- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 29-07-2020.

U.S. stock-index futures rose on Wednesday, as investors hoped the Federal Reserve to signal it remains supportive of the economy as the country struggles in its fight against the COVID-19 pandemic.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 22,397.11 | -260.27 | -1.15% |

Hang Seng | 24,883.14 | +110.38 | +0.45% |

Shanghai | 3,294.55 | +66.59 | +2.06% |

S&P/ASX | 6,006.40 | -14.10 | -0.23% |

FTSE | 6,149.04 | +19.78 | +0.32% |

CAC | 4,967.25 | +38.31 | +0.78% |

DAX | 12,841.38 | +6.10 | +0.05% |

Crude oil | $41.28 | +0.58% | |

Gold | $1,953.30 | +0.45% |

(company / ticker / price / change ($/%) / volume)

ALCOA INC. | AA | 13.13 | 0.22(1.70%) | 5133 |

ALTRIA GROUP INC. | MO | 42.75 | 0.23(0.54%) | 6048 |

Amazon.com Inc., NASDAQ | AMZN | 3,035.50 | 35.17(1.17%) | 41918 |

American Express Co | AXP | 94.7 | 0.28(0.30%) | 832 |

AMERICAN INTERNATIONAL GROUP | AIG | 31 | 0.05(0.16%) | 543 |

Apple Inc. | AAPL | 375.5 | 2.49(0.67%) | 159330 |

AT&T Inc | T | 29.75 | 0.06(0.20%) | 31868 |

Boeing Co | BA | 171.36 | 0.52(0.30%) | 612232 |

Caterpillar Inc | CAT | 139.03 | 1.00(0.72%) | 694 |

Chevron Corp | CVX | 89.82 | 0.71(0.80%) | 2037 |

Cisco Systems Inc | CSCO | 46.55 | 0.27(0.58%) | 8244 |

Citigroup Inc., NYSE | C | 51.35 | 0.08(0.16%) | 19007 |

E. I. du Pont de Nemours and Co | DD | 54.32 | 0.30(0.56%) | 217 |

Exxon Mobil Corp | XOM | 43.77 | 0.22(0.51%) | 13794 |

Facebook, Inc. | FB | 231.12 | 1.00(0.43%) | 66774 |

FedEx Corporation, NYSE | FDX | 168.43 | 1.50(0.90%) | 137 |

Ford Motor Co. | F | 7.07 | 0.06(0.86%) | 242871 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.36 | 0.13(0.98%) | 22275 |

General Electric Co | GE | 6.99 | 0.10(1.45%) | 1760773 |

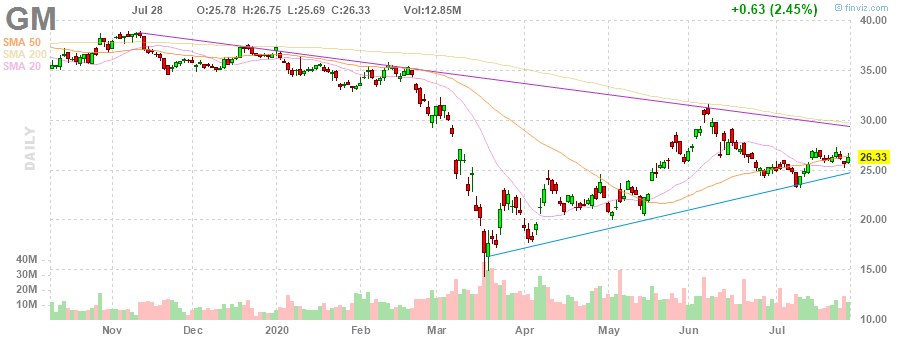

General Motors Company, NYSE | GM | 27.41 | 1.08(4.10%) | 382668 |

Goldman Sachs | GS | 202.1 | 0.48(0.24%) | 776 |

Google Inc. | GOOG | 1,511.31 | 10.97(0.73%) | 1121 |

Hewlett-Packard Co. | HPQ | 16.88 | 0.18(1.08%) | 4458 |

Home Depot Inc | HD | 265.8 | 0.52(0.20%) | 8936 |

HONEYWELL INTERNATIONAL INC. | HON | 153 | 0.99(0.65%) | 861 |

Intel Corp | INTC | 49.42 | 0.18(0.37%) | 305771 |

International Business Machines Co... | IBM | 124.95 | 0.48(0.39%) | 4754 |

Johnson & Johnson | JNJ | 147.25 | 0.42(0.29%) | 17343 |

JPMorgan Chase and Co | JPM | 97.5 | 0.18(0.19%) | 8150 |

McDonald's Corp | MCD | 196.5 | 0.26(0.13%) | 18367 |

Merck & Co Inc | MRK | 79.63 | -0.06(-0.08%) | 38048 |

Microsoft Corp | MSFT | 202.81 | 0.79(0.39%) | 112754 |

Nike | NKE | 96.5 | 0.23(0.24%) | 4164 |

Pfizer Inc | PFE | 39.4 | 0.38(0.97%) | 212691 |

Procter & Gamble Co | PG | 128.01 | 0.13(0.10%) | 4437 |

Starbucks Corporation, NASDAQ | SBUX | 78.48 | 3.84(5.14%) | 102945 |

Tesla Motors, Inc., NASDAQ | TSLA | 1,501.62 | 25.13(1.70%) | 98177 |

The Coca-Cola Co | KO | 48.28 | 0.10(0.21%) | 2901 |

Twitter, Inc., NYSE | TWTR | 36.99 | 0.38(1.04%) | 12645 |

UnitedHealth Group Inc | UNH | 300.42 | 0.49(0.16%) | 8770 |

Verizon Communications Inc | VZ | 57.47 | -0.01(-0.02%) | 1309 |

Visa | V | 193.7 | -3.04(-1.55%) | 27962 |

Wal-Mart Stores Inc | WMT | 132.36 | 0.60(0.46%) | 1927 |

Walt Disney Co | DIS | 116.2 | 0.02(0.02%) | 9592 |

Yandex N.V., NASDAQ | YNDX | 57.75 | 0.75(1.32%) | 22544 |

Apple (AAPL) target raised to $340 from $295 at Credit Suisse

Raytheon Technologies (RTX) downgraded to Hold from Buy at Argus

FXStreet notes that the S&P 500 maintains a bearish “reversal day” and the index shows potential to form a small “head and shoulders” top if the market can close below 3198, which would reinforce the Credit Suisse analyst team bias for a short term phase of risk-off.

“A small bearish ‘outside day’ yesterday increases the risk to see the construction of a ‘right-hand shoulder’ to a small potential ‘head and shoulders’ top, with the market also still maintaining a bearish ‘reversal day’ from late last week and with the Nasdaq 100 also seen at risk of a ‘double top’ following its own bearish ‘reversal day’.”

“Key near-term support stay seen at its 13-day average at 3215, with a break below 3200/3198 still needed to confirm the aforementioned top. This would then open the door to a swing lower within the broader sideways range with support seen next at 3173, ahead of 3154 and then more importantly 3116.”

“Resistance is seen at 3233 initially, with a move above 3244/48 needed to ease the topping threat and see a move back to 3266. Above 3279/81 though is needed to reassert an upward bias again, with the top of the February gap seen at 3328/38.”

Boeing (BA) reported Q2 FY 2020 loss of $4.79 per share (versus -$5.82 per share in Q2 FY 2019), much worse than analysts’ consensus estimate of -$2.63 per share.

The company’s quarterly revenues amounted to $11.807 bln (-25.0% y/y), missing analysts’ consensus estimate of $12.946 bln.

BA rose to $173.30 (+1.44%) in pre-market trading.

General Motors (GM) reported Q2 FY 2020 loss of $0.50 per share (versus earnings of $1.64 per share in Q2 FY 2019), better than analysts’ consensus estimate of -$1.76 per share.

The company’s quarterly revenues amounted to $16.800 bln (-53.4% y/y), generally in line with analysts’ consensus estimate of $16.927 bln.

GM rose to $27.35 (+3.87%) in pre-market trading.

General Electric (GE) reported Q2 FY 2020 loss of $0.15 per share (versus earnings of $0.17 per share in Q2 FY 2019), worse than analysts’ consensus estimate of -$0.09 per share.

The company’s quarterly revenues amounted to $17.750 bln (-38.4% y/y), beating analysts’ consensus estimate of $17.269 bln.

GE rose to $7.02 (+1.89%) in pre-market trading.

Visa (V) reported Q2 FY 2020 earnings of $1.07 per share (versus $1.37 per share in Q2 FY 2019), beating analysts’ consensus estimate of $1.04 per share.

The company’s quarterly revenues amounted to $4.837 bln (-18.6% y/y), generally in line with analysts’ consensus estimate of $4.847 bln.

V fell to $194.00 (-1.39%) in pre-market trading.

Starbucks (SBUX) reported Q3 FY 2020 loss of $0.46 per share (versus earnings of $0.78 per share in Q3 FY 2019), better than analysts’ consensus estimate of -$0.57 per share.

The company’s quarterly revenues amounted to $4.222 bln (-38.1% y/y), beating analysts’ consensus estimate of $4.138 bln.

The company issued in-line guidance for Q4 FY 2020, projecting EPS of $0.18-0.33 versus analysts’ consensus estimate of $0.27 and its prior guidance of $0.15-0.40.

It also issued upside guidance for FY 2020, projecting EPS of $0.83-0.98 versus analysts’ consensus estimate of $0.77 and its prior guidance of $0.55-0.95.

SBUX rose to $78.80 (+5.57%) in pre-market trading.

Advanced Micro (AMD) reported Q2 FY 2020 earnings of $0.18 per share (versus $0.08 per share in Q2 FY 2019), beating analysts’ consensus estimate of $0.17 per share.

The company’s quarterly revenues amounted to $1.930 bln (+26.1% y/y), beating analysts’ consensus estimate of $1.856 bln.

The company also issued upside guidance for Q3 and FY 2020. It sees Q3 revenues of $2.55 bln, +/- $100 mln, equating to revenues of $2.45-$2.65 bln versus analysts’ consensus estimate of $2.3 bln. For FY 2020, it predicts revenues growth of 32%, equating to revenues of ~$8.88 bln versus analysts’ consensus estimate of $8.39 bln.

AMD rose to $75.57 (+11.77%) in pre-market trading.

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -58.47 | 22657.38 | -0.26 |

| Hang Seng | 169.5 | 24772.76 | 0.69 |

| KOSPI | 39.13 | 2256.99 | 1.76 |

| ASX 200 | -23.7 | 6020.5 | -0.39 |

| FTSE 100 | 24.38 | 6129.26 | 0.4 |

| DAX | -3.38 | 12835.28 | -0.03 |

| CAC 40 | -10.68 | 4928.94 | -0.22 |

| Dow Jones | -205.49 | 26379.28 | -0.77 |

| S&P 500 | -20.97 | 3218.44 | -0.65 |

| NASDAQ Composite | -134.18 | 10402.09 | -1.27 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.