- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EU session review: Euro Declines for Second Day on Greece, Finland

EU session review: Euro Declines for Second Day on Greece, Finland

The euro fell for a second day against the dollar on speculation Greece will be unable to avoid a default, even after officials said debt restructuring isn’t being discussed.

The single currency declined to a two-week low versus the yen on concern election gains by Finland’s euro-skeptic bloc will hinder regional efforts to assist ailing nations, including Portugal and Ireland.

Greek bond yields surged to records.

“The latest developments in the euro region have a potential to provide hurdles for the euro,” said Jane Foley, a senior currency strategist at Rabobank International. “The situation in Finland has to be monitored very closely, because it’s reflecting a trend in the political landscape of the region. There’s clearly fear among voters that they have to pay for fiscal mistakes of others.”

Greece found support from IMF Managing Director Dominique Strauss-Kahn and French Finance Minister Christine Lagarde after German Finance Minister Wolfgang Schaeuble was quoted as saying “further measures may have to be taken” if Greece fails an audit in June.

New Zealand’s dollar dropped against all of its major counterparts as data showed consumer prices rose less than forecast. New Zealand’s consumer prices rose 0.8% in the first quarter from three months earlier, the government said today. Economists forecast a 1% gain.

EUR/USD tries to recover, but reached $1.4390 only before was dragged down to a fresh session lows around $1.4265.

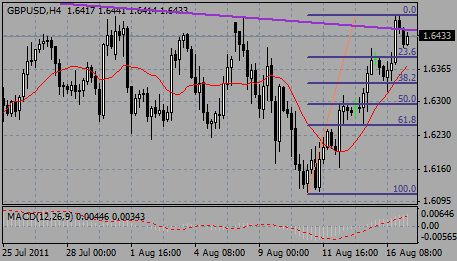

GBP/USD fell from $1.6310 to $1.6240. Later rate recovered to $1.6270.

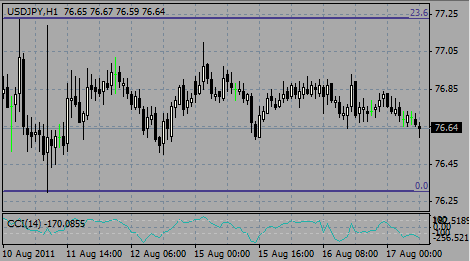

USD/JPY printed lows around Y82.60 before it was back to Y82.90.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.