- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 21-07-2020.

U.S. stock-index futures rose on Tuesday, underpinned by positive earnings reports from IBM (IBM; +4.5%) and Coca-Cola (KO; +3.2%), as well as hopes for more stimulus in the U.S.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 22,884.22 | +166.74 | +0.73% |

Hang Seng | 25,635.66 | +577.67 | +2.31% |

Shanghai | 3,320.89 | +6.75 | +0.20% |

S&P/ASX | 6,156.30 | +154.70 | +2.58% |

FTSE | 6,288.75 | +27.23 | +0.43% |

CAC | 5,145.63 | +52.45 | +1.03% |

DAX | 13,255.14 | +208.22 | +1.60% |

Crude oil | $42.03 | +2.71% | |

Gold | $1,842.00 | +1.35% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 157.95 | 1.58(1.01%) | 2451 |

ALCOA INC. | AA | 12.96 | 0.24(1.89%) | 16487 |

ALTRIA GROUP INC. | MO | 41 | 0.13(0.32%) | 19273 |

Amazon.com Inc., NASDAQ | AMZN | 3,247.06 | 50.22(1.57%) | 113027 |

American Express Co | AXP | 95.18 | 1.18(1.26%) | 3513 |

AMERICAN INTERNATIONAL GROUP | AIG | 31.82 | 0.41(1.31%) | 2901 |

Apple Inc. | AAPL | 396.19 | 2.76(0.70%) | 235999 |

AT&T Inc | T | 30.02 | 0.17(0.57%) | 115683 |

Boeing Co | BA | 176.69 | 2.27(1.30%) | 165772 |

Caterpillar Inc | CAT | 135.5 | 0.87(0.65%) | 16643 |

Chevron Corp | CVX | 86.58 | 1.31(1.54%) | 28069 |

Cisco Systems Inc | CSCO | 47.27 | 0.30(0.64%) | 21180 |

Citigroup Inc., NYSE | C | 50.62 | 0.48(0.96%) | 121873 |

E. I. du Pont de Nemours and Co | DD | 53.58 | 0.43(0.81%) | 712 |

Exxon Mobil Corp | XOM | 43.2 | 0.70(1.65%) | 67050 |

Facebook, Inc. | FB | 247.14 | 1.72(0.70%) | 80047 |

FedEx Corporation, NYSE | FDX | 166.45 | 2.32(1.41%) | 1764 |

Ford Motor Co. | F | 6.72 | 0.06(0.90%) | 430856 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.57 | 0.14(1.04%) | 39807 |

General Electric Co | GE | 6.96 | 0.09(1.31%) | 457496 |

General Motors Company, NYSE | GM | 26.39 | 0.38(1.46%) | 22016 |

Goldman Sachs | GS | 214.1 | 2.39(1.13%) | 9736 |

Google Inc. | GOOG | 1,577.62 | 11.90(0.76%) | 3870 |

Hewlett-Packard Co. | HPQ | 17.89 | 0.24(1.36%) | 5486 |

Home Depot Inc | HD | 262 | 1.83(0.70%) | 20713 |

HONEYWELL INTERNATIONAL INC. | HON | 154.6 | 1.21(0.79%) | 632 |

Intel Corp | INTC | 61.57 | 0.42(0.69%) | 59811 |

International Business Machines Co... | IBM | 132.7 | 6.33(5.01%) | 136156 |

Johnson & Johnson | JNJ | 150.3 | 0.70(0.47%) | 4978 |

JPMorgan Chase and Co | JPM | 98.2 | 0.90(0.93%) | 74446 |

McDonald's Corp | MCD | 192.9 | 1.29(0.67%) | 20050 |

Merck & Co Inc | MRK | 79.95 | 0.54(0.68%) | 38095 |

Microsoft Corp | MSFT | 213.4 | 1.80(0.85%) | 417866 |

Nike | NKE | 97 | 1.35(1.41%) | 6469 |

Pfizer Inc | PFE | 36.88 | 0.38(1.04%) | 232156 |

Procter & Gamble Co | PG | 125.9 | 0.66(0.53%) | 1935 |

Starbucks Corporation, NASDAQ | SBUX | 75.4 | 0.44(0.59%) | 20118 |

Tesla Motors, Inc., NASDAQ | TSLA | 1,664.83 | 21.83(1.33%) | 390444 |

The Coca-Cola Co | KO | 47.45 | 1.33(2.88%) | 348777 |

Travelers Companies Inc | TRV | 119.5 | 0.73(0.61%) | 189 |

Twitter, Inc., NYSE | TWTR | 37.67 | 0.61(1.65%) | 103044 |

UnitedHealth Group Inc | UNH | 303.25 | -0.21(-0.07%) | 14769 |

Verizon Communications Inc | VZ | 56.12 | 0.25(0.45%) | 5648 |

Visa | V | 199.75 | 1.28(0.64%) | 24231 |

Wal-Mart Stores Inc | WMT | 132.1 | 0.63(0.48%) | 15047 |

Walt Disney Co | DIS | 118.81 | 1.02(0.87%) | 17680 |

Yandex N.V., NASDAQ | YNDX | 57.32 | 1.13(2.01%) | 14198 |

Tesla (TSLA) downgraded to Mkt Perform from Mkt Outperform at JMP Securities

FXStreet reports that analysts at Credit Suisse apprise that S&P 500 has finally seen a clear break above the June high at 3233 for a resumption of the uptrend with resistance seen next at 3260 above which can see the top of the gap at 3328/38.

“The S&P 500 has finally seen a clear break and close above key resistance from the 3233 June high, albeit on low volume and strength has already extended to next flagged resistance from the bottom of the February ‘pandemic’ gap at 3260. Although this should be respected we look for a clear break in due course with resistance seen next at 3288, ahead of 3318 and then the top of the February gap at 3328/38, which we look to prove a tougher barrier. Should strength directly extend, we think this can clear the way for a move back to the 3394 high.”

“Support is seen at 3233/31 initially, with 3215 now ideally holding to keep the immediate risk higher. Below can see a fall back to price/gap support at 3200/3198, with the key 13-day average now at 3185.”

FXStreet notes that both banks and U.S. consumers have a much stronger financial foundation than they did prior to the 2008 crisis but many investors may remain skeptical that the sector can outperform coming out of the current recession. Lisa Shalett from Morgan Stanley explains three main reasons to add financials to the portfolio.

“Second-quarter earnings for financials have largely beaten expectations: Recently reported financial results included some meaningful upside surprises, with banks reporting credit charge-offs that were better than thought, reserve ratios in good shape and, on average, solid balance sheet health. Unlike previous recessions where capital market activities have slowed, Federal Reserve policy moves seem to have boosted transactions.”

“Valuations seem attractive: As a result of underperforming the S&P 500 since the 2008 crisis, the financial sector now appears sharply undervalued. For the past 20 years, the financial sector has had a price-to-earnings ratio just below the S&P 500. Now the sector trades at nearly half the P/E of the index.”

“Rising interest rates could lift profitability: Financials have tended to earn more money when long-term rates are higher than short-term rates, since they can borrow at low rates and lend at higher rates, allowing for higher net interest margins. The yield curve is nearly flat now, but already, inflation expectations are moving higher, which should eventually lead to rising long-term rates. Interest rates may need to lead the way before financials outperform other sectors, but our confidence is growing that rising rates are coming.”

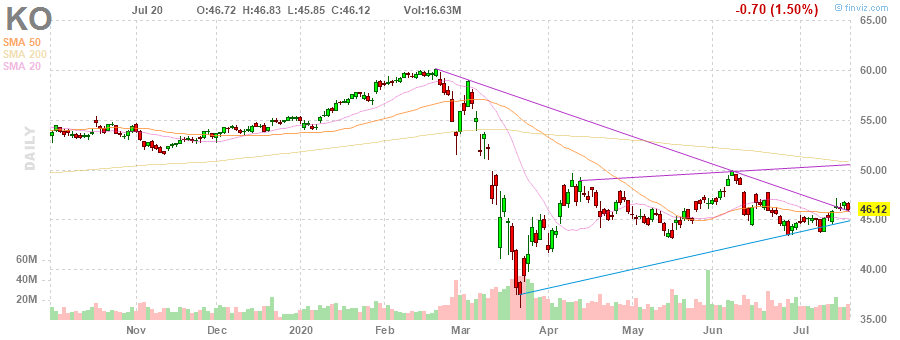

Coca-Cola (KO) reported Q2 FY 2020 earnings of $0.42 per share (versus $0.63 per share in Q2 FY 2019), beating analysts’ consensus estimate of $0.41 per share.

The company’s quarterly revenues amounted to $7.200 bln (-28.0% y/y), generally in line with analysts’ consensus estimate of $7.256 bln.

KO rose to $46.96 (+1.82%) in pre-market trading.

IBM (IBM) reported Q2 FY 2020 earnings of $2.18 per share (versus $3.17 per share in Q2 FY 2019), beating analysts’ consensus estimate of $2.09 per share.

The company’s quarterly revenues amounted to $18.123 bln (-5.4% y/y), beating analysts’ consensus estimate of $17.721 bln.

IBM rose to $133.38 (+5.55%) in pre-market trading.

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 21.06 | 22717.48 | 0.09 |

| Hang Seng | -31.18 | 25057.99 | -0.12 |

| KOSPI | -2.99 | 2198.2 | -0.14 |

| ASX 200 | -32 | 6001.6 | -0.53 |

| FTSE 100 | -28.78 | 6261.52 | -0.46 |

| DAX | 127.31 | 13046.92 | 0.99 |

| CAC 40 | 23.76 | 5093.18 | 0.47 |

| Dow Jones | 8.92 | 26680.87 | 0.03 |

| S&P 500 | 27.11 | 3251.84 | 0.84 |

| NASDAQ Composite | 263.9 | 10767.09 | 2.51 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.