- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-05-2014

Gold $1,288.00 -6.50 -0.50%

ICE Brent Crude Oil $110.54 +0.85 +0.77%

NYMEX Crude Oil $103.78 +0.91 +0.88%

Nikkei 14,042.17 -33.08 -0.24%

Hang Seng 22,836.52 +1.84 +0.01%

Shanghai Composite 2,024.95 +16.83 +0.84%

S&P 1,888.03 +15.20 +0.81%

NASDAQ 4,131.54 +34.65 +0.85%

Dow 16,533.06 +158.75 +0.97%

FTSE 1,364.76 +7.76 +0.57%

CAC 4,469.03 +16.68 +0.37%

DAX 9,697.87 +58.79 +0.61%

EUR/USD $1,3685 -0,09%

GBP/USD $1,6898 +0,36%

USD/CHF Chf0,8932 +0,15%

USD/JPY Y101,42 +0,11%

EUR/JPY Y138,80 +0,02%

GBP/JPY Y171,37 +0,47%

AUD/USD $0,9245 +0,05%

NZD/USD $0,8571 0,00%

USD/CAD C$1,0913 +0,07%

01:00 Australia Consumer Inflation Expectation May +2.4%

01:45 China HSBC Manufacturing PMI (Preliminary) May 48.1 48.4

03:00 New Zealand Expected Annual Inflation 2y from now Quarter II +2.3%

06:58 France Manufacturing PMI (Preliminary) May 51.2 51.1

06:58 France Services PMI (Preliminary) May 50.4 50.3

07:28 Germany Manufacturing PMI (Preliminary) May 54.1 54.0

07:28 Germany Services PMI (Preliminary) May 54.7 54.8

07:58 Eurozone Manufacturing PMI (Preliminary) May 53.4 53.2

07:58 Eurozone Services PMI (Preliminary) May 53.1 53.0

08:30 United Kingdom Business Investment, q/q Quarter I +2.4% +2.3%

08:30 United Kingdom Business Investment, y/y Quarter I +8.7%

08:30 United Kingdom PSNB, bln April 4.9 3.6

08:30 United Kingdom GDP, q/q (Revised) Quarter I +0.8% +0.8%

08:30 United Kingdom GDP, y/y (Revised) Quarter I +3.1% +3.1%

09:00 Eurozone European Parliamentary Elections

10:00 United Kingdom CBI industrial order books balance May -1 4

12:30 Canada Retail Sales, m/m March +0.5% +0.2%

12:30 Canada Retail Sales ex Autos, m/m March +0.6% +0.5%

12:30 U.S. Initial Jobless Claims May 297 312

13:43 U.S. Manufacturing PMI (Preliminary) May 55.4 55.6

14:00 U.S. Leading Indicators April +0.8% +0.4%

14:00 U.S. Existing Home Sales April 4.59 4.71

The stock

indices stocks were up due to the better-than-expected consumer confidence in

the Eurozone. The consumer confidence in the Eurozone was -7.1 in May, from a

decrease of 8.6 in April. Analysts had expected a decline of 8.0.

Earlier in

the trading session, the current account surplus in the Eurozone was 18.8

billion euro in March, after a surplus of 21.9 billion euro in February. Analysts

had expected an increase to 24.2 billion euro.

A.P.

Moeller-Maersk A/S shares rose 3.9% after the company forecasted an increase of

its profit in 2014.

Current

figures:

Name Price Change Change %

FTSE

100 6,821.04 +19.04 +0.28%

DAX 9,697.87 +58.79 +0.61%

CAC 40 4,469.03 +16.68 +0.37%

WTI oil price rose today , while reaching a one-month high as a government report pointed to the decline in U.S. oil inventories for the previous week . As for oil Brent, then a rise in prices helps the tense situation in Libya.

Department of Energy data on changes in stocks in the week 12-18 May showed

- Oil reserves decreased by 7,226 million barrels to 391.297 million barrels ;

- Gasoline inventories rose by 0.97 million barrels . to 213.378 million barrels . ;

- Distillate stocks rose by 3.339 million barrels . to 116.277 million barrels .

- Refining capacity utilization rate of 88.7 % against 88.8 % a week earlier ;

- Oil terminal in Cushing fell by 0.25 million barrels . to 23,216 million barrels .

"Increasing production of shale oil in the United States a million barrels a year restrains the growth of the market in terms of geopolitical uncertainty and is the main reason that oil prices have not grown even stronger," - said the risk manager in the oil market Mitsubishi Corp in Tokyo Tony Noonan .

We also recall that yesterday its reserves data published Petroleum Institute API. They showed :

- Capacity utilization in the week 90.3 % vs. 89.1 %

- Distillate stocks last week 1.4 million barrels

- Gasoline inventories last week 0.135 million barrels

- Crude oil inventories -10.3 million barrels

Regarding the situation in Libya, it is worth noting that on the eve of Tripoli fighting began again , and two days earlier , armed men seized the parliament and demanded Libya stop his work . The authorities offered to hold national elections in June to resolve the crisis , which arose because of the political struggle between different factions . Production at the Libyan oilfields El Feel and El Shahara has not begun within a week after the government agreed with the rebels who occupied the field of their discovery and production of oil in the country is 200 thousand barrels per day , compared with 1.4 million last year.

The cost of the July futures on U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 103.61 per barrel on the New York Mercantile Exchange (NYMEX).

July futures price for North Sea Brent crude oil mixture rose 83 cents to $ 110.55 a barrel on the London exchange ICE Futures Europe.

The U.S.

dollar climbed against the most major currencies due to increasing U.S. treasury

yields, amid the release of Federal Reserve's meeting minutes and the speech

of Fed Chair Janet Yellen. Market participants are awaiting the Fed's view of

the economy. Recently published U.S. economic data was mixed and showed uneven

recovery of the U.S. economy.

The euro dropped

against the U.S. dollar. Further stimulus measures by European Central Bank and

the weak growth figures in the Eurozone weighed on the euro.

The current

account surplus in the Eurozone was 18.8 billion euro in March, after a surplus

of 21.9 billion euro in February. Analysts had expected an increase to 24.2

billion euro.

The consumer

confidence in the Eurozone was -7.1 in May, from a decrease of 8.6 in April.

Analysts had expected a decline of 8.0.

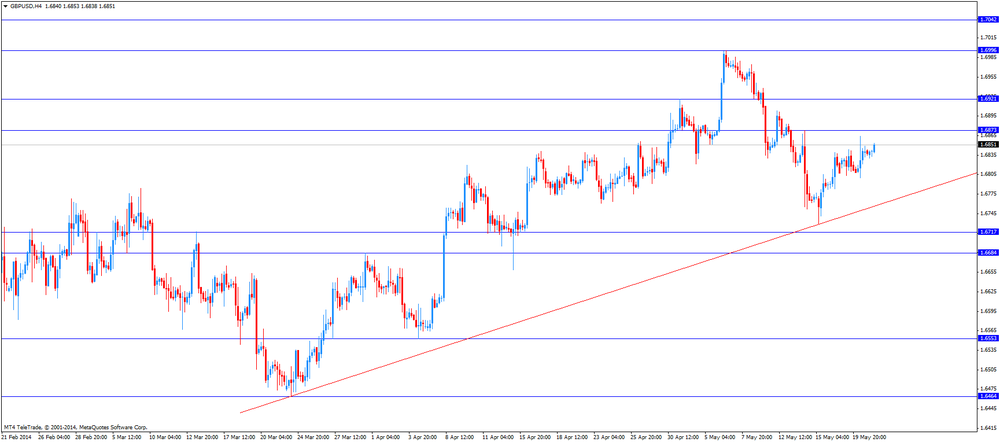

The British

pound rose against the U.S. dollar after the release of the

better-than-expected U.K. retail sales, but later lost a part of its gains.

U.K. retail sales increased 1.3% in April, from a 0.1% gain in March. Analysts

had expected a 0.4% increase.

On a yearly

basis, U.K. retail sales rose 6.9% in April, exceeding expectations for a 5.2%

increase. That was the fastest pace since May 2004. U.K. retail sales climbed

4.8% in March.

The retail

sales increase was driven by a supermarket price war between Morrisons, Tesco,

Asda and Sainsbury's. Food sales rose 3.6% in April from March and at annual

rate of 6.3%. That was highest annual growth since January 2002.

Bank of

England's minutes of its May meeting showed that the Bank of England

policymakers voted unanimously to maintain interest rates unchanged at record

lows this month. But some policymakers thought the arguments in favour of an

interest-rate hike were growing stronger.

The

Canadian dollar dropped against the U.S. dollar. No economic data was published

in Canada.

The New

Zealand dollar traded near 3-week lows against the U.S. dollar. Declining dairy

prices and the weak economic data in Australia had a negative impact on the

kiwi. Dairy prices at the GlobalDairyTrade auction declined. Market

participants speculate that the New Zealand dollar is overvalued as Reserve

Bank of New Zealand governor Graeme Wheeler warned this month. No economic data

was published in New Zealand.

The

Australian dollar decreased against the U.S. dollar after the release of the

weak economic data in Australia. The Westpac consumer sentiment in Australia

decreased 6.8% in May, after a 0.3% gain in April.

Wage prices

in Australia increased 0.7% in the first quarter (Q4 2003: +0.7%). Analysts had

expected a 0.8% rise.

The

Australian dollar also came under pressure due to the falling iron ore prices.

Iron ore is Australia's biggest export (about 20% of all exports).

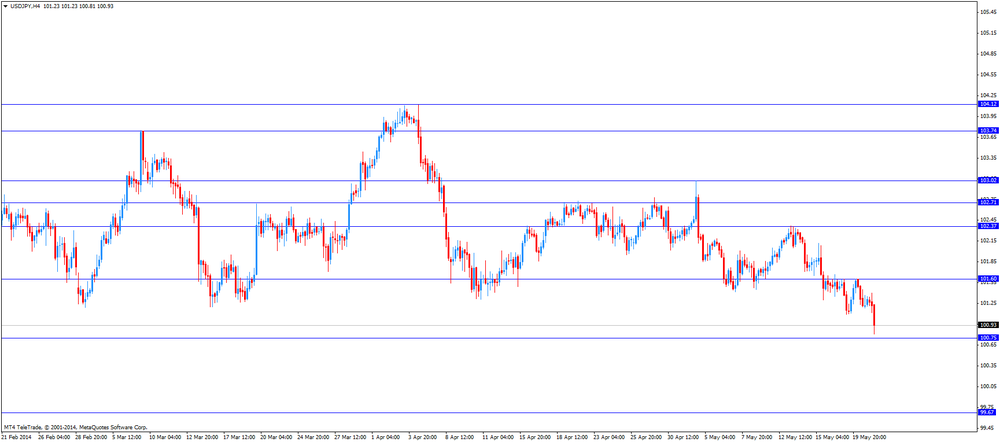

The

Japanese yen hits 3.5-month highs against the U.S. dollar after the Bank of

Japan left monetary policy unchanged on Wednesday, but later lost all its gains.

The Bank of Japan will continue to increase the monetary base at a pace of ¥60

trillion to ¥70 trillion per year. Japan’s central bank expects a moderate

economic recovery.

Japan’s

trade deficit was ¥808.9 billion in April, compared to a deficit of ¥1,714.2

billion in March. Analysts had forecasted a deficit of ¥640.0 billion.

Gold prices declined moderately today , which was associated with the strengthening of the U.S. dollar and expectations of the publication of the minutes of the last meeting of the U.S. Federal Reserve .

"In the past few weeks gold ranges ," said analyst Mitsubishi Corp Jonathan Butler. "We have seen occasional bursts when there were new news from Russia, but the geopolitical risk factor is largely laid low . No news about the U.S. economy and the situation in Ukraine does not allow traders to open new positions . "

Sales of gold futures today additionally caused a further weakening of investment demand for gold bullion . The assets of the world's largest holder of gold investment institutions ETFs SPDR Gold Trust declined yesterday by 1.79 m and amounted to 780.19 tons ( the lowest since December 2008 ) .

We also add that investors remained cautious ahead of the publication of minutes of the last meeting to determine monetary policy the Fed on Wednesday in order to get information about the central bank's vision of the current situation in the economy.

Meanwhile, experts say that can give support to the market expectations of growth in demand in India in the II half since the new government supposedly soften restrictions on gold imports .

The cost of the June gold futures on the COMEX today dropped to $ 1290.10 .

EUR/USD $1.3650, $1.3700/10, $1.3800

USD/JPY Y101.00, Y101.25, Y101.50, Y101.70/75

GBP/USD $1.6775, $1.6880

EUR/GBP stg0.8200/05

AUD/USD $0.9200, $0.9300, $0.9345

USD/CAD C$1.0850, C$1.0895-900, C$1.0920

U.S. stock-index futures rose as investors awaited the minutes from the Federal Reserve’s latest meeting to help gauge the strength of the economic recovery.

Global markets:

Nikkei 14,042.17 -33.08 -0.24%

Hang Seng 22,836.52 +1.84 +0.01%

Shanghai Composite 2,024.95 +16.83 +0.84%

FTSE 6,804.22 +2.22 +0.03%

CAC 4,462.77 +10.42 +0.23%

DAX 9,690.87 +51.79 +0.54%

Crude oil $102.98 (+0.63%)

Gold $1292.00 (-0.19%)

(company / ticker / price / change, % / volume)

Walt Disney Co | DIS | 81.14 | +0.06% | 3.4K |

Caterpillar Inc | CAT | 101.65 | +0.09% | 1.3K |

Exxon Mobil Corp | XOM | 100.76 | +0.09% | 0.3K |

Wal-Mart Stores Inc | WMT | 75.77 | +0.11% | 0.2K |

3M Co | MMM | 139.59 | +0.15% | 0.8K |

Intel Corp | INTC | 26.08 | +0.15% | 2.1K |

McDonald's Corp | MCD | 101.69 | +0.16% | 6.7K |

Cisco Systems Inc | CSCO | 24.16 | +0.17% | 0.7K |

Microsoft Corp | MSFT | 39.75 | +0.18% | 0.3K |

Visa | V | 208.38 | +0.22% | 0.1K |

The Coca-Cola Co | KO | 40.67 | +0.22% | 1.3K |

AT&T Inc | T | 35.61 | +0.31% | 2.6K |

International Business Machines Co... | IBM | 185.50 | +0.33% | 3.5K |

Boeing Co | BA | 130.03 | +0.35% | 2.9K |

Nike | NKE | 73.52 | +0.35% | 0.1K |

Pfizer Inc | PFE | 29.36 | +0.38% | 4.4K |

Home Depot Inc | HD | 78.27 | +0.40% | 0.2K |

Goldman Sachs | GS | 156.99 | +0.41% | 0.7K |

JPMorgan Chase and Co | JPM | 53.95 | +0.43% | 25.4K |

Verizon Communications Inc | VZ | 48.87 | +0.45% | 2.1K |

General Electric Co | GE | 26.43 | +0.49% | 1.2K |

Merck & Co Inc | MRK | 56.36 | +0.64% | 5.8K |

Upgrades:

American International Group Inc (AIG) upgraded to Buy from Neutral at Goldman

Downgrades:

Other:

Home Depot (HD) target raised to $97 from $96 at RBC Capital Mkts

Cisco Systems (CSCO) target raised to $28 from $25 at Stifel

The Bank of

Japan (BoJ) released the interest rate decision on Wednesday:

- BoJ has

left its key interest rate at 0.1%;

- Bank of

Japan will continue to increase the monetary base at a pace of ¥60 trillion to

¥70 trillion per year.

The Bank of

Japan Governor Haruhiko Kuroda said in a press conference:

- Japanese economy

is on its “gradual recovery track”

- He doesn't

see much need for further stimulus measures;

- BoJ will

continue with the current monetary policy until the 2% inflation target is

achieved;

- He doesn’t

see any reason for the yen to strengthen;

- There are no changes in the upward trend of the

stock markets.

Economic calendar

(GMT0):

00:30 Australia Westpac Consumer

Confidence May +0.3% -6.8%

01:30 Australia Wage Price Index, q/q Quarter I +0.7%

+0.8% +0.7%

01:30 Australia Wage Price Index, y/y Quarter I +2.6%

+2.6% +2.6%

03:00 Japan BoJ Interest Rate

Decision 0.10% 0.10%

0.10%

03:00 Japan Bank of Japan Monetary Base

Target 270 270

270

03:00 Japan BoJ Monetary Policy

Statement

05:00 Japan BoJ monthly economic

report May

07:30 Japan BOJ Press Conference

08:00 Eurozone Current account, adjusted,

bln March 21.9 24.2

18.8

08:30 United Kingdom Retail Sales (YoY) April +4.2% +5.3% +6.9%

08:30 United Kingdom Bank of England Minutes

08:30 United Kingdom Retail Sales (MoM) April +0.1% +0.4%

+1.3%

The U.S.

dollar traded higher against the most major currencies amid the release of

Federal Reserve's meeting minutes and the speech of Fed Chair Janet Yellen.

Market participants are awaiting the Fed's view of the economy. Recently

published U.S. economic data was mixed and showed uneven recovery of the U.S.

economy.

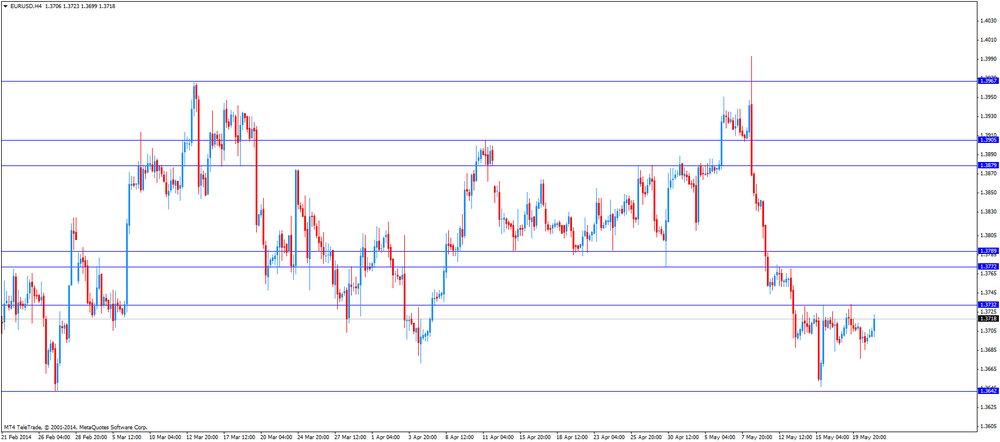

The euro slid

against the U.S. dollar. Further stimulus measures by European Central Bank and

the weak growth figures in the Eurozone weighed on the euro.

The current

account surplus in the Eurozone was 18.8 billion euro in March, after a surplus

of 21.9 billion euro in February. Analysts had expected an increase to 24.2

billion euro.

The British

pound rose against the U.S. dollar after the release of the

better-than-expected U.K. retail sales. U.K. retail sales increased 1.3% in

April, from a 0.1% gain in March. Analysts had expected a 0.4% increase.

On a yearly

basis, U.K. retail sales rose 6.9% in April, exceeding expectations for a 5.2%

increase. That was the fastest pace since May 2004. U.K. retail sales climbed

4.8% in March.

The retail

sales increase was driven by a supermarket price war between Morrisons, Tesco,

Asda and Sainsbury's. Food sales rose 3.6% in April from March and at annual

rate of 6.3%. That was highest annual growth since January 2002.

Bank of

England's minutes of its May meeting showed that the Bank of England

policymakers voted unanimously to maintain interest rates unchanged at record

lows this month. But some policymakers thought the arguments in favour of an

interest-rate hike were growing stronger.

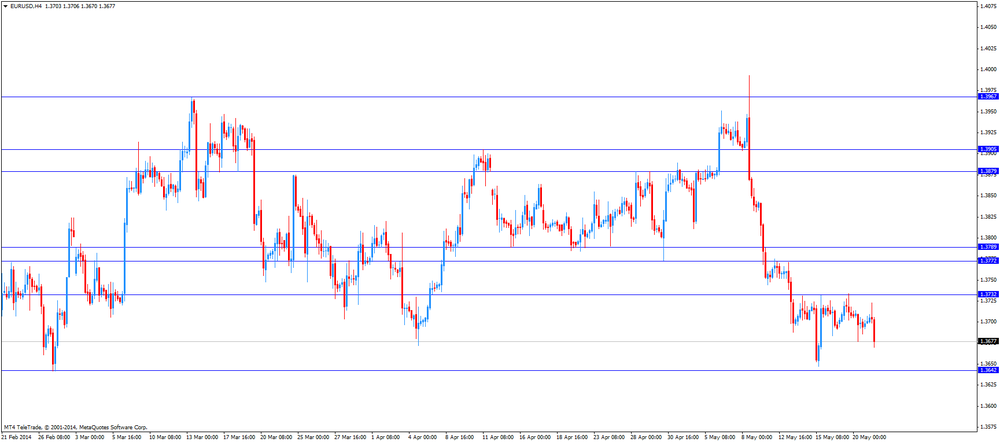

EUR/USD:

the currency pair declined to $1.3670

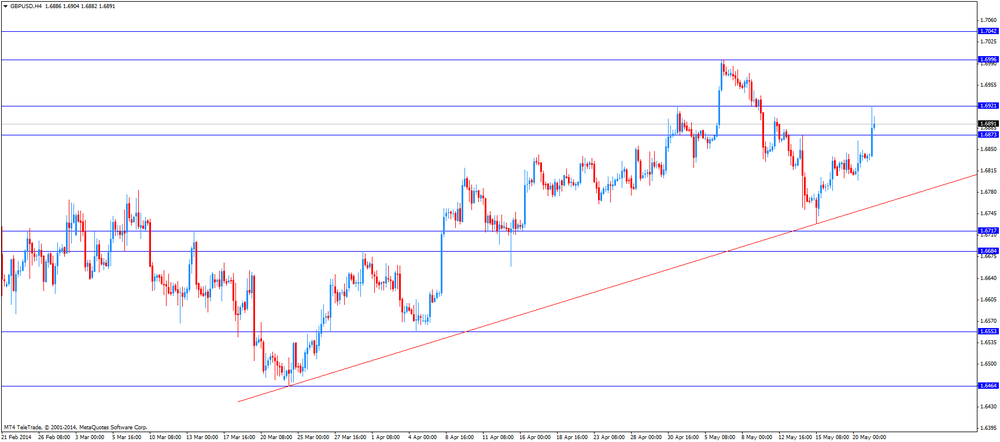

GBP/USD:

the currency pair increased to $1.6921

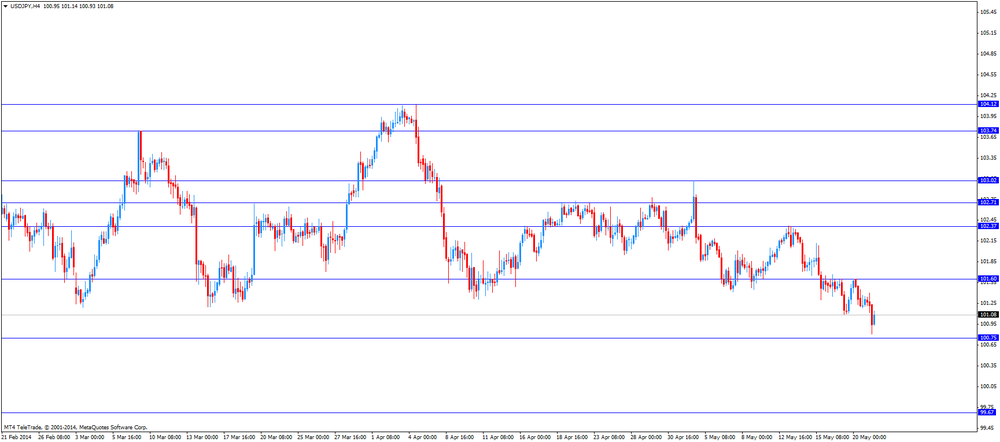

USD/JPY:

the currency pair declined to Y100.81

The most

important news that are expected (GMT0):

14:00 Eurozone

Consumer Confidence May

-8.6 -8.0

14:00 U.S. FOMC Member Dudley Speak

15:30 U.S. Fed Chairman Janet Yellen

Speaks

17:30 U.S. FOMC Member Narayana

Kocherlakota

18:00 U.S. FOMC meeting minutes

EUR/USD

Offers $1.3800, $1.3770/80, $1.3750, $1.3730/35

Bids $1.3670-68, $1.3648, $1.3645/40, $1.3635, $1.3600

GBP/USD

Offers $1.7010-20, $1.7000, $1.6940/50

Bids $1.6875-70, $1.6850-45

AUD/USD

Offers $0.9375/80, $0.9345/50, $0.9300, $0.9270/80, $0.9245/50

Bids $0.9220/10, $0.9200, $0.9150

EUR/JPY

Offers Y139.75/80, Y139.50, Y139.20, Y138.95/00

Bids Y138.00, Y137.50, Y137.00

USD/JPY

Offers Y102.00, Y101.80, Y101.65/70, Y101.50, Y101.20

Bids Y100.80, Y100.50, Y100.25

EUR/GBP

Offers stg0.8195/205, stg0.8160/65

Bids stg0.8100, stg0.8090, stg0.8050, stg0.8035/30, stg0.8005/000

The stock

indices stocks traded mixed amid the consumer confidence in the Eurozone. The

consumer confidence should be -8.0 in May, from -8.6 in April.

The current

account surplus in the Eurozone was 18.8 billion euro in March, after a surplus

of 21.9 billion euro in February. Analysts had expected an increase to 24.2

billion euro.

A.P.

Moeller-Maersk A/S shares rose 2.9% after the company forecasted an increase of

its profit in 2014.

Current

figures:

Name Price Change Change %

FTSE

100 6,789.28 -12.72 -0.19%

DAX 9,647.68 +8.60 +0.09%

The Office

of National Statistics released the retail sales in the U.K. U.K. retail sales

increased 1.3% in April, from a 0.1% gain in March. Analysts had expected a

0.4% increase.

On a yearly

basis, U.K. retail sales rose 6.9% in April, exceeding expectations for a 5.2% increase.

That was the fastest pace since May 2004. U.K. retail sales climbed 4.8% in

March.

The retail

sales increase was driven by a supermarket price war between Morrisons, Tesco,

Asda and Sainsbury's. Food sales rose 3.6% in April from March and at annual

rate of 6.3%. That was highest annual growth since January 2002.

Bank of

England's minutes of its May meeting showed that the Bank of England

policymakers voted unanimously to maintain interest rates unchanged at record

lows this month. But some policymakers thought the arguments in favour of an

interest-rate hike were growing stronger.

EUR/USD $1.3650, $1.3700/10, $1.3800

USD/JPY Y101.00, Y101.25, Y101.50, Y101.70/75

GBP/USD $1.6775, $1.6880

EUR/GBP stg0.8200/05

AUD/USD $0.9200, $0.9300, $0.9345

USD/CAD C$1.0850, C$1.0895-900, C$1.0920

Asian stock

indices were exhibiting a mixed trend on Wednesday. The Japanese stock index

Nikkei 225 dropped due to the stronger yen. The yen strengthened after the Bank

of Japan refrained from boosting stimulus measures. The Bank of Japan will

continue to increase the monetary base at a pace of ¥60 trillion to ¥70

trillion per year. Japan’s central bank expects a moderate economic recovery.

Japan’s

trade deficit was ¥808.9 billion in April, compared to a deficit of ¥1,714.2

billion in March. Analysts had forecasted a deficit of ¥640.0 billion.

Chinese

stock indices rose due to speculation that state-linked investors are purchasing

equities and expectations of market reforms in the coal sector.

Indexes on

the close:

Nikkei

225 14,042.17 -33.08 -0.24%

Hang

Seng 22,836.52 +1.84 +0.01%

Shanghai

Composite 2,024.95 +16.83 +0.84%

Lenovo

Group Ltd. shares climbed 2.6% after reporting a rise in full-year profit.

Economic

calendar (GMT0):

00:30 Australia Westpac Consumer Confidence May +0.3% -6.8%

01:30 Australia Wage Price Index, q/q Quarter I +0.7% +0.8% +0.7%

01:30 Australia Wage Price Index, y/y Quarter I +2.6% +2.6% +2.6%

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 270 270 270

03:00 Japan BoJ Monetary Policy Statement

05:00 Japan BoJ monthly economic report May

07:30 Japan BOJ Press Conference

08:00 Eurozone Current account, adjusted, bln March 21.9 24.2 18.8

08:30 United Kingdom Retail Sales (YoY) April +4.2% +5.3% +6.9%

08:30 United Kingdom Bank of England Minutes

08:30 United Kingdom Retail Sales (MoM) April +0.1% +0.4% +1.3%

The U.S.

dollar traded lower against the most major currencies amid the release of

Federal Reserve's meeting minutes later in the day. Market participants are

awaiting the Fed's view of the economy. Recently published U.S. economic data

was mixed and showed uneven recovery of the U.S. economy.

The New

Zealand dollar traded near 3-week lows against the U.S. dollar. Declining dairy

prices and the weak economic data in Australia had a negative impact on the

kiwi. Dairy prices at the GlobalDairyTrade auction declined. Market participants

speculate that the New Zealand dollar is overvalued as Reserve Bank of New Zealand governor

Graeme Wheeler warned this month. No economic data was published in New

Zealand.

The

Australian dollar decreased against the U.S. dollar after the release of the weak

economic data in Australia. The Westpac consumer sentiment in Australia

decreased 6.8% in May, after a 0.3% gain in April.

Wage prices

in Australia increased 0.7% in the first quarter (Q4 2003: +0.7%). Analysts had

expected a 0.8% rise.

The

Australian dollar also came under pressure due to the falling iron ore prices. Iron

ore is Australia's biggest export (about 20% of all exports).

The

Japanese yen hits 3.5-month highs against the U.S. dollar after the Bank of

Japan left monetary policy unchanged on Wednesday. The Bank of Japan will

continue to increase the monetary base at a pace of ¥60 trillion to ¥70

trillion per year. Japan’s central bank expects a moderate economic recovery.

Japan’s trade

deficit was ¥808.9 billion in April, compared to a deficit of ¥1,714.2 billion

in March. Analysts had forecasted a deficit of ¥640.0 billion.

EUR/USD:

the currency pair traded mixed

GBP/USD:

the currency pair traded mixed

USD/JPY:

the currency pair declined to Y101.16

The most

important news that are expected (GMT0):

14:00 Eurozone Consumer Confidence May -8.6 -8.0

14:00 U.S. FOMC Member Dudley Speak

15:30 U.S. Fed Chairman Janet Yellen Speaks

17:30 U.S. FOMC Member Narayana Kocherlakota

18:00 U.S. FOMC meeting minutes

EUR / USD

Resistance levels (open interest**, contracts)

$1.3832 (2893)

$1.3799 (1690)

$1.3750 (723)

Price at time of writing this review: $ 1.3707

Support levels (open interest**, contracts):

$1.3664 (3359)

$1.3625 (6645)

$1.3562 (3535)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 47210 contracts, with the maximum number of contracts with strike price $1,4000 (4915);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 69332 contracts, with the maximum number of contractswith strike price $1,3700 (6645);

- The ratio of PUT/CALL was 1.47 versus 1.49 from the previous trading day according to data from May, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.7101 (1844)

$1.7002 (2696)

$1.6904 (1949)

Price at time of writing this review: $1.6836

Support levels (open interest**, contracts):

$1.6795 (1389)

$1.6698 (2498)

$1.6599 (1532)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 25134 contracts, with the maximum number of contracts with strike price $1,7000 (2696);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 24383 contracts, with the maximum number of contracts with strike price $1,6700 (2498);

- The ratio of PUT/CALL was 0.97 versus 1.04 from the previous trading day according to data from May, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.