- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 24-03-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 07:00 | United Kingdom | Retail Price Index, m/m | February | -0.4% | 0.5% |

| 07:00 | United Kingdom | Producer Price Index - Output (MoM) | February | 0.3% | 0% |

| 07:00 | United Kingdom | Producer Price Index - Input (MoM) | February | 0.9% | -2% |

| 07:00 | United Kingdom | Producer Price Index - Output (YoY) | February | 1.1% | 0.9% |

| 07:00 | United Kingdom | Producer Price Index - Input (YoY) | February | 2.1% | -0.9% |

| 07:00 | United Kingdom | Retail prices, Y/Y | February | 2.7% | 2.5% |

| 07:00 | United Kingdom | HICP ex EFAT, Y/Y | February | 1.6% | |

| 07:00 | United Kingdom | HICP, m/m | February | -0.3% | 0.3% |

| 07:00 | United Kingdom | HICP, Y/Y | February | 1.8% | 1.7% |

| 09:00 | Germany | IFO - Current Assessment | March | 99 | 93.6 |

| 09:00 | Germany | IFO - Expectations | March | 93.2 | 81.9 |

| 09:00 | Germany | IFO - Business Climate | March | 96 | 87.7 |

| 11:00 | United Kingdom | CBI retail sales volume balance | March | 1 | -12 |

| 12:30 | U.S. | Durable goods orders ex defense | February | 3.6% | -0.9% |

| 12:30 | U.S. | Durable Goods Orders ex Transportation | February | 0.9% | -0.4% |

| 12:30 | U.S. | Durable Goods Orders | February | -0.2% | -0.8% |

| 13:00 | U.S. | Housing Price Index, m/m | January | 0.6% | 0.3% |

| 14:00 | Belgium | Business Climate | March | -2.7 | |

| 14:00 | Switzerland | SNB Quarterly Bulletin | |||

| 14:30 | U.S. | Crude Oil Inventories | March | 1.954 | 2.9 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 07:00 | United Kingdom | Retail Price Index, m/m | February | -0.4% | 0.5% |

| 07:00 | United Kingdom | Producer Price Index - Output (MoM) | February | 0.3% | 0% |

| 07:00 | United Kingdom | Producer Price Index - Input (MoM) | February | 0.9% | -2% |

| 07:00 | United Kingdom | Producer Price Index - Output (YoY) | February | 1.1% | 0.9% |

| 07:00 | United Kingdom | Producer Price Index - Input (YoY) | February | 2.1% | -0.9% |

| 07:00 | United Kingdom | Retail prices, Y/Y | February | 2.7% | 2.5% |

| 07:00 | United Kingdom | HICP ex EFAT, Y/Y | February | 1.6% | |

| 07:00 | United Kingdom | HICP, m/m | February | -0.3% | 0.3% |

| 07:00 | United Kingdom | HICP, Y/Y | February | 1.8% | 1.7% |

| 09:00 | Germany | IFO - Current Assessment | March | 99 | 93.6 |

| 09:00 | Germany | IFO - Expectations | March | 93.2 | 81.9 |

| 09:00 | Germany | IFO - Business Climate | March | 96 | 87.7 |

| 11:00 | United Kingdom | CBI retail sales volume balance | March | 1 | -12 |

| 12:30 | U.S. | Durable goods orders ex defense | February | 3.6% | -0.9% |

| 12:30 | U.S. | Durable Goods Orders ex Transportation | February | 0.9% | -0.4% |

| 12:30 | U.S. | Durable Goods Orders | February | -0.2% | -0.8% |

| 13:00 | U.S. | Housing Price Index, m/m | January | 0.6% | 0.3% |

| 14:00 | Belgium | Business Climate | March | -2.7 | |

| 14:00 | Switzerland | SNB Quarterly Bulletin | |||

| 14:30 | U.S. | Crude Oil Inventories | March | 1.954 | 2.9 |

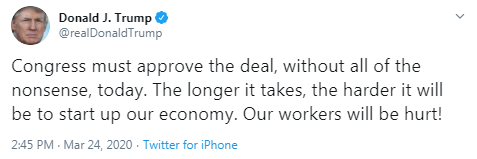

- Says bill will pay full salary for four months for workers out of job

FXStreet notes that we’re living through a period of unprecedented market volatility as well as remarkable velocity of price movements. Lisa Shalett, a Chief Investment Officer at Morgan Stanley, analyzes the market shifts.

“Too few buyers, when nearly every asset class is declining in price, is a recipe for the kind of extreme volatility across asset classes we’re seeing lately.”

“Our global-growth forecasts have also come down, and we foresee a global recession for the first half of 2020, followed by a recovery in the second half, with fourth-quarter GDP growth of more than 2%.”

“Market shifts have been fast and gut-wrenching, but not completely irrational. The worst economic damage can be confined to the second quarter, setting the stage for a healthy rebound into 2021. The next three weeks could be critical to assessing the damage and the repairs ahead.”

- Rate of infection is going up, apex will be sooner and higher

- Infection rate doubling every 3 days

- New York new cases were 5707 yesterday

- The number of beds we have procured now are nowhere near enough

- Will use university dorms, talking to hotels but we need staff

- Have procured 7000 ventilators, need 'at a minimum' 30,000

- If we don't have the ventilators in 14 days, it doesn't help us

- Indians are ordered to stay home when possible

FXStreet reports that UOB Group’s Economist Ho Woei Chen, CFA, assessed the recent decision by the PBoC to leave the Loan Prime Rate (LPR) unchanged last Friday.

“The People’s Bank of China (PBoC) kept its Loan Prime Rate (LPR) unchanged from the previous month against consensus expectation of a 5-10 bps rate cut. The 1Y LPR and 5Y & above LPR are maintained at 4.05% and 4.75% respectively. This further confirms official rhetoric that the Chinese economy is returning to normalcy from the COVID-19 pandemic as PBoC does not see the urgency to further lower its broad lending rates.”

“Given the recent aggressive monetary easing across major central banks, PBoC’s steady hands… has come as a relief because it suggests the COVID-19 pandemic may now be under control in the world’s second largest economy.”

“Year-to-date, the PBoC has cut its 1Y LPR and 5Y & above LPR by 10 bps and 5 bps respectively. This follows a cut to the 1Y Medium-term Lending Facility (MLF) rate by 10 bps to 3.15% on 17 February. The central bank has also lowered banks’ reserve requirement ratios (RRR) twice this year with the latest targeted 50-100 bps cut effective from 16 March.”

“Overall, we still see room for monetary easing via cuts to the LPR and RRR ahead to provide further boost to the economy but PBoC’s approach will continue to be prudent and any easing from here will be modest on the back of a domestic economic recovery.”

The U.S. Commerce Department announced on Tuesday that the sales of new single-family homes dropped 4.4 percent m-o-m to a seasonally adjusted annual rate of 765, 000 units in February.

Economists had forecast the sales pace of 750,000 last month.

January's sales pace was revised up to 800,000 units (+10.5 percent m-o-m) from the originally reported 764,000 units (+7.9 percent m-o-m).

According to the report, the February decline in purchases of new homes was due to decreases in the West (-17.2 percent m-o-m) and the Midwest (-7.3 percent m-o-m), which more than offset gains in the Northeast (+38.9 percent m-o-m) and the South (+1 percent m-o-m).

In y-o-y terms, new home sales recorded a 14.3 percent jump in February.

Preliminary data released by IHS Markit on Tuesday pointed to a sharp contraction in business activity in March, due to the escalation of the coronavirus disease 2019 (COVID-19) outbreak.

According to the report, the Markit flash manufacturing purchasing manager's index (PMI) came in at 49.2 in March, down from 50.7 in February. That pointed to the fastest deterioration in operating conditions since the depths of the financial crisis. Economists had expected the reading to decrease to 42.8. A reading above 50 signals an expansion in activity, while a reading below this level signals a contraction. According to the report, the lower headline index reading was buoyed by longer supplier delivery times, while steep rates of contraction were recorded for production and new orders, both of which fell to the greatest extent since 200.

Meanwhile, the Markit flash services purchasing manager's index (PMI) tumbled to 39.1 this month, from 49.4 in the prior month. The latest reading signaled the fastest contraction in business activity in the ten-and-a-half year series history. Economists had expected the reading to drop to 42.0. According to the report, the contraction in headline index was driven by a steep fall in new business, which decreased the most since data collection began in late-2009, as both domestic and foreign client demand weakened. In addition, employment fell at the sharpest pace since October 2019.

Overall, IHS Markit Flash U.S. Composite PMI Output Index came in at 40.5 in March, down from 49.6 in February, pointing to the steepest contraction in the private sector since comparable survey data were available in October 2009.

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at HIS Markit, noted "US companies reported the steepest downturn since 2009 in March as measures to limit the COVID-19 outbreak hit businesses across the country. The service sector has been especially badly affected, with consumer-facing industries such as restaurants, bars and hotels bearing the brunt of the social distancing measures, while travel and tourism has been decimated. However, manufacturing is also reporting a slump in demand, with production falling at a rate not seen since 2009, linked to either weak client demand, lost exports or supply shortages."

"The survey underscores how the US is likely already in a recession that will inevitably deepen further. The March PMI is roughly indicative of GDP falling at an annualised rate approaching 5%, but the increasing number of virus-fighting lockdowns and closures mean the second quarter will likely see a far steeper rate of decline," he added.

FXStreet reports that analysts at Danske Bank think the March PMIs gave the first piece of evidence that the euro area economy is heading for a steep recession.

“The March PMI points to a growth contraction of around 2% q/q. With many government containment measures stepped up in the past few days and production closures in industry and the important car sector only just starting to bite, further PMI declines in coming months seem likely to us.”

“We lower our annual 2020 forecasts for Germany and the euro area to -2.8% and -3.2%, respectively.”

“We expect unemployment to increase by some 2m in coming months.”

“Our forecast assumes a gradual opening up of the economy throughout the course of Q2, followed by a strong rebound in growth in Q3.”

U.S. stock-index futures surged on Tuesday, as reports that Democrats and Republicans neared a deal on a $2 trillion economic rescue package gave a shot of optimism to markets, suffering the biggest selloff since the global financial crisis.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 18,092.35 | +1,204.57 | +7.13% |

| Hang Seng | 22,663.49 | +967.36 | +4.46% |

| Shanghai | 2,722.44 | +62.27 | +2.34% |

| S&P/ASX | 4,735.70 | +189.70 | +4.17% |

| FTSE | 5,190.63 | +196.74 | +3.94% |

| CAC | 4,085.55 | +171.24 | +4.37% |

| DAX | 9,281.79 | +540.64 | +6.18% |

| Crude oil | $24.30 | | +4.02% |

| Gold | $1,676.80 | | +6.92% |

- Says the Games will take place "no later than summer 2021"

FXStreet reports that in the opinion of Karen Jones from Commerzbank, the U.S. Dollar index charted a high of 102.99 last week, which alongside a large divergence of the daily RSI reflects a loss of upside momentum.

“We note the TD perfected set up on the daily chart and the 13 count on the 240 minute chart, all imply that the market is in need of consolidation and/or a correction lower.”

“TD resistance lies at 103.20. This has occurred just ahead of the 103.82 2017 high and we suspect that the market will consolidate its recent sharp gains.”

“We would allow for a retracement back into the 99.80/98.80 (38.2% and 50% retracement), but we should see recovery from there. Provided it stabilises there we should see a reattempt on the 103.82 2017 high.”

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 123 | 5.13(4.35%) | 20332 |

| ALCOA INC. | AA | 6.05 | 0.38(6.70%) | 73880 |

| ALTRIA GROUP INC. | MO | 31.98 | 1.44(4.72%) | 101185 |

| Amazon.com Inc., NASDAQ | AMZN | 1,952.31 | 49.48(2.60%) | 120888 |

| American Express Co | AXP | 72.84 | 3.88(5.63%) | 23920 |

| AMERICAN INTERNATIONAL GROUP | AIG | 20.69 | 1.39(7.20%) | 10266 |

| Apple Inc. | AAPL | 235.5 | 11.13(4.96%) | 960044 |

| AT&T Inc | T | 28.23 | 1.46(5.45%) | 397652 |

| Boeing Co | BA | 122 | 16.38(15.51%) | 991426 |

| Caterpillar Inc | CAT | 97 | 5.15(5.61%) | 15167 |

| Chevron Corp | CVX | 58.5 | 4.28(7.89%) | 112600 |

| Cisco Systems Inc | CSCO | 36.8 | 2.20(6.36%) | 114485 |

| Citigroup Inc., NYSE | C | 37.75 | 2.36(6.67%) | 116322 |

| E. I. du Pont de Nemours and Co | DD | 29.75 | 1.29(4.53%) | 2809 |

| Exxon Mobil Corp | XOM | 33.8 | 2.35(7.47%) | 448949 |

| Facebook, Inc. | FB | 154.91 | 6.81(4.60%) | 182503 |

| FedEx Corporation, NYSE | FDX | 116.25 | 4.49(4.02%) | 4455 |

| Ford Motor Co. | F | 4.4 | 0.39(9.73%) | 890761 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 6.04 | 0.65(12.06%) | 137066 |

| General Electric Co | GE | 6.58 | 0.47(7.69%) | 952551 |

| General Motors Company, NYSE | GM | 18.79 | 1.19(6.76%) | 38677 |

| Goldman Sachs | GS | 142.2 | 7.23(5.36%) | 16638 |

| Google Inc. | GOOG | 1,099.97 | 43.35(4.10%) | 16645 |

| Hewlett-Packard Co. | HPQ | 14.52 | 0.82(5.99%) | 16884 |

| Home Depot Inc | HD | 170.5 | 8.11(4.99%) | 25076 |

| HONEYWELL INTERNATIONAL INC. | HON | 109 | 5.14(4.95%) | 1643 |

| Intel Corp | INTC | 53.35 | 3.77(7.60%) | 204018 |

| International Business Machines Co... | IBM | 99 | 4.23(4.46%) | 25898 |

| International Paper Company | IP | 28.24 | 1.77(6.69%) | 2491 |

| Johnson & Johnson | JNJ | 116.53 | 5.39(4.85%) | 37617 |

| JPMorgan Chase and Co | JPM | 83.85 | 4.82(6.10%) | 1313665 |

| McDonald's Corp | MCD | 144.4 | 7.30(5.32%) | 35334 |

| Merck & Co Inc | MRK | 68.5 | 2.10(3.16%) | 14253 |

| Microsoft Corp | MSFT | 142.4 | 6.42(4.72%) | 650699 |

| Nike | NKE | 65.24 | 2.44(3.89%) | 30439 |

| Pfizer Inc | PFE | 29.62 | 1.13(3.97%) | 65917 |

| Procter & Gamble Co | PG | 100 | 2.30(2.35%) | 27514 |

| Starbucks Corporation, NASDAQ | SBUX | 59.99 | 3.44(6.08%) | 55150 |

| Tesla Motors, Inc., NASDAQ | TSLA | 464.94 | 30.65(7.06%) | 408397 |

| The Coca-Cola Co | KO | 41 | 3.44(9.16%) | 192591 |

| Twitter, Inc., NYSE | TWTR | 25.33 | 0.64(2.59%) | 204656 |

| United Technologies Corp | UTX | 79 | 4.05(5.40%) | 17046 |

| UnitedHealth Group Inc | UNH | 202 | 7.14(3.66%) | 10311 |

| Verizon Communications Inc | VZ | 52 | 1.69(3.36%) | 54105 |

| Visa | V | 144.33 | 8.59(6.33%) | 75705 |

| Wal-Mart Stores Inc | WMT | 118.34 | 4.06(3.55%) | 28053 |

| Walt Disney Co | DIS | 91.8 | 6.04(7.04%) | 198642 |

| Yandex N.V., NASDAQ | YNDX | 31 | 1.86(6.38%) | 11967 |

- But notes they haven't yet made decision on ETF purchases

Ford Motor (F) downgraded to Neutral from Buy at UBS; target lowered to $4.30

Tesla (TSLA) downgraded to Hold from Buy at Argus

Coca-Cola (KO) upgraded to Buy from Hold at HSBC Securities; target $45

Intel (INTC) upgraded to Neutral from Sell at Goldman; target lowered to $54

Intel (INTC) upgraded to Outperform from Neutral at Exane BNP Paribas; target $65

Tesla (TSLA) upgraded to Neutral from Sell at UBS; target lowered to $410

Travelers (TRV) upgraded to Overweight from Neutral at Atlantic Equities; target $125

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 08:15 | France | Services PMI | March | 52.5 | 42 | 29.0 |

| 08:15 | France | Manufacturing PMI | March | 49.8 | 40 | 42.9 |

| 08:30 | Germany | Services PMI | March | 52.5 | 42.3 | 34.5 |

| 08:30 | Germany | Manufacturing PMI | March | 48 | 39.6 | 45.7 |

| 09:00 | Eurozone | Manufacturing PMI | March | 49.2 | 39 | 44.8 |

| 09:00 | Eurozone | Services PMI | March | 52.6 | 39 | 28.4 |

| 09:30 | United Kingdom | Purchasing Manager Index Manufacturing | March | 51.7 | 45 | 48 |

| 09:30 | United Kingdom | Purchasing Manager Index Services | March | 53.2 | 45 | 35.7 |

| 11:00 | United Kingdom | CBI industrial order books balance | March | -18 | -35 | -29 |

GBP appreciated against other major currencies in the European session on Tuesday, as the U.S. Federal Reserve's pledge to buy a potentially unlimited amount of government debt and the Bank of Japan's (BoJ) extension of risky asset-buying boosted risk sentiment.

The UK's PM Boris Johnson announced a nationwide lockdown in an effort to curb the coronavirus outbreak, calling it the "biggest threat this country has faced for decades". The latest data from the Department of Health and Social Care revealed that 6,650 people have tested positive for Covid-19 and 335 patients have died as of March 23.

Investors also received gloomy data from IHS Markit and CIPS, which showed that the UK private sector saw its record decline in business activity in March amid emergency public health measures to contain the spread of COVID-19. The IHS Markit/CIPS UK Composite PMI tumbled to 37.1 in March from 53.0 in February, signaling the fastest downturn in private sector business activity since the series began in January 1998. The prior low of 38.1 was seen in November 2008.

In its turn, the Confederation of British Industry's (CBI) latest survey revealed the manufacturing output expectations for the next three months fell to -20, the lowest level since the financial crisis, as the COVID-19 outbreak gained pace in the UK and Europe.

FXStreet notes that as the US steps up its fight against COVID-19, the Fed introduced unlimited QE and announced a USD300bn funding package to support households and businesses. The dollar responded well to the announcement, economists at ANZ Research apprise.

“Key measures announced Monday include buying unlimited amounts of Treasuries, MBS and CMBS and USD300bn in financing to large corporates, SMEs and households.”

“In times of crisis, the US dollar’s reserve currency status and global demand for dollar funding make the US’s situation somewhat different from other current account deficit countries.”

“We will be watching to see if the post GFC experience of QE will hold for the USD as the fiscal expansion unfolds.”

FXStreet notes that the coronavirus outbreak has now evolved into a pandemic with serious consequences for the world economy. Analysts at Nordea outline three scenarios for the global economy.

“The baseline scenario: the initial shock to global economic activity will be huge, probably at least comparable to the two worst quarters during the global financial crisis. We expect global growth to be around -1% in 2020 followed by +5.5% in 2021 in the U-shaped baseline scenario.”

“The upside risk scenario: the positive risk scenario looks much like the baseline U-shaped scenario, but the recovery is faster, like a V-shape. We expect global growth to end around 1% in 2020 and 6% in 2021.”

“The downside risk scenario: several risks have the potential to make any eventual recovery very gradual and seem more like an L-shape than a U-shape.”

FXStreet notes that the release of the US Markit PMI surveys at 13:45 GMT will be the data calendar highlight. Analysts at TD Securities share their forecast.

“We are forecasting both the manufacturing and services PMI to plummet to 40 each.”

“In addition, new home sales will probably be held down by COVID-19 disruption in coming months, but they likely remained fairly strong in February (TD: 765k).”

The latest survey by the Confederation of British Industry (CBI) revealed on Thursday the UK manufacturers' order books dropped in March.

According to the report, the CBI's monthly factory order book balance fell to -29 in March from -18 in the previous month. Economists had forecast the reading to come in at -35. That was the lowest reading since October 2019 and below the survey's long-run average of -13.

The CBI also reported that output expectations for the next three months tumbled from +8 in February to -20 in March, marking the weakest expectations since the financial crisis, as the COVID-19 outbreak gained pace in the UK and Europe. However, output prices are expected to increase somewhat in the next three months.

Anna Leach, CBI Deputy Chief Economist, noted: "The manufacturing sector is facing unprecedented challenges due to COVID-19, such as widespread disruption to supply chains and weakening demand due to domestic containment measures. With expectations for output set to fall in the coming months, it's now more important than ever manufacturers get the support they need."

FXStreet reports that economists at UBS continue to believe that a disciplined, diversified, and far-sighted approach to investing will remain the best way to grow capital over the long term.

"We recently shifted an overweight in emerging market equities to an overweight in emerging market hard-currency sovereign bonds, given that, in our view, these bonds look closer to pricing our downside scenario than EM equities."

"We remain overweight US high yield credit, US TIPS versus high grade bonds and a basket of select EM currencies. We also see the British pound as undervalued relative to the US dollar."

"We think investors should seek those stocks with earnings that are relatively resilient to our virus scenarios, such as companies exposed to the 5G rollout in Asia; fintech, ecommerce, online gaming, and online education; as well as China property stocks listed in Hong Kong, and Japanese automation and machinery companies."

"We also recommend global quality stocks including European companies with solid cash flows and exposure to emerging markets, and select companies in the US consumer discretionary, communication services, and tech sectors."

CNBC reports that world markets are facing a simple but serious problem: There just aren't enough dollars to execute trades and transactions.

That explains why the trade-weighted dollar index, gained more than 4% last week. The broad dollar index measures the value of the dollar against a basket of currencies, namely the euro, pound, yen, Canadian dollar, Swiss franc and Swedish krona.

Given the scarcity of dollars, the U.S. Federal Reserve last week announced that it set up financing channels with nine other central banks, including the Reserve Bank of Australia and Monetary Authority of Singapore, to stabilize currency markets.

That opened access to $450 billion of additional dollar funds, with a commitment to keep the arrangement in place for at least six months.

However, analysts aren't sure if that amount will be enough to contain the fear among investors who are hoarding dollars as market gains evaporate.

Khoon Goh, head of research at Melbourne-based ANZ Bank, thinks the greenback will rise to 105 on the dollar index in the short term.

"The swap lines will help to some extent. However, it is unlikely to be sufficient given the extent of dollar demand. From a technical perspective, the dollar looks overbought, so some consolidation can be expected. However, this is likely just a pause before another push higher," Goh told CNBCl.

The Fed announced open-ended additional stimulus on Monday, and Goh acknowledged that some steam came off the dollar rally.

"We will probably see the greenback consolidate for a while, but the key will be how other major central banks respond as well," he said. "If the (European Central Bank) and (Bank of Japan) also start to announce more measures of their own, that could still push the dollar index toward 105 over the short term."

FXStreet reports that central bank purchases, deep recession and disinflation will push down on yields, according to economists at ABN Amro.

"We remain of the view that core eurozone bond yields and US Treasury yields will decline."

"Although the government announcements imply large amounts of extra supply, we think that the impact on yields will be more than offset by central bank purchases, the deep recession and eventual disinflation."

"When the crisis fighting is over, both the ECB and the Fed will still be faced with an inflation issue. In particular, the deep recession that we have now entered will over time lead to disinflation."

According to the report from IHS Markit/ CIPS, March data highlight that the COVID-19 outbreak has already dealt the UK economy a more severe blow than at any time since comparable figures were first available over 20 years ago. The latest UK Composite PMI was compiled between 12-20 March 2020.

The combined monthly decline in output across manufacturing and services exceeded that seen even at the height of the global financial crisis, with the IHS Markit/CIPS Flash Composite PMI falling almost 16 points since February 2020.

At 37.1 in March, down from 53.0 in February, the seasonally adjusted IHS Markit / CIPS Flash UK Composite Output Index - which is based on approximately 85% of usual monthly replies - signalled the fastest downturn in private sector business activity since the series began in January 1998. The prior low of 38.1 was seen in November 2008.

A rapid decline in business activity across the service economy led the overall downturn in March (index at 35.7) as emergency public health measures to halt the spread of coronavirus caused demand to slump. Moreover, the latest PMI figures were compiled in advance of the UK government's decision to order pubs, restaurants and other leisure businesses to close by midnight on 20th March. Manufacturing production also dropped sharply during the latest survey period (index at 44.3), with the rate of decline the steepest since July 2012. Other indicators pointed to similar signs of distress.

New orders across the private sector as a whole fell at the sharpest rate seen since December 2008. Business expectations for the year ahead meanwhile slumped to the lowest seen since data for this series was available in 2012 by a wide margin.

March data signalled a rapid change of direction for employment across the UK private sector amid escalating measures to fight the spread of coronavirus, highlighting the challenges faced by policymakers to help businesses and households through the current public health emergency. The flash PMI signalled a fall in employment across the manufacturing and services to an extent not seen since July 2009.

According to provisional PMI survey data, the eurozone economy suffered an unprecedented collapse in business activity in March as the coronavirus outbreak intensified.

At 31.4 in March, the 'flash' IHS Markit Eurozone Composite PMI collapsed from 51.6 in February to register the largest monthly fall in business activity since comparable data were first collected in July 1998. The prior low was seen in February 2009, when the index hit 36.2.

While growth had accelerated modestly in the first two months of the year, March saw widespread disruptions to business from increasingly strict measures to contain the spread of the coronavirus 2019 (COVID-19) outbreak.

The services sector was especially hard hit, notably within consumer-facing industries such as travel, tourism and restaurants. The survey's service sector business activity index slumped just over 24 points from 52.6 in February to reach 28.4, surpassing the survey's prior low of 39.2 (recorded in February 2009) by a wide margin.

Manufacturing saw a less severe, though nevertheless still steep, downturn in production. The survey's gauge of factory output dropped just over nine points, down from 48.7 to 39.5, registering the largest monthly contraction of production since April 2009.

According to the latest 'flash' PMI survey data from IHS Markit, business activity in Germany fell sharply in March, led by a record contraction in the country's service sector.

The headline Flash Germany Composite PMI Output Index plunged from 50.7 in February to 37.2, its lowest since February 2009. The preliminary data were based on responses collected between March 12-23.

The sharp drop in activity in March was driven by the service sector, where businesses highlighted the impact of efforts to contain the spread of the coronavirus disease 2019 (COVID-19). The Flash Germany Services PMI Activity Index came in at 34.5, its lowest since data collection for the service sector started in June 1997.

Data also showed a deepening downturn in the manufacturing sector. Production fell sharply and at the joint-fastest rate since early-2009 (matching the rate of decline seen in July 2012, at the depths of the eurozone debt crisis). The headline Flash Germany Manufacturing PMI sank to 45.7, though it was supported somewhat by a further increase in supplier delivery times - the most marked since July 2018 - and a noticeably slower fall in stocks of purchases, both linked to supply-side disruption.

FXStreet reports that unemployment rate is set to reach 11% by June and the Australian economy is expected to contract by 3.5% in June, Bill Evans, a Chief Economist at Westpac Institutional Bank briefs.

"We estimate that there will be 814k in job losses in the June quarter lifting the unemployment rate to 11.1%."

"Working through our GDP estimates on an industry basis and acknowledging that output is not always aligned with employment this approach points to a contraction in GDP of 3.5% in the June quarter."

"Overall through the year, we expect GDP to contract by -3.0%, while the unemployment rate will have lifted from 5.1% to 8.8%."

FXStreet reports that cable is not "out of the woods" yet and could still test the 1.1400 area in the next weeks, suggested FX Strategists at UOB Group.

24-hour view: "We noted yesterday that 'there is some tentative sign that the recent frenetic drop in GBP is about to stabile' and expected GBP to 'trade in a broad 1.1600/1.1900 range for now'. GBP subsequently traded within a lower range than anticipated (between 1.1445 and 1.1740). GBP is likely still taking a 'pause' after dropping sharply recently and for today, GBP is expected to trade between 1.1500 and 1.1780."

Next 1-3 weeks: "GBP dropped to a fresh low of 1.1413 last Friday before snapping higher to 1.1955 (closed at 1.1671, +1.66%). There is some tentative sign that the recent weakness is stabilizing but only a move above 1.2150 (no change in 'strong resistance' level) would indicate that GBP is ready to take a breather from its recent ferocious drop. Meanwhile, GBP could continue to trade in a volatile manner but at this stage, we are not ruling out a break of 1.1400 just yet."

-

Growth phase will only be possible once the coronavirus spread slows

-

We have committed to pay debt back from 2023

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:30 | Japan | Manufacturing PMI | March | 47.8 | 44.8 | |

| 00:30 | Japan | Nikkei Services PMI | March | 46.8 | 32.7 | |

| 05:00 | Japan | Leading Economic Index | January | 91.0 | 90.3 | 90.5 |

| 05:00 | Japan | Coincident Index | January | 94.4 | 94.7 | 95.2 |

During today's Asian trading, the US dollar fell against the euro, the yen, and the currencies of Asian emerging markets on the background of the actions of the Federal reserve system, which announced large-scale quantitative easing.

The Fed announced yesterday that it will buy back government bonds on a virtually unlimited scale, as well as launch a number of new business lending programs. The measures taken by the Fed, as expected in the Central Bank, "will support a wide range of markets and institutions, thereby supporting the flow of loans to the economy."

The Fed also promised that it "will continue to use the full range of tools to maintain the flow of credit to households and companies."

The Fed's willingness to do almost everything possible to mitigate the negative effects of the coronavirus pandemic on the American economy has led to a significant increase in investor interest in risk. In addition, the Fed's swap lines with a number of Central banks in other countries ensure the availability of dollars abroad, experts say .

The ICE index, which tracks the dollar's performance against six currencies (the euro, swiss franc, yen, canadian dollar, pound and swedish krona), fell 0.95%.

The Thai prime minister confirms that they will impose an emergency decree to curb the spread of the coronavirus epidemic

CNBC reports that an early look at Chinese business conditions in March shows little indication the economy has recovered much from the shock of the coronavirus in the first two months of the year, according to the China Beige Book.

The firm conducts an independent survey of more than 3,300 Chinese businesses every quarter. Its primary indicators for the first quarter have fallen to their lowest level in nearly 10 years of tracking China's economy, according to an early look brief.

"Crucially the results continued to deteriorate into mid-March when most firms were re-opening and supposedly 'back to work,'" the report said. "Nationally, our revenue index plunged to -26 this quarter while profits dove in tandem, to -22."

In China, official figures in the last two weeks or so say the largest companies and key businesses have resumed work at a rate close to 80% or 90%, if not higher. However, that of small- and medium-sized companies - which contribute to the majority of growth and jobs in the country - has been lower, at above 60%.

"Output contracted (in March) even more than it had in February, employee workweeks shrank further, and hiring continued to decline despite labor supply shortages worsening," Shehzad Qazi, managing director at China Beige Book, said in an email on Friday. The larger takeaway is clearly that return to work has not meant return to growth for China (at least not as yet)."

The China Beige Book said it's "not unreasonable" that gross domestic product will contract 10% to 11% in the first quarter, even with a slight upturn in the last few weeks of this month.

-

CNBC reports that Italy's health ministry said as of 6 p.m. local time on March 23, there were a total of 63,927 confirmed cases in the country.

-

China's National Health Commission said there were 78 new confirmed cases, of which 74 were imported.

-

Chinese leaders remain concerned about a resurgence of the coronavirus within the country, even as the number of new confirmed cases has dwindled, with most coming from travelers returning from overseas.

-

The state of Washington on Monday issued a stay at home order effective immediately, Gov. Jay Inslee announced in a series of tweets.

-

Global cases: At least 334,981, according to the latest figures from the World Health Organization

-

Global deaths: At least 14,652, according to the latest figures from the WHO

EUR/USD

Resistance levels (open interest**, contracts)

$1.0969 (1424)

$1.0938 (882)

$1.0910 (255)

Price at time of writing this review: $1.0852

Support levels (open interest**, contracts):

$1.0702 (1621)

$1.0684 (1927)

$1.0661 (3645)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date April, 3 is 85342 contracts (according to data from March, 23) with the maximum number of contracts with strike price $1,1000 (4204);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2280 (117)

$1.2189 (133)

$1.2060 (106)

Price at time of writing this review: $1.1663

Support levels (open interest**, contracts):

$1.1528 (1803)

$1.1506 (195)

$1.1490 (98)

Comments:

- Overall open interest on the CALL options with the expiration date April, 3 is 17478 contracts, with the maximum number of contracts with strike price $1,3200 (2380);

- Overall open interest on the PUT options with the expiration date April, 3 is 21781 contracts, with the maximum number of contracts with strike price $1,2900 (2837);

- The ratio of PUT/CALL was 1.25 versus 1.26 from the previous trading day according to data from March, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 334.95 | 16887.78 | 2.02 |

| Hang Seng | -1108.94 | 21696.13 | -4.86 |

| KOSPI | -83.69 | 1482.46 | -5.34 |

| ASX 200 | -270.6 | 4546 | -5.62 |

| FTSE 100 | -196.89 | 4993.89 | -3.79 |

| DAX | -187.8 | 8741.15 | -2.1 |

| CAC 40 | -134.49 | 3914.31 | -3.32 |

| Dow Jones | -582.05 | 18591.93 | -3.04 |

| S&P 500 | -67.52 | 2237.4 | -2.93 |

| NASDAQ Composite | -18.85 | 6860.67 | -0.27 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.