- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Forex: Tusday's review

Forex: Tusday's review

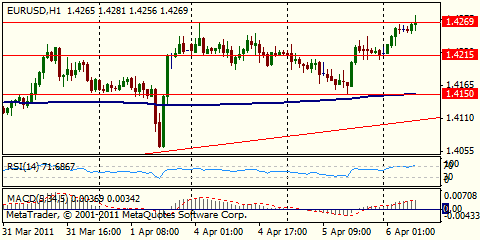

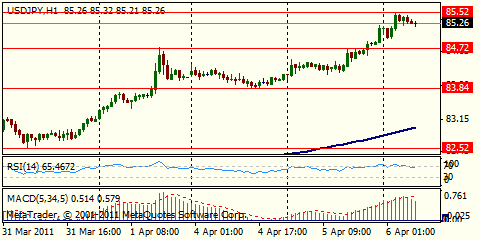

The dollar rose against the yen after Federal Reserve Chairman Ben S. Bernanke said yesterday inflation must be watched “extremely closely,” spurring bets interest rates may be raised sooner than forecast.

Australia’s dollar dropped from almost a record after the Reserve Bank of Australia Governor Glenn Stevens held the overnight cash target rate at 4.75 percent for a fourth straight meeting as floods disrupted coal mining in the nation’s northeast and a rising currency tempered inflation.

FOMC said: "To mitigate (infl) risks... agreed that FOMC would continue its planning for the eventual exit from the current, exceptionally accommodative stance of monetary policy. In light of uncertainty about the economic outlook, it was seen as prudent to consider possible exit strategies for a range of potential economic outcomes. A few participants indicated that economic conditions might warrant a move toward less-accommodative monetary policy this year; a few others noted that exceptional policy accommodation could be appropriate beyond 2011." Also, "A few members noted that evidence of a stronger recovery, or of higher inflation or rising infl expectations, could make it appropriate to reduce the pace or overall size of the purchase program. Several others indicated that they did not anticipate making adjustments to the program before its intended completion."

Recall that staff forecasts were rev down for growth, up for inflation.

UK data: at 0830GMT with UK industrial production and manufacturing output data. IP is expected to come slow slightly to +0.4% m/m, 4.3% y/y with manufacturing at 0.6% m/m, 5.8% y/y.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.