of the ground lost on the second half of September when it was hammered by concerns about the fuel and labor shortages caused by Brexit restrictions

Furthermore, rising expectations about the possibility that the Bank of England will lead the world’s major central banks on hiking interest rates are also increasing demand for the GBP.

With inflation accelerating at levels almost twice the Bank’s target for price stability, BoE officials have started to openly suggest the possibility of accelerating the monetary policy normalization plan. BoE Governor, Andrew Bailey, has supported this idea, suggesting this weekend that the Bank of England "will have to act" as rising energy prices are threatening to spill over consumer prices.

On the other end, the US dollar pulled lower on Tuesday. The US Dollar Index is trading 0.2% lower on the day, after having bottomed at 93.45, its lowest level in the last three weeks, weighed by a somewhat brighter market mood and a pause on the US Treasury bond’s rally.

GBP/USD: BoE’s aggressive rate hike cycle, not enough to lift the pound – MUFG

From a broader perspective, the FX analysis team at MUFG warns about further GBP weakness when monetary tightening is confirmed: The faster pace of tightening poses some upside risk to our pound forecasts in the near term. However, we are still sticking to our view that the GBP is more likely to weaken heading into year-end given the more challenging backdrop of slowing global growth, higher inflation and tightening liquidity conditions which should be less supportive for risk assets and high beta currencies like the pound.”

Technical levels to watch

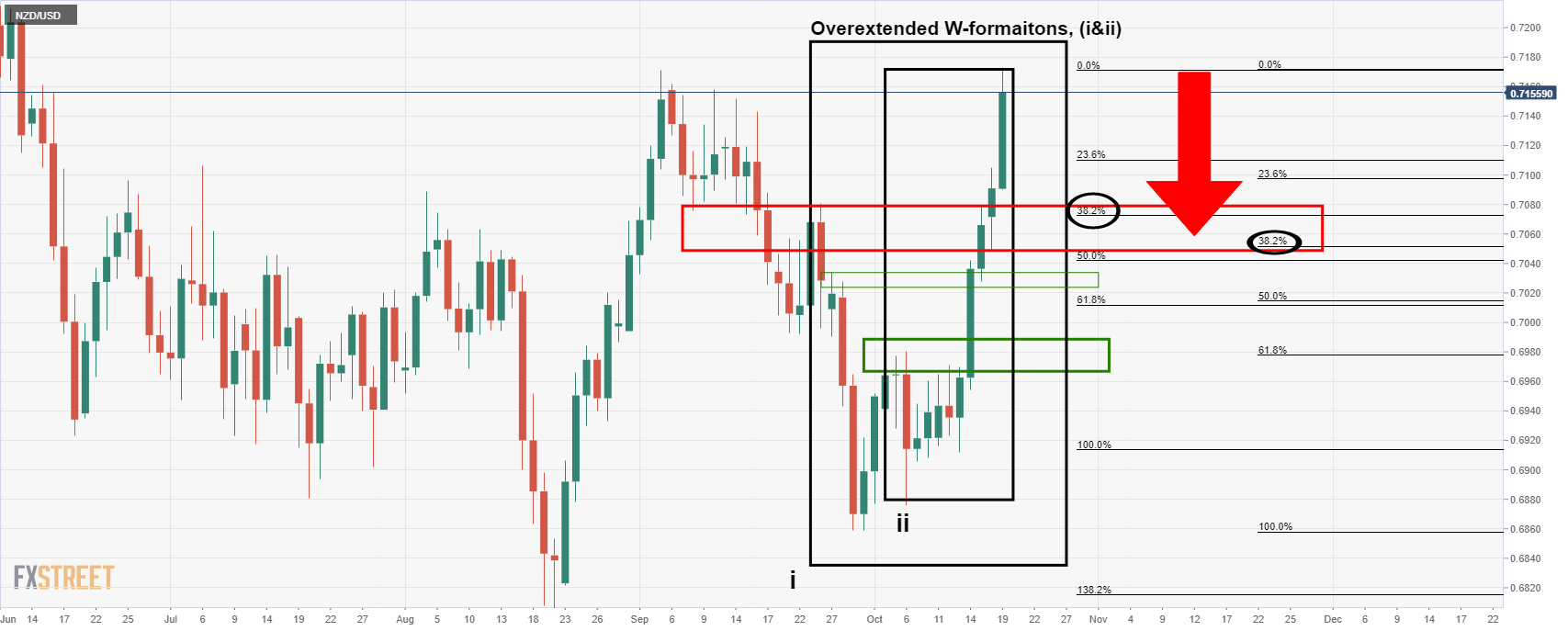

- NZD/USD runs into weekly and daily resistance, eye son the downside.

- 0.7050 is a confluence level of support to target.

The NZD/USD price has extended beyond the weekly resistance line as it was illustrated as a possibility in the analysis from Monday's North American session, NZD/USD Price Analysis: Meeting resistance and W-formation is bearish:

NZD/USD weekly chart, before & after

''Meanwhile, from a weekly perspective, the price has corrected deeply to a 78.6% Fibonacci from trendline resistance. It then shot higher in a three-line strike as pe the bodies of the candles. In any case, the bullish engulfing rally has penetrated the resistance line so there are prospects of a breakout, in contrast to the daily chart's W-formations.''

After ...

The price has rallied into a wall of resistance which could now serve as a supply zone that will reject NZD/USD for a restest the old dynamic resistance line as counter-trendline support.

NZD/USD daily W-formations

This would rhyme with the bearish reversion W-formations on the daily chart, as illustrated in Monday's daily chart analysis:

However, given the bullish extension, the analysis needs to be adjusted as follows:

The 38.2% Fibonacci channel between Wi and Wii offers a target area between 0.7080 and 0.7050 as the closest round numbers, the latter being aligned to the weekly counter trendline.

Federal Reserve Governor Christopher Waller was making remarks on Tuesday and outlining the case for why Fed officials may have misdiagnosed the current pace of price increases as temporary.

''If high inflation continues through the end of the year the Fed may have to adopt a more aggressive policy response to control it,'' he said.

Waller also said he too still believes the economy has seen the worst of the current coronavirus wave, that labour and other supply shortages will ease over time, and that "the escalation of inflation will be transitory.

''I still see supply and demand working here to moderate price increases so that inflation moves back toward 2%," the Fed's established target. That would mean any change in the Federal Reserve's key policy interest rate "is still some time off."

Waller said he feels the risks are shifting, and he is now "greatly concerned" the current fast rise in prices may continue.

"The next several months are critical for assessing whether the high inflation numbers we have seen are transitory," Waller said in remarks prepared for delivery at the Stanford Institute for Economic Policy Research.

"If monthly prints of inflation continue to run high through the remainder of this year, a more aggressive policy response than just tapering may well be warranted in 2022."

"Firms are reporting that they have more pricing power now than they have had in many years, as consumers seem to be accepting higher prices," he said.

Market implications

The greenback has struggled against its rivals as measured by the DXY index. These currencies, such as GBP, have been recently boosted by expectations of sooner-than-previously expected interest rate hikes. Additionally, US yields have appeared to stabilize on which has likely reduced demand for the greenback.

- EUR/GBP is range-bound during the New York session, trapped around the 0.8430-60 range.

- Central bank policy divergence will ultimately benefit the British pound.

- EUR/GBP: A break below 0.8400 could open the door for a test of 2020 lows around 0.8340.

The EUR/GBP edges lower during the New York session, losing 0.25%, trading at 0.8435 at the time of writing. Investors’ appetite for riskier assets is on, as US stock indices rise between 0.43% and 0.67%, on the back of good US Q3 corporate earnings, which seem to ease markets’ worries about inflation.

Central bank policy divergence boosts the British pound

Over the weekend, ECB President Christine Lagarde reiterated that inflation is transitory. Meanwhile, her counterpart BoE’s Governor Andrew Bailey commented that the Bank of England “Will have to act” to curb inflationary pressures.

EUR/GBP Price Forecast: Technical outlook

The EUR/GBP daily chart shows the pair is in a downtrend, but testing support at 0.8430, which was unsuccessfully tested two times. The Relative Strength Index (RSI), a momentum indicator, is at 34, edging lower, indicating downward pressure on the cross.

For British pound buyers, a breach below the 2021 lows could send the pair tumbling towards the 2020 lows of February 18, 2020, at 0.8348, followed by the 0.8300 figure. Nonetheless, cautions is warranted, as the RSI at 34 suggests the EUR/GBP pair could reach oversold levels that could trigger a correction before resuming the previous trend.

For euro buyers, a daily close above 0.8500 would be necessary to challenge EUR/GBP sellers. In that outcome, the first resistance level would be the confluence of the 50 and the 100-day moving averages (DMA’s) around the 0.8540-0.8555 area. A clear break of the before-mentioned could spur a rally towards the convergence of a downward slope trendline, with the 200-DMA and 0.8600 psychological level.

- The euro advances higher to reach four-month highs above 133.00.

- The yen remains sold across the board.

- EUR/JPY's rally might extend to 137.51 – Commerzbank.

The euro keeps trading higher against a weaker Japanese yen on Tuesday, buoyed by a higher risk appetite and broad-based yen weakness. The pair is set to extend its rally for the ninth consecutive day, reaching fresh four-month highs above 133.00.

The yen remains weak across the board

The EUR/JPY maintains its bid tone intact after having rallied about 3.5% over the last two weeks, favored by a weaker yen amid a combination of factors. The positive market mood, triggered by strong quarterly earnings by Johnson & Johnson and Travelers has supported the euro, to the detriment of the safe-haven yen, although the JPY is suffering longer-standing issues.

The yen has slumped to three-year lows against the US dollar, with the market positioning for an imminent announcement of QE tapering by the Federal Reserve and speculation about rate hikes in 2022 increases. These expectations have boosted US T-Bond yields, while the Bank of Japan maintains its yield control curve, ultimately crushing the yen’s appeal for the investors.

Beyond that, the surging price of energy, which the country has to import, is threatening to thwart the post-pandemic recovery, which is adding negative pressure on the JPY.

EUR/JPY’s rally could extend towards 137.51 – Commerzbank

From a technical perspective, Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, remains bullish on the pair and sees scope for a run to levels past 137.00: “EUR/JPY has maintained its gains. We look for a move to 132.69/80, the 23rd June high, and 78.6% retracement. This is regarded as the last defense for the 134.12 June peak (…) Longer-term, a break above here is favored and will introduce scope to 137.51.”

Technical levels to watch

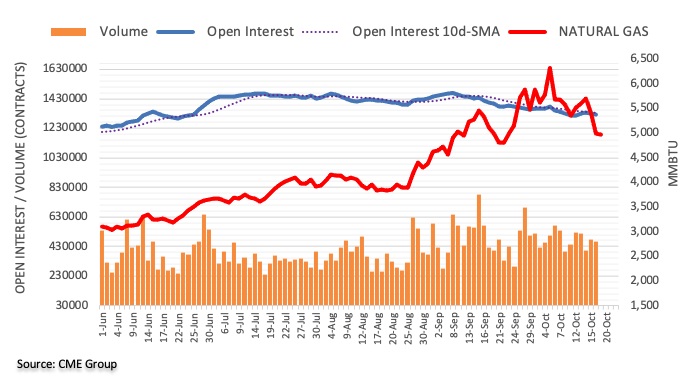

- Precious metals are supported as the US dollar gives background to rival currencies.

- The stagflation theme is alive and well for the precious metals hedge.

- Silver prices are in a bullish cycle since bursting out from the Reverse Head and Shoulders formation.

The price of silver is firm on Tuesday as the US dollar gives back some ground while rival currencies play catch up due to their central banks taking part in the lift-off theme. At the time of writing, XAU/USD is trading at $23.7590, rising 2.44% on the day and travelling from a low of $23.1882 to a high of $24.1237.

The US dollar has struggled against its rivals on Tuesday in a bout of profit-taking that had otherwise benefitted by expectations of sooner-than-previously expected interest rate hikes. Additionally, US yields have appeared to stabilize on which has likely reduced demand for the greenback.

''Market pricing for Fed hikes is far too hawkish,'' analysts at TD Securities argued. ''The aggressive bear flattening trend in the US yield curve highlights the market's intense focus on pricing the Fed's exit. However, market pricing for Fed hikes fails to consider that a rise in inflation tied to a potential energy shock and lingering supply chain shortages would be unlikely to elicit a Fed response,'' the analysts said.

USD's rival currencies catching up

Moreover, currencies, including the Great British pound and the New Zealand dollar, are benefiting from rising interest rate increase expectations. The Bank of England has been sounding the inflation warnings and its intention to act while NZ's inflation report came in super hot this week also. As a result, the British pound rallied 0.60% to $1.3810 as money markets priced in a cumulative 35 basis points in rate hikes by the end of the year and the New Zealand dollar has gained 0.95% to $0.7152 after data on Monday showed the fastest consumer-price inflation in more than a decade.

Additionally, there has been a rise in short-term bond yields, with short-dated yields climbing comparatively more than in the United States, exposing the US dollar to profit-taking this week. This in turn has helped precious metals to stabilise and recover come ground with silver leading the way.

Silver technical analysis

The price is silver has rallied from the daily head and shoulders set-up and in a classic breakout scenario, the price corrected to old resistance before the next push higher. At this juncture, the price is meeting the resistance of the old structure and would be expected to retrace to restest old resistance near 23.60 and where it meets a 61.8% Fibonacci retracement level. From there, a fresh bullish impulse could emerge.

- The S&P 500 Index advances beyond 4.500 on a five-day rally.

- Upbeat quarterly earnings have boosted risk appetite.

The main Wall Street indexes are trading higher on Tuesday, with the S&P 500 reaching levels past 4,500 following a five-day rally. The positive quarterly earnings reported by Johnson and Johnson and Travelers have revived investors’ optimism seen last week after the upbeat results in the financial sector, with concerns about high inflation and supply chain disruptions fading into the background.

Johnson and Johnson’s shares are 4.10% up today after the company reported a 10.7% year-on-year increase in sales in the third quarter. Travelers Companies’ shares are 2.51% buoyed by better than expected sales results.

Down to sectors, the biggest winners are the Energy and Healthcare, up 1.37% and 1.22% up respectively, with the Consumer Staples sector 0.41% down as the worst-performing sector today.

On the macroeconomic front, US homebuilding activity contracted unexpectedly in September, revealing that shortages in raw materials and labor are starting to squeeze the sector. Housing starts declined by 1.6% in September, while building permits contracted at a 7.7% pace, casting doubt over the possibility of an immediate recovery.

S&P 500 daily chart

- The Australian dollar surges almost 1% as central banks around the globe normalize monetary policy.

- An upbeat market sentiment boosts the commodity currencies, like the AUD and the NZD.

- The RBA last meeting minutes confirmed that they would not hike rates to cool off the real estate market.

The AUD/USD is soaring during the New York session, gaining 0.99%, trading at 0.7484 at the time of writing. A positive market mood surrounds the financial markets, as US stock earnings ease concerns around elevated prices. The largest US stock indexes rise between 0.50% and 0.82%, while the greenback weakens across the board.

The Reserve Bank of Australia would not hike rates to cool off the real estate market

On Tuesday, the Reserve Bank of Australia unveiled the minutes of the last meeting. They said that higher interest rates would help lower upward prices in the real estate market, though it would come at the cost of fewer jobs and weaker wages growth. Furthermore, the minutes revealed that such a move would distance the bank from achieving monetary policy goals – namely, full employment and inflation around the 2-3% target.

RBA policymakers have been vocal about not raising rates to help them cool off of the real estate market, as they try to increase the pace of wages growth and return inflation to the 2-3% target on a sustainable basis.

Despite the abovementioned, investors have increased the odds of a 2022 interest rate hike. The Bank of England and other developed economies see their central banks switching towards a normal monetary policy. The outcome of those bets is the price action of the day, with commodity currencies like the Australian and the New Zealand dollar printing fresh highs against the greenback.

Meanwhile, the US economic docket featured the Housing Starts and the Building Permits for September. Housing Starts rose to 1.555M lower than the 1.62M expected. In contrast, the Building Permits, which measures the construction sector, increased to 1.589M, lower than the 1.68M, due to a shortage of skilled employees and elevated raw materials costs.

AUD/USD Price Forecast: Technical outlook

In the daily chart, the AUD/USD shows the spot price is above the September 3 high at 0.7477, which supports the upward move, but it would require a daily close above it to confirm the break of structure towards the upside.

In that outcome, the first resistance would be the psychological 0.7500. A breach of the latter would expose the 200-day moving average (DMA) at 0.7564, immediately followed by a downward slope trendline that confluences around the 0.7600 psychological resistance.

On the flip side, failure at 0.7477 would expose the AUD/USD to downward pressure that could tumble the pair towards 0.7400 and beyond.

Federal Reserve Governor Michelle Bowman said on Tuesday that the US may see inflation lasting longer than expected a few months ago.

Bowman did not comment on her outlook for monetary policy in remarks prepared for a virtual event hosted by the Richmond Fed.

However, she noted the obstacles making it difficult for many women to work, combined with an increase in retirements. She explained that this could hinder the labour market recovery and be a drag on the US economy.

''Women with young children left the labour force at a higher rate than other workers and some are still struggling to find childcare they can afford'', Bowman said.

''And many of the older workers who left the labour force during the pandemic, including a high share of women, may not return,'' Bowman added.

"The loss of these workers will limit the productive capacity of the economy, and may make it harder, or even impossible in the near term, to return to the high level of employment achieved before the pandemic," Bowman said in remarks prepared for the event.

Bowman did not comment on her outlook for monetary policy in the prepared remarks.

Market implications

Meanwhile, the US dollar has struggled against its rivals which have been recently boosted by expectations of sooner-than-previously expected interest rate hikes. Additionally, US yields have appeared to stabilize on which has likely reduced demand for the greenback.

- The US Dollar, steady above 113.85 returns near multi-year highs.

- The yen remains heavy on the back of Treasury yields' differentials.

- USD/JPY: Weakness seen as corrective while above 112.40 – Credit Suisse.

The US dollar has regained lost ground, after a weak opening against the Japanese yen on Tuesday. The pair retreated from the three-year high at 114.45 hit on Monday, to session lows at 113.85 before bouncing up and returning to the 114.30 area.

Risk appetite and flat US yields have weighed on the USD

The JPY attempted to bounce up, after having depreciated nearly 5% over the last four weeks. A higher risk appetite on the back of upbeat quarterly earnings results at Johnson and Johnson and Travelers had revived appetite for risk, while the consolidation of US T-Bond yields curbed demand for the USD offering some respite to its main rivals.

The yen’s rebound, however, has been short-lived. The Japanese currency, particularly sensitive to monetary policy differentials, remains heavy while the market positions for an imminent announcement that the Federal Reserve starts to taper its massive stimulus program. These expectations have been widening the treasury yield gap between the US and Japan -whose central bank maintains the 10-year note near zero through a yield control curve- which is crushing investors’ appeal for the yen.

USD/JPY: Weakness seen as corrective while above 112.40 – Credit Suisse

From a technical point of view, the FX Analysis team at Credit Suisse sees the pair biased higher while 112.40 support remains intact: “With a major base in place above the 112.40 high of 2019, we maintain our view that weakness will be corrective and temporary only. A clear break of 113.99 should mark a near-term top to add weight to our view for a setback to 113.81/61 initially, with fresh buyers expected here for now. A break can see a deeper retreat towards 113.08/04 but this will ideally prove the limit of the downturn.”

Technical levels to watch

- The dollar bounces up from multi-month lows at 1.2310.

- The pause on US bond yield's rally has weighed on the greenback.

- USD/CAD might reach 1.22 by year-end – Scotiabank.

The US dollar is trimming losses against its Canadian counterpart after having bottomed at 3, ½-month lows at 1.2310 earlier on Wednesday. The pair has returned to 1.2350, yet still about 0.25% down on the day.

The USD dips again as US yields’ rally stalls

The greenback has given away the mild recovery posted on Monday, weighed by a pause on US T-Bond yields’ rally and a higher appetite for risk. US yields have stalled near multi-year highs on Tuesday, after having surged over the last two weeks, with the investors positioning for an imminent announcement of QE tapering by the Federal Reserve.

Additionally, the better than expected earnings reports by Johnson & Johnson and Travellers have improved the market mood. These figures follow a string of bright results in the financial sector last week, to boost appetite for risk, weighing on demand for the safe-haven USD.

On a broader picture, the commodity-sensitive Canadian dollar remains buoyed by the solid rally on crude prices. The US benchmark WTI oil is trading at multi-year highs, beyond $83, which has pushed the CAD nearly 4% higher against the greenback over the last four weeks.

Macroeconomic data has not been of any help to the USD either, US building activity contracted unexpectedly in September, revealing that shortages in raw materials and labor are starting to squeeze the sector, and triggering concerns about its potential impact on the economic growth. Housing starts declined 7.7% in September, and August’s reading has been revised down to a 5.6% growth from the 6% previously estimated.

USD/CAD: Seen at 1.2200 ahead of the year-end – Scotiabank

From a technical perspective, the FX Analysis Team at Scotiabank observe further downside potential in the pair: “If the USD manages to steady around 1.2365/70 into this week, a modest correction could develop. We expect USD gains to remain limited to the low/mid 1.24s, however, with daily and weekly trend momentum signals aligned bearishly for the USD (…) We think USD/CAD can print a 1.22 handle ahead of year-end.”

Technical levels to watch

- Gold recovers after Friday’s crash, up 18% during the New York session.

- Risk-on market sentiment fueled some flows towards the non-yielding metal, weakening the greenback.

- XAU/USD: Strong resistance at $1,800 threatens to push gold prices towards the 2021 year low.

Gold (XAU/USD) climbs during the New York session, up 0.18%, trading at $1,768.11 at the time of writing. Investors’ mood is in risk-on mode, as solid US corporate earnings show that the US economy is strong, easing concerns about higher inflation. Furthermore, central banks around the globe tightening monetary policy conditions may help to bring down elevated prices.

Meanwhile, gold, the hedge against inflation, recovered some of its brightness since the Friday crash, which saw the yellow metal tumbling $32.00 on the back of a good US Retail Sales Report.

The US 10-year Treasury yield edges higher three and a half basis points (bps), sits at 1.620, whereas the greenback falls 0.25%, currently at 93.748, as risk appetite decreases the safe-haven status of the buck.

XAU/USD Price Forecast: Technical outlook

In the daily chart, XAU/USD briefly touched the 50-day moving average (DMA) at $1,778.43 but retreated due to intense selling pressure. Around the $1,800 area, the 100 and the 200-DMA’s confluence and a downward slope trendline add stress on gold.

Failure to break above the 100, 200-DMA, and the downward slope trendline, could send gold tumbling towards the October 6 low at $1,765.09. A breach of the latter would expose crucial support levels, as the September 29 low at $1,745.56, followed by the August 9 low at $1,687.78

On the flip side in the outcome of an upside break above the psychological $1,800 could pave the way for further gains, but there would be some hurdles on the way. The first resistance would be September 3 high at $1,834.02, followed by the June 11 high at $1,903.03.

- The euro retreats to 1.1640 from three-week highs at 1.1640.

- The dollar loses ground as US bond yields' rally stalls.

- EUR/USD: Above 1.1665, the pair might reach the mid-range of 1.17 – Scotiabank.

The euro has extended its recovery on Tuesday, fueled by a positive market mood, to reach the upper range of 1.1600 for the first time since late September. The pair has pulled back afterwards, to consolidate well above 1.1600, putting some distance from the 15-month low hit last week, at 1.1520 area.

US dollars weakness is giving a breather to the euro

The common currency has been buoyed by a weaker greenback on Tuesday. The US dollar is losing ground, weighed by a pause on the US T-Bond yields’, which had surged to multi-month highs over the last weeks, amid the increasing expectations of QE tapering by the Federal Reserve.

Furthermore, the brighter market sentiment, with Johnson & Johnson’s and Travellers posting better than expected quarterly earnings, have revived the optimism observed last week on the back of upbeat reports from the major banks, which has increased demand for riskier assets. The US Dollar Index, as a result, is trading about 0.25% lower on the day, after having bottomed at 93.45, its lowest level in the last three weeks.

On the macroeconomic front, US building activity has shown an unexpected contraction in September, revealing that shortages in raw materials and labour are starting to squeeze the construction sector and may have a negative impact on the third quarter's economic growth. Housing starts declined 7.7% in September, and August’s reading has been revised down to a 5.6% growth from the 6% previously estimated.

EUR/USD: Breach of 1.1665 could send the pair to the mid-range of 1.17 – Scotiabank

The FX Analysis team at Scotiabank sees the pair trading near a key resistance level that might offer a fresh impulse to the EUR/USD’s recovery: The EUR/USD rally has extended to retest 1.1665 resistance so it will be pivotal in determining whether this EUR rebound extends or starts to fizzle out (…) A push above 1.1665 will drive the EUR on to the mid-1.17s.”

Technical levels to watch

- The British pound recovers on the back of a hawkish BoE as investors increase the odds of a December’s rate hike.

- Positive market sentiment spurred by US corporate earnings and “stable” energy prices weaken the buck.

- Rising US T-bond yields reinforce the market’s expectations of a bond taper announcement at the Fed’s November meeting.

The GBP/USD stage a recovery of Monday’s losses, advances 0.53%, trading at 1.3799 during the New York session at the time of writing. Solid corporate earnings, stability around energy prices, and central banks tightening monetary policy keep investors on a positive tone.

The abovementioned triggered a dollar sell-off, witnessed by the US Dollar Index that measures the greenback’s performance against six peers, slides 0.30%, sits at 93.71, well below the 94.00 threshold, despite increasing odds of a bond tapering announcement by the Federal Reserve.

Meanwhile, the US 10-year Treasury yield climbs three basis points, up to 1.614%, reinforcing the markets expectations of the Federal Reserve tightening monetary conditions.

BoE and Fed monetary policy divergence, favors the British pound

Nonetheless, the Bank of England (BoE) and the Federal Reserve (Fed) diverge in their monetary policies. The BoE is already reducing its bond purchasing program, while the Fed could announce it in the November meeting. But as of the last couple of weeks, BoE policymakers like Michael Saunders and Governor Andrew Bailey have been vocal about higher prices, signaling that the bank could hike rates before the end of the year, giving an edge to the British pound over the greenback.

The US macroeconomic front featured the September Housing Starts for September, which rose to 1.555M lower than the 1.62M expected, trailing the August 1.58M. Further, the Building Permits increased to 1.589M shorter than the 1.68M foreseen by analysts.

The fall in the reading is due to supply-chain constraints, shortages of skilled employees, and elevated material costs that continue to challenge builders.

GBP/USD Price Forecast: Technical outlook

The GBP/USD pair reached a daily high around 1.3833 which tested the 200-day moving average (DMA) at 1.3843 but retreated the move below the 100-DMA that lies at 1.3806. The Relative Strength Index (RSI) at 61 indicates the pair still has upward pressure but is under heavy selling pressure, as dollar bulls defend the 1.3800-50 area.

For GBP/USD buyers to lift the pound higher, they will need a daily close above the 100 and the 200-DMA. In that outcome, the first resistance would be 1.3900. A breach of the latter could propel the pair towards the 1.4000 figure.

On the flip side, failure around the 1.3800-50 area could open the way for downward pressure that can tumble the pair, firstly towards the 50-DMA at 1.3710, and then the October 11 high at 1.3673 support.

European Central Bank (ECB) chief economist Philip Lane said on Tuesday that it is challenging to reconcile the market rate pricing with forward guidance, as reported by Reuters.

"Markets may not have fully absorbed the ECB's forward guidance," Lane added.

Market reaction

The shared currency came under modest selling pressure after these comments. As of writing, the EUR/USD pair, which touched a multi-week high of 1.1670 earlier in the day, was trading at 1.1632, where it was up 0.2% on a daily basis.

- Wall Street's main indexes continue to edge higher.

- Healthcare shares post strong gains after the opening bell.

Major equity indexes in the US opened in the positive territory on Tuesday as the market mood remains upbeat ahead of key quarterly earnings figures. As of writing, the S&P 500 was up 0.3% on the day at 4,500, the Dow Jones Industrial Average was rising 0.2% at 35,310 and the Nasdaq Composite was gaining 0.4% at 15,079.

Among the 11 major S&P 500 sectors, the Healthcare Index is up 0.8% as the top gainer after the opening bell. On the other hand, the Consumer Staples Index is losing 0.4%.

Earlier in the day, the data from the US showed that Building Permits and Housing Starts decreased by 7.7% and 1.6%, respectively, in September but these prints don't seem to be having a noticeable impact on risk sentiment.

Wake Up Wall Street: Risk is back, memes on the attack, but is Netflix set to crack?

S&P 500 chart (daily)

EUR/USD has repeatedly failed to hold below the 1.1550 area this month. Some pullback or consolidation is not exceptional, therefore, economists at Rabobank stick to the view of lower EUR/USD ahead.

EUR/USD still seen at 1.15 on a three-month view

“We are viewing the current pullbacks in the USD as corrective and continue to expect the USD to push higher over the medium-term.”

“While the recent sell-off in the EUR suggests it may be more sensitive to hawkish remarks from ECB members in the build-up to forthcoming ECB meetings, the cautious stance of the policy guidance from the central bank suggests that room for a concerted recovery in the EUR is still limited.”

“On the margin, the approach of the French Presidential election next year and the tensions regarding the rule of law between the EU and Poland and Hungary may also weigh on the EUR going forward.”

“We retain our three-month forecast of EUR/USD 1.15.”

The GBP/USD pair is making some clear headway above the 1.38 area. A test of the 200-day moving average (DMA) at 1.3848 is on the radar, economists at Scotiabank report.

Short-term cable bullish

“OIS pricing does reflect a minor check in the recent firming in rate hike expectations but this likely reflects broader market moves rather than any real doubts about the BoE outlook at this point we remain constructive on the GBP on the crosses.”

“We are cautious about reading too much into developments but the GBP enjoys the backing of solid trend oscillators on the intraday and daily studies and is trading well through key, short-term MA signals which puts the 200-DMA at 1.3848 on the radar.”

“Key resistance is 1.3913, the mid-September high.”

- USD/TRY clinches new all-time peak around 9.3700.

- The lira remains under heavy pressure ahead of the CBRT.

- Investors see the CBRT cutting rates on Thursday.

Another day, another all-time high in USD/TRY. This time, the pair advanced to the 9.3700 area after losing some upside traction.

USD/TRY keeps looking to the CBRT

Curiously, the lira now manages to regain some composure and forces USD/TRY to abandon the area of recent all-time highs near 9.3700 and head lower towards the 9.3200 zone on Tuesday.

The selloff in the greenback in combination with extreme overbought levels of the pair might have combined to spark the ongoing knee-jerk in spot, although it should be considered temporary, as the risk for TRY remains tilted well to the downside for the time being.

Indeed, the broad consensus among investors expects the Turkish central bank (CBRT) to reduce further (100 bps?) the One-Week Repo Rate at its event on Thursday. It is worth recalling that the depreciation in the lira gathered unusual pace after President Erdogan removed three CBRT officials earlier in the month, undermining further the credibility around the monetary authority (if there still was some left).

However, prospects for a reduction of the policy rate have been growing since CBRT Governor S.Kavcioglu announced some weeks ago that the core inflation rate will now be used to set the level of the key interest rate. So, all in all, the September’s interest rate cut should not have surprised anybody…

USD/TRY key levels

So far, the pair is losing 0.13% at 9.3163 and a drop below 9.0873 (10-day SMA) would aim for 8.9588 (20-day SMA) and finally 8.8317 (monthly low Oct.4). On the other hand, the next up barrier lines up at 9.3699 (all-time high Oct.19) followed by 10.0000 (round level).

- Gold is trading above $1,780 in early American session.

- 10-year US Treasury bond yield rose into the positive territory above 1.6%.

- Greenback remains on the back foot after disappointing US data.

The XAU/USD pair broke above $1,770 in the European session and climbed to a daily high of $1,785 in the last hour before edging slightly lower. As of writing, the pair was up 0.85% on the day at $1,780.

Earlier in the day, the broad-based selling pressure surrounding the dollar and falling US Treasury bond yields fueled the gold's rally.

With risk flows dominating the financial markets, the US Dollar Index (DXY) dropped to a multi-week low of 93.50. The data from the US showed on Tuesday that Housing Starts and Building Permits fell by 1.6% and 7.7%, respectively, in September. Although the initial market reaction to these readings was largely muted, the dollar started to find some demand on the back of recovering US T-bond yields.

At the moment, the benchmark 10-year US T-bond yield is up 0.5% on the day at 1.61% and the DXY is down 0.28% at 93.68, capping gold's upside for the time being.

Meanwhile, major equity indexes in the US remain on track to open in the negative territory, suggesting that the greenback is likely to remain on the back foot if the market mood remains upbeat in the second half of the day.

There won't be any high-tier data releases from the US in the remainder of the day and investors will remain focused on the risk perception and yields.

Gold technical outlook

The Relative Strength Index (RSI) indicator on the four-hour chart is holding near 60, suggesting that there is more room on the upside before gold becomes technically overbought. Additionally, the previous two candles on the same chart closed above the 200-day SMA, confirming the bullish bias.

The initial resistance is located at $1,787 (September 22 high) ahead of $1,800 (psychological level, static resistance). On the downside, $1,770 (former resistance, 200-period SMA) aligns as the first support before $1,763/60 (static level, 100-period SMA) and $1,750 (static level).

EUR/USD’s bounce tests 1.1665 key resistance. Above here, the world’s most popular currency pair would move to the mid-1.17s but ECB policymakers stay dovish, limiting euro’s upside potential, economists at Scotiabank report.

ECB members remark the cautious stance of the policy guidance

“ECB’s Rehn and Villeroy were speaking earlier and both senior policymakers reiterated the ECB’s dovish policy outlook. The broader dovishness among ECB policymakers gives us little confidence that the EUR rally will extend significantly in the near to medium term.”

“The EUR/USD rally has extended to retest 1.1665 resistance so it will be pivotal in determining whether this EUR rebound extends or starts to fizzle out.”

“A push above 1.1665 will drive the EUR on to the mid-1.17s.”

- Building Permits in US fell sharply in September.

- US Dollar Index stays in the negative territory, holds above 93.50.

Housing Starts in the US declined by 1.6% on a monthly basis in September after rising by 1.2% in August, the data published jointly by the US Census Bureau and the US Department of Housing and Urban Development showed on Tuesday.

Further details of the publication revealed that Building Permits, which rose by 5.6% in August, plunged by 7.7% in the same period.

Market reaction

The US Dollar Index managed to recover modestly from daily lows after the data and was last seen losing 0.3% on a daily basis at 93.65.

The International Monetary Fund said on Tuesday that it expects the Chinese economy to grow by 8% in 2021 but added that the economic recovery remains unbalanced, as reported by Reuters.

Additional takeaways

"Asia's economy to expand 5.7% in 2022, up 0.4% from April forecast."

"Untimely policy normalization or misconstrued policy communications' by the US could trigger capital outflow, push up borrowing costs for Asian emerging economies."

"Risks to Asia growth tilted down on pandemic uncertainty, supply chain disruptions, potential spillovers from fed policy normalisation."

"Asia's economy to expand 6.5% in 2021, down 1.1% from April forecast."

Market reaction

This report doesn't seem to be having a noticeable impact on market mood. As of writing, the S&P Futures were up 0.5% at 4,500.

- EUR/USD advances for the second session in a row above 1.1600.

- The 1.1700 level and the 55-day SMA at 1.1719 come next.

EUR/USD accelerates gains to the 1.1670 region on Tuesday, opening the door at the same time for the continuation of the move higher.

That said, and after surpassing the previous top at 1.1624 (October 14), the pair could now attempt to retake the round level at 1.1700 the figure ahead of the interim hurdle at the 100-day SMA, today at 1.1719. Further north comes the short-term resistance line around 1.1740. A breakout of the latter should see the selling pressure mitigated and therefore allow for extra gains to the next relevant resistance in the mid-1.1700s.

In the meantime, the near-term outlook for EUR/USD is seen on the negative side below the key 200-day SMA, today at 1.1924.

EUR/USD daily chart

- AUD/USD is clinging to strong daily gains on Tuesday.

- Upbeat market mood is helping AUD find demand.

- US Dollar Index remains on the back foot ahead of mid-tier data.

After managing to close near 0.7400 on Monday, the AUD/USD pair regained its traction during the Asian trading hours on Tuesday and climbed to its highest level since early September at 0.7476 before going into a consolidation phase. As of writing, the pair was up 0.78% on a daily basis at 0.7468.

DXY turns south as risk flows return

The positive shift witnessed in market sentiment seems to be boosting AUD/USD on Tuesday. Reflecting the upbeat mood, US stock index futures are up between 0.4% and 0.5%, suggesting that Wall Street's main indexes remain on track to open in the positive territory. On the flip side, the greenback is struggling to find demand as a safe haven and the US Dollar Index (DXY) is losing 0.4% at 93.57.

Earlier in the day, the Reserve Bank of Australia's (RBA) meeting minutes didn't offer any fresh insights into the bank's policy outlook. The RBA reiterated that the economic activity is expected to return to pre-pandemic levels in the second half of 2022 and added that they don't expect to reach the inflation target until 2024.

Later in the session, September Housing Starts and Building Permits data from the US will be looked upon for fresh impetus.

On Wednesday, the Westpac Leading Index for September will be featured in the Australian economic docket.

Technical levels to watch for

- DXY accelerates losses and retests the 93.50 zone on Tuesday.

- There is an interim support at the 93.18, the 55-day SMA.

DXY extends the downside for the fifth consecutive session on Tuesday and visits again the 93.50 region, where some initial contention turned up so far.

In case the selling impulse gathers further steam, the 55-day SMA at 93.18 should offer some minor contention ahead of a deeper pullback to the 93.00 neighbourhood (low September 23). Further south comes the 100-day SMA, today at 92.57.

Looking at the broader picture, the constructive stance on the index is seen unchanged above the 200-day SMA at 91.82.

DXY daily chart

In an interview with Reuters on Tuesday, European Central Bank (ECB) policymaker Bostjan Vasle said there are early signs that wage pressures in the euro area could become material and pose inflation risks.

Additional takeaways

"ECB should end the Pandemic Emergency Purchase Program (PEPP) in March if economic trends continue."

"Real financing conditions remain favourable despite nominal yield rises."

"Open to discussion on keeping some but not all of PEPP's flexibility."

Market reaction

The EUR/USD pair consolidates its impressive daily gains ahead of the American session and was last seen rising 0.45% on the day at 1.1660.

- GBP/USD preserves its bullish momentum during the European session.

- US Dollar Index continues to push lower toward 93.50.

- Wall Street's main indexes remain on track to open higher.

The GBP/USD pair continued to push higher during the European trading hours and reached its strongest level in a month at 1.3832. As of writing, the pair was up 0.75% at 1.3828.

USD selloff picks up steam

The heavy selling pressure surrounding the greenback on Tuesday seems to be fueling the pair's rally. In the absence of high-tier macroeconomic data releases, the risk-positive market environment is making it difficult for the dollar to find demand. The US Dollar Index was last seen losing 0.42% on the day at 93.55.

Later in the session, September Housing Starts and Building Permits data will be featured in the economic docket. In the meantime, the US stock index futures are up between 0.35% and 0.45%, suggesting that risk flows are likely to continue to dominate the financial markets in the second half of the day.

On the other hand, increasing Bank of England rate hike expectations ahead of Wednesday's September UK inflation report is allowing the British pound to outperform its rivals.

UK September CPI Inflation Preview: Will rising price pressures boost British pound?

Technical levels to watch for

Quek Ser Leang at UOB Group’s Global Economics & Markets Research noted that USD/IDR is unlikely to breach the key support at 14,000 for the time being.

Key Quotes

“We highlighted last Monday (11 Oct, spot at 14,210) that ‘downward momentum has increased’. We added, ‘a break of September’s low at 14,170 would not be surprising but the next major support at 14,120 is unlikely to come under threat’. We underestimated the downward momentum as USD/IDR cracked both 14,170 and 14,120 (USD/IDR dropped to 14,050 on Friday before extending its decline earlier today). Not surprisingly, the rapid drop is severely oversold but with no signs of stabilization just yet, further weakness is not ruled out.”

“That said, in view of the deeply oversold conditions, a break of the round-number support at 14,000 appears unlikely. On the upside, a breach of 14,140 would indicate that the current weakness has stabilized.”

- EUR/JPY’s needle-like rally remains everything but abated on Tuesday.

- There is now scope for a visit to the 2021 highs past 134.00 near term.

EUR/JPY extends the upside momentum and already surpasses the key barrier at 133.00 the figure on turnaround Tuesday.

The sharp move higher shows no signs of exhaustion so far, although the current overbought condition of the cross could trigger some consolidation or even a corrective move in the short-term horizon. Once digested one or the other, the cross should be able to resume the uptrend and attempt an assault to the YTD high at 134.12 recorded on June 1.

In the broader scenario, while above the 200-day SMA at 129.94, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

EUR/USD has started to push higher. Analysts at Credit Suisse look for a deeper corrective rebound to 1.1671, then the 55-day average at 1.1720.

See: EUR/USD set to see further gains towards the 1.1750 level – SocGen

Support at 1.1608 to hold