- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EU session review: Euro holds tight after ECB decision and ahead of Trichet's speach

EU session review: Euro holds tight after ECB decision and ahead of Trichet's speach

Data released:

08:30 UK CIPS services index (April) 54.3 55.8 57.1

10:00 Germany Manufacturing orders (March) seasonally adjusted -4.0% 0.6% 2.4%

10:00 Germany Manufacturing orders (March) not seasonally adjusted, workday adjusted Y/Y 9.7% 15.5% 20.1%

11:00 UK BoE meeting announcement 0.50% 0.50% 0.50%

11:45 EU(17) ECB meeting announcement 1.25% 1.25% 1.25%

The euro hovered close to a 17-month peak against the dollar and hit a 13-month high against the pound on Thursday as investors awaited the Trichet's speach.

But in Europe the euro dragged lower on release of much weaker than expected German mfg orders data (-4.0% m/m versus median +0.4%).

While no move was expected from the ECB at today’s meeting following April’s 25 basis point rate rise, investors were set to focus on comments from Jean-Claude Trichet, ECB president, for clues as to future monetary tightening. Forecasts were split as to whether Mr Trichet would signal a move in June or July.

Ulrich Leuchtmann at Commerzbank said it was more likely that Mr Trichet would signal a rate rise in June than July.

“If we are right, the euro should find strong support against the dollar and we would not be able to exclude an attack on the psychologically important $1.50 mark,” he said.

The Bank of England has kept UK interest rates at a record low of 0.5%.

The pound suffered after a survey suggested activity in the UK services sector slowed markedly in April, further denting expectations that the Bank would move to abandon its ultra-loose monetary policy stance.

The UK services sector purchasing managers’ index dropped 54.3 in April, below expectations for a reading of 56.0.

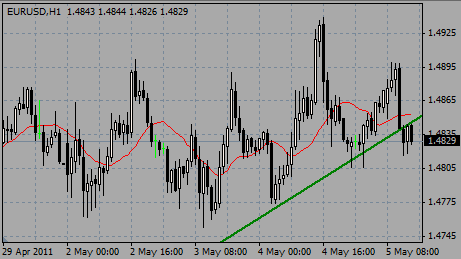

EUR/USD tested $1.4900, but failed to break above and fell to a new session lows around $1.4815 on weak German news. Later rate recovered to $1.4825.

GBP/USD fell from $1.6545 to $1.6455 after the dissapointed data. Rate tried to recover and was back to $1.6500.

USD/JPY continued to go down and printed lows around Y79.55. Later rate recovered, but in general remained weak as the Japanese FinMin is reported as saying that current FX moves different from time of G7 intervention in March.

US data also comes at 1230GMT, when initial jobless claims are expected to fall 19,000 to 410,000 in the April 30 week after rising sharply in the previous week.

At 1330GMT, Fed Chairman Ben Bernanke delivers a speech to the Chicago Fed's Annual Conference on Bank Structure and Competition.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.