- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EU session review: Euro rises after German IFO

EU session review: Euro rises after German IFO

Data released:

06:00 Germany GDP (Q1) revised 1.5% 1.5% 1.5%

06:00 Germany GDP (Q1) revised Y/Y 4.9% 4.9% 4.9%

06:45 France Business confidence (May) 107 109 109 (110)

08:00 Germany IFO business climate index (May) 114.2 110.0 114.2 (110.4)

08:30 UK PSNCR (April), bln 3.3 2.0 24.8

08:30 UK PSNB (April), bln 7.7 5.0 16.4

09:00 EU(17) Industrial orders (April) -1.8% -1.0% 0.5 (0.9)%

09:00 EU(17) Industrial orders (April) Y/Y 14.1% 12.9% 21.5 (21.3)%

11:30 UK CBI retail sales volume balance (May) 18% 12% 21%

The euro rose against the dollar as German business confidence unexpectedly stayed near a record in May, fueling bets that the European Central Bank will resume raising interest rates even as the debt crisis intensifies.

The Ifo institute said its business climate index held at 114.2 from April after economists forecast a decline to 113.7.

Europe’s common currency has dropped about 6% from its 2011 high against the dollar on May 4, amid concern that Greece may have to restructure its debt.

A restructuring would be a “horror story” that the central bank cannot accept, ECB Governing Council member Christian Noyer told reporters today.

The euro pared gains against the yen as a report showed European industrial orders declined more than economists forecast in March. Orders in the euro area slipped 1.8% from February, when they increased 0.5%. Economists had forecast a drop of 1.1%.

The pound fell versus the euro after Moody’s Investors Service placed U.K. financial institutions on review for downgrades and Britain posted a larger budget deficit than predicted.

Lloyds Banking Group Plc (LLOY) and Royal Bank of Scotland Group Plc are among 14 U.K. lenders whose debt Moody’s is considering downgrading as withdrawal of government support may increase their credit risk. The outlook on Barclays Plc (BARC)’s senior debt and deposit ratings was changed to negative from stable, Moody’s said in a statement today.

Britain had net borrowing of 10 billion pounds ($16 billion) last month, the largest for any April since at least 1993, data showed today. The median of forecasts was for a shortfall of 6.5 billion pound.

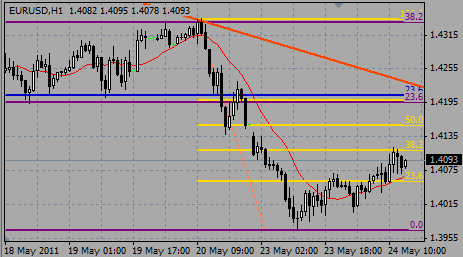

EUR/USD tested highs on $1.4115, but failed to hold above the figure and retreated to $1.4070. But decline was weak and there is a room for a second test of highs.

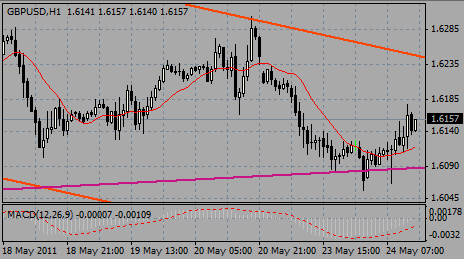

GBP/USD tested $1.6180 after the release of stronger than forecast CBI data, but the report fails to prompt any further rally and rate retreats. Back under $1.6140 to open a deeper move toward $1.6120/15 ahead of $1.6105/00.

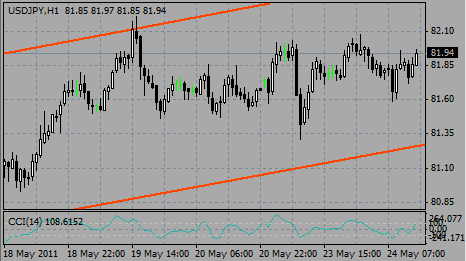

USD/JPY challenges Y82.00, correcting from Asian lows around Y81.60.

US data come at 1400GMT with report on New home sales.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.