- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EU session review: Pound at three-week low as oil, retail sales sparks concern about recovery

EU session review: Pound at three-week low as oil, retail sales sparks concern about recovery

Data released

07:00 Germany GDP (Q4) preliminary 0.4% 0.4% 0.7%

07:00 Germany GDP (Q4) preliminary Y/Y 4.0% 4.0% 3.9%

07:45 France Consumer confidence (February), new method 85 85 85

09:00 Italy Retail sales (December) adjusted 0.2% - -0.3%

09:00 Italy Retail sales (December) Y/Y unadjusted 0.4% - 1.0%

10:00 Italy Business confidence (February) 103.0 103.8 103.4 (103.6)

10:00 EU(17) Economic sentiment index (February) 107.8 106.7 106.8 (106.5)

10:00 EU(17) Business climate indicator (February) 1.45 - 1.45 (1.58)

11:00 UK CBI retail sales volume balance (February) 6% 31% 37%

The pound slid to a three-week low against the euro on concern a surge in oil prices may derail the global economic recovery, and a report showed retailers expect no growth next month.

Sterling fell after oil surged to a 30-month high of more than $119 a barrel. Central bank policy maker David Miles said officials shouldn’t rush to raise interest rates to prove they are “tough” on inflation as forecasts warrant a “very gradual” tightening.

“Rate expectations are being pushed back a bit because the market is seeing the oil price as being stagflationary,” said Steve Barrow at Standard Bank Plc. “It’s both inflationary and a source of weaker growth. That’s something which is likely to weigh on sterling.”

Retailers saying sales volumes increased from a year ago outnumbered those reporting declines by 6 percentage points, compared with 37 percentage points in January, the Confederation of British Industry said today.

Brent oil surged after Barclays Capital estimated that political revolt in Libya, which holds Africa’s biggest crude reserves, caused it to cut two-thirds of output. As much as 1 million barrels of Libya’s 1.6 million barrels of daily oil production, the ninth-largest among the 12 members of the Organization of Petroleum Exporting Countries, may have been lost, Barclays said in a report yesterday. Goldman Sachs Group Inc. estimated disruptions at 500,000 barrels a day.

Britain’s currency has gained 3.6% against the dollar this year amid mounting pressure on the Bank of England to raise its key rate from a record low 0.5% as inflation persists above its target. Consumer-price growth accelerated to 4% last month, a Feb. 15 report showed, the 14th consecutive month above the 2% goal.

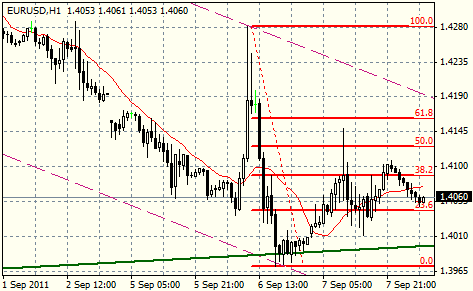

EUR/USD rose from $1.3700 to $1.3808 before retreated to $1.3750 and currently holds within the $1.3750/85 range.

GBP/USD recovered to $1.6212 following its decline to $1.6140. In general rate remains under pressure.

USD/JPY set stable a bit higher lows on Y81.85. A break of Y8175 to open a deeper move toward next support area between Y81.65/50.

US data starts at 1330GMT, when initial jobless claims are expected to fall 5,000 to 405,000 in the February 19 week after rising in the previous week.

At the same time, durable goods orders are expected to surge 3.0% in January after the 2.3% drop in December.

At 1500GMT the New Home Sales data is due, where the pace of new home sales is expected to slow to a 305,000 annual rate in January after the December spike.

The weekly EIA Crude Oil Stocks data is due at 1600GMT.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.