- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EU session review: Dollar reaches 4-month low before U.S. jobs data release

EU session review: Dollar reaches 4-month low before U.S. jobs data release

Data released

08:00 UK Halifax house price index (February) -0.9% -0.6% 0.8%

08:00 UK Halifax house price index (February) 3m Y/Y -2.8% -2.5% -2.4%

The dollar fell to its weakest level in four months against the euro as stock markets rose before a report that may show U.S. employers added the most jobs since May, curbing demand for the currency as a haven.

The euro headed for a third straight weekly increase against the greenback, the longest run of gains since October, after European Central Bank President Jean-Claude Trichet said yesterday the ECB may increase interest rates at its next meeting.

The euro has jumped 1.3% since Feb. 25 against a basket of developed nations’ currencies as investors increased wagers the ECB would raise it key rate, which is already 0.75% higher than the upper end of the Federal Reserve target range.

An “increase of interest rates in the next meeting is possible,” Trichet said yesterday. Trichet and board member Lorenzo Bini Smaghi are among the ECB policy makers scheduled to speak in Paris and Cape Town today.

“It’s absolutely clear that the ECB will raise rates in April, with some now expecting 75 basis points worth of hikes this year,” said Yuji Saito at Credit Agricole Corporate & Investment Bank. “The euro will likely strengthen further, initially targeting $1.4080,” the Nov. 8 high, he said.

Sterling declined against the dollar after house prices fell in February, fueling concern that the economic recovery won’t be sustained.

U.K. house prices fell 0.9% from January, when they rose 0.8%. Britain’s economy shrank 0.6% in the fourth quarter.

EUR/USD holds within the $1.3950/80 range.

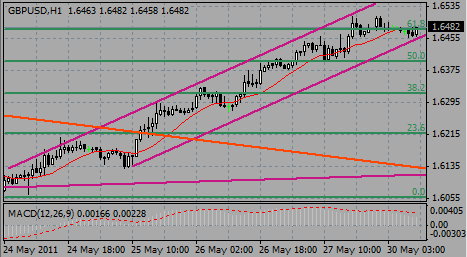

GBP/USD initially fell to session lows around $1.6232 before it recovered to $1.6306. Rate failed to hold above and was back under Y1.6300.

USD/JPY rose from Y82.30 to current Y82.75.

U.S. nonfarm payrolls report is due to come at 13:30 GMT. Analysts expect the report to show a rise of 185,000, following a tepid 36,000 increase previously.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.