- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 11-01-2012.

European stocks fell from a one-week high as Fitch Ratings said the European Central Bank must do more to prevent debt crisis from spreading and a report indicated the German economy is shrinking.

The Stoxx Europe 600 Index dropped 0.4 percent to 249.93 at the close of trading, after earlier climbing as much as 0.3 percent. The gauge has still advanced 2.2 percent this year as economic reports around the world added to optimism the global economy can withstand the euro area’s debt crisis.

S&P 500 1,290 -2.26 -0.17%, NASDAQ 2,706 +3.69 +0.14%, Dow 12,428 -34.06 -0.27%

Metro AG (MEO), Germany’s largest retailer, declined 3.3 percent to 28.36 euros after Benjamin Peters, an analyst at UBS AG, cut the stock to “sell” from “neutral.” The shares “will come under increasing pressure from earnings downgrades,” Peters wrote in a report.

Nestle SA, the world’s biggest food company, fell 1.7 percent to 53.85 Swiss francs after Bank of America Corp. downgraded the stock to “neutral” from “buy.”

Aryzta AG (ARYN), a Swiss supplier of bakery products to supermarkets and restaurants, tumbled 6.8 percent to 42.8 francs after it sold 4.25 million new shares at 41 francs each. That was the largest drop since April 2009 and the worst performance in the Stoxx 600 today.

Italian banks advanced today, with Banca Popolare di Milano Scarl (PMI) jumping 9.4 percent to 29.4 euro cents. Banca Monte dei Paschi di Siena SpA (BMPS) increased 8.1 percent to 21.3 euro cents. UniCredit SpA (UCG) gained 5.5 percent to 2.56 euros as the shares were raised to “outperform” from “underperform” by Sanford C. Bernstein & Co. analysts, who cited the stock’s “now attractive” valuation. The bank was also upgraded to “neutral” from “reduce” by WestLB

U.S. stocks fell, snapping a two-day advance for the Standard & Poor’s 500 Index, amid concern that Europe’s debt crisis will stifle global economic growth.

S&P 500 1,290 -2.26 -0.17%

NASDAQ 2,706 +3.69 +0.14%

Dow 12,428 -34.06 -0.27%

Leading the Dow's decliners were energy and consumer-staple stocks. Coca-Cola dropped 2.1% and Chevron lost 1%. Telecommunications and materials limited some of the losses. Verizon Communications rose 1% and AT&T added 0.5%.In corporate news, Urban Outfitters plunged 18% after the apparel retailer said its chief executive officer, Glen Senk, has resigned to pursue another opportunity. He will be succeeded as CEO by Richard Hayne, currently the company's chairman.

Supervalu sank 11% after the supermarket operator's third-quarter loss widened on larger writedowns and weaker sales. Revenue fell short of expectations and the company cut its sales view for the current year.

Lennar jumped 8% after the homebuilder reported better-than-expected revenue, offsetting earnings that fell shy of estimates.

Resistance 2:1300 (psychological level)

Resistance 2:1290/92 (area of October and Jan 10 highs)

Resistance 1:1287 (session high)

Current price: 1285,25

Resistance 1:1279 (area of Jan 6 high, session low and support line from Dec 28)

Support 2 : 1267 (Jan 6-9 low)

Support 3 : 1260 (Jan 5 low)

U.S. stock futures fell as Microsoft Corp. (MSFT) declined and amid concern that Europe’s debt crisis will stifle global economic growth.

Shares of MSFT fell after saying that industrywide sales of personal computers will probably be lower than analysts projected.

Global stocks:

Nikkei 8,448 +25.62 +0.30%

Hang Seng 19,152 +147.66 +0.78%

Shanghai Composite 2,276 -9.70 -0.42%

FTSE 5,664 -32.92 -0.58%

CAC 3,202 -9.06 -0.28%

DAX 6,151 -11.80 -0.19%

Crude oil: $101.47 (-0,8%).

Gold: $1640.40 (+0,6%).

Asian stock markets were mixed Wednesday, with resources plays rising sharply in Sydney on strong copper imports from China, though exporters in Seoul and Tokyo pulled back as sentiment remained fragile amid continued caution over the euro-zone debt crisis.

Nikkei 225 8,448 +25.62 +0.30%

Hang Seng 19,158 +154.16 +0.81%

S&P/ASX 200 4,188 +35.29 +0.85%

Shanghai Composite 2,276 -9.70 -0.42%

James Hardie Industries SE (JHX), a maker of building materials that gets most of its sales in the U.S., climbed 3 percent in Sydney. AU Optronics Corp. (2409), a supplier of liquid-crystal displays to Nokia Oyj and Dell Inc., gained 4.4 percent in Taipei. China Unicom (Hong Kong) Ltd. fell 3.7 percent amid concern competition will increase among mainland telecoms.

James Hardie rose 3 percent to A$7.12 in Sydney. LG Display Co. (034220), the world’s second-largest LCD maker by sales, gained 2.7 percent to 26,800 won in Seoul.

Asian stocks rose on stronger U.S. economic reports.

Exporters rose as consumer borrowing in the U.S. surged by the most in 10 years, indicating households are optimistic enough to take on debt and banks are more willing to lend.

Honda increased 1.4%. Hyundai Motor Co., South Korea’s largest automaker, advanced 2.3%. Samsung Electronics Co., the world’s second-biggest maker of mobile phones by sales, added 1%.

Olympus Corp. surged 20% after the Nikkei reported the scandal-hit camera maker will likely retain its listing on the Tokyo Stock Exchange and as the company took legal action against executives over a $1.7 billion accounting fraud.

European stocks rose as mining companies rallied after Alcoa Inc. (AA) kicked off the U.S. earnings season with results that met analysts estimates.

BHP Billiton Ltd. (BHP) climbed more than 3% as copper rebounded from a one-week low on record monthly imports of the metal in China.

European stocks retreated yesterday, trimming three weeks of gains for the Stoxx 600, as a meeting between German Chancellor Angela Merkel and French President Nicolas Sarkozy failed to ease concern that euro-leaders will fail to do enough to resolve the sovereign-debt crisis.

The European stocks gained before Merkel and the International Monetary Fund’s managing director Christine Lagarde meet in Berlin.

A gauge of bank shares rose 3.6%. Commerzbank AG surged 4.8%, UniCredit SpA soared 6%.

US stocks rose amid bets that China may act to spur economic growth.

Stocks rose as a drop in China’s import growth bolstered forecasts for monetary easing. German Chancellor Angela Merkel and International Monetary Fund Managing Director Christine Lagarde were scheduled to meet in Berlin as pressure grows to complete a Greek debt swap needed to put a rescue plan in place.

US stocks pared gains as Alcoa Inc. (AA), the largest U.S. aluminum producer, tumbled from today’s peak.

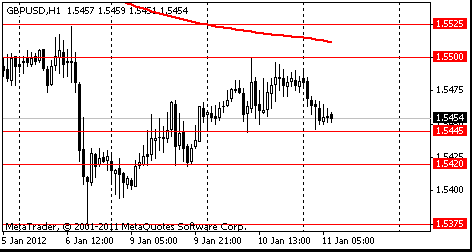

Resistance 3 : $1.5560 (61.8% FIBO $1.5670-$1.5375)

Resistance 2 : $1.5525 (50.0% FIBO $1.5670-$1.5375, Jan 6 high)

Resistance 1 : $1.5500 (Jan 10 high)

The current price: $1.5454

Support 1 : $1.5445 (Jan 10 low)

Support 2 : $1.5420 (low of the American session on Jan 9)

Support 3 : $1.5375/60 (area of Dec low and Jan 6 low)

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.