- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 08-03-2018.

(index / closing price / change items /% change)

Nikkei +115.35 21368.07 +0.54%

TOPIX +5.99 1709.95 +0.35%

Hang Seng +457.60 30654.52 +1.52%

CSI 300 +40.95 4077.60 +1.01%

Euro Stoxx 50 +35.92 3413.28 +1.06%

FTSE 100 +45.40т7203.24 +0.63%

DAX +110.21 12355.57 +0.90%

CAC 40 +66.27 5254.10 +1.28%

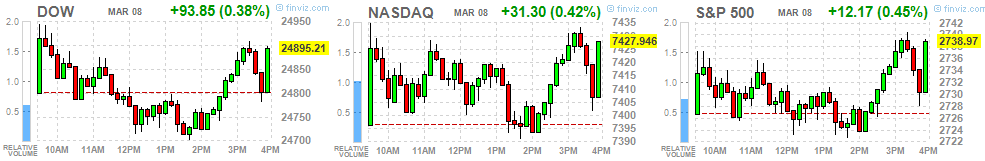

DJIA +93.85 24895.21 +0.38%

S&P 500 +12.17 2738.97 +0.45%

NASDAQ +31.30 7427.95 +0.42%

S&P/TSX +66.09 15538.70 +0.43%

The major stock indexes of the US ended the session above zero in anticipation of President Donald Trump's announcement of an increase in metal tariffs and amid fears that this move could trigger a global trade war.

According to the latest information, President Trump signed a decree on the introduction of tariffs for the import of metals. This decree sets a tariff of 25% for steel imports, 10% for aluminum imports, while Mexico and Canada do not fall under tariffs

The focus of attention of market participants was also data on the US labor market. The Ministry of Labor stated that the number of Americans applying for new unemployment benefits rose last week, retreating from the lowest level since 1969. Initial claims for unemployment benefits increased by 21,000 to 231,000, seasonally adjusted for the week to March 3. Economists were expecting 220,000 new applications. The four-week moving average, a more stable measure, increased by 2,000 to 222,500 people. But the number of repeated applications fell to 1,870,000 for the week to February 24.

The cost of oil declined markedly, and was on the way to a second consecutive weekly drop, due to the sharp strengthening of the dollar, as well as increased production and oil reserves in the US. The increase in crude oil reserves in the US, which was reported by the US Energy Ministry on the eve, was not as large as expected, given that reserves tend to grow by the end of winter, as refineries are carrying out maintenance. The US Energy Ministry reported that in the week of February 24 - March 2, oil reserves increased by 2.408 million barrels, to 425,906 million barrels. Expected to increase by 2.723 million barrels.

Most components of the DOW index recorded a rise (22 out of 30). The leader of growth was the shares of Johnson & Johnson (JNJ, + 1.80%). Outsider were the shares of International Business Machines Corporation (IBM, -1.50%).

Almost all sectors of S & P completed the auction in positive territory. The consumer goods sector grew most (+ 0.7%). The largest decline was in the commodity sector (-0.4%).

At closing:

Dow + 0.38% 24.895.21 +93.85

Nasdaq + 0.42% 7.427.95 +31.30

S & P + 0.45% 2.738.97 +12.17

U.S. stock-index futures rose on Thursday, as investors were encouraged by signs that President Donald Trump's planned steep import tariffs on steel and aluminum could exclude some key trading partners.

Global Stocks:

Nikkei 21,368.07 +115.35 +0.54%

Hang Seng 30,654.52 +457.60 +1.52%

Shanghai 3,289.29 +17.63 +0.54%

S&P/ASX 5,942.90 +40.90 +0.69%

FTSE 7,162.42 +4.58 +0.06%

CAC 5,219.33 +31.50 +0.61%

DAX 12,224.20 -21.16 -0.17%

Crude $61.23 (+0.13%)

Gold $1,325.80 (-0.14%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 231.75 | -1.91(-0.82%) | 622 |

| ALCOA INC. | AA | 46.91 | -0.08(-0.17%) | 2914 |

| Amazon.com Inc., NASDAQ | AMZN | 1,527.50 | -10.14(-0.66%) | 103173 |

| American Express Co | AXP | 94.98 | -1.09(-1.13%) | 933 |

| Apple Inc. | AAPL | 175.39 | -1.28(-0.72%) | 256591 |

| AT&T Inc | T | 36.69 | -0.18(-0.49%) | 10801 |

| Barrick Gold Corporation, NYSE | ABX | 11.8 | -0.04(-0.34%) | 10838 |

| Boeing Co | BA | 342.75 | -6.17(-1.77%) | 42267 |

| Caterpillar Inc | CAT | 150.5 | -3.25(-2.11%) | 17018 |

| Chevron Corp | CVX | 112.8 | -0.85(-0.75%) | 4668 |

| Cisco Systems Inc | CSCO | 43.91 | -0.38(-0.86%) | 25034 |

| Citigroup Inc., NYSE | C | 73.35 | -0.71(-0.96%) | 31727 |

| Deere & Company, NYSE | DE | 157.02 | -1.49(-0.94%) | 1164 |

| Exxon Mobil Corp | XOM | 75.36 | -0.82(-1.08%) | 52809 |

| Facebook, Inc. | FB | 178.5 | -1.28(-0.71%) | 97048 |

| Ford Motor Co. | F | 10.51 | -0.12(-1.13%) | 70147 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 18.43 | -0.27(-1.44%) | 4308 |

| General Electric Co | GE | 14.51 | -0.13(-0.89%) | 252184 |

| General Motors Company, NYSE | GM | 37.47 | -0.46(-1.21%) | 17257 |

| Goldman Sachs | GS | 263.7 | -3.23(-1.21%) | 13890 |

| Google Inc. | GOOG | 1,089.01 | -6.05(-0.55%) | 6204 |

| Home Depot Inc | HD | 179.11 | -1.50(-0.83%) | 3822 |

| HONEYWELL INTERNATIONAL INC. | HON | 148 | -1.33(-0.89%) | 1102 |

| Intel Corp | INTC | 50.28 | -0.43(-0.85%) | 216767 |

| International Business Machines Co... | IBM | 154.76 | -0.96(-0.62%) | 2303 |

| International Paper Company | IP | 56.67 | -1.03(-1.79%) | 1085 |

| Johnson & Johnson | JNJ | 127.5 | -0.72(-0.56%) | 2110 |

| JPMorgan Chase and Co | JPM | 113.9 | -1.26(-1.09%) | 19107 |

| McDonald's Corp | MCD | 150.14 | -1.06(-0.70%) | 4022 |

| Merck & Co Inc | MRK | 54.03 | -0.27(-0.50%) | 4041 |

| Microsoft Corp | MSFT | 92.66 | -0.66(-0.71%) | 90035 |

| Nike | NKE | 64.4 | -0.84(-1.29%) | 1172 |

| Pfizer Inc | PFE | 35.66 | -0.22(-0.61%) | 4712 |

| Procter & Gamble Co | PG | 79.68 | -0.34(-0.42%) | 1567 |

| Starbucks Corporation, NASDAQ | SBUX | 56.6 | -0.43(-0.75%) | 6144 |

| Tesla Motors, Inc., NASDAQ | TSLA | 325.77 | -2.43(-0.74%) | 19889 |

| The Coca-Cola Co | KO | 43.75 | -0.18(-0.41%) | 5835 |

| Twitter, Inc., NYSE | TWTR | 33.93 | -0.50(-1.45%) | 108534 |

| United Technologies Corp | UTX | 129.91 | -1.70(-1.29%) | 1262 |

| UnitedHealth Group Inc | UNH | 224.2 | -1.98(-0.88%) | 845 |

| Verizon Communications Inc | VZ | 48.6 | -0.29(-0.59%) | 4259 |

| Visa | V | 119.9 | -1.16(-0.96%) | 6877 |

| Wal-Mart Stores Inc | WMT | 88.21 | -0.85(-0.95%) | 19965 |

| Walt Disney Co | DIS | 103.98 | -0.96(-0.91%) | 3194 |

| Yandex N.V., NASDAQ | YNDX | 42.1 | -0.56(-1.31%) | 14425 |

UnitedHealth (UNH) initiated with a Overweight at Barclays; target $265

Tesla (TSLA) target lowered to $347 from $367 at Citigroup

Exxon Mobil (XOM) target lowered to $81 from $84 at Citigroup; Neutral

Asia-Pacific stocks rebounded solidly Thursday, as markets in the U.S. and Europe stabilized overnight following weakness sparked by top White House economic adviser Gary Cohn's resignation.

Stocks across Europe finished with gains Wednesday, though shares of metal producers were hit after the resignation of White House economic adviser Gary Cohn. The former Goldman Sachs executive was widely seen as a markets-friendly and stabilizing force in the Trump administration and his departure further stokes worries about the likelihood of a global trade war.

The S&P 500 index and the Dow Jones Industrial Average closed lower Wednesday as the resignation of top White House economic adviser Gary Cohn stoked fears of a trade war but the tech-laden Nasdaq bucked the trend to extend its winning streak to a fourth session.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.