- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 13-01-2012.

Stocks tumbled as a European government official said France is among several euro-area countries facing downgrades by S&P in the review, which is due at 20:00 GMT. Germany, Europe’s biggest economy, will retain its AAA rating in a review of euro-area countries’ credit grades by S&P, the official said on condition of anonymity because the announcement has yet to be made.

Concern about potential downgrades overshadowed data showing that confidence among U.S. consumers rose more than forecast in January to the highest level in eight months, a sign household spending may hold up early this year. Separate figures showed that the U.S. trade deficit widened more than forecast in November as American exports declined and companies stepped up imports of crude oil and automobiles.

All groups in the S&P 500 declined as financial, industrial and commodity gauges slid at least 1%. JPMorgan, the largest U.S. bank by assets, fell 3.8%. Bank of America Corp. (BAC), Morgan Stanley and Citigroup Inc. retreated at least 2.%.

Resistance 3:1286 (61,8 % FIBO of today's falling)

Resistance 2:1283 (50,0 % FIBO of today's falling)

Resistance 1:1280 (38.2 % FIBO of today's falling, Jan 12 low)

Current price: 1276,50

Support 1:1272 (session low)

Support 2 : 1267 (Jan 6-9 lows)

Support 3 : 1260 (Jan 5 low)

The trade deficit in the U.S. widened in November for the first time in five months as oil imports rose.

Separately, the Thomson Reuters-University of Michigan preliminary index of consumer sentiment in January increased to 71.5 from 69.9 at the end of December, according to the median forecast before the report at 14:55 GMT.

Global stocks:

Nikkei 8,500 +114.43 +1.36%Hang Seng 19,204 +109.04 +0.57%

Shanghai Composite 2,245 -30.43 -1.34%

FTSE 5,641 -21.51 -0.38%

CAC 3,223 +22.67 +0.71%

DAX 6,187 +8.02 +0.13%

Crude oil: $98.71 (-0,4%).

Gold: $1639.00 (-0,5%).

European (SXXP) stocks climbed, with the benchmark Stoxx Europe 600 Index headed for its fourth weekly advance, as Italy prepares to sell more debt. U.S. index futures were little changed, while Asian shares rose.

FTSE 100 5,693 +30.19 +0.53%

CAC 40 3,240 +40.01 +1.25%

Xetra DAX 6,233 +54.11 +0.88%

Commerzbank jumped 6.1 percent after German newspaper Handelsblatt reported that the lender will raise its capital levels without seeking government aid. GN Store Nord A/S (GN), a Danish maker of hearing aids and headsets, rallied 13 percent after one of its units won a settlement from Telekomunikacja Polska SA (TPS) over a dispute in Poland. Invensys Plc (ISYS) slumped the most in almost nine years after revealing 60 million pounds ($92 million) in additional costs.

Asian stocks rose, with a regional benchmark index poised for its longest streak of weekly advances in a year, as lower Italian and Spanish borrowing costs added to optimism Europe’s debt crisis may be contained.

Nikkei 225 8,500 +114.43 +1.36%

Hang Seng 19,177 +81.39 +0.43%

S&P/ASX 200 4,196 +14.89 +0.36%

Shanghai Composite 2,245 -30.43 -1.34%

Canon Inc. (7751), a camera maker that gets a third of its sales in Europe, climbed 3.1 percent in Tokyo. JGC Corp. (1963), Japan’s biggest building of industrial facilities by sales, jumped 3.9 percent after its venture won a $15 billion contract to build a liquefied natural gas facility in Australia. Belle International Holdings Ltd., China’s biggest shoe retailer, plunged 7.6 percent after reporting slower sales growth.

Japanese stocks fell as weaker exports and a shrinking German economy added to concern the global economy is slowing.

Germany’s gross domestic product contracted about 0.25 percent in the fourth quarter from the previous three months, the government said yesterday, adding to signs Europe’s largest economy may be on the brink of recession.

Canon Inc., a camera maker that gets a third of its revenue in Europe, fell 0.9% after a report Japan’s trade surplus narrowed on a stronger yen and weak overseas demand.

Brokerages led declines after Nomura Holdings Inc. said individual investors are buying fewer stocks.

Komatsu Ltd., a construction machinery maker that relies on China for 23% of its sales, rose 2.7% after slowing mainland inflation raised expectations the government will take action to encourage growth.

European stocks declined after reports that showed U.S. retail sales and initial jobless claims missed economists’ forecasts outweighed lower borrowing costs at Spanish and Italian debt auctions.

Spain auctioned 9.98 billion euros ($12.7 billion) of bonds maturing in 2015 and 2016, including a new three-year benchmark security, twice the maximum target of 5 billion euros set for the sale. The yield on the three-year notes was 3.384 percent, compared with 5.187 percent when the nation sold similar notes in December.

Italy sold 12 billion euros of Treasury bills, meeting its target, and its borrowing costs plunged. The Rome-based Treasury sold 8.5 billion euros one-year bills at a rate of 2.735 percent, down from 5.952 percent at the last auction.

The European Central Bank kept the benchmark interest rate at a record low of 1%, as predicted.

Tesco Plc dropped 16%, leading retail shares lower, after the U.K.’s largest supermarket chain said it was “disappointed” with holiday sales.

Delhaize dropped 11%. The owner of Food Lion supermarkets plans to cut about 5,000 positions and expects a 2.4 percent drop in revenue as it closes stores in the U.S. and Europe. Costs related to the closures will hurt earnings by about 205 million euros starting in the first quarter, the Brussels-based company said.

Vestas lost 7.1%. The biggest wind- turbine maker said it’s cutting 2,335 jobs worldwide and a further 1,600 posts are at risk in the U.S. this year as a tax credit expires.

RBS advanced 5.6%. Britain’s biggest government-owned lender will cut 3,500 jobs at its investment bank over the next three years as it exits its unprofitable cash equities and mergers advisory operations.

UniCredit (UCG) SpA climbed 14%. The stock was raised to “buy” from “neutral” at Citigroup Inc., which said the stock would suit a high-risk investment strategy as it offers significant “upside potential.”

U.S. stocks rose as a drop in borrowing costs at debt auctions in Europe overshadowed disappointing data on American jobless claims and retail sales.

Stocks rose as Spain sold 10 billion euros ($13 billion) of bonds, twice the target for the sale, while Italy sold 12 billion euros of bills, easing concerns the countries would struggle to finance their debts. European Central Bank President Mario Draghi said the bank has averted a serious credit shortage and there are signs the economy is stabilizing.

Stocks fell earlier as jobless claims climbed by 24,000 to 399,000 in the week ended Jan. 7, compared with a median estimate of 370,000. U.S. retail sales rose 0.1% in December cs cons. +0.3%.

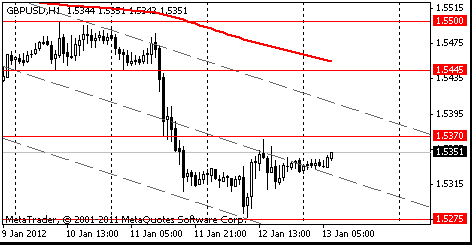

Resistance 3 : $1.5500 (Jan 10 high)

Resistance 2 : $1.5445 (MA (233) H1)

Resistance 1 : $1.5370 (Jan 12 high)

The current price: $1.5351

Support 1 : $1.5275 (Jan 12 low)

Support 2 : $1.5200 (psychological level)

Support 3 : $1.5125 (Jul 21 low)

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.