- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 23-07-2020.

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 158.99 | 0.28(0.18%) | 224 |

ALCOA INC. | AA | 13.09 | 0.02(0.15%) | 1434 |

ALTRIA GROUP INC. | MO | 41.5 | 0.16(0.39%) | 1702 |

Amazon.com Inc., NASDAQ | AMZN | 3,100.31 | 0.40(0.01%) | 54003 |

American Express Co | AXP | 97 | 0.46(0.48%) | 1126 |

AMERICAN INTERNATIONAL GROUP | AIG | 32.22 | 0.03(0.09%) | 325 |

Apple Inc. | AAPL | 388.5 | -0.59(-0.15%) | 212477 |

AT&T Inc | T | 30.38 | 0.22(0.73%) | 737354 |

Boeing Co | BA | 179.45 | -0.34(-0.19%) | 76707 |

Chevron Corp | CVX | 91.1 | 0.06(0.07%) | 13831 |

Cisco Systems Inc | CSCO | 46.91 | 0.01(0.02%) | 16143 |

Citigroup Inc., NYSE | C | 51.7 | 0.04(0.08%) | 38898 |

Exxon Mobil Corp | XOM | 43.65 | 0.04(0.09%) | 33776 |

Facebook, Inc. | FB | 239.95 | 0.08(0.03%) | 72582 |

FedEx Corporation, NYSE | FDX | 165.5 | 0.36(0.22%) | 6145 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.7 | 0.08(0.59%) | 58060 |

Ford Motor Co. | F | 6.88 | 0.04(0.58%) | 225517 |

General Motors Company, NYSE | GM | 26.4 | 0.10(0.38%) | 15335 |

Goldman Sachs | GS | 206.03 | 0.03(0.01%) | 19673 |

Google Inc. | GOOG | 1,572.86 | 4.37(0.28%) | 3512 |

Hewlett-Packard Co. | HPQ | 17.72 | -0.01(-0.06%) | 2246 |

Home Depot Inc | HD | 265.74 | 0.57(0.22%) | 14380 |

Intel Corp | INTC | 61.15 | 0.10(0.16%) | 53431 |

International Business Machines Co... | IBM | 128.8 | 0.13(0.10%) | 12700 |

Johnson & Johnson | JNJ | 149.5 | -0.51(-0.34%) | 7406 |

McDonald's Corp | MCD | 198.55 | -0.07(-0.04%) | 17336 |

Merck & Co Inc | MRK | 78.88 | 0.10(0.13%) | 1519 |

Microsoft Corp | MSFT | 208 | -3.75(-1.77%) | 966319 |

Nike | NKE | 98.5 | -0.41(-0.41%) | 8699 |

Pfizer Inc | PFE | 39.18 | 0.62(1.61%) | 949427 |

Procter & Gamble Co | PG | 125.72 | 0.37(0.30%) | 8580 |

Starbucks Corporation, NASDAQ | SBUX | 77.33 | 0.09(0.12%) | 8574 |

Tesla Motors, Inc., NASDAQ | TSLA | 1,655.00 | 62.67(3.94%) | 553601 |

The Coca-Cola Co | KO | 48.49 | 0.01(0.02%) | 22604 |

Travelers Companies Inc | TRV | 122.5 | 0.26(0.21%) | 737 |

Twitter, Inc., NYSE | TWTR | 38.81 | 1.87(5.06%) | 4008178 |

UnitedHealth Group Inc | UNH | 307 | 0.29(0.09%) | 12196 |

Verizon Communications Inc | VZ | 55.9 | 0.15(0.27%) | 5010 |

Visa | V | 198.51 | -0.35(-0.18%) | 8238 |

Wal-Mart Stores Inc | WMT | 133.2 | 0.54(0.41%) | 4900 |

Walt Disney Co | DIS | 118.9 | -0.13(-0.11%) | 21527 |

Yandex N.V., NASDAQ | YNDX | 56.07 | -0.46(-0.81%) | 7038 |

Freeport-McMoRan (FCX) reported Q2 FY 2020 earnings of $0.03 per share (versus -$0.04 per share in Q2 FY 2019), beating analysts’ consensus estimate of -$0.03 per share.

The company’s quarterly revenues amounted to $3.054 bln (-13.9% y/y), generally in line with analysts’ consensus estimate of $3.057 bln.

FCX rose to $13.70 (+0.59%) in pre-market trading.

AT&T (T) reported Q2 FY 2020 earnings of $0.83 per share (versus $0.89 per share in Q2 FY 2019), beating analysts’ consensus estimate of $0.80 per share.

The company’s quarterly revenues amounted to $40.950 bln (-8.9% y/y), generally in line with analysts’ consensus estimate of $40.868 bln.

T rose to $30.60 (+1.46%) in pre-market trading.

Twitter (TWTR) reported Q2 FY 2020 loss of $0.16 per share (versus earnings of $0.05 per share in Q2 FY 2019), worse than analysts’ consensus estimate of -$0.01 per share.

The company’s quarterly revenues amounted to $0.683 bln (-18.8% y/y), missing analysts’ consensus estimate of $0.708 bln.

Twitter’s average monetizable daily active users (mDAU) were 186 mln for Q2, compared to 139 mln in the same period of the previous year and compared to 166 mln in the previous quarter.

TWTR rose to $38.93 (+5.39%) in pre-market trading.

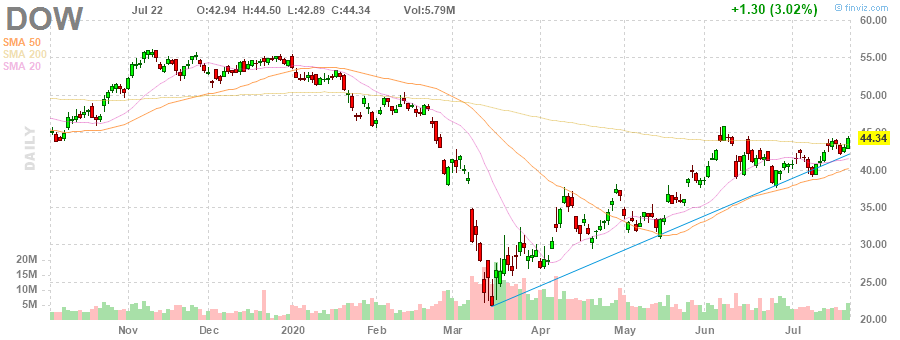

Dow (DOW) reported Q2 FY 2020 loss of $0.26 per share (versus earnings of $0.86 per share in Q2 FY 2019), slightly worse than analysts’ consensus estimate of -$0.25 per share.

The company’s quarterly revenues amounted to $8.354 bln (-24.2% y/y), beating analysts’ consensus estimate of $7.948 bln.

DOW rose to $45.04 (+1.58%) in pre-market trading.

FXStreet reports that the Credit Suisse analyst team notes that S&P 500 while above 3248 can keep the immediate risk higher with resistance still seen initially at 3288, and eventually at the top of the February gap at 3328/38.

“The S&P 500 stays a little sluggish near-term but with the market holding high-level support at 3248 as well as its break above key resistance from the 3233 June high, albeit on low volume, we continue to give the upside the benefit of the doubt still.”

“Resistance is seen next at 3279/81, ahead of 3318 and then the top of the February gap at 3328/38, which we look to prove a tougher barrier. Should strength directly extend, we think this can clear the way for a move back to the 3394 high.”

“Support at 3248 ideally holds to keep the immediate risk higher. A break can see a fall back to 3233/31, potentially 3215, with more important support seen at the price/gap and 13-day average support at 3207/3198. Only a close below here would be seen raising the prospect of a more concerted correction lower.”

Tesla (TSLA) reported Q2 FY 2020 earnings of $2.18 per share (versus -$1.12 per share in Q2 FY 2019), better than analysts’ consensus estimate of -$0.16 per share.

The company’s quarterly revenues amounted to $6.036 bln (-4.9% y/y), beating analysts’ consensus estimate of $5.310 bln.

TSLA rose to $1,679.78 (+5.49%) in pre-market trading.

Microsoft (MSFT) reported Q4 FY 2020 earnings of $1.46 per share (versus $1.37 per share in Q4 FY 2019), beating analysts’ consensus estimate of $1.38 per share.

The company’s quarterly revenues amounted to $38.033bln (+12.8% y/y), beating analysts’ consensus estimate of $36.547 bln.

MSFT fell to $208.02 (-1.76%) in pre-market trading.

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -132.61 | 22751.61 | -0.58 |

| Hang Seng | -577.72 | 25057.94 | -2.25 |

| KOSPI | -0.17 | 2228.66 | -0.01 |

| ASX 200 | -81.2 | 6075.1 | -1.32 |

| FTSE 100 | -62.63 | 6207.1 | -1 |

| DAX | -67.58 | 13104.25 | -0.51 |

| CAC 40 | -67.16 | 5037.12 | -1.32 |

| Dow Jones | 165.44 | 27005.84 | 0.62 |

| S&P 500 | 18.72 | 3276.02 | 0.57 |

| NASDAQ Composite | 25.77 | 10706.13 | 0.24 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.