- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 08-03-2017.

(index / closing price / change items /% change)

Nikkei -90.12 19254.03 -0.47%

TOPIX -4.79 1550.25 -0.31%

Hang Seng +101.20 23782.27 +0.43%

CSI 300 -5.23 3448.73 -0.15%

Euro Stoxx 50 +4.50 3389.62 +0.13%

FTSE 100 -4.38 7334.61 -0.06%

DAX +1.17 11967.31 +0.01%

CAC 40 +5.48 4960.48 +0.11%

DJIA -69.03 20855.73 -0.33%

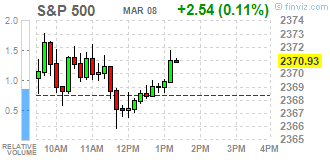

S&P 500 -5.41 2362.98 -0.23%

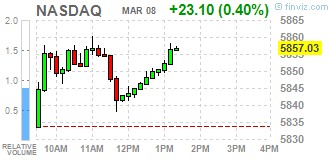

NASDAQ +3.62 5837.55 +0.06%

S&P/TSX -111.80 15496.98 -0.72%

Major US stock indexes ended the session mainly in the red, as the growth in financial performance after a strong employment report was offset by a decrease in shares in the energy sector.

Data from Automatic Data Processing (ADP) showed that the growth rate of employment in the private sector of the US accelerated in February stronger than expected. According to the report, in February the number of employed increased by 298 thousand people compared to the revised upward indicator for January at the level of 261 thousand (originally reported growth of 246 thousand). Analysts had expected that the number of employed will increase by 190 thousand.

In addition, wholesale stocks in the US fell somewhat more than anticipated in January, but investment in inventories could still contribute to economic growth in the first quarter. The Ministry of Trade reported that wholesale stocks decreased by 0.2%, the biggest drop since February 2016, after rising 1.0% in December. The ministry reported last month that wholesale inventories were down 0.1% in January.

Oil futures fell by about 5%, due to mixed data on oil products stocks and general strengthening of the US dollar. The US Energy Ministry reported that in the week of February 25-March 3, oil reserves increased significantly, exceeding forecasts, while stocks of gasoline and distillate sharply decreased. According to the data, oil reserves increased by 8.2 million barrels to 528.4 million barrels. Analysts had expected an increase of only 1.660 million barrels.

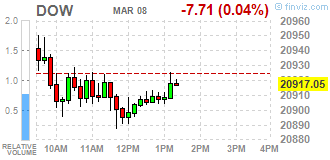

The components of the DOW index have mostly declined (23 out of 30). Caterpillar Inc. shares fell more than others. (CAT, -2.70%). The leader of growth was shares of Microsoft Corporation (MSFT, + 0.78%).

The sectors of the S & P index showed mixed dynamics. Most of all, the main materials sector fell (-2.2%). The leader of growth was the healthcare sector (+ 0.3%).

At closing:

Dow -0.33% 20,855.35 -69.41

Nasdaq + 0.06% 5,837.55 +3.62

S & P -0.23% 2,363.05 -5.34

U.S. stock-indexes S&P 500 and the Dow Jones Industrial Average swung between losses and gains on Wednesday as gains in financials following a strong private sector hiring report were offset by declines in energy stocks. The ADP National Employment report showed the U.S. private sector added 298,000 jobs last month, much bigger than the 190,000 estimated by economists on average.

Most of Dow stocks in negative area (17 of 30). Top loser - Caterpillar Inc. (CAT, -1.85%). Top gainer - E. I. du Pont de Nemours and Company (DD, +0.98%).

S&P sectors mixed. Top loser - Basic Materials (-1.7%). Top gainer - Healthcare (+0.6%).

At the moment:

Dow 20913.00 0.00 0.00%

S&P 500 2369.50 +3.00 +0.13%

Nasdaq 100 5369.25 +19.50 +0.36%

Oil 51.16 -1.98 -3.73%

Gold 1208.00 -8.10 -0.67%

U.S. 10yr 2.56 +0.05

U.S. stock-index futures were flat as investors lacked a clear market-moving catalyst.

Global Stocks:

Nikkei 19,254.03 -90.12 -0.47%

Hang Seng 23,782.27 +101.20 +0.43%

Shanghai 3,241.18 -1.22 -0.04%

FTSE 7,339.79 +0.80 +0.01%

CAC 4,965.28 +10.28 +0.21%

DAX 11,994.71 +28.57 +0.24%

Crude $52.48 (-1.24%)

Gold $1,209.90 (-0.51%)

Upgrades:

Downgrades:

Other:

Exxon Mobil (XOM) target lowered to $85 from $90 at HSBC Securities

European stocks slipped Tuesday, dampened by downbeat data from Germany, the continent's largest economy, before the European Central Bank issues a policy update later this week. Tuesday's fall marked the fourth loss in a row for the pan-European benchmark, with equities largely pulling back after last week hitting their highest level in a year.

The Dow and the S&P 500 on Tuesday logged their first back-to-back declines since late January as sharp losses in energy and telecommunications sectors dragged on the broader market. On the docket are the all-important nonfarm payrolls data on Friday and two major central bank meetings from the European Central Bank on Thursday and the Federal Reserve next week.

Asian equity investors were cautious early Wednesday, taking their cue from a lack of risk appetite in the U.S. overnight, as global markets continued to drift. Markets have been stuck in range-bound trading for much of the week as traders nervously await further clues from the U.S. Federal Reserve and President Donald Trump on the country's monetary and fiscal policy outlook.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.