- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 18-02-2016.

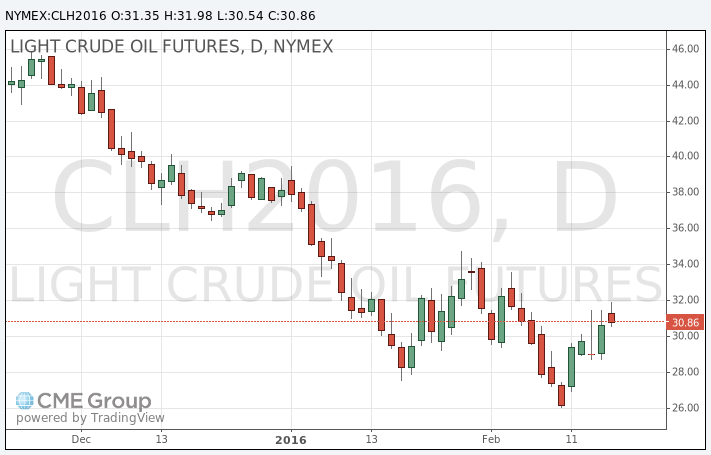

Oil prices fell after the release of the U.S. crude oil inventories data. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Thursday. U.S. crude inventories rose by 2.15 million barrels to 504.1 million in the week to February 12.

Analysts had expected U.S. crude oil inventories to rise by 4.0 million barrels.

Gasoline inventories increased by 3.0 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, increased by 36,000 barrels.

U.S. crude oil imports rose by 795,000 barrels per day.

Refineries in the U.S. were running at 88.3% of capacity, up from 86.1% the previous week.

Earlier this week, oil prices rose on news that Russia and Saudi Arabia agreed to freeze the oil production at the level of January if other oil producers join.

WTI crude oil for February delivery declined to $30.54 a barrel on the New York Mercantile Exchange.

Brent crude oil for February fell to $34.45 a barrel on ICE Futures Europe.

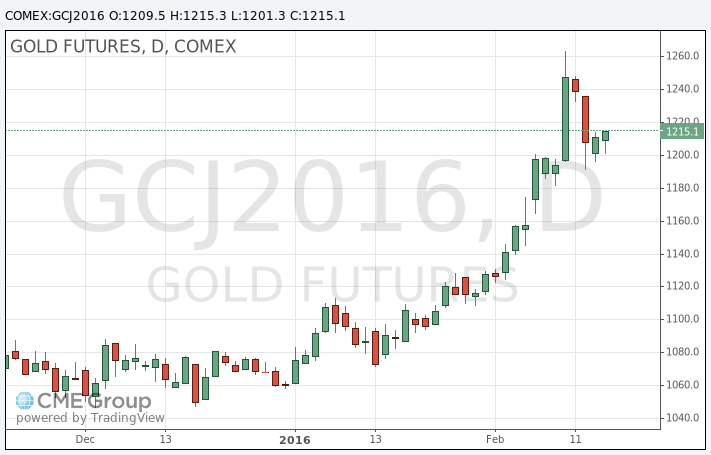

Gold price rose on a weaker U.S. dollar. The U.S. dollar fell against other currencies after the release of the U.S. economic data. The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending February 13 in the U.S. declined by 7,000 to 262,000 from 269,000 in the previous week. Analysts had expected jobless claims to rise to 275,000.

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index climbed to -2.8 in February from -3.5 in January, exceeding expectations for an increase to -3.0.

The Conference Board released its leading economic index (LEI) for the U.S. on Thursday. The leading economic index fell 0.2% in January, missing expectations for a 0.2% decrease, after a 0.3% decline in December. "The U.S. LEI fell slightly in January, driven primarily by large declines in stock prices and further weakness in initial claims for unemployment insurance. Despite back-to-back monthly declines, the index doesn't signal a significant increase in the risk of recession, and its six-month growth rate remains consistent with a modest economic expansion through early 2016," director of business cycles and growth research at The Conference Board, Ataman Ozyildirim, said.

Concerns over the slowdown in the global economy also supported gold. The Organization for Economic Cooperation and Development (OECD) released its growth forecast on Thursday. The OECD downgraded its global growth outlook. The OECD expect the global economy to grow 3.0% in 2016, down from the previous estimate of 3.3%, and at 3.3% in 2017, down from the previous estimate of 3.6%.

March futures for gold on the COMEX today increased to 1218.30 dollars per ounce.

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Thursday. U.S. crude inventories rose by 2.15 million barrels to 504.1 million in the week to February 12.

Analysts had expected U.S. crude oil inventories to rise by 4.0 million barrels.

Gasoline inventories increased by 3.0 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, increased by 36,000 barrels.

U.S. crude oil imports rose by 795,000 barrels per day.

Refineries in the U.S. were running at 88.3% of capacity, up from 86.1% the previous week.

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending February 13 in the U.S. declined by 7,000 to 262,000 from 269,000 in the previous week.

Analysts had expected jobless claims to rise to 275,000.

Jobless claims remained below 300,000 the 50th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims climbed by 30,000 to 2,273,000 in the week ended February 06.

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Thursday. The Chinese consumer price index (CPI) rose at annual rate of 1.8% in January, in missing expectations for a 1.9% increase, after a 1.6% gain in December.

Food prices rose at an annual rate of 4.1% in January, while non-food prices increased 1.2%.

On a monthly basis, consumer price inflation increased 0.5% in January, after a 0.5% rise in December.

The Chinese producer price index (PPI) dropped 5.3% in January, beating expectations for a 5.4% fall, after a 5.9% decline in December.

The rating agency Standard & Poor's (S&P) on Wednesday downgraded sovereign debt ratings of Saudi Arabia, Brazil, Kazakhstan, Bahrain and Oman. The agency said that the reason is falling oil prices. Saudi Arabia's rating was lowered to A- stable from A+ negative. Brazil's rating was cut to BB from BB+. Bahrain's rating was downgraded BB from BBB-, Oman's rating to BBB- stable from BBB+ negative, while Kazakhstan's rating to BBB- from BBB negative.

The Fed released its January monetary policy meeting minutes on Wednesday. The Fed kept its interest rate unchanged in January. Fed officials expressed concerns about global financial conditions and considered to change the number of interest rate hikes this year.

"Members observed that if the recent tightening of global financial conditions was sustained, it could be a factor amplifying downside risks," the minutes said.

According to the minutes, downside risks from low oil energy prices to the outlook are increased.

The Fed noted that it will closely monitor global economic and financial developments.

Some Fed officials expressed concerns that the slowdown in the Chinese economy would have a negative impact on the U.S. economy.

West Texas Intermediate futures for March delivery surged to $33.57 (+9.49%), while Brent crude rose to $35.11 (+1.77%) after Iran welcomed plans by Russia and Saudi Arabia to freeze production levels. However Tehran did not indicate how it will act.

Analysts are still skeptical about the recent deal. Simply freezing production does not presume output cuts and will not be enough to support prices. Current market conditions need more concrete actions. Besides, all major oil producers would have to act and this would be difficult to achieve.

Gold is currently at $1,210.40 (-0.08%) holding above the key $1,200 an ounce level after minutes from the Federal Reserve's January meeting suggested the central bank of the U.S. could delay the next rate hike amid growing economic uncertainties. Recently the non-interest-paying precious metal benefited from speculation that the Fed would not be able to raise rates as fast as it planned.

On Wednesday Bank of America Merrill Lynch cut its forecast for the number of rate hikes the Federal Reserve will conduct this year to 2 from a 3-4 range projected earlier.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.