- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 07-03-2017.

(index / closing price / change items /% change)

Nikkei -34.99 19344.15 -0.18%

TOPIX +0.14 1555.04 +0.01%

Hang Seng +84.79 23681.07 +0.36%

CSI 300 +7.48 3453.96 +0.22%

Euro Stoxx 50 -2.34 3385.12 -0.07%

FTSE 100 -11.13 7338.99 -0.15%

DAX +7.74 11966.14 +0.06%

CAC 40 -17.19 4955.00 -0.35%

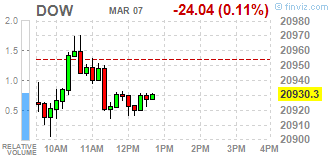

DJIA -29.58 20924.76 -0.14%

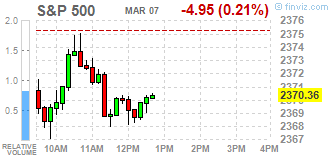

S&P 500 -6.92 2368.39 -0.29%

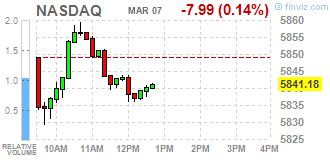

NASDAQ -15.24 5833.93 -0.26%

S&P/TSX -20.97 15608.78 -0.13%

The main US stock indexes have declined moderately amid a fall in pharmaceutical companies' shares caused by President Trump's tweet about a drop in drug prices.

The focus of the market was also the report of the Department of Commerce, which showed that the US trade deficit jumped to almost a 5-year high in January, as rising oil prices helped increase imports, suggesting that trade will again adversely affect economic growth in the first Quarter. According to the report, the trade deficit increased by 9.6% and amounted to $ 48.5 billion, which is the highest since March 2012. The trade balance deficit remained at $ 44.3 billion in December. Economists predicted an increase in the trade deficit to $ 48 billion in January. Given the inflation, the deficit rose to $ 65.3 billion from $ 62 billion in December. Both exports and imports, adjusted for inflation, were the highest in January.

In addition, the data showed that the index of economic optimism in the US, calculated by the newspaper Investor's Business Daily and the research firm TechnoMetrica Institute of Policy and Politics, declined in March by 1.1 points, to 55.3 points. Experts expected that the index will increase to 57.1 points from 56.4 points in February.

Components of the DOW index finished trading mostly in the red (21 out of 30). More shares fell shares Verizon Communications Inc. (VZ, -1.29%). The leader of growth was the shares of The Boeing Company (BA, + 0.57%).

Almost all sectors of the S & P index recorded a decline. The health sector fell most (-0.9%). The growth leader was the conglomerate sector (+ 0.1%).

At closing:

Dow -0.14% 20.924.35 -29.99

Nasdaq -0.26% 5,833.93 -15.25

S & P -0.29% 2,368.36 -6.95

U.S. stocks pared losses late Tuesday morning as a decline in drug stocks, triggered by President Donald Trump's tweet about lowering drug prices, was countered by gains in technology shares.

Pharmaceutical stocks came under fire after Trump said he was working on a new system to increase competition in the drugs industry and bring down prices.

Trump also backed a draft bill unveiled by Republicans on Monday to repeal and replace the Obamacare healthcare law but said the bill was open to negotiation.

Most of Dow stocks in negative area (19 of 30). Top loser - Verizon Communications Inc. (VZ, -0.90%). Top gainer - The Boeing Company (BA, +0.62%).

Most of S&P sectors also in negative area. Top loser - Healthcare (-0.6%). Top gainer - Conglomerates (+0.2%).

At the moment:

Dow 20919.00 -38.00 -0.18%

S&P 500 2368.75 -6.75 -0.28%

Nasdaq 100 5350.50 -10.50 -0.20%

Oil 53.33 +0.13 +0.24%

Gold 1218.50 -7.00 -0.57%

U.S. 10yr 2.51 +0.01

U.S. stock-index futures fell as investors prepared for an interest rate hike by the Fed next week.

Global Stocks:

Nikkei 19,344.15 -34.99 -0.18%

Hang Seng 23,681.07 +84.79 +0.36%

Shanghai 3,242.64 +8.77 +0.27%

FTSE 7,353.73 +3.61 +0.05%

CAC 4,958.64 -13.55 -0.27%

DAX 11,972.59 +14.19 +0.12%

Crude $53.51 (+0.60%)

Gold $1,220.40 (-0.42%)

European stocks closed lower on Monday, with the banking sector under pressure as German lender Deutsche Bank AG shares slid on its plans for a share sale. Investors showed little appetite for risky assets Monday, and that risk-off mode helped to pull shares of Deutsche Bank DBK, -7.89% DB, -3.82% down 7.9%, wiping out roughly $2 billion from the bank's market capitalization. The shares tumbled after the bank said it is planning an 8 billion euro ($8.5 billion) share sale in a bid to strengthen its capital position.

U.S. equity benchmarks closed down Monday, but off session lows, amid concerns over growing geopolitical tensions which have helped to refocus investors' attention on stock prices that have gotten rich by some measures. The downturn for stocks comes as North Korea tested four ballistic missiles off its east coast early Monday, Seoul time.

Asian stock markets were mostly higher in thin trading as investors assessed the prospects for further gains after a rally leading up to a near-certain U.S. interest-rate increase. South Korean and Hong Kong-listed Chinese stocks posted the biggest increases among equity gauges, with trading volumes down across the board.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.