- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 31-07-2020.

U.S. stock-index futures rose on Friday, following better-than-expected earnings reports from some of the biggest tech companies and market leaders, including Facebook (FB), Amazon (AMZN), Alphabet (GOOG) and Apple (AAPL).

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,710.00 | -629.23 | -2.82% |

Hang Seng | 24,595.35 | -115.24 | -0.47% |

Shanghai | 3,310.01 | +23.18 | +0.71% |

S&P/ASX | 5,927.80 | -123.30 | -2.04% |

FTSE | 5,974.61 | -15.38 | -0.26% |

CAC | 4,863.28 | +10.34 | +0.21% |

DAX | 12,476.71 | +97.06 | +0.78% |

Crude oil | $40.36 | +1.10% | |

Gold | $1,992.60 | +2.59% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 151.75 | -0.37(-0.24%) | 7880 |

ALCOA INC. | AA | 13.18 | 0.00(0.00%) | 652 |

ALTRIA GROUP INC. | MO | 41.41 | -0.17(-0.41%) | 6822 |

Amazon.com Inc., NASDAQ | AMZN | 3,220.00 | 168.12(5.51%) | 171716 |

American Express Co | AXP | 93.6 | -1.05(-1.11%) | 9236 |

AMERICAN INTERNATIONAL GROUP | AIG | 32 | 0.22(0.69%) | 4962 |

Apple Inc. | AAPL | 409.75 | 24.99(6.50%) | 1926350 |

AT&T Inc | T | 29.53 | -0.04(-0.14%) | 118413 |

Boeing Co | BA | 161.69 | -0.26(-0.16%) | 137087 |

Caterpillar Inc | CAT | 138.1 | 1.37(1.00%) | 44258 |

Chevron Corp | CVX | 82.92 | -3.35(-3.88%) | 150576 |

Cisco Systems Inc | CSCO | 46.5 | 0.06(0.13%) | 57820 |

Citigroup Inc., NYSE | C | 50.18 | -0.18(-0.36%) | 147075 |

E. I. du Pont de Nemours and Co | DD | 53.7 | -0.06(-0.11%) | 9093 |

Exxon Mobil Corp | XOM | 40.95 | -0.92(-2.20%) | 348889 |

Facebook, Inc. | FB | 251.15 | 16.65(7.10%) | 1003771 |

FedEx Corporation, NYSE | FDX | 172.7 | -0.01(-0.01%) | 3125 |

Ford Motor Co. | F | 6.93 | 0.19(2.82%) | 618061 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13 | 0.06(0.46%) | 26775 |

General Electric Co | GE | 6.3 | 0.04(0.64%) | 668205 |

General Motors Company, NYSE | GM | 25.21 | 0.01(0.04%) | 44437 |

Goldman Sachs | GS | 198.5 | -1.03(-0.52%) | 21571 |

Google Inc. | GOOG | 1,515.01 | -16.44(-1.07%) | 18338 |

Hewlett-Packard Co. | HPQ | 17.36 | 0.12(0.70%) | 27938 |

Home Depot Inc | HD | 264.8 | -1.51(-0.57%) | 14947 |

HONEYWELL INTERNATIONAL INC. | HON | 149.72 | 0.56(0.38%) | 701 |

Intel Corp | INTC | 48.43 | 0.44(0.92%) | 318619 |

International Business Machines Co... | IBM | 122.79 | -0.11(-0.09%) | 14464 |

Johnson & Johnson | JNJ | 147.3 | 0.46(0.31%) | 17569 |

JPMorgan Chase and Co | JPM | 96.55 | -0.47(-0.48%) | 92559 |

McDonald's Corp | MCD | 194.2 | -1.21(-0.62%) | 13481 |

Merck & Co Inc | MRK | 81.3 | 2.31(2.92%) | 157613 |

Microsoft Corp | MSFT | 205 | 1.10(0.54%) | 198467 |

Nike | NKE | 96.3 | -0.52(-0.54%) | 9543 |

Pfizer Inc | PFE | 38.79 | 0.05(0.13%) | 145073 |

Procter & Gamble Co | PG | 129.16 | -2.26(-1.72%) | 22573 |

Starbucks Corporation, NASDAQ | SBUX | 76.48 | -0.16(-0.21%) | 12889 |

Tesla Motors, Inc., NASDAQ | TSLA | 1,520.00 | 32.51(2.19%) | 129655 |

The Coca-Cola Co | KO | 47.53 | -0.16(-0.34%) | 15730 |

Travelers Companies Inc | TRV | 115 | -0.93(-0.80%) | 3988 |

Twitter, Inc., NYSE | TWTR | 37.45 | 0.73(1.99%) | 88417 |

UnitedHealth Group Inc | UNH | 304.99 | -0.24(-0.08%) | 451 |

Verizon Communications Inc | VZ | 57.03 | -0.27(-0.47%) | 12447 |

Visa | V | 193.85 | -0.21(-0.11%) | 23419 |

Wal-Mart Stores Inc | WMT | 129.82 | -0.30(-0.23%) | 26115 |

Walt Disney Co | DIS | 115.5 | -0.16(-0.14%) | 29087 |

Yandex N.V., NASDAQ | YNDX | 56.67 | -0.56(-0.98%) | 4636 |

Apple (AAPL) target raised to $470 from $400 at Cowen

Amazon (AMZN) target raised to $4000 from $3600 at Telsey Advisory Group

Exxon Mobil (XOM) reported Q2 FY 2020 loss of $0.70 per share (versus earnings of $0.61 per share in Q2 FY 2019), worse than analysts’ consensus estimate of -$0.60 per share.

The company’s quarterly revenues amounted to $32.605 bln (-52.8% y/y), missing analysts’ consensus estimate of $38.157 bln.

XOM fell to $40.98 (-2.13%) in pre-market trading.

FXStreet notes that the S&P 500 Index has yet again held above key support at 3205/3198, which reduces the topping threat somewhat, although economists at Credit Suisse still lean towards a breakdown below this level on balance.

“S&P 500 moved higher on Thursday as the market saw a sharp intraday reversal back higher after yet again holding support from its rising 13-day exponential average, now at 3225 as well as the range lows at 3215/3198. This leaves the market still trapped in its range and whilst we remain of the view the threat of a correction lower remains in place, this threat is somewhat reduced given the market’s ongoing resilience above key supports.”

“We need to see a close below 3225 to see the topping threat increase again, although only below 3205/3198 would finally see this confirmed, with support then seen initially at 3173. Above 3265/66 would instead open the door to a retest of the ‘reversal day’ high and price resistance at 3279/81.”

“Ultimately we need to see above 3279/81 to ease the threat of a corrective setback for an extension of the rally with resistance seen next at 3288 and the more importantly at the top of the February price gap at 3328/38.”

Merck (MRK) reported Q2 FY 2020 earnings of $1.37 per share (versus $1.30 per share in Q2 FY 2019), beating analysts’ consensus estimate of $1.05 per share.

The company’s quarterly revenues amounted to $10.872 bln (-7.6% y/y), beating analysts’ consensus estimate of $10.524 bln.

MRK rose to $81.20 (+2.80%) in pre-market trading.

Chevron (CVX) reported Q2 FY 2020 loss of $1.59 per share (versus earnings of $2.27 per share in Q2 FY 2019), worse than analysts’ consensus estimate of -$0.89 per share.

The company’s quarterly revenues amounted to $13.949 bln (-64.1% y/y), missing analysts’ consensus estimate of $21.707 bln.

CVX fell to $84.00 (-2.63%) in pre-market trading.

Caterpillar (CAT) reported Q2 FY 2020 earnings of $1.03 per share (versus $2.83 per share in Q2 FY 2019), beating analysts’ consensus estimate of $0.72 per share.

The company’s quarterly revenues amounted to $9.997 bln (-30.7% y/y), beating analysts’ consensus estimate of $9.397 bln.

CAT rose to $141.00 (+3.12%) in pre-market trading.

Ford Motor (F) reported Q2 FY 2020 loss of $0.35 per share (versus earnings of $0.28 per share in Q2 FY 2019), better than analysts’ consensus estimate of -$1.16 per share.

The company’s quarterly revenues amounted to $16.622 bln (-53.5% y/y), beating analysts’ consensus estimate of $15.629 bln.

F rose to $6.92 (+2.67%) in pre-market trading.

Apple (AAPL) reported Q3 FY 2020 earnings of $2.58 per share (versus $2.18 per share in Q3 FY 2019), beating analysts’ consensus estimate of $2.07 per share.

The company’s quarterly revenues amounted to $59.685 bln (+10.9% y/y), beating analysts’ consensus estimate of $52.555 bln.

The company’s board of directors also approved a four-for-one stock split to make the stock more accessible to a broader base of investors.

AAPL rose to $408.50 (+6.17%) in pre-market trading.

Amazon (AMZN) reported Q2 FY 2020 earnings of $10.30 per share (versus $5.22 per share in Q2 FY 2019), beating analysts’ consensus estimate of $1.62 per share.

The company’s quarterly revenues amounted to $88.912 bln (+40.2% y/y), beating analysts’ consensus estimate of $81.269 bln.

The company also issued upside guidance for Q3, projecting revenues of $87-93 bln versus analysts’ consensus estimate of $86.36 bln and operating income of $2.00-5.00 bln versus analysts’ consensus estimate of $2.90 bln.

AMZN rose to $3,218.01 (+5.44%) in pre-market trading.

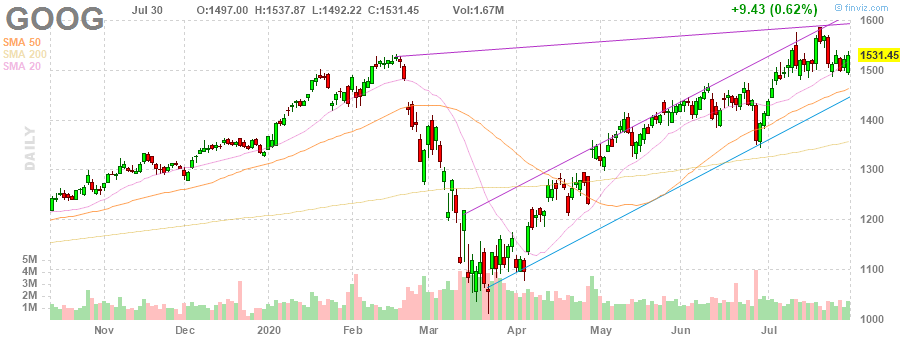

Alphabet (GOOG) reported Q2 FY 2020 earnings of $10.13 per share (versus $14.21 per share in Q2 FY 2019), beating analysts’ consensus estimate of $8.23 per share.

The company’s quarterly revenues amounted to $38.297 bln (-1.7% y/y), beating analysts’ consensus estimate of $37.342 bln.

GOOG rose to $1,543.06 (+0.76%) in pre-market trading.

Facebook (FB) reported Q2 FY 2020 earnings of $1.80 per share (versus $1.99 per share in Q2 FY 2019), beating analysts’ consensus estimate of $1.38 per share.

The company’s quarterly revenues amounted to $18.690 bln (+10.7% y/y), beating analysts’ consensus estimate of $17.361 bln.

FB rose to $248.20 (+5.84%) in pre-market trading.

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -57.88 | 22339.23 | -0.26 |

| Hang Seng | -172.55 | 24710.59 | -0.69 |

| KOSPI | 3.85 | 2267.01 | 0.17 |

| ASX 200 | 44.7 | 6051.1 | 0.74 |

| FTSE 100 | -141.47 | 5989.99 | -2.31 |

| DAX | -442.61 | 12379.65 | -3.45 |

| CAC 40 | -105.8 | 4852.94 | -2.13 |

| Dow Jones | -225.92 | 26313.65 | -0.85 |

| S&P 500 | -12.22 | 3246.22 | -0.38 |

| NASDAQ Composite | 44.87 | 10587.81 | 0.43 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.