- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 16-02-2018.

The main US stock indexes mostly rose, supported by the increase in shares of the utilities sector and the health sector.

In the focus of attention of market participants were also statistics on the US, which exceeded expectations. As it became known, in January, the bookmarks of new homes in the US rose sharply, which could lead to economic growth and slow down the growth of house prices. The number of bookings of new homes increased by 9.7% compared to a month earlier to an annual value of 1.326 million units, the Ministry of Commerce said on Friday. This marked the third growth in four months. Construction companies are also planning to increase construction later this year. The number of building permits increased by 7.4%, to an annual rate of 1.396 million units.

However, preliminary research results submitted by Thomson-Reuters and the Michigan Institute showed that the mood sensor among American consumers grew in February despite the average forecasts of experts. According to the data, in February, the consumer sentiment index rose to 99.9 points compared to the final reading for January at 95.7 points. According to average estimates, the index had to fall to the level of 95.5 points.

Most components of the DOW index recorded a rise (20 out of 30). Leader of growth were the shares of Pfizer Inc. (PFE, + 1.93%). Outsider were shares of Caterpillar Inc. (CAT, -1.95%).

Almost all sectors of S & P completed the auction in positive territory. The utilities sector grew most (+ 0.8%). The decrease was demonstrated only by the base materials sector (-0.3%).

At closing:

Dow + 0.08% 25.219.38 +19.01

Nasdaq -0.23% 7.239.46 -16.97

S & P + 0.04% 2.732.22 +1.02

U.S. stock-index futures were flat on Friday, following a rally that lasted five straight days as investors shrug off inflation fears and focus on growth in the economy and corporate profits.

Global Stocks:

Nikkei 21,720.25 +255.27 +1.19%

Hang Seng -

Shanghai -

S&P/ASX 5,904.00 -5.00 -0.08%

FTSE 7,287.83 +53.02 +0.73%

CAC 5,273.59 +51.07 +0.98%

DAX 12,411.72 +65.55 +0.53%

Crude $61.45 (+0.18%)

Gold $1,358.00 (+0.20%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 234.26 | -0.61(-0.26%) | 507 |

| ALTRIA GROUP INC. | MO | 65.4 | 0.08(0.12%) | 633 |

| Amazon.com Inc., NASDAQ | AMZN | 1,456.60 | -5.16(-0.35%) | 62481 |

| American Express Co | AXP | 96.78 | 0.22(0.23%) | 275 |

| Apple Inc. | AAPL | 172.46 | -0.53(-0.31%) | 342914 |

| Barrick Gold Corporation, NYSE | ABX | 13.3 | -0.04(-0.30%) | 11722 |

| Boeing Co | BA | 357.35 | 0.89(0.25%) | 17267 |

| Caterpillar Inc | CAT | 160.5 | 0.52(0.33%) | 3216 |

| Chevron Corp | CVX | 113 | 0.47(0.42%) | 688 |

| Citigroup Inc., NYSE | C | 77.17 | 0.09(0.12%) | 11670 |

| Deere & Company, NYSE | DE | 168.19 | 1.38(0.83%) | 117872 |

| Exxon Mobil Corp | XOM | 76.15 | -0.06(-0.08%) | 5160 |

| Facebook, Inc. | FB | 179.95 | -0.01(-0.01%) | 83196 |

| Ford Motor Co. | F | 10.78 | 0.02(0.19%) | 66345 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.15 | 0.03(0.16%) | 1301 |

| General Motors Company, NYSE | GM | 41.87 | 0.02(0.05%) | 2278 |

| Goldman Sachs | GS | 267.81 | 0.13(0.05%) | 1990 |

| Google Inc. | GOOG | 1,090.01 | 0.49(0.05%) | 7839 |

| Hewlett-Packard Co. | HPQ | 21.69 | 0.24(1.12%) | 2111 |

| Home Depot Inc | HD | 185.31 | 0.04(0.02%) | 7843 |

| Intel Corp | INTC | 45.91 | -0.01(-0.02%) | 42884 |

| International Business Machines Co... | IBM | 155.32 | -0.69(-0.44%) | 1159 |

| Johnson & Johnson | JNJ | 131.5 | 0.27(0.21%) | 3108 |

| JPMorgan Chase and Co | JPM | 115.46 | -0.05(-0.04%) | 5883 |

| McDonald's Corp | MCD | 159.85 | -0.93(-0.58%) | 19066 |

| Merck & Co Inc | MRK | 56.42 | 0.43(0.77%) | 287 |

| Microsoft Corp | MSFT | 92.6 | -0.06(-0.06%) | 94240 |

| Nike | NKE | 67.99 | -0.30(-0.44%) | 3811 |

| Procter & Gamble Co | PG | 82.51 | 0.10(0.12%) | 3307 |

| Starbucks Corporation, NASDAQ | SBUX | 56.79 | 0.21(0.37%) | 3474 |

| Tesla Motors, Inc., NASDAQ | TSLA | 332.65 | -1.42(-0.42%) | 13997 |

| The Coca-Cola Co | KO | 45.71 | 0.93(2.08%) | 155634 |

| Twitter, Inc., NYSE | TWTR | 33.45 | -0.16(-0.48%) | 65181 |

| Verizon Communications Inc | VZ | 49.76 | 0.02(0.04%) | 3710 |

| Visa | V | 122.31 | 0.03(0.02%) | 1524 |

| Wal-Mart Stores Inc | WMT | 103.45 | 0.22(0.21%) | 11661 |

| Walt Disney Co | DIS | 105.5 | 0.32(0.30%) | 3056 |

| Yandex N.V., NASDAQ | YNDX | 41.1 | -0.86(-2.05%) | 4650 |

Apple (AAPL) resumed with a Mkt Perform at Raymond James

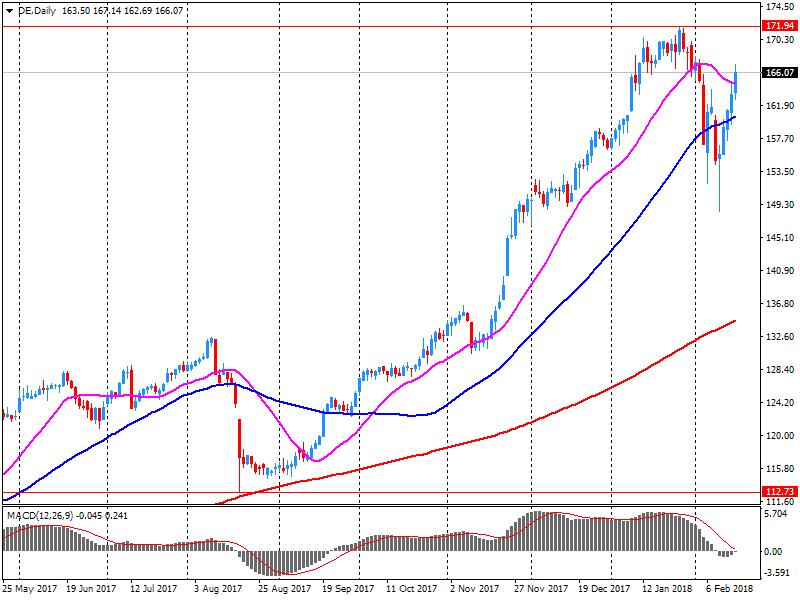

Deere (DE) reported Q1 FY 2018 earnings of $1.31 per share (versus $0.61 in Q1 FY 2017), beating analysts' consensus estimate of $1.20.

The company's quarterly revenues amounted to $5.974 bln (-6.7% y/y), missing analysts' consensus estimate of $6.405 bln.

The company issued upside guidance for Q2, projecting Q2 revenues of +30-40% to ~$9.44-10.16 bln (versus analysts' consensus estimate of $9.11 bln). It also raised guidance for FY2018, projecting FY2018 revenues of +29% from +22% to ~$33.39 bln (versus analysts' consensus estimate of $32.25 bln ).

DE rose to $169.30 (+1.49%) in pre-market trading.

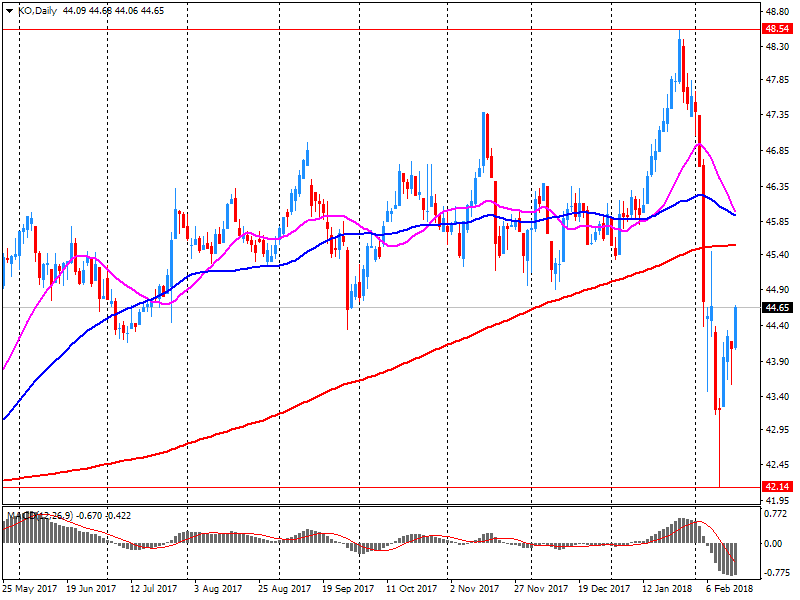

Coca-Cola (KO) reported Q4 FY 2017 earnings of $0.39 per share (versus $0.37 in Q4 FY 2016), beating analysts' consensus estimate of $0.38.

The company's quarterly revenues amounted to $7.512 bln (-20.2% y/y), beating analysts' consensus estimate of $7.361 bln.

The company issued upside guidance for FY2018, projecting EPS +8-10% to $2.06-2.10 (versus analysts' consensus estimate of $1.99) and 4% growth in organic revenues.

KO rose to $46.06 (+2.86%) in pre-market trading.

European stocks on Thursday ended higher, with Airbus SE shares soaring after a well-received financial update, as traders appeared to regain their appetite for riskier assets. Meanwhile, weakness in the dollar was encouraging investors to load up on commodity-related shares.

U.S. stocks on Tuesday finished in the green, marking a third consecutive gain for equity gauges, ahead of a key inflation reading, even as shades of last week's brutal selling lingered.

Stocks in Japan, Australia and New Zealand gained Friday, while a number of major markets were closed for the Lunar New Year holiday, as investors regained confidence in equities after sharp slides last week.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.