- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Asian session:

Asian session:

Data:

05:00 Japan Housing Starts, y/y +2.7%

05:00 Japan Construction Orders, y/y -10.7%

Canada’s currency climbed to its strongest level in almost three years against its U.S. counterpart as crude oil, the nation’s biggest export, had its biggest weekly gain since 2009.

The loonie, as the Canadian currency is known for the image of the aquatic bird on the C$1 coin, was poised for a 2.4 percent monthly increase versus the U.S. dollar before the Bank of Canada’s meeting next week.

New Zealand’s dollar strengthened for a third day against the greenback as gains in Asian stocks revived demand for higher-yielding currencies.

Australia’s currency weakened earlier after Wen said yesterday that China set an annual economic expansion target of 7 percent for the 12th 5-year plan period, which covers 2011 through 2015. The target was 7.5 percent for the period from 2006 through 2010, with actual growth surpassing that each year.

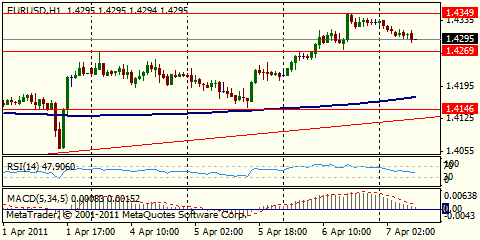

EUR/USD: the pair shown high in the field of $1.3780 then decreased.

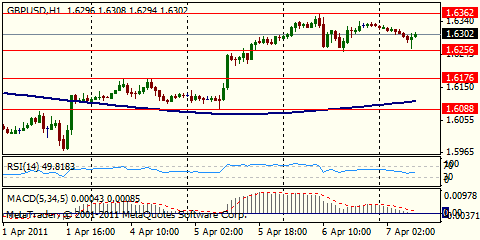

GBP/USD: the pair bargained within the limits of $1.6070-$ 1.6160.

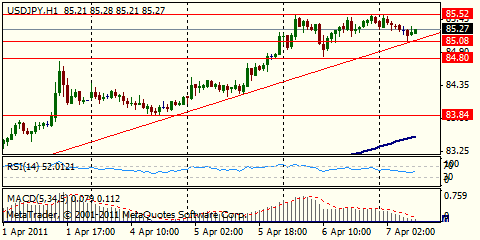

USD/JPY: the pair bargained within the limits of Y81.60-Y81.75.

Core-European data for Monday starts at 0700GMT with German import prices for January and ends at 1000GMT with the EMU flash HICP data for February.

US: UK data is limited to the January Land Registry House Price data, which is due at 1100GMT.

US data starts at 1330GMT with the ISM-NY Business Index Personal Income & Expenditures data and the PCE Price Index. Personal income is expected to rise 0.4% in January, as payrolls rose only 36,000 and the workweek fell to 34.2 hours, offset by a 0.4% jump in hourly earnings. PCE is expected to rise 0.4%, as retail sales were up 0.3%, both including and excluding auto sales. The core PCE price index is expected to rise 0.2%.

US data continues at 1430GMT with the weekly MNI Capital Goods Index. Then, at 1445GMT, the Chicago PMI is expected to fall to a reading of 68.0 in February. Other regional data already released have suggested modest expansion. Further US data includes the 1500GMT release of NAR Pending Home Sales as well as the weekly MNI Retail Trade Index

and Dallas Fed Manufacturing Outlook Survey both at 1530GMT.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.