- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 26-03-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 07:00 | United Kingdom | Nationwide house price index, y/y | March | 2.3% | 2.1% |

| 07:00 | United Kingdom | Nationwide house price index | March | 0.3% | 0.1% |

| 07:45 | France | Consumer confidence | March | 104 | 92 |

| 12:30 | U.S. | Personal spending | February | 0.2% | 0.2% |

| 12:30 | U.S. | Personal Income, m/m | February | 0.6% | 0.4% |

| 12:30 | U.S. | PCE price index ex food, energy, m/m | February | 0.1% | 0.2% |

| 12:30 | U.S. | PCE price index ex food, energy, Y/Y | February | 1.6% | 1.7% |

| 14:00 | U.S. | Reuters/Michigan Consumer Sentiment Index | March | 101 | 90 |

| 17:00 | U.S. | Baker Hughes Oil Rig Count | March | 664 | |

| 18:00 | U.S. | FOMC Member Bostic Speaks |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 07:00 | United Kingdom | Nationwide house price index, y/y | March | 2.3% | 2.1% |

| 07:00 | United Kingdom | Nationwide house price index | March | 0.3% | 0.1% |

| 07:45 | France | Consumer confidence | March | 104 | 92 |

| 12:30 | U.S. | Personal spending | February | 0.2% | 0.2% |

| 12:30 | U.S. | Personal Income, m/m | February | 0.6% | 0.4% |

| 12:30 | U.S. | PCE price index ex food, energy, m/m | February | 0.1% | 0.2% |

| 12:30 | U.S. | PCE price index ex food, energy, Y/Y | February | 1.6% | 1.7% |

| 14:00 | U.S. | Reuters/Michigan Consumer Sentiment Index | March | 101 | 90 |

| 17:00 | U.S. | Baker Hughes Oil Rig Count | March | 664 | |

| 18:00 | U.S. | FOMC Member Bostic Speaks |

FXStreet reports that analysts at Natixis note that all euro-zone countries have announced a massive budgetary response to the crisis but it is uncertain that governments have this unlimited budgetary capacity.

“We expect growth in 2020 (at an annual average) to come in around -2% in France and Spain, -3% in Germany, and -4% in Italy.”

“Given the loss of growth compared with what was expected (3 to 4 percentage points), we can expect an increase in fiscal deficits of at least 2 percentage points of GDP.”

“If all euro-zone countries are affected, a mutualisation of additional fiscal deficits reduces the weight for the peripheral countries but does not solve the overall problem of excess fiscal deficits.”

“The only solution is then monetisation of these additional fiscal deficits by the ECB, and therefore a significant increase in QE on government bonds (by at least EUR 250 billion if the additional fiscal deficits are 2% of GDP).”.

FXStreet notes that while no policy changes were made today, the Bank of England (BoE) stands ready to adjust its asset purchase programme. Analysts at Nordea see more GBP weakness ahead.

“In line with expectations, the BoE did not change any of its policy instruments today.”

“On inflation, the CPI index is expected to decline to below 1% in the spring due to lower oil prices primarily.”

“In terms of the sterling, the reaction was fairly muted as the outcome was in line with expectations. We still look for GBP downside given the increasingly concerning corona situation in the UK, fear of returning no-deal Brexit headlines as well as an exposed banking sector.”

- Will take all necessary health measures and seek adequate financing to contain pandemic

- We are committed to presenting united front against coronavirus

- Tackling the pandemic and its intertwined health, social and economic impacts is our absolute priority

- We are committed to protect the lives, safeguard jobs and income

- Response requires transparent, robust, large scale and coordinated response

- We are committed to restoring confidence preserving financial stability, reviving growth and recovering stronger

- We are committed to helping all countries in need and coordinating on public health and financial measures

- commit to all necessary health measures and financing to contain pandemic and protect people including most vulnerable

- Says she's certain the House will pass the bill

- IMF's projectsthat there will be a contraction in the global output in 2020 and a recovery in 2021

- Depth of contraction and speed of recovery depend on containment of pandemic

- Targeted fiscal support to households, businesses needed otherwise it will take years to overcome bankruptcies and layoffs

- Emerging markets are the main focus of attention

- Asked G20 to double emergency financing capacity, to boost global liquidity through sizeable SDR allocations

FXStreet notes that U.S. jobless claims were off the charts at 3.28 million last week. Increase of 3 million from the previous week, nearly 2% of labour force, Josh Nye, a Senior Economist at the Royal Bank of Canada, briefs.

“Today's initial claims figure was at the upper end of the wide range of market expectations. In any case, it's absolutely shocking to see 2% of the US labour force making jobless claims in a single week.”

“The scale of layoffs underscores the need for more generous unemployment insurance to help people through this unprecedented period of economic disruption.”

The Commerce Department released on Thursday its "third" estimate for the U.S. gross domestic product (GDP) for the fourth quarter of 2019, which revealed the U.S. economy grew as expected in the reviewed period.

According to the estimate, the U.S. real GDP increased at an annual rate of 2.1 percent q-o-q last quarter, the same pace as in the third quarter.

Economists had expected GDP to boost by 2.1 percent.

According to the report, the gain in real GDP in the fourth quarter reflected positive contributions from personal consumption expenditures (PCE), exports, residential fixed investment, federal government spending, and state and local government spending, which were partly offset by negative contributions from private inventory investment and nonresidential fixed investment. Meanwhile, imports, which are a subtraction in the calculation of GDP, dropped.

At the same time, the real GDP growth in the fourth quarter was the same as that in the third as a downturn in imports and an acceleration in government spending were offset by a larger decline in private inventory investment and a slowdown in PCE.

FXStreet reports that economists at JP Morgan Asset Management apprise that dramatic Fed action should provide investors with some sense of stability in an otherwise extremely volatile world.

“Stability in the financial system should provide a confidence boost to investors otherwise worried about potential liquidity crises, particularly as they relate to redemptions of investments.”

“Support for small and medium-sized businesses should help to shore up economic health, and potentially prevent the spread of wider-reaching damages related to rising unemployment and falling income.”

“Increased Fed activity should put downward pressure on yields across the curve, supporting a duration trade and positioning bonds as an ‘insurance’ asset.”

“Low interest rates in the U.S. and around the world should encourage risk taking, as the opportunities for yield in fixed income dry up.”

(company / ticker / price / change ($/%) / volume)

| Ford Motor Co. | F | 5.23 | -0.16(-2.97%) | 1590287 |

| ALCOA INC. | AA | 7.16 | 0.07(0.99%) | 26742 |

| 3M Co | MMM | 130.55 | -0.99(-0.75%) | 7599 |

| ALTRIA GROUP INC. | MO | 34.11 | -0.26(-0.76%) | 5704 |

| Amazon.com Inc., NASDAQ | AMZN | 1,903.60 | 17.76(0.94%) | 65906 |

| American Express Co | AXP | 90 | -0.17(-0.19%) | 9996 |

| AMERICAN INTERNATIONAL GROUP | AIG | 25.39 | -0.33(-1.28%) | 8816 |

| Apple Inc. | AAPL | 245.5 | -0.02(-0.01%) | 860237 |

| AT&T Inc | T | 28.75 | 0.35(1.23%) | 122333 |

| Boeing Co | BA | 168.02 | 9.29(5.85%) | 1478347 |

| Caterpillar Inc | CAT | 103.07 | -1.60(-1.53%) | 8927 |

| Chevron Corp | CVX | 69 | -0.27(-0.39%) | 28850 |

| Cisco Systems Inc | CSCO | 37.64 | -0.03(-0.08%) | 89860 |

| Citigroup Inc., NYSE | C | 42 | 0.14(0.33%) | 85161 |

| Deere & Company, NYSE | DE | 127.89 | -0.60(-0.47%) | 278806 |

| E. I. du Pont de Nemours and Co | DD | 32.75 | -0.48(-1.44%) | 1328 |

| Exxon Mobil Corp | XOM | 37.01 | -0.28(-0.75%) | 125442 |

| Facebook, Inc. | FB | 156.2 | -0.01(-0.01%) | 146647 |

| FedEx Corporation, NYSE | FDX | 117.9 | -0.41(-0.35%) | 1261 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 7.17 | -0.08(-1.10%) | 39918 |

| General Motors Company, NYSE | GM | 21.25 | -0.24(-1.12%) | 90668 |

| Goldman Sachs | GS | 154.48 | -0.65(-0.42%) | 17261 |

| Google Inc. | GOOG | 1,105.00 | 2.51(0.23%) | 14310 |

| Hewlett-Packard Co. | HPQ | 15.8 | 0.42(2.73%) | 1778 |

| Home Depot Inc | HD | 181 | -0.76(-0.42%) | 18061 |

| HONEYWELL INTERNATIONAL INC. | HON | 129.1 | -0.55(-0.42%) | 2752 |

| Intel Corp | INTC | 51.89 | 0.63(1.23%) | 103272 |

| International Business Machines Co... | IBM | 105.71 | -0.14(-0.13%) | 23842 |

| JPMorgan Chase and Co | JPM | 91.37 | -0.36(-0.39%) | 70114 |

| McDonald's Corp | MCD | 161.8 | -1.18(-0.72%) | 29693 |

| Merck & Co Inc | MRK | 67.63 | -0.59(-0.86%) | 19401 |

| Microsoft Corp | MSFT | 147.76 | 0.84(0.57%) | 429504 |

| Nike | NKE | 78.78 | -0.23(-0.29%) | 33243 |

| Pfizer Inc | PFE | 29.69 | -0.06(-0.20%) | 20855 |

| Procter & Gamble Co | PG | 101.1 | 0.18(0.18%) | 14238 |

| Starbucks Corporation, NASDAQ | SBUX | 65.6 | -0.21(-0.32%) | 106799 |

| Tesla Motors, Inc., NASDAQ | TSLA | 535.44 | -3.81(-0.71%) | 355516 |

| The Coca-Cola Co | KO | 42.15 | 0.54(1.30%) | 74335 |

| Travelers Companies Inc | TRV | 91.06 | -1.12(-1.22%) | 2876 |

| Twitter, Inc., NYSE | TWTR | 25.85 | -0.12(-0.46%) | 75281 |

| United Technologies Corp | UTX | 94.52 | -1.67(-1.74%) | 8795 |

| UnitedHealth Group Inc | UNH | 231.48 | -3.01(-1.28%) | 19193 |

| Verizon Communications Inc | VZ | 49.82 | -0.12(-0.24%) | 37564 |

| Visa | V | 160.7 | -1.08(-0.67%) | 36253 |

| Wal-Mart Stores Inc | WMT | 109.41 | 0.01(0.01%) | 38853 |

| Walt Disney Co | DIS | 100.45 | -0.28(-0.28%) | 120108 |

| Yandex N.V., NASDAQ | YNDX | 32.62 | -0.80(-2.39%) | 14207 |

Dow (DOW) initiated with a Sector Weight at KeyBanc Capital Markets

DuPont (DD) initiated with an Overweight at KeyBanc Capital Markets; target $44

Walmart (WMT) initiated with an Underperform at Exane BNP Paribas; target $98

Alphabet A (GOOGL) target lowered to $1350 from $1535 at Monness Crespi & Hardt

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 09:00 | Eurozone | Private Loans, Y/Y | February | 3.7% | 3.8% | 3.8% |

| 09:00 | Eurozone | ECB Economic Bulletin | ||||

| 09:00 | Eurozone | M3 money supply, adjusted y/y | February | 5.2% | 5.2% | 5.5% |

| 12:00 | United Kingdom | Bank of England Minutes | ||||

| 12:00 | United Kingdom | Asset Purchase Facility | 645 | 645 | ||

| 12:00 | United Kingdom | BoE Interest Rate Decision | 0.1% | 0.1% | ||

| 12:30 | U.S. | Continuing Jobless Claims | March | 1702 | 1708 | 1803 |

| 12:30 | U.S. | Goods Trade Balance, $ bln. | February | -65.9 | -59.89 | |

| 12:30 | U.S. | Initial Jobless Claims | March | 282 | 1000 | 3283 |

| 12:30 | U.S. | PCE price index ex food, energy, q/q | Quarter IV | 2.1% | 1.2% | 1.3% |

| 12:30 | U.S. | GDP, q/q | Quarter IV | 2.1% | 2.1% | 2.1% |

USD traded lower against its major counterparts in the European session on Thursday, as market participants assessed the Fed's Chair remarks and the weekly jobless claims. The U.S. Dollar Index (DYX) is down 0.77% at 100.27.

The Fed Chairman, Jerome Powell, who appeared on NBC this morning, and said that the central bank "will not run out of ammunition" and that they "have policy room for more action". He also added that there is nothing fundamentally wrong with the U.S. economy and that the economic activity is expected to resume in the second half of the year.

The data from the Labor Department revealed the number of applications for unemployment benefits climbed much more than forecast last week as businesses across the country had shut down amid a policy of social distancing aimed at keeping the coronavirus from freely spreading. According to the report, the initial claims for unemployment benefits jumped to a seasonally adjusted 3,283,000 for the week ended March 21. That was the highest reading since the series began in 1967. Economists had expected 1,000,000 new claims last week.

Investors welcomed the U.S. Senate’s passage of a $2 trillion fiscal stimulus package to mitigate the economic impact of the coronavirus, but there are already signals that some U.S. states will need more money for medical supplies.

The data from the Labor Department revealed on Thursday the number of applications for unemployment benefits climbed much more than forecast last week as businesses across the country had shut down amid a policy of social distancing aimed at keeping the coronavirus from freely spreading.

According to the report, the initial claims for unemployment benefits jumped to a seasonally adjusted 3,283,000 for the week ended March 21. That was the highest reading since the series began in 1967.

Economists had expected 1,000,000 new claims last week.

Claims for the prior week were revised upwardly to 282,000 from the initial estimate of 281,000.

The Bank of England (BoE) announced its Monetary Policy Committee (MPC) voted 9-0 to maintain Bank Rate at 0.1 percent at its March meeting.

The MPC also voted unanimously to continue with the program of £200 billion of UK government bond and sterling non-financial investment-grade corporate bond purchases to take the total stock of these purchases to £645 billion.

In its statement, the BoE notes:

- Economic consequences of these developments are becoming more apparent and a very sharp reduction in activity is likely;

- There is a risk of longer-term damage to the economy, especially if there are business failures on a large scale or significant increases in unemployment;

- There is little evidence as yet to assess the precise magnitude of the economic shock from Covid-19;

- It is probable that global GDP will fall sharply during the first half of this year;

- Unemployment is likely to rise rapidly across a range of economies;

- The nature of the economic shock from Covid-19 is very different from those to which the MPC has previously had to respond;

- The scale and duration of the shock to economic activity, while highly uncertain, will be large and sharp but should ultimately prove temporary, particularly if job losses and business failures can be minimized;

- If needed, the MPC can expand asset purchases further;

- The MPC will continue to monitor the situation closely and, consistent with its remit, stands ready to respond further as necessary to guard against an unwarranted tightening in financial conditions, and support the economy.

- Says the ECB sees its current Pandemic Emergency Purchase Program (PEPP) as a "far more powerful" tool to deal with the current crisis

FXStreet reports that in the opinion of analysts at HSBC Group, FX market could see a heightened risk of large EUR tensions as the glue holding the EUR family together is tested.

“Combination of cyclical pressures and a nation-centric political response risks exposing some of the structural frailties of the EUR project.”

“Fiscal tensions could become acutely evident in 2021 as countries are forced to rectify this year’s tolerated fiscal largesse.”

“The EUR will likely face some temporary pressure as the market prices in a discount for a higher probability of a EUR break-up amid the strains of COVID-19.”

- Only limit for Fed is amount of backstop it gets from Treasury

- Effectively, every $1 of Treasury backstop can support $10 worth in Fed loans

- Fed ready to step in wherever credit is not flowing and will continue to do it aggressively

- Current crisis is not a typical downturn

- When the virus is under control, confidence will return

- Trying to assure rebound is vigorous when it comes

- Says we could see a good rebound on other side

- We may well be in a recession

- The priority should be to get virus under control

- If we get virus under control, the economy can resume

- There is nothing fundamentally wrong with our economy

- Economic activity expected to resume in second half of the year

- I don't see risks around Fed's recent actions

- We're not going to run out of ammunition when it comes to upcoming lending

FXStreet reports that most recessions start with a fairly gradual rise in jobless claims, but this one looks quite different. Multiple states have indicated that filings ran at multiples of previous trends last week, economists at TD Securities inform.

"Our 2.5 million forecast for the total is more than triple anything previously reported. The all-time high was 695K, in 1982. The high in the 2008-09 recession was 665K."

"Real GDP will likely continue to show a fairly solid Q4 pace after this week's revision (TD 2.2%; consensus: 2.1%)."

"The numbers will almost certainly change dramatically in 2020: We forecast a 3.0% rate of decline (q/q AR) in Q1, a 25.0% rate of decline in Q2, a 15.0% rate of increase in Q3 and 0.0% in Q4."

FXStreet reports that AUD/USD is set to remain prey to global risk sentiment, occasionally probing above 0.60 but overall biased back towards the 0.55 handle multi-week, according to analysts at Westpac Institutional Bank.

"Our Economics team has slashed its Q2 GDP forecast to -3.5%qtr then -0.3%qtr in Q3, sending the unemployment rate soaring to 11%. However this grim outlook doesn't necessarily mean fresh weight on AUD/USD."

"AUD/USD is likely to remain prey to global risk sentiment, which means occasional squeezes to 0.60 or above but underlying fragility that leaves open a return to the 0.55 handle on renewed waves of risk aversion and/or USD funding strains."

-

The ECB has started bond purchases under its €750 billion pandemic emergency purchase program (PEPP)

-

Greek debt eligible for PEPP but there is no 'catch-up' buying

FXStreet reports that early Canadian economic data for March looks dreadful although that is not unexpected, as Nathan Janzen from the Royal Bank of Canada notes.

"The Canadian Federation of Independent Business reported that business confidence fell to its lowest level on record in March, below the lows in the 2008/09 financial crisis."

"Surge in employment insurance claims flagging historically unprecedented unemployment surge."

"Risks appear to be tilted to the downside relative to the 3.0% GDP contraction we expect in Q1 - and that is ahead of what is almost certain to be a double-digit contraction in Q2."

"There is still light at the end of the tunnel, but the near-term will be dark days for the economy."

RTE reports that the coronavirus outbreak will see a 2% recession in the eurozone this year, S&P Global has estimated today.

The credit rating agency warned that the contraction could be as much as 10% if the current lockdowns in the 19-country region last as long as four months.

With the economic costs "mounting quickly as measures to contain the virus increase... the eurozone and UK economies are now facing a recession of -2% for 2020," the agency said in a new report.

Risks are still to the downside, however.

"For example, we estimate a lockdown of four months could lower eurozone GDP by up to 10% this year," S&P said.

FXStreet reports that EUR/USD remains upside corrective near term. Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, analyzes the EUR/USD pair technically.

"Rallies have reached 1.0926/41, the September and October lows and are likely to be contained by the band of moving averages at 1.1008/82. While capped here our bias will remain negative and attention should then revert to the 1.0636 recent low."

"Longer term the market has eroded the 35 year uptrend at 1.0782/74 on a weekly basis. Failure here is considered to be a major break down and targets 1.0340, the 2017 low."

According to the report from European Central Bank, annual growth rate of broad monetary aggregate M3 increased to 5.5% in February 2020 from 5.2% in January. Economists had expected a 5.2% increase

Annual growth rate of narrower monetary aggregate M1, comprising currency in circulation and overnight deposits, increased to 8.1% in February from 7.9% in January. The annual growth rate of short-term deposits other than overnight deposits (M2-M1) was -0.4% in February, compared with -0.2% in January. The annual growth rate of marketable instruments (M3-M2) increased to 2.5% in February from -0.7% in January.

Annual growth rate of adjusted loans to households stood at 3.8% in February, compared with 3.7% in January

Annual growth rate of adjusted loans to non-financial corporations decreased to 3.0% in February from 3.2% in January

FXStreet reports that brent crude oil hovered around USD27/bbl, as stimulatory measures failed to impress the oil market amid deteriorating demand, economists at ANZ Bank inform.

"With lockdowns in many countries, expectations of oil demand contracting by more than 10mb/d are rising. Such demand loss will increase the supply glut."

"Production increases by Saudi Arabia and Russia loom, and things still look uncertain due to the ongoing price war between these two countries."

"The US Secretary Pampeo urged Saudi Arabia to reassure global energy and financial markets when the world faces serious economic uncertainty."

"The latest weekly US inventories report showed an increase of 1.62m barrels, the highest since July."

According to the report from IFO institute, sentiment among German exporters has deteriorated drastically. In March, the ifo Export Expectations in manufacturing decreased from minus 1.1 points to minus 19.8 points. This marks the biggest drop since German reunification and brings the index to its lowest level since May 2009. The coronavirus pandemic is slowing down global trade and cross-border logistics is becoming more difficult. This affects Germany as an exporting nation particularly strongly.

Export expectations fell in almost all industrial sectors, in some cases significantly. The automotive industry was hit particularly hard and now expects significant declines in exports. In mechanical engineering, the outlook is also gloomy, and the same is true for manufacturers of textiles and clothing. Among manufacturers of electrical equipment and in the chemical industry, meanwhile, the observed decline was comparatively moderate.

The ECB released a legal text for its new pandemic emergency purchase program (PEPP), According to the document, Сentral bank will not apply its self-imposed purchase limits on the €750 billion program.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 07:00 | Germany | Gfk Consumer Confidence Survey | April | 8.3 | 7.1 | 2.7 |

| 07:00 | United Kingdom | Retail Sales (MoM) | February | 1.1% | 0.2% | -0.3% |

| 07:00 | United Kingdom | Retail Sales (YoY) | February | 0.9% | 0.8% | 0% |

During today's Asian trading, the US dollar fell against the euro and the yen. The ICE Dollar index, which tracks the dynamics of the dollar against six major currencies, fell by 0.28%.

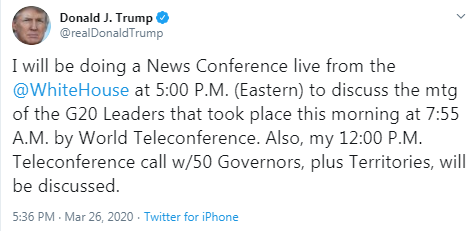

Experts note that the risk appetite of investors is currently neutral, as the market is waiting for data on the us labor market, as well as a teleconference of the leaders of the G-20.

The number of new applications for unemployment benefits in the US probably rose sharply last week due to restrictions imposed in response to the spread of the coronavirus, which has already led to the termination of many small businesses.

The consensus forecast of experts provides for an increase in the number of initial jobless claims to 1 million compared to 281 thousand a week earlier, according to data from Trading Economics.

Analysts also note a slight weakening of demand for dollar liquidity for the last time. However, in their opinion, at the end of the month, we can expect short-term jumps in speculative demand for the us currency, which will lead to its strengthening.

eFXdata reports that Barclays Research discusses USD/CAD outlook and adopts a bullish bias expecting the pair to rally through 1.47 in Q2.

"The loonie has taken a severe hit from the COVID-19 pandemic, which has led markets to hoard USD amid the imminence of a global recession that will affect the Canadian economy through a number of channels. Oil prices have dropped to unsustainable levels below the cost of production, which could lead to production curtailments in Canada," Barclays notes.

"On the domestic front, rail blockades have been temporarily suspended as the government managed to reach a tentative deal with the indigenous groups but a collapse in talks could aggravate the supply chain disruptions. Canada has announced a fiscal stimulus and tax deferral package worth 4% of GDP and aid to the tourism, airline and energy sectors that have been hit the hardest. Once the virus concerns settle and fiscal and monetary stimuli kick in, we expect the loonie to regain some lost ground during the second half of the year," Barclays adds.

-

CNBC reports that the Korea Centers for Disease Control and Prevention reported a jump of 104 cases and five more deaths. That brings the country's total to 9,241 cases and 131 fatalities.

-

China's National Health Commission reported it had 67 new confirmed cases, and six more deaths as of March 25. All the new cases were imported.

-

Spain reported 738 coronavirus-related deaths in the past 24 hours - its highest daily death toll yet, according to Reuters. Spain's death toll has now surpassed China, days after Italy overtook China.

-

Global cases: At least 416,686.

-

Global deaths: At least 18,589.

-

Top six countries with the highest number of reported cases: China (81,869), Italy (69,176), U.S. (51,914), Spain (39,673), Germany (31,554), Iran (27,017).

According to the report from GfK Group, coronavirus (COVID-19) is having an enormous impact on consumer sentiment in Germany. Both economic and income expectations, as well as propensity to buy are expected to suffer heavy losses. As a result, GfK has forecast a figure of 2.7 points for April 2020, 5.6 points lower than March's level (revised to 8.3 points).

The significant increase in the number of infections in Germany and the accompanying measures and restrictions have caused the consumer climate to collapse. At just 2.7 points, the index is at its lowest level since May 2009. At that time, during the financial and economic crisis, the consumer climate was at 2.6 points.

"In light of the current development, we are withdrawing our consumer forecast of one percent growth for 2020. Retailers, manufacturers and service providers must prepare for a recession," explains Rolf Bürkl, GfK Consumer Expert. "How severe this recession will be will ultimately depend on when the economy finds its way back to normality. A reliable forecast regarding consumption can only be made once we can predict how long the protective measures to combat corona will remain in place."

Office for National Statistics said, in the three months to February 2020, the quantity bought in retail sales fell for the fourth consecutive month by 0.6%; this was across all stores except non-store retailing.

In February 2020, the monthly growth rate in the quantity bought fell by 0.3%, with a range of retailers providing feedback on the adverse effect of the extreme rainfall on sales. Economists had expected a 0.2% increase

When compared with the same month a year earlier, February 2020 remained flat; the lowest year-on-year growth rate since March 2013 at negative 1.6%. Economists had expected a 0.8% increase

Online sales as a proportion of all retailing was 19.6% in February 2020, up from the 19.1% reported in January 2020.

The data collection for the period was completed by 29 February and is largely unaffected by recent developments with the coronavirus; however, a small number of retailers suggested that online orders shipped from China were reduced because of the impact of COVID-19.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1077 (1180)

$1.1039 (4230)

$1.1006 (2009)

Price at time of writing this review: $1.0911

Support levels (open interest**, contracts):

$1.0852 (3305)

$1.0828 (1622)

$1.0798 (1927)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date April, 3 is 85015 contracts (according to data from March, 25) with the maximum number of contracts with strike price $1,1000 (4230);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2049 (53)

$1.2008 (14)

$1.1955 (26)

Price at time of writing this review: $1.1826

Support levels (open interest**, contracts):

$1.1683 (108)

$1.1614 (140)

$1.1576 (65)

Comments:

- Overall open interest on the CALL options with the expiration date April, 3 is 18775 contracts, with the maximum number of contracts with strike price $1,3200 (2379);

- Overall open interest on the PUT options with the expiration date April, 3 is 22167 contracts, with the maximum number of contracts with strike price $1,2900 (2837);

- The ratio of PUT/CALL was 1.18 versus 1.24 from the previous trading day according to data from March, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 1454.28 | 19546.63 | 8.04 |

| Hang Seng | 863.7 | 23527.19 | 3.81 |

| KOSPI | 94.79 | 1704.76 | 5.89 |

| ASX 200 | 262.4 | 4998.1 | 5.54 |

| FTSE 100 | 242.19 | 5688.2 | 4.45 |

| DAX | 173.69 | 9874.26 | 1.79 |

| CAC 40 | 189.6 | 4432.3 | 4.47 |

| Dow Jones | 1177.19 | 21882.1 | 5.69 |

| S&P 500 | 28.23 | 2475.56 | 1.15 |

| NASDAQ Composite | -33.57 | 7384.29 | -0.45 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.