- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-10-2021

- DXY grinds higher following its bounce off three-week low.

- Short-term moving averages, seven-week-old previous support line probe upside amid bearish MACD signals.

US Dollar Index (DXY) bulls pause around 93.75 after the strongest up-move in over a week. That being said, the greenback gauge seesaws in a choppy range, following its U-turn from the monthly low, by the press time of Friday’s Asian session.

Although monthly horizontal support triggered the DXY rebound, a confluence of 10-DMA and 21-DMA, as well as the support-turned-resistance line from early September, offer a strong resistance around the 94.00 threshold.

Also challenging the upside momentum are the bearish MACD signals and 23.6% Fibonacci retracement level (Fibo.) of September-October advances.

Hence, US Dollar Index buyers need validation from the 94.00 round figure for conviction, a break of which will challenge the monthly peak of 94.56.

Alternatively, a downside break of the stated horizontal support near 93.50 won’t hesitate to recall the DXY sellers targeting 61.8% Fibo. near 92.95. It’s worth noting that the 93.00 round figure may add strength to the stated support.

US Dollar Index: Daily chart

Trend: Pullback expected

Boris Johnson would be prepared to accept a limited role for the European Court of Justice in a bid to unlock a deal with Brussels over the Northern Ireland protocol, government figures say, as The Times reports.

'In public Johnson and Lord Frost, the Brexit minister, have insisted that the EU must agree to drop any role for the court. But senior figures have privately raised the prospect of a compromise that would allow a limited role for the ECJ in interpreting the application of EU law in Northern Ireland.''

''Under the plan, disputes would go to an independent arbitration panel, with the ECJ asked to interpret narrow matters of EU law as a last resort if dispute resolution failed.''

Market implications

This is a welcome update for GBP although the rising US dollar and yields could hamstring GBP/USD to the downside in the immediate future. The DXY, an index that measures the greenback vs a basket of currencies, is potentially above to make a move to the upside again in an extension of the recovery from 93.50 support.

Meanwhile, GBP/USD is testing daily support but it could remain trapped for the meanwhile. A break of the dynamic trendline would open prospects of a run towards the neckline of the W-formation near 1.3620.

- GBP/JPY remains quiet on Friday in the early Asian trading hours.

- The cross-currency pair surrenders gain near 158.20.

- Momentum oscillators hold onto the overbought zone, throwing caution for aggressive bids.

The GBP/JPY cross-currency stays relatively quiet on Friday. The pair remains pressured near 158.22. At the time of writing, GBP/JPY is trading at 157.18, down 0.1% for the day.

GBP/JPY daily chart

On the daily chart, the GBP/JPY cross currency pair seems exhausted near a fresh six-year high made on Wednesday. The double top near 158.22 prompts bears to take some action. If the price breaks below the intraday low it could fall back to Monday’s low at 156.61.

A break of the 156.00 psychological level, which coincides with the 23.6% Fibonacci Retracement from the lows of 149.23 could mean a low of October 15 at 155.42 for the pair. Furthermore, the Moving Average Convergence and Divergence (MACD) trades in the overbought zone. Any downtick in the MACD would bring the 154.75 horizontal support level back into the picture.

Alternatively, on the reverse side of the trade, the upside target appears at the previous day’s high of 158.21. Next, the GBP/JPY bulls seek the June 2016 high of 160.67.

GBP/JPY additional levels

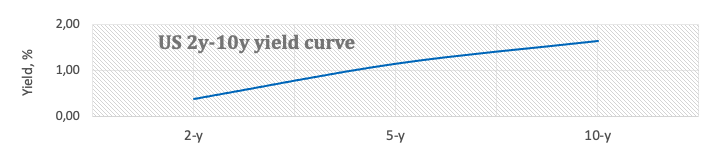

US inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data jumped to the highest levels last seen during 2012 by the end of Thursday’s North American trading.

In doing so, the risk barometer extends recovery moves from late September while flashing 2.64% at the latest.

The same favors US Treasury yields that recently track reflation fears to rally, the 10-year coupon pokes a five-month high around 1.70% at the latest. This phenomenon underpins the US dollar’s safe-haven demand amid Fed tapering chatters.

It’s worth noting that the US dollar witnessed a rally in the past when the US 10-year Treasury yields crossed the 1.70% mark.

On Thursday, Federal Reserve Governor Christopher Waller said that the next few months will be critical to see whether inflation is transitory, as reported by Reuters. Before that, Federal Reserve Governor Randal Quarles and Cleveland Fed President Loretta Mester highlighted inflation fears.

It should be noted, however, be observed that the 2.64% level of the stated inflation gauge is the tough resistance and hence a cautious view is needed for a sustained break of the 2.64% level for the US dollar bulls, which in turn could weigh on gold prices.

Read: Gold Price Forecast: XAU/USD steady around $1,780.00 capped by high US T-bond yields

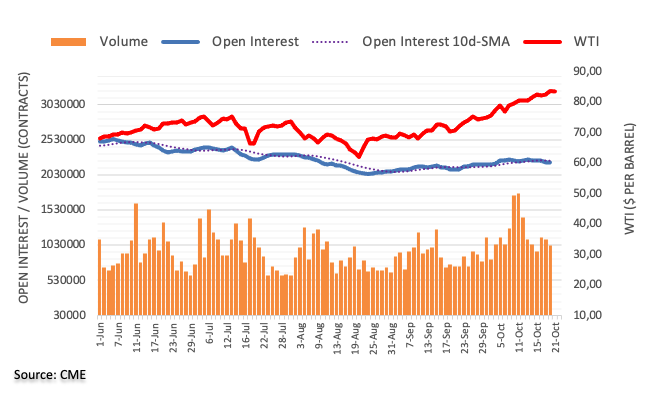

- WTI keeps pullback from multi-day top, retreats of late.

- Immediate falling trend line, downbeat Momentum line favor sellers.

- Weekly support line adds to the downside filters.

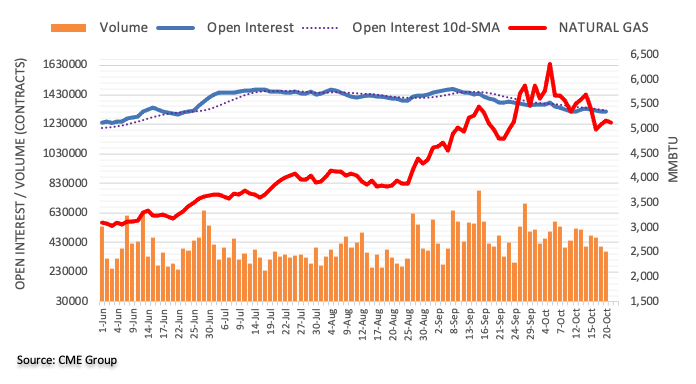

WTI fades late Thursday’s bounce off $80.60, following its U-turn from a seven-year high, during Friday’s Asian session. That said, the quote drops back to $82.00 by the press time.

The black gold tracks a nearby descending trend line, coupled with a falling Momentum line, to suggest further weakness.

However, 200-HMA and an upward sloping support line, respectively around $81.30 and $81.10, challenge short-term declines of the commodity prices.

Also acting as a downside filter is the 61.8% Fibonacci retracement of October 13-21 upside, near $80.70, as well as the $80.00 psychological magnet.

Alternatively, an upside break of the nearby resistance line, around $82.40 at the latest, will recall the WTI buyers and direct them to the latest top surrounding $83.70.

Though, Monday’s top near $83.15 and multiple lows marked during November 2012 near $84.10-20 act as extra resistances to watch during the quote’s fresh upside.

WTI: Hourly chart

Trend: Further weakness expected

- AUD/NZD remains in consolidation as supply battles with demand.

- AUD/USD bulls appear to be buying into supply which could lead to a breakout.

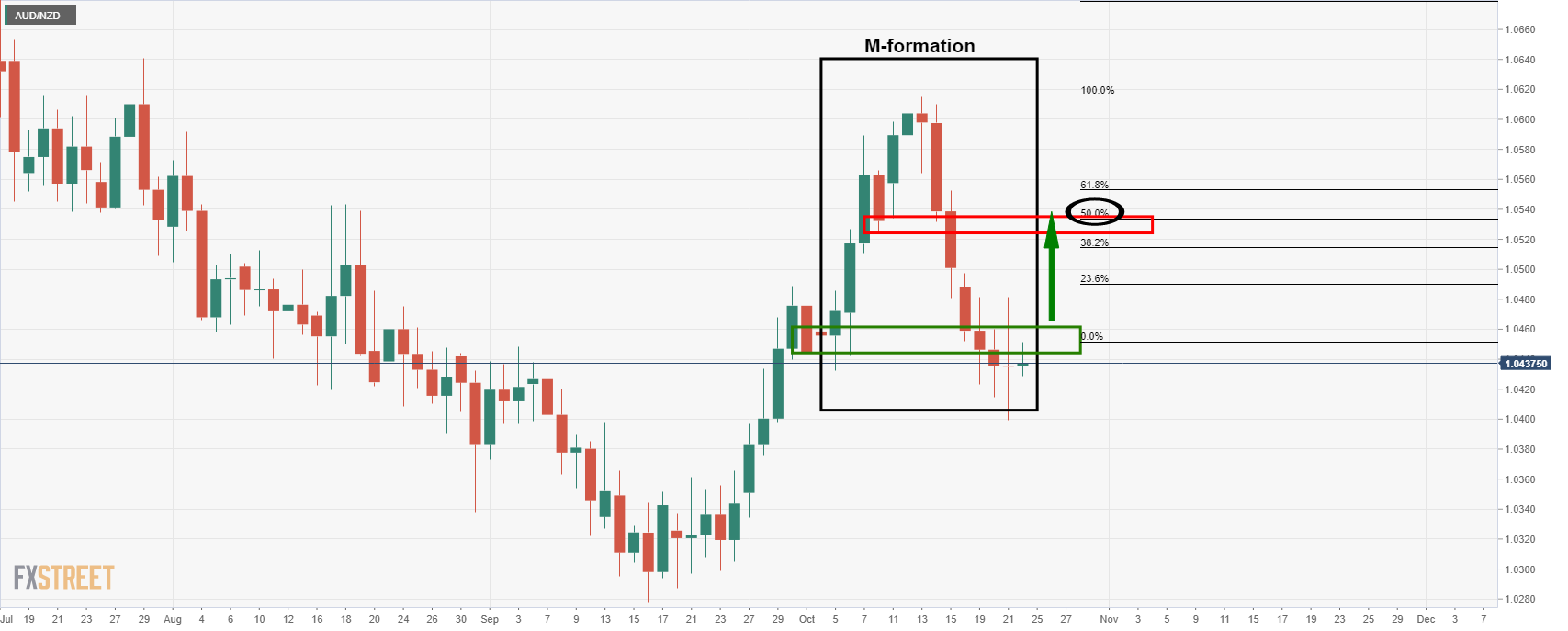

- The daily M-formation's neckline is compelling as an upside target.

The following is an update of the prior analyst as follows AUD/NZD Price Analysis: Accumulation is occurring, bulls are taking over. The market is moving sideways and a trapped environment between hourly support and resistance but there are prospects of a bullish breakout to test the neckline of the following daily M-formation at 1.0524:

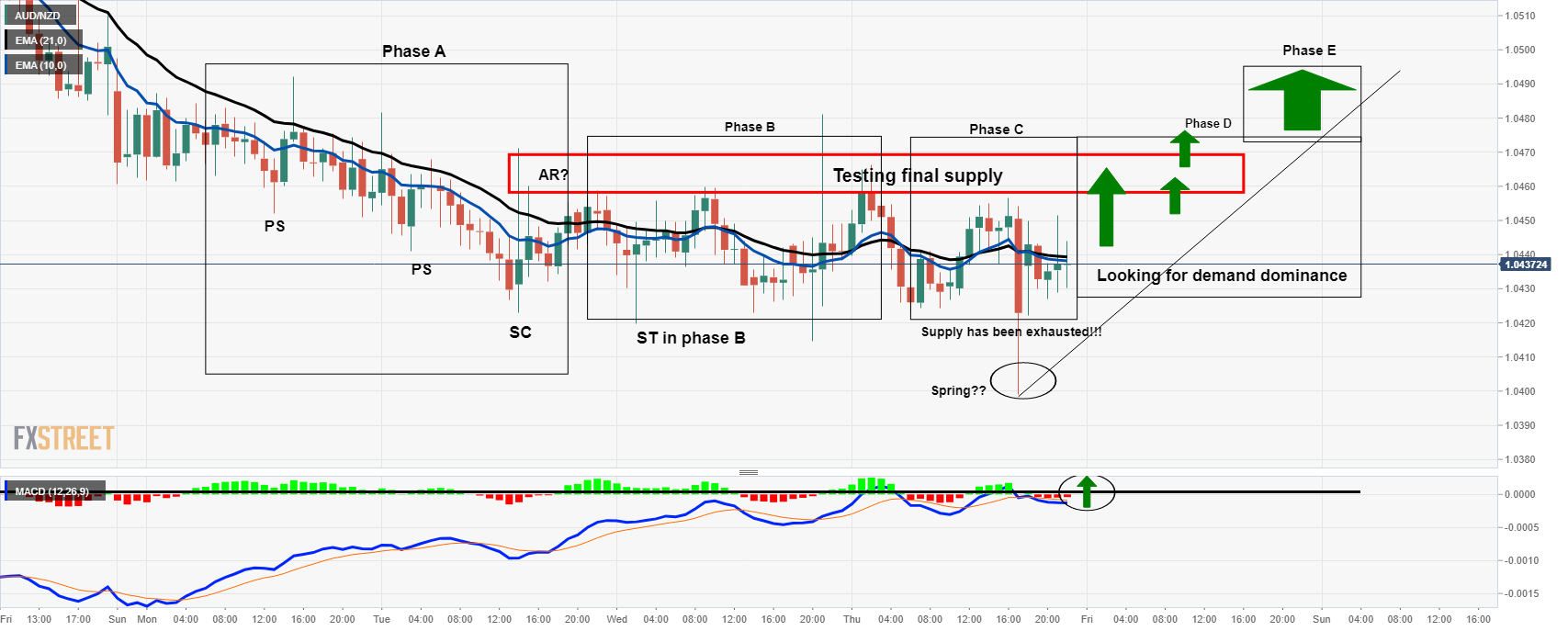

Meanwhile, on the hourly chart, the Wycoff theory is put to test on the following chart which has been updated from this in yesterday's analysis...

...to the following...

In this updated version in today's live market analysis, we can see that the supply was still not exhausted and that the market was not ready to move higher. However, we could now be seeing those final offers being accumulated in what would be expected to result in a move to resistance and demand dominance:

If the spring has been identified correctly this time around, then this is the end of phase C and a breakout is imminent. MACD zero line cross and the 10/21 EMA crossover are useful to determine the bias. While there have been a couple of false signals since yesterday, ideally they should be accompanied by a break of resistance structures within the accumulation. So far, we have not seen this.

- USD/JPY remains muted on the last day of the week in the initial Asia session.

- The US dollar trades below 94.00 tracks higher US T-bond yields.

- The Japanese yen gains amid a risk-off mood.

USD/JPY continues to extend the previous session’s sluggish momentum on Friday. The pair stayed in a relatively narrow price band of 114.00 and 114.50. At the time of writing, USD/JPY is trading at 114.01, up 0.05% for the day.

The US benchmark 10-year Treasury bond yields trade at 1.69%, following a better-than expected jobless claims data. Investors continue to anticipate the Fed’s tapering next month tracing strong corporate earnings, which boosted hopes of a continued economic recovery. The US Initial Jobless Claims reported at 290K below the market forecast of 300K.

Atlanta Federal Reserve President Raphael Bostic said he expected an interest rate hike in the later part of 2022 amid higher inflation concerns as well economic growth.

On the other hand, the Japanese yen managed to gain on the back of its safe-have appeal. Investors' sentiment was dented following the renewed China’s Evergrande default risk. In addition to that, the US is planning to hold a virtual meeting between US President Joe Biden and China’s President XI-jinping. It is worth noting that, S&P 500 Futures is trading at 4,531, down 0.23% for the day.

As for now, traders are waiting for Japanese Inflation data, US Markit Manufacturing Purchasing Managers Index (PPI) to gauge the market sentiment.

USD/JPY additional levels

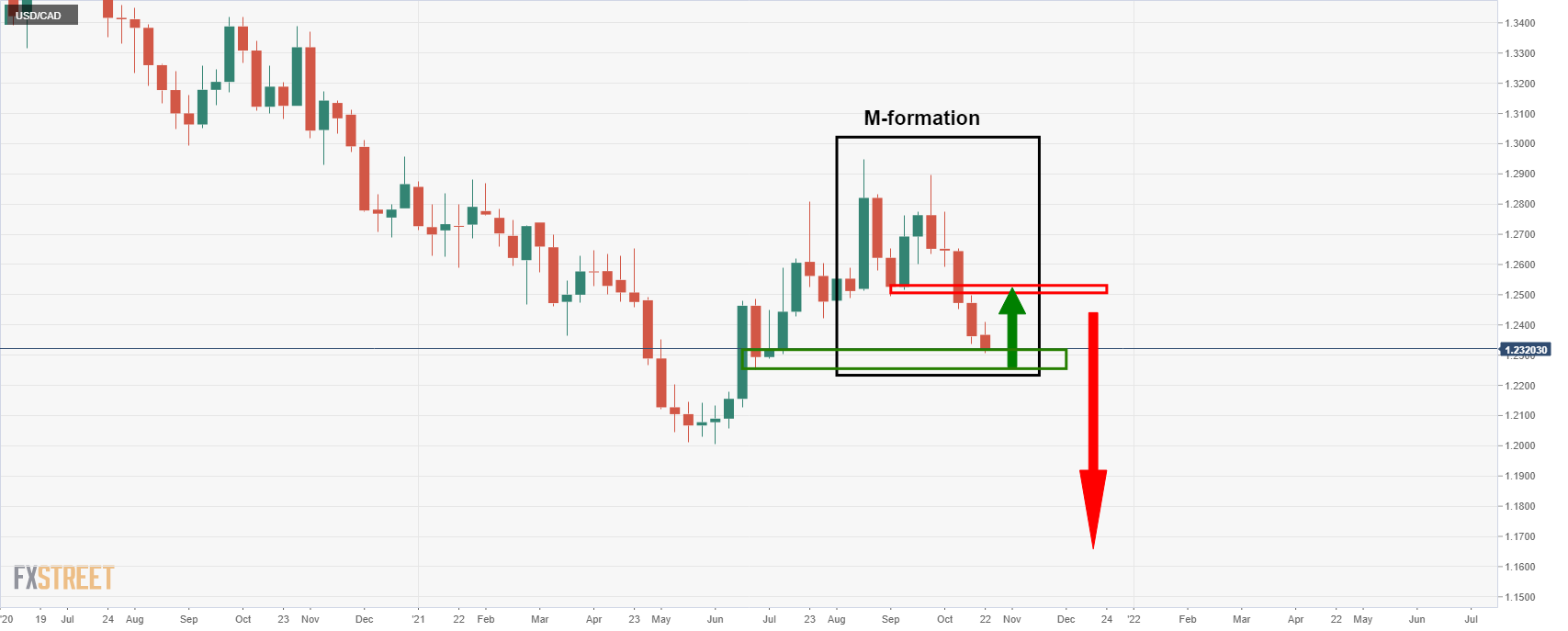

- USD/CAD struggles to keep the bounce off four-month low.

- Oil prices dwindle amid inflation-led risk aversion, China-linked fears.

- Canada data came in softer, US ones were mixed as well.

- Canada Retail Sales, US PMIs are eyed but USD may benefit from safe-haven demand.

USD/CAD grinds higher past 1.2350 following its rebound from early June lows to post the strongest daily run-up in October. That said, the quote seesaws near 1.2370 by the press time of the initial Asian session on Friday.

Alike other currency pairs, USD/CAD also portrayed the US dollar’s recovery moves, the first in seven, while taking a U-turn from the multi-day low the previous day.

The US Dollar Index (DXY) rebound could be linked to the inflation-led fears and the China woes that dragged down the market sentiment and commodities, offering a double-down weigh on the Canadian Dollar. The reason could be linked to Canada’s heavy reliance on WTI crude oil as an export income.

Federal Reserve Governor Christopher Waller said on Thursday that the next few months will be critical to see whether inflation is transitory, as reported by Reuters. Previously, Federal Reserve Governor Randal Quarles and Cleveland Fed President Loretta Mester highlighted inflation fears.

Further, China’s troubled reality firm Evergrande managed to get an extension on a defaulted $260 million bond but the global rating giant Fitch cites property stress from Beijing to join the macro policy trade-off risks. This came after it failed to seal an asset sale deal with Hopson and flashed another red signal to the investors. Additionally, power cuts in China remain the key problem for the world’s biggest industrial player even as the government restarts some of the coal mines to battles energy shortages.

Against this backdrop, equities stalled and the US 10-year Treasury yields jump to a fresh high since early April. Also, WTI crude oil prices took a U-turn from a seven-year high recently pressured around $82.50.

It’s worth mentioning that the second-tier data from Canada, mainly linked to employment and housing came in softer while US economics were mixed, which in turn helped the USD/CAD to recover.

Looking forward, Canadian Retail Sales for August will precede the US PMIs for October to entertain the USD/CAD traders. However, major attention will be on the risk catalysts for fresh impulse.

Technical analysis

Despite bouncing off multi-day low, 10-DMA and a horizontal area comprising lows marked since early July, respectively around 1.2395 and 1.2425-30, guard short-term USD/CAD recovery moves. Meanwhile, June’s low near 1.2350 limits nearby declines.

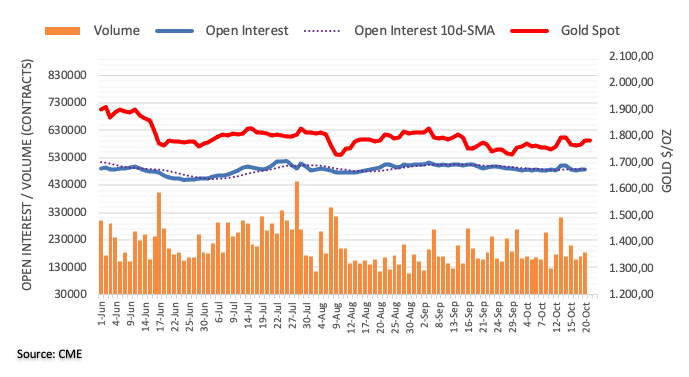

- Gold is range-trading within the $1,767-88 area awaits a fresh catalyst.

- The market sentiment is dismal due to inflation worries clouding the financial markets.

- XAU/USD: It is tilted to the upside in the short term but will face strong resistance at $1,800.00.

On Thursday, gold (XAU/USD) seesawed around $1,767-88, subject to the movement in US T-bond yields. As the Asian session begins, the non-yielding metal is barely up 0.08%, trading at $1,783.50 during the day at the time of writing. During the New York session, the market sentiment improved as the Wall Street close approached, ending with a positive mood; however, as the Asian session opened, conditions have worsened, as portrayed by falling equity futures.

Based on the abovementioned, factors like inflation, mentioned by most central bank policymakers around the globe, dented the market sentiment as it remains the main narrative for the day. Throughout the week, robust US corporate earnings kept up investors’ spirits, despite higher CPI reading like in New Zealand, which boosted the antipodean currencies against the greenback. On the softer tone was the UK inflation figure, which trailed the estimated by analysts.

The consequence of elevated prices spurred a sell-off in the bond market as bond yields rose. In the case of the US, the 10-year benchmark note rate rose to 1.68% on Thursday, the highest level since the 1.78% March high, which reflects investors confidence that the Federal Reserve will need to hike rates soon, to curb inflation. That jump in the US yield capped gold upside move in its attempt towards $1,800.00.

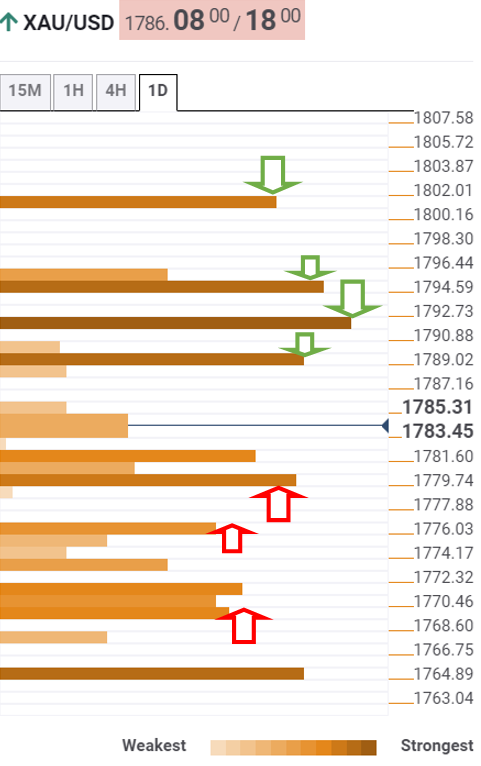

XAU/USD Price Forecast: Technical outlook

The 1-hour chart depicts that gold (XAU/USD) has been up and down, failing to challenge the $1,800.00 level. At press time, it is trading above the hourly moving averages (HMA’s), indicating an upside bias, but the slope of the before mentioned is flat, so the non-yielding metal is range-bound.

The Relative Strength Index (RSI), a momentum indicator, is at 52 with a downward slope, but it supports the upward trend as it remains above the 50-midline.

Gold (XAU/USD) buyers will need a break of the $1,790.00 level to challenge $1,800.00. In case of that outcome, key resistance levels would be exposed. The first one would be the September 14 swing highs around $1,808.50, followed by the September 7 swing highs around $1,827.00.

- EUR/USD holds lower grounds inside fortnight-old rising channel formation.

- Convergence of Fibonacci retracements, channel’s support restricts immediate downside.

- Descending RSI joins double tops around 1.1665-70 to keep bears hopeful.

EUR/USD fades bounce off 1.1620 amid a quiet start to Friday’s Asian session. In doing so, the major currency pair remains near crucial support confluence following its rejection from an important short-term Fibonacci retracement (Fibo.) level, namely 61.8% Fibo. of September 22 to October 12 downturn.

Given the descending RSI conditions and a double top around 1.1665-70, not to forget sustained trading below 200-SMA, EUR/USD prices are likely to remain weak.

However, the support line of a two-week-old ascending trend channel joins 38.2% Fibonacci retracement of the stated short-term moves, also 23.6% Fibo. level of a decline from early September, restrict the quote’s immediate downside around 1.1620-15.

Hence, a clear break of the stated support level becomes necessary for the EUR/USD bears to aim for the yearly low surrounding 1.1525. Though, the 1.1570 level may act as a buffer during the fall.

Meanwhile, recovery moves remain less important until crossing the 1.1665-70 level. Also challenging the EUR/USD bulls are the 200-SMA level of 1.1675 and the stated channel’s resistance line close to 1.1690.

Should the EUR/USD buyers manage to cross the 1.1690 hurdle, the late September highs near 1.1755 will be in focus.

EUR/USD: Four-hour chart

Trend: Further weakness expected

“The Reserve Bank of Australia (RBA) is closely watching a spike in inflation,” said the RBA Governor Philip Lowe, per Reuters, while speaking at a conference hosted by the Universidad de Chile on early Friday morning in Asia.

The policymaker adds that he did not think the rise would be sustained unless it led to sustainably higher wages growth.

Key quotes

Policymakers broadly understood why the spike in inflation was occurring.

Whether it turned into a permanent lift depended on whether it fed through to the labor market.

Is it going to reset expectations about what type of wage growth people should get, or will the spike dissipate and we will go back to the type of labor market outcomes we’ve seen before the pandemic?

So there is quite a lot of uncertainty around that issue, but we are watching very carefully.

Read: AUD/USD: Bear’s return eyes 0.7420 amid inflation-linked fears, China woes

"Vaccinations are our armor," said New Zealand (NZ) PM Jacinda Ardern while unveiling the new measures, the easy one, to battle the coronavirus during Friday morning in Asia.

“In a suite of announcements that establish a pathway out of restrictions the Government is also providing up to $940 million per fortnight to support businesses through the challenging period, particularly those in Auckland,” said NZ Herald.

“A new $120m fund has also been established to help lift Māori vaccination rates,” the news adds.

While red, orange and green tags term the measures are “traffic light”, some additional details are as follows:

- Vaccination passports - to visit bars and visit close business settings, you will need to be vaccinated.

- Highly targeted and localized lockdowns may be used if needed.

- First step is with high vaccination rates, target is 90% full vaccinated for each DHB in NZ.

- Auckland will move into the red setting as soon as all three DHBs (District Health Boards) hit the 90 percent fully vaccination target.

Read: NZD/USD bears step in and heavy daily candle expected to contain the bulls

- AUD/USD remains pressured after reversing from a three-month high.

- Fed tapering chatters, fears of higher inflation propelled US Treasury yields, RBA's Lowe cited inflation woes as well.

- China-led risk-off also underpins US dollar’s safe-haven demand.

- Preliminary PMIs for October are eyed for fresh impulse, risk catalysts are the key.

AUD/USD holds lower ground near 0.7460, following the U-turn from a multi-day high to end-up marking the heaviest daily fall in October. That said, the quote seesaws inside a choppy range as traders await fresh clues during early Friday morning in Asia.

The US Federal Reserve’s (Fed) “transitory” tag for inflation joins the European Central Bank’s (ECB) woes that the reflation wave is in for a strong run to renew rate hike calls and underpinned the Treasury yields, which in turn recalled the US dollar bulls. Also, sentiment-negative headlines from China weighed on the commodities and antipodeans, exerting an additional burden on the AUD/USD prices.

Federal Reserve Governor Christopher Waller said on Thursday that the next few months will be critical to see whether inflation is transitory, as reported by Reuters. On the same line, European Central Bank (ECB) Governing Council member Ignazio Visco said on Thursday that supply bottlenecks are starting to weigh on the Italian economy and added that they could last for longer than expected, per Reuters. At home, the RBA Governor Philip Lowe also spoke for inflation fears as Reuters reports, "The Reserve Bank of Australia is closely watching a spike in inflation, with Governor Philip Lowe saying on Friday he did not think the rise would be sustained unless it led to sustainably higher wages growth."

Elsewhere, China’s Evergrande managed to get an extension on a defaulted $260 million bond but the global rating giant Fitch cites property stress from Beijing to join the macro policy trade-off risks. The troubled real-estate firm also failed to seal an asset sale deal with Hopson and flashed another red signal to the investors Further, power cuts in China remain as the key problem for the world’s biggest industrial player even as the government restarts some of the coal mines to battles energy shortages.

Talking about data, Aussie NAB Business Confidence dropped to -1 from 17 in Q3 while US Philadelphia Fed Manufacturing Survey data also softened to 23.8 versus 25 expected and 30.7 prior. Additionally, US weekly Initial Jobless Claims weakened to 290K but the Existing Home Sales rose 7.0% versus a prior contraction of 2.0%.

Amid these plays, equity bulls stalled and the US 10-year Treasury yields jump to a fresh high since early April, helping the US Dollar Index (DXY) to snap a six-day downtrend despite renewing a three-week low earlier on Thursday.

Looking forward, headlines concerning inflation and China will be hot to direct short-term AUD/USD moves ahead of the preliminary activity numbers for October from the US. Should the PMIs arrive as stronger, the reflation fears can exert additional downside pressure on the quote.

Technical analysis

AUD/USD bulls got a rejection from a nearly seven-month-old horizontal resistance area surrounding 0.7530-35 amid overbought RSI conditions. The following weakness also broke multiple supports established since June near 0.7480-75. Even so, bears remain cautious until the quote stays beyond the monthly support line near 0.7420. Meanwhile, an upside clearance of 0.7535 will escalate the north-run towards late June’s peak of 0.7617.

- NZD/USD bulls taking profits ahead of the weekend.

- The correction is strong and could keep the kiwi down for days to come ahead of next major data release.

- RBNZ is price sin for a 25bp hike, risk is if bank does more.

NZD/USD is trading around -6% lower on the day after falling in a short correction from a high of 0.7218 to a low of 0.7140. The US dollar is little changed but US yields have moved higher again in the bullish cycle and from a technical perspective, there could be more upside to follow shortly.

Meanwhile, the focus has been on the inflation for New Zealand with the Q3 CPI inflation data arriving at a much faster than expected 4.9% YoY has been the trigger for the latest spate of fears around RBNZ policy. As it is, the money market is fully priced for a 25 bps move before the end of this year and partly priced for a more significant amount of tightening. The market is assuming that a 25 bps rate hike is a done deal.

''This implies that the key element for markets in the coming weeks surrounds the risk of a larger move,'' analysts at Rabobank argued. ''The release of New Zealand’s Q3 labour data on November 2 will be watched closely in particular for any signs of a pick-up in wage inflation. Also key in the coming weeks will be the decision by the government regarding the loosening of lockdown restrictions in Auckland.''

US yields in focus

Meanwhile, market-implied expectations for US inflation for the next five years have surged to the highest in 15 years as measured by breakevens, Bloomberg reported.

US yields on Thursday have indeed moved higher on Thursday with the 10-year printing a fresh 1.682% high on the approach to the March highs of 1.774% from a technical perspective:

From a daily perspective, there are prospects of a move beyond the daily highs towards a -272% Fibonacci retracement of the current daily flag's range:

Looking forward, analysts at ANZ Bank still think the NZD will benefit from higher interest rates, affirming both carry and confidence in the Reserve Bank of New Zealand’s inflation credentials. ''Amid rising global inflation, it’s logical that the NZD should strengthen, softening the blow,'' the analysts added.

NZD/USD technical analysis

''The Kiwi is about 3/4 of a cent off yesterday’s peak, having experienced the biggest correction since the current rally started just over a week ago,'' analysts at ANZ Bank explained.''

''At this stage, it looks more like a rebalancing rather than the start of a fresh downtrend.''

The price is meeting an area of strong support and high volumes there and below which could equate to a move to the upside if it holds. However, the corrective candle is very strong so the momentum could give the price pinged to the floor especially as the weekend approaches.

If the support breaks, the price could easily move through the volumes to reach at least 38.2% Fibonacci retracement of the bullish impulse. This will be the last defence for the 50% mean reversion target.

- The US Dollar is firmly up on the back of inflation concerns.

- US Initial Jobless Claims drop for the second-consecutive week, at 290K.

- GBP/USD: Will finish the year around 1.3800 – Scotiabank.

The British pound extends its slide below 1.3800 during the New York session, losses 0.26%, trading at 1.3788 at the time of writing. As portrayed by US stocks indices rising between 0.19% and 0.58%, the market mood has slightly improved, except for the Dow Jones Industrial, dropping 0.12%.

DXY recovers from early week losses

The US Dollar Index, which measures the greenback’s performance against a basket of six peers, advances firmly 0.17%, currently at 93.722, uplifted by higher US T-bond yields, which rallied on the expectations that high inflation in the country, might force the Federal Reserve to react, hiking interest rates, sooner than later.

Meanwhile, the US 10-year Treasury yield climbs four basis points, sitting at 1.677% at press time.

On the macroeconomic front, in the UK, the Public Sector Net Borrowing for September, at £21.014B, was lower than the £27.152B expected

On the US economic docket, US data was mixed. Weekly jobless claims have dropped to their lowest levels in 19 months and existing home sales increased 7.0% to 6.29 million in September, the highest reading since January. Contrarily, the Philadelphia Fed Manufacturing survey slid to 23.8 from 30.7 in the previous month.

GBP/USD: Will finish the year around 1.3800 – Scotiabank

The FX Analysis team at Scotiabank expects the pair to end the year around 1.3800:

“The GBP remains well supported by hawkish BoE expectations that should prevent sustained declines under 1.36, but we think there is likely more downside than upside risk to market expectations for BoE tightening as already over 100bps in hikes are priced in between now and end-2022.”

“We think the GBP/USD will struggle to make a push toward a test of 1.40 despite the high probability of at least one hike shortly and think it more likely that the pound closes the year near the 1.38 level.”

What you need to know on Friday, October 22:

Risk turned off on Thursday, with the dollar making the most out of it. The American currency appreciated against most major rivals, except safe-haven CHF and JPY. There was no particular catalyst behind the dismal sentiment, although renewed inflation concerns may be part of it. The closely watched 10-year US Treasury yield hit yet another multi-month high of 1.683%, finishing the day around 1.67%.

The EUR/USD pair pulled lower and trades near a critical Fibonacci support level at 1.1615. GBP/USD failed once again around 1.3830, and settled in the 1.3780 price zone. AUD/USD retreated from a fresh 3-monht high and settled around 0.7460, while USD/CAD bounced to the 1.2370 price zone.

Gold finished the day pretty much unchanged around $ 1782 a troy ounce, while crude oil prices plunged after hitting three-year highs. A forecast for a warmer winter in the US offset supply concerns. WTI settled at $82.50 a barrel.

The US Federal Reserve banned stock trading and restricted other investing activities by top officials. The movement came after chair Jerome Powell sold up to $5 million worth of stock from his personal account in early October.

European and Asian indexes closed mostly in the red, although Wall Street managed to recover ahead of the close, with US indexes ended the day mixed.

Friday will bring the preliminary estimates of October PMIs for most major economies.

Dogecoin remains the king of all memecoins as analysts expect DOGE to resume its bull run

Like this article? Help us with some feedback by answering this survey:

- The Dow Jones Industrial Average is down 0.17% to 35,442.5.

- The S&P 500 is just shy of a record close Wednesday. The Nasdaq rose 0.5%.

- US yields are making fresh cycle highs with more to come.

US stocks are on Thursday while government bond yields have touched a fresh five-month high after initial jobless claims fell to their latest low since the start of the pandemic.

The Dow Jones Industrial Average is down 0.17% to 35,442.53 the low on the day after setting an intraday high, while the S&P 500 added 0.18% after six straight gains that left it just shy of a record close Wednesday. The Nasdaq rose 0.5%. The S&P 500 posted 51 new 52-week highs and no new lows; the Nasdaq Composite recorded 93 new highs and 33 new lows. Consumer discretionary shares have fared best so far, while materials and energy lagged.

Seven of the 11 major S&P 500 sectors were trading lower, with energy stocks declining the most. Consumer discretionary was the biggest percentage gainer among the S&P sectors so far, with help from Amazon.com Inc. Meanwhile, analysts are expecting S&P 500 third-quarter earnings to rise 33.7% year-on-year, according to Refinitiv.

In the economic calendar, Initial jobless claims fell to 290,000 in the US during the week ended Oct. 16 from an upwardly revised 296,000 in the previous week. The four-week moving average fell by 15,250 to 319,750, a new low since the start of the COVID-19 pandemic. In other data, the US existing home sales climbed 7% in September to a seasonally adjusted annual rate of 6.29 million from 5.88 million in August, exceeding expectations for a rise to 6.1 million.

Meanwhile, market-implied expectations for US inflation for the next five years have surged to the highest in 15 years as measured by breakevens, Bloomberg reported.

US yields on Thursday have indeed moved higher on Thursday with the 10-year printing a fresh 1.682% high on the approach to the March highs of 1.774% from a technical perspective:

From a daily perspective, there are prospects of a move beyond the daily highs towards a -272% Fibonacci retracement of the current daily flag's range:

S&P 500 technical analysis

-637704399854184329.png)

The S&P 500 is a compelling technical picture given the counter-trendline and combination of the W-formation. Both are bearish as the counter-trendline would be expected to act as resistance on a restest and the W-formaiton is a reversion pattern. The price would be expected to test the neckline of the W-formation at 4,483 following a restest of the counter trendline.

- EUR/JPY breaks below 133.00 amid risk-off market due to US high inflation concerns.

- EUR/JPY: Stall at a confluence of a previous daily high and a Pitchfork’s top-line, in line with a correction move.

- EUR/JPY: A move towards the critical support area around 131.50 is on the books.

The EUR/JPY declines during the New York session, down 0.56%, trading at 132.38 at the time of writing.

The market sentiment is dismal, as portrayed by falling US stock indices falling between 0.06% and 0.41%, except the Nasdaq Composite, which rises 0.27%. Meanwhile, the US T-bond 10-year benchmark coupon rallies almost five basis points, sitting at 1.681%, the highest level since March 2021. The market seems convinced that high inflation will force the Federal Reserve to act faster than expected.

EUR/JPY Price Forecast: Technical outlook

Daily chart

The daily chart depicts the cross-currency stalled at 133.37, briefly up of the Andrew’s Pitchfork indicator top-line, retreating the upside move, testing the July 1 high at 132.43, which was previous resistance, turned support. Nevertheless, despite the abovementioned, the EUR/JPY has an upward bias confirmed by the daily moving averages (DMA’s) remaining below the spot price.

A Thursday daily close below 132.43 could spur a move towards the confluence of the 38.2% Fibonacci retracement with the mid-line of Andrew’s Pîtchfork indicator around the 131.55 area, which could find dip-buyers, as the confluence of two indicators would exert upward pressure around the area. However, in the outcome of breaking lower, a dip towards the 50% Fibonacci retracement at 130.93 is on the books before resuming the upward move.

The Relative Strength Index (RSI), a momentum indicator, is at 65, aiming lower, suggesting that a correction might be underway before turning north in line with the prevalent trend.

- The euro dips further end hits session lows near 1.1600.

- The USD firms up on inflation fears.

- EUR/USD is expected to return below 1.1600 – Scotiabank.

The euro has extended its reversal from week-highs at 1.1665 to hit fresh session lows at 1.1600 during Thursday's late US session. The pair is giving away gains, after a three-day rally, weighed by higher demand for USD amid a sourer market sentiment.

The US dollar picks up on inflation concerns

The common currency has been trading on a soft tone as the risk rally witnessed on previous days faded. Quarterly earnings have failed to lift spirits and concerns about the surging inflation and supply chain disruptions have returned to the spotlight, boosting demand for safe assets against riskier currencies like the euro.

Furthermore, US T-Bond yields have resumed their rally, with the US benchmark 10-year note hitting 4-month highs at 1.68%. The market is assuming that the persistently high inflation will force the Federal Reserve to accelerate its monetary policy normalization plan, which has provided additional support to the greenback.

On the macroeconomic front, US data has been mixed. Weekly jobless claims have dropped to their lowest levels in 19 months and existing home sales increased 7.0% to 6.29 million in September, the highest reading since January. On the other hand, The Philadelphia Fed Manufacturing survey dropped to 23.8 from 30.7 in the previous month.

EUR/USD: Seen returning below 1.1600 – Scotiabank

The FX Analysis team at Scotiabank, e3xpects the pair to decline further on Friday, to end the week below 1.1600: “Friday’s release of preliminary PMIs in the eurozone that will likely reflect the impact of high energy prices in the region. However, with the hit to manufacturing generally expected, only a large data miss could see the EUR/USD fall under the key 1.16 level. (…) The intraday low of ~1.1635 is support followed by 1.1600/15. Resistance is 1.1665/85.”

Technical levels to watch

A broad set of other restrictions on the investing activities of Federal Reserve officials has been implemented by the US Federal Reserve on Thursday that has banned individual stock purchases. This follows reports from around six weeks ago of active trading by some senior policymakers triggered an ethics uproar, Reuters reported.

''The new rules will limit the types of financial securities the Fed’s top officials can own, including an outright ban on purchases of individual stocks or holding individual bonds. It also requires advance notice and approval of any transactions, and stipulates investments be held for at least a year.''

“These tough new rules raise the bar high in order to assure the public we serve that all of our senior officials maintain a single-minded focus on the public mission of the Federal Reserve,” Federal Reserve Board Chair Jerome Powell said a statement.

Market implications

While not necessarily impactful, the new rules come after two of the 12 regional Federal Reserve bank presidents resigned after reports of their active trading during 2020.

- The US dollar bounces up from 0.9170 and approaches 0.9200 area.

- The Swiss franc appreciates as market sentiment sours.

- USD/CHF: Below 0.9215, further corrective weakness is likely– Credit Suisse.

The US dollar is attempting to set a bottom at 0.9170 five-week lows on the late US trading session. The pair has pared previous losses, returning to 0.9185 and trading nearly flat on daily charts.

Risk aversion buoys the Swiss franc

The Swiss Franc appreciated earlier today, favored by the adverse market sentiment. Unlike previous sessions, quarterly earnings have failed to distract the market from the risks of surging inflation pressures and supply chain bottlenecks, which has reflected in higher demand for safe havens like the Swiss franc and the Japanese yen.

Macroeconomic data has been unable to lift the greenback, with releases from the US sending mixed signals. On the one hand, weekly jobless claims have declined against expectations, to reach 19-month lows, and existing home sales increased 7% to 6.29 million in September, the highest level since January. The Philadelphia Fed Manufacturing index, however, deteriorated in September, due, in part to supply shortages.

USD/CHF: Confirmation below 0.9215 would increase bearish pressure – Credit Suisse

From a technical perspective, the FX Analysis team at Credit Suisse points out to key support at 0.9215: “Whilst our core outlook stays bullish, we cannot rule out further corrective weakness whilst below 0.9274 and more important support if the market does manage to close below 0.9214 is at the 200-day average at 0.9139, which is expected to hold if reached.”

Technical levels to watch

- Gold is firmly bid and riding weekly dynamic trendline support.

- Inflation concerns are being weighed by investors and priced into the markets.

- US dollar finding support on rising US yields and prospects of higher highs.

The price of gold on Thursday remains in familiar ranges, consolidated in the region of $1.780 and supported as investors weigh the probabilities of the Federal Reserve tapering and the likely hood of earlier than first anticipated rate hikes from the US central bank. At the time of writing, XAU/USD is trading at $1,779.81 and has travelled in a narrow range between $1,776.55 and $1,789.46.

US 10-yields in focus

In prior analysis, it was explained the 10-year US yields were on the verge of a break higher: ''...they could be about to surge to the upside from a technical perspective as the yield spikes from the 21-50 hour SMMA cloud.''

Prior analysis:

US yields on Thursday have indeed moved higher on Thursday with the 10-year printing a fresh 1.682% high on the approach to the March highs of 1.774% from a technical perspective:

From a daily perspective, there are prospects of a move beyond the daily highs towards a -272% Fibonacci retracement of the current daily flag's range:

In turn, the US dollar is finding support and the combination of prospects of the Federal Reserve raising rates sooner for fear of prolonged and sticky inflation is proving to be a headwind for gold prices.

US dollar on tenterhooks

The US dollar index was 0.15% higher at the time of writing around the highs of the day at 93.72 and holding nicely above Tuesday's three-week low of 93.501. However, it has declined 1.1% from a 15-month peak that hit last week. Expectations that the Fed could soon scale back pandemic-era stimulus has underpinned the dollar over the past few months. However, in recent times, other central banks have been sounding the inflation alarms.

Central banks, such as the Bank of England and the Reserve Bank of New Zealand, are seemingly about to put peddle to the metal and deal with inflation headwinds by raising rates, jumping the queue in front of the Fed. This has given rise to strength elsewhere and enabled precious metals to advance over the past couple of weeks.

Moreover, the Federal Reserve, while widely expected to announce the tapering of its bond purchase at a policy meeting in early November, it is expected to distance itself from future rate hikes for now. Money markets are pricing in just one US rate hike in 2022 after the Fed is expected to have finished its tapering process in the middle of next year.

''While gold prices remain relatively range-bound, they are facing tremendous pressure as market pricing for Fed hikes continue to firm into 2022,'' analysts at TD Securities said. ''Yet, we argue that market pricing for Fed hikes remains far too hawkish, as it fails to consider that a rise in inflation tied to a potential energy shock and lingering supply chain shortages would be unlikely to elicit a Fed response,'' the analysts argued.

''The market is increasingly pricing in a policy mistake which is unlikely to take place, considering that central banks are likely to look past these disruptions as their reaction functions have been historically more correlated to growth than inflation. Reasons to own the yellow metal are growing more compelling as Fed pricing is likely to unwind.''

Gold technical analysis

For an in-depth technical analysis of gold, see here: Gold Chart of the Week: XAU hit the $1,800 target, now what?

The price rides the dynamic trendline support towards the resistance as illustrated below. However, a move beyond $1,800 is required if the bulls are going to take charge again, or otherwise, a break below the trendline support and then $1,750 will open the risk of a downside continuation.

This can be illustrated better from a weekly perspective, as follows:

The price has met a 61.8% Fibonacci retracement of the prior bearish impulse but stays bid for another attempt.

- Silver retreats from $24,50 highs and tests support at $24.00 area.

- Precious metals dip with the USD picking up on inflation concerns.

- XAG/USD remains positive while above $23.40.

Silver futures are testing support at $24.00 after pulling back from six-week highs near $.24.50 weighed by a stronger US dollar with the risk rally coming to an end.

Metal prices pull back on inflation fears

Precious metals are trading lower on Friday, as higher inflation pressures have returned to the market, pushing US Treasury bond yields higher and ultimately buoying demand for the US dollar.

The US benchmark 10-year bond yield has edged up to fresh 4-month highs at 1.68% on Thursday, with the investors assuming that the persistently high inflation will force the Federal Reserve to accelerate its monetary policy normalization plan.

The US Dollar Index, which measures the value of the dollar against a basket of the most traded currencies, has edged up about 0.2% today, following a five-day decline from year-to-date highs at 94.54.

XAG/USD: remains positive while above $23.40

In a broader view, silver futures remain positive while above $23.40, where trendline support from late-September lows and the 50-period SMA meet. Below here, the next potential targets might be $23.00 (October 18 low), and 22.20/35 (October 6 and 12 lows).

On the upside, a bullish reaction past $24.45 (Intra-day high) would open the path towards early September highs at $24.80 and $25.20 (August 3, 4 lows).

XAG/USD 4-hour chart

Technical levels to watch

- The market sentiment is downbeat as riskier assets weaken against the US dollar safe-haven status.

- AUD/USD falls on higher US T-bond yields, showing investors seem convinced that rising inflation will force the Fed to act fast.

- AUD/USD: Will dip towards support at 0.7427 and 0.7338 – Commerzbank.

The AUD/USD slides for the first time on the week, down 0.65%, trading at 0.7467 during the New York session at the time of writing.

The pair retreated from the 200-day moving average at around 0.7545 due to an adverse market sentiment surrounding the financial markets, triggered by the Chinese real-estate giant Evergrande, which dented investors’ market appetite for riskier assets.

Furthermore, the US 10-year Treasury yield advances four basis points, sits at 1.674%, just short of 2021 high, provides additional support to the greenback. The market seems convinced that rising inflation will force the Fed to act faster than expected, despite how vocal have Fed policymakers have been lately.

In the meantime, the US Dollar Index, which tracks the greenback’s performance against six rivals, rises a decent 0.06%, currently, at 93.66, weighing on the AUD/USD.

US Initial Jobless Claims fell more than expected, showing an improvement in the labor market

On the macroeconomic front, the Australian economic docket was absent.

On the US front, the Initial Jobless Claims for the week ending on October 16 fell to 290,000, better than the 300,000 estimated by analysts, showing that the labor market is resilient, as it is starting to accelerate the pace moderately. Moreover, the 4-week moving average decreased by 122,000, to sit at 2,481,000 in the week ending on October 9.

AUD/USD Price Forecast: To dip towards support at 0.7427 and 0.7338 – Commerzbank

According to Karen Jones, Team Head FICC, an analyst at Commerzbank said: “AUD/USD’s rally has reached the 55-week ma at 0.7516, above here lies the 200-day ma 0.7565. We would expect to see some profit taking in this vicinity (…) Very near term, we would allow for a small retracement.”

Further added, “Dips should find interim support at 0.7427 the 4th August high and 0.7338 (20-day ma), and this guards the 29th September low at 0.7171.”

- The sterling retreats from 158.20 to test levels below 157.00.

- The yen appreciates on risk aversion.

- GBP/USD: Heading towards 163.91 while above 156.60 – Credit Suisse.

The British pound has given away all the ground taken over the last two days, against a stronger JPY, favored by a deteriorated market sentiment. The pair has pulled back from multi-year highs at 158.20 to test prices right below 157.00

The yen appreciates on risk aversion

The risk-sensitive sterling remains sold on Thursday, with the yen building up as the investors run to safe assets. With US corporate earnings failing to extend the positive mood witnessed on previous days, concerns about supply chain disruptions and the timing of the Fed’s monetary policy normalization have returned to the limelight.

US stock markets are trading mixed on Thursday. The Dow Jones and the S&P 500 indexes are 0.4% and 0.36% down respectively while the Nasdaq Index appreciates 0.38%. Disappointing quarterly earnings from the technological firm IBM have dampened sentiment and fuelling demand for the safe-haven yen.

On the macroeconomic docket, in absence of key releases in the UK and Japan, better than expected US weekly jobless claims and the strong US home sales figures have been offset by the downbeat Philadelphia Fed Manufacturing Survey, which has reactivated concerns about the economic impact of supply bottlenecks.

GBP/JPY: Heading to 163.91 while above 156.60 – Credit Suisse

From a technical perspective, the FX Analysis team at Credit Suisse maintains their positive bias while support at 156.60 holds: “With a major base already established in February 2021, we look for a move to next resistance at 159.80, then 163.91 (…) The broken 156.62/06 highs should now floor the market over the medium-term.”

Technical levels to watch

- WTI falls almost $3 due to an optimistic weather announcement by the National Oceanic and Atmospheric Administration.

- Beijing’s signal to intervene in the coal market added further pressure on crude oil prices.

- Bank of America and Iraq oil minister, see crude oil topping at $100.00 by the first half of 2022.

Western Texas Intermediate (WTI) falls around 2.57% during the New York session, trading at $81.26 at the time of writing. Mixed market sentiment surrounds the financial markets due to Evergrande’s woes once again on the headlines, weaker than expected IBM earnings, and inflationary pressures.

US crude oil benchmark WTI retreated from the 2021 high at $86.00 on the back of an announcement by the National Oceanic and Atmospheric Administration. According to Reuters, the report said that “winter weather in much of the US is expected to be warmer than average.”

Furthermore, in China, coal prices fell 11%, as Beijing signaled that it might intervene to cool the market, which also exerted downward pressure on the black gold.

Despite the fall in oil prices, the Iraq oil minister Ihsan Abdul Jabbar said that crude prices could hit the triple digits for the first time since 2014, in the first six months of 2022. Additionally, Bank of America said that the energy crisis could propel oil prices above $100, according to Bloomberg.

WTI Price Forecast: Technical outlook

Daily chart

WTI is tilted to the upside, as depicted by the daily moving averages well below the price. However, the Relative Strength Index (RSI) at 64 exiting from overbought levels spurred a violent correction of $3 from the 2021 top.

Wednesday low at $80.77 is the first support, but a daily close below the latter could trigger a correction before resuming the upward trend in crude oil prices. In that outcome, WTI could slide to the October 13 low at $79.40, which is the first demand zone. If that level is broken, would leave the July 6 high at $77.00 as the next place to “buy the dip.”

- The New Zealand dollar closes a six-day rally, pulling back from 0.7215

- The USD picks up, favored by a moderate risk aversion.

NZD/USD: Upside bias remains positive while above 0.7160/70.

The New Zealand dollar is about to put an end to a six-day rally against its American counterpart, weighed by a weaker sentiment. The pair has retreated from four-month lows at 0.7215 and is looking for support above previous highs at 0.7160/70.

Risk aversion weighs on the kiwi

The NZD/USD is losing momentum on the back of sourer market sentiment on Thursday as the optimism triggered by the upbeat earnings reports released earlier this week, has faded. Wall Street is trading mixed following disappointing earnings data by the technological firm IBM which has revived concerns about supply chain disruptions.

Beyond that, ongoing concerns about Evergrande’s crisis in China extending into the country’s property sector are keeping demand for the risk-sensitive kiwi restrained. The threat of a deeper liquidity crisis continues gripping the sector; with news about more defaults popping up which is triggering declines on the bonds of most companies of the sector.

NZD/USD: Support art 0.7160/70 maintains the positive bias intact

From a technical perspective, the pair remains strong while above 0.7160/70 (September 3, 10 high). Below there, a further retreat below the 200-day SMA, at 0.7090 area would increase negative pressure and might send the pair to test the psychological level at 0.7000.

On the upside, immediate resistance remains at 0.7220 (Intra-day high) and then 0.7240 (Jun. 7 high), which would clear the path towards 0.7315 (May 23 high).

Technical levels to watch

Analysts at Rabobank expect the European Central Bank (ECB) to keep its monetary policy on hold until December. According to them, October’s meeting will reflect the increased uncertainty surrounding inflation.

Key Quotes:

“The October meeting will probably pass without any policy changes. Nonetheless, the ECB may further steer expectations towards the December policy recalibration. In light of new inflation concerns, the market is now even pricing in a rate hike for 2022. The Council may want to reiterate that the recent inflation shocks have not changed their plans of a transition phase after the end of PEPP in order to keep financing conditions favourable.”

“Speaking of that transition phase, we do not expect to get any details on the design aspects that the ECB is exploring at next week’s meeting. The workshops in which the Council discusses the available options will likely not take place until next month. In the meantime, leaks or trial balloons can certainly expected. In fact, we have already seen a few.”

“With the ECB looking to keep its options open, that leaves the route of verbal intervention: the ECB needs to stress that it is taking a different stance than most other central banks, and that the Council continues to look through the current inflation surge.”

Growth has slowed down during the third quarter in China amid a number of headwinds, including regulatory storms, default risk of real estate giant, the electricity crunch and the authorities’ new campaign of “common prosperity” and social equality, points out the Research Department at BBVA.

Key Quotes:

“Economic structure remains unbalanced as the economy depends too much on exports while domestic consumption and investment keep lackluster.”

“Compared with high inflation pressure in US and the EU, China’s CPI is still at bay, with a weak pass-through effect from PPI to CPI.”

“Diverging with the QE Tapering in the advanced economies, China’s monetary policy will be more easing to deal with growth slowdown.”

“We lower our 2021 GDP prediction to 8% y/y from 8.2% previously; we also lower our 2022 GDP forecast from 5.5% to 5.2%.”

- The euro consolidates around 1.1640 after rejection at 1.1665.

- The pair loses steam as risk appetite wanes.

- EUR/USD: Failure at 1.1750 might send the pair down to 1.1495 – SocGen.

The euro has put an end to a three-day recovery and remains moving back and forth between 1.1630 and 1.1650, after pulling back from session highs at 1.1665 reached during Thursday’s Asian session.

A risk-off mood weighs on the euro

The pair is looking for direction, with the US dollar firming up and most stock markets trading in the red as the risk rally witnessed earlier this week has cooled. With inflation concerns back to the table, investors are looking for safety in the US dollar and the Japanese yen to the detriment of riskier currencies like the euro.

Corporate earnings, one of the main triggers of risk appetite over the last two days, have disappointed on Thursday, with the technological giant IBM posting weaker than expected quarterly results.

The macroeconomic calendar has been sending mixed signals on Thursday. US weekly jobless claims have dropped to their lowest levels in 19 months, with 296,000 new applicants last week, and existing home sales increased 7.0% to 6.29 Million in September, the best reading since January. On the other hand, The Philadelphia Fed Manufacturing survey dropped to 23.8 from 30.7 in the previous month in yet another evidence that supply chain disruptions are squeezing economic acivity.

EUR/USD: Failure at 1.1750 might send the pair down to 1.1495 – SocGen

According to the FX Analysis team at Société Générale, the pair should rise above 1.1750 to confirm recovery: “EUR/USD has staged a bounce from 1.1525 and could head towards a multi-month descending channel at 1.1750 (…) Failure to cross this can result in further pullback towards March 2020 peak of 1.1495/1.1450.”

Technical levels to watch

- US dollar strengthens versus commodity currencies as stocks and crude oil slide.

- USD/CAD extends gains during the American session, upside still seen as corrective.

The USD/CAD is rising on Thursday after posting on Wednesday the lowest daily close since early July. The pair bottomed at 1.2288 on Asian hours and then bounced to the upside. During the American session it printed a fresh daily high at 1.2353 and then pulled back to 1.2345.

The main trend in USD/CAD continues to point to the downside and the current move higher could be seen as corrective. The pair needs a daily close under 1.2300 to suggest bears are still in control.

The US dollar is holding onto daily gains across the board, except versus the Japanese yen. The DXY is up by 0.03%, ending a six-day negative streak. Higher US yields and a deterioration in market sentiment helped the greenback. The USD/CAD also finds support from a correction in crude oil prices. The WTI barrel is pulling back from multi-year highs, and trades under $81.00.

US economic data showed a decline in Initial Jobless Claims to the lowest since March 2020 below 300K. On the negative front, the Philly Fed retreated from 30.7 to 23.8 (consensus: 25). Existing Home Sales rebounded more than expected by 7% in September. Home prices rose 0.4% in September in Canada.

On Friday, preliminary Markit PMI is due in the US and in Canada the August retail sales report with preliminary numbers for September.

Technical levels

- GBP/USD stalls at 1.3838 for the third day in a row.

- Investors bets increase on a Bank of England hike rate by November’s meeting.

- US Initial Jobless Claims drop for the second-consecutive week, at 290K.

The British pound edges lower during the New York session, stalls around 1.3811, loses 0.09%, trading at 1.3817 at the time of writing.

The market sentiment is a mixed bag, depicted by falling European equity indices. At the same time, all US stock indices post moderated gains, except for the Dow Jones Industrial that is losing 0.24%, due to worse than expected IBM earnings. Furthermore, the oil rally stalled, while Evergrande’s worries surround the financial markets once more, as its shares plunged 11.6% after a $2.6 billion stake sell fell through, and the risk of a possible spillover remains. Safe-haven currencies like the US Dollar and the Japanese yen rose against most G8 currencies.

The US Dollar Index that tracks the greenback’s performance against a basket of six peers is up 0.02% at 93.62, while the US 10-year Treasury yield rallies four basis points, up to 1.673%, almost ten basis points short of 2021 high.

GBP/USD found a wall at 1.3838 for the third time in the week

The British pound stalled once again at the 1.3838 resistance for the third consecutive day. Investors bets on a Bank of England hiking rates had increased since October 9. Two policymakers expressed concerns about elevated prices, signaling that the BoE will step up and act to curb inflationary pressures.

However, despite what the UK’s central bank has been vocal about inflation, there are some variables that the BoE has to account for. COVID-19 cases are increasing, and with the furlough program coming to an end, some bank analysts and strategists are starting to become more neutral on the British pound, according to Bloomberg.

Moreover, the North Ireland protocol discussions between the UK and the Eurozone threaten to begin a trade war, severely hurting the UK economy.

On the macroeconomic front, in the UK, the Public Sector Net Borrowing for September, at £21.014B, was lower than the £27.152B expected

On the US economic docket, the Initial Jobless Claims for the week ending on October 16 fell to 290K, lower than the 300K foreseen by analysts, showing the labor market is starting to accelerate the pace moderately. Further, the 4-week moving average decreased by 122K, to sit at 2,481K in the week ending on October 9.

That said, the GBP/USD main driver would be the Bank of England decision, but also the Fed’s bond taper announcement and the market sentiment could hold back investors to open new positions in the pair.

- Yen among top performers on Thursday, recovers recent lost ground.

- USD/JPY down despite higher US bond yields.

- The rejection from above 114.00 suggests some upside exhaustion.

The USD/JPY is retreating on Thursday after hitting the highest level in years. Recently it dropped to 113.63, the lowest level in a week. The move lower took place even as US yields printed fresh monthly highs and amid a stronger dollar. The yen is among the top performers as US stocks trade mixed.

Economic data from the US showed Initial Jobless Claims dropped more than expected to the lowest since March 2020. On the negative front, the Philly Fed pulled back from 30.7 to 23.8, below expectations. Existing Home Sales rebounded more than expected. The greenback did not benefit from the numbers.

Rejection from above 114.00 points to some consolidation

If USD/JPY fails to rise back above 114.00 and post a weekly close below it would suggest some consolidation or even an extension of the current correction before the next move. After rising during four consecutive weeks and reaching a long–term barrier around 114.00, the rally could need to take a pause.

The initial support stands around 113.60 followed by 113.20 and then 112.10. A weekly close well above 114.00 should clear the way to more gains.

Technical levels

Democratic US Senator Joe Manchin said on Thursday that Democratic lawmakers are moving closer to an agreement on a "topline" figure for the spending bill, as reported by Reuters.

"Negotiations are ongoing, we're still talking to the White House," Manchin added. "The child tax credit is being negotiated, the program already in place through 2025."

On a similar note, US Senate Democratic Leader Chuck Schumer that they were "getting closer" to US President Joe Biden's agenda bill.

It's worth noting that Biden has reportedly lowered the spending bill target to between $1.75 trillion and $1.9 trillion.

Market reaction

These comments don't seem to be having a noticeable impact on market sentiment. As of writing, the S&P 500 Index was virtually unchanged on the day at 4,535.

There shouldn't be a big market shock when the Federal Reserve starts reducing its asset purchases, Federal Reserve Governor Christopher Waller said on Thursday, as reported by Reuters.

Additional takeaways

"There is no theory of how large a central bank's balance sheet should be."

"Current size of the balance sheet has caused no problems for financial market or macroeconomy."

"We can run off our balance sheet by quite a margin over the next couple of years if we want to."

"I have always favored market-based surveys of inflation expectations."

"You have still got to pay attention to household inflation surveys though."

"I am looking at both sets of data on inflation expectations."

Market reaction

The US Dollar Index continues to move sideways around 93.60 after these comments.

- Consumer Confidence Indicator for euro area edged lower in October.

- EUR/USD continues to fluctuate around 1.1650 on Thursday.

Consumer confidence in the euro area weakened in October with the European Commission's Consumer Confidence Indicator falling to -4.8 (flash) from -4 in September. This reading came in slightly better than the market expectation of -5. Moreover, the Consumer Confidence Indicator in the EU declined to -6.1 (flash) from -5.2.

Market reaction

This report doesn't seem to be having a noticeable impact on the common currency's performance against its major rivals. As of writing, the EUR/USD pair was posting small daily losses at 1.1642.

- The upside momentum in EUR/JPY faltered near 133.50.

- The yen regains traction as US yields grind lower.

- US Initial Claims rose by 290K, Philly Fed Index disappoints.

The recovery in the Japanese yen motivates the sharp rally in EUR/JPY to enter a pause mode after hitting fresh tops in the mid-133.00s on Wednesday.

EUR/JPY off 4-month peaks

Despite the ongoing corrective pullback, EUR/JPY manages to cling to the positive territory for the third week in a row and sheds ground for the first time after ten consecutive daily advances. In addition, the cross has almost fully retraced the January-August drop.

In fact, yields of the key US 10-year benchmark note and the long end of the curve recede from recent tops, prompting the Japanese yen to regain some ground lost vs. its American counterpart. Yields in the front end of the curve, in the meantime, reverse two daily decline and retake the 0.40% level.

In the docket, US weekly Claims rose by 290K in the week to October 16, while the Philly Fed Index came in short of expectations at 23.8 for the current month. Later, Existing Home Sales and the CB Leading Index will close the daily calendar.

EUR/JPY relevant levels

So far, the cross is losing 0.51% at 132.44 and a surpass of 133.48 (monthly high Oct.20) would expose 133.76 (high Jun.10) and then 134.12 (2021 high Jun.1). On the downside, the next support comes at 131.85 (10-day SMA) followed by 131.02 (Fibo level) and finally 130.38 (100-day SMA).

- The risk-off impulse in the markets extended some support to the safe-haven gold.

- Elevated US bond yields, a modest USD strength capped the upside for the metal.

- Bulls need to wait for a move beyond the $1,800 mark before placing fresh bets.

- Gold Price Forecast: Will XAU/USD find acceptance above channel hurdle at $1791?

Gold reversed an early North American session dip to the $1,776 area and turned positive for the third successive day, though remained below weekly tops touched earlier this Thursday. Currently hovering around the $1,782-83 region, the risk-off impulse in the markets turned out to be a key factor that acted as a tailwind for the safe-haven precious metal.

Investors turned nervous amid fresh concerns about potential contagion from China Evergrande's debt crisis. The heavily indebted developer said on Wednesday that a $2.6 billion stake in its property services unit failed. However, the market reaction, so far, has been limited amid reports that Evergrande has won more than a three-month extension to the maturity of a $260 million bond. Moreover, Chinese officials that the trouble in the sector would not be allowed to escalate into a full-blown crisis.

This, along with a goodish US dollar rebound from three-week lows, kept a lid on any meaningful gains for the dollar-denominated commodity. The greenback drew some support from a fresh leg up in the US Treasury bond yields. In fact, the yield on the benchmark 10-year US government bond moved back to the 1.67% mark, or the highest level since May amid expectations for an early policy tightening by the Fed. This was seen as another factor that contributed to cap the upside for the non-yielding gold, at least for now.

Despite signs of weakening economic activity, market players seem convinced that the Fed would be forced to adopt a more aggressive policy response to contain stubbornly high inflation. The speculations seemed unaffected by the overnight comments by Fed Governor Randal Quarles, saying that it would be premature to start raising interest rates in the face of high inflation that is likely to recede next year. Nevertheless, investors have been pricing in the possibility of a potential interest rate hike in 2022.

On the economic data front, the US Weekly Initial Jobless Claims dropped to 290K during the week ended October 15 as against expectations for a modest rise to 300K from 296K previous. This, to a larger extent, helped offset a weaker than anticipated Philly Fed Manufacturing Index, which fell to 23.8 for the current month from 30.7 in September and did little to influence the USD price dynamics. Thursday's US economic docket also features the release of Existing Home Sales data, though is unlikely to provide any impetus to gold prices.

Technical outlook

From a technical perspective, bulls might still wait for a sustained move beyond the $1,800 confluence hurdle before placing fresh bets. The mentioned handle comprises technically significant 100/200-day SMAs, which if cleared decisively will set the stage for additional gains. The next relevant barrier is pegged near the $1,808-10 region, above which gold seems all set to accelerate the momentum towards challenging the $1,832-34 heavy supply zone.

On the flip side, any meaningful pullback is likely to find decent support near the $1,775 area. Some follow-through weakness could drag gold prices back towards the $1,763-60 region. Failure to defend the mentioned support levels would negate any near-term positive bias and prompt aggressive technical selling. This, in turn, will expose the $1,750 support zone before the XAU/USD eventually drops further towards September monthly swing lows, around the $1723-21 region.

Levels to watch

Economists at TD Securities think a modest bounceback in the yen is starting to look a bit more likely. EUR/JPY looks stretched – this should weigh on USD/JPY but 112 looks to be formidable support.

There is a solid case for yen weakness

“As much as yen weakness is likely to persist over the medium-term, we think there is scope for a tactical reprieve as front-end receivers look more attractive in our view.”

“EUR/JPY has stalled around 133, which is just shy of its cyclical high around 134.”

“Given our view on the ECB and our bias for the EUR to remain relatively soggy, a retracement to 131 seems probable. This would also coincides with the 50% retracement of the high/lows since June. This should help pull USD/JPY lower, though we are inclined to think that 112 should be rather solid support.”

Federal Reserve Governor Christopher Waller said on Thursday that the next few months will be critical to see whether inflation is transitory, as reported by Reuters.

Waller further noted that he expects inflation to retreat toward the Fed's goal of 2% in 2022.

"The Fed may have to act faster if inflation remains too high," he added. "I've always had a very optimistic outlook for the US economy and there are no signs of a credit-fuelled bubble."

Market reaction

These remarks don't seem to be having a noticeable impact on the dollar's performance against its rivals. As of writing, the US Dollar Index was posting small daily gains at 93.63.

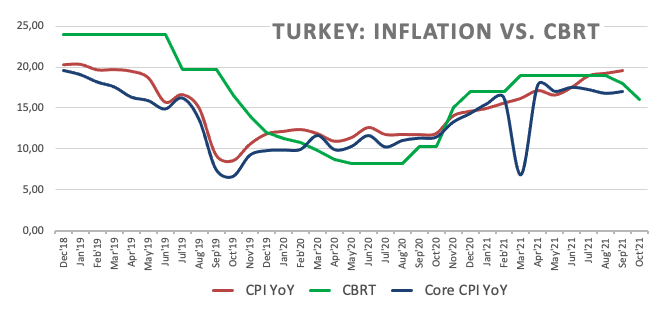

The Central Bank of the Republic of Turkey (CBRT) surprised by lowering its policy (one-week repo) rate by 200 basis points to 16% from 18%. Consequently, the lira fell a further 2% immediately after the announcement, and USD/TRY peaked at 9.4867. Economists at TD Securities think that the USD/TRY trajectory will continue to be upwards.

CBRT cuts deeper against the odds

“The CBRT surprised by cutting the benchmark one-week repo rate by 200bps to 16% today. This leads us to add an additional 50bps of easing for the remainder of 2021 . But the pace and magnitude will strictly hinge on the lira performance.”

“We think that the USD/TRY trajectory will continue to be upwards, but we do not exclude temporary drops that can embolden the CBRT to act more resolutely in cutting.”

“We continue to forecast USD/TRY at 9.15 in Q4 and 9.75 in Q1 2022. We for now hold onto these forecasts, but see an increasing risk that the lira may weaken much faster and bring forward to 2022 (if not earlier) the breach of the historical 10 mark.”

- AUD/USD witnessed an intraday turnaround from multi-month tops touched earlier this Thursday.

- The risk-off impulse, elevated US bond yields revived the USD demand and exerted some pressure.

- The lack of follow-through selling warrants some caution before positioning for any corrective slide.

The AUD/USD pair remained on the defensive through the early North American session, albeit has managed to rebound from pips from daily swing lows. The pair was last seen trading just below the key 0.7500 psychological mark, down over 0.25% for the day.

The pair struggled to capitalize on its early positive move to the highest level since early July and witnessed an intraday turnaround from the 0.7535 area. The corrective pullback was sponsored by a goodish pickup in demand for the US dollar, which drew some support from the risk-off impulse and elevated US Treasury bond yields.

Investors turned nervous amid renewed worries about potential contagion from China Evergrande's debt crisis. The heavily indebted developer said on Wednesday that a $2.6 billion stake in its property services unit failed. This, in turn, tempered investors' appetite for perceived riskier assets and benefitted the safe-haven USD.

Meanwhile, the yield on the benchmark 10-year US government bond held steady near the 1.67% mark, or the highest level since May and extended additional support to the greenback. Investors seem convinced that a faster than expected rise in inflation might force the Fed to adopt a more aggressive policy response in 2022.

On the economic data front, the US Weekly Initial Jobless Claims dropped to 290K during the week ended October 15 as against expectations for a modest rise to 300K from 296K previous. This, to a larger extent, helped offset a weaker than anticipated Philly Fed Manufacturing Index, which fell to 23.8 for the current month from 30.7 in September.

The USD bulls seemed rather unaffected by mixed economic data, instead took cues from an extension of the recent rally in the US bond yields. In fact, the yield on the yield on the benchmark 10-year US government bond held steady near the 1.67% mark, or the highest level since May amid expectations for an early policy tightening by the Fed.

This week's dismal US macro releases – Industrial Production and housing market data – pointed to weakening economic activity. Investors, however, seem convinced that a faster than expected rise in inflation might force the Fed to adopt a more aggressive policy response and have been pricing in the possibility of a rate hike in 2022.

It will now be interesting if the AUD/USD pair can attract fresh buying at lower levels or the pullback suggests that the recent strong positive move witnessed from September swing lows has run out of steam. Nevertheless, the lack of any strong follow-through selling warrants some caution before confirming that the pair has topped out.

Technical levels to watch

- Philly Fed Manufacturing Index edged lower in October.

- US Dollar Index stays in the positive territory above 93.60.

The Federal Reserve Bank of Philadelphia reported on Thursday that the headline Manufacturing Activity Index of the Manufacturing Business Outlook Survey declined to 23.8 in October from 30.7 in September. This reading came in weaker than the market expectation of 25.

Further details of the publication revealed that the New Orders Index improved to 30.8 from 15.9, the Employment Index edged higher to 30.7 from 26.3 and the Prices Paid Index rose to 70.3 from 67.3.

Market reaction

The US Dollar Index showed little to no reaction to this report and was last seen posting small daily gains at 93.64.

- Weekly Initial Jobless Claims in US declined by 6,000.

- US Dollar Index clings to modest daily gains above 93.60.

There were 290,000 initial claims for unemployment benefits in the US during the week ending October 16, the data published by the US Department of Labor (DOL) revealed on Thursday. This reading followed the previous print of 296,000 (revised from 293,000) and came in better than the market expectation of 300,000.

Market reaction

There was no immediate market reaction to this report and the US Dollar Index was last seen posting modest daily gains at 93.67.

Additional takeaways

"The 4-week moving average was 319,750, a decrease of 15,250 from the previous week's revised average."

"The advance seasonally adjusted insured unemployment rate was 1.8% for the week ending October 9."

"The advance number for seasonally adjusted insured unemployment during the week ending October 9 was 2,481,000, a decrease of 122,000 from the previous week's revised level."

- EUR/USD gives away some gains after testing 1.1670.

- Further up comes the 55-day SMA at 1.1711.

EUR/USD falters once again in the area of recent multi-week highs around 1.1670 on Thursday.

If this area if cleared, then the pair could attempt to take out the round level at 1.1700 the figure ahead of the interim hurdle at the 55-day SMA, today at 1.1711. Further north comes the short-term resistance line near 1.1730. A breakout of the latter should see the selling pressure mitigated and therefore allow for extra gains to the next relevant resistance in the mid-1.1700s.

In the meantime, the near-term outlook for EUR/USD is seen on the negative side below the key 200-day SMA, today at 1.1918.

EUR/USD daily chart

Economists at Scotiabank forecast USD/CAD at 1.20 by mid-2022. They have upgraded their Bank of Canada expectations and see the BoC hiking 100bps next year.

BoC tightening expectations upgraded

“Higher than expected Canadian inflation data yesterday and perhaps even our own, upgraded forecasts for the BoC (we now expect 100bps of tightening in H2 next year and a further 100bps in 2023) have served to bolster market confidence in monetary policy tightening risks in Canada.”

“We expect the CAD the strengthen a little more in the medium-term, reaching 1.20 in H2 next year, and to stay stronger for a little longer as a consequence of our upgraded BoC forecast.”

“We look for the CAD to retain a firm undertone over the next few days but more cautious trading could develop ahead of Thursday’s policy decision.”

- USD/CHF failed to capitalize on its modest intraday uptick to levels just above the 0.9200 mark.

- The risk-off impulse in the markets benefitted the safe-haven CHF and exerted some pressure.

- Elevated US bond yields revived the USD demand and helped limit further losses for the major.

The USD/CHF pair retreated over 25 pips from the early European session swing highs and dropped to the lowest level since mid-September, around the 0.9180 region in the last hour.

The pair struggled to preserve its modest intraday gains to levels just above the 0.9200 mark and has now drifted into the negative territory for the third successive day. The risk-off impulse in the markets benefitted the safe-haven Swiss franc, which, in turn, was seen as a key factor that prompted fresh selling around the USD/CHF pair on Thursday.

Worries about potential contagion from China Evergrande's debt crisis resurfaced after the heavily indebted developer said on Wednesday that a $2.6 billion stake in its property services unit failed. This, in turn, tempered investors' appetite for perceived riskier assets and drove flows towards traditional safe-haven currencies, including the CHF.

Meanwhile, the intraday pullback seemed rather unaffected by a modest pickup in the US dollar demand, which drew some support from elevated US Treasury bond yields. In fact, the yield on the benchmark 10-year US government bond held steady near the 1.67% mark, or the highest level since May amid expectations for an early policy tightening by the Fed.