- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 30-07-2020.

U.S. stock-index futures fell on Thursday, as investors digested poor macro data and awaited Big Tech’s earnings reports after the bell.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 22,339.23 | -57.88 | -0.26% |

Hang Seng | 24,710.59 | -172.55 | -0.69% |

Shanghai | 3,286.82 | -7.73 | -0.23% |

S&P/ASX | 6,051.10 | +44.70 | +0.74% |

FTSE | 6,023.57 | -107.89 | -1.76% |

CAC | 4,887.51 | -71.23 | -1.44% |

DAX | 12,488.64 | -333.62 | -2.60% |

Crude oil | $40.55 | -1.74% | |

Gold | $1,941.60 | -0.60% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 154.51 | -1.74(-1.11%) | 4441 |

ALCOA INC. | AA | 12.97 | -0.21(-1.59%) | 6699 |

ALTRIA GROUP INC. | MO | 41.6 | -0.03(-0.07%) | 4539 |

Amazon.com Inc., NASDAQ | AMZN | 3,021.00 | -12.53(-0.41%) | 56263 |

American Express Co | AXP | 95.25 | -1.44(-1.49%) | 3988 |

AMERICAN INTERNATIONAL GROUP | AIG | 32.15 | -0.52(-1.59%) | 5757 |

Apple Inc. | AAPL | 376.75 | -3.41(-0.90%) | 363615 |

AT&T Inc | T | 29.41 | -0.15(-0.51%) | 48545 |

Boeing Co | BA | 163.52 | -2.49(-1.50%) | 202888 |

Caterpillar Inc | CAT | 138.95 | -1.58(-1.12%) | 3592 |

Chevron Corp | CVX | 88.94 | -1.13(-1.25%) | 12761 |

Cisco Systems Inc | CSCO | 45.85 | -0.86(-1.84%) | 101458 |

Citigroup Inc., NYSE | C | 51.49 | -1.03(-1.96%) | 58060 |

Deere & Company, NYSE | DE | 178.5 | -1.75(-0.97%) | 3585 |

E. I. du Pont de Nemours and Co | DD | 54.99 | -0.23(-0.42%) | 5393 |

Exxon Mobil Corp | XOM | 43.48 | -0.55(-1.25%) | 52018 |

Facebook, Inc. | FB | 231.1 | -2.19(-0.94%) | 115617 |

FedEx Corporation, NYSE | FDX | 176.49 | 6.94(4.09%) | 103635 |

Ford Motor Co. | F | 6.81 | -0.11(-1.59%) | 441722 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.09 | -0.21(-1.58%) | 42881 |

General Electric Co | GE | 6.52 | -0.07(-1.06%) | 933798 |

General Motors Company, NYSE | GM | 25.45 | -0.44(-1.70%) | 73709 |

Goldman Sachs | GS | 199.91 | -2.67(-1.32%) | 22094 |

Google Inc. | GOOG | 1,509.00 | -13.02(-0.86%) | 10977 |

Hewlett-Packard Co. | HPQ | 16.91 | -0.17(-1.00%) | 14766 |

Home Depot Inc | HD | 262.72 | -1.94(-0.73%) | 4151 |

HONEYWELL INTERNATIONAL INC. | HON | 152.07 | -2.51(-1.62%) | 335 |

Intel Corp | INTC | 47.53 | -0.54(-1.12%) | 411096 |

International Business Machines Co... | IBM | 124.25 | -1.07(-0.85%) | 6026 |

International Paper Company | IP | 38 | 1.25(3.40%) | 21876 |

Johnson & Johnson | JNJ | 149.4 | 2.86(1.95%) | 87669 |

JPMorgan Chase and Co | JPM | 98.13 | -1.55(-1.56%) | 98737 |

McDonald's Corp | MCD | 194.3 | -1.91(-0.97%) | 7728 |

Merck & Co Inc | MRK | 79.02 | -0.33(-0.42%) | 25823 |

Microsoft Corp | MSFT | 201.35 | -2.71(-1.33%) | 281603 |

Nike | NKE | 96.06 | -0.91(-0.94%) | 4634 |

Pfizer Inc | PFE | 38.71 | -0.17(-0.44%) | 134371 |

Procter & Gamble Co | PG | 130.3 | 1.99(1.55%) | 151482 |

Starbucks Corporation, NASDAQ | SBUX | 76.82 | -0.60(-0.78%) | 24845 |

Tesla Motors, Inc., NASDAQ | TSLA | 1,490.00 | -9.11(-0.61%) | 109504 |

The Coca-Cola Co | KO | 47.6 | -0.42(-0.87%) | 12528 |

Travelers Companies Inc | TRV | 115.36 | -1.49(-1.28%) | 514 |

Twitter, Inc., NYSE | TWTR | 36.7 | -0.46(-1.24%) | 14943 |

UnitedHealth Group Inc | UNH | 302 | -4.68(-1.53%) | 983 |

Verizon Communications Inc | VZ | 57.15 | -0.30(-0.52%) | 5557 |

Visa | V | 197.03 | -1.55(-0.78%) | 12503 |

Wal-Mart Stores Inc | WMT | 130.04 | -0.65(-0.50%) | 14255 |

Walt Disney Co | DIS | 114.9 | -0.71(-0.61%) | 40204 |

Yandex N.V., NASDAQ | YNDX | 56.26 | -1.35(-2.34%) | 9174 |

Walmart (WMT) initiated with a Neutral at MKM Partners; target $147

MasterCard (MA) reported Q2 FY 2020 earnings of $1.36 per share (versus $1.89 per share in Q2 FY 2019), beating analysts’ consensus estimate of $1.18 per share.

The company’s quarterly revenues amounted to $3.300 bln (-19.8% y/y), beating analysts’ consensus estimate of $3.259 bln.

MA rose to $313.00 (+1.20%) in pre-market trading.

FXStreet reports that economists at Credit Suisse note that Euro Stoxx 50 has fallen sharply, near 2% down on a day to 3237, with support seen at the 63-day average and the important end of June low at 3170/50, which if broken would trigger a top.

“Euro Stoxx remains capped by its 200-day average, currently seen at 3349, and has fallen sharply below 3277 in today’s open, which keeps the immediate risk lower within this range, with support seen next at 3241, ahead of the 63-day average and the important end of June low at 3170/50. Despite the current weakness, only a close below here would be seen raising the prospect of a more important turn lower.”

“Resistance is seen at 3281 initially, with the immediate risk seen lower in the range whilst below 3311/17. Only a close back above the 200-day average at 3349 though would be seen reasserting an upward bias with resistance then seen next at 3380, then 3401.”

Int'l Paper (IP) reported Q2 FY 2020 earnings of $0.77 per share (versus $1.15 per share in Q2 FY 2019), beating analysts’ consensus estimate of $0.39 per share.

The company’s quarterly revenues amounted to $4.866 bln (-14.1% y/y), missing analysts’ consensus estimate of $4.974 bln.

IP rose to $37.70 (+2.59%) in pre-market trading.

Procter & Gamble (PG) reported Q4 FY 2020 earnings of $1.16 per share (versus $1.10 per share in Q4 FY 2019), beating analysts’ consensus estimate of $1.01 per share.

The company’s quarterly revenues amounted to $17.698 bln (+3.5% y/y), beating analysts’ consensus estimate of $16.974 bln.

The company also issued guidance for FY 2021, projecting EPS of +3-7% (implying $5.27-5.48) versus analysts’ consensus estimate of $5.23 and revenues of +1-3% (implying $71.66-73.08 bln) versus analysts’ consensus estimate of $71.68 bln.

PG rose to $131.00 (+2.10%) in pre-market trading.

FXStreet reports that according to economists at Credit Suisse, the S&P 500 is expected for now to be capped at the top of its February “pandemic” gap at 3328/38. At the same time, the VIX continues to hold key support and is set for a fresh rise.

“While support at 3198 holds though the immediate bias can stay higher for now for a test on the top of the February gap at 3328/38. We continue though to look for this to remain tough resistance for now for lengthier consolidation. However, a break in due course should clear the way for a challenge on the 3394 record high.”

“Below 3198 can mark a minor top to reinforce the likelihood for further range-trading with support then seen back at 3128/16, which we would look to hold. A break though can see a retest of support from the 200-day average, currently seen at 3046, but with only a close back below here seen raising the risk we are seeing the construction of a potentially important top.”

“The VIX continues to (just) hold key support from the top of its 2019 range at 24.81/23.54 and we look for a fresh attempt to set a near-term base above 28.58, for a rise back to 33.67 initially. A close below 23.54 though would be seen opening the door to more ‘normal’ conditions with support seen at 20 next.”

PayPal (PYPL) reported Q2 FY 2020 earnings of $1.07 per share (versus $0.86 per share in Q2 FY 2019), beating analysts’ consensus estimate of $0.88 per share.

The company’s quarterly revenues amounted to $5.260 bln (+22.0% y/y), beating analysts’ consensus estimate of $4.994 bln.

The company issued upside guidance for Q3 FY 2020, projecting revenues growth of ~23% (25% on FX neutral basis), equating to revenue of approximately $5.385 bln versus analysts’ consensus estimate of $5.06 bln.

For FY 2020, it guided EPS growth of ~25%, equating to $3.88 versus analysts’ consensus estimate of $3.39 and revenues growth of ~17% (~19% on FX neutral basis), equating to revenue of approximately $20.79 bln versus analysts’ consensus estimate of $20.37 bln.

PYPL rose to $189.90 (+2.87%) in pre-market trading.

FXStreet notes that the pace of recovery over the next 18 months will define the US economic outlook over the next 3-5 years. Morgan Stanley outlines four scenarios for life after COVID.

“Base Case: Navigating a New Normal. A vaccine arrives in the spring of 2021, following a second wave of rising infection rates and business tightening in the fall of 2020. Real GDP returns to pre-COVID levels by the end of 2021 but with subdued near-term productivity growth, lower capital expenditures from businesses and higher unemployment levels through 2025. In this case, consumers could remain cautious with wallets, resulting in an elevated savings rate of 10% and subdued spending habits. One area where spending could pick up is housing.”

“Base Case +: Getting Back to Normal. A slightly more positive scenario, compared to the base case, assumes a viable vaccine in the spring of 2021 but without a severe outbreak in the fall and, consequently, less risk aversion among consumers and businesses. Productivity would pick up and help bring GDP growth closer to 2%, enabling growth to resume pre-COVID levels by 2025.”

“Bull Case: Riding a Robust Recovery. A vaccine arrives well before the spring of 2021, and low-risk aversion among consumers and businesses brings a swift return to life as normal. All told, life after COVID wouldn’t be materially different than before the pandemic. Bull-case outlook pegs average GDP growth at 2.4% through 2025. This optimistic outlook has unemployment levels falling back to 3.5%, saving levels drifting down to 7.3% and inflation rising 2.5%. Notably, this scenario could double productivity growth to as high as 2%, thanks to greater workforce engagement and technology improvements.”

“Bear Case: Dealing with Deep Scars. No vaccine for two to five years. This results in a crisis of consumer confidence, a surge in savings, structurally higher unemployment and lasting economic damage. Should more unemployment become permanent, rather than temporary, the effects on the labor market can be significant over time.”

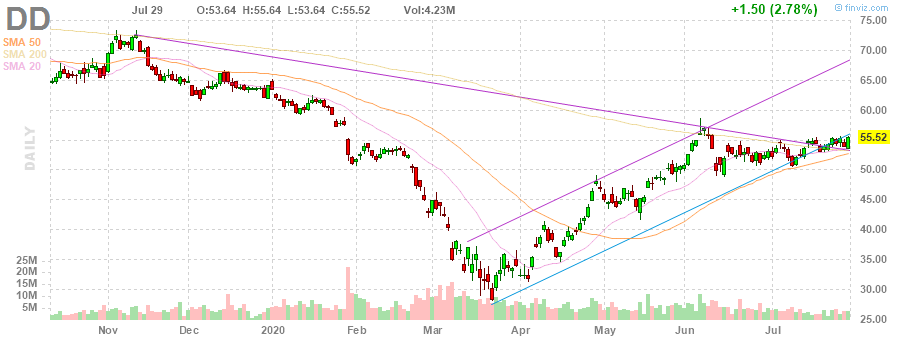

DuPont (DD) reported Q2 FY 2020 earnings of $0.70 per share (versus $0.97 per share in Q2 FY 2019), beating analysts’ consensus estimate of $0.58 per share.

The company’s quarterly revenues amounted to $4.828 bln (-11.7% y/y), beating analysts’ consensus estimate of $4.711 bln.

DD stood at $55.22 (0.0%) in pre-market trading.

The company also issued guidance for Q3 FY 2020, projecting EPS of $0.71-0.73 versus analysts’ consensus estimate of $0.71 and revenues slightly up sequentially versus analysts’ consensus estimate of $5.01 bln.

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -260.27 | 22397.11 | -1.15 |

| Hang Seng | 110.38 | 24883.14 | 0.45 |

| KOSPI | 6.17 | 2263.16 | 0.27 |

| ASX 200 | -14.1 | 6006.4 | -0.23 |

| FTSE 100 | 2.2 | 6131.46 | 0.04 |

| DAX | -13.02 | 12822.26 | -0.1 |

| CAC 40 | 29.8 | 4958.74 | 0.6 |

| Dow Jones | 160.29 | 26539.57 | 0.61 |

| S&P 500 | 40 | 3258.44 | 1.24 |

| NASDAQ Composite | 140.85 | 10542.94 | 1.35 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.