- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-07-2017

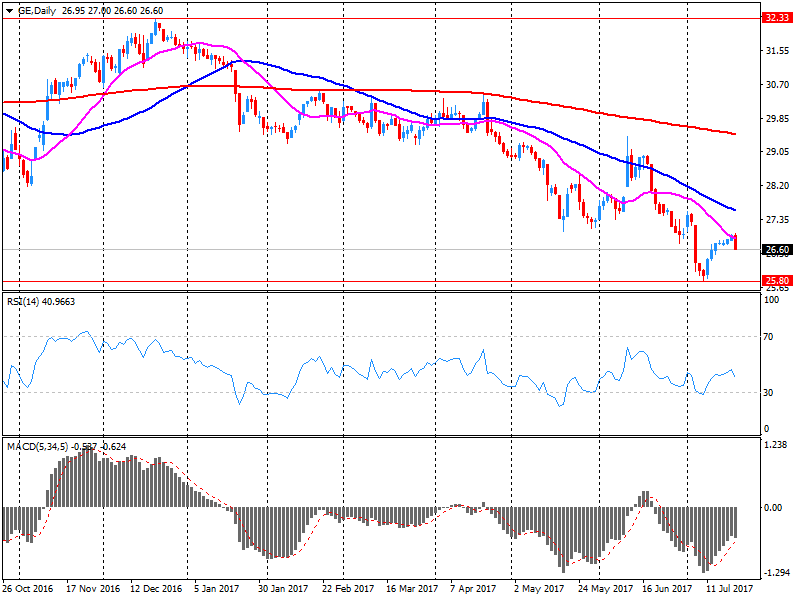

Major US stock indexes fell slightly, retreating from record levels, due to the weak reporting of the industrial heavyweight General Electric (GE) and a significant drop in oil prices.

As it became known, GE net profit fell by 34% per annum in the first half of 2017, to $ 1.9 billion. Revenues decreased by 7% to $ 57.2 billion. In the second quarter, GE net profit amounted to $ 1.4 billion , Which was 2.1 times less than last year. Revenue fell 12% to $ 29.6 billion.

Oil fell by about 2.7%, continuing yesterday's dynamics, which was due to another concern about the persistence of oil surplus in the world market after reports of growth in OPEC supplies in July. Supplies from OPEC members in July will exceed 33 million barrels per day, which is more than 600,000 barrels per day more than the average in the first half of 2017, according to Petro-Logistics SA, which tracks tanker movements.

Next week, Exxon Mobil (XOM), Chevron (CVX), Verizon (VZ), Boeing (BA), Procter & Gamble (PG), Intel (INTC), Caterpillar (CAT), Merck (MRK), Coca -Cola (KO), 3M (MMM) and many others. In addition, an important event next week will be a meeting of the Fed, which is scheduled for July 25-26.

Most components of the DOW index finished trading in the red (19 out of 30). Leader of growth were shares of Visa Inc. (V, + 1.50%). Outsider were shares of General Electric (GE, -2.92%).

S & P sectors demonstrated mixed dynamics. The utilities sector grew most (+ 0.7%). The largest decrease was shown by the sector of basic materials (-0.8%).

At this moment:

Dow -0.15% 21.580.07 -31.71

Nasdaq -0.04% 6.387.75 -2.25

S & P -0.04% 2.472.54 -0.91

EURUSD:1.1490-00 (EUR 1.1bln) 1.1550-55 (660m) 1.1600 (400m)

USDJPY: 111.40-50 (USD 980m) 111.75-80 (825m) 112.00 (510m) 112.25-35 (660m)

GBPUSD: 1.3000 (GBP 545m) 1.3150 (320m)

U.S. stock-index futures fell slightly as investors digested a slew of earnings from notable companies like Microsoft (MSFT), General Electric (GE), Honeywell (HON) and Visa (V), among others.

Global Stocks:

Nikkei 20,099.75 -44.84 -0.22%

Hang Seng 26,706.09 -34.12 -0.13%

Shanghai 3,238.16 -6.71 -0.21%

S&P/ASX 5,722.84 38.61 -0.67%

FTSE 7,477.81 -10.06 -0.13%

CAC 5,147.73 -51.49 -0.99%

DAX 12,255.53 -191.72 -1.54%

Crude $46.50 (-0.90%)

Gold $1,251.70 (+0.50%)

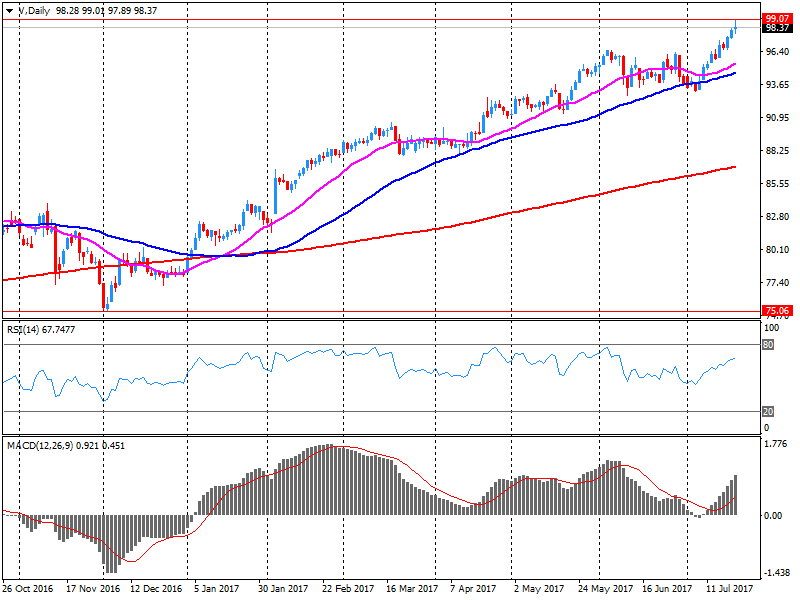

Visa (V) target raised to o $111 from $98 at RBC Capital

Visa (V) target raised to $114 from $107 at JPM

Visa (V) target raised to $107 from $105 at Cowen & Co.

Visa (V) target raised to $120 from $105 at Instinet

Microsoft (MSFT) target raised to $86 from $75 at BMO

Johnson & Johnson (JNJ) downgraded to Sell from Neutral at BTIG Research

Johnson & Johnson (JNJ) downgraded to Underweight from Neutral at Alembic Global Advisors

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 36.5 | -0.22(-0.60%) | 641 |

| ALTRIA GROUP INC. | MO | 73.5 | -0.09(-0.12%) | 1472 |

| Amazon.com Inc., NASDAQ | AMZN | 1,021.00 | -7.70(-0.75%) | 17869 |

| Apple Inc. | AAPL | 150.1 | -0.24(-0.16%) | 31407 |

| AT&T Inc | T | 36.57 | 0.05(0.14%) | 849 |

| Barrick Gold Corporation, NYSE | ABX | 16.49 | 0.17(1.04%) | 22270 |

| Cisco Systems Inc | CSCO | 31.8 | -0.06(-0.19%) | 5352 |

| Citigroup Inc., NYSE | C | 66.2 | -0.16(-0.24%) | 6151 |

| Exxon Mobil Corp | XOM | 80.85 | -0.01(-0.01%) | 685 |

| Facebook, Inc. | FB | 164.28 | -0.25(-0.15%) | 35212 |

| Ford Motor Co. | F | 11.63 | -0.07(-0.60%) | 136235 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.15 | 0.11(0.84%) | 30717 |

| General Electric Co | GE | 25.91 | -0.78(-2.92%) | 2539638 |

| General Motors Company, NYSE | GM | 36.1 | -0.31(-0.85%) | 6138 |

| Goldman Sachs | GS | 221.75 | -0.55(-0.25%) | 8787 |

| Google Inc. | GOOG | 968 | -0.15(-0.02%) | 1439 |

| Hewlett-Packard Co. | HPQ | 18.95 | 0.01(0.05%) | 3521 |

| Home Depot Inc | HD | 147.7 | 0.67(0.46%) | 10313 |

| HONEYWELL INTERNATIONAL INC. | HON | 135.25 | 0.30(0.22%) | 7520 |

| International Business Machines Co... | IBM | 147.6 | -0.06(-0.04%) | 289 |

| Johnson & Johnson | JNJ | 135.7 | -0.87(-0.64%) | 2002 |

| JPMorgan Chase and Co | JPM | 90.95 | -0.25(-0.27%) | 2931 |

| McDonald's Corp | MCD | 154.7 | 0.49(0.32%) | 343 |

| Microsoft Corp | MSFT | 74 | -0.22(-0.30%) | 1484857 |

| Nike | NKE | 58.84 | -0.26(-0.44%) | 2278 |

| Pfizer Inc | PFE | 33.64 | 0.10(0.30%) | 1078 |

| Procter & Gamble Co | PG | 88.38 | -0.22(-0.25%) | 2637 |

| Starbucks Corporation, NASDAQ | SBUX | 58 | -0.03(-0.05%) | 2381 |

| Tesla Motors, Inc., NASDAQ | TSLA | 329.2 | -0.72(-0.22%) | 20484 |

| The Coca-Cola Co | KO | 44.99 | 0.17(0.38%) | 215 |

| Twitter, Inc., NYSE | TWTR | 20.36 | -0.17(-0.83%) | 56744 |

| Visa | V | 98.8 | 0.69(0.70%) | 58103 |

| Yandex N.V., NASDAQ | YNDX | 31.3 | -0.06(-0.19%) | 1300 |

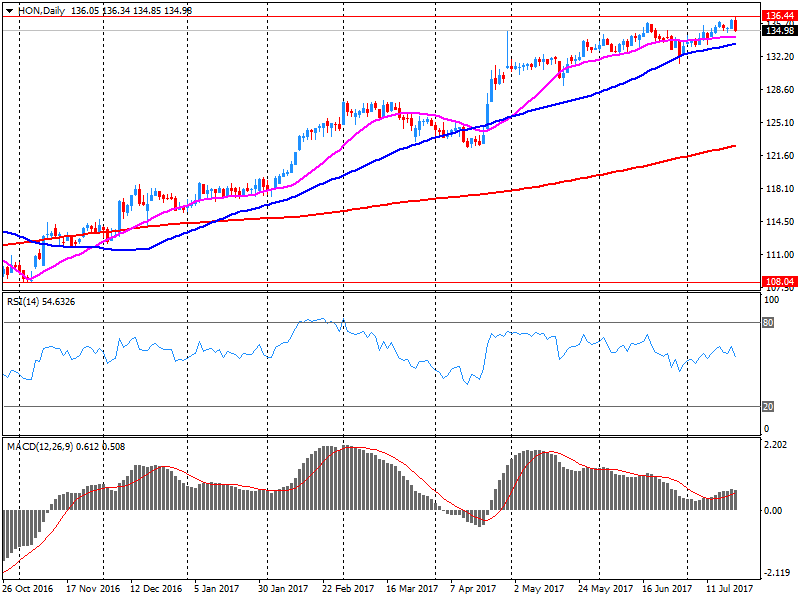

Honeywell (HON) reported Q2 FY 2017 earnings of $1.80 per share (versus $1.64 in Q2 FY 2016), beating analysts' consensus estimate of $1.78.

The company's quarterly revenues amounted to $10.078 bln (+0.9% y/y), beating analysts' consensus estimate of $9.886 bln.

HON rose to $135.25 (+0.22%) in pre-market trading.

General Electric (GE) reported Q2 FY 2017 earnings of $0.28 per share (versus $0.51 in Q2 FY 2016), beating analysts' consensus estimate of $0.25.

The company's quarterly revenues amounted to $29.558 bln (-11.8% y/y), beating analysts' consensus estimate of $29.068 bln.

GE fell to $25.85 (-3.15%) in pre-market trading.

Visa (V) reported Q2 FY 2017 earnings of $0.86 per share (versus $0.69 in Q2 FY 2016), beating analysts' consensus estimate of $0.81.

The company's quarterly revenues amounted to $4.545 bln (+25.8% y/y), beating analysts' consensus estimate of $4.355bln.

V rose to $98.80 (+0.70%) in pre-market trading.

Sales were up in 5 of 11 subsectors, representing 56% of total retail trade.

Higher sales at motor vehicle and parts dealers were the main contributor to the gain. Excluding sales in this subsector, retail sales were down 0.1% in May.

After removing the effects of price changes, retail sales in volume terms rose 1.1%.

Following a decrease in April, sales at motor vehicle and parts dealers increased 2.4% in May. Higher sales at new car dealers (+2.7%) accounted for most of the gain at the subsector level. Used car dealers (+4.7%) and automotive parts, accessories and tire stores (+2.7%) also posted higher sales. Sales at other motor vehicle dealers (-4.2%) were down for the fourth time in five months.

Higher receipts were reported at food and beverage stores (+0.9%). The main contributors to the gain were supermarkets and other grocery stores (+0.9%) and beer, wine and liquor stores (+2.4%). Following a 3.5% increase in April, lower sales were reported at specialty food stores (-2.2%).

Sales at electronics and appliance stores (+1.2%) continued their upward trend in May, rising for a fifth consecutive month.

Microsoft (MSFT) reported Q2 FY 2017 earnings of $0.75 per share (versus $0.69 in Q2 FY 2016), beating analysts' consensus estimate of $0.71.

The company's quarterly revenues amounted to $24.700 bln (+9.1% y/y), beating analysts' consensus estimate of $24.294 bln.

MSFT fell to $73.86 (-0.48%) in pre-market trading.

The Consumer Price Index (CPI) rose 1.0% on a year-over-year basis in June, following a 1.3% gain in May.

Energy prices decreased in the 12 months to June, after increasing in May. At the same time, prices for food rose year over year in June, following a small decline in May.

Excluding food and energy, the CPI was up 1.4% on a year-over-year basis in June, matching the gain in May.

Prices were up in seven of the eight major components in the 12 months to June, with the shelter index and the recreation, education and reading index contributing the most to the year-over-year rise in the CPI. The clothing and footwear index declined on a year-over-year basis.

Transportation costs rose 0.6% on a year-over-year basis in June, following a 2.2% gain in May. This deceleration was led by gasoline prices, which fell 1.4% in the 12 months to June, after increasing 6.8% in May. The purchase of passenger vehicles index declined for the first time since February 2015, down 0.2% year over year in June. Meanwhile, passenger vehicle insurance premiums rose 2.1% in the 12 months to June, following a 1.4% increase in May.

-

Inflation forecasts cut by 0.1 pct point for 2017-2019; long-term projection unchanged

-

Gdp growth seen at 1.9 pct vs 1.7 seen 3 months ago, 2018-2019 gdp also revised up

-

Risks for inflation tilted to the downside in longer term, balanced for gdp growth

-

Unemployment projections cuts by 0.2-0.3 pct point for all years

Public sector net borrowing (excluding public sector banks) increased by £1.9 billion to £22.8 billion in the current financial year-to-date (April 2017 to June 2017), compared with the same period in 2016.

The Office for Budget Responsibility (OBR) forecast that public sector net borrowing (excluding public sector banks) will be £58.3 billion during the financial year ending March 2018.

Public sector net borrowing (excluding public sector banks) increased by £2.0 billion to £6.9 billion in June 2017, compared with June 2016.

Public sector net borrowing (excluding public sector banks) decreased by £25.9 billion to £46.2 billion in the financial year ending March 2017 (April 2016 to March 2017) compared with the financial year ending March 2016; this is the lowest net borrowing since the financial year ending March 2008.

The Office for Budget Responsibility (OBR) forecast that public sector net borrowing (excluding public sector banks) would be £51.7 billion during the financial year ending March 2017.

Public sector net debt (excluding public sector banks) was £1,753.5 billion at the end of June 2017, equivalent to 87.4% of gross domestic product (GDP), an increase of £128.5 billion (or 3.6 percentage points as a ratio of GDP) on June 2016.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1723 (1617)

$1.1702 (3678)

$1.1678 (5169)

Price at time of writing this review: $1.1648

Support levels (open interest**, contracts):

$1.1586 (164)

$1.1557 (729)

$1.1522 (649)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 4 is 70958 contracts (according to data from July, 20) with the maximum number of contracts with strike price $1,1500 (5169);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3106 (2297)

$1.3056 (2158)

$1.3017 (1094)

Price at time of writing this review: $1.2988

Support levels (open interest**, contracts):

$1.2960 (475)

$1.2943 (346)

$1.2921 (405)

Comments:

- Overall open interest on the CALL options with the expiration date August, 4 is 27215 contracts, with the maximum number of contracts with strike price $1,3100 (3054);

- Overall open interest on the PUT options with the expiration date August, 4 is 26104 contracts, with the maximum number of contracts with strike price $1,2800 (3095);

- The ratio of PUT/CALL was 0.96 versus 0.95 from the previous trading day according to data from July, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

Inflation targetting still useful

-

Aware rising power prices not good for household budget

-

Paying fair amount of attenton to underemployment

-

The rising AUD is complicating the economy's adjustment

-

Discussion of neutral rates had no implications for policy

In June 2017 compared with June 2016 visitor arrivals were up 33,900 to 230,100.

The biggest changes were in arrivals from:

-

United Kingdom (up 15,300)

-

Australia (up 8,400)

-

Indonesia (up 2,800)

-

United States (up 2,500)

-

Ireland (up 1,400).

Overseas trips by New Zealand residents were up 22,400 to 261,800.

The biggest changes were in departures to:

-

Australia (up 2,000)

-

China (up 1,600)

-

United States (up 1,600)

-

Fiji (up 1,500)

-

Philippines (up 1,100).

Permanent and long-term arrivals were up 1,000 to 9,200.

Permanent and long-term departures were up 600 to 5,100.

Equities across the Asia-Pacific region were lower on Friday, taking a breather from the recent surge where gains in Australian shares lagged behind other indexes as sharp moves its currency plagued stocks. Though the Aussie dollar retreated slightly against the greenback Friday after hitting a two-year high on Wednesday, it was still up 1.2% this week, driven in part by strong jobs data and a recent surge in the price of iron-ore, one of the country's main commodity exports.

European stocks reversed course and closed lower Thursday as investors weighed the possibility the European Central Bank is moving closer to reducing monetary stimulus for the eurozone economy that has helped pushed equities to record highs. German, French, Spanish and Italian shares flipped down at the same time the euro leapt to its highest in more than a year against the U.S. dollar. Those moves were made on the prospect that the ECB will soon say it's time to start winding down its massive program of bond purchases.

U.S. stocks finished mostly lower on Thursday as Home Depot weighed on the Dow, but the Nasdaq bucked the trend to match its best win streak since February 2015 and closed at a record.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.