- Analytics

- Market analysis

- Market Opinions

- The British Pound Is Set for a Negative Mood As Post-Brexit Talks Are in a Blind Alley

The British Pound Is Set for a Negative Mood As Post-Brexit Talks Are in a Blind Alley

The UK labour data and inflation figures initially boosted the British Pound in the first half of the week, but all the positive effects disappeared as the EU ambassadors failed to agree on the approach to be used in the so-called "level playing field" from which mandatory conditions in post-Brexit trade talks could be created by the side of continental Europe.

GBP/USD was trading around 1.2985 by Wednesday afternoon and jumped to the 1.3020 area, onto better-than-expected consumer price and retail price values.. Just a couple of hours later, it lost ground and finished the day at the 1.2915 level.

Representatives of the 27 EU member states have disagreed with what Brussels will require from London as concerns to easy market access. The Financial Times shares the following view of the situation: "The atmosphere sours amid charges of hypocrisy and reneging on agreements. The row centres on EU demands that Britain sign up to a "level playing field" of common standards in areas such as environmental law, labour policy and state aid. Britain has complained that the requirements go far beyond what is contained in agreements the bloc has with other countries such as Canada; the EU insists that the cases cannot be compared".

In particular, France wants a further toughening of the bloc's demands. "There must be [custom] controls in the Irish Sea," French European Affairs Minister Amelie de Montchalin told the Senate during the hearing, according to Reuters. "We must not cede to the pressures of a timetable. France would not sign a bad post-Brexit deal with the United Kingdom on Dec. 31 just for the sake of agreeing one to meet a deadline," she added.

"The EU now hopes that ambassadors can complete their work on the text at a meeting on Monday, paving the way for European affairs ministers to sign it off the following day," the Financial Times claims in its article. But even a common point of view from all the 27 EU countries would not be a guarantee of success in negotiations with the UK. Bloomberg reported on Wednesday that the British government unveiled plans to end what it calls the UK's dependence on "cheap low-skilled labour" and introduce a system that will require migrants to prove they can speak English that they have a job and that they receive a minimum of £20,480 ($26,520) annual salary.

This was just two days before the Guardian quoted the UK government's chief trade negotiator David Frost as calling for a "Canada free trade agreement-type relationship" during a speech in Brussels. "The EU's demand would compromise Britain's sovereign order and would be unsustainable and undemocratic. Any idea that the UK should follow EU rules would be contrary to the fundamentals of what it means to be an independent country," he told an audience at the Unversité Libre de Bruxelles. "To think that we might accept EU supervision on so-called level playing field issues simply fails to see the point of what we are doing," and that was not "a simple negotiating position which might move under pressure - it is the point of the whole project," he added.

Canada's deal with the EU took seven years to negotiate and it eliminates most import tariffs on goods. It also increases quotas, which mean that the amount of a product can be exported without extra charges, but it does not remove the quotas entirely. The EU's position, for now, is to qualify for a zero-tariff, zero-quota free trade agreement (FTA) and have the UK promise not to lower its standards in the areas of environment, labour law, climate change and taxation. The EU's main negotiator says Canada and Britain are not the same. The former is roughly 4,000 miles away the latter 21 miles, and the UK needs to match some requirements that are closer to the present EU rules to avoid undercutting the EU economy.

A possible failure of negotiations may produce a higher chance for the UK to revert to the World Trade Organisation (WTO) rules, which would probably mean unfavourable business conditions. Therefore, as market investors are too busy with all these arguments, they have forgotten, for a while, about quite inspiring UK statistical data. The Unemployment Rate confirmed its ten-year lowest level at 3.8%, as the Employment Change came out at a high at the180,000 mark (that data represents the three-month moving average compared to the same period a year earlier). The Average Earnings could be considered as a weak point in the labour report, as the earnings growth slows for the fifth month in a row. But even this contradictory set of data caused the British currency to jump from the 1.2990 to the 1.3045 area.

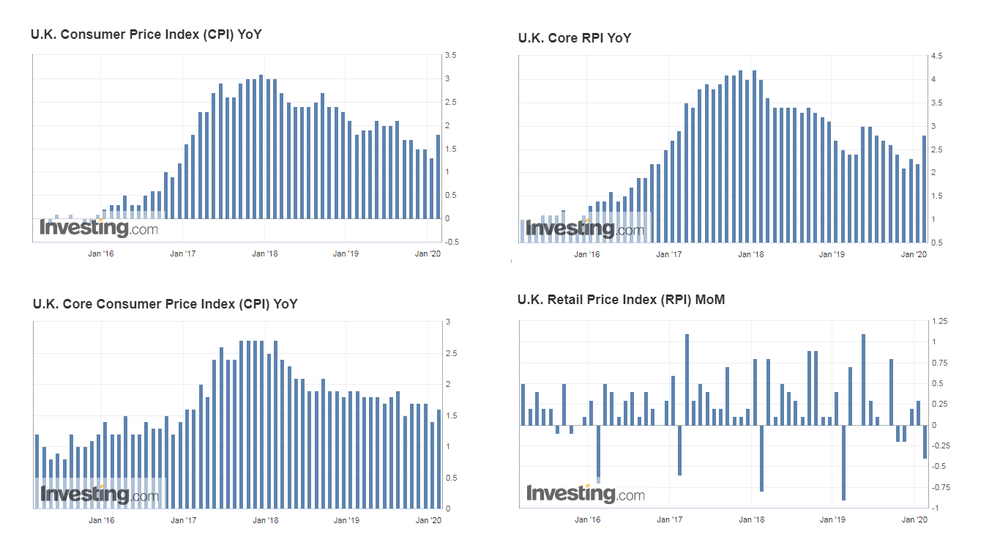

The UK Consumer Price Index (CPI) had a really remarkable jump from 1.3% to 1.8% year-to-year with a support of the same outstanding rise in the Retail Price Index (RPI). RPI differs from CPI as it only measures goods and services bought for the purpose of consumption by the vast majority of households and includes housing costs and mortgage, which are excluded from CPI. A month-by-month CPI and RPI was negative but that is a common seasonal feature for all February's inflation data.

Pic 1. U.K. Consumer Price and Retail price data

Source: Investing.com

So, a much higher than expected reading of year-to-year inflation could be taken as a clearly bullish signal for the Pound since such an inflationary picture immediately reduces the chances for the Bank of England rate cut in the nearest months. This potentially positive effect is now almost not taken into account by the market, but investors may be willing to dip into their piggy banks at an appropriate time if other positive economic information is accumulated or if there is any good news from the EU-UK negotiations, sooner or later.

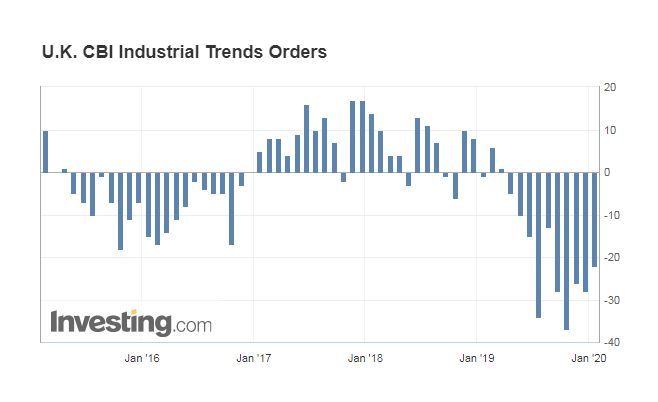

Three more British statistical reports are going to be published by the end of this week. The Retail Sales figures came out this morning at 9am GMT and they were quite inspiring with better than expected figures. The Confederation of British Industry (CBI) will publish its Industrial Trends Orders later today at 11.00 am GMT, which is expected to confirm a positive trend. This indicator measures economic expectations of the manufacturing executives in the UK and is compiled from a survey of about 550 manufacturers. Any level above zero indicates that order volume is expected to increase; while a level below zero indicates that lower volumes are expected. The Industrial Trends Orders have been deeply below zero for the last ten months, so it is likely to expect the order to be situation in less negative territory.

Pic 2. U.K. CBI Industrial Trends Orders

Source: Investing.com

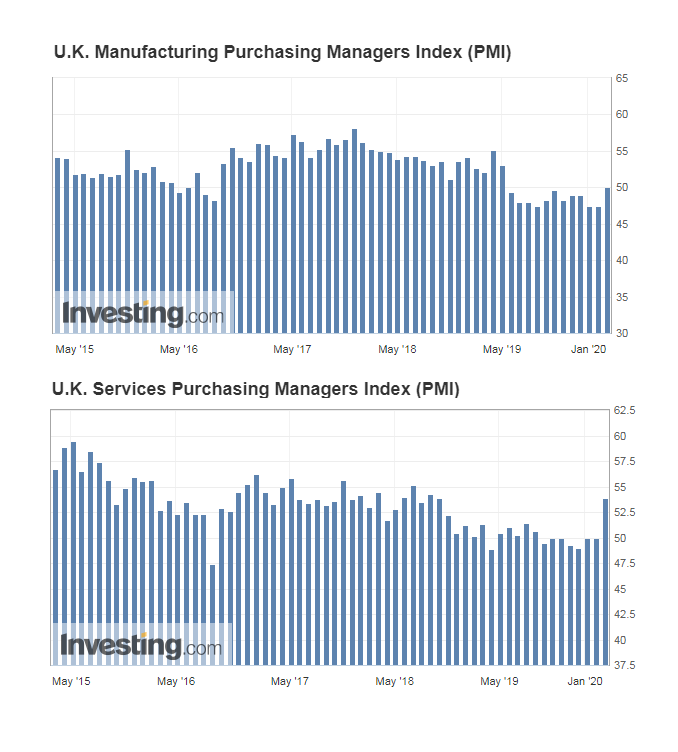

Last but not the least, the last report from the UK for the week will be the fresh Purchasing Managers' Indexes (PMI) series on Friday. A month ago, statistical data for PMI was improving, especially with PMI in the service segment of the British economy. This data should certainly be monitored, especially if the dynamics of the PMI confirm the previous slightly positive signs that were shown by the GDP report, which came out at the beginning of February. A negative scenario could show the PMI data failing to stay above the 50 mark this time.

Pic 3. U.K. Manufacturing PMI and Service PMI

Source: Investing.com

Disclaimer:

Analysis and opinions provided herein are intended solely for informational and educational purposes and don't represent a recommendation or investment advice by TeleTrade.

Indiscriminate reliance on illustrative or informational materials may lead to losses.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.