- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EU session review: Yen, Franc climb as quakes boost safe-heaven demand; Pound falls on inflation data

EU session review: Yen, Franc climb as quakes boost safe-heaven demand; Pound falls on inflation data

Data released

06:00 Germany CPI (March) final 0.5% 0.5% 0.5%

06:00 Germany CPI (March) final Y/Y 2.1% 2.1% 2.1%

06:00 Germany HICP (March) final Y/Y 2.3% 2.2% 2.2%

08:30 UK Trade in goods (February), bln -6.8 -7.8 -7.8 (-7.1)

08:30 UK Non-EU trade (February), bln -2.9 -4.7 -4.2

08:30 UK HICP (March) 0.3% 0.6% 0.7%

08:30 UK HICP (March) Y/Y 4.0% 4.4% 4.4%

08:30 UK HICP ex EFAT (March) Y/Y 3.2% - 3.4%

08:30 UK Retail prices (March) 0.5% 0.5% 0.1%

08:30 UK Retail prices (March) Y/Y 5.3% 5.5% 5.5%

08:30 UK RPI-X (March) Y/Y - 5.5%

09:00 Germany ZEW economic expectations index (April) 7.6 11.5 14.1

The yen and Swiss franc rose after more earthquakes shook buildings in Tokyo and Japan raised the severity rating for the nuclear crisis that began last month, reviving demand for the safest assets.

The yen appreciated as officials said the accident at the Fukushima Dai-Ichi power plant may release more radiation than the 1986 Chernobyl disaster.

The IMF lowered its 2011 forecast for Japanese growth to 1.4 percent from 1.6 percent in its World Economic Outlook report yesterday, citing effects from the disaster. The forecast for next year was raised to 2.1 percent from 1.8 percent.

The euro rose as the International Monetary Fund and European Commission prepare to meet in Lisbon to discuss an 80 billion-euro ($116 billion) aid program for Portugal. The pound sank after data showed inflation slowed.

A report today showed German investor confidence fell more than economists forecast in April after the European Central Bank raised interest rates and Portugal become the third euro- region nation to seek a bailout.

The ZEW Center for European Economic Research said its index of investor and analyst expectations declined to 7.6 from 14.1 in March. Economists expected a drop to 11.3.

The pound slumped to its weakest against the euro in almost six months.

Statistics showed U.K. inflation unexpectedly slowed last month, weakening the case for the Bank of England to raise interest rates. Consumer prices rose 4% from a year earlier, down from the 4.4% pace in February.

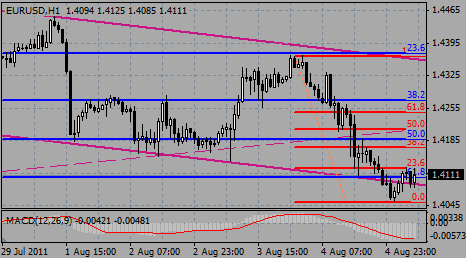

EUR/USD rose from $1.4380 to $1.4480 before retreated to current $1.4471.

GBP/USD fell after the weak UK data. Rate fell from $1.6320 to $1.6220 before recovered to $1.6280.

USD/JPY recovered from Asian lows around Y83.40 to Y84.40.

US data include International trade report for February with an expected deficit of -45.5 bln after -46.3 bln.

At 13:00 GMT BOC announces its rate decision. Analysts predict rate remains unch at 1.00%.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.