- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 16-02-2016.

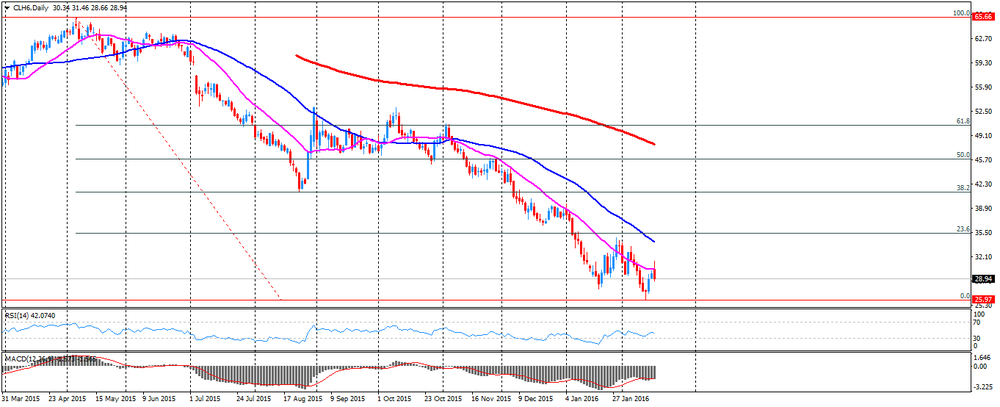

Oil prices traded lower on news that Russia and Saudi Arabia on Tuesday agreed to freeze the oil production at the level of January if other oil producers join. Energy ministers from Saudi Arabia, Russia, Qatar and Venezuela met in Doha today to discuss the situation in the oil market.

The Saudi Arabian oil minister Ali al-Naimi noted that freezing oil production at January levels was an adequate measure, adding that new measures of stabilisation could be considered in the next few months.

Iranian Oil Minister Bijan Zanganeh said on Tuesday that the country would not agree to freeze its oil production at January levels, adding that Iran would not give up its share of the global oil market.

Iran announced on Sunday that it boosted its oil output by 400,000 barrels per day.

WTI crude oil for March delivery fell to $28.99 a barrel on the New York Mercantile Exchange.

Brent crude oil for March decreased to $32.32 a barrel on ICE Futures Europe.

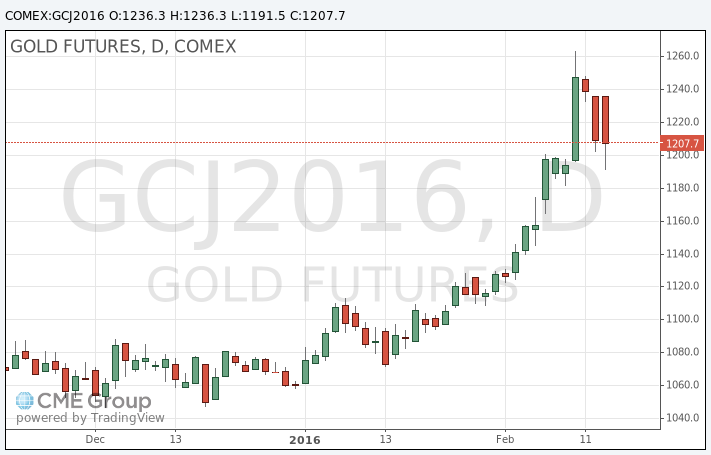

Gold price fell below $1,200 per ounce, but later rose to $1,215 as oil prices remained volatile and as market participants are concerned about the slowdown in the global economy.

Market participants also eyed the mixed U.S. economic data. The New York Federal Reserve released its survey on Tuesday. The NY Fed Empire State manufacturing index rose to -16.64 in February from -19.37 in January, missing expectations for an increase to -10.00.

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Tuesday. The NAHB housing market index declined to 58 in February from 61 in January, missing expectations for a decrease to 60.

April futures for gold on the COMEX today traded in the range of 1190.40 and 1,215 dollars per ounce.

Iranian Oil Minister Bijan Zanganeh said on Tuesday that the country would not agree to freeze its oil production at January levels, adding that Iran would not give up its share of the global oil market.

"Iran will not relinquish over its market share," he said.

Iran announced on Sunday that it boosted its oil output by 400,000 barrels per day.

Russia and Saudi Arabia on Tuesday agreed to freeze the oil production at the level of January if other oil producers join. Energy ministers from Saudi Arabia, Russia, Qatar and Venezuela met in Doha today to discuss the situation in the oil market.

The Saudi Arabian oil minister Ali al-Naimi noted that freezing oil production at January levels was an adequate measure, adding that new measures of stabilisation could be considered in the next few months.

The People's Bank of China (PBoC) released its new loans data on Tuesday. New loans in local currency in China were 2,510 billion yuan in January, up from December's 597.8 billion yuan and exceeding expectations of 1,800 billion yuan.

M2 money supply jumped by 14.0% year-on-year in January, after a 13.3% gain in December.

Total social financing increased to 3.42 trillion yuan in January from 1.82 trillion yuan in December.

Bloomberg reported, using data released by the China Banking Regulatory Commission (CBRC) on Monday, that bad-loan ratio in China rose to 1.67% of assets in 2015 from 1.25% in 2014, while the industry's bad-loan coverage ratio fell to 181% from more than 200% a year earlier.

West Texas Intermediate futures for March delivery rallied to $30.74 (+4.42%), while Brent crude jumped to $34.70 (+3.92%) amid hopes for cooperation between producers. Anonymous sources said Saudi Arabia's oil minister Ali Al Naimi will meet Russia's Alexander Novak in Qatar later today. The agenda of the meeting is unknown.

Public finances in Saudi Arabia and other Gulf countries suffered severely, which raises expectations for a deal between producers.

However some analysts are skeptical about output cuts. "We continue to believe that if prices were to be artificially supported with production cuts it would only give more expensive forms of production more room to breathe and would only solve the problem in the short term," Phillip Futures said.

Gold fell to $1,196.40 (-3.47%) as risk appetite and higher stocks decreased demand for the precious metal. Goldman Sachs said it expects prices to decline further with a three-month target of $1,100 per ounce, while a 12-month target stands at $1,000. Some analysts say that the latest declines were inevitable after a fast increase last week.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.