- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 09-03-2017.

(index / closing price / change items /% change)

Nikkei +64.55 19318.58 +0.34%

TOPIX +4.43 1554.68 +0.29%

Hang Seng -280.71 23501.56 -1.18%

CSI 300 -21.79 3426.94 -0.63%

Euro Stoxx 50 +20.27 3409.89 +0.60%

FTSE 100 -19.65 7314.96 -0.27%

DAX +11.08 11978.39 +0.09%

CAC 40 +21.03 4981.51 +0.42%

DJIA +2.46 20858.19 +0.01%

S&P 500 +1.89 2364.87 +0.08%

NASDAQ +1.26 5838.81 +0.02%

S&P/TSX -0.14 15496.84 +0.00%

Major US stock indexes registered a slight increase, as shares of financial sector companies went up against the backdrop of signs of strength in the labor market and an almost certain increase in interest rates.

Investors also awaited an important report on employment in the non-agricultural sector, which could strengthen the chances of raising rates during the meeting of the Federal Reserve System on March 14-15. According to the futures market, now the probability of an increase in the rate of the Fed at the March meeting is 90.8%.

In addition, as it became known, the number of Americans who applied for unemployment benefits last week recovered from the nearly 44-year low, but continued to point to a tightening of the labor market. Initial applications for unemployment benefits increased by 20,000 to 243,000, seasonally adjusted for the week ending March 4, the Ministry of Labor said. Appeals for the previous week were not revised and remained at the level of 223,000, which is the lowest level since March 1973.

A separate report showed that import and export prices in the US rose slightly more than expected in February. The report said that import prices rose 0.2% in February after climbing a revised upward 0.6% in January. Economists had expected that import prices would rise by 0.1% compared to the 0.4% increase originally reported for the previous month.

The components of the DOW index have mostly grown (22 out of 30). The leader of growth was the shares of Johnson & Johnson (JNJ, + 1.47%). Caterpillar Inc. shares fell more than others. (CAT, -1.84%).

The sectors of the S & P index finished the session in different directions. The conglomerate sector fell most of all (-1.4%). The leader of growth was the healthcare sector (+ 0.6%).

At closing:

DJIA +3.63 20859.36 + 0.02%

S & P 500 + 2.77 2365.75 + 0.12%

NASDAQ +1.26 5838.81 + 0.02%

Major U.S. stock-indexes little changed on Thursday, as bank stocks climbed amid signs of strength in the labor market and a near-certain interest rate hike. The S&P financial index .SPSY rose 0.6 percent as investors turned their attention to a crucial nonfarm payrolls report on Friday that would bolster already sky-high odds of a rate hike during the Federal Reserve's meeting on March 14-15.

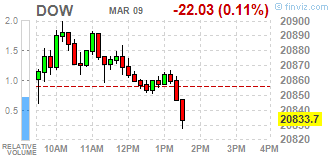

Most of Dow stocks in negative area (17 of 30). Top loser - Caterpillar Inc. (CAT, -2.02%). Top gainer - Johnson & Johnson (JNJ, +1.35%).

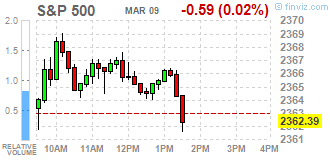

S&P sectors mixed. Top loser - Conglomerates (-1.3%). Top gainer - Healthcare (+0.6%).

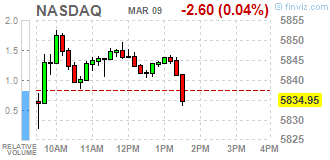

At the moment:

Dow 20815.00 -8.00 -0.04%

S&P 500 2361.75 +0.75 +0.03%

Nasdaq 100 5368.50 +1.50 +0.03%

Oil 48.96 -1.32 -2.63%

Gold 1203.40 -6.00 -0.50%

U.S. 10yr 2.58 +0.03

U.S. stock-index futures fell as oil prices dropped below $50 and investors remained cautious ahead of Friday's nonfarm payrolls data that could significantly affect expectations about the further actions of the Fed.

Global Stocks:

Nikkei 19,318.58 +64.55 +0.34%

Hang Seng 23,501.56 -280.71 -1.18%

Shanghai 3,216.58 -24.08 -0.74%

FTSE 7,293.02 -41.59 -0.57%

CAC 4,955.55 -4.93 -0.10%

DAX 11,968.64 +1.33 +0.01%

Crude $49.44 (-1.67%)

Gold $1,207.20 (-0.18%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 35.67 | -0.32(-0.89%) | 24424 |

| ALTRIA GROUP INC. | MO | 75.9 | 0.06(0.08%) | 93804 |

| Amazon.com Inc., NASDAQ | AMZN | 850.24 | -0.26(-0.03%) | 20742 |

| Apple Inc. | AAPL | 138.71 | -0.29(-0.21%) | 378940 |

| AT&T Inc | T | 41.69 | -0.08(-0.19%) | 295008 |

| Barrick Gold Corporation, NYSE | ABX | 17.75 | -0.07(-0.39%) | 92255 |

| Caterpillar Inc | CAT | 92.9 | -0.33(-0.35%) | 36480 |

| Chevron Corp | CVX | 109 | -0.61(-0.56%) | 97141 |

| Citigroup Inc., NYSE | C | 61.25 | 0.14(0.23%) | 146322 |

| Exxon Mobil Corp | XOM | 80.7 | -0.33(-0.41%) | 230022 |

| Facebook, Inc. | FB | 137.62 | -0.10(-0.07%) | 144798 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.25 | -0.19(-1.53%) | 154787 |

| General Electric Co | GE | 29.76 | -0.04(-0.13%) | 435768 |

| General Motors Company, NYSE | GM | 37.3 | 0.03(0.08%) | 68276 |

| Goldman Sachs | GS | 250.54 | 0.30(0.12%) | 21386 |

| Google Inc. | GOOG | 835 | -0.37(-0.04%) | 15244 |

| Intel Corp | INTC | 35.6 | -0.02(-0.06%) | 269532 |

| JPMorgan Chase and Co | JPM | 91.26 | 0.05(0.05%) | 174681 |

| Merck & Co Inc | MRK | 65.69 | -0.11(-0.17%) | 132889 |

| Nike | NKE | 56.58 | 0.07(0.12%) | 66508 |

| Pfizer Inc | PFE | 33.75 | -0.16(-0.47%) | 292426 |

| Procter & Gamble Co | PG | 90.15 | 0.01(0.01%) | 128285 |

| Tesla Motors, Inc., NASDAQ | TSLA | 247.98 | 1.11(0.45%) | 5168 |

| Verizon Communications Inc | VZ | 49.2 | 0.04(0.08%) | 196041 |

| Visa | V | 89 | 0.04(0.05%) | 675 |

| Walt Disney Co | DIS | 110.6 | -0.24(-0.22%) | 71956 |

| Yandex N.V., NASDAQ | YNDX | 23.09 | -0.34(-1.45%) | 6410 |

Upgrades:

Downgrades:

Other:

Tesla (TSLA) initiated with a Mkt Perform at Bernstein; target $250

U.K. stocks ended a highly volatile session slightly lower on Wednesday after the British government laid out plans for spending and taxes as it works to exit from the European Union. U.K. Treasury chief Philip Hammond outlined the last budget before the U.K. begins its flight out of the European Union. He said the 2017 forecast for British economic growth was upgraded, to 2% from a previous estimate of 1.4%. But growth is expected to slow in 2018.

The Dow industrials and S&P 500 closed lower for a third consecutive session Wednesday as oil prices dropped and a stronger-than-expected report on private-sector employment helped to bolster expectations for an interest-rate hike next week.

Prices in China rose less than expected in February as demand for food eased after the Lunar New Year holiday, the third piece of Chinese data that raised eyebrows this week. China's consumer-price index inched up 0.8% in February from a year earlier, compared with a 2.5% gain in January, the National Bureau of Statistics said Thursday.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.