- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 22-10-2021

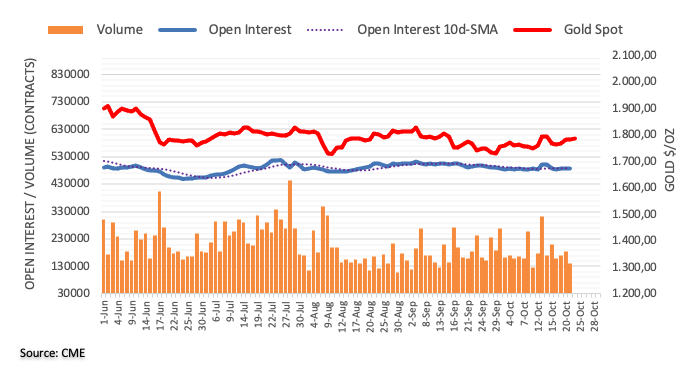

- XAU/USD ended the day in a high tone, clung above $1,790.00.

- Fed’s Chairman Powell: High inflation will likely last well into next year.

- XAU/USD: Has an upward bias, but higher US bond yields and market sentiment could impact the non-yielding metal.

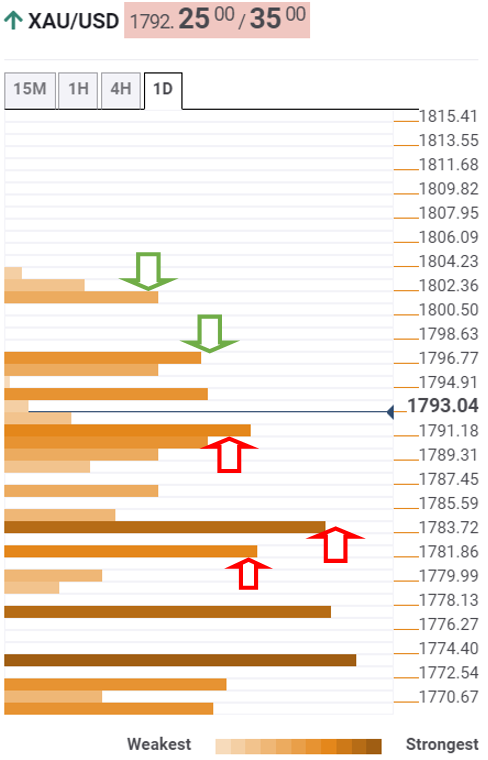

Gold (XAU/USD) finished the day at $1,792.59 for a 0.54% gain at the time of writing. The yellow metal had a roller-coaster session, reaching a daily high at $1,813.82, then retreating the move down to $1,782.76, on Federal Reserve Chairman Jerome Powell comments at a virtual appearance at the Bank for International Settlements event.

Powell speech: High inflation will likely last well into next year

On Friday, Fed Chairman Jerome Powell commented that the US central bank is on track to begin the bond taper. Furthermore, he added that if the economy evolves as the Fed expected, the QE reduction program will finish by half of 2022. Nevertheless, he reinforced that once the bond taper ends, that would not mean hiking rates afterward.

Regarding inflation, Powell said that inflation would remain higher well into the following year. However, they [Fed] still expect it would move down towards the Fed 2% target. Moreover, he added that “If we [Fed] see persistent inflation, we will use our tools.”

Market’s reaction

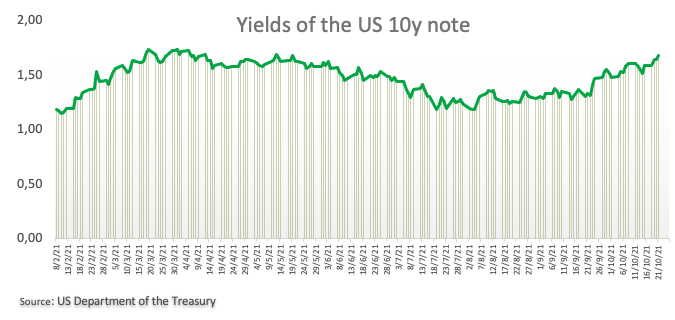

The US Dollar Index recovered some of its losses but ended the day in the red, lost 0.16%, closed at 93.60. The 10-year benchmark note rate dropped 3.7 basis points (bps) down to 1.638%.

XAU/USD Price Forecast: Technical outlook

The XAU/USD daily chart depicts that the yellow metal is under heavy selling pressure. The 100 and the 200-day moving averages (DMA’s) finished the session on top of the spot price, indicating that gold is under some selling pressure. Momentum indicator like the Relative Strength Index (RSI) at 58 shows the yellow metal is tilted to the upside, but to exacerbate an upward move, it will need a daily close above $1,800.00.

In that outcome, the first resistance level would be the confluence of a downward slope trendline with the September 3 high at $1,833.83. A sustained break above the latter could accelerate the XAU/USD rally towards $1,900.00.

On the flip side, another failure at $1,800.00 will keep gold prices trapped within the weekly range of $1,760.00-$1,800.00 range.

- BoE's Chief Economist Huw Pill: Inflation in the UK could top 5%.

- Brexit: The EU could terminate the post-Brexit trade deal with the UK.

- EUR/GBP: The 1-hour chart depicts the pair is tilted to the upside, confirmed by RSI at 63.50 and aiming higher.

The EUR/GBP edges higher as the New York session progresses, gains almost half percent, trading at 0.8461 during the day at the time of writing. In the Asian session, the pair reached the day's lows, around 0.8420, as the Bank of England Chief Economist Huw Pill said UK inflation could hit 5%.

In an interview with the Financial Times, Huw Pill said that he would not be surprised if the BoE saw an inflation print close to or above 5% in the following months. Pill added that for a central bank with an inflation target of 2%, a 5% reading would be "very uncomfortable."

Huw Pill's comments are much in line with the BoE Governor Andrew Bailey, which said on Sunday that if rising inflation is stickier than expected, the bank "will have to act" to contain upside risks.

Brexit: The EU could terminate the post-Brexit trade deal with the UK

According to Bloomberg, the EU could end the post-Brexit trade deal with the UK.

Both sides are under intense negotiations after the EU offers some proposals like reducing or slashing inspections between the two territories and easing imports of goods, including meats, sausages, and medicines.

Despite that offer, what the UK wants is the removal of the oversight of the European Court of Justice from Northern Ireland.

"Should the UK stick to its position that the top EU court should have no role in Northern Ireland's trade affairs, then a deal is unlikely, one of the people said."

Once the news hit the wires, the GBP/USD plunged to 1.3736 after the report.

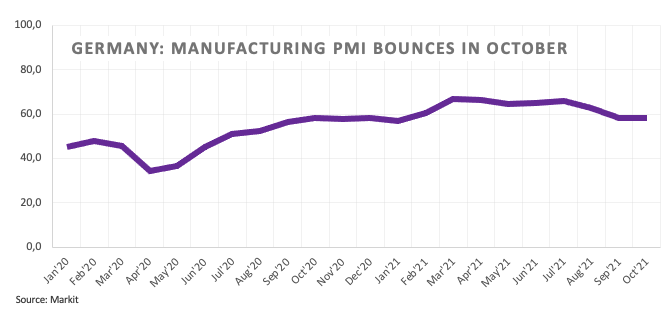

On the macroeconomic front, the Eurozone docket featured the IHS Markit PMI's for October. The German PMI Manufacturing PMI rose to 58.2 versus a 56.5, foreseen, contrary to the Services PMI, which increased to 52.4 lower than the 55 estimated. The Markit PMI Composite, which considers both readings, was at 52, lower than the 54 expected.

Meanwhile, the UK economic docket unveiled the Retail Sales for September, which shrank 0.6% on a monthly basis, worse than the 0.2% expansion expected by analysts. Moreover, the annual figure collapsed 2.6% versus a -1.7% estimated by investors.

EUR/GBP Price Forecast: Technical outlook

In the 1-hour chart, the EUR/GBP pair trades above the 1-hour simple moving averages (H-SMA's), closing to the October 20 high at 0.8460. Around that level lies the R3 pivot point at 0.8462. In the outcome of an upside break, the first resistance level would be the October 15 high at 0.8486. If the pair has enough legs to extend the upward move, the next resistance would be the October 13 high at 0.8497.

Momentum indicator like the Relative Strength Index (RSI) is at 63.50, aiming higher, indicating the EUR/GBP pair has enough room for another leg-up before reaching overbought levels.

- WTI futures pare losses and return near multi-year highs at $83.95.

- Oil prices consolidate after a six-week rally.

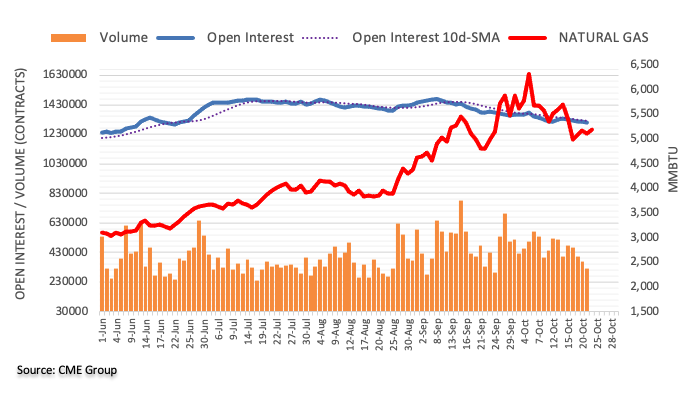

Front-month WTI futures have bounced up at $82.50, regaining previous losses to return to levels near multi-year highs at $83.95. On a broader picture, however, crude prices remain within previous ranges, consolidating after a nine-week rally.

Oil’s rally stalls on renewed COVID-19 fears

Oil prices retreated earlier today as the German Chancellor, Angela Merkel, and Federal Reserve’s Chairman, Jerome Powell, warned about demand disruptions if COVID-19 infections reemerge. The surge of coronavirus cases registered in China and Russia has raised concerns that the pandemic might not be over yet.

Furthermore, the Baker Hughes report has shown the first decline in oil rigs in the last seven weeks. The amount of US rigs drilling for oil declined to 443 this week, from 445 on the previous one, while natural gas fell by one to 542, according to the report.

On Thursday, a report released by the National Oceanic And Atmospheric Administration revealed that the next winter is expected to be warmer than the average in the US, which added negative pressure to crude futures.

WTI prices consolidate below $84.00

Crude prices have remained trading rangebound between 80.75 and 83.90 for most of the week, consolidating after having surged more than 35% over the last two months. On the upside, a clear move above $83.95 might open the path towards the 90.00 psychological area.

On the downside, immediate support lies at intra-day level $82.50 and $81.50 (October 22 low) ahead of October 20 and 21lows at $80.80.

Technical levels to watch

- Wall Street main indices drop between 0.23% and 0.98%, except for the Dow Jones up 0.18%.

- Fed Chairman Powell, concerned about high inflation.

- Communications and Construction drag the S&P 500 down.

The S&P 500 shed previous daily gains, drops 0.12%, sits at 4,544.36, as Fed’s Chairman Jerome Powell admits that the central banks monitor price pressures carefully and would act as required.

As the S&P500 cash market opened, the market sentiment was upbeat, with the three major US equity indices, the S&P 500, the Dow Jones Industrial, and the Nasdaq, were in the green. But as Fed Chairman Jerome Powell began his speech, conditions changed. At press time, the abovementioned indices record losses between 0.23% and 0.98%, except for the Dow Jones Industrial, up 0.18%.

The sectors of the $&P 500 which lose the most are the Communications followed by Construction, recording losses of 2.61% and 0.46%, respectively. Whereas the winners are Financials up some 1.27% and Real Estate gaining 0.74%, which lie on the back of higher US T-bond yields.

Fed Chairman Powell, concerned about high inflation

The Federal Reserve Chairman Jerome Powell said he is concerned about higher inflation and added that the central bank would monitor for signals that housholds and businesses are expecting sustained upward price pressures.

Powell added that the Fed is on track to begin the taper, and if the economy evolves as they (the Fed) expected, it will be completed by the first half of 2022. He reiterated that although he favors the timing of the QE reduction, he added, “I don’t think it is time to raise rates.”

S&P 500 Daily chart

- US dollar recovery attempts capped at 0.9170.

- The dollar remains bid as Fed tightening expectations fade.

- USD/CHF: Expected to drop towards 0.9081– Commerzbank.

The US dollar has attempted to bounce up from six-week lows at 0.9120, following a three-week decline from levels above 0.9300. The pair, however, has lacked follow-through, with the 0.9170 resistance area keeping upside attempts on hold.

The Swiss franc strengthens amid a risk-off mood

The greenback has failed to perform a significant recovery on Friday and is on track to close a three-week decline, with the Swiss franc favored by the risk-off market mood. Concerns about inflation and the supply chain bottlenecks have returned to the spotlight, with expectations about Fed rate hikes fading.

Federal Reserve Chairman, Jerome Powell has provided some support for the USD in a virtual appearance, confirming the bank’s commitment to start reducing bond purchases. The dollar’s reaction, however, has been limited, with nothing new coming out of the speech, as Powell downplayed the possibility of interest rate hikes in the coming months.

USD/CHF expected to depreciate further, aiming 0.9081 – Credit Suisse

From a technical perspective, Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, sees the pair in a broader downside trend, heading to levels below 0.9100: USD/CHF is vulnerable near-term, it is under pressure and we would allow for further losses (…) It is possible that this is only an ABC correction but intraday Elliott wave counts remain negative and we suspect that the market will see a deeper sell-off to the 0.9142 200-day ma and potentially the 2020-2021 uptrend at 0.9081.”

Technical levels to watch

- The pound retreats further from 158.20 highs, reaching levels sub 156.00.

- Sterling's rally loses steam as BoE tightening expectations fade.

- GBP/USD is now testing support at 156.00.

The British pound has depreciated for the second consecutive day on Friday, retreating further from multi-year highs at 158.20, to seek support at 156.00 area. The pair is set to post a 0.6% weekly reversal, after having surged about 4.5% over the previous two weeks.

GBP loses momentum as BoE hike expectations fade

Pound’s rally has lost steam this week, as the market shifted its focus to the surging inflation and global supply restrictions, with the expectations of earlier than expected rate hikes by the Bank of England taking a backseat. Investors’ hopes that consumer inflation pressures would force the BoE to accelerate its monetary tightening plans have been pushing GBP crosses higher across the board over the last weeks.

Beyond that, news reporting that the EU is weighing to terminate the Brexit deal if the standoff with the UK about the Northern Ireland's border continues, has added negative pressure on the sterling.

On the macroeconomic front, releases in the UK have been mixed on Friday. Services and manufacturing activity performed better than forecast in September, according to the Markit/CIPS Purchasing Managers’ Indexes, whereas retail consumption contracted beyond expectations, increasing concerns about the impact of the supply crisis on the country’s economic growth.

GBP/JPY: testing support at 156.00

Pound’s reversal has extended to test support at 156.00 (April 21 high). Below here, bearish momentum might gain traction with next potential targets at 155.35 (Intra-day level) and 154.80 (38.2% Fibonacci retracement of October’s rally.

On the upside, a bullish reaction from current levels should extend beyond 156.60/70 (Oct. 18, 21 lows) and retest intra-day highs at 157.60 before setting course towards 158.20 (Oct. 19, 21 highs).

Technical levels to watch

- EUR/USD shed previous daily gains on Fed’s Chairman Powell amid US dollar weakness.

- EUR/USD clingd to its daily wins amid lower US T-bond yields.

- The EUR/USD 1-hour chart depicts the shared currency trading below the 100-SMA, opening the door for a 1.1600 test.

The EUR/USD climbs during the New York session, gaining a minimal 0.03% trading at 1.1627 at the time of writing. During the last couple of hours, the single currency printed a new daily high at 1.1655 but retreated towards 1.1621, on Federal Reserve Chairman Jerome Powell’s remarks.

Powell’s comments dented the market sentiment

Previous to the Fed’s Chairman Powell speech, the market sentiment was upbeat. As he progressed on his speech and through the Q&A session, investors’ mood switched towards a risk-off as portrayed by falling US equity markets. In the meantime, the US Dollar Index, which tracks the buck’s performance versus six rivals, slides 0.11%, currently at 93.66, whereas the US 10-year Treasury yield retraced the upside move to sit at 1.643%, three basis points lower than the open.

Jerome Powell said that the Fed is on track to begin the taper, and if the economy evolves as they (the Fed) expected, it will be completed by the first half of 2022. He reiterated that although he favors the timing of the QE reduction, he added, “I don’t think it is time to raise rates.”

Eurozone and US PMI barely moved the EUR/USD pair

On the macroeconomic front, the Eurozone docket featured the IHS Markit PMI’s for October for France and Germany were mixed, but investors’ main focus was the German figures. The German PMI Manufacturing PMI rose to 58.2 versus a 56.5, foreseen, contrary to the Services PMI, which increased to 52.4 lower than the 55 estimated. The Markit PMI Composite, which considers both of the readings, was at 52, lower than the 54 expected.

Across the pond, the US economic docket unveiled the IHS Markit PMI for Manufacturing and Services for October, offering mixed figures. The Market Manufacturing PMI increased to 59.2, worse than the 60.3 estimated. Regarding the Markit Services PMI, it rose to 58.2 higher than the 55.1 foreseen.

EUR/USD Price Forecast: Technical outlook

The EUR/USD 1-hour chart depicts that the shared currency remains under intense selling pressure. The high of the day around 1.1655 was severely rejected towards 1.1625, breaking a rising upward slope trendline. At press time, the pair trades beneath the abovementioned and below the 50 and the 100-hour simple moving averages (H-SMA’s), confirming the selling pressure.

Nevertheless, the pair found support at the Thursday low around 1.1619, but a break below would open the door for a test of the 1.1600 figure.

- Silver dives from $24,85 to $24.20 after Powell's speech.

- Fed Powell confirms QE tapering and demand for metals plunge.

- XAG/USD remains bullish, with the $24,85 resistance area on focus.

Silver futures have pulled back from levels right below two-month highs, at $24.87, retreating to the $24.20 area on the back of the US dollar’s bullish reaction to Fed Powel’s comments.

Metal prices die as Powell confirms QE tapering

Precious metals have turned lower on Friday, to give away previous gains, following Federal Reserve Chairman Powell’s comments in a virtual appearance. Powell has confirmed the bank’s plan to start rolling back bonds purchases but he has played down the idea of accelerating interest rate hikes.

The market reaction has favored the dollar’s recovery, with the USD Index appreciating 0.2% after bouncing up from session lows at 93.50 to 93.75 highs, while Stock markets and precious metals have turned lower.

XAG/USD: remains positive, with $24.85 resistance on focus

Technical indicators remain fairly positive on a broader view, with silver futures likely to retest early September highs at $24.80. If that level gives way, the pair might take a break before aiming towards $25.20 (August 3, 4 lows) and April’s top, at $26.00.

On the downside, immediate support lies at 24.10 (October 21 low) and below here, trendline support from late-September lows, now around $23.40, maintain the positive trend. Below here, bears might gain momentum and pull the pair to $23.00 (October 18 low) and 22.20/35 (October 6 and 12 lows).

Technical levels to watch

- Gold drops $30 on Powell's comments to $1,780.

- Powell confirms Fed tapering plans and sents gold plunging.

- XAU/USD’s dives to test support at $1.770/80.

Gold futures have reversed course on Friday’s US trading session. The yellow metal has lost about $30 in a matter of minutes, retreating from six-week highs at $1,813 to $1,780 on the back of Fed Powell’s speech.

Powell’s confirms QE tapering and gold plunges

Bullion has lost most of the ground gained earlier today, weighed by the US dollar’s bullish reaction to Federal Reserve chairman Powell’s words. Powell has reaffirmed the bank’s plan to start reducing its bond’s purchases and has played down the possibility of an interest rate hike in the coming months. The market reaction has favoured the dollar’s recovery, weighing on stock markets and commodities.

Gold prices had appreciated about 1% previously, favoured by increasing concerns about the persistently high inflation. Buoyed by its status as a traditional hedge against inflation pressures and a broad-based US dollar correction, the yellow metal was on track to post its best weekly performance in the last months.

XAU/USD’s reversal tests support at $1.770/80

Gold’s reversal has been contained at $1.770/80 previous resistance area. Below here bears might gain traction and send the pair towards $1,745 (October 6 low) before facing a key support area at $1,725 (September 29, 30 low).

On the upside, immediate resistance will be now at $1,807/10 (Sept. 15 high/Intra-day high) ahead of September’s peak. At $1.830 and 1,865 (Jun. 15 high).

Technical levels to watch

- AUD/USD fell in the last hour 40 pips as Fed’s Chairman Powell speaks.

- The market sentiment worsened, witnessed by US stocks falling on the back of Fed’s Powell.

- Powell speech: High inflation will likely last well into next year.

The AUD/USD retreats from daily highs around 0.7511, slides 0.07% during the New York session is trading at 0.7454 at the time of writing. The pair shed 40 pips in the last hour as Federal Reserve Chairman Jerome Powell hit the wires.

Powell speech: High inflation will likely last well into next year

On Friday, according to Reuters, Chairman Powell said that high inflation would likely last well into next year but added that they still expect it to move back down toward their 2% goal.

Furthermore, he added that “If we see persistent inflation, we would use our tools.” Concerning the labor market, he said that job growth could move back to higher levels witnessed the last summer, but it could take longer than the Fed thought.

Risk-off mood spurred by Fed’s Powell

Meanwhile, the market mood dampened as the New York session progressed. Major US equity markets lose between 0.19% and 1.14%, at press time, while the US Dollar Index edges lower 0.07%, sits at 93.71, following the US T-bond yields footsteps, with the 10-year yield dropping one a half basis point, currently at 1.662%.

AUD/USD Price Forecast: Technical outlook

The AUD/USD 1-hour chart depicts the pair briefly broke below Thursday low (0.7457), but at press time, the pair is at 0.7462, closing to the Friday’s open, but below the 100-simple moving average (SMA) at 0.7476, which could act as resistance.

For AUD/USD sellers, they would need a sustained break below 0.7453, so they could challenge the confluence of the S1 pivot point and the 200-SMA around 0.7433.

On the flip side, buyers will need to reclaim the 100-SMA. In that outcome, a challenge towards the daily pivot point at 0.7489, followed by the 0.7500 figure, is on the cards.

The Central Bank of Russia (CBR) rose the key interest rate by 75bps on Friday, to 7.5% surprising market participants. Market consensus was for a 25bps hike. Analysts at TD Securities now forecast a 50bps rate hike in December. They consider an increase of 25bps or 75bps are equally likely.

Key Quotes:

“The CBR signaled that more hikes are possible and, we think, likely. With one more meeting left in 2021 (17 Dec), the key decision will be whether the CBR can hike by 25bps, 50bps or more. The CBR also published today its medium-term macroeconomic forecasts that project the average key rate in the 7.5-7.7% range for the remainder of the year. The range widens to 7.3%-8.3% in 2022. A hold looks increasingly unlikely in December, so we will focus on tightening scenarios only.”

“We now forecast a further 50bps hike in December with the key rate at 8% by year-end. A hike of 25bps or 75bps are equally likely, but with lower probability than our baseline forecast. The key rate should further rise to 8.50% by March 2022, while easing can start in September to end 2022 at 7.50%.”

“The CBR has been one of the most hawkish central banks globally since March 2021. As a result, USDRUB trades over 8% lower since the start of 2021. Going forward, we continue to like RUB and Russian assets vs USD due to continued strong fundamentals. We also like RUB vs TRY due to diverging policy paths.”

- US dollar jumps across the board following Fed Chair Powell comments.

- USD/CAD rose to test the 1.2380 resistance area.

The USD/CAD climbed from 1.2350 to 1.2383, matching Thursday’s high. The pair remains near the high, with a strong bullish impulse. A break higher would clear the way for a test of 1.2400.

A stronger US dollar across the board has been the critical driver in USD/CAD. Fed Chair Powell mentioned that high inflation will likely last well into next year. He affirmed that it is the time to taper QE but not to raise rates. US stocks turned negative after Powell’s comments and commodities reversed sharply.

The USD/CAD faces a key barrier around 1.2400/10. If it breaks higher it could clear the way to more gains. Analysts at ING see the rally in CAD looking quite tired. “We expect to see more support in USD/CAD around the 1.2300 level. Most of the positives (BoC tightening, solid economic recovery, higher energy prices) appear in the price and our short-term fair value model currently shows a 1.5% undervaluation in USD/CAD.”

A key event next week will be the Bank of Canada meeting. At ING, they do expect the central bank to deliver another round of tapering “but that is a move that is likely fully priced in.” They see the balance of risks clearly tilted to the upside for USD/CAD next week. “August GDP data released two days after the BoC meeting may provide only a small help to CAD.”

Technical levels

- The dollar remains bid and reaches one-week lows near 113.50.

- Profit-taking hurts the USD as Fed tightening expectations wane.

- USD/JPY ready to extend gains beyond 115.00.

The US dollar is heading lower on Friday, extending its reversal from multi-year highs at 114.70 to session lows right above 113.55. The greenback is on track to post its first negative weekly performance since late August.

The US dollar dips as Fed tightening expectations wane

Investors’ expectations that the Federal Reserve would lead the world’s major central banks on the monetary policy normalization path, which had been boosting the US dollar over the last two months, have faded into the background, denting demand for the USD.

The market has been repricing monetary tightening expectations, as other central banks, like the BoE or the BoC, have started to anticipate the possibility of hiking rates to tackle inflation pressures.

Furthermore, profit-taking might also be responsible, at least in part, for the current dollar weakness. With the USD Index reaching one-year highs against its main rivals last week, some investors might have closed long positions.

The broader picture, however, remains fairly supportive of the greenback, with the yen hampered by an adverse monetary policy differential. The Federal Reserve is about to start rolling back its monetary stimulus program and will probably start hinting towards interest rate hikes in mid-2022. With the BoJ still immerse in an ultra-expansive policy and maintaining a yield control curve, the widening gap between the US and Japanese yields will remain clearly favorable for the USD.

USD/JPY: Seen appreciating beyond 115.00 – ING

According to the FX Analysis team at the ING Bank, the current reversal is just a corrective reaction ahead of further appreciation: “On USD/JPY, we do not want to miss out on a big upmove through 115.00. We have a conviction call that the Fed will have to turn more hawkish – USD positive against the low-yielders (…) We are very bullish on USD/JPY and see the correction finding support somewhere in the 113.20/70 area.”

Technical levels to watch

Data released on Friday showed an increase in August retail sales in Canada of 2.1%, slightly above the 2% expected. For September preliminary data points to a contraction. According to analysts at CIBC markets won't take much joy in the August increase in retail sales, with the flash estimate of September looking weaker than anticipated and coming alongside a similarly disappointing manufacturing print for that month.

Key Quotes:

“Retail sales roared back in August, but then took another breather in September. With a yo-yo in sales continuing into the end of the third quarter, the level of sales in September was back where it stood in June and July. That said, while goods sales continued to be plagued by the global semiconductor shortage, the employment data suggested that services sectors appeared to be gaining strength heading into the end of the quarter. As a result, we continue to expect that the economy was able to continue to soak up more slack in September.”

“Statistics Canada's flash estimate of September retail sales revealed an ugly 1.9% retreat after the rebound in August. The separately-released sneak peak of manufacturing sales for the same month showed a similarly dreadful drop of 3.2%. Both, appear to have been impacted by the supply crunch in the auto sector, with the factory report directly referencing the transportation equipment industry as the main source of weakness.”

“The ugly flash readings for retail sales and manufacturing will dent our previously heady GDP forecast for the month. However, while goods sectors were plagued by supply chain challenges, according to the Labour Force Survey data, activity across a range of services sectors was increasing. The federal election would have helped GDP during the month too. As a result, we're still comfortable forecasting that the economy expanded by roughly 0.5% during the month.”

Jerome Powell, Chair of the Board of Governors of the Federal Reserve System, said on Friday that he thinks that it is the time to start reducing asset purchases but added it's not time to raise rates yet, as reported by Reuters.

Additional takeaways

"Risks are clearly to longer, more persistent bottlenecks, and thus to higher inflation."

Our policy is well-positioned to manage a range of outcomes."

"We need to watch carefully to see whether the economy is evolving with our expectations and adapt accordingly."

Market reaction

The US Dollar Index edged slightly higher after these comments and was last seen losing 0.07% on the day at 93.68.

- GBP/USD broke below 1.3800 on weaker than expected UK Retail Sales.

- The market sentiment is positive, but the British pound failed to capitalize on its risk-sensitive status.

- Investors’ focus turns to the Fed Chairman Jerome Powell, who is on the wires,

The GBP/USD slides for the second day in a row, down 0.18%, trading at 1.3768 during the New York session at the time of writing. Worse than expected, UK retail sales data pushed the pair towards the Thursday low at 1.3776 but bounced off, failing to break above the 1.3800 figure.

The market sentiment is upbeat, with the US S&P 500 printing new all-time highs, while other major US equity indices rise between 0.17% and 0.33%, except for the Nasdaq Composite, which falls 0.36%.

The GBP could not extend its rally beyond 1.3800 amid risk-on market sentiment and dollar weakness

The British pound failed to capitalize on favorable market sentiment amid US dollar weakness across the board. The US Dollar Index, which tracks the greenback’s performance against a basket of its peers, drops 0.20%, sits at 93.58, underpinned by falling yields, for the first time in the week, losing one basis point, currently at 1.658% after touching a weekly high of around 1.70%.

On the macroeconomic front, the UK docket featured the Retail Sales for September, which shrank 0.6% on a monthly basis, worse than the 0.2% expansion expected by analysts. Furthermore, the annual figure collapsed 2.6% versus a -1.7% estimated by investors. According to the Office of National Statistics, people reduce their spending in household hood stores (-9.3%), such as furniture and lighting stores, which was the driver for the fall in the figure.

Moving onto more UK economic data, the IHS Markit/CIPS UK Manufacturing Purchasing Managers’ Index (PMI) unexpectedly improved to 57.7 in October versus 55.8 expected and 57.1 – September’s final reading. Traders lifted the GBP/USD pair on the news, bounced off the day’s lows, and briefly broke the 1.3800 figure.

Across the pond, the US economic docket unveiled the IHS Markit PMI for Manufacturing and Services for October, offering mixed figures. The Market Manufacturing PMI rose to 59.2, lower than the 60.3 estimated. Regarding the Markit Services PMI, it grew to 58.2 higher than the 55.1 foreseen.

The Federal Reserve Chairman Jerome Powell is on the wires. Investors’ focus turns to the Fed Chairman’s words, expecting hints or clues about bond tapering, monetary policy, or inflation.

GBP/USD Price Forecast: Technical outlook

The 1-hour chart depicts the pair is trading briefly above the Thursday lows (1.3775) as Jerome Powell takes center stage. In case of some hawkish remarks, the Wednesday low at 1.3742, followed by the Tuesday low at 1.3720, would be support levels for US dollar buys, to account for them. To the upside, the 1.3800 figure, followed by the weekly high around 1.3838, are resistance levels for GBP/USD traders.

Jerome Powell, Chair of the Board of Governors of the Federal Reserve System, said on Friday that high inflation will likely last well into next year but added that they still expect it to move back down toward their 2% goal, per Reuters.

Additional takeaways

"Supply bottlenecks are still weighing."

"Cannot rule out another COVID spike this winter."

"I think job growth will move back to high levels of last summer, but could take longer than we thought."

"Fed tools don't do much for supply constraints."

"Supply-side constraints have gotten worse in some cases recently."

"If we see persistent inflation, we would use our tools."

"We need to make sure our policy is positioned for a range of outcomes."

Next week, will be the European Central Bank (ECB) meeting. According to analysts at MUFG Bank the central bank is set to dent any upside potential for EUR/USD. They see Lagarde pushing back aggressively on market pricing, consistent with the new monetary strategy.

Key Quotes:

“One highlight of this week has been the resignation of Jens Weidmann from the ECB two years into his second eight-year term, citing personal reasons. While it is easy to dismiss this or even conclude it as being a dovish development with a hawk set to be replaced, the event could well be an indication of the scale of opposition building to the ECB’s current monetary stance. However, we do not expect possible building opposition to be on show next week and expect President Lagarde to push back strongly against the recent shift in rate expectations.”

“Lagarde is also going to have added justification given the increased evidence that supply constraints are curtailing economic activity. While the advance manufacturing PMI picked up in October, the services component was much weaker than expected, suggesting the energy price spike could be starting to impact sentiment on the consumer side.”

“The dollar remains under downward pressure with global risk appetite improving. The avoidance of default in China could see this momentum continue but we do not see much upside for EUR/USD given the ECB’s message is unlikely to be supportive.”

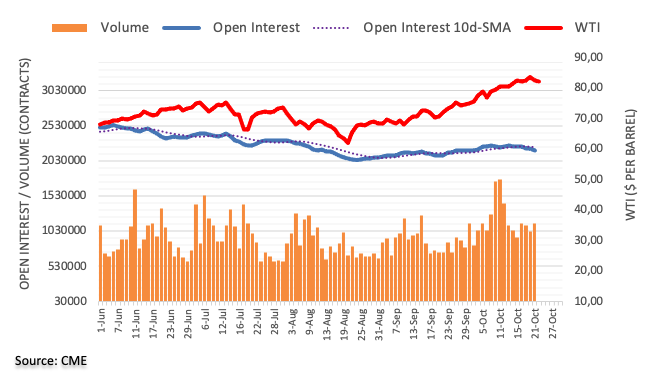

- Metals are rising sharply, amid risk appetite, a weaker dollar and a retreat in US yields.

- XAU/USD testing the $1810 resistance area.

- Price heads for a weekly close above the 20-week moving average.

Gold is rising sharply on Friday, extending weekly gains. The ounce gains more than $20 and recently reached at $1812, the highest level since mid-September. It remains near the top, with the bullish momentum intact.

Metals are posting important gains on Friday. The rally is being reinforced by a correction of the US dollar and a modest recovery in US bonds. The 10-year yields pulled back to 1.65% from 1.69%. Stocks in the US are mixed but off lows, also helping commodities.

Levels to watch

If XAU/USD holds firms above $1811 it could clear the way to additional gains, targeting the $1820 level. Above attention would turn to the critical resistance band at $1830/35 (July, August and September highs) that if broken, would strengthen then medium-term outlook.

On the flip side, a slide under $1800 would alleviate the bullish pressure while under 1790$ should warn about a potential reversal.

Technical levels

The Norwegian krone has benefitted from a supportive global risk sentiment throughout the week. In the week ahead, economists at ING think the NOK rally may pause.

Time for a breather in EUR/NOK

“The krone is already scoring as quite expensive against both the EUR and the USD according to our short-term fair value model.”

“While some other overvalued currencies will face a catalyst for a potential correction next week (like CAD with the BoC meeting), for NOK to give up gains we would likely need to see a deterioration in risk sentiment and/or a drop in oil prices.”

“October unemployment data out of Norway should have limited impact – we expect EUR/NOK to gravitate around 9.70 in the week ahead.”

The Bank of Canada (BoC) meeting week might prove to be a catalyst for an upside correction in USD/CAD, in the view of economists at ING. They suspect that the BoC may fall short of explicitly endorsing the current market pricing.

BoC to taper, but may fall short of aggressive tightening expectations

“The rally in CAD is looking quite tired, and we expect to see more support in USD/CAD around the 1.2300 level.”

“We do expect the BoC to deliver another round of tapering – cutting weekly purchases from CAD2 B to CAD1 B – but that is a move that is likely fully priced in. The main market focus will be on the forward-looking language, and here we suspect that the Bank may simply reiterate they expect the first hike in 2H22, hence falling short of the market’s aggressive tightening expectations.”

“With the USD correction now past us, we see the balance of risks clearly tilted to the upside for USD/CAD next week.”

“August GDP data released two days after the BoC meeting may provide only a small help to CAD.”

Australian policymakers are not turning any less dovish. In the week ahead, AUD will face the test of 3Q CPI data out of Australia. Softening price pressures are set to underpin the Reserve Bank of Australia’s (RBA) dovish stance, weighing on the pound, economists at ING report.

Decelerating inflation to argue in favour of RBA dovishness

“The Reserve Bank of Australia intervened for AUD1 B on Friday to defend its 0.10% yield target on the April 2024 government security.”

“The Evergrande story in China appears to have taken a less concerning path, and this is clearly benefitting the highly exposed AUD. Still, we think there were indications that the market had already turned quite relaxed on the impact of the Evergrande debt crisis, and it seems hard to see any more significant upside room for AUD on the back of this story.”

“Markets are widely expecting a deceleration from the 3.8% 2Q figure as covid restrictions generated some deflationary pressures in late summer. Anyway, decreasing price pressures should all but underpin the RBA’s dovish stance and we think the release may prompt some re-pricing of tightening expectations (40bp priced in for the next year) and weigh on AUD.”

- Markit Services PMI and Composite PMI surpassed expectations in October.

- US Dollar Index continues to push lower toward 93.50.

The business activity in the US service sector expanded at a more robust pace than expected in early October with IHS Markit's Services PMI rising to 58.2 (preliminary) from 54.9 in September. This reading surpassed analysts' estimate of 55.1.

Meanwhile, the Composite PMI improved to 57.3 from 55 and came in better than the market consensus of 54.7.

Commenting on the data, "October saw resurgent service sector activity as COVID-19 case numbers continued to fall, marking an encouragingly strong start to the fourth quarter for the economy," said Chris Williamson, Chief Business Economist at IHS Markit. "Hiring has likewise picked up as firms have been encouraged to expand capacity to meet rising demand."

Market reaction

The US Dollar Index edges lower after this report and was last seen losing 0.2% on the day at 93.57.

- EUR/USD stays firm on the back of dollar weakness.

- EMU, German flash Manufacturing PMI surprised to the upside,

- US advanced Manufacturing PMI disappoints in October.

The persevering selling pressure in the greenback helps EUR/USD advancing to the area of daily highs near 1.1650 on Friday.

EUR/USD closes its second straight week with gains

EUR/USD keeps the recovery from last week’s YTD lows well and sound for the time being, advancing for the second week in a row albeit with gains limited around 1.1670.

The improved sentiment in the risk complex weighed on the buck in spite of the recent move higher in US yields, where the front end climbed to levels last traded in March 2020 around 0.48% (October 21) and the 10y reference briefly tested 1.70% for the first time since April.

In the docket, preliminary PMIs in the core euro area (Germany, France and the bloc as a whole) are seen rebounding in October, while the US Manufacturing PMI is expected to ease to 59.2 in the current month (from 60.7) and the Services PMI is predicted to improve to 58.2 (from 54.9).

EUR/USD levels to watch

So far, spot is gaining 0.20% at 1.1645 and faces the next up barrier at 1.1669 (monthly high Oct.19) followed by 1.1709 (55-day SMA) and finally 1.1755 (weekly high Sep.22). On the other hand, a break below 1.1602 (20-day SMA) would target 1.1571 (low Oct.18) en route to 1.1524 (2021 low Oct.12).

- US Markit Manufacturing PMI declined slightly in October's flash estimate.

- US Dollar Index stays in the negative territory after the data.

The economic activity in the US manufacturing sector continued to expand in October, albeit at a slightly slower pace than it did in September, with IHS Markit's Manufacturing PMI declining to 59.2 (preliminary) from 60.7. This reading missed the market expectation of 60.3.

Commenting on the data, "while manufacturers also continue to report strong demand, factory production remains plagued by constraints, including record supply chain bottlenecks and labor shortages," noted Chris Williamson, Chief Business Economist at IHS Markit."Prices paid by factories for raw materials rose at yet another new record pace as a result."

Market reaction

The greenback remains on the back foot after this data and the US Dollar Index was last seen losing 0.17% on the day at 93.60.

- Wall Street's main indexes trade mixed on Friday.

- Falling technology stocks weigh on Nasdaq ahead of the weekend.

Major equity indexes started the last day of the week mixed amid varying performances of major sectors. As of writing, the S&P 500 was virtually unchanged on the day at 4,549, the Dow Jones Industrial Average was up 0.15% at 35,657 and the Nasdaq Composite was down 0.3% at 15,168.

Pressured by the large losses witnessed in Twitter Inc and Facebook shares, the Communication Services Index is down more than 1% after the opening bell. On the other hand, the Financials Index is rising 0.8% as the best-performing sector in the early trade.

Later in the session, FOMC Chairman Jerome Powell will be speaking at a panel discussion on monetary challenges in the wake of COVID. The IHS Markit will release the preliminary Services and Manufacturing PMIs as well.

S&P 500 chart (daily)

The USD/JPY rally has taken a breather over the last week after some strong gains. The highlight of the week ahead will be Thursday’s Bank of Japan meeting where a fresh update on the Outlook for Activity and prices will be published. Economists at ING stay bullish and see substantial gains to the 115.00 level.

Big update from the BoJ

“Back in July, the BoJ had forecast CPI at 0.6%, 0.9% and 1.0% in FY21-23 respectively. We doubt there will be any substantial upward revisions which will prompt a re-pricing of the typically super-dovish BoJ policy cycle.”

“On USD/JPY, we do not want to miss out on a big upmove through 115.00. We have a conviction call that the Fed will have to turn more hawkish – USD positive against the low-yielders.”

“We are very bullish on USD/JPY and see the correction finding support somewhere in the 113.20/70 area.”

The CAD has steadied and regained a little ground after closing weakly against the USD on Thursday. Analysts at Scotiabank expect the USD/CAD to test the 1.230 support with a break below here to expose key support at 1.2288.

Resistance seen at 1.2385

“There is a high degree of bearish momentum still evident in the short-term (intraday and daily) DMI oscillators and this is impeding the USD’s recovery potential at the moment.”

“Intraday selling pressure has been fairly steady and may test intraday support at 1.2320. Weakness below here should see another run towards to figure and now key support at 1.2288, yesterday’s low.”

“Resistance is 1.2385.”

- USD/TRY pushes higher and advances to the 9.6500 region.

- The lira extends the rout after the CBRT’s interest rate cut.

- The Turkish currency already loses nearly 15% since September.

The selling pressure around the Turkish lira picks up renewed pace and pushes USD/TRY to another all-time high past 9.6500 on Friday.

USD/TRY higher as investors flee the lira

USD/TRY advances for the second session in a row and trades just below the earlier fresh record high above 9.6500 as market participants intensify the exodus from the Turkish currency.

Indeed, there seems to be no respite for the downside pressure hitting the lira after the Turkish central bank (CBRT) caught everybody off guard and cut the One-Week Repo Rate by a shocking two full percentage points at its meeting on Thursday.

The lira sheds already nearly 14% since September and around 25% since President Erdogan removed former CBRT Governor N.Agbal in mid-March, soon after he hiked rates to 19.00%. In the bond market, yields of the Turkish reference 10y bond climb to levels last seen in May 2019 past 19.50% so far.

USD/TRY key levels

So far, the pair is up 0.98% at 9.5953 and a drop below 9.2475 (10-day SMA) would aim for 9.0599 (20-day SMA) and finally 8.8317 (monthly low Oct.4). On the other hand, the next up barrier lines up at 9.6583 (all-time high Oct.22) followed by 10.0000 and then… the moon?

- EUR/USD resumes the upside around 1.1640 on Friday.

- Extra gains are likely if 1.1670 is cleared (in the near term).

Bulls retake the upper hand and encourage EUR/USD to regain the upside traction and the 1.1640 zone at the end of the week.

If this area if cleared – ideally in the very near term - then the pair could attempt to take out the round level at 1.1700 ahead of the interim hurdle at the 55-day SMA, today at 1.1709. Further north comes the short-term resistance line near 1.1730. A breakout of the latter should see the selling pressure mitigated and therefore allow for extra gains to the next relevant resistance in the mid-1.1700s.

In the meantime, the near-term outlook for EUR/USD is seen on the negative side below the key 200-day SMA, today at 1.1916.

EUR/USD daily chart

The S&P 500 has moved to a new record high above 4546. Analysts at Credit Suisse expect the index to extend its advance towards the 4600/06 region.

Initial support moves to 4542/21

“With momentum strong and with the short and medium-term moving averages having now also posted a bull cross, we maintain our core bullish outlook and look for a sustained break to new highs.”

“We see resistance next at 4565 ahead of 4574 ahead of the beginning of what we continue to see as its ‘typical’ extreme (10% above the 200-day average) and psychological barrier at 4600/06. We would expect an initial but temporary pause here.”

“Support moves to 4542/41 initially, with the recent price gap at 4524/20 ideally still holding to keep the immediate risk higher. Below can see a setback to 4496, then 4486/76, with fresh buyers expected here.”

EUR/USD is marginally stronger despite mixed PMIs. But economists at Scotiabank see limited momentum toward a firm breach past the mid-1.16s area.

ECB rate hikes are too far to provide support for the euro in the short run

“France’s services PMI beat estimates but the manufacturing index missed expectations. German services missed and manufacturing beat (though mainly due to supply bottlenecks pushing up prices). The eurozone services data followed Germany’s with the index decelerating to 54.7 from 56.4 in September and 55.4 expected while manufacturing ticked marginally lower to 58.5 (57.1 expected from 58.6).”

“We think that, in any case, ECB rate hikes are too far in the future to provide support for the EUR in the short run even if the ECB signals that it may go sooner than expected by economists.”

“The Tuesday and Thursday highs of ~1.1665/70 are key resistance before 1.17 where the 50-day MA at 1.1707 also awaits.”

“The EUR has found intermediate support at ~1.1620 ahead of firmer in the 1.1590/600 zone.”

- A combination of factors prompted fresh selling around USD/CAD on the last day of the week.

- A generally positive risk tone weighed on the safe-haven USD and exerted downward support.

- An uptick in crude oil, stronger Canadian data underpinned the loonie and added to the selling.

The USD/CAD pair refreshed daily lows in reaction to better-than-expected Canadian macro data, albeit quickly recovered a few pips thereafter. The pair was last seen trading around the 1.2335 region, still down nearly 0.25% for the day.

The pair met with fresh supply on Friday and eroded a major part of the previous day's recovery gains from sub-1.2300 levels or four-month lows. The downfall was sponsored by renewed US dollar selling bias and a pickup in crude oil prices, which tend to underpin the commodity-linked loonie.

Easing worries about a credit crunch in China's real estate sector boosted investors confidence on the last day of the week. This was evident from a generally positive tone around the equity markets, which, in turn, was seen as a key factor that dented the greenback's relative safe-haven status.

On the other hand, the Canadian dollar benefitted from a fresh leg up in crude oil prices and slightly better-than-expected domestic data. Statistics Canada reported that Retail Sales rose 2.1% MoM in August as against the 0.6% decline reported in the previous month and 2% growth anticipated.

That said, elevated US Treasury bond yields – amid hawkish Fed expectations – should help limit any deeper USD losses and act as a tailwind for the USD/CAD pair. Investors seem convinced that the Fed would be forced to adopt a more aggressive policy response to contain stubbornly high inflation.

Hence, the market focus would be on Fed Chair Jerome Powell's remarks during a virtual panel discussion later this Friday. This, along with the release of flash US Manufacturing/Services PMI and the US bond yields, will influence the USD and provide some impetus to the USD/CAD pair.

Technical levels to watch

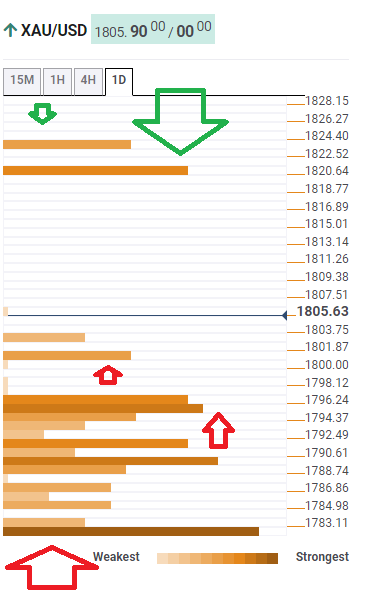

- Gold has broken above $1,800, this time in a more significant manner.

- The upbeat mood in markets and the breather in the rise of US yields is helping.

- Gold Price Forecast: XAU/USD eyes a firm break above $1795 amid growing inflation fears

Bitcoin has reached all-time highs, stocks have followed – is it time for gold to break higher? XAU/USD is, at least, moving above $1,800. Last week's upside move proved indecisive, but this latest surge is more substantial. The precious metal is already valued at $1,805.

How is XAU/USD positioned on the technical chart?

Gold Price: Key levels to watch

The Technical Confluences Detector is showing that the precious metal faces resistance at $1,820, which is where the Pivot Point one-month Resistance 1 hits the price.

It is followed by $1,823, which is where another pivot point awaits, the one-week Resistance 2.

Looking down, some support is at $1,801, where the previous week's top converges with the PP one-day Resistance 3.

Another cushion awaits at $1,795, which is the confluence of the Simple Moving Average 10-15m, the previous 4h-high and the PP one-week R1.

Much lower, a barrier against bearish attacks is at $1,783, which is where the Fibonacci 38.2% one-week and the BB 4h-Middle meet up.

XAU/USD Confluence levels

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

USD/MXN has staged a pullback after probing 20.90 last week. Nonetheless, economists at Société Générale expect the pair to retake its march forward to the March peak of 21.60.

Downside limited

“A large down move is not envisaged; 20.00 and recent low at 19.85 are near-term supports.”

“The up move could persist towards 20.90 and March peak of 21.60.”

- Gold gained traction for the fourth successive day amid renewed USD selling bias.

- Elevated US bond yields, the dominant risk-on mood might cap any additional gains.

- Hawkish signals from major central banks could also act as a headwind for the metal.

- Gold Price Forecast: XAU/USD eyes a firm break above $1795 amid growing inflation fears

Gold gained traction for the fourth successive day and shot to the $1,800 neighbourhood, back closer to one-month tops heading into the North American session on Friday. The momentum was exclusively sponsored by the emergence of fresh selling around the US dollar, which tends to underpin demand for the dollar-denominated commodity. The USD downtick lacked any obvious fundamental catalyst and remained limited amid elevated US Treasury bond yields. This, along with a generally positive tone around the equity markets, might keep a lid on any further gains for the safe-haven XAU/USD.

The yield on the benchmark 10-year US government bond held steady near the 1.70% threshold, or the highest level since May amid expectations for an early policy tightening by the Fed. The FOMC meeting minutes released last week reaffirmed that the US central bank remains on track to begin rolling back its massive pandemic-era stimulus by the end of this year. The markets have also been pricing in the possibility of an interest rate hike in 2022 amid worries about a faster-than-expected rise in inflation. This further contributed to the recent spike in bond yields.

Meanwhile, reports indicated that the Bank of Japan is discussing phasing out the COVID-19 loan program if infections in the country continue to dwindle. Apart from this, the Bank of England officials have signalled about an imminent interest rate hike later this year. This, in turn, should act as a headwind for the non-yielding gold, warranting some caution before placing aggressive bullish bets amid the dominant risk-on mood in the markets. The global risk sentiment got a boost amid easing concerns about a credit crunch in China's real estate sector

China Evergrande Group made funds available on Thursday for a bond coupon originally due on September 23 and averted a default. The heavily indebted developer, however, announced on Friday it has not made substantial progress in disposing of the real-estate giant's assets. The group further noted that it cannot guarantee it will be able to continue to meet the financial obligations under contracts. This seemed to be a key factor that provided an additional lift to gold prices over the past hour or so.

Friday's key focus would be on Fed Chair Jerome Powell's remarks during a virtual panel discussion later this Friday. This, along with the US bond yields and flash US Manufacturing/Services PMI prints for October, should influence the USD price dynamics. Apart from this, the broader market risk sentiment might further contribute to producing some meaningful trading opportunities around gold.

Technical outlook

From a technical perspective, a sustained strength beyond the $1,800 mark will confirm a near-term bullish breakout through the 100/200-day SMAs confluence hurdle. This will set the stage for a further near-term appreciating move for gold and push spot prices to the next relevant resistance near the $1,816-18 region. The momentum could further get extended towards challenging a key barrier near the $1,832-34 heavy supply zone.

On the flip side, the $1,789-88 region now seems to protect the immediate downside ahead of the daily swing lows, around the $1,783-82 zone. This is followed by support near the $1,775 level and the $1763-60 region, which if broken will negate any near-term positive bias. The XAU/USD might then turn vulnerable to break below the $1,750 support and accelerate the fall towards September monthly swing lows, around the $1723-21 region.

Levels to watch

- Retail Sales in Canada rose more than expected in August.

- USD/CAD stays in the negative territory below 1.2350 after the data.

Retail Sales in Canada rose by 2.1% on a monthly basis in August, the data published by Statistics Canada showed on Friday. This reading followed July's contraction of 0.6% and came in slightly better than the market expectation for an increase of 2%.

Excluding automobiles, Retail Sales in Canada increased by 2.8% in the same period as expected.

Market reaction

The USD/CAD pair showed no immediate reaction to this report and was last seen trading at 1.2330, where it was down 0.28% on a daily basis.

EUR/CHF has unexpectedly broken below major support at 1.0704/1.0696. We Economists at Credit Suisse look for a move to support at 1.0605/00.

Bearish bias while below 1.0767

“EUR/CHF has unexpectedly turned back lower and broken below major support at 1.0704/1.0696, which turns our bias to the downside. Support is seen next at the 1.0660 low from November 2020, then retracement support at 1.0642, before another prominent price low at 1.0605/00, where we would expect to see a fresh pause.”

“Ultimately, the magnitude of this potential breakdown suggests we could even move beyond here over the medium term and move all the way to the long-term support level at the 2020 low at 1.0503/00, which is likely to be a much tougher support level if reached.”

“First resistance moves to 1.0726, then the recent high at 1.0764/67, before the cluster of resistances at 1.079 1/081 0, which includes the 55-day average, with a break above here needed to instead suggest a false breakdown.”

- GBP/USD lacked any firm directional bias and remained confined in a range on Friday.

- Upbeat UK PMIs offset dismal Retail Sales figures and underpinned the British poud.

- Renewed USD selling bias further extended support, though bulls lacked conviction.

The GBP/USD pair lacked any firm directional bias and seesawed between tepid gains/minor losses, around the 1.3800 mark through the mid-European session.

The pair witnessed some intraday selling and dropped to two-day lows near the 1.3770 area in reaction to dismal UK Retail Sales figures, which unexpectedly dropped by 0.2% in September. Excluding the auto motor fuel sales, the core retail sales decline by -0.6% MoM and added to signs of weakness in the economic recovery.

This comes on the back of softer UK consumer inflation figures released earlier this week and dashed hopes for an imminent rate hike by the Bank of England in November. This turned out to be a key factor that weighed on the British pound and exerted some downward pressure on the GBP/USD pair, though the downside seemed cushioned.

Investors, however, seem convinced that the BoE will eventually hike interest rates from record lows before the end of this year. This, along with stronger-than-expected UK PMI prints for October and renewed US dollar selling bias, helped limit the downside, rather assisted the GBP/USD pair to find some buyers at lower levels.

Meanwhile, reports that China Evergrande made funds available for a bond coupon to a trustee account helped ease concerns about a credit crunch in China's real estate sector. The was seen as a key factor that failed to assist the safe-haven USD to capitalize on the previous day's goodish rebound from three-week lows.

That said, elevated US Treasury bond yields held investors from placing aggressive bearish bets around the USD and capped the upside for the GBP/USD pair, at least for now. In fact, the yield on the benchmark 10-year US government bond held steady just below the 1.70% threshold, or the highest level since May touched on Thursday.

Growing markets acceptance that the Fed would be forced to adopt a more aggressive policy response to contain stubbornly high inflation continued acting as a tailwind for the US bond yields. Hence, the focus will remain on Fed Chair Jerome Powell's comments during a virtual panel discussion later this Friday.

This, along with the US bond yields and the broader market risk sentiment, will influence the USD price dynamics and provide some impetus to the GBP/USD pair. Apart from this, traders will further take cues from the flash version of the US Manufacturing and Services PMI, due for release during the early North American session.

Technical levels to watch

- Silver caught some fresh bids on Friday and moved back closer to multi-week tops.

- The set-up remains tilted in favour of bulls and supports prospects for further gains.

- Any meaningful slide below the $24.00 mark could be seen as a buying opportunity.

Silver regained positive traction on the last day of the week and inched back closer to six-week tops during the mid-European session. The white metal was last seen trading just below the mid-$24.00s, up around 0.70% for the day.

From a technical perspective, the XAG/USD has been consolidating in a range around the 38.2% Fibonacci level of the $28.75-$21.42 downfall. Given the recent breakout through a downward sloping trend-line extending from July swing highs and an inverted head and shoulders neckline, the bias remains tilted in favour of bullish traders.

The constructive setup is reinforced by the fact that technical indicators on the daily chart have been gaining positive traction and are still far from being in the overstretched zone. Moreover, RSI (14) on the 4-hour chart has eased from the overbought territory and supports prospects for a further near-term appreciating move.

Hence, a subsequent move towards testing September monthly swing highs, around the $24.80-85 region, remains a distinct possibility. Bulls might eventually aim to reclaim the key $25.00 psychological mark, which coincides with the 50% Fibo. level.

On the flip side, the overnight swing lows, around the $24.00 mark now seems to protect the immediate downside. Any subsequent decline could be seen as a buying opportunity near the $23.75-70 region. This, in turn, should help limit the corrective pullback near the mentioned trend-line support breakpoint, around the $23.50-45 region.

Silver daily chart

Technical levels to watch

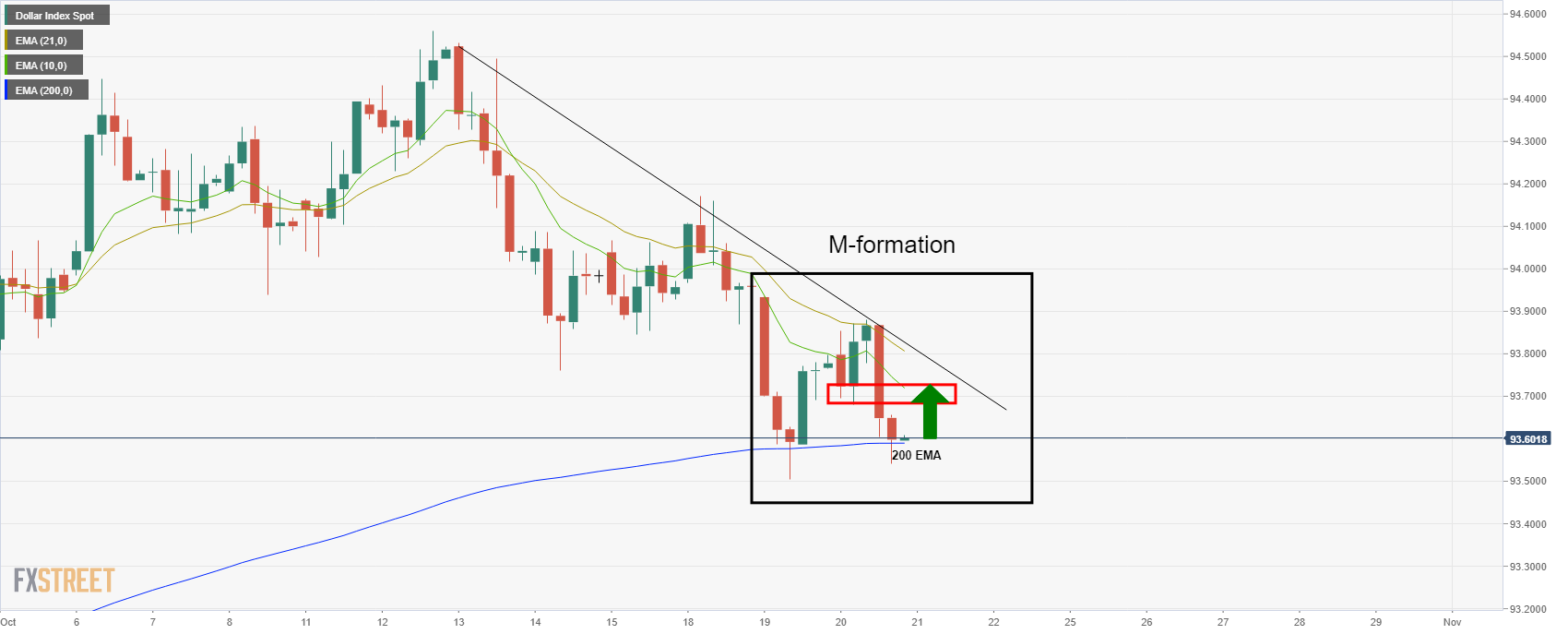

- DXY could not sustain Thursday’s bullish attempt to 93.80.

- Solid contention remains around the mid-93.00s so far.

DXY resumes the downside after the recent failed attempt to re-visit the 94.00 neighbourhood (Thursday).

Further consolidation is now likely amidst the current price action. However, if sellers manage to drag the index further south of 93.50 then DXY could be poised for a deeper pullback to the 55-day SMA at 93.25 followed by late September lows around 93.00 (September 23/24).

Looking at the broader picture, the constructive stance on the index is seen unchanged above the 200-day SMA at 91.87.

DXY daily chart

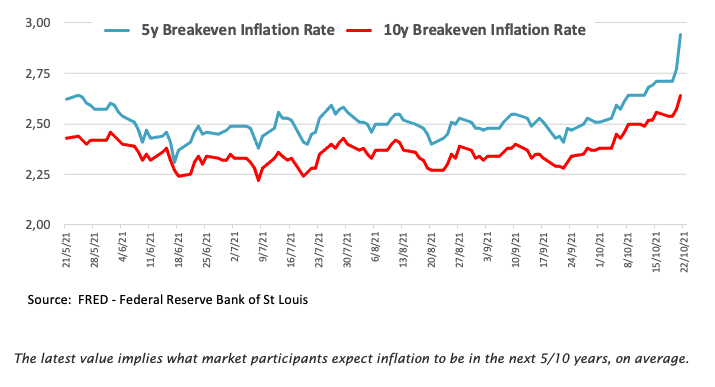

According to Reuters, a key market gauge of the long-term inflation gauge in the eurozone hit 2% for the first time since 2014.

"The five-year, five-year breakeven inflation forward has risen from just under 1.30% at the start of the year, driven by recovery from the COVID-19 pandemic and elevated current inflation readings spurred on by supply bottlenecks and high energy prices," Reuters explained.

source: Reuters

Market reaction

This development doesn't seem to be having a significant impact on the shared currency's performance against its rivals. As of writing, the EUR/USD pair was up 0.15% on a daily basis at 1.1637.

- EUR/JPY manages to reverse Thursday’s strong pullback.

- The resumption of the upside could well see the YTD high retested.

EUR/JPY’s needle-like upside seems to have met some decent hurdle in the vicinity of 133.50 on Thursday, sparking quite a moderate corrective downside afterwards.

The cross corrected lower following recent overbought levels. However, the current positive outlook should allow for the continuation of the uptrend in the not-so-distant future, with minor hurdles at 133.68 (June 15) and 133.76 (June 10) ahead of the more relevant YTD high at 134.12 recorded on June 1.

In the broader scenario, while above the 200-day SMA at 130.04, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

- AUD/USD regained positive traction on Friday and reversed the previous day’s retracement slide.

- An improvement in the risk sentiment undermined the safe-haven USD and remained supportive.

- Elevated US bond yields did little to impress the USD bulls or hinder the strong intraday move up.

The AUD/USD pair built on its intraday ascent and climbed back above the key 0.7500 psychological mark during the first half of the European session.

Following the previous day's turnaround from the highest level since July, the AUD/USD pair caught some fresh bids on the last day of the week amid the emergence of fresh selling around the US dollar. Reports that China Evergrande made funds available for a dollar bond coupon eased concerns about a credit crunch in China's real estate sector and boosted investors' sentiment. This, in turn, undermined the safe-haven greenback and acted as a tailwind for the perceived riskier aussie.

The intraday USD downtick comes despite elevated US Treasury bond yields, bolstered by expectations for an early policy tightening by the Fed. Investors have been pricing in the possibility of an interest rate hike in 2022 amid worries about a faster than expected rise in inflation. The speculations were reinforced by Fed Governor Christopher Waller’s comments on Thursday, saying that the US central bank may have to act faster if inflation continues to climb and remains too high.

Hence, Friday's focus will be on a scheduled speech by Fed Chair Jerome Powell, which will play a key role in influencing the USD price dynamics. Heading into the key event risk, the US economic docket, highlighting the release of flash PMI prints for October, and the US bond yields will be looked upon for some impetus around the AUD/USD pair. Apart from this, traders might further take cues from the broader market risk sentiment to grab some short-term opportunities heading into the weekend.

Technical levels to watch

USD/KRW has retracted towards first support of daily Ichimoku cloud near 1165. However, economists at Société Générale expect the pair to rebound towards the 1200/10 region.

Bounce expected

“Only a break below 1165 will mean a deeper down move.”

“A rebound is likely towards recent peak at 1200/1210, the 61.8% retracement from 2020.”

- USD/CAD witnessed fresh selling on Friday and reversed a major part of the overnight gains.

- Renewed USD weakness turned out to be a key factor that acted as a headwind for the pair.

- An uptick in oil prices underpinned the loonie and further contributed to the intraday selling.

The USD/CAD pair remained depressed through the first half of the European session and was last seen hovering near the lower boundary of its daily trading range, below mid-1.2300s.

The pair struggled to capitalize on the previous day's solid bounce of nearly 100 pips from sub-1.2300 levels, or four-month lows, instead met with some fresh supply on the last day of the week. The emergence of fresh selling around the US dollar was seen as a key factor that acted as a headwind for the USD/CAD pair. Apart from this, a modest uptick in crude oil prices underpinned the commodity-linked loonie and contributed to the intraday selling bias.

Reports that China Evergrande made funds available for a bond coupon to a trustee account helped ease concerns about a credit crunch in China's real estate sector. This, along with signs of stability in the equity markets, dented the greenback's relative safe-haven status. That said, elevated US Treasury bond yields should help limit any deeper losses for the USD and lend some support to the USD/CAD pair, warranting caution before placing fresh bearish bets.

In fact, the yield on the benchmark 10-year US government bond held steady near the highest level since May amid prospects for an early policy tightening by the Fed. Investors seem convinced that the Fed would be forced to adopt a more aggressive policy response to contain stubbornly high inflation. The speculations were reinforced by comments from Fed Governor Christopher Waller, saying that the US central bank may have to act faster if inflation remains too high.

Hence, Friday's key focus will be on a scheduled speech by Fed Chair Jerome Powell, due later during the North American session. Heading into the key event risk, traders might take cues from the release of the flash US PMI prints for October and monthly Canadian Retail Sales data. Apart from this, oil price dynamics and the US bond yields, might provide some impetus to the USD/CAD pair and allow traders to grab some short-term opportunities.

Technical levels to watch

The main unit of China Evergrande Group, Hengda Real Estate Group Co, announced on Friday that it has not made substantial progress in disposing of the real-estate giant's assets, as reported by Reuters.

The group further noted that it cannot guarantee it will be able to continue to meet the financial obligations under contracts.

Market reaction

This development doesn't seem to be having a significant impact on market sentiment. As of writing, the Dow Futures were flat on the day and the S&P Futures were down 0.08%.

- GBP/JPY attracted some dip-buying on Friday and reversed an early dip to the 156.80 area.

- Upbeat UK PMIs overshadowed dismal Retail Sales and acted as a tailwind for the sterling.

- Stability in the equity markets undermined the safe-haven JPY and further extended support.

The GBP/JPY cross quickly recovered around 50 pips from the early European session lows, albeit lacked any follow-through and was last seen trading with modest gains, around the 157.25-30 region.

Following an early uptick to the 157.65 region, the GBP/JPY cross witnessed some selling in reaction to dismal UK Retail Sales figures that added to signs of weakness in the economic recovery. Against the backdrop of this week's softer UK consumer inflation figures, the data further dashed hopes for an imminent rate hike by the Bank of England in November. This, in turn, was seen as a key factor that acted as a headwind for the British pound.

Investors, however, seem convinced that the BoE will eventually hike interest rates from record lows before the end of this year. This, along with stronger-than-expected UK PMI prints for October, assisted the GBP/JPY cross to attract some buying near the 156.85-80 region, just ahead of weekly lows. The Services PMI rose to a four-month high, while the gauge for the manufacturing sector unexpectedly edged higher during the reported month.

Meanwhile, reports that China Evergrande made funds available for a bond coupon to a trustee account helped ease concerns about a credit crunch in China's real estate sector. This was evident from stability in the equity markets, which undermined demand for the safe-haven Japanese yen and provided an additional lift to the GBP/JPY cross. That said, the uptick lacked any strong follow-through and warrants some caution for aggressive bullish traders.

Technical levels to watch

EUR/NOK is now trading around 9.70 after reaching a record low at 9.65 for the first time since 2019. While economists at Nordea cannot exclude the possibility of a stronger krone if oil prices keep climbing, they still believe that the risk is to the upside in EUR/NOK.

Upside risks in EUR/NOK

“We believe that the central bank will reduce the NOK purchases to around 300-400m/day in November, as a result of the 2022 budget proposal. The reduction of NOK purchases from Norges Bank means less tailwinds for NOK from November onward. But until then, NOK could continue to go stronger with the buying flow from petroleum companies and Norges Bank.”

“The uncanny low RSI suggests that EUR/NOK will either consolidate or move higher in the upcoming period. But with the moves we have seen lately, it's hard to be sure when this strong downward trend in EUR/NOK will be put off course.”

“In the short-term, oil prices could rise above $90/barrel according to the global EIA’s oil storage outlook. If oil prices continue to rise, we could see EUR/NOK approaching 9.50-9.60.”

- EUR/USD fades Thursday’s downtick and regains the 1.1640 zone.

- The greenback resumes the downside on the back of lower yields.

- EMU, Germany flash Manufacturing PMIs surprised to the upside.

The single currency quickly leaves behind Thursday’s downtick and motivates EUR/USD to retake the 1.1640 region at the end of the week.

EUR/USD propped up by data

EUR/USD regains upside traction and returns to the 1.1650 zone on Friday on the back of the resumption of the selling pressure in the greenback and the upbeat tone in the broad risk-linked universe.

In fact, lower US yields weigh once again on the buck and forces the US Dollar Index (DXY) to fade the bullish intentions recorded during the previous session.

Also supporting the firm note in the pair emerges the better-than-expected preliminary readings for the Manufacturing PMI in both Germany and the broader Euroland for the current month.

Data wise across the pond, Markit will publish the flash PMIs also for the month of October.

What to look for around EUR

EUR/USD advanced further and clinched fresh October peaks near 1.1670 earlier in the week. While the improvement in the sentiment surrounding the risk complex lent extra wings to the par, price action is expected to keep looking to dollar dynamics for the time being, where tapering chatter remains well in centre stage. In the meantime, the idea that elevated inflation could last longer coupled with the loss of momentum in the economic recovery in the region, as per some weakness observed in key fundamentals, are seen pouring cold water over investors’ optimism as well as bullish attempts in the European currency.

Key events in the euro area this week: Preliminary PMIs in the euro zone (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the region. Sustainability of the pick-up in inflation figures. Probable political effervescence around the EU Recovery Fund in light of the rising conflict between the EU, Poland and Hungary. ECB tapering speculations.

EUR/USD levels to watch

So far, spot is gaining 0.13% at 1.1638 and faces the next up barrier at 1.1669 (monthly high Oct.19) followed by 1.1709 (55-day SMA) and finally 1.1755 (weekly high Sep.22). On the other hand, a break below 1.1602 (20-day SMA) would target 1.1571 (low Oct.18) en route to 1.1524 (2021 low Oct.12).

USD/JPY has experienced an accelerated uptrend after breaking above the 2020 peak of 112.23. Economists at Société Générale expect the pair to correct lower but with the 113.30 level holding.

Support 113.30, resistance 114.70

“An initial pullback can’t be ruled out however 113.30, the 23.6% retracement from August could provide support.”

“A large decline is not envisaged so long as 2020 highs of 112. 23/111.65 holds.”

“Beyond 114.70, the pair could persist with its up move towards next objectives could be at projections of 115.50/115.85 and 116.50.”

USD/RUB has reached potential support at 70.60/70.40. Economists at Société Générale expect the pair to bounce towards the June low of 71.50 and beyond on a break above here.

Failure to hold 70.60/70.40 to open up 69.60

“USD/RUB has formed a daily Bullish Engulfing denoting possibility of a bounce. First layer of hurdle is located at June low of 71.50. This must be overcome for an extended rebound.”

“Failure to hold 70.60/70.40 would denote continuation in decline towards projections at 69.60.”

- DWAC surges to over $70 in Friday premarket.

- Digital World Acqusitions Corp. plans to take Trump's Truth Social platform public.

- DWAC soared 357% on Thursday.

...And he’s back! After getting banished from both Twitter (TWTR) and Facebook (FB) in the deluge that followed the failed coup attempt on the US Capitol by his supporters on January 6, Donald Trump is once again remaking his business persona, this time as the principle figure behind a new social media company that is yet to be launched but already has a billion dollar blank check company lined up to take it public.

Digital World Acquisition Corp. (DWAC), a Special Purpose Acquisition Company or SPAC, announced its agreement on Thursday to take Trump Media & Technology Group public. Shares of the SPAC rose 357% on the news as retail traders piled in, causing DWAC’s market capitalization to reach $1.5 billion. At the time of writing, DWAC is up another 65% in Friday’s premarket.

DWAC News: the case for a conservative social media giant

The real estate scion, turned casino empresario, turned public company CEO, cum reality television star and controversial one-term US President is now aiming his sights on Silicon Valley.

Trump Media & Technology Group (TMTG) thus far only has a pitch deck for Truth Social – his attempt to upend the power of the two aforementioned social media behemoths (interestingly, Alphabet’s (GOOGL) YouTube does not receive the same vehemence in the pitch deck. I wonder why?). Truth Social’s raison d'être is surely Trump’s lifelong passion for striking back against his detractors, but the business model offers a reasonable proposal.

The elevator pitch is that the social media business is “ripe for further segmentation.” This is another way of saying that Trump voters and American conservatives at large would desire a social media channel outside of the mainstream where they could have a safe space from censorship, a la Fox News.

“TMTG aspires to create a media powerhouse to rival the liberal media consortium and fight back against the ‘Big Tech’ companies of Silicon Valley, which have used their unilateral power to silence opposing voices in America,” screams the pitch deck.

Truth Social would harness Trump’s heavy following – 146.5 million followers between Twitter, Facebook and Instagram before his excommunication – to steal eye balls away from entrenched social media platforms. The company points to a survey showing that 30% of those surveyed by the Hill newspaper back in March would join a Trump-back social media platform. Another 16% answered “maybe”.

DWAC Technical Analysis: only the retail trade will tell

After closing at $9.96 on Wednesday as one of many unknown SPACs, DWAC opened Thursday on the news at $12.73 before veering up to a high of $52, just above the 261.8% Fibonacci level at $51.78. The $50 level appears to have acted as resistance on Thursday, but as the Friday premarket has traded DWAC up to $76.30, it would be expected that $50 would now act as support. The 161.8% Fibonacci at $35.76 is the only other support level in the region.