- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 28-07-2016.

(index / closing price / change items /% change)

Nikkei 22 16,476.84 -1.13%

Shanghai Composite 2,994.98 +0.10%

CAC 40 4,420.58 -0.59%

Xetra DAX 10,274.93 -0.43%

FTSE 100 6,721.06 -0.44%

S&P 500 2,170.06 +0.16%

Dow Jones 18,456.35 -0.09%

U.S. stocks rose, lifting the S&P 500 Index within striking distance of an all-time high, amid a mix of corporate results as investors await data Friday on the strength of the American economy. Stimulus bets influenced currency markets ahead of the Bank of Japan's policy meeting.

The S&P 500 staged an afternoon comeback to end five points below its record after falling as much as 0.4 percent. Earnings from Ford Motor Co. to Facebook Inc. tugged indexes in opposite directions. Google parent Alphabet Inc. surged almost 5 percent at 4:10 p.m. after its profit topped estimates. Amazon.com Inc. slipped 1 percent in late trading.

The dollar weakened on the Federal Reserve's assurance that it will raise rates gradually, while the yen erased gains before the BOJ stimulus decision. The pound slid on bets the Bank of England will lower rates next week. Oil slipped toward $41 a barrel, approaching a bear market.

While the prospects for additional central-bank support bolstered equities, better-than-forecast economic data and corporate earnings that broadly beat projections have also helped lift the S&P 500 this month. The gauge posted seven records in 10 days in a midmonth stretch, and it's rebounded 18 percent since its low in February. It's up 6 percent this year -- one of the best gains in developed-world equities.

Ford sank 8.2 percent after earnings missed estimates. General Motors Co. dropped 3.3 percent. Whole Foods Markets Inc. sank 9.5 percent on poor results. Facebook climbed to a record on sales that topped forecasts. MasterCard Inc., the second-largest U.S. payments network, advanced after saying profit rose 6.7 percent as customer card spending increased.

Major U.S. stock-indexes demonstrated moderate declines amid disappointing data from the U.S. Labor Department, as well as mixed earnings reports that are unlikely to help to clarify the strength of the economy. In addition, investors continued to assess the implications of the Federal Reserve's most recent statement.

U.S. Labor Department revealed that the number of people claiming unemployment benefits grew to to 266,000 for the week ended July 22. That was above analysts' expectations of 260,000.

Focus is on Facebook (FB) and Ford Motor (F). Facebook posted its financials after yesterday's session. The company's results significantly exceeded analysts' expectations. Facebook's shares rose 0.52%.

The quarterly results of Ford Motor (F) disappointed investors, as posted profit missed analysts' expectations. The Ford's shares plunged by 9.65%. The shares of other automakers were also under pressure, with General Motors (GM) tumbling by 3.76% and Fiat Chrysler (FCAU) falling by 5.45%.

Investors also expect the release of quarterly results of Amazon.com Inc. (AMZN) and Alphabet Inc. (GOOG), which are set to be published after the market's close today.

.

Most of Dow stocks in negative area (22 of 30). Top loser - The Boeing Company (BA, -2.46%). Top gainer - Apple Inc. (AAPL, +0.74%).

Most of S&P sectors in negative area. Top loser - Basic Materials (-0.65%). Top gainer - Conglomerates (+0.82%).

At the moment:

Dow 18321.00 -69.00 -0.38%

S&P 500 2156.25 -4.25 -0.20%

Nasdaq 100 4696.00 -11.75 -0.25%

Crude Oil 41.08 -0.84 -2.00%

Gold 1340.70 +6.20 +0.46%

U.S. 10yr 1.51 -0.01

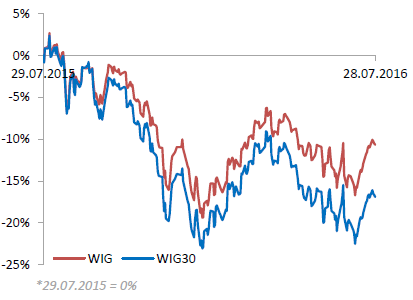

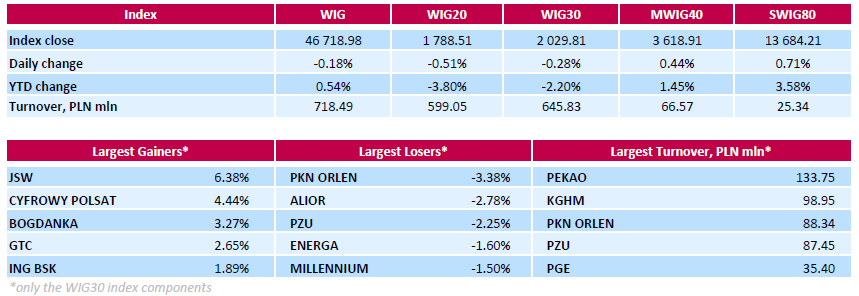

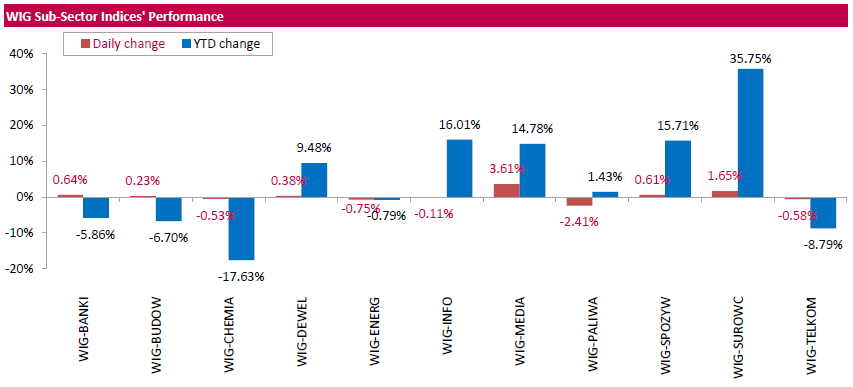

Polish equity market closed lower on Thursday. The broad market measure, the WIG Index, declined by 0.18%. Sector performance within the WIG Index was mixed. Media (+3.61%) outperformed, while oil and gas (-2.41%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, fell by 0.28%. In the index basket, the decliners were led by oil refiner PKN ORLEN (WSE: PKN), which tumbled by 3.38%. Other major laggards were bank ALIOR (WSE: ALR), insurer PZU (WSE: PZU) and genco ENERGA (WSE: ENG), which plunged by 2.78%, 2.25% and 1.60% respectively. On the other side of the ledger, coking coal miner JSW (WSE: JSW) led the gainers, jumping by 6.38%, partially supported by an analyst upgrade. It was followed by media group CYFROWY POLSAT (WSE: CPS), thermal coal miner BOGDANKA (WSE: LWB) and property developer GTC (WSE: GTC), which advanced by 4.44%, 3.27% and 2.65% respectively.

In the afternoon, we met weekly data from the US labor market. The number of applications for unemployment benefits in the US rose at the about 14 thousand, what is a result of slightly higher than forecast, but remains at a very low level, and 73 weeks in a row is below the critical limit of 300 thousand. From the point of view of investors is not important information because it does not lead to any changes.

The market in the United States opens in neutral and remains with a well-known consolidation. The Federal Reserve and the data from the labor market have not proved an important stimulus, and today it is difficult to expect changes as a result of the empty calendar.

U.S. index futures were little changed as investors assessed a mixed bag of corporate earnings and the Fed's yesterday statement.

Global Stocks:

Nikkei 16,476.84 -187.98 -1.13%

Hang Seng 22,174.34 -44.65 -0.20%

Shanghai 2,994.98 +2.98 +0.10%

FTSE 6,743.64 -6.79 -0.10%

CAC 4,452.35 +5.39 +0.12%

DAX 10,311.25 -8.300 -0.08%

Crude $42.01 (+0.21%)

Gold $1341.30 (+1.10%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 10.75 | 0.08(0.7498%) | 17962 |

| ALTRIA GROUP INC. | MO | 68.81 | 0.88(1.2954%) | 17960 |

| Amazon.com Inc., NASDAQ | AMZN | 739.63 | 4.04(0.5492%) | 9804 |

| Apple Inc. | AAPL | 104.31 | 7.64(7.9032%) | 4208997 |

| AT&T Inc | T | 42.38 | 0.00(0.00%) | 4474 |

| Barrick Gold Corporation, NYSE | ABX | 20.62 | 0.17(0.8313%) | 45981 |

| Boeing Co | BA | 137.5 | 2.65(1.9651%) | 172227 |

| Caterpillar Inc | CAT | 82.42 | -0.33(-0.3988%) | 5709 |

| Chevron Corp | CVX | 102.61 | -0.07(-0.0682%) | 770 |

| Cisco Systems Inc | CSCO | 30.91 | 0.03(0.0971%) | 16933 |

| Citigroup Inc., NYSE | C | 44.22 | 0.07(0.1586%) | 25189 |

| E. I. du Pont de Nemours and Co | DD | 69.53 | 0.37(0.535%) | 1872 |

| Exxon Mobil Corp | XOM | 91.5 | -0.03(-0.0328%) | 5074 |

| Facebook, Inc. | FB | 122.43 | 1.21(0.9982%) | 431905 |

| Ford Motor Co. | F | 13.83 | -0.03(-0.2165%) | 62069 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.71 | 0.03(0.2366%) | 103109 |

| General Electric Co | GE | 31.54 | 0.07(0.2224%) | 12787 |

| General Motors Company, NYSE | GM | 32.05 | -0.10(-0.311%) | 662 |

| Goldman Sachs | GS | 161.35 | 0.19(0.1179%) | 1490 |

| Google Inc. | GOOG | 739.94 | 1.52(0.2058%) | 3358 |

| Intel Corp | INTC | 35.09 | 0.00(0.00%) | 47843 |

| International Business Machines Co... | IBM | 162.45 | 0.33(0.2036%) | 1135 |

| Johnson & Johnson | JNJ | 125.3 | 0.15(0.1199%) | 655 |

| JPMorgan Chase and Co | JPM | 64.1 | -0.03(-0.0468%) | 5337 |

| McDonald's Corp | MCD | 121.8 | 0.09(0.0739%) | 6954 |

| Merck & Co Inc | MRK | 58.36 | 0.00(0.00%) | 600 |

| Microsoft Corp | MSFT | 56.74 | -0.02(-0.0352%) | 20181 |

| Pfizer Inc | PFE | 36.88 | 0.05(0.1358%) | 3385 |

| Procter & Gamble Co | PG | 85.31 | 0.04(0.0469%) | 1394 |

| Starbucks Corporation, NASDAQ | SBUX | 58.3 | -0.01(-0.0172%) | 2266 |

| Tesla Motors, Inc., NASDAQ | TSLA | 229.1 | -0.41(-0.1786%) | 8838 |

| The Coca-Cola Co | KO | 44.22 | -0.66(-1.4706%) | 227847 |

| Twitter, Inc., NYSE | TWTR | 16.42 | -2.03(-11.0027%) | 1347813 |

| United Technologies Corp | UTX | 108.5 | 0.61(0.5654%) | 3418 |

| UnitedHealth Group Inc | UNH | 141.5 | -0.20(-0.1411%) | 700 |

| Verizon Communications Inc | VZ | 54.84 | 0.03(0.0547%) | 3260 |

| Walt Disney Co | DIS | 96.96 | 0.27(0.2792%) | 4090 |

| Yahoo! Inc., NASDAQ | YHOO | 38.84 | 0.08(0.2064%) | 3117 |

| Yandex N.V., NASDAQ | YNDX | 21.2 | 0.07(0.3313%) | 1934 |

Upgrades:

Apple (AAPL) upgraded to Buy from Long-term Buy at Hilliard Lyons

Downgrades:

Facebook (FB) downgraded to Neutral from Buy at Monness Crespi & Hardt

Other:

Facebook (FB) target raised to $160 from $155 at Axiom Capital

Facebook (FB) target raised to $150 from $140 at Mizuho

Facebook (FB) target raised to $150 from $130 at Needham

Facebook (FB) target raised to $185 at Piper Jaffray

Facebook (FB) target raised to $150 at Cowen; Outperform

Facebook (FB) target raised to $170 from $165 at RBC Capital Mkts

Coca-Cola (KO) target lowered to $50 from $54 at Stifel

Intl Paper reported Q2 FY 2016 earnings of $0.92 per share (versus $0.97 in Q2 FY 2015), beating analysts' consensus estimate of $0.84.

The company's quarterly revenues amounted to $5.322 bln (-6.9% y/y), generally in-line with analysts' consensus estimate of $5.314 bln.

IP closed Wednesday's trading session at $45.59 (-0.02%).

Ford Motor reported Q2 FY 2016 earnings of $0.52 per share (versus $0.47 in Q2 FY 2015), missing analysts' consensus estimate of $0.60.

The company's quarterly revenues amounted to $37.000 bln (+5.4% y/y), beating analysts' consensus estimate of $36.279 bln.

F fell to $12.88 (-6.94%) in pre-market trading.

The first half of today's session showed clearly that the Warsaw Stock Exchange remains true to its independence, especially when located near resistance. The round level of 1,800 points well act as a barrier for demand. While the blue chips sector caught short of breath and is on the verge of breaking, generating a signal that could be an invitation to expand profit taking, the second and third line are doing much better. The mWIG40 increases (+0,12%) and even more stable behaves the sWIG80 (+0,25%), so the sentiment among these companies is still good

At the halfway point of listing the WIG20 index was at the level of 1,786 points (-0,61%).

European stocks traded slightly downward. Investors analyzed a mixed corporate reporting, as well as waiting for the results of stress tests in the euro zone, which will be published tomorrow.

Focus was also are the results of the July meeting of the Fed. Recall, as expected the Fed left interest rates unchanged, but gave no clear signals about future plans. Investors slightly reduced the likelihood of a rate hike in September, although the Central Bank has improved the economic outlook and said that short-term risks to the economy declined.

According to CME Group, futures on interest rates Fed point to 18% probability of a rate hike in September.

Some support the market have the latest data on Germany and the euro zone. Germany Ministry of Labor said that the number of applications for unemployment benefits in July fell by 7,000 after declining in June 6000. The unemployment rate in July remained at the level of 6.1%, in line with expectations.

Meanwhile, the European Commission reported that the index of economic sentiment rose in July to 104.6 points compared with 104.4 points in June. Experts expect that figure will drop to 103.7 points. Sentiment among consumers fell in July from -7.2 points to -7.9 points, confirming the initial assessment and forecasts. Sentiment in the services sector rose to 11.1 from 10.9 in June (revised from 10.8). Analysts had expected a decline to 10.3. Meanwhile, the index of business optimism in industry rose to -2.4 points to -2.8 points in June. It was expected that the index would fall to -3.4 points. Sentiment Index in the business community has improved to 0.39 points versus 0.22 points in June. Analysts predicted that the rate will fall to 0.17 points. Sentiment index for the retail sector rose to 1.8 from 0.8, and the confidence index for construction reached a level of -16.3 versus -18.2 in June.

The composite index of Europe's largest enterprises Stoxx 600 lost 0.4%.

Shares of the banking sector shows the largest decline among the 19 industry groups in anticipation of the stress tests outcomes "Markets are now digest all previous successes after a decline due to Brexit, - said Philippe Gijsels BNP Paribas -. Corporate profits were generally good, except for a few companies. Investors can exercise some caution on the eve of the meeting of the Bank of Japan and after a strong rally, which may indicate some overbought ".

Shares of Royal Dutch Shell Plc fell 2.5 percent after the company reported that the amount of profit was less than half the average analysts' estimates

Quotes of Lloyds Banking Group Plc fell 3.7 percent amid falling outlook for capital formation in 2016 that increased concerns about rising dividends.

The cost of Dialog Semiconductor Plc sank 7.1 percent as the company cut its forecast for full-year sales

Capitalization of JCDecaux SA decreased by 7 percent after the company's statement that the expected slowdown in the UK will influence the local advertising market

Saipem SpA shares fell 9 percent after lowering profit and sales forecasts for 2016.

At the moment:

FTSE 100 6731.58 -18.85 -0.28%

DAX -5.45 10314.10 -0.05%

CAC -8.35 4438.61 -0.19%

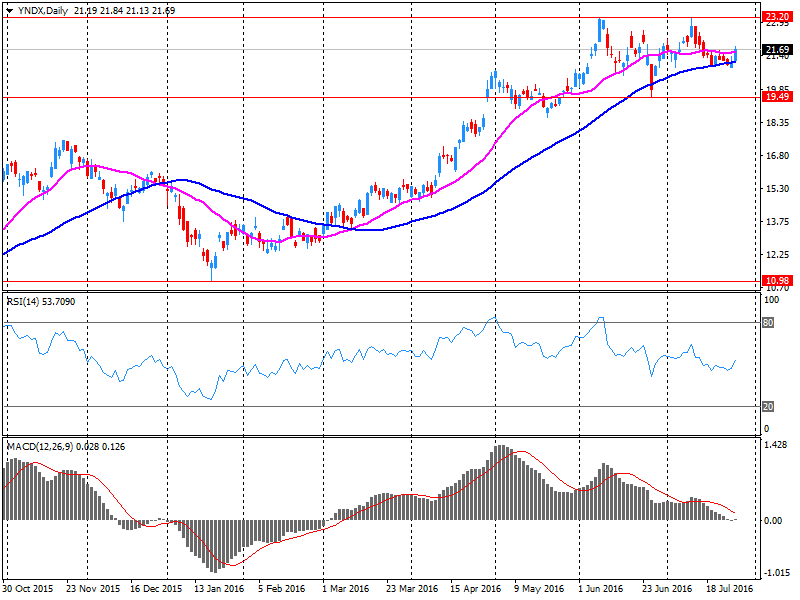

Yandex N.V.reported Q2 FY 2016 earnings of RUB 12.05 per share (versus RUB 8.63 in Q2 FY 2015), beating analysts' consensus estimate of RUB 9.26.

The company's quarterly revenues amounted to RUB 18.040 bln (+29.6% y/y), beating analysts' consensus estimate of RUB 17.611 bln.

YNDX rose to $22.38 (+3.09%) in pre-market trading.

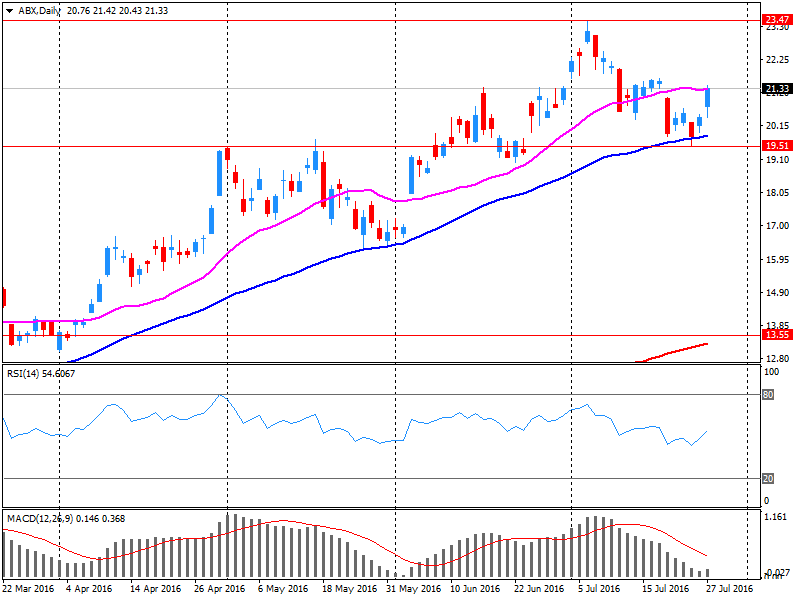

Barrick Gold reported Q2 FY 2016 earnings of $0.14 per share (versus loss of $0.01 in Q2 FY 2015), missing analysts' consensus estimate of $0.15.

The company's quarterly revenues amounted to $2.012 bln (-9.8% y/y), missing analysts' consensus estimate of $2.073 bln.

ABX fell to $21.24 (-0.52%) in pre-market trading.

WIG20 index opened at 1791.55 points (-0.34%)*

WIG 46780.65 -0.05%

WIG30 2033.44 -0.10%

mWIG40 3600.11 -0.08%

*/ - change to previous close

On the Warsaw market contracts started from cosmetic minus (-0.22%). The same FOMC message has not changed much and the market remains in consolidation.

The WIG20 index started today's session with downward move by 0.34% to 1,791 points. At the same time, the German DAX opened with a loss of less than half. The little gains on Pekao may be a good news in the context of yesterday discounts. The market itself is moving on well-known yesterday levels and its image remains neutral.

The highlight of the last hours of the financial markets was the end of the Fed meeting. Nothing special has been passed in the message and the Fed left its key interest rate in the range of 0.25-0.5%, while stating that the short-term risk to the US economic growth weakened.

The probability of increases after yesterday's meeting did not change significantly, where possible deadline for such a move is now estimated on December (approx. 40%) after the US presidential election. After this message, the price of gold rose and the dollar weakened.

In the morning, most Asian parquet on the little lost, led by the Nikkei falling by 1,0%. Contracts in the US are stable, but the expectations indicate the possibility of light falls on the opening in Europe.

From the point of view of the Warsaw Stock Exchange it is a neutral picture of the situation. There is no strong impulse to snatch the market from around 1,800 points. Investors will continue to focus its attention on the banking sector, we are still waiting for the results of stress tests of European banks (Friday) and the law on foreign currency loans in Poland (by the end of the week).

European stocks finished higher Wednesday, with surges in shares of French firms LVMH Moët Hennessy Louis Vuitton and Peugeot SA helping to offset a drop in Deutsche Bank AG shares after the German lender's profit plunged.

The Stoxx Europe 600 SXXP, +0.43% rose 0.4% to end at 342.74.

U.S. stocks ended slightly lower Wednesday after the Federal Reserve said improving economic conditions could justify an interest-rate hike as soon as September. The S&P 500 SPX, -0.12% shed 3 points, or 0.1% to 2,166, as declines in utilities and consumer-staples shares weighed on the index. The Dow industrials DJIA, -0.01% finished flat at 18,472, despite a strong performance by Apple Inc. AAPL, +6.50% which reported stronger-than-expected quarterly earnings late Tuesday. The Nasdaq Composite gained 30 points, or 0.6%, to 5,139. Economic data released Wednesday seemed to contradict the Fed's sanguine outlook. Durable-goods orders sank in June at the fastest clip in nearly two years.

Asian stocks edged up on Thursday after the Federal Reserve provided an positive assessment of the world's largest economy and lifted risk sentiment.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.2 percent after briefly climbing to its highest level since August 2015.

Australian shares rose 0.4 percent and Shanghai .SSEC gained 0.3 percent, trimming some of the heavy 1.9 percent loss suffered the previous day.

News that Chinese regulators are planning a tough clampdown on wealth management products to curb risks to the country's banking system had weighed heavily on Chinese stocks, but investors are still wading through the details.

Japan's Nikkei fell 0.7 percent, hurt by a stronger yen and nerves before the Bank of Japan's monetary policy decision on Friday.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.