- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 12-01-2012.

European stocks declined after reports that showed U.S. retail sales and initial jobless claims missed economists’ forecasts outweighed lower borrowing costs at Spanish and Italian debt auctions. The Stoxx Europe 600 Index fell 0.2 percent to 249.50 at the close in London. The gauge had earlier advanced as much as 0.9 percent after Spain and Italy sold debt, raising their targeted amounts at lower yields. Tesco Plc dropped 16 percent, leading retail shares lower, after the U.K.’s largest supermarket chain said it was “disappointed” with holiday sales.

FTSE 100 5,662 -8.40 -0.15%, CAC 40 3,200 -4.85 -0.15%, Xetra DAX 6,179 +26.87 +0.44%

UniCredit (UCG) SpA climbed 14 percent to 2.90 euros. The stock was raised to “buy” from “neutral” at Citigroup Inc., which said the stock would suit a high-risk investment strategy as it offers significant “upside potential.”

Sulzer jumped 5.1 percent to 112.50 Swiss francs. The company said 2011 orders rose 14 percent, or 8.4 percent nominally, to 3.6 billion francs ($3.8 billion).

Petroplus Holdings AG surged 16 percent to 1.39 francs, the most since November 2006. Europe’s largest independent refiner has reached a temporary agreement with lenders to renegotiate its debts and maintain operations at its Coryton and Ingolstadt refineries.

Solar shares gained after a government body said China plans to double solar capacity this year. The head of China’s National Energy Administration, Liu Tienan, said yesterday that the country will install 3 gigawatts in 2012.

Wacker Chemie AG (WCH), the second-biggest maker of solar-grade silicon, advanced 6 percent to 78 euros. Solarworld AG (SWV), Germany’s largest solar-panel maker, rose 10.4 percent to 3.96 euros.

S&P 500 1,292 -0.72 -0.06%, NASDAQ 2,715 +4.38 +0.16%, Dow 12,432 -17.48 -0.14%

Stocks fell as data showed that more Americans than forecast filed applications for unemployment benefits last week, raising the possibility that a greater-than-usual increase in temporary holiday hiring boosted December payrolls. Sales at U.S. retailers in December rose less than forecast, restrained by cheaper fuel prices and holiday discounting that helped hold down the value of goods sold.Chevron Corp. (CVX) slid 2.5 percent after oil-refining profit at the energy company slumped. Bank of America Corp. (BAC) reversed an earlier rally as a 2.3 percent decline helped drag financial shares lower. Sears Holdings (SHLD) Corp. sank 4.2 percent after vendor loans are said to be halted by CIT Group Inc. Dow Chemical Co. rose 2.4 percent as the European Union removed tariffs against the U.S. on a chemical used in paints and paper coatings.

Oil climbed on concern that a strike in Nigeria will curb supplies and European Central Bank President Mario Draghi said there are some signs the euro-area economy is stabilizing.

Currently Light Sweet Crude Oil futeres are trading at $102,11 per barrel (+1,2%).

Resistance 3:1310 (Aug'2010 high)

Resistance 2:1300 (psychological level)

Resistance 1:1297 (session high)

Current price: 1283,75

Resistance 1:1283 (support line from Dec 28)

Resistance 2:1279 (area of Jan 6 high, Jan 11 low)

Support 3 : 1267 (Jan 6-9 lows)

U.S. stock futures trimmed gains after government data showed retail sales trailed projections and jobless claims increased more than forecast, damping optimism in the economic outlook.

Jobless claims climbed to 399К in the week ended Jan. 7. The median forecast of economists projected 375,000. Retail sales climbed 0.1% in December. Economists forecast a 0.3%.

U.S. futures followed European shares higher earlier today as Spain sold 10 billion euros ($13 billion) of bonds, twice the target for the sale, while Italy sold 12 billion euros of bills, easing concerns the countries would struggle to finance their debts. The European Central Bank held interest rates steady after two straight cuts as signs of respite from the sovereign debt crisis gave it scope to pause.

Global Stocks:

Nikkei 8,386 -62.29 -0.74%

Hang Seng 19,095 -56.56 -0.30%

Shanghai Composite 2,275 -1.04 -0.05%

FTSE 5,669 -2.21 -0.04%

CAC 3,225 +20.20 +0.63%

DAX 6,209 +56.37 +0.92%

Crude oil: $101.48 (+0,6%).

Gold: $1654.70 (+0,9%).

Asian stock markets were mostly lower Thursday, amid inflation data in China that failed to meet expectations and fears of a possible recession in Europe. Data released Thursday showed China's inflation eased slightly in December to 4.1 percent, from November's 4.2 percent. But analysts had hoped to see more improvement.

Nikkei 225 8,386 -62.29 -0.74%

Hang Seng 19,087 -64.96 -0.34%

S&P/ASX 200 4,181 -6.53 -0.16%

Shanghai Composite 2,275 -1.04 -0.05%

Olympus rose 2.27 per cent to 1,258 yen following an Asahi Shimbun report that it was planning a capital tie-up with firms that could include Panasonic, Sony, Fujifilm and South Korea's Samsung Electronics.

The company said no decision has been made. The report was seen as positive for Olympus's share price as such a tie-up meant the company was more likely to be able to remain listed, said an analyst at a Japanese brokerage.

Panasonic Corp., a maker of home appliances, slid 2.5 percent to 628 yen. A Panasonic official said on Thursday: "We are not considering a capital tie-up at this point." Panasonic's comment has failed to extinguish talk in Japan that it might yet take a stake in Olympus, once the disgraced firm has finally put the accounting scandal behind it. Panasonic President Fumio Ohtsubo, also speaking at the Las Vegas event earlier this week, had said: "The situation is unclear, so we aren't doing anything at this time."

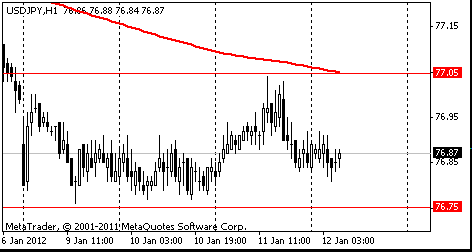

Resistance 3: Y77.60 (61.8% FIBO Y78.20-Y76.60)

Resistance 2: Y77.35/40 (Jan 6 high, 50.0% FIBO Y78.20-Y76.60)

Resistance 1: Y77.05 (Jan 11 high, MA(233) H1)

The current price: Y76.91

Support 1:Y76.75 (Jan 9 low)

Support 2:Y76.55 (Nov 18 low)

Support 3:Y76.10 (Sep 22 low)

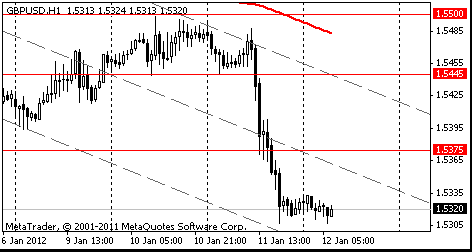

Resistance 3 : $1.5500 (Jan 10 high)

Resistance 2 : $1.5445 (resistance line from Jan 4)

Resistance 1 : $1.5375 (middle line from Jan 4)

The current price: $1.5320

Support 1 : $1.5270 (Oct 6 low)

Support 2 : $1.5200 (psychological level)

Support 3 : $1.5125 (Jul 21 low)

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.