- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 17-02-2016.

(raw materials / closing price /% change)

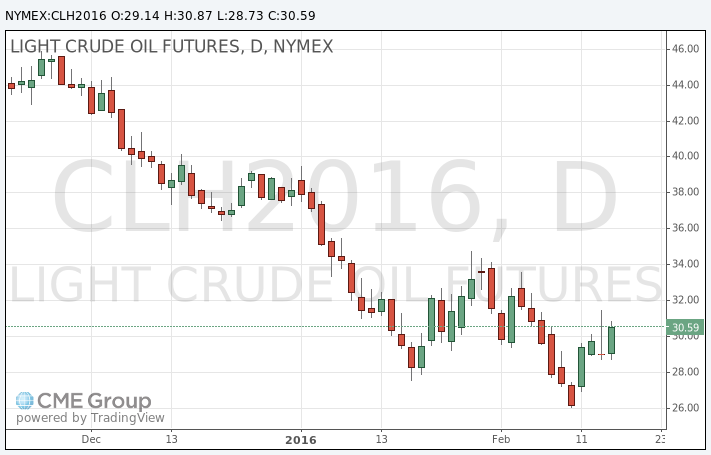

Oil 31.43 +2.51%

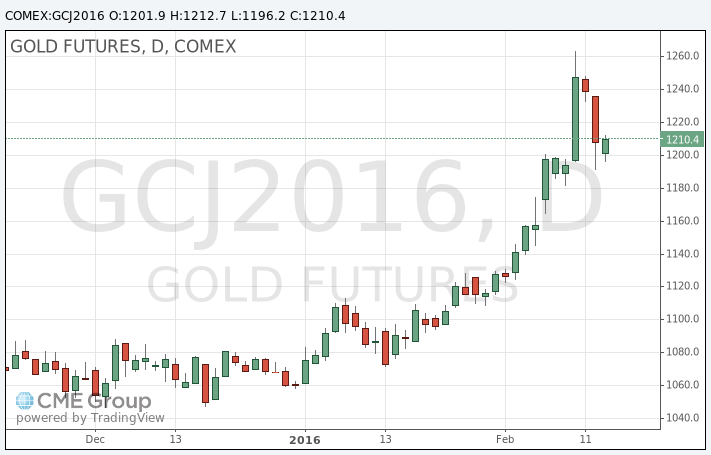

Gold 1,209.00 -0.20%

Oil prices traded higher on news that Iran supports the decision to freeze the oil production at the level of January. Iranian Oil Minister Bijan Zanganeh said on Wednesday that the country support the decision to freeze the oil production at the level of January.

"The decision that was taken for the OPEC and non-OPEC members to keep their production ceiling to stabilize the market and prices for the benefit of producers and consumers, is supported by us," he said.

It is unclear if Iran keeps its oil output at its January level as the country targets its pre-sanctions oil output levels.

Russia and Saudi Arabia on Tuesday agreed to freeze the oil production at the level of January if other oil producers join.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Thursday.

WTI crude oil for March delivery increased to $30.87 a barrel on the New York Mercantile Exchange.

Brent crude oil for March increased to $34.15 a barrel on ICE Futures Europe.

Gold price climbed ahead the release of the latest Fed's monetary policy minutes later in the day. Market participants hope for some hints regarding further interest rate hikes.

Market participants also eyed the mixed U.S. economic data. The U.S. Commerce Department released the housing market data on Wednesday. Housing starts in the U.S. declined 3.8% to 1.099 million annualized rate in January from a 1.143 million pace in December, missing expectations for an increase to 1.170 million.

The Federal Reserve released its industrial production report on Wednesday. The U.S. industrial production climbed 0.9% in January, missing expectations for a 0.4% increase, after a 0.7% decline in December.

April futures for gold on the COMEX today rose to 1212.70 dollars per ounce.

Zhao Chenxin, a spokesman for the National Development and Reform Commission (NDRC), said on Wednesday that China's economy would expand at a medium- to high-rate.

"China's status as the world's largest holder of foreign exchange reserves has not changed, the large-scale trade surplus has not changed and the steady progress in the yuan internationalisation has not changed," he added.

Iranian Oil Minister Bijan Zanganeh said on Wednesday that the country support the decision to freeze the oil production at the level of January.

"The decision that was taken for the OPEC and non-OPEC members to keep their production ceiling to stabilize the market and prices for the benefit of producers and consumers, is supported by us," he said.

It is unclear if Iran keeps its oil output at its January level as the country targets its pre-sanctions oil output levels.

According to the latest Bank of America Merrill Lynch fund manager survey, 27% of respondents said that the U.S. recession was the biggest risk to markets. 23% of respondents noted that emerging market or energy debt defaults were the biggest risks to markets.

West Texas Intermediate futures for March delivery is currently at $29.11 (+0.24%), while Brent crude is at $32.35 (+0.53%) as initial optimism after Russia-Saudi meeting faded. Yesterday oil prices rose as much as 6% after Russia, Saudi Arabia, Qatar and Venezuela agreed to freeze output at January levels if other producers do the same. However, other producers may refuse to freeze output and undermine the agreement. Besides, many experts don't believe this agreement provides an efficient solution even if it works.

"In other words, this deal would simply maintain the excess supply that is now in place. This might be better than a further increase, but it is not the output cuts that some in the markets have been hoping for," Capital Economics said.

Gold is currently at $1,205.50 (-0.22%) holding above the key $1,200 an ounce level in choppy trade on Wednesday morning. Gains in U.S. stocks and signs of stabilization on Asian stock markets decreased demand for the safe-haven asset. Investors are waiting for U.S. Federal Reserve's meeting minutes to find clues on the interest rates outlook. The minutes will be released later today. Recently the non-interest-paying precious metal benefited from speculation that the Fed would not be able to raise rates as fast as it planned.

(raw materials / closing price /% change)

Oil 29.24 +0.69%

Gold 1,200.10 -0.67%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.