- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 20-02-2018.

(index / closing price / change items /% change)

Nikkei -224.11 21925.10 -1.01%

TOPIX -12.70 1762.45 -0.72%

Euro Stoxx 50 +27.29 3435.08 +0.80 %

FTSE 100 -0.89 7246.77 -0.01%

DAX +102.30 12487.90 +0.83%

CAC 40 +33.68 5289.86 +0.64%

DJIA -254.63 24964.75 -1.01%

S&P 500 -15.96 2716.26 -0.58%

NASDAQ -5.16 7234.31 -0.07%

S&P/TSX -13.20 15439.44 -0.09%

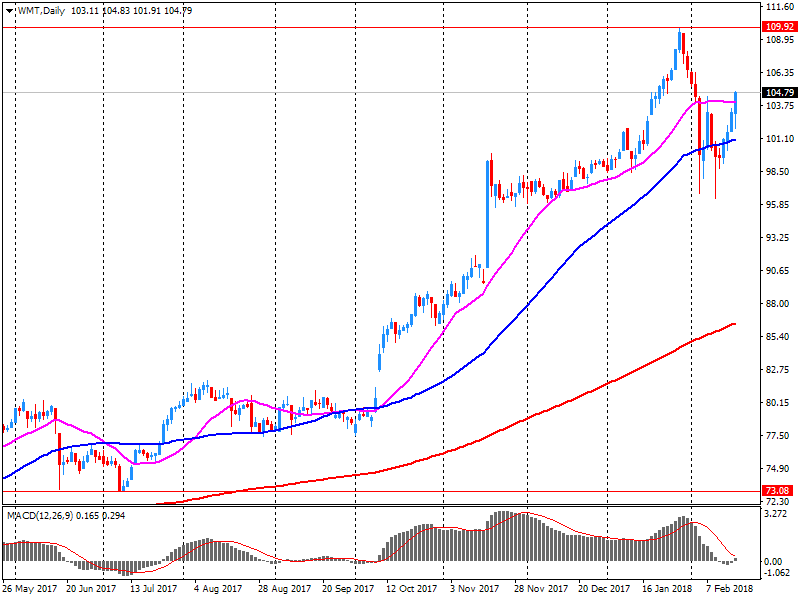

Major US stock indexes finished trading in negative territory, suffering from the collapse of Walmart shares (WMT) and a noticeable decline in quotations of the health sector.

So, Wal-Mart reported receiving in the last reporting period a profit of $ 1.33 per share, which was $ 0.04 below the average forecast of analysts, and revenues of $ 135.15 billion (+4.2 % y / y), which slightly surpassed the average market forecast. At the same time, the forecast announced by it showed that in the fiscal year 2019 (FY) the company expects to earn profits at the level of $ 4.75-5.00 per share, which is below the average forecast of analysts $ 5.08. Wal-Mart also decided to increase the annual dividend payout for 2019 FY in the amount of $ 2.08 / share, which is 2% more than $ 2.04 / share paid for the last financial year. WMT shares in the premarket fell by 7.2%.

Brent crude oil prices declined on Tuesday amid a stronger US dollar and partial profit-taking, while WTI rose slightly, resulting in a discount between two key futures contracts reaching a six-month low.

Most components of the DOW index recorded a decline (25 out of 30). Outsider were shares Walmart Inc. (WMT, -10.11%). The leader of growth was shares of Intel Corporation (INTC, + 1.70%).

Almost all sectors of S & P finished trading in the red. The health sector showed the greatest decline (-1.1%). Only the technological sector grew (+ 0.2%).

At closing:

Dow -1.01% 24,964.75 -254.63

Nasdaq -0.07% 7,234.31 -5.16

S & P -0.58% 2,716.26 -15.96

U.S. stock-index futures dropped on Tuesday, as a rise in bond yields and frustrating quarterly results and guidance from Walmart (WMT) halted a six-day winning streak for the major indexes.

Global Stocks:

Nikkei 21,925.10 -224.11 -1.01%

Hang Seng 30,873.63 -241.80 -0.78%

Shanghai -

S&P/ASX 5,940.90 -0.70 -0.01%

FTSE 7,228.65 -19.01 -0.26%

CAC 5,266.58 +10.40 +0.20%

DAX 12,407.69 +22.09 +0.18%

Crude $61.83 (+0.45%)

Gold $1,342.00 (-1.05%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 235 | -1.67(-0.71%) | 704 |

| ALCOA INC. | AA | 46.76 | -0.60(-1.27%) | 4691 |

| ALTRIA GROUP INC. | MO | 65.4 | -0.06(-0.09%) | 1215 |

| Amazon.com Inc., NASDAQ | AMZN | 1,446.09 | -2.60(-0.18%) | 44529 |

| American Express Co | AXP | 96.16 | -0.63(-0.65%) | 218 |

| AMERICAN INTERNATIONAL GROUP | AIG | 59.88 | 0.41(0.69%) | 1165 |

| Apple Inc. | AAPL | 172.1 | -0.33(-0.19%) | 345569 |

| AT&T Inc | T | 37.1 | -0.04(-0.11%) | 3666 |

| Barrick Gold Corporation, NYSE | ABX | 13.03 | -0.15(-1.14%) | 69942 |

| Boeing Co | BA | 353.1 | -1.94(-0.55%) | 20653 |

| Caterpillar Inc | CAT | 155.6 | -0.69(-0.44%) | 6904 |

| Chevron Corp | CVX | 111.95 | -0.19(-0.17%) | 1669 |

| Cisco Systems Inc | CSCO | 44.14 | -0.19(-0.43%) | 23454 |

| Citigroup Inc., NYSE | C | 76.35 | -0.47(-0.61%) | 4373 |

| Deere & Company, NYSE | DE | 168.2 | -1.24(-0.73%) | 2261 |

| Exxon Mobil Corp | XOM | 76.16 | -0.38(-0.50%) | 35007 |

| Facebook, Inc. | FB | 176.69 | -0.67(-0.38%) | 71997 |

| Ford Motor Co. | F | 10.59 | -0.02(-0.19%) | 18945 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 18.45 | -0.28(-1.49%) | 15561 |

| General Electric Co | GE | 14.97 | -0.08(-0.53%) | 101757 |

| General Motors Company, NYSE | GM | 40.92 | -0.17(-0.41%) | 10290 |

| Hewlett-Packard Co. | HPQ | 21.2 | -0.20(-0.93%) | 920 |

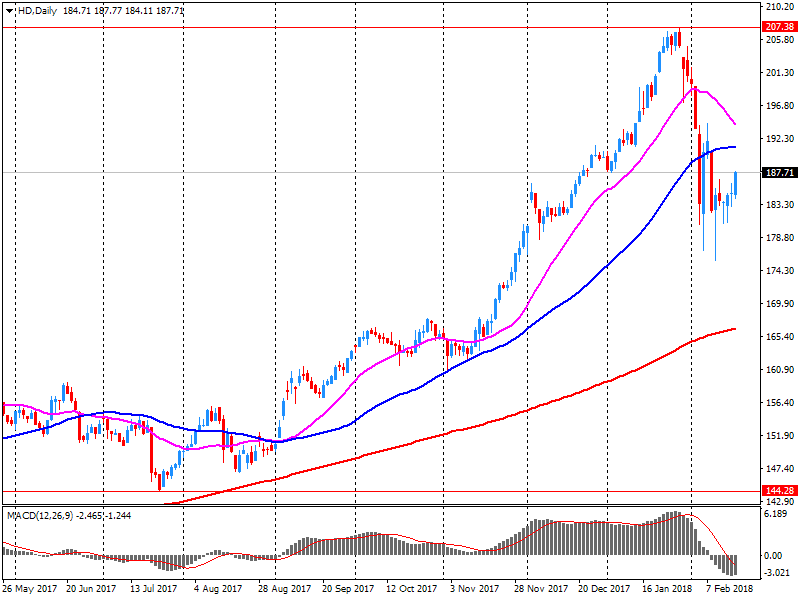

| Home Depot Inc | HD | 192.02 | 5.05(2.70%) | 140674 |

| HONEYWELL INTERNATIONAL INC. | HON | 154.48 | 0.45(0.29%) | 571 |

| Intel Corp | INTC | 45.38 | -0.18(-0.40%) | 59548 |

| International Business Machines Co... | IBM | 155.7 | -0.48(-0.31%) | 5136 |

| Johnson & Johnson | JNJ | 133.27 | 0.12(0.09%) | 4853 |

| JPMorgan Chase and Co | JPM | 114.35 | -0.33(-0.29%) | 4785 |

| McDonald's Corp | MCD | 157.2 | -0.59(-0.37%) | 2513 |

| Merck & Co Inc | MRK | 56.1 | -0.19(-0.34%) | 3488 |

| Microsoft Corp | MSFT | 91.5 | -0.50(-0.54%) | 31622 |

| Nike | NKE | 67.81 | -0.49(-0.72%) | 2391 |

| Pfizer Inc | PFE | 36.24 | -0.02(-0.06%) | 3823 |

| Procter & Gamble Co | PG | 82.16 | -0.44(-0.53%) | 2113 |

| Starbucks Corporation, NASDAQ | SBUX | 56.24 | -0.24(-0.42%) | 444 |

| Tesla Motors, Inc., NASDAQ | TSLA | 334.29 | -1.20(-0.36%) | 19701 |

| The Coca-Cola Co | KO | 44.95 | -0.03(-0.07%) | 2801 |

| Twitter, Inc., NYSE | TWTR | 32.77 | -0.29(-0.88%) | 46061 |

| United Technologies Corp | UTX | 129 | -0.26(-0.20%) | 662 |

| Verizon Communications Inc | VZ | 50.05 | -0.10(-0.20%) | 996 |

| Visa | V | 121.63 | -0.22(-0.18%) | 3067 |

| Wal-Mart Stores Inc | WMT | 96.66 | -8.12(-7.75%) | 1051184 |

| Walt Disney Co | DIS | 106.59 | 0.06(0.06%) | 9340 |

| Yandex N.V., NASDAQ | YNDX | 42.15 | 0.05(0.12%) | 8015 |

Home Depot (HD) reported Q4 FY 2018 earnings of $1.69 per share (versus $1.44 in Q4 FY 2017), beating analysts' consensus estimate of $1.64.

The company's quarterly revenues amounted to $23.883 bln (+7.5% y/y), generally in-line with analysts' consensus estimate of $23.653 bln.

The company issued in-line guidance for FY 2019, projecting EPS of $9.31 (versus analysts' consensus estimate of $9.32) at revenues of $107.46 bln (versus analysts' consensus estimate of $107.09 bln).

It also increased quarterly dividend to $1.03/share from $0.89/share.

HD rose to $192.78 (+3.11%) in pre-market trading.

Wal-Mart (WMT) reported Q4 FY 2018 earnings of $1.33 per share (versus $1.30 in Q4 FY 2017), missing analysts' consensus estimate of $1.37.

The company's quarterly revenues amounted to $135.150 bln (+4.2% y/y), beating analysts' consensus estimate of $133.627 bln.

The company issued downside EPS guidance for FY 2019, projecting EPS of $4.75-5.00 versus analysts' consensus estimate of $5.08.

It also approved an annual cash dividend for FY 2019 of $2.08 per share, an increase of 2 percent from the $2.04 per share paid for the last fiscal year.

WMT fell to $100.74 (-3.86%) in pre-market trading.

European stocks closed lower Monday, dragged down in part by falls for consumer products heavyweight Reckitt Benckiser Group PLC and German automobile maker Daimler AG. Traders confronted a scarcity of catalysts in what was a relatively quiet day, with equity markets in the U.S. and China closed for holidays.

U.S. stock futures were trading lower on Monday, reversing Friday's mostly upbeat action, though analysts warned against reading too much into the moves, given traders are off for Presidents Day. American stock markets and the bond market are closed for the holiday, and there are no economic releases expected, as federal agencies are shuttered.

Asian stocks were largely lower Tuesday, though Hong Kong equities rebounded from early weakness following the Lunar New Year holiday. The Hang Seng Index HSI, -0.30% slipped 0.3%, after earlier dropping as much as 1.3% when big financial stocks, particularly China-based companies, experienced weakness. Index heavyweights Tencent 0700, +0.63% and HSBC HSBC, +0.15% each rose nearly 1%.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.