- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 25-10-2021

- GBP/JPY struggles to keep rebound from one-week low.

- UK Brexit Minister doubts EU proposals, sets December deadline to solve NI border issue.

- Covid cases jump in Britain, Virus-led restrictions ease in Japan.

- Risk catalysts are the key amid a light calendar.

GBP/JPY takes rounds to 156.50, fading the previous day’s recovery moves during Tuesday’s Asian session. The cross-currency pair struggles for a clear direction as mixed concerns for yen joins Brexit woes and coronavirus fears from the UK.

Risk appetite improved headlines from China and concerning Evergrande joined hopes of US stimulus, backed by US President Joe Biden and House Speaker Nancy Pelosi.

While upbeat sentiment weighed on the US Treasury yields and should have helped the Japanese yen (JPY), fears that recently easy activity restrictions in Tokyo and surrounding prefectures after 11 months of hardships may renew the COVID-19 cases probe the pair bears.

Elsewhere, UK Brexit Minister conveys dissatisfaction with the Eurozone’s Brexit proposals and gives time until December 2021 to solve the Northern Ireland (NI) issue. “The EU's current proposals to reform the Northern Ireland Protocol "don't go far enough", the UK's Brexit minister has said, as he set a December deadline for the two sides to find a solution,” said Sky News. It's worth noting that a delegation from Brussels will arrive in London on Tuesday to discuss the matter.

Additionally weighing on the cable is the fears of faster virus mutations in the UK and the latest jump in the covid cases. “UK has seen close to 40,000 new cases per day for the last 4 days. UK health secretary has warned people of not letting their guard down as there could be 100,000 COVID cases per day as the country heads into the winter season,” said CNBC.

Against this backdrop, Wall Street benchmarks closed positive, refreshing records, while the US 10-year Treasury yields seek further clues following two days of downside. That said, S&P 500 Futures print mild gains by the press time.

Given the light calendar and mixed catalysts, the Brexit talks and covid updates are important to forecast short-term GBP/JPY moves.

Technical analysis

Despite bouncing off 10-day EMA, around 156.15 by the press time, GBP/JPY remains below the previous support line from October 01, close to 157.15, keeping bears hopeful.

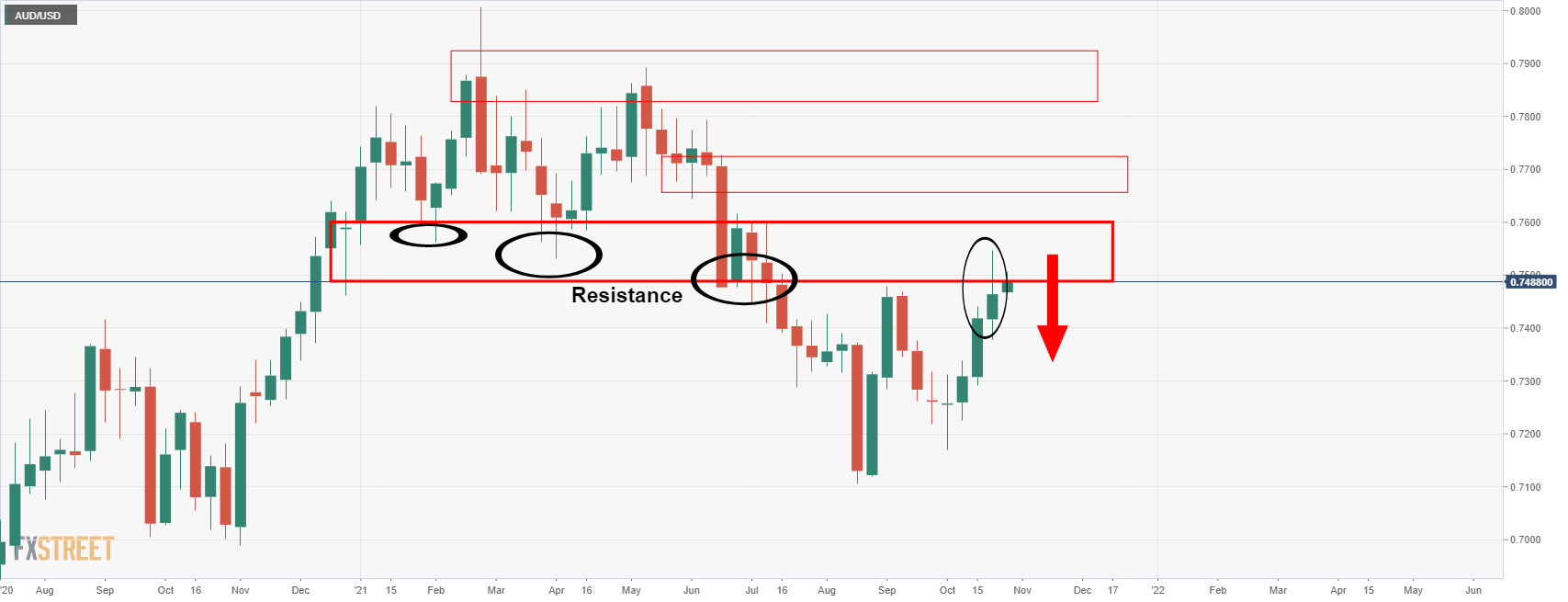

- AUD/USD is testing the waters in the 0.75 area.

- Weekly resistance is a conundrum for the bulls at this juncture.

AUD/USD is on the verge of a break of 0.75 psychological resistance, but the longer-term time frames are less than favourable given the amount of weekly resistance ahead.

Meanwhile, the event for the day is the Consumer Price Index and the following is the hourly picture leading into the event:

AUD/USD 1-HR chart

The price broke the trendline resistance in 0.7485 during the start of the European session ad has since carved a fresh dynamic resistance near 0.75 the figure. A break of that will open risk towards 0.7505. On the downside, and should the data disappoint, the bears will be seeking a break below 0.7480 for a run towards 0.7440.

Meanwhile, the following is a top-down analysis of the weekly and daily charts that illustrate the predicament for the bulls.

Daily chart

The daily chart is offering prospects of an upside continuation and while it is probable that the market will indeed continue higher, the weekly resistance must be noted.

Weekly chart

As illustrated on the weekly chart above for AUD/USD, the price is testing a wall of resistance. There is room to move a touch higher but last weeks' candle was lacking bullish momentum which leaves a bearish bias while below 0.7550.

- AUD/JPY fades rebound from 50-SMA, stays inside short-term ascending triangle.

- MACD teases bulls, monthly support line adds to the downside filters.

AUD/JPY retreats towards 85.00, down 0.05% intraday around 85.15 during Tuesday’s Asian session.

In doing so, the cross-currency pair fails to keep the last week’s recovery moves from 50-SMA. However, a two-week-old rising trend line, forming part of a short-term triangle, joins the stated short-term moving average and MACD conditions to keep buyers hopeful.

Hence, the latest pullback moves may aim to rest 50-SMA level of 85.00 while the stated triangle’s support line will also challenge the AUD/JPY bears around 84.85.

Should the quote drops below 84.85, it confirms the bearish chart pattern and signals downside towards the 84.00 round figure and monthly support line near 83.30.

On the contrary, an upside clearance of 85.55 horizontal hurdle will direct AUD/JPY prices toward the latest peak near 86.25.

In a case where the pair buyers keep reins past 86.25, March 2016 peak surrounding 86.70 and the 87.00 round figure will be in focus.

AUD/JPY: Four-hour chart

Trend: Bullish

- USD/CAD trades cautiously following the previous session’s gains on Tuesday.

- WTI retreats from $84.00 and is exerting pressure on the Canadian dollar.

- Fed/ BoC rate hike bets, inflation, and higher commodity prices take the center stage.

The USD/CAD pair accumulates gains on Tuesday in the early Asian trading hours. The pair touched the 1.2400 mark in the US session. At the time of writing, USD/CAD is trading at 1.2383, up 0.03% for the day.

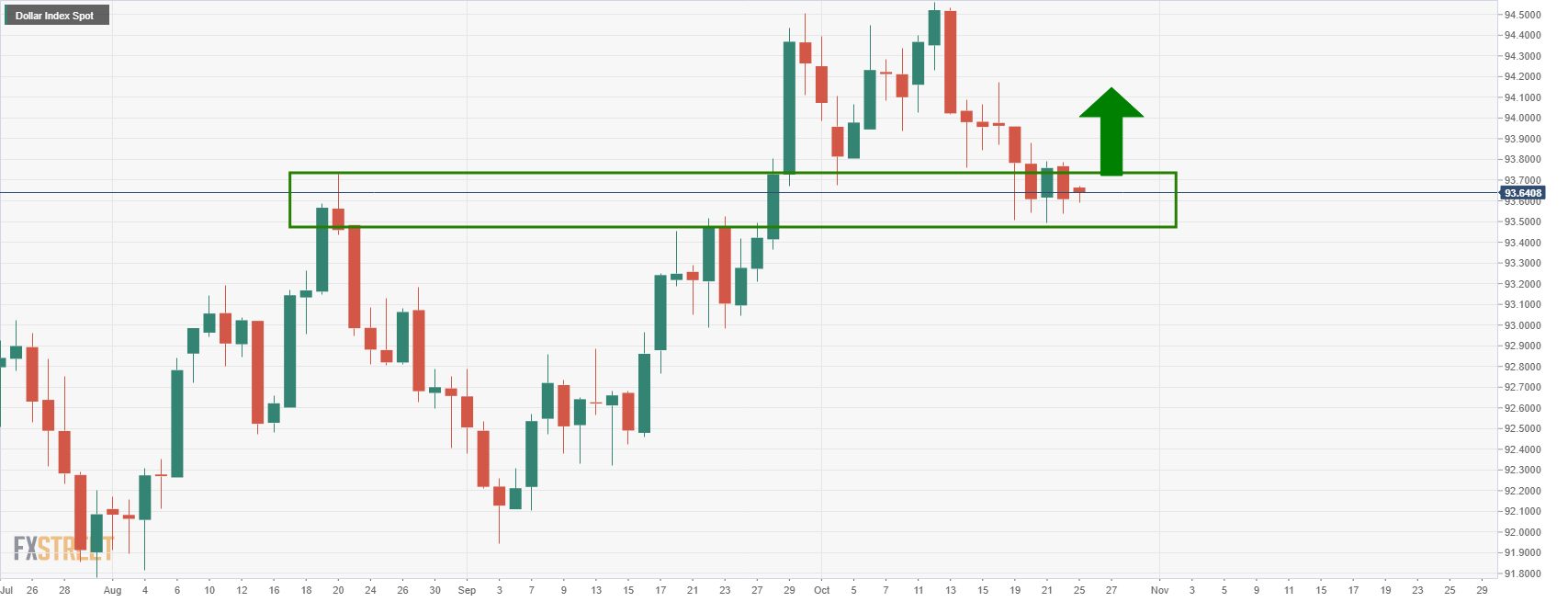

The appreciative move in the US dollar keeps USD/CAD higher. The US Dollar Index (DXY), which measures the performance of the greenback against its six major rivals, trades at 93.81, up 0.21%. Investors anticipate Fed’s tapering while digesting delay in rate hike expectations. US corporate results remained strong despite inflation concerns, which helped the greenback in finding some traction.

Crude oil, a key Canadian export, retreated from fresh 7-year highs, which pushed the loonie lower against the USD. In addition to that, a Reuters poll reported that the Bank of Canada (BoC) will raise interest rates as early as Q3, 2022, at least three months earlier than previously expected. The Market is already pricing in the first hike as early as April.

As for now, traders are waiting for the US Housing Price Index, S&P/Case-Shiller Home Price Indices, and New Home Sales data to take fresh trading impetus.

USD/CAD additional levels

- EUR/USD trades below the 4-hour 10 & 20 EMA bearish crossover.

- The US dollar is finding its form into critical events this week, including the ECB.

EUR/USD is trading in a tight range ahead of the Tokyo open near to 1.1610. EUR/USD fell from 1.1645 to 1.1610 overnight and remains capped by the 4-hour 10/20 EMA bearish crossover. The downside came from the dollar steadying on Monday afternoon after bouncing off a one-month low. Traders now look ahead to key data events for the week ahead, including the European Central Bank meeting this Thursday.

The forex space is being governed by markets that are weighing the prospects of higher interest rates for different currencies. This makes this weeks calendar critical as it may set the stage for many weeks to come. So far, the rebound in the greenback has come at the expense of the euro, the Japanese yen and the Swiss franc in the main.

ECB in focus

For today, bar the Aussie inflation readings, will be a quieter day for economics whereby we will see markets focused on US New Home Sales and a speech by the ECB's Villeroy on Tuesday. The bigger event, however, will be the ECB that meets this week and comments from the bank could shift views on how many inflationary pressures could impact interest rates.

''Whilst it has signalled that December is the meeting to expect a comprehensive update on post-PEPP plans, the current rise in inflation demands attention,'' analysts at ANZ Bank argued. ''Our analysis estimates inflation will prove more persistent than transitory next year, though we also think that the ECB will push back against expectations of rates rises in 2022.''

- WTI keeps pullback from seven-year high, retreats of late.

- Saudi Arabia outlines Mideast Green initiative, shows readiness to ease supply constraints.

- US-Iran tussles could renew on chatters over Syrian done attack.

- Risk-on mood, geopolitics may challenge oil bears, weekly API stockpiles eyed.

WTI holds lower grounds following a U-turn from a fresh multi-day high, pressured around $83.25 during Tuesday’s Asian session. In doing so, the black gold struggles to justify headlines from the Middle East, as well as risk-on mood, amid the US dollar rebound.

The US Dollar Index (DXY) refreshed three-week lows before posting the heaviest daily jump in two weeks on Monday. The greenback gauge seems to have benefited from the market’s cautious sentiment ahead of Thursday’s advance estimation of the US Q3 GDP amid hawkish Fedspeak and mixed data.

On the other hand, market sentiment improved headlines from China and concerning Evergrande joined hopes of US stimulus, backed by US President Joe Biden and House Speaker Nancy Pelosi.

More recently, doubts that Iran was behind the drone attack on the US airbase in Syria should have probed the oil sellers. However, Saudi Arabia’s “aims to reach "net zero" emissions of greenhouse gases, mostly produced by burning fossil fuels, by 2060,” per Reuters, challenge the energy buyers.

Even so, "We would need prices to rise to $110 /bbl to stifle demand enough to balance the market deficit we currently see in 1Q22 given our expectation that OPEC+ continues on the current path of +0.4 mb/d per month increases in quotas," said Goldman Sachs per Reuters.

Amid these plays, Wall Street closed positive and the S&P 500 Futures print mild gains by the press time.

Moving on, WTI traders should wait for the weekly oil stockpile data from the American Petroleum Institute (API), prior 3.294M, for fresh impulse. Though, qualitative factors and the US dollar moves will also be important to watch.

Technical analysis

10-DMA precedes monthly support line, respectively around $82.30 and $81.90 to restrict short-term WTI downside. Meanwhile, bulls need a daily closing beyond November 2012 lows near $84.10 to excel further.

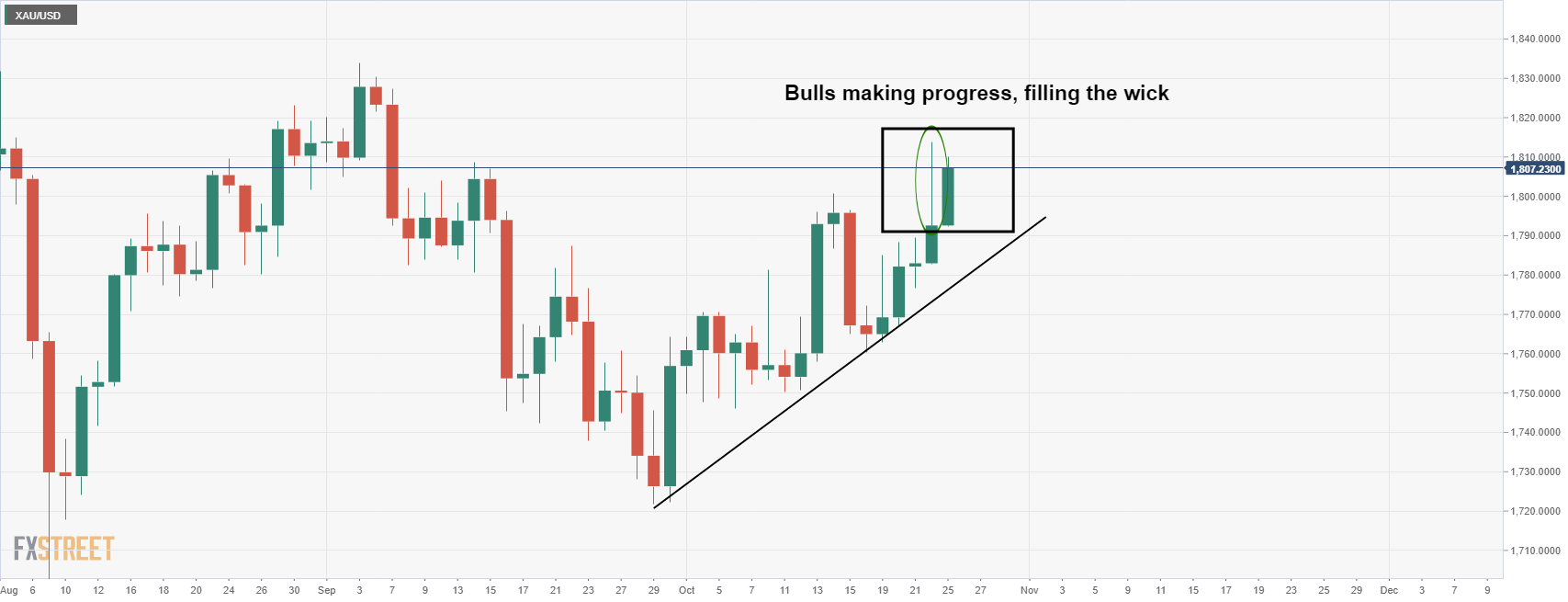

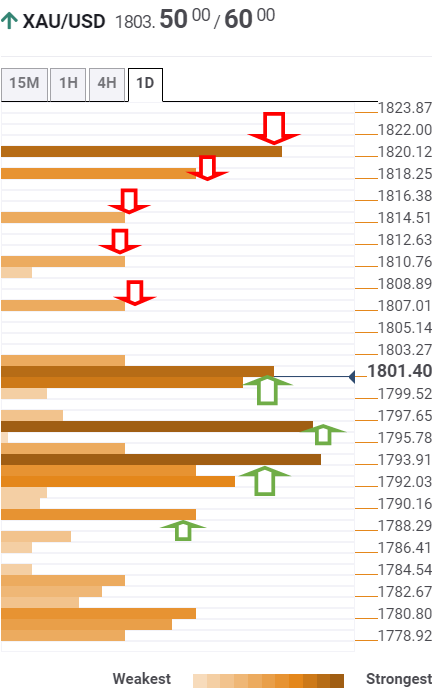

- On Monday, gold advanced $17 during the day, despite risk-on market sentiment.

- Gold has rallied for five consecutive days, climbing almost $50 until the current market price.

- XAU/USD: The daily chart is tilted to the upside, but strong resistance at $1,834 lies ahead.

- US 10-year T-bond yield: A break below 1.55% could push gold prices toward $1,834 and beyond.

Gold (XAU/USD) is barely flat as the New York session winds down and the Asian session begins, is trading at $1,807.68 during the day at the time of writing. On Monday, the non-yielding metal rose almost 1%, from $1,792 to $1,810, amid lower US T-bond yields, with the 10-year yield dropping from 1.678% to 1.633%.

Risk-on market sentiment prevailed during the Monday New York session as portrayed by US stock indices rising between 0.18% and 1.04%, gaining follow-through in the Asian session. Equity futures in Asia climb between 0.12% and 0.31%, except for the FTSE China A 50, down some 0.30%.

Gold reached five days in a row in advance; though the gains have been minimal, the price steadily climbed towards $1,800. The Federal Reserve entered the blackout period until the November 2-3 meeting, when investors expect the announcement of the bond tapering program. Those expectations kept gold from a steep upward move, as the market cautiously weighs inflationary pressures and the possibility of higher rates in the US.

XAU/USD Price Forecast: Technical outlook

Daily chart

On Monday, gold (XAU/USD) broke a five-month-old downward slope trendline along with the confluence of the 100 and the 200-day moving averages (DMA’s), printing a daily close above $1,800 for the first time since September 8. The abovementioned could well be a strong signal that the yellow-metal might be headed toward higher prices, but the September 3 high at $1,834 would be the first resistance level to surpass on its way towards $1,900. In case of that outcome, there would be nothing on the $1,900 path.

On the flip side, a reversal towards $1,780 could exert additional downward pressure to XAU/USD, leaving $1,746 as the first support area. A clear break of the latter could expose essential support areas—the September 29 low at $1,721, followed by the August 9 low at $1,687.

The Relative Strength Index (RSI) at 62 above the 50-midline supports the upside bias, but the slope is flattish so that gold might be headed for consolidation.

US Government Bond 10-year Treasury yield

The daily chart of the US 10-year Treasury yield depicts a negative divergence with the yield pushing higher, while the Relative Strength Index tops is printing lower highs.

The abovementioned suggest that the US 10-year bond coupon might be headed lower, but at press time, it is testing an area supported for about four months. Also, around the 1.55% area lies an upward trendline broken to the downside in July, but reclaimed its support status on October 15, when the 10-year reached a high of 1.579%. Hence, confirmation of the negative divergence could open the way for another leg-down in yields, thus propelling gold prices higher.

- GBP/USD fails to extend the first daily gains in three.

- Steady RSI, sustained trading below key SMAs keeps sellers hopeful.

- Previous resistance line from July adds strength to immediate support.

GBP/USD drops back to 1.3765 after snapping a two-day downtrend. In doing so, the cable pair fades the previous day’s bounce off the three-month-old resistance-turned-support during the early Asian session on Tuesday.

Given the quote’s inability to cross the 100-DMA and 200-DMA, coupled with the steady RSI, GBP/USD prices are likely to retest the previous resistance line around 1.3740-35. Also adding to the support’s strength is an ascending trend line from September 30.

It should be noted, however, that the pair’s weakness past 1.3735 will make it vulnerable to rest the early October’s top near 1.3675 before highlighting lows marked in August and July, respectively around 1.3600 and 1.3570 for the bears.

Alternatively, the 100-DMA level of 1.3792 precedes the 1.3800 round figure to guard the short-term GBP/USD recovery moves.

Following that, the recent swing high near 1.3835 and 200-DMA level close to 1.3850 will be the key to watch.

Overall, GBP/USD is likely to witness additional downside towards the key support confluence but bears should wait for confirmation.

GBP/USD: Daily chart

Trend: Further weakness expected

- USD/JPY accumulates gains on Tuesday in the initial Asian session.

- The US dollar holds above 93.80 despite slightly weaker US T-bond yields.

- Yellen's comments on inflation, higher equity market, and Fed tapering influences traders' decisions .

USD/JPY makes steady moves following the previous session’s movement. The pair retreated from the highs of 2018 high near 114.69 on Wednesday, and continued to move in a familiar trading range. At the time of writing USD/JPY is trading at 113.72, up 0.02% so far.

The US benchmark 10-year T bond yields trades lower at 1.63% which undemins the demand for the greenback. The yields took a tour to the south following US Treasury Secretary Janet Yellen remarks on inflation where she expected US inflation to return to normal by the second half of 2022.

In addition to that, US House Speaker Nancy Pelosi remained hopeful to pass an infrastructure bill and have a deal on the social policy bill by the end of the week. US Senator Joe Manchin also said that a deal on the outlines of the plan is within reach this week.

On the other hand the Japanese yen lost its ground on improved risk appetite among investors. It is worth noting that, S&P 500 Futures are trading at 4,563,up 0.11% so far.

As for now traders are waiting for the US Housing Price Index, S&P/Case-Shiller Home Price indices, and US Consumer Confidence to gauge the market sentiment.

USD/JPY additional levels

- US stocks begin the key week on a positive note, Dow, S&P refresh all-time highs.

- Upbeat performance of techs, US stimulus hopes join Fed blackout period to help the bulls.

- A 100,000 car order from Hertz boosted Tesla, Facebook earnings fail to lure bulls.

US equities extend Friday’s upbeat performance, backed by sentiment-positive news from Tesla to kick-start the heavy reporting week. That said, US stimulus hopes and an absence of Fedspeak, not to forget mixed US data, also helped stock buyers to keep the reins.

Amid these plays, Dow Jones Industrial Average (DJIA) and S&P 500 refresh record top with 0.18% and 0.47% daily gains, closing respectively around 35,741 and 4,566, following a run-up to 35,787 and 4,572. Additionally, Nasdaq gained 0.90%, or 136 points to end Monday’s trading around 15,226.

Market sentiment improved on Monday, keeping Friday’s optimism, after headlines from China and concerning Evergrande joined hopes of US stimulus, backed by US President Joe Biden and House Speaker Nancy Pelosi. However, the market’s wait for the advance US Q3 GDP, up for publishing on Thursday, probed the bulls following Friday’s hawkish Fedspeak.

Tesla stocks refresh all-time high, rising 13% on a day following the Electric Vehicle (EV) order from Hertz. “The company's market capitalization passed $1 trillion after Hertz Global agreed to buy 100,000 cars from the EV maker by the end of 2022,” said Reuters. On the other hand, Facebook registers a daily fall amid concerns over the prevalence of abusive content on its platform as well as softer Q3 revenues. It’s worth noting that shares of Pinterest dropped around 13% on Monday on the news that Paypal isn’t in to bid for the company.

Talking about US data, Dallas Fed Manufacturing Business Index rose past market consensus and prior readings in October but the Chicago Fed National Activity Index turned negative, -0.13 versus +0.05 previous readouts.

Looking forward, chatters from the Middle East, over US-Iran tussle and Saudi Arabia’s rejection to inflation further oil supplies, will join second-tier US data to entertain traders. However, major attention will be given to the earnings and the advance readings of the US Q3 GDP, up for publishing on Thursday.

Read: Forex Today: Central banks and US growth under the spotlight

- NZD/USD kick-starts the trading week inside the short-term range, poking the top of late.

- Market sentiment improves on stimulus hopes, China and Evergrande news.

- NZ markets resume trading after Labour Day holiday with light calendar in the Pacific.

- Second-tier US data, risk catalysts in focus ahead of Thursday’s US Q3 GDP.

NZD/USD holds onto the immediate trading range surrounding 0.7150, following a firmer performance of Monday. That being said, the kiwi pair seesaws near 0.7160 as the markets in New Zealand (NZ) begin the week’s trading on Tuesday, after an extended weekend.

Market sentiment improved on Monday, keeping Friday’s optimism, after headlines from China and concerning Evergrande joined hopes of US stimulus. Also favoring the risk-on is the firmer equities and receding covid fears. However, the absence of NZ traders and the market’s wait for the advance US Q3 GDP, up for publishing on Thursday, probed the quote’s latest moves.

US President Joe Biden and House Speaker Nancy Pelosi remain hopeful of getting the much-awaited infrastructure spending package passed soon. The policymakers have recently been ready to trim the package size and hence the stimulus gets less criticism from Republicans.

Elsewhere, China gets a formal seat on the United Nations and the People’s Bank of China (PBOC) stays ready for further injection, recently by 190 billion yuan. Further, Evergrande announced the restart of some cities after paying the US bond coupons the last week.

At home, receding virus cases and faster vaccinations help the NZ policymakers to stay hopeful of overcoming the coronavirus-led activity restrictions. “Deputy Prime Minister Grant Robertson confirmed today officials expect Counties Manukau to hit the 90 percent first vaccination target within the week - meaning second doses across Counties Manukau and the region's two other DHBs should be complete by the end of November,” said NZ Herald.

Alternatively, fears that COVID-19 regains momentum in China and the Fed tapering remains on the table keep the NZD/USD bulls challenged ahead of the key data/events.

Amid these plays, US equities closed higher, refreshing record tops, whereas the US 10-year Treasury yields dropped 2.2 basis points (bps) by the end of Monday’s North American trading session. However, the US Dollar Index (DXY) firmed after refreshing the three-week low.

Given the NZ traders’ return, NZD/USD may witness an active day and can overcome the immediate trading range. However, the recent USD strength and a lack of fresh positives may question the bulls. It’s worth noting that the US housing data, Consumer Confidence and Richmond Manufacturing Index may also entertain the pair traders.

Technical analysis

Although NZD/USD keeps pullback from a four-month-long ascending resistance line, near 0.7225, bullish MACD signals and Friday’s Doji keeps buyers hopeful until the quote stays beyond 200-DMA level surrounding the 0.7100 threshold.

- AUD/USD bulls meet resistance ahead of critical events this week.

- Aussie CPI will be the focus in Asia today.

AUD/USD was ending the day on Wall Street in the green by near to 0.4% after travelling from a low of 0.7461 to a high of 0.7505 on Monday's business. For Tuesday, the pair kicks off the Asian session up against a wall of weekly, daily and hourly resistance. For the day ahead, the Aussie Consumer Price Index will be a focus for traders.

The US dollar steadied on Monday afternoon after bouncing off a one-month low as traders weighed the prospects of a tighter US monetary policy. The risk events this week are heavy, so investors could be favouring the greenback as investors position for uncertainty. The euro, the Japanese yen and the Swiss franc were taking the brunt of the move into the US dollar. The dollar index against major currencies DXY steadied with a gain of nearly 0.23% for the day by the closing bell on Wall Street.

Meanwhile, there is a number of major events this week for forex. On Thursday, the European Central Bank will meet in US economic data, we have US Gross Domestic Product as well as inflation data from both the Us and across the pond, not to mention the domestic Consumer Price Index today for AUD. On top of this, there is also the Bank of Canada on Wednesday.

Critical events coming up

With respect to the Aussie CPI, analysts at TD Securities explained that ''new dwelling prices are expected to rise sharply as the dampening effect from the HomeBuilder grants fades, while higher fuel and motor vehicle prices will add to higher transport costs.'' Additionally, the analysts said, ''global supply-chain disruptions may also result in broad-based inflationary pressures. If our forecasts are correct, markets could retest the RBA and implies more pain for AU front-end rates.''

AUD/USD weekly resistance

US officials believe Iran was behind a drone attack that occurred last week at the military outpost in southern Syria where American troops are based.

key notes

Officials said Monday the US believes that Iran resourced and encouraged the attack.

They were Iranian drones, and Iran appears to have facilitated their use.

Officials believe the attacks involved as many as five drones laden with explosive charges, and that they hit both the US side of al-Tanf garrison and the side where Syrian opposition forces stay.

Market implications

There has been no reaction, thus far, to this developing situation but what is important, for now, is that there were no reported injuries or deaths as a result of the attack.

- XAG/USD: Weekly chart depicts the white metal is tilted to the upside but will face resistance at $25.00.

- XAG/USD: Daily chart portrays an upward trend, but RSI is aiming high near overbought levels, indicating that it could consolidate.

- XAG/USD: The 4-hour shows that silver upward move is overextended, as the RSI is one tick below overbought levels.

Silver (XAG/USD) begins the week in a positive tone, climbing 0.97%, trading at $24.54 during the New York session at the time of writing. The market sentiment is upbeat, portrayed by rising US stock indices, recording gains between 0.12% and 1.01%, contrarily US T-Bond yields slide, with the 10-year note rate falling one and a half basis points, sitting at 1.639%.

Meanwhile, the US Dollar Index, which price influences commodity prices, is rising 0.24%, currently at 93.83, putting a lid on silver prices, as it failed to break above $25.00 during the Monday session.

XAG/USD Price Forecast: Technical outlook

Weekly chart

The white metal is trading above the 38.2% Fibonacci retracement and the 100-week simple moving average (WSMA), near the tops of the month. Silver has an upside bias confirmed by the Relative Strenght Index (RSI), a momentum indicator is at 51, aiming higher.

Nevertheless, to continue its upward move, XAG/USD buyers will need to break above the 50% Fibonacci retracement at $25.10 to reclaim medium-term upward bias.

Daily chart

Silver follows the higher-timeframe analysis, as the daily chart depicts the white-metal is in an uptrend. The Relative Strength Index (RSI) at 67 confirms the upward bias, but it is close to overbought levels.

XAG/USD buyers will need a daily close above the 100-day moving average (DMA) at $24.52 to gain further upward strength.

In the case of that outcome, the confluence of the 200-DMA and a downward slope trendline around the $25.20-$25.50 range would be resistance for XAG/USD buyers. A breach of the latter could expose additional supply zones, like the August 4 high at $26.00, followed by the July 16 high at $26.45.

4-hour chart

Silver is in an uptrend, but it has the challenge of printing another leg-up above the $24.82 to extend the rally. The Relative Strength Index (RSI) is at 69, one tick short of reaching overbought levels, leading to a consolidation phase. Nevertheless, in case of a break above the latter, it could extend the rally towards $25.00 and beyond.

On the flip side, failure at the abovementioned level could open the door for a XAG/USD decline towards $24.20-30, as the RSI exits overbought levels before resuming the upward trend.

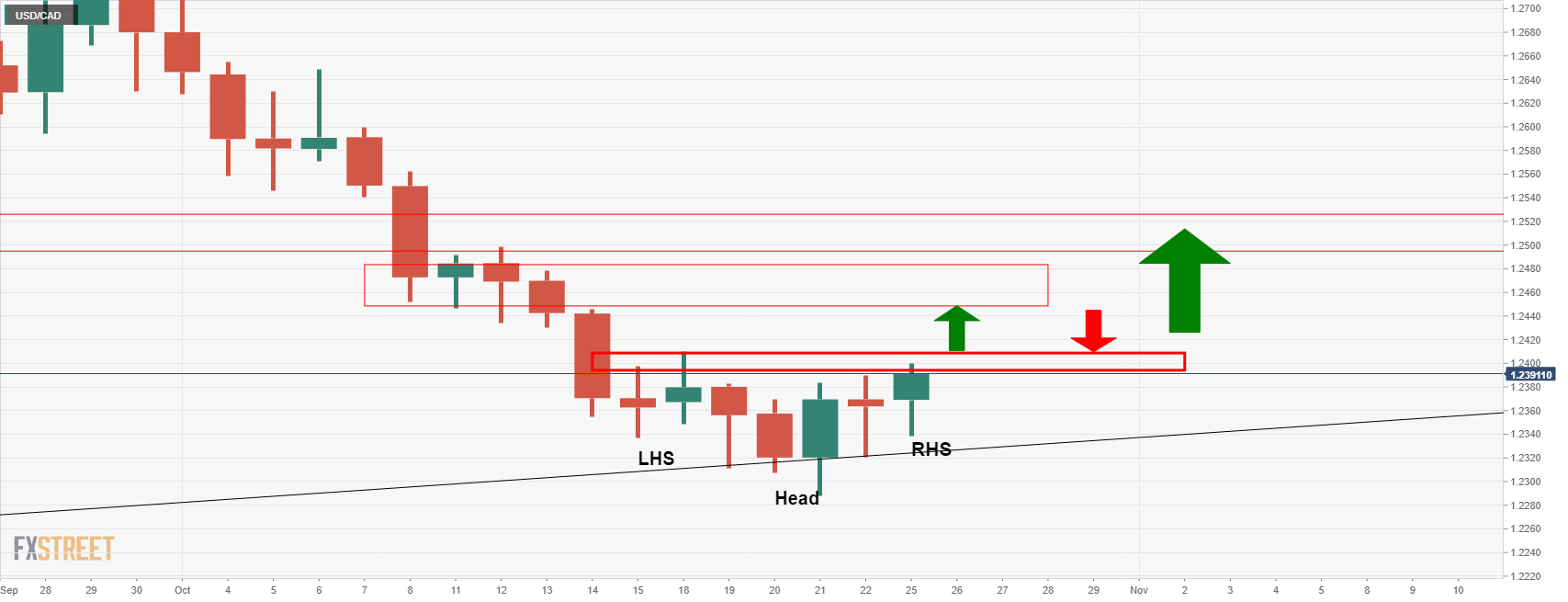

- USD/CAD is leaning with a bullish bias from a weekly, daily and hourly perspective.

- The bulls are on the verge of a break of the daily H&S neckline.

USD/CAD has been on the backfoot for the month of October so far and sharply so. However, there appears to be a short of momentum into the bull's hands which is illustrated in the following top-down analysis below:

USD/CAD weekly chart

The weekly chart is showing signs of stability at this juncture and a retest of the old support that would be expected to act as resistance this time around is a high probability. This would equate to a bid from what is looking like the makings of a dynamic supporting trendline into the neckline of the M-formation near 1.2500. Should that hold, then the risks will shift to the downside for a restest of the territory below the dynamic support.

USD/CAD daily chart

From a daily perspective, we have the makings of a reverse head and shoulders which aligns with the weekly bullish outlook. If the price breaks the neckline resistance, then there will be more resistance expected within the 11 Oct daily candle's range. this could lead to rejection on the first attempt and a restest of the H&S's neckline near to 1.2410 prior to the move into the weekly chart's neckline target near 1.2500.

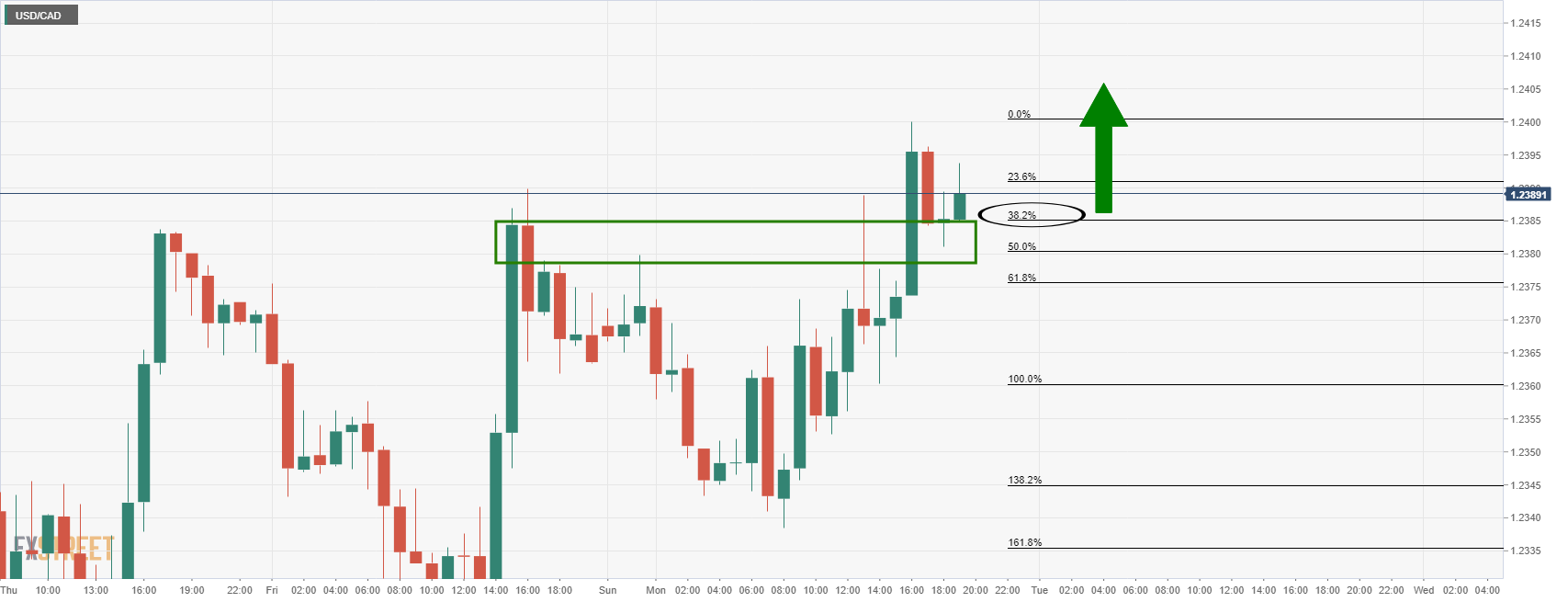

USD/CAD hourly chart

The hourly chart also represents a bullish bias in that the price has already corrected to the 38.2% Fibonacci retracement level of the recent bullish hourly impulse. This is a level where demand could lead to an eventual rally and fresh bullish impulse, in line with the break of the daily H&S neckline.

What you need to know on Tuesday, October 26:

The week started with a pitch of caution ahead of multiple first-tier events. The European Central Bank, the Bank of Japan, and the Bank of Canada will have monetary policies this week. Furthermore, the US will release the preliminary estimate of its Q3 Gross Domestic Product, and core PCE inflation, the US Federal Reserve favourite inflation measure.

The American dollar ended the day mixed against its major rivals, particularly strengthening against the EUR and the CAD. The first was affected by dismal German data, while the second suffered from retreating oil prices. The EUR/USD pair trades around 1.1610 after falling to 1.1590. USD/CAD nears the 1.2400 figure.

GBP and AUD are up against the greenback, although holding below the highs posted last week. Finally, the USD/JPY pair hovers around 113.60, marginally higher on a daily basis.

US Treasury yields kick-started the day ticking higher but finished the day below Friday’s closing levels. The yield on the 10-year benchmark stands around 1.63% after peaking at 1.67%.

Wall Street managed to post modest gains, enough to reach fresh all-time highs.

Mastercard gears up to offer crypto services to network-wide banks and institutions

Like this article? Help us with some feedback by answering this survey:

- The pound ticks up on Monday and returns to 156.50 area.

- The yen loses ground amid a moderate risk appetite.

- GBP/JPY remains positive, aiming to 158.22 – DBS Bank.

The British pound has edged up on Monday against a somewhat softer Japanese yen. The pair found support 155.90 lows, on its retreat from multi-year highs above 158.00, and has advanced to consolidate at the 155.50 area.

The Japanese yen eases on a moderate risk appetite

The safe-haven yen has lost ground on a very calm session on Monday, with the risk-sensitive pound supported by a mild appetite for risk. In absence of key macroeconomic releases, market sentiment has remained fairly positive, with the major stock indexes in the green.

From a wider perspective, however, the major currencies have been trading without a clear direction, with the investors reluctant to place large bets ahead of a string of high-relevance events due later this week.

The monetary policy releases by the Bank of Japan, Bank of Canada, and the European Central Bank, plus the preliminary estimations of US Q3 Gross Domestic product data are expected to open a new impulse to the market and st the near-term direction for the major crosses.

GBP/JPY: Aiming towards the 158.22 high – DBS Bank

The pound remains biased higher, according to Benjamin Wong, Strategist at DBS Bank, heading to levels past 158.00: “A quick look at the daily Ichimoku charts shows bullish momentum remains in a feverish pitch, and there is no affirmation that the 158.22 highs are a verified absolute top. Hence, we remain open to the possibility of the cross assailing higher levels before it ends terminally the bull run that currently came off 148.47, the July 2021 lows.”

Technical levels to watch

- GBP/USD is at the mercy of the markets balancing Brexit and COVID risks to BOE.

- BoE is being priced to hike, but some think it is a rate hike too soon and a mistake.

Sterling rose slightly on Monday but remained within recent ranges as analysts weigh up the expectations that the Bank of England will raise rates against economic data and Brexit headlines.

British Brexit minister David Frost said on Monday that the European Union's proposals to solve the problem of trade involving Northern Ireland did not go far enough and significant gaps remained between the two sides.

It would appear that the UK will continue to play rhetorical brinkmanship, holding off on triggering Article 16 while Frost tries to extract further concessions from European Commission Vice President Maroš Šefčovič. Sooner or later, though, Johnson will have to make a particularly difficult decision: compromise and move on, or provoke a war the UK could well lose.

BoE in focus, a hike too soon?

Meanwhile, money markets are pricing in a rate hike by the Bank of England at its meeting on 4 Nov. However, data from the UK last week was mixed which has resulted in traders dialling back rate hike expectations so soon. For instance, business activity surveys showed improvement as the economy unexpectedly regained momentum in October, but Retail Sales figures were worse than expected which has taken the shine out of the pound recently.

A segment of the market likely believes that policymakers could be making a mistake by tightening policy too quickly. This leaves the pound vulnerable to the downside given that speculators have switched to a small net long position on the pound in the week to Oct 19, positioning data from CFTC showed.

Meanwhile, UK breakeven inflation rates continue to climb. ''This seems to be telling us that the market believes that the BoE is falling behind the curve in terms of fighting inflation, and yet most analysts would probably agree with us that a rate hike now is a mistake,'' analysts at Brown Brothers Harriman argued.

GBP/USD technical analysis

- EUR/USD clings to the 1.1600 figure, despite overall US dollar strength across the board.

- EUR/USD: If the inverse head-and-shoulders neckline is broken, it will expose 2021 low at 1.1524.

- EUR/USD: The pair needs to reach 1.1700, to confirm the inverse head-and-shoulders pattern.

The EUR/USD slides on Monday during the New York session, trading at 1.1613, down 0.27% at the time of writing. Fading inflation worries, European and US stock indices in the green, and falling US T-bond yields portray a risk-on market sentiment. Safe-haven currencies like the Japanese yen and the Swiss franc fall, except for the US dollar, which benefits from the minimal drop of US yields.

During the Asian session, the shared currency began the week on the front foot, reached a daily high at 1.1665, but as European and American traders got to their desks, the EUR/USD dropped to 1.1590 before settling around the 1.1600 figure.

EUR/USD Price Forecast: Technical outlook

Daily chart

Despite reaching a low below 1.1600, the EUR/USD bounced off the inverse head-and-shoulders neckline. In the last five days, the pair looks trendless, with no clear direction, seesawing around the 1.1590-1.1660 range. The inverse head-and-shoulders pattern could well not be one, as the pair has failed to reach the 1.1700 target. However, as the daily moving averages (DMA’s) with a downward slope remain above the spot price, the EUR/USD is headed to the downside.

For EUR/USD sellers to resume the downward trend, they will need a daily close below the neckline, around 1.1590. In that outcome, the EUR/USD could tumble down to the 2021 lows around 1.1524., but it would find the October 18 1.1571 low as the first support level, before the 1.1524.

On the flip side, an EUR/USD daily upside close above 1.1665 could open the way for the inverse head-and-shoulders pattern of 1.1700.

The Relative Strength Index (RSI) is at 45, aiming lower, indicating that another leg-down might be on the cards.

KEY ADDITIONAL LEVELS TO WATCH

- The euro extends losses to test levels right below132.00.

- Expectations of a dovish ECB are weighing on the EUR.

- EUR/JPY testing support at 131.80.

The common currency is heading south for the third consecutive day against the Japanese yen on Monday. The pair is extending its reversal from last week’s highs at 133.50 area, to levels right below 132.00.

The euro, on the defensive ahead of the ECB monetary policy meeting

The moderate risk appetite witnessed at the week opening, with most equity markets posting gains, has not been enough to lift the euro. The pair remains weighed by rising inflation concerns, ahead of the European Central Bank’s monetary policy meeting, whose conclusions will be released next Thursday.

The next ECB meeting has gathered higher interest for the investors, with inflation pressures rising to levels difficult to ignore. The bank, however, is widely expected to maintain its commitment to the ultra-loose policy and keep its message on the dovish side to avoid creating tensions in peripheral markets. With the rest of the banks starting to set the stage for policy normalization, this will weigh on demand for the euro.

EUR/JPY: Hovering above 131.80 support

The pair is now testing support at 131.80 (61.8% Fibonacci retracement of the May-August decline) Below here, the pair could extend its reversal towards 131.25 (October 11, 12 highs) and then the 100-day SMA at 130.40.

On the upside, the pair should return above 132.80 (October 22 high) to retest October 21 high at 133.50 on track to 2021 highs at 134.00.

Technical levels to watch

- Gold prices are holding in bullish territory as the New York session progresses.

- Bulls are in charge and target the $1,830s on the approach to Friday's closing high near $1,816.

- XAU/USD bears and bulls fight over $1,800, focus shifts to US GDP

The price of gold has started out the week on the front foot as bulls attack territory towards the highs of Friday's business near to $1,814. At the time of writing, XAG/USD is trading at $1,806 and 0.75% higher on the day. The price of gold has travelled from a low of $1,792.28 to a high of $1,810.07 so far.

The US dollar rose from a one-month low in mid-Asian session as investors looked ahead to central bank meetings and economic data coming later this week. The greenback catches a bid when the concentration is focussed on the Federal Reserve and prospects of a tighter US monetary policy. The risk events this week are heavy which tend to support flows into the greenback as investors position for uncertainty.

Inflation concerns fueling bid in gold

The dollar index DXY was up nearly 0.4 at 93.964 for the day after having fallen to a low of 93.484 which was a one month low following comments on Friday from Federal Reserve Chair Jerome Powell that affirmed plans to cut back on bond purchases.

The 10-year US Treasury rose at the start of the week in Asia to a high of 1.673% whereby the US dollar was supported. However, there has been a turn of trajectory in New York trade and the yield has slipped below the prior day's close and is down some 0.18% at the time of writing which would be expected to give support to the price of gold.

''Inflation concerns are fueling a push higher in gold,'' analysts at TD Securities explained. ''Investors are cautious about the yellow metal as they remain intensely focused on pricing the Fed's exit,'' the analysts explained further.

''Yet, we argue that market pricing for Fed hikes remains far too hawkish, as it fails to consider that a rise in inflation tied to a potential energy shock and lingering supply chain shortages would be unlikely to elicit a Fed response,''

''Reasons to own the yellow metal are growing more compelling as Fed pricing is likely to unwind. In this context, gold prices are tremendously underperforming against historical analogs, but a breakout in the yellow metal from its multi-month downtrend could signal that inflation-hedging flows are finally trumping the speculative exodus tied to Fed pricing,'' the analysts concluded.

ECB vs Fed meetings in focus

Meanwhile, the key data points for the week will be with US Gross Domestic Product and PCE as well as the European Central Bank. In this regard, outcomes will impact the US dollar and therefore gold prices will be vulnerable also. As for the ECB, this is a major risk event for markets given the move higher in yields in recent weeks has presented a challenge for the central bank.

''The October ECB meeting was supposed to be a boring one, but given risen market expectations, now the ECB needs to emphasize its forward guidance. We expect a slightly dovish market reaction to the ECB’s message on Thursday,'' analysts at Nordea argued.

Key points

The analysts at Nordea offered a number of key points ahead of the meeting that takes place later this week on Thursday:

- Previous ECB comments have failed to change market pricing much, and we expect Lagarde to try to emphasize the ECB’s dovish guidance on rates.

- Rapidly rising inflation expectations may already worry the more hawkish Governing Council members.

- Short end pricing may correct somewhat lower on Thursday, but in the bigger picture global inflation worries still have room to escalate.

Overall, this is a slightly dovish forecast that would be expected to weigh on the euro and support the US dollar as investors anticipate that the Fed is ready and willing to announce tapering at the upcoming FOMC meeting on Nov 3.

Powell himself said Friday that “The risks are clearly now to longer and more persistent bottlenecks, and thus to higher inflation.” He added that “I would say our policy is well-positioned to manage a range of plausible outcomes. I do think it’s time to taper and I don’t think it’s time to raise rates.”

Gold technical analysis

From a daily perspective, the price is attempting a move higher, as Friday's price action shows, and the wick's high of the daily candle was a likely target for the sessions ahead, as illustrated in the following pre-market open analysis: Chart of the Week: Gold bears lurk at weekly trend line resistance

''$1,835 guards territory to $1,880 as follows:

''

''

Gold bulls making progress

- USD/CHF begins the week on the right foot, up 0.43%.

- Risk-on market sentiment weighs on the Swiss franc.

- Inflation worries ease as investors focus on stocks, as US Government T-bond yields fall.

The USD/CHF climbs at the beginning of the week, trading at 0.9195 during the New York session at the time of writing. The market sentiment is positive, portrayed by US stock indices rising between 0.22% and 1.10%, while the US dollar is also gaining traction, hurting the Swiss franc and the Japanese yen.

In the meantime, inflation worries seem to fade some as witnessed by falling US T-bond yields. The 10-year benchmark note rate falls two basis points (bps) to sit at 1.634%, while the 30-year US Treasury yield is flat at 2.085%. Contrarily the US Dollar Index, which tracks the performance of the greenback against a basket of its peers, advances some 0.20%, currently at 93.83.

USD/CHF Price Forecast: Technical outlook

Daily chart

The USD/CHF is trading above the 100-day moving average (DMA), which lies at 0.9180. Early during the Asian session, the pair traded sideways around the three-month support at 0.9150. However, the confluence of an upward slope trendline from June to August lows unsuccessfully broken, and the October 22 low at 0.9150 spurred a bounce up to 0.9200.

For USD/CHF buyers to resume the upward trend, they will need a daily close above 0.9200. In that outcome, the 50-day moving average (DMA) at 0.9217 would be the first resistance. An upside break could push the price toward the October 18 high at 0.9273, followed by the October 12 high at 0.9313.

On the flip side, failure at 0.9200 would keep the USD/CHF range-bound within the 50-pip range of 0.9150-0.9200. Either way, in case of a break lower of the range, it would open a test of the 0.9100 figure, which was unsuccessfully tested two times in September.

The Relative Strength Index (RSI) is at 44, aiming higher, indicating that the pair could trend up, but it does not have enough upward force, so traders might wait for the RSI to pierce above the 50-midline, before putting aggressive bets.

KEY ADDITIONAL LEVELS TO WATCH

- The kiwi treads water between 0.7130 and 0.7180.

- FX markets remain directionless ahead of key releases this week.

- NZD/USD expected to keep appreciating on the b ack of higher global inflation – ANZ.

The New Zealand dollar is ticking up against the USD on Monday, supported by a modest appetite for risk. The pair has bounced up from 0.7130 lows, although it remains limited below 0.7180.

Sideways trading ahead of key events this week

The kiwi has been trading within recent ranges, slightly higher on the day despite the US dollar’s firmer tone. The US Dollar Index, which measures the value of the dollar against a basket of the most traded currencies has appreciated about 0.2%.

The major currency crosses, however, remain practically flat on the day, with the investors reluctant to place significant bets ahead of key releases later this week. The monetary policy decisions by the European Central Bank, the Bank of Japan and the Bank of Canada, and the preliminary Q3 US Gross Domestic Product are expected to set the direction of currency markets.

NZD/USD: Expected to appreciate amid rising global inflation – ANZ

From a wider perspective, FX analysts at ANZ Bank expect the pair to keep appreciating, supported by the rising inflation: “This correction has really been an AUD and NZD one as markets fade the spectacular rallies seen on crosses like NZD/EUR and NZD/JPY. At this stage it looks more like a rebalancing rather than the start of a fresh downtrend (…) We still think the NZD will benefit from higher interest rates, affirming both carry and confidence in the RBNZ’s inflation credentials.”

Technical levels to watch

- The US dollar edges up, yet it remains capped below 114.00.

- Major currency crosses, flat ahead of key events this week.

- USD/JPY: Set to retest 114.55 – Commerzbank.

The US dollar has edged up on a calm session on Monday, to trim losses following a three-day reversal from four-year highs at 114.65. The pair has remained steady above 113.50 on Monday, yet unable to post a significant recovery, with upside attempts limited below 113.85.

The dollar steadies ahead of key macroeconomic data

Most major currencies have remained trading sideways within previous ranges, with the investors awaiting the release of monetary policy decisions by the European Central Bank, Bank of Japan, and the Bank of Canada plus the preliminary estimation of the third quarter’s US Gros Domestic Product.

The US dollar has been trading on a slightly firmer tone, especially during the Asian and European trading sessions. A moderate appetite for risk, reflected in the positive equity markets has weighed on the safe-haven Japanese yen. Most European markets have closed positive, while in the US, the Dow Jones ticks 0.1% up, the S&P Index rises 0.4% and the Nasdaq Index advances 0.8% buoyed by strong advances in Tesla and Paypal shares.

On the other hand, persisting inflation concerns, with oil prices hitting fresh multi-year highs earlier today, and softer US T-Bond yields, have weighed on demand for the greenback.

USD/JPY: Aiming to 114.55 – ING

On a broader view, Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, maintains her positive outlook for the USD: “USD/JPY failed to close above the 114.55 October 2018 high last week and has now eased back to the 23.6% retracement at 113.38. Provided this holds the downside we should see recovery and a reattempt on the 114.55 high.”

Technical levels to watch

- The Aussie dollar advances amid risk-on market sentiment in the financial markets.

- The Fed bond taper announcement is perceived as positive for the US dollar, portrayed by the AUD/USD pair.

- Fed’s Chairman Powell: “If we see persistent inflation, we will use our tools.”

The Australian dollar climbs for the second consecutive day, trading at 0.7489 during the New York session at the time of writing. Investors sentiment is positive, as heavy-tech US companies will reveal earnings for the Q3, while US T-bond yields fell, while the US dollar gains.

Despite broad US dollar strength, risk-sensitive currencies like the AUD, the GBP, and the NZD advance during the day. The US Dollar Index, which tracks the buck’s performance against six rivals, is up 0.25%, sitting at 93.84.

The AUD/USD pair reached a daily high at 0.7504 but retreated the move towards 0.7475. Investors seem nervous to open aggressive bets in the pair, as the Fed bond tapering announcement is nearby, perceived as dollar positive. Contrary, despite reducing its bond purchasing program, the Reserve Bank of Australia had sound dovish as they expressed they would raise rates until 2024.

Also, more market participants start betting that the Federal Reserve will make two hikes by 2022, the first one at the beginning of the second half, while the latter by the end of the year. Furthermore, on Friday. Federal Reserve Chairman Powell said that high inflation would likely last well into next year but added that they still expect it to move back down toward their 2% goal.

Furthermore, he added that “If we see persistent inflation, we will use our tools.”

That said, the AUD/USD price action is confined to remain at familiar levels around 0.7400-0.7500, waiting for a fresh catalyst.

In the week ahead, the Australian economic docket will feature inflation figures due on Wednesday. The latter, along with the Advance US GDP for the third quarter on Thursday, will help determine the pair’s trend. Meanwhile, the pair direction will lie on the US dollar sentiment as well as the market mood.

KEY ADDITIONAL LEVELS TO WATCH

- Crude oil futures give away gains after hitting fresh highs at $85.35.

- The oil rally remains intact, boosted by concerns of an oil crunch.

- WTI: Testing support at $83.90 previous resistance.

Front-month WTI is losing steam on Monday’s US trading session after having climbed to a fresh seven-year high above $85.00 earlier today. Crude prices have retreated more than $1,00 so far, hitting session lows at $84.00 area and turning negative on daily charts.

Fears of an energy crunch are boosting oil prices

The West Texas Intermediate (WTI) futures remain moving within a solid upside trend, buoyed by concerns that the tight supply and increasing demand for crude, as the global economy recovers from the COVID-19 crisis, might lead to an energy crunch this winter.

A report from the US bank Goldman Sachs forecasting that we could be “at the beginning of a material repricing for higher oil” has contributed to boosting WTI prices to fresh highs. Goldman Sachs affirms that the UK benchmark Brent oil could hit $90 per barrel by the end of the year (about 4.5% above current prices), as demand is rebounding further and oil producers are dragging their feet to increase supply.

WTI prices about to test support at $83.90

On the downside, WTI futures might find support at the previous resistance level 83.90 (October 18 and 20 highs) below here, next potential targets might be at $82.50 and $81.50 (October 22 low).

Alternatively, if the mentioned 83.90 level holds, upside momentum would remain intact, to set another attempt to break intra-day high at 85.35, on its way towards the 90.00 psychological area.

Technical level to watch

- Euro under pressure as focus turn to Thursday’s European Central Bank meeting.

- EUR/GBP remains sideways near monthly lows, under 0.8470.

The EUR/GBP turned to the downside after being unable to hold above 0.8460 and recently printed a fresh daily low at 0.8426. The cross remains near the lows with a bearish bias but is above the strong support area at around 0.8420.

The euro is among the worst performers on Monday ahead of Thursday’s European Central Bank meeting. Weaker-than-expected German economic data and the EUR/USD of a multi-day range weighed on EUR/GBP.

The ECB meeting is probably the key event for EUR/GBP of the week. “There will be plenty of speculation regarding the end of the PSPP and some form of increasing the PSPP purchase. We expect ECB to flag risks to the outlook and as such not deviate from the current baseline and send new policy signals already now but wait for a new projections round in December”, explained analysts at Danske Bank. The fact there is no unanimous expectation about what the ECB might do or say, will likely trigger volatility in euro’s crosses on Thursday and keep them exposed to rumours prior to the announcement.

From a technical perspective, the EUR/GBP chart shows risk tilted to the downside. While above 0.8420 losses seem limited; a break below should clear the way for a test of 0.8400. A firm recovery above 0.8475 should alleviate the bearish pressure. The next resistance stands at 0.8515.

Technical levels

- The US dollar pulls back after being rejected at 1.2390.

- The pair remains flat ahead of key macroeconomic events later this week.

- USD/CAD might extend losses towards 1.2200 – MUFG.

The US dollar opened the week on a moderately positive tone, and extended its rebound from Friday’s low at 1.2335 to hit resistance again at 1.2385/90 area. The pair has retreated to 1.2360 afterward and remains practically flat on the day.

Sideways trading ahead of key macroeconomic data

The major currency crosses are trading within previous ranges on Monday, with the US dollar slightly firmer against its main rivals in a choppy trading session. Investors remain reluctant to place significant bets ahead of the release of US GDP data and the monetary policy decisions of the European Central Bank, Bank of Japan, and the Bank of Canada.

In absence of relevant macroeconomic releases today, persisting inflation concerns and a moderate pullback on US Treasury yields, are keeping US dollar bulls in check. The 10-year bond has ticked down to 1.63% on Monday from multi-month highs at 1.68% last week which is weighing on demand for the greenback.

Regarding the Canadian dollar, rising expectations that the Bank of Canada will be forced to start hiking rates ahead of schedule are supporting the CAD, which has appreciated more than 3% in the last five weeks. In this context, some market voices, anticipate that the BoC might start raising the tone of its message after this week’s meeting, which might give a fresh boost to the loonie.

USD/CAD: Scope to a slide to 1.22 –MUFG

From a technical perspective, the FX Analysis Team at MUFG observes the CAD supported by fundamentals, which could drive the pair towards 1.2200 in the near-term: “The Canadian rate market has moved sharply over the past month to price in both earlier BoC hikes and a larger hiking cycle. Weekly QE purchases are currently running at CAD2 B, and the BoC could announce plans to formally bring an end to QE this year. To reinforce upward momentum for the CAD, the BoC will also have to drop forward rate guidance (..)The next key support area comes in at around the 1.2200-level.”

Technical levels to watch

- Euro trims losses versus US dollar, recovers 1.1600.

- US dollar retreats across the board as US yields slide.

The EUR/USD bottomed earlier on Monday at 1.1589, reaching the lowest level in a week. After the beginning of the American session, it rebounded, and it is hovering around 1.1615, down for the day, but off lows.

The break under 1.1615 in EUR/USD ended days of a range trading between 1.1615 and 1.1670. The euro is back near the 1.1620 area; a recovery back above should alleviate the bearish pressure. The euro remains among the worst performers on Monday ahead of Thursday’s ECB meeting.

“The Eurozone focus is on the ECB meeting, but I don't think it's a big market driver, barring a jaw-dropping shift to a hawkish bias. What the euro needs, if it is to make a break higher, is better economic data. Supply-chain issues have hurt and if that doesn't change, then the euro will meander until the US rate outlook triggers the next leg down in EUR/USD and a further reversal of the move up we've seen since the Fed came to everyone's aid in March 2020”, said Kit Juckes, Chief Global FX Strategist at Société Générale.

The dollar lost momentum amid a decline in US yields. The 10-year dropped from 1.68% to 1.62% in a few minutes, and pushed the DXY away from the 94.00 area. Also, risk appetite weighed on the greenback. The S&P 500 index hit a record high and is up 0.28%; the Nasdaq gains 0.52%.

Economic data from the US surpassed expectations with the Dallas Fed Manufacturing Index rising to 14.6 in October above the 6.8 of market consensus. The key report will be Q3 growth numbers on Thursday.

Technical levels

- The British pound advances despite US dollar strength across the board.

- Brexit: David Frost said, “The problem with the EU proposals on Northern Ireland is that they don’t go far enough.”

- BoE Tenreyro: Not in a rush to lift rates.

The GBP/USD stalled at 1.3800 for the second consecutive day in a row, failing to print a sustained break above the figure, but as of the last couple of hours, it bounced off the daily low at 1.3739, trading at 1.3768 during the New York session at the time of writing.

The risk-sensitive British pound is advancing, despite US dollar strength across the board. Worries about inflation seem to easy a little, as major US heavy-tech companies, like Facebook, Alphabet, Apple, and Facebook, will unveil earnings for the third quarter, keeping the market sentiment upbeat.

Meanwhile, the US Dollar Index that tracks the greenback’s performance against a basket of peers advances 0.16%, at 93.79, while the US 10-year treasury yield sheds almost three basis points, down to 1.627%.

Brexit woes seem to keep GPB/USD price action within the 1.3700-1.3800 range. On Monday, David Frost, British Brexit main negotiator, said that the EU proposals would not deliver the “freeing up of trade” they would want to see, per Reuters. Further added, “The problem with the EU proposals on Northern Ireland is that they don’t go far enough.”

BoE Tenreyro: Not in a rush to lift rates

Earlier during the day, Silvana Tenreyro, an external member of the Bank of England, said that she needed more time to judge how the furlough scheme would affect the labor market, signaling that she was not in a rush to lift rates. Moreover added that inflation pressures from surging energy prices were likely to fade quickly.

Tenreyro, still one of the dovish members of the BoE, adopted a different tone to the one portrayed by Governor Andrew Baily, which said that the BoE “will need to act” to curb inflationary pressures.

According to Brown Brothers Harriman in a note to clients, the expectations of a Bank of England tightening remain elevated. “Q4 liftoff is fully priced in, along with four more hikes over the course of 2022,” said in the note.

Across the pond, in the US, the blackout period for Federal Reserve members would leave investors, with a good number of policymakers favoring the bond taper announcement by the November meeting.

In the US economic docket, the Dallas Fed Manufacturing Business Index rose to 14.6, higher than the 6.8 foreseen by economists. Additional details of the publication showed that the Employment Index rose to 28.3 from 26.3, and the New Orders Index climbed to 14.9 from 9.5.

KEY ADDITIONAL LEVELS TO WATCH

David Frost, the British minister responsible for implementing the Brexit deal, said on Monday that the European Union's proposals wouldn't deliver the "freeing up of trade" they would want to see, as reported by Reuters.

"The problem with the EU proposals on Northern Ireland is that they don't go far enough," Frost added and reiterated that significant gaps remain.

Market reaction

The initial market reaction to these comments was largely muted. As of writing, the GBP/USD pair was trading at 1.3758, where it virtually unchanged on a daily basis.

- Dallas Fed Manufacturing Index rose more than expected in October.

- US Dollar Index stays in the positive territory near 93.80.

The activity in Texas' manufacturing sector continued to expand at a robust pace in October with the headline General Business Activity Index of the Dallas Fed's monthly survey improving to 14.6 from 4.6 in September. This reading surpassed the market expectation of 6.8.

On a negative note, the Manufacturing Output Index edged lower to 18.3 from 24.2 in September. Additional details of the publication showed that the Employment Index rose to 28.3 from 26.3 and the New Orders Index climbed to 14.9 from 9.5.

Market reaction

This report doesn't seem to be having a noticeable impact on the greenback's performance against its major rivals. As of writing, the US Dollar Index was up 0.2% on the day at 93.80.

- Wall Street's main indexes opened near last week's closing levels.

- Energy stocks post strong gains on the back of rising crude oil prices.

- Technology shares underperform after the opening bell on Monday.

Major equity indexes in the US started the new week in a relatively calm manner amid varying performances of major sectors. As of writing, the S&P 500 Index was unchanged on the day at 4,542, the Dow Jones Industrial Average was losing 0.1% at 35,642 and the Nasdaq Composite was flat at 15,092.

Among the 11 major S&P 500 sectors, the Energy Index is up 1.1% supported by rising crude oil prices. Earlier in the day, the barrel of West Texas Intermediate (WTI) hit its strongest level in seven years at $85.35.

On the other hand, the Communication Services Index is down 0.55% as the biggest decliner after the opening bell.

Earlier in the day, the Federal Reserve Bank of Chicago reported that the economic growth lost momentum in September with its National Activity Index dropping to -0.13 from 0.05 in August.

S&P 500 chart (daily)

- Gold caught some fresh bids on Monday amid the latest COVID-19 breakout in China.

- Resurgent USD demand, elevated US bond yields could cap gains for the commodity.

- Acceptance above 100/200-day SMAs supports prospects for further near-term gains.

Gold attracted fresh buying on the first day of a new trading week and built on the intraday positive move through the early North American session. The latest COVID-19 outbreak in China raised concerns about the imposition of economically damaging lockdowns amid the country's ‘zero-tolerance approach to the disease. This, to a larger extent, overshadowed the dominant risk-on mood in the markets and turned out to be a key factor that acted as a tailwind for the safe-haven XAU/USD.

Apart from this, the uptick could further be attributed to some technical buying following Friday's break through the 100/200-day SMAs confluence hurdle. That said, a solid US dollar rebound from near one-month tops might hold bullish traders from placing aggressive bets around the dollar-denominated gold. The greenback was back in demand in the wake of the emergence of heavy selling around the shared currency and was further underpinned by elevated US Treasury bond yields.

In fact, the yield on the benchmark 10-year US government bond held steady above the 1.65% threshold amid growing acceptance that the Fed will tighten its policy sooner than anticipated. The Fed Chair Jerome Powell reaffirmed on Friday that the US central bank remains on track to begin rolling back its massive pandemic-era stimulus. Adding to this, worries that the recent widespread rally in commodity prices will stoke inflation have been fueling speculations about a potential interest rate hike in 2022. This could further collaborate to cap the upside for the non-yielding gold.

Market participants now look forward to the Advance US GDP report, scheduled for release on Thursday for a fresh impetus. This, along with key central bank meetings in Canada, Japan and the Eurozone will infuse some volatility around gold during the second half of the week. In the meantime, the US bond yields will play a key role in influencing the USD price dynamics amid absent relevant market moving economic releases. Apart from this, traders might further take cues from the broader market risk sentiment to grab some short-term opportunities.

Technical outlook

From a technical perspective, Friday’s pullback from an intermediate resistance near the $1,812-14 region, or six-week tops warrants some caution for bullish traders. That said, the emergence of dip-buying near the 100/200-day SMAs confluence supports prospects for additional gains. Hence, a subsequent strength towards challenging the next major hurdle, around the $1,832-34 supply zone, remains a distinct possibility.

On the flip side, the daily swing lows, around the $1,792 region, which coincides with the confluence resistance breakpoint, should continue to protect the immediate downside. Any subsequent fall could find decent support near the $1,782 horizontal zone, which if broken decisively will shift the near-term bias in favour of bearish traders. Gold prices might then turn vulnerable to accelerate the decline towards the $1,760 horizontal support en-route monthly swing lows, around the $1,745 region.

Levels to watch

Bank of England (BOE) policymaker Silvana Tenreyro noted on Monday that the recent moderation in the gross domestic product growth looks set to continue over the winter months, as reported by Reuters.

Additional takeaways

"Uncertainty over furlough scheme effects should be resolved over the coming months, which should help paint a clearer picture of labour market."

"We will also continue to learn more about the persistence of disruptions to global and domestic supply chains and their impact on the UK inflation outlook."

"There is a possibility that higher inflation or higher inflation expectations begin to feed through into higher wage demands."

"There is also a risk that the end of the furlough scheme leads to a loosening in the labour market and moderation in wage pressures."

Market reaction

The GBP/USD pair continues to move sideways around mid-1.3700s following these comments.

Bank of England (BOE) policymaker Silvana Tenreyro said on Monday that some inflation drivers are expected to remain short-lived and added that the monetary policy can do little to affect them, as reported by Reuters.

Additional takeaways

"Since August, we have had large upside news for near-term inflation from energy prices, an effect which should fade quickly."

"Effects of supply chain disruption should also be temporary but the speed of rotation back to normal is a key uncertainty."

"Balance of recent news on the economy is unlikely to have a large effect on the amount of tightening required over the next few years."

"Domestic cost pressures will depend on the evolution of the labour market now that the furlough scheme has ended."

"My policy votes will aim to strike a balance between these different effects and risks."

Market reaction

These don't seem to be having a significant impact on the British pound's performance against its major rivals. As of writing, the GBP/USD pair was virtually unchanged on the day at 1.3752.

- The risk-on mood assisted the perceived riskier aussie to gain traction on Monday.

- Elevated US bond yields revived the USD demand and capped any meaningful gains.

- Investors now await the Australian CPI report and Advanced US GDP for a fresh impetus.

The AUD/USD pair maintained its bid tone through the early North American session and was last seen trading around the 0.7485-90 region, up 0.35% for the day.

The pair attracted fresh buying on the first day of a new trading week amid the dominant risk-on mood in the markets, which tends to benefit the perceived riskier aussie. However, a goodish pickup in the US dollar failed to assist the AUD/USD pair to capitalize on its move or find acceptance above the key 0.7500 psychological mark.

The greenback drew some support from elevated US Treasury bond yields and staged a solid rebound from near one-month lows touched earlier this Monday. In fact, the yield on the benchmark 10-year US government bond held steady above the 1.65% threshold growing acceptance that the Fed will tighten its policy sooner than anticipated.

The Fed Chair Jerome Powell reaffirmed on Friday that the US central bank remains on track to begin rolling back its massive pandemic-era stimulus. The markets have also been pricing in the possibility of a potential interest rate hike in 2022 amid worries that the recent widespread rally in commodity prices will stoke inflation.

This, in turn, was seen as a key factor that kept a lid on any meaningful gains for the AUD/USD pair amid absent relevant market moving economic releases from the US. Investors also refrained from placing aggressive bets, rather preferred to wait on the sidelines ahead of this week's important macro data from Australia and the US.

The quarterly Australian consumer inflation figures are due for release on Wednesday. This, along with the Advance US Q3 GDP report on Thursday, will help determine the next leg of a directional move for the AUD/USD pair. In the meantime, the USD price dynamics and the broader market risk sentiment will be looked upon for some trading impetus.

Technical levels to watch

- Chicago Fed's National Activity Index fell into the negative territory in September.

- US Dollar Index continues to push higher toward 94.00.

The data published by the Federal Reserve Bank of Chicago showed on Monday that the National Activity Index (CFNAI) declined to -0.13 in September from 0.05 (revised from 0.29) in August.

This print suggests that the economic activity grew at a slower pace in September than it did in August.

"The CFNAI Diffusion Index, which is also a three-month moving average, edged up to +0.22 in September from +0.20 in August," the publication further read.

Market reaction

The greenback continues to outperform its rivals after this report and the US Dollar Index was last seen gaining 0.26% on the day at 93.85.

- Silver gained some positive traction on Monday, albeit lacked any follow-through buying.

- The set-up seems tilted in favour of bullish traders and supports prospects for further gains.

- Any meaningful pullback might still be seen as a buying opportunity near the $24.00 mark.

Silver edged higher on the first day of a new trading week, albeit struggled to capitalize on the move and remained capped near the 100-day SMA resistance around mid-$24.00s.

From a technical perspective, last week's sustained strength beyond a short-term descending trend-line resistance validated an inverted head and shoulders bullish breakout. A subsequent move and acceptance above the 38.2% Fibonacci level of the $28.75-$21.42 downfall supports prospects for additional gains.

The constructive set-up is reinforced by bullish technical indicators on the daily chart, which are still far from being in the overnight territory. Hence, some follow-through move beyond the $24.80-85 region, towards reclaiming the key $25.00 psychological mark, remains a distinct possibility.

The latter coincides with the 50% Fibo. level, which if cleared decisively should set the stage for an extension of the appreciating move. The XAG/USD could then climb to an intermediate hurdle near the $25.55-60 region before eventually darting towards the $26.00 mark, or the 61.8% Fibo. level.

On the flip side, any meaningful pullback might continue to attract some buying near the $24.00 mark, which now seems to act as a strong base for the XAG/USD. Failure to defend the mentioned support might prompt some technical selling and accelerate the corrective slide towards mid-$23.00s.

This is closely followed by the $23.20-15 confluence support, comprising of the descending trend-line resistance breakpoint and the 23.6% Fibo. level. A convincing break below will shift the bias in favour of bearish traders and expose the next relevant support near mid-$22.00s.

Silver daily chart

Technical levels to watch

- NZD/USD struggles to gather bullish momentum on Monday.

- US Dollar Index edges higher toward 94.00 following a weak start to the week.

- Eyes on mid-tier macroeconomic data releases from the US.

After closing the second straight week in the positive territory, the NZD/USD pair edged higher during the Asian session on Monday but lost its bullish momentum. As of writing, the pair, which touched a daily high of 0.7180, is virtually unchanged on a daily basis at 0.7150.

DXY rebounds toward 94.00 on rising yields

The renewed USD strength during the European trading hours seems to be weighing on NZD/USD. The US Dollar Index is currently rising 0.26% on the day at 93.85. In the absence of high-tier macroeconomic data releases, the more-than-1% increase witnessed in the benchmark 10-year US T-bond yield is providing a boost to the greenback at the start of the week.

The Federal Reserve Bank of Chicago's National Activity Index and the Dallas Fed Manufacturing Survey will be featured in the US economic docket later in the day. On Tuesday, Trade Balance data from New Zealand will be looked upon for fresh impetus.

In the meantime, US stock index futures are up between 0.1% and 0.3%. In case Wall Street's main indexes gain traction after the opening bell, the dollar could have a hard time finding demand as a safe haven and NZD/USD could look to edge higher. Nevertheless, investors are likely to keep a close eye on the US T-bond yields as well.

Technical levels to watch for

- USD/TRY witnessed a modest pullback from fresh record highs touched earlier this Monday.

- Extremely overbought conditions seemed to be the only factor that prompted profit-taking.

- The near-term fundamental backdrop remains tilted firmly in favour favours bullish traders.

The USD/TRY pair witnessed a modest pullback from a record high level of 9.8505 touched earlier this Monday and has now filled the weekly bullish gap opening.

The Turkish lira plunged in reaction to developments over the weekend, wherein President Tayyip Erdogan told his foreign ministry to expel the ambassadors of 10 Western countries. This comes after the Turkish central bank (CBRT) last week decided to cut interest rates from 19% to 16%, which was seen as another factor that acted as a headwind for the domestic currency.

On the other hand, the recent strong rally in the US Treasury bond yields continued lending some support to the US dollar. This, in turn, provided an additional lift to the USD/TRY pair, though extremely overbought conditions kept a lid on any further gains, rather prompted some profit-taking at higher levels. That said, the bias remains tilted in favour of bullish traders.

Investors expect that the country’s business conditions could worsen if it gets into another conflict with the west. Adding to this, CBRT believes that high interest rates lead to high inflation and has adopted an unorthodox monetary policy. Conversely, growing market acceptance for an early policy tightening by the Fed supports prospects for the emergence of some dip-buying.

Hence, it will be prudent to wait for a strong follow-through selling before confirming that the recent bullish trajectory has run out of steam and that the USD/TRY pair has topped out.

The Turkish lira is under pressure. Axel Rudolph, Senior FICC Technical Analyst at Commerzbank, expects the USD/TRY pair to reach new all-time highs at the psychological 10.0000 mark.

Immediately bullish while above the October 20 low at 9.2010

“USD/TRY’s advance has reached all our daily Point & Figure upside targets and may touch the psychological 10.0000 mark around which it is expected to soon stall. If not, we would have to allow for an hourly 0.01 x 3 Point & Figure upside target at 11.0400 to be reached.”

“We will stay immediately bullish while the cross remains above the October 20 low at 9.2010. Below it, a two-month support line can be found at 9.1721 and the September high at 8.9636. Further down sits the early October low at 8.8037. While remaining above the latter level, overall upside pressure should retain the upper hand.”

USD/BRL trades at levels last seen in April when the pair reached the 5.7560 mark. Above here lies 5.8795/5.9710 and the psychological 6.000 level, Axel Rudolph, Senior FICC Technical Analyst at Commerzbank, reports.

Recent surge higher has nearly reached the 5.7560 April high

“USD/BRL’s rise is seen to accelerate higher and has practically reached the April high at 5.7560. The next higher March peak at 5.8795 may soon also be reached. Further up the May 2020 high can be found at 5.9710 and also the psychological 6.0000 mark.”

“While the currency pair stays above the 5.4342 mid-October low we will retain our short-term bullish view. Further down meander the 200 and 55-day moving averages at 5.3533/14 and lies the five-month uptrend line at 5.3022.”

EUR/CHF maintains its breakdown below major support at 1.0704/1.0696. Subsequently, economists at Credit Suisse stay biased to the downside, with next support at 1.0660.

EUR/CHF’s decline to take a breather at 1.0600

“EUR/CHF maintains its break below major support at 1.0704/1.0696, which turned our bias to the downside. Support is seen next at the 1.0660/57 low from November 2020, before retracement support at 1.0642, then another prominent price low at 1.0605/00, where we would expect to see another pause.”

“The magnitude of this potential breakdown suggests we could even move beyond here over the medium-term and move all the way to the long-term support level at the 2020 low at 1.0503/00, which is likely to be a much tougher support level if reached.”

“First resistance stays at 1.0726, then the recent high at 1.0764/67, before the 55-day average at 1.0789, with a break above here needed to instead suggest a false breakdown.”

USD/RUB is seen slipping back towards the December 2018 high at 69.78. Below this mark lies the 2014-2021 uptrend at 69.52, Axel Rudolph, Senior FICC Technical Analyst at Commerzbank, reports.

Russian rouble appreciates

“USD/RUB continues its descent towards the December 2018 high at 69.78. The next lower 2014-2021 uptrend line at 69.52 may be reached as well. Below it sits the 68.04 June 2020 low.”