- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 07-03-2018.

(index / closing price / change items /% change)

Nikkei -165.04 21252.72 -0.77%

TOPIX -12.34 1703.96 -0.72%

Hang Seng -313.81 30196.92 -1.03%

CSI 300 -29.91 4036.65 -0.74%

Euro Stoxx 50 +19.50 3377.36 +0.58%

FTSE 100 +11.09 7157.84 +0.16%

DAX +131.49 12245.36 +1.09%

CAC 40 +17.60 5187.83 +0.34%

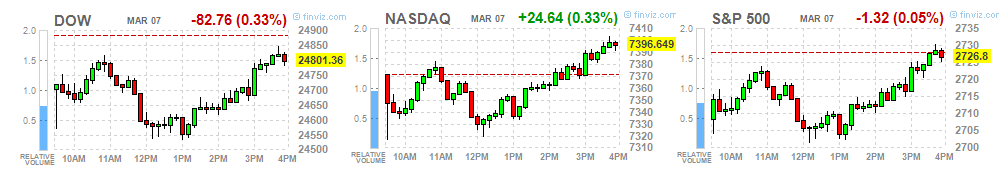

DJIA -82.76 24801.36 -0.33%

S&P 500 -1.32 2726.80 -0.05%

NASDAQ +24.64 7396.65 +0.33%

S&P/TSX -72.58 15472.61 -0.47%

Major US stock indexes ended the session in different directions, as investors were concerned about the resignation of the chief economic adviser to the US president and confident free-trade supporter Gary Cohn from the White House.

The negative trend began on Tuesday night after Cohn, the tax reform architect, in December, said he would retire, which, according to sources, was due to the fact that he could not convince President Trump to drop the introduction high import tariffs on metals.

In addition, the focus of investors' attention was data on the United States. The report Automatic Data Processing (ADP) reported that the growth rate of employment in the private sector of the US slightly accelerated in February, and were stronger than projected. In February, the number of employed increased by 235 thousand people compared to the figure for January at 234 thousand. Analysts had expected that the number of employed will increase by 195 thousand.

At the same time, the US trade deficit in January rose to more than 9-year high, and the deficit with China expanded dramatically, which suggests that Trump's trading strategy, "America first" is unlikely to have a significant impact on the deficit. The Department of Trade said that the deficit jumped 5.0% to 56.6 billion. This was the highest level since October 2008 and followed the revised with a small increase in deficit of 53.9 billion in December.

In addition, the Beige Book review of the Fed indicated that in all 12 regions of the US, economic growth rates ranged from modest to moderate. It also became known that in many of the 12 regions wage growth accelerated to moderate rates, and employment growth was moderate compared to the previous several months, which indicates the preservation of unused labor resources. In addition, the report indicated an acceleration in consumer price growth. According to reports from most regions, inflation has accelerated from "modest" to moderate.

Most components of the DOW index finished trading in the red (18 out of 30). Outsider were shares of Exxon Mobil Corporation (XOM, -2.65%). The leader of growth was the shares of International Business Machines Corporation (IBM, + 1.71%).

Most S & P sectors recorded a decline. The largest drop was shown by the base materials sector (-0.9%). The technological sector grew most (+ 0.8%)

At closing:

Dow -0.33% 24,801.36 -82.76

Nasdaq + 0.33% 7.396.65 +24.64

S & P -0.05% 2,726.86 -1.26

U.S. stock-index futures fell on Wednesday, as the reports about the resignation of Trump's top economic adviser Gary Cohn, a supporter of free trade in the White House, provoked worries that the U.S. president may impose steep metal tariffs and trigger a global trade war.

Global Stocks:

Nikkei 21,252.72 -165.04 -0.77%

Hang Seng 30,196.92 -313.81 -1.03%

Shanghai 3,271.46 -18.18 -0.55%

S&P/ASX 5,902.00 -60.40 -1.01%

FTSE 7,160.63 +13.88 +0.19%

CAC 5,164.01 -6.22 -0.12%

DAX 12,170.50 +56.63 +0.47%

Crude $62.37 (-0.37%)

Gold $1,332.00 (-0.24%)

(company / ticker / price / change ($/%) / volume)

| Amazon.com Inc., NASDAQ | AMZN | 1,527.50 | -10.14(-0.66%) | 103173 |

| Google Inc. | GOOG | 1,089.01 | -6.05(-0.55%) | 6204 |

| 3M Co | MMM | 231.75 | -1.91(-0.82%) | 622 |

| ALCOA INC. | AA | 46.91 | -0.08(-0.17%) | 2914 |

| American Express Co | AXP | 94.98 | -1.09(-1.13%) | 933 |

| Apple Inc. | AAPL | 175.39 | -1.28(-0.72%) | 256591 |

| AT&T Inc | T | 36.69 | -0.18(-0.49%) | 10801 |

| Barrick Gold Corporation, NYSE | ABX | 11.8 | -0.04(-0.34%) | 10838 |

| Boeing Co | BA | 342.75 | -6.17(-1.77%) | 42267 |

| Caterpillar Inc | CAT | 150.5 | -3.25(-2.11%) | 17018 |

| Chevron Corp | CVX | 112.8 | -0.85(-0.75%) | 4668 |

| Cisco Systems Inc | CSCO | 43.91 | -0.38(-0.86%) | 25034 |

| Citigroup Inc., NYSE | C | 73.35 | -0.71(-0.96%) | 31727 |

| Deere & Company, NYSE | DE | 157.02 | -1.49(-0.94%) | 1164 |

| Exxon Mobil Corp | XOM | 75.36 | -0.82(-1.08%) | 52809 |

| Facebook, Inc. | FB | 178.5 | -1.28(-0.71%) | 97048 |

| Ford Motor Co. | F | 10.51 | -0.12(-1.13%) | 70147 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 18.43 | -0.27(-1.44%) | 4308 |

| General Electric Co | GE | 14.51 | -0.13(-0.89%) | 252184 |

| General Motors Company, NYSE | GM | 37.47 | -0.46(-1.21%) | 17257 |

| Goldman Sachs | GS | 263.7 | -3.23(-1.21%) | 13890 |

| Home Depot Inc | HD | 179.11 | -1.50(-0.83%) | 3822 |

| HONEYWELL INTERNATIONAL INC. | HON | 148 | -1.33(-0.89%) | 1102 |

| Intel Corp | INTC | 50.28 | -0.43(-0.85%) | 216767 |

| International Business Machines Co... | IBM | 154.76 | -0.96(-0.62%) | 2303 |

| International Paper Company | IP | 56.67 | -1.03(-1.79%) | 1085 |

| Johnson & Johnson | JNJ | 127.5 | -0.72(-0.56%) | 2110 |

| JPMorgan Chase and Co | JPM | 113.9 | -1.26(-1.09%) | 19107 |

| McDonald's Corp | MCD | 150.14 | -1.06(-0.70%) | 4022 |

| Merck & Co Inc | MRK | 54.03 | -0.27(-0.50%) | 4041 |

| Microsoft Corp | MSFT | 92.66 | -0.66(-0.71%) | 90035 |

| Nike | NKE | 64.4 | -0.84(-1.29%) | 1172 |

| Pfizer Inc | PFE | 35.66 | -0.22(-0.61%) | 4712 |

| Procter & Gamble Co | PG | 79.68 | -0.34(-0.42%) | 1567 |

| Starbucks Corporation, NASDAQ | SBUX | 56.6 | -0.43(-0.75%) | 6144 |

| Tesla Motors, Inc., NASDAQ | TSLA | 325.77 | -2.43(-0.74%) | 19889 |

| The Coca-Cola Co | KO | 43.75 | -0.18(-0.41%) | 5835 |

| Twitter, Inc., NYSE | TWTR | 33.93 | -0.50(-1.45%) | 108534 |

| United Technologies Corp | UTX | 129.91 | -1.70(-1.29%) | 1262 |

| UnitedHealth Group Inc | UNH | 224.2 | -1.98(-0.88%) | 845 |

| Verizon Communications Inc | VZ | 48.6 | -0.29(-0.59%) | 4259 |

| Visa | V | 119.9 | -1.16(-0.96%) | 6877 |

| Wal-Mart Stores Inc | WMT | 88.21 | -0.85(-0.95%) | 19965 |

| Walt Disney Co | DIS | 103.98 | -0.96(-0.91%) | 3194 |

| Yandex N.V., NASDAQ | YNDX | 42.1 | -0.56(-1.31%) | 14425 |

Int'l Paper (IP) downgraded to Market Perform from Outperform at BMO Capital Markets

Int'l Paper (IP) downgraded to Market Perform from Outperform at Wells Fargo

European stocks closed lower Wednesday, in line with losses in other global equity markets as investors start to price in the probability that the Federal Reserve will ramp up its pace in raising borrowing costs this year.

U.S. stocks closed lower in a volatile session Wednesday, reversing their earlier gains as Wall Street digested data that were seen as underlining the economy's robust health, although that same strength could warrant the Federal Reserve to turn more hawkish and increase corporate borrowing costs.

Asia-Pacific stocks began March by extending losses logged at the end of February - though markets in China were an exception ahead of annual legislative meetings. Thursday's early weakness in the region followed a second-straight late-session slide in the U.S., as investors weigh the likelihood of a faster pace of U.S. interest-rate rises and its likely effect on markets. The weakness also follows the worst monthly performance for most indexes in Asia-Pacific in two years.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.