- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Forex: Tusday's review

Forex: Tusday's review

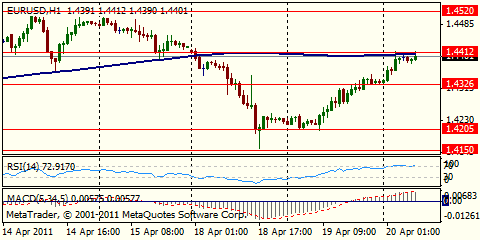

The euro advanced against the dollar and yen on speculation the European Central Bank will raise interest rates further even as nations such as Greece struggle to contain sovereign-debt turmoil.

The ECB governing council member Nout Wellink said in Toronto the central bank’s April 7 interest-rate increase sent to investors an “extremely important” signal aimed at preventing expectations of higher inflation.

Germany’s purchasing managers’ index for manufacturing unexpectedly climbed to 61.7 this month from 60.9 in March, according to Markit Economics. The median forecast of economists was for a decrease to 60.

Europe’s shared currency has dropped 1.6% over the past week. Citigroup Inc. said it has established a bet the euro will decline against the dollar.

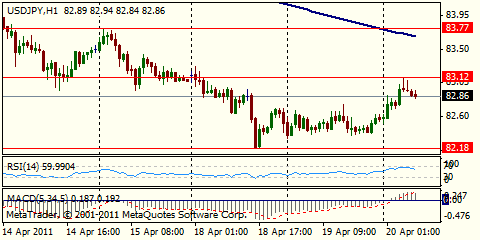

The Canadian dollar rallied against the greenback as a government report showed the annual inflation rate accelerated to a two-year high, exceeding all economists’ forecasts.

The consumer price index advanced 3.3% in March from a year earlier, compared with 2.2% pace of increase in the previous month, Statistics Canada reported. The median forecast of economists was for a 2.8% annual rate.

The Bank of Canada will hold the target rate for overnight loans between commercial banks at 1% during the second quarter and boost it to 1.5% during the third quarter, according to a survey.

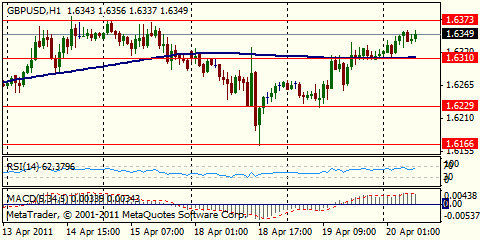

The minutes of the latest Bank of England MPC meeting, in April, are due for release at 0830GMT along with the latest Trends in Lending data. Analysts do not expect any change in the split seen in March, where five

voted for unchanged policy. Posen's unchanged rate decision also came with a call for a further stg50 billion of QE, while Sentance voted for a 50bps hike and Weale & Dale looked for a 25bps hike. At this meeting,

the MPC would have had a preview of the March inflation data, which fell back unexpectedly.

9.6% in February. The supply of homes for sale has dipped in recent months as sales improved, but the reverse was true in February. US data rounds off with the weekly Crude Oil Stocks data at 1430GMT.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.