- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 25-07-2016.

(index / closing price / change items /% change)

Nikkei 225 16,620.29 -0.04%

Shanghai Composite 3,016.8 +0.13%

S&P/ASX 200 5,533.56 +0.64%

CAC 40 4,388 +0.16%

Xetra DAX 10,198.24 +0.50%

FTSE 100 6,710.13 -0.30%

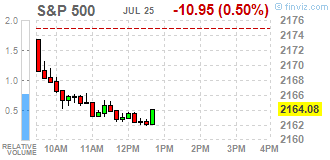

S&P 500 2,168.48 -0.30%

Dow Jones 18,493.06 -0.42%

S&P/TSX Composite 14,498.1 -0.70%

U.S. stocks retreated from records as a tumble in the price of crude sank energy shares with investors looking to central-bank policy decisions later in the week.

Earnings remain in focus, with companies including Texas Instruments Inc., Sprint Corp. and Gilead Sciences Inc. scheduled to report earnings Monday. Profits and sales have broadly topped projections so far this season, and analysts have eased their estimates for declines in net income.

Energy shares sank 2 percent for the biggest drop in a month. Chesapeake Energy Corp. and Devon Energy Corp. fell at least 4.4 percent to pace declines. Materials producers also fell, as gains in the dollar damped demand for products denominated in the currency.

Among stocks moving, Yahoo! Inc. lost 2.7 percent and Verizon Communications Inc. slipped after the internet portal agreed to sell its main web business to the wireless carrier. In earnings news, Roper Technologies Inc. fell the most in the S&P 500 after missing profit estimates. Micron Technology Inc. jumped 6 percent after adopting a poison pill takeover defense.

The S&P 500 reached a seventh all-time high in 10 sessions on Friday, after going more than 13 months without a record. The advances came as companies showed signs of breaking a four-quarter-long decline in sales, fueling optimism that a long-awaited rebound in earnings is at hand. Still, further stock gains may be harder to combine, according to Kully Samra, a client manager at Charles Schwab Corp., which has $2.4 trillion in client assets.

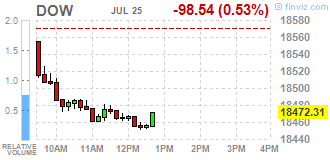

Major U.S. stock-indexes retreated from record levels as weak oil prices weighed on energy shares. Exxon (XOM) and Chevron (CVX) lost around 2 percent, dragging down the S&P and the Dow. In addition, investors turned cautious ahead of the U.S.Federal Reserve meeting this week.

Most of Dow stocks in negative area (26 of 30). Top looser - Chevron Corporation (CVX, -2,26%).. Top gainer - Nike Inc. (NKE, +0,21%).

All S&P sectors in negative area. Top looser - Basic Materials (-0,6%).

At the moment:

Dow 18381.00 -97.00 -0.52%

S&P 500 2156.25 -11.25 -0.52%

Nasdaq 100 4645.25 -12.00 -0.26%

Crude Oil 43.00 -1.19 -2.69%

Gold 1320.20 -3.20 -0.24%

U.S. 10yr 1.56 -0.01

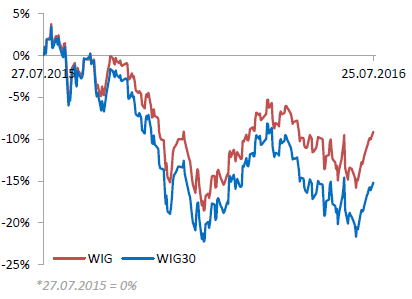

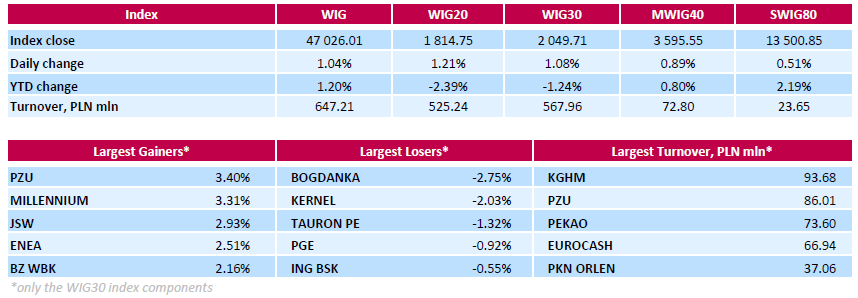

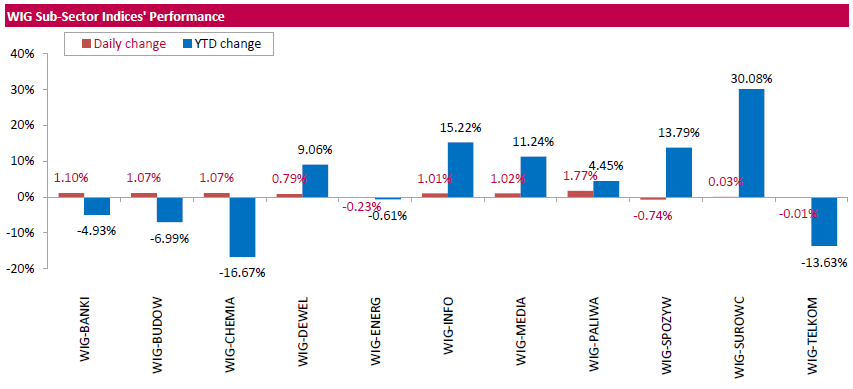

Polish equity market closed higher on Monday. The broad market benchmark, the WIG Index, surged by 1.04%. The WIG sub-sector indices were mainly higher, with oil and gas stocks' measure (+1.77%) outperforming.

The large-cap stocks grew by 1.08%, as measured by the WIG30 Index. Within the index components, insurer PZU (WSE: PZU) and bank MILLENNIUM (WSE: MIL) recorded the biggest gains, up 3.4% and 3.31% respectively. Other major advancers were coking coal miner JSW (WSE: JSW), genco ENEA (WSE: ENA), bank BZ WBK (WSE: BZW) and oil refiner PKN ORLEN (WSE: PKN), adding between 2.05% and 2.93%. On the other side of the ledger, thermal coal miner BOGDANKA (WSE: LWB) and agricultural producer KERNEL (WSE: KER) led a handful of decliners, dropping by 2.75% and 2.03% respectively.

The market in the United States opened with a slight decrease, which fairly quickly began to grow. The scale of the changes may not be large, but the descent of contracts to session lows indicates pressure of supply side, which from the point of view of European stock markets is a negative surprise. In this context the DAX react with cosmetic decline and the WIG20 remains stable. Did not change the level of activity of trading on the Warsaw Stock Exchange. In addition we have empty calendar macro today, which does not help. Afternoon on the Warsaw parquet is marked by consolidation and a lack of ideas for further trade.

U.S. index futures held steady, after equities capped their longest run of weekly gains since March amid optimism over corporate earnings.

Global Stocks:

Nikkei 16,620.29 -6.96 -0.04%

Hang Seng 1,993.44 +29.17 +0.13%

Shanghai 3,016.8 +3.99 +0.13%

FTSE 6,726.64 -3.84 -0.06%

CAC 4,400.43 +19.33 +0.44%

DAX 10,231.24 +83.78 +0.83%

Crude $43.50 (-1.56%)

Gold $1316.70 (-0.51%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 10.54 | -0.03(-0.2838%) | 11500 |

| Amazon.com Inc., NASDAQ | AMZN | 747 | 2.14(0.2873%) | 10042 |

| American Express Co | AXP | 64.2 | -0.08(-0.1245%) | 100 |

| Apple Inc. | AAPL | 98.4 | -0.26(-0.2635%) | 60138 |

| AT&T Inc | T | 42.95 | -0.16(-0.3711%) | 7572 |

| Barrick Gold Corporation, NYSE | ABX | 20.36 | -0.19(-0.9246%) | 26819 |

| Boeing Co | BA | 132.32 | -1.15(-0.8616%) | 1325 |

| Cisco Systems Inc | CSCO | 30.76 | 0.05(0.1628%) | 6609 |

| Citigroup Inc., NYSE | C | 44.3 | -0.00(-0.00%) | 16661 |

| Deere & Company, NYSE | DE | 78.85 | -1.27(-1.5851%) | 5399 |

| Facebook, Inc. | FB | 121.59 | 0.59(0.4876%) | 74651 |

| Ford Motor Co. | F | 13.88 | 0.04(0.289%) | 33767 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.58 | -0.09(-0.7103%) | 64620 |

| General Electric Co | GE | 31.95 | -0.11(-0.3431%) | 48059 |

| General Motors Company, NYSE | GM | 32.17 | 0.01(0.0311%) | 6319 |

| Goldman Sachs | GS | 160.19 | -0.22(-0.1371%) | 550 |

| Google Inc. | GOOG | 742.95 | 0.21(0.0283%) | 1201 |

| Home Depot Inc | HD | 136.67 | 0.15(0.1099%) | 650 |

| HONEYWELL INTERNATIONAL INC. | HON | 115.57 | -0.04(-0.0346%) | 300 |

| Intel Corp | INTC | 34.57 | -0.09(-0.2597%) | 6046 |

| International Business Machines Co... | IBM | 161.67 | -0.40(-0.2468%) | 2310 |

| Johnson & Johnson | JNJ | 125.03 | -0.00(-0.00%) | 355 |

| JPMorgan Chase and Co | JPM | 64.1 | 0.06(0.0937%) | 800 |

| McDonald's Corp | MCD | 128.2 | -0.06(-0.0468%) | 3065 |

| Microsoft Corp | MSFT | 56.45 | -0.12(-0.2121%) | 11034 |

| Pfizer Inc | PFE | 36.75 | 0.01(0.0272%) | 2447 |

| Starbucks Corporation, NASDAQ | SBUX | 57.7 | -0.20(-0.3454%) | 2065 |

| Tesla Motors, Inc., NASDAQ | TSLA | 222.6 | 0.33(0.1485%) | 9804 |

| Twitter, Inc., NYSE | TWTR | 18.36 | -0.01(-0.0544%) | 42133 |

| Verizon Communications Inc | VZ | 56.49 | 0.39(0.6952%) | 10550 |

| Visa | V | 79.99 | 0.08(0.1001%) | 1657 |

| Walt Disney Co | DIS | 97.5 | -0.21(-0.2149%) | 2000 |

| Yahoo! Inc., NASDAQ | YHOO | 38.9 | -0.48(-1.2189%) | 517546 |

| Yandex N.V., NASDAQ | YNDX | 21.18 | -0.05(-0.2355%) | 520 |

Upgrades:

Hewlett Packard Enterprise (HPE) upgraded to Buy from Neutral at Citigroup

Downgrades:

Deere (DE) downgraded to Underweight from Neutral at Piper Jaffray

Other:

July 26

Before the Open:

3M Company (MMM). Consensus EPS $2.07, Consensus Revenue $7710.77 mln.

Caterpillar (CAT). Consensus EPS $0.96, Consensus Revenue $10127.95 mln.

DuPont (DD). Consensus EPS $1.10, Consensus Revenue $6979.50 mln.

Freeport-McMoRan (FCX). Consensus EPS -$0.01, Consensus Revenue $3684.28 mln.

McDonald's (MCD). Consensus EPS $1.39, Consensus Revenue $6265.41 mln.

United Tech (UTX). Consensus EPS $1.68, Consensus Revenue $14692.67 mln.

Verizon (VZ). Consensus EPS $0.94, Consensus Revenue $30984.40 mln.

After the Close:

Apple (AAPL). Consensus EPS $1.39, Consensus Revenue $42135.16 mln.

Twitter (TWTR). Consensus EPS $0.09, Consensus Revenue $607.41 mln.

July 27

Before the Open:

Altria (MO). Consensus EPS $0.80, Consensus Revenue $5007.24 mln.

Boeing (BA). Consensus EPS $2.47, Consensus Revenue $24247.74 mln.

Coca-Cola (KO). Consensus EPS $0.58, Consensus Revenue $11638.47 mln.

After the Close:

Barrick Gold (ABX). Consensus EPS $0.15, Consensus Revenue $2073.46 mln.

Facebook (FB). Consensus EPS $0.81, Consensus Revenue $6007.47 mln.

July 28

Before the Open:

Ford Motor (F). Consensus EPS $0.60, Consensus Revenue $36278.36 mln.

Intl Paper (IP). Consensus EPS $0.84, Consensus Revenue $5313.96 mln.

Yandex N.V.(YNDX). Consensus EPS $9.08, Consensus Revenue $17563.74 mln.

After the Close:

Alphabet (GOOG). Consensus EPS $8.06, Consensus Revenue $20767.03 mln.

Amazon (AMZN). Consensus EPS $1.12, Consensus Revenue $29572.97 mln.

July 29

Before the Open:

Chevron (CVX). Consensus EPS $0.34, Consensus Revenue $29683.44 mln.

Exxon Mobil (XOM). Consensus EPS $0.64, Consensus Revenue $64001.29 mln.

Merck (MRK). Consensus EPS $0.91, Consensus Revenue $9788.12 mln.

The first half of trading on the Warsaw Stock Exchange confirmed the positive behavior of the first bars, where the approach of 1% was maintained, and even increased slightly. Thus, output above the 1,800 points level remains in force.

The stronger reading of the Ifo index started trading in Germany, which helps to our parquet. The only drawback is the level of turnover, which does not impress. In the mid-session the WIG20 index was at the level of 1,813 points (+1.14%) with PLN 167 mln turnover.

European stocks resumed their growth, approaching the six-month highs, helped by positive data on Germany and corporate news.

The research results, published by the Ifo Institute, showed that in July, business sentiment in Germany deteriorated less than expected, indicating the economy's resilience to the impacts of Brexit. According to the data, the business climate index fell to 108.3 points from 108.7 points in June. Analysts had forecast a drop to 107.5. The index of business expectations dropped to 102.2 vs. 103.1 in June, while the current conditions index rose to 114.7 from 114.6, both better than forecasts.

Support fpr indices also have tje G20 meeting outcome. Finance ministers and heads of central banks of the G20 expressed their determination on the issue of strengthening economic growth. "We are taking measures to build confidence and support growth. In light of recent events, we reaffirm our determination to use all policy tools - monetary, fiscal and structural - individually and collectively to achieve our goal - to ensure strong, sustainable and balanced growth.".

At the same time, investors are cautious on the eve of US and Japan events this week, the central bank meetings. Despite the fact that the recent strong US data increases the likelihood of the Fed raising rates, it is unlikely to happen at the July meeting. According to a Reuters survey results, just over half of the 100 economists expect the Fed to raise rates in the 4th quarter to 0.50-0.75 percent to 0.25-0.50 percent currently. The change is likely to occur in December. With regard to the meeting of the Central Bank of Japan, Bloomberg's survey revealed that 78% of respondents belive that is likely the Central Bank decides to increase ETF purchases. Also not ruled out further reduction in interest rates and an increase in government bond purchases

The composite index of Europe's largest enterprises Stoxx 600 is trading with an increase of 0.6 percent.

William Hill Plc Quotes jumped 6.1 percent amid reports that 888 Holdings Plc and The Rank Group are considering a joint takeover bid for the bookmaker.

Cost of Ericsson AB increased by 3.2 percent, as the Chief Executive Officer has resigned after more than six years in the company's management.

SEB SA Shares rose 6.5 percent after the company said it is seeking to increase its operating result from activity by more than 10 percent.

Share price of Baer Group Ltd. rose 4% after the profit growth in the first half of the year exceeded expectations.

The cost of Air France-KLM Group fell 2.6 percent after Societe Generale SA analysts advised selling shares of the airline.

At the moment:

FTSE 100 +8.51 6738.99 + 0.13%

DAX +89.72 10237.18 + 0.88%

CAC 40 +30.42 4411.52 + 0.69%

WIG20 index opened at 1798.64 points (+0.32%)

WIG 46781.98 0.52%

WIG30 2040.24 0.61%

mWIG40 3573.61 0.27%

*/ - change to previous close

The futures market (WSE: FW20U1620) began from increase of 0.28% to 1,805 points. Contracts on the DAX also rose at the opening but in a slightly smaller scale.

Our opening seems to be adjusting to a successful Friday session in New York, but runs below the highs of the last day of the previous week. We are located on known levels of consolidation around the level of 1800 points.

The cash market (the WIG20 index) opens with an increase of 0.32% to 1,798 points. In Frankfurt, the opening is upward, but barely reaches 0.1%. In Warsaw, moods tend to be better than in Western Europe and the spot market follows in the footsteps of early positive behavior contracts. The market takes on new highs of growth and boosters already reaches 1%. The increases are fairly widely spread and also apply to the small and medium-sized companies. It is quite surprising behavior in the face of a rather balanced attitude of environment. As we may see, the Warsaw Stock Exchange maintains its individuality.

At the beginning of the new week, investors sentiment remains balanced. Asia is dominated by light increases and contracts in the US slightly go down after Friday's rally on Wall Street of 0.5%. This indicates the possibility of stabilizing the WIG20 around the level of 1,800 points, which on Friday once again has not been defeated. In the short term the upward trend is still valid, but as shown by the last sessions, a stop would be something natural in present location of the index.

In the macro calendar the most important event will of course be Wednesday's FOMC decision on interest rates in the US. Today we will know the index of Ifo Institute from Germany. German data will be closely watched in the context of a negative surprise in the case of the ZEW index. During the weekend, in Germany, there were a series of attacks, which may somewhat undermine sentiment. Recent months, however, indicates that investors with each attack less likely to consider it. This time, however, may worry the country and the number of attacks. So far, Germany were considered safer from France, but this may change.

European stocks ended Friday little changed, but posted weekly gains, as investors sifted through corporate earnings reports for reasons to cheer after the European Central Bank failed to deliver a boost the previous day.

The marginal decline in equities picked up from a downward move from Thursday, when the pan-European index shed 0.1% after the ECB decided to leave monetary policy unchanged. The bank, lead by President Mario Draghi, expects its interest rates to remain at the present level or lower for an "extended period," and it plans to continue its bond-buying program until at least March 2017.

U.S. stocks rose cautiously Friday to notch a fourth week of gains, with a rally by telecom shares offsetting weakness in the industrial sector as investors awaited next week's Federal Reserve policy statement.

The S&P 500 Index SPX, +0.46% advanced 9.86 points, or 0.5%, to close at a new all-time high of 2,175.03, boosted by 1.3% jumps in both telecom and utilities, sectors typically viewed as defensive.

The Dow Jones Industrial Average DJIA, +0.29% rose 53.62 points, or 0.3%, to close at 18,570.85, led by gains in Visa Inc. V, +1.42% American Express Co. AXP, +1.34% and Microsoft Corp. MSFT, +1.38% offsetting declines in General Electric Co. GE, -1.63% and Caterpillar Inc. CAT, -0.79% The gains come after the blue-chip gauge snapped its nine-session win streak on Thursday.

Meanwhile, the Nasdaq Composite Index COMP, +0.52% rose 26.26 points, or 0.5%, to close at 5,100.16, its highest close of 2016.

Asian shares held near nine-month highs on Monday as worries over the impact of Britain's Brexit vote eased amid efforts to maintain growth, while the dollar was buoyed by a run of solid U.S. economic data.

Policy makers from the Group of 20 countries agreed to work to support global growth and better share the benefits of trade, in a weekend meeting dominated by the impact of Britain's exit from Europe and fears of rising protectionism.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.1 percent to stand just below its nine-month peak hit on Thursday. Japan's Nikkei .N225 rose 0.4 percent.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.