- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- US focus: Yen gains as Japan's latest quake cuts demand for higher-yielding assets

US focus: Yen gains as Japan's latest quake cuts demand for higher-yielding assets

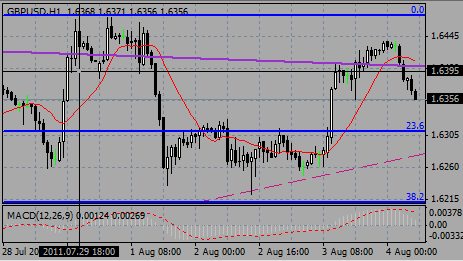

The yen gained Monday, rising from an 11-month low against the euro, after an aftershock of Japan’s March 11 earthquake discouraged demand for higher-yielding assets.

The dollar remained lower versus the yen as Federal Reserve Vice Chairman Janet Yellen said the gain in food and fuel costs doesn’t warrant a reversal of monetary stimulus.

The euro fell against the dollar on speculation the European Central Bank’s recent interest-rate increase may make it harder for nations including Ireland and Portugal to contain debt.

The euro has gained 8% against the dollar since the start of this year as improving economic growth in Germany and accelerating inflation boosted speculation that interest rates would be lifted.

European Central Bank President Jean-Claude Trichet and colleagues raised the main refinancing rate last week to 1.25% from a record low 1%, where it had been since 2009, and left the door open for further rate increases.

Portugal will start negotiations with the European Union and the International Monetary Fund this week on a rescue package estimated at 80 billion euros ($115 billion.)

The Dollar Index dropped 0.2% to 74.940 after falling on April 8 to as low as 74.838, the least since December 2009.

U.S. congressional leaders and President Barack Obama averted a government shutdown by reaching an agreement on April 8, less than two hours before the government’s funding authority was due to expire.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.