- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EU session review: Yen falls on weak data; Pound rises

EU session review: Yen falls on weak data; Pound rises

Data released:

08:30 UK Retail sales (April) 1.1% 0.6% 0.2%

08:30 UK Retail sales (April) Y/Y 2.8% 2.1% 1.3%

10:00 UK CBI industrial order books balance (May) -2% -7% -11%

The pound fluctuated against the euro and the dollar after data showed retail sales climbed 1.1% from March, when they rose a revised 0.3%. The median forecast of economists was for a 0.8% increase. The pound fell earlier after an index of consumer sentiment declined.

Franc was under pressure as Swiss investor confidence dropped for the first time in three months in May as a worsening European debt crisis and an appreciating franc clouded the economic growth outlook.

An index of investor and analyst expectations fell to minus 11.5 from 8.8 in April.

The yen fell after Japan’s economy fell into recession in the first quarter as production and consumer spending were hit by the March earthquake and tsunami.

Gross domestic product fell by an annualised 3.7% in the first three months, after a revised fall of 3% in last quarter of 2010. Analysts had expected the economy to contract by just 1.9%.

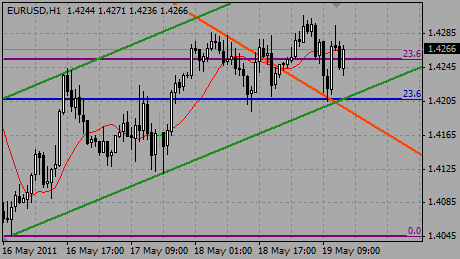

EUR/USD earlier fell to the $1.4202 session lows before later recovered to $1.4295. But bulls failed to breng the rate above the $1.4300 and euro fell to $1.4250/60 on position-adjusting.

GBP/USD rose from $1.6130 to $1.6206 and retreated. Currently rate holds around $1.6184.

USD/JPY rose from Y81.50 to Y81.95, before set stable within the Y81.80/95 range.

Today's focus is on Jobless claims, Existing home sales and Philadelphia Fed index.

Almost as expected, initial jobless claims fell by 44k to 434k in the week ending 7 May. But they have remained elevated, partly because of production disruptions related to the Japanese disaster. We expect initial jobless claims to have fallen to 425k in the week ending 14 May.

Existing home sales rose a stronger than expected 3.7% mom in March, and given that forerunning pending home sales increased by almost 6% in the previous two months, we predict that existing home sales will have gone up again to 5.22m in April. However, the annual rate would still deteriorate from -6.25% to -10%.

Philadelphia Fed index plunged from an extraordinarily high level of 43.4 to a mere 18.5 in April. As manufacturing is still leading the upswing, we expect the index to recover to 22.0 in May.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.