- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

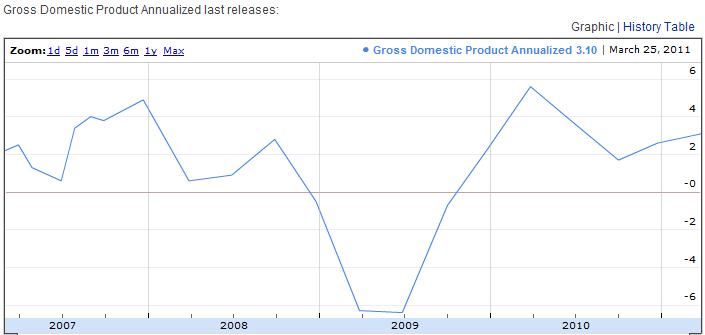

- US Q1 GDP preliminary data are due to come at 12:30 GMT with median of +0.5% m/m and +1.8% y/y

US Q1 GDP preliminary data are due to come at 12:30 GMT with median of +0.5% m/m and +1.8% y/y

Median estimate for the first publication of GDP for Q1 is +1.8% y/y after +3.1% in Q2, wit promising employment numbers on the one hand and underlying weakness in the housing market on the other that has led a number of prominent institutions to downgrade their economic growth forecasts for Q1 and 2011 as a whole.

As a reminder, yesterday Bernanke said in the press conference that he believes GDP growth will be less than 2% as slower consumer spending and a wider trade deficit slowered economic activity at the start of the year.

Possible outcome:

Above estimates: A strong reading above 1.8% should give the USD some strength to correct the selling pressure. Data should ideally breach the psichological 2% band, this could trigger a strong rebound in the Dollar, aiming to set under $1.4800. Below this achievable break, not much support is seen until $1.4700, stronger support, ahead of $1.4650.

Below estimates: Should the number fall short of 1.8%, then the Dollar is poised to extend gains towards the next area of resistance at $1.4900. Upon the touch of this new high, the doors for $1.5000 big round number will get widely opened. From a weekly perspective, the chart does not show much resistance until $1.5120/30 area.

In line with expectations: Data in line with estimates may not be good enough for the Dollar. However, Euro may find it hard to overstrech much further. For these reasons, we favour quotes to consolidate near highs with the potential to see a pullback to $1.4700.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.