- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EU session review: Yen, Swiss Franc decline as stocks advance, concern over oil price eases

EU session review: Yen, Swiss Franc decline as stocks advance, concern over oil price eases

Data released

09:00 EU(17) M3 money supply (January) adjusted Y/Y 1.5% 1.9% 1.7%

09:00 EU(17) M3 money supply (3 months to January) adjusted Y/Y 1.7% - 1.6%

09:30 UK GDP (Q4) revised Y/Y -0.6% -0.4% -0.5%

09:30 UK GDP (Q4) revised Y/Y 1.5% 1.8% 1.7%

The yen and franc declined before a report that is forecast to show U.S. economic growth quickened and as stocks rose, denting demand for the perceived safety of the Japanese and Swiss currencies.

“The yen is overbought, and there’s potential for further losses once the crisis is resolved,” said Jane Foley, a senior currency strategist at Rabobank. Losses by the yen may be limited as the Libyan crisis “is clearly not resolved yet and the market won’t want to leave a lot of risk open over the weekend,” Foley said.

The franc retreated from a record high against the dollar on speculation the Libyan rebellion won’t trigger an oil-price rally sufficient to dent the global economic recovery.

Libyan leader Muammar Qaddafi, who has lost control of much of his country’s oil-rich east, appealed on state television to citizens to end violence as his forces stepped up a crackdown on opponents. The nation holds Africa’s largest crude oil reserves.

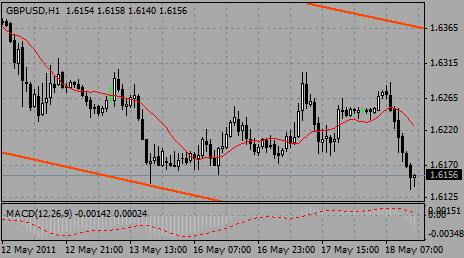

The pound slumped to its weakest level this month against the euro after a report showed Britain’s economy shrank more than initially estimated in the fourth quarter.

U.K. gross domestic product contracted 0.6% in the fourth quarter, the Office for National Statistics said today, more than the Jan. 25 estimate of a 0.5% drop.

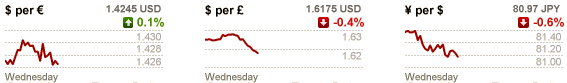

EUR/USD consolidated within the $1.3815/40 for the most hours in EU before weakened to current $1.3775/80. Bids at $1.3770/75 give some support to euro.

GBP/USD fell to the lows around $1.6070 before trying to recover to $1.6100. In general rate remains under pressure.

USD/JPY holds between Y81.80/Y82.05.

U.S. gross domestic product probably grew at a 3.3% annual rate in the fourth quarter, Commerce Department figures will show today, according to the median prediction. That’s higher than an initial estimate of 3.2% reported on Jan. 28.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.